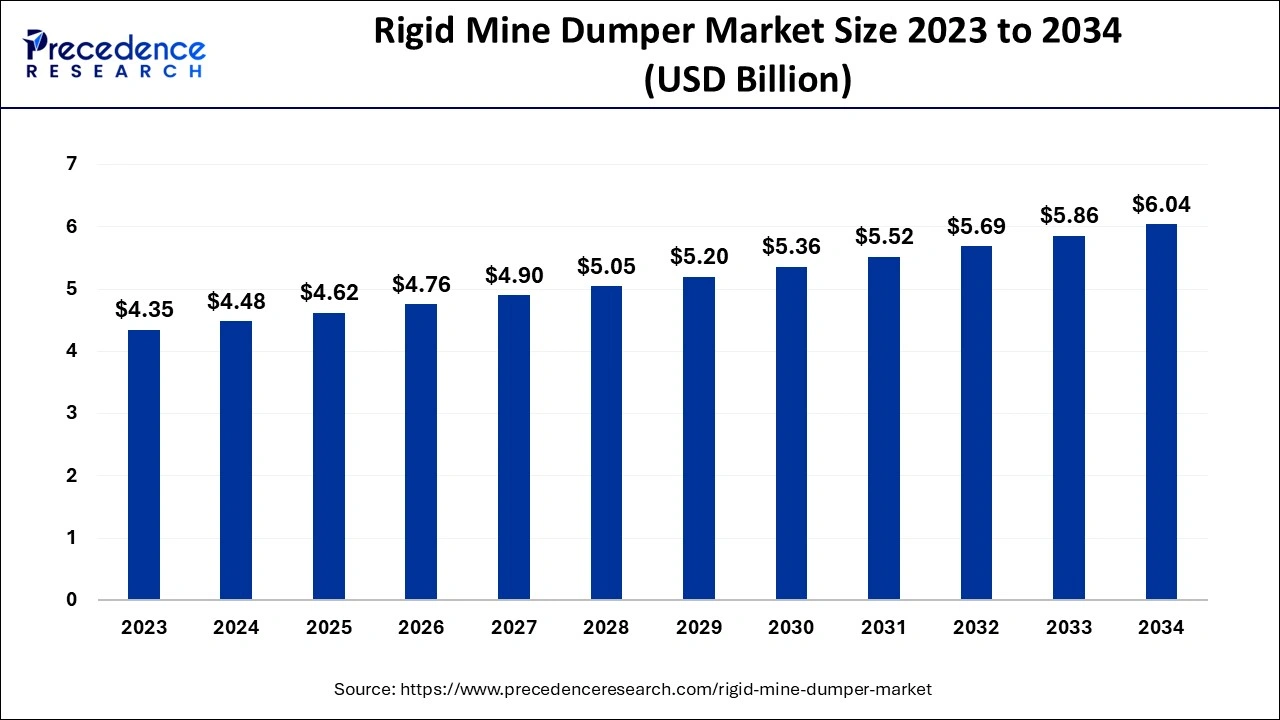

The global rigid mine dumper market size accounted for USD 4.48 billion in 2024, grew to USD 4.62 billion in 2025 and is projected to surpass around USD 6.04 billion by 2034, representing a CAGR of 3.03% between 2024 and 2034. The North America rigid mine dumper market size is evaluated at USD 1.43 billion in 2024 and is expected to grow at a CAGR of 3.17% during the forecast year.

The global rigid mine dumper market size is calculated at USD 4.48 billion in 2024 and is predicted to reach around USD 6.04 billion by 2034, expanding at a CAGR of 3.03% from 2024 to 2034. Major drivers of the rigid mine dumper market are rising needs for minerals, technological innovation, enhanced safety and efficiency, development in infrastructures, and high-end standards for emissions.

Artificial intelligence applications in the rigid mine dumper market are making it easier to conduct business by enhancing productivity, safety, and overall operations. The machines develop a strategy dependent on AI to guide preventative and predictive maintenance based on analyzing the equipment’s performance. AI-based autonomous driving systems reduce the risk of human intervention, optimize the route, and increase the payload factor to make it safer. The rigid mine dumpers have incorporated artificial intelligence in their operations to enhance the operations in the mining segment.

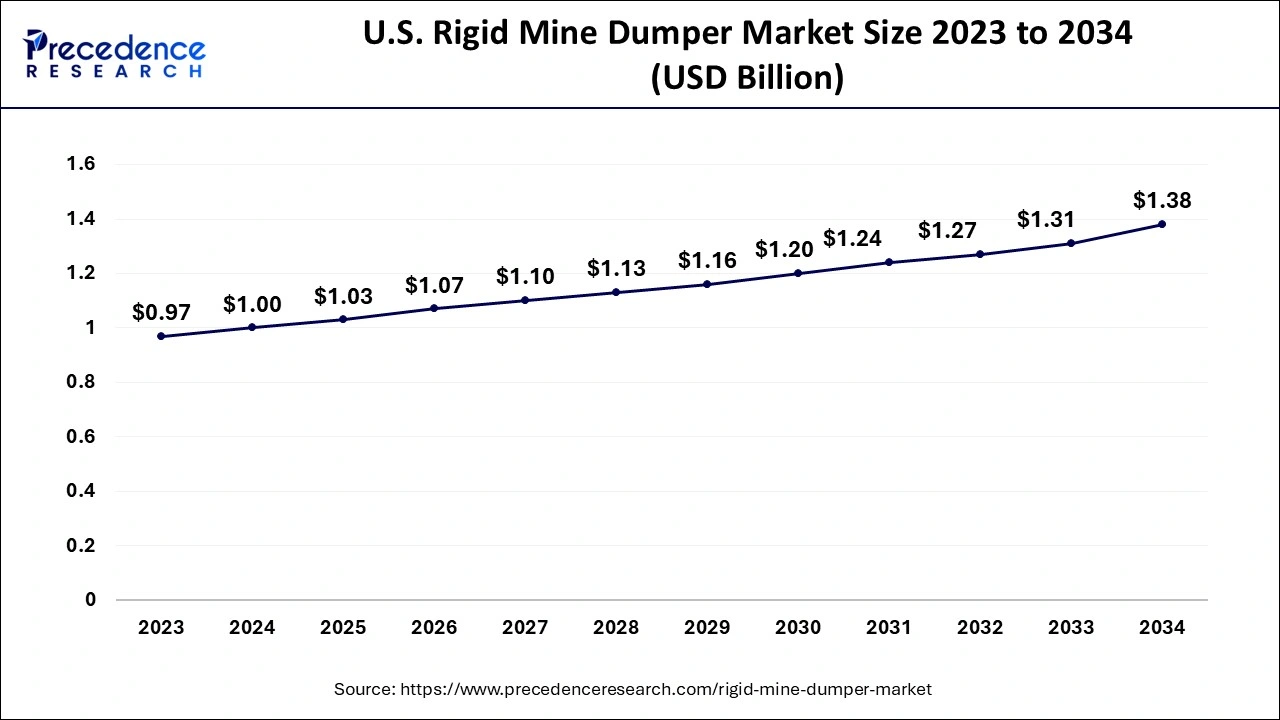

The U.S. rigid mine dumper market size is exhibited at USD 1.00 billion in 2024 and is projected to be worth around USD 1.38 billion by 2034, growing at a CAGR of 3.26% from 2024 to 2034.

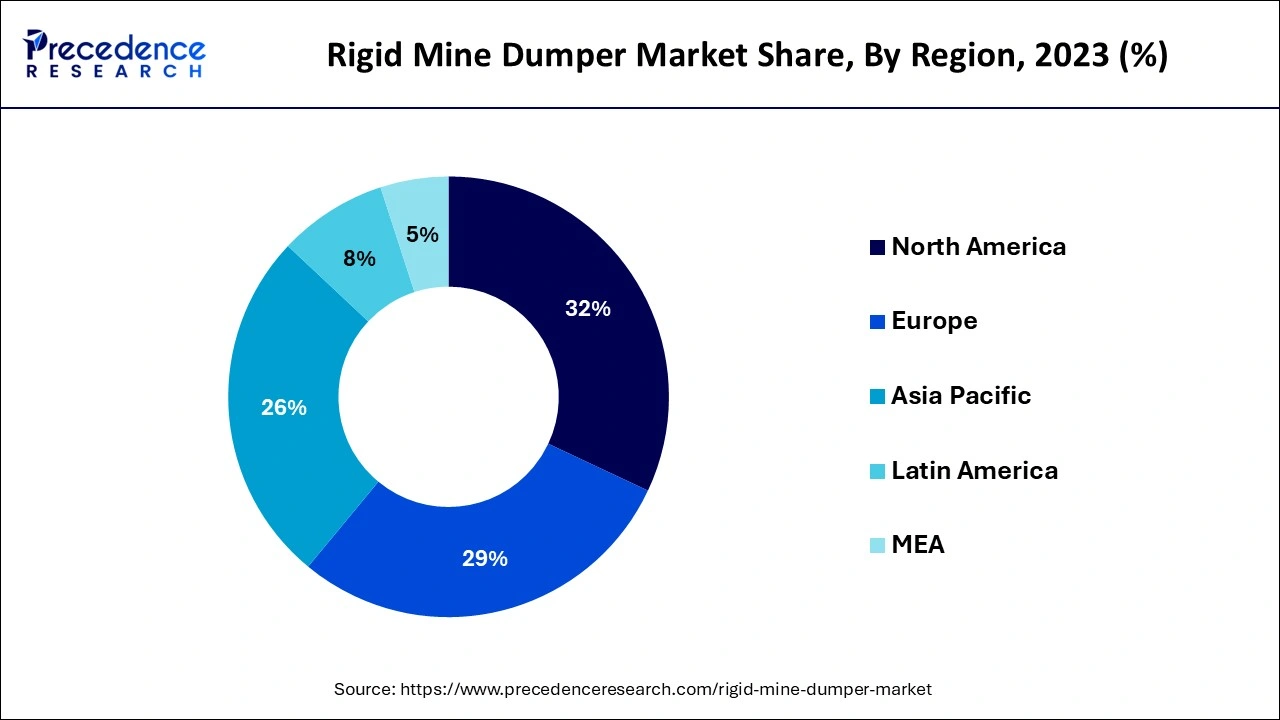

North America dominated the rigid mine dumper market with the largest share in 2023. This is mainly due to increased demand for mining equipment, including rigid mine dumpers. These robust vehicles play a crucial role in the region’s mining sector, where they are used especially to transport mined products such as coal, ores, and minerals. The U.S. held the maximum share of the market. The country is known for its innovation and adoption of advanced technologies in mining operations. Moreover, the mining industry in North America relies heavily on rigid mine dumpers to aid effective material handling operations.

Asia Pacific is expected to witness the fastest growth in the coming years. There is an increasing need for rigid mine dumpers due to the rising mining activities in the region. China and India are the leading consumers of rigid mine dumpers since they boast the largest mining industry. Moreover, with the rapid urbanization in countries like India and China, there is a rapid growth in mining and construction activities, boosting the demand for mining equipment. The rising investments in mining projects further contribute to regional market growth.

A rigid mine dumper is a heavy-duty vehicle mainly used to transport material in mining areas with huge production capacity. The mode of transportation is meant to work under rough and difficult slopes, slanting ground, and slippery and consistent terrains. Fixed-site mine dumpers are useful in the mining industry since they enable the transportation of massive quantities of material within the mine. The necessity of the safety of the workers during transportation is solved by the installation of cameras, sensors, and alarms on the vehicles. Shuttle cars are also specifically built to be used in harsh climate environments, and they are highly recommended for hot and wet climates, which is typical of mines.

The increasing demand for efficient transport in the mining process and the growth of the mining industry worldwide are the trending factors that influence the rigid mine dumper market. The need for robust, heavy-duty vehicles that can traverse difficult terrain and transport huge cargo is driving businesses to purchase sophisticated rigid dump trucks. This market is expected to continue growing due to the increasing demand for minerals, along with utilizing modern technologies in the mining industry.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.04 Billion |

| Market Size in 2024 | USD 4.48 Billion |

| Market Size in 2025 | USD 4.62 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.03% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 203 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for minerals

The rigid mine dumper market is experiencing an increasing demand for better and more effective operations in mines. The market for minerals like iron ore and copper is increasing significantly because of their rising use in the construction, manufacturing, and energy sectors. Expanding mining and energy industries are demanding more effective rigid mine dumpers that will help maintain a proper logistics chain. As the mining businesses expand, there is a need for powerful and high-carrying capacity dump trucks. An increase in the use of metals, the inclusion of IoT by presenting these vehicles for monitoring, next-generation dumping truck technologies, and automation.

Expensive to acquire and maintain

Rigid mine dumpers are costly to purchase and maintain, which makes them too expensive for some mining companies, particularly those operating in developing countries. Moreover, the issue of safety of working with such big machines must be given maximum concern. The rigid mine dumpers also have the disadvantage of being dangerous to workers in the case of an accident. Substantial hindrances may include the upfront purchase price and ongoing maintenance expenses, mainly for smaller mining firms.

Growing investments

Capital investments are responsible for the growth and development of the rigid mine dumper market. There is a need for mining resources, including metals, minerals, and coal, as global infrastructure projects continue to grow. These resources need transportation, and rigid mine dumpers are useful for transporting bulk quantities of the material extracted in a mine. The mining companies need to increase their production levels, especially to meet large infrastructure projects like roads, railways, and urban development, hence requiring more rigid dumpers.

The new types of dumpers possessing automation and artificial intelligence are being implemented to improve operations and efficiency while decreasing the number of accidents at difficult mining sites. The increase in infrastructure projects also holds potential for the rigid mine dumper market since it increases the requirements for resource transportation and extraction.

The mechanical drive dumper segment noted the largest share of the rigid mine dumper market in 2023. A mechanical drive dumper is a kind of dump truck for mining, civil construction, and other quarry works. The mechanical drive dumper is attributed to having a powerful climbing capacity, high rate of work, and versatility across working environments. This is used to transport materials such as dirt, gravel, demolition wastes, and coal, among others. These are equipped with an open-box bed that is hinged at the back part with hydraulic rams that can be used to tip the material. A mechanical drive can do more with equal power or deliver the same performance with less power than an electric drive, translating into better fuel savings. A mechanical drive truck can create and store a better peak torque than electric trucks.

The electric drive dumper segment is projected to witness the fastest growth in the rigid mine dumper market during the forecast period. Electric dumpers are operated using electric motors and, therefore, are considered to be environmentally friendly as compared to diesel-operated dumpers. Unlike traditional diesel dump trucks, electric dump trucks emit trace quantities of emissions, which affect greenhouse gas emissions and air pollution. These technologies improve the features and capability of electric dump trucks, and they offer almost the same output as conventional diesel trucks. Also, lower operating and maintenance costs of electric vehicles (EVs) compared to internal combustion engine vehicles (ICEVs) contribute to the increasing adoption in construction and mining industries.

The mining industry segment contributed the largest share of the rigid mine dumper market in 2023. Mining industries need to get a lot of material in bulk to conduct operations efficiently. The dumper trucks have a carrying capacity, and they can transport a good amount of material from the loading area to the site. In the mining segment, construction dumpers are used for better production with efficiency at a larger load. They can handle massive loads, making it possible to transport materials such as minerals and rocks, improving productivity in the mining industry. The dumpers have different working models in mining, which can be mining dumpers for opencast mining, quarries, or underground mining operations.

The energy industry segment is projected to witness the fastest growth in the rigid mine dumper market during the forecast period. Dump trucks or dumpers are commonly utilized within the energy industry to transfer commodities such as coal, amongst other bulk products. The energy sector also uses rigid mine dumpers for several applications, comprising the transportation of materials in oil and gas exploration and renewable energy projects. These dump trucks are useful in the associated technical and freight activities for the mining, movement, and treatment of energy products. They have robust design and high payload capacity, which makes them ideal for the demanding environments associated with energy production and exploration activities.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client