March 2025

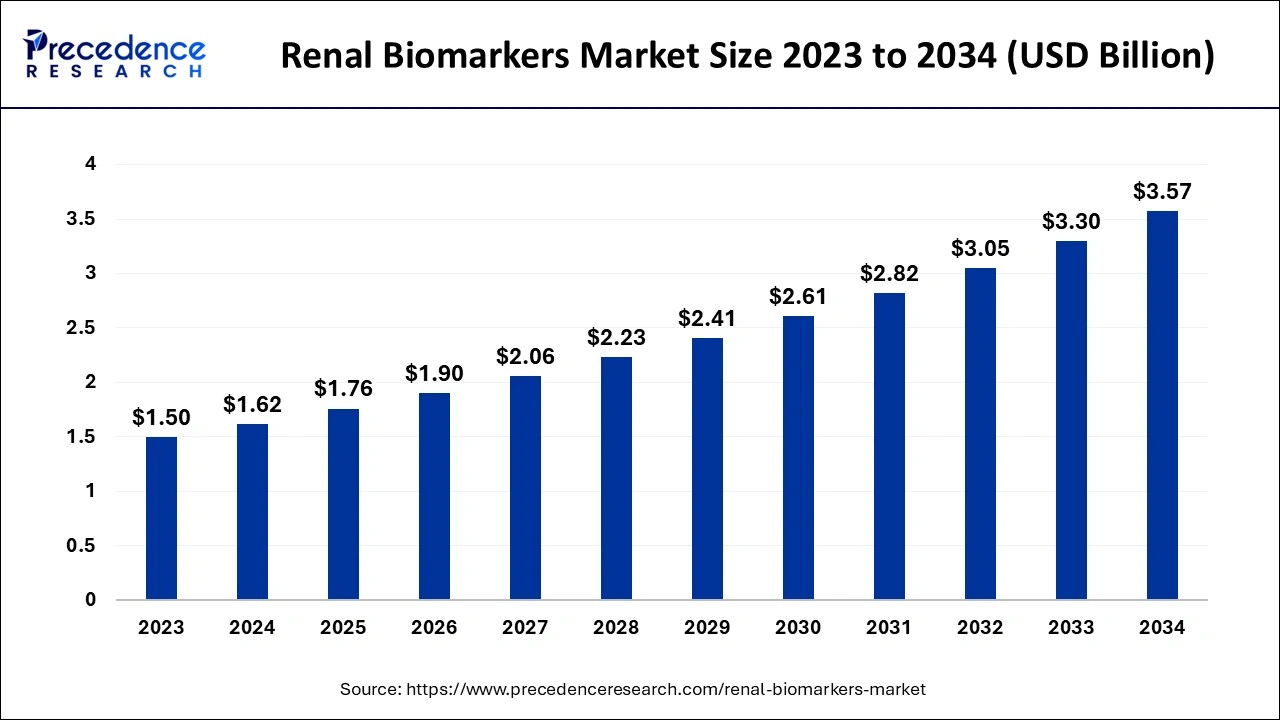

The global renal biomarkers market size accounted for USD 1.62 billion in 2024, grew to USD 1.76 billion in 2025 and is predicted to be worth around USD 3.57 billion by 2034, registering a solid CAGR of 8.21% between 2024 and 2034. The North America renal biomarkers market size is evaluated at USD 780 million in 2024 and is estimated to grow at CAGR of 8.29% during the forecast period.

The global renal biomarkers market size is calculated at USD 1.62 billion in 2024 and is projected to reach around USD 3.57 billion by 2034, expanding at a CAGR of 8.21% from 2024 to 2034. The renal biomarkers market is driven by rising demand for the evaluation of kidney function to determine the severity and nature of kidney injury.

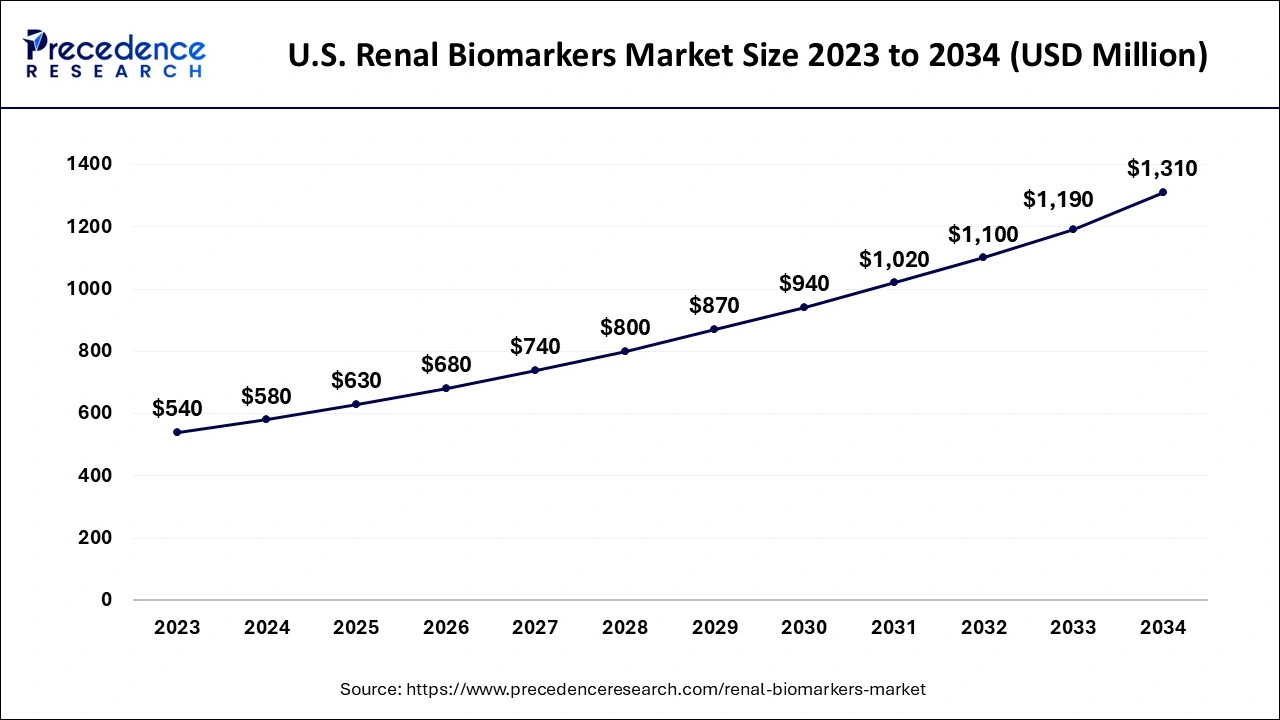

The U.S. renal biomarkers market size is exhibited at USD 580 million in 2024 and is projected to hit around USD 1,310 million by 2034, growing at a CAGR of 8.38% from 2024 to 2034.

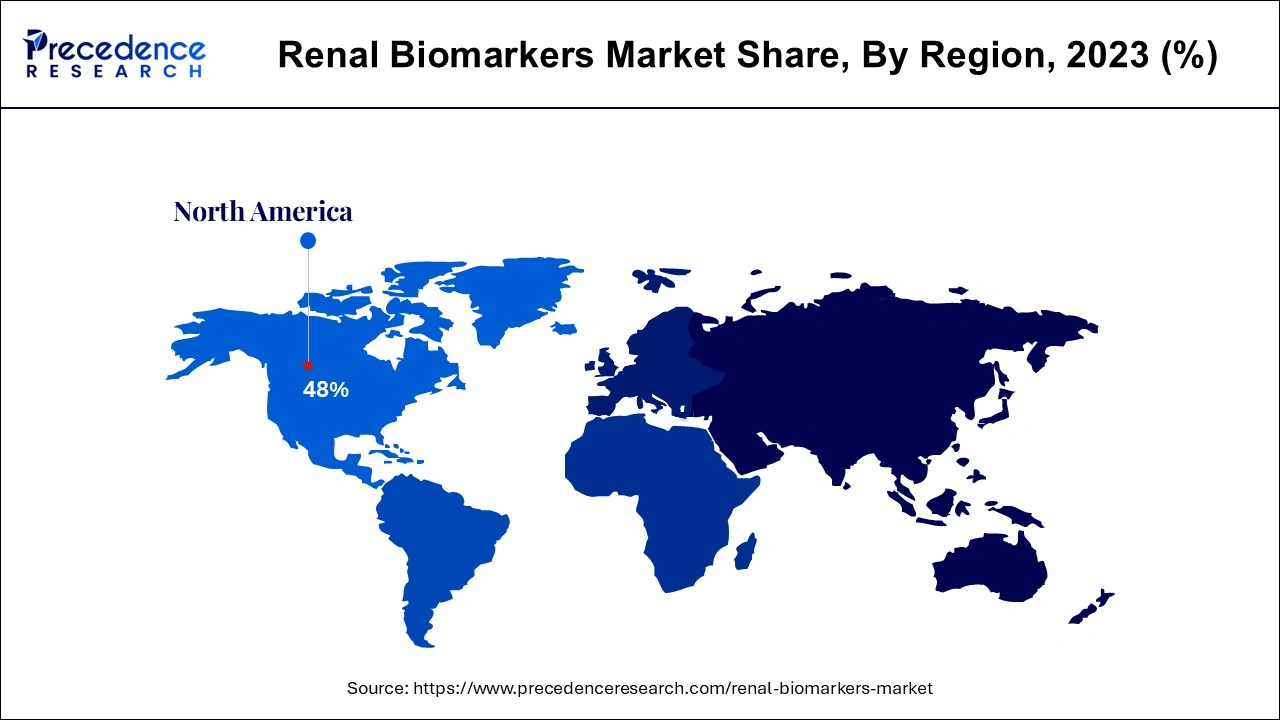

North America led the renal biomarkers market in 2023. The market is highly driven by the rising prevalence of kidney diseases in North America. 1 in 3 adults in the United States, which is about 35.5 million people, is at risk for kidney disease. The rising number of kidney diseases is directly proportional to the increasing rate of diabetes and hypertension. North America is home to major key players in diagnostics companies, laboratories, and research centers.

Asia Pacific is anticipated to witness the fastest growth in the renal biomarkers market during the forecasted years. The growing market factors in this region are increased incidence rates and technological advancements. The Asia Pacific Society of Nephrology (APSN) provides extensive guidelines for the management of diabetic kidney disease.

A biomarker is a biological molecule found in blood, body fluids, or tissues. This helps the professional understand the body's response to the treatment given for a disease or condition. In the case of renal biomarkers, they estimate the patient’s kidney functions, and they are also used to evaluate pathogenic processes and pharmacological responses to therapy. Renal biomarker helps determine the glomerular filtration rate (GFR) of the kidney. Measurement of glomerular filtration rate helps in the diagnosis of chronic kidney disease, monitors the disease, and calculates the drug dosage. However, GFR can be measured in most clinical and research premises; therefore, filtration markers such as Serum Creatinine (SCr) and cystatin C (CysC) are used. Another biomarker, albuminuria, is known to predict a decline in kidney functions and the progression of the disease.

How is AI Changing the Renal Biomarkers Market?

Artificial Intelligence (AI) in medicine is primarily divided into two categories virtual and physical. The application of virtual AI includes managing health records, diagnoses, prescribing medication, clinical decisions, determining mental health, and imaging analysis. Physical AI applications in the renal biomarkers market include the collection of data such as heart rate and blood pressure and image-based applications such as MRI scans or biopsies. The incorporation of AI in renal biomarkers comes under the visual application.

AI is still in the developing stage of the renal biomarkers market. It used machine learning algorithms to improve urinary tract infection detection using renal analysis to evaluate renal pathology during kidney transplantation. It is also used in risk prediction for chronic kidney disease. Acute kidney injury is a result of a sudden decrease in the glomerular filtration rate. Al helps healthcare professionals identify AKI at an early stage, which helps improve patient outcomes.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.57 Billion |

| Market Size in 2024 | USD 1.62 Billion |

| Market Size in 2025 | USD 1.76 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.21% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Biomarker, Diagnostic Technique, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increase in renal disorder

The demand for the renal biomarkers market services is increasing due to the rising number of renal disorder cases globally. The most common leading causes of chronic kidney disorders are diabetes and high blood pressure. Untreated diabetes damages the blood vessels in the kidneys that filter waste from the blood; this leads to damage to the kidneys. High blood pressure constricts and narrows the blood vessels present in the kidney, which slows down the blood flow and eventually stops the kidney from working. Chronic kidney disease is clinically silent or asymptomatic (no signs or symptoms) for a long period; therefore, biomarkers are the best method for diagnosing, evaluating, and treating CKD.

Variability

Variability arises when biomarkers are used to determine the presence of disease, rate of exposure, and susceptibility in the renal biomarkers market. These factors vary from person to person. The main reason for fluctuating results within individuals is due to laboratory errors or unique conditions. Measurement errors are quite common, but another reason for improper biomarker results is the individual rate of exposure, consumption of any drugs or medication, or diet affects the results. Professionals investigate these factors to understand the main cause of variability.

Clinical research

Biomarkers have extensive potential to transform clinical research departments in the foreseeable future. Renal biomarker provides real-time, objective data on patient health and treatment outcomes. With advanced technology and regulatory framework, the renal biomarkers market is expected to witness the integration of digital biomarkers in clinical research. Digital biomarker devices will help recognize hidden insights, touchpoints, and connections. The data collected using this will offer strategic direction to drug development for manufacturing companies in clinical research. The digital biomarker tools include a smartwatch and sensor-embedded wearable device, which collects data passively.

The functional biomarker segment held the biggest share of the renal biomarkers market in 2023. Functional biomarkers offer an analysis of the physiological activity of the body. This specific kind is used in drug development studies; therefore, this is used to assess the effects of targeted and modified treatment activity over disease. This method is applied in clinical trials, patient diagnostics, and disease progression research. Functional biomarkers are widely observed in clinical practice as they highlight the performance, social and economic status, some pathologies, and the presence of addition within a patient.

The up-regulate protein segment is anticipated to show considerable growth in the renal biomarkers market during the forecast period. Up-regulated protein biomarkers serve as potential early diagnostic biomarkers. Up-regulated protein is a process that takes place within the cell that is triggered by a signal. This course of action results in increased expression of one or more genes along with the protein encoded in the gene. For instance, when a cell is deficient in some receptor. Un-regulated protein provides receptor protein to synthesize and transport to the membrane of the cell, and hence, the sensitivity of the cell returns to normal.

The enzyme-linked immunosorbent assay (ELISA) segment generated the highest share of the renal biomarkers market in 2023. The Enzyme-linked immunosorbent assay antibody tests are highly projected for a common autoimmune kidney disease that can lead to kidney failure. This is a laboratory technique, and there are plenty of variations in the tests that are used. One of the more common is to detect and measure antibodies. Other uses are estimating hormone levels, tracking disease outbreaks in the community, screening blood donations, and detecting non-medical drugs.

The colorimetric assay segment is projected to witness the fastest growth in the renal biomarkers market during the forecast period. Colorimetric test is used in the detection of infection-causing microorganisms and antimicrobial resistance. It offers sensitive, rapid, selective, and economical diagnostic tests that are critical to starting the right treatment. The colorimeter assay is used in hospitals and laboratories to analyze biochemical samples, such as urine, cerebrospinal fluids, plasma, and biochemical samples. This technique is widely used to determine serum components, proteins, glucose levels, and various biochemical compounds quantitatively.

The diagnostic laboratory segment dominated the global renal biomarkers market in 2023. Laboratory diagnostics are widely performed to check for kidney diseases. American Clinical Laboratory Association supports clinical laboratories in the diagnosis and management of kidney health. Glomerular filtration rate (GFR) is performed to check kidney functions. The urine test checks albumin (a protein that passes when the kidney is damaged). Blood Urea Nitrogen (BUN) and creatinine A levels indicate early signs of kidney diseases. Cystatine C helps to predict the high accuracy of at-risk patients developing CKD and AKI. The innovative diagnostic laboratory also assists in kidney transplantation and avoids unnecessary biopsies.

The hospital segment is expected to grow at the fastest rate in the renal biomarkers market during the forecast period of 2024 to 2034. The hospital had only blood and urine tests available on the premises. For more detailed results, the patient is recommended to visit a diagnostic laboratory. With the provided urine sample, doctors examine the presence of bacteria, pus, or blood in the urine. A blood test determines how well the kidney removes waste, toxins, and extra fluid from the blood.

Segments Covered in the Report

By Biomarker

By Diagnostic Technique

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

October 2024

August 2024

September 2024