November 2024

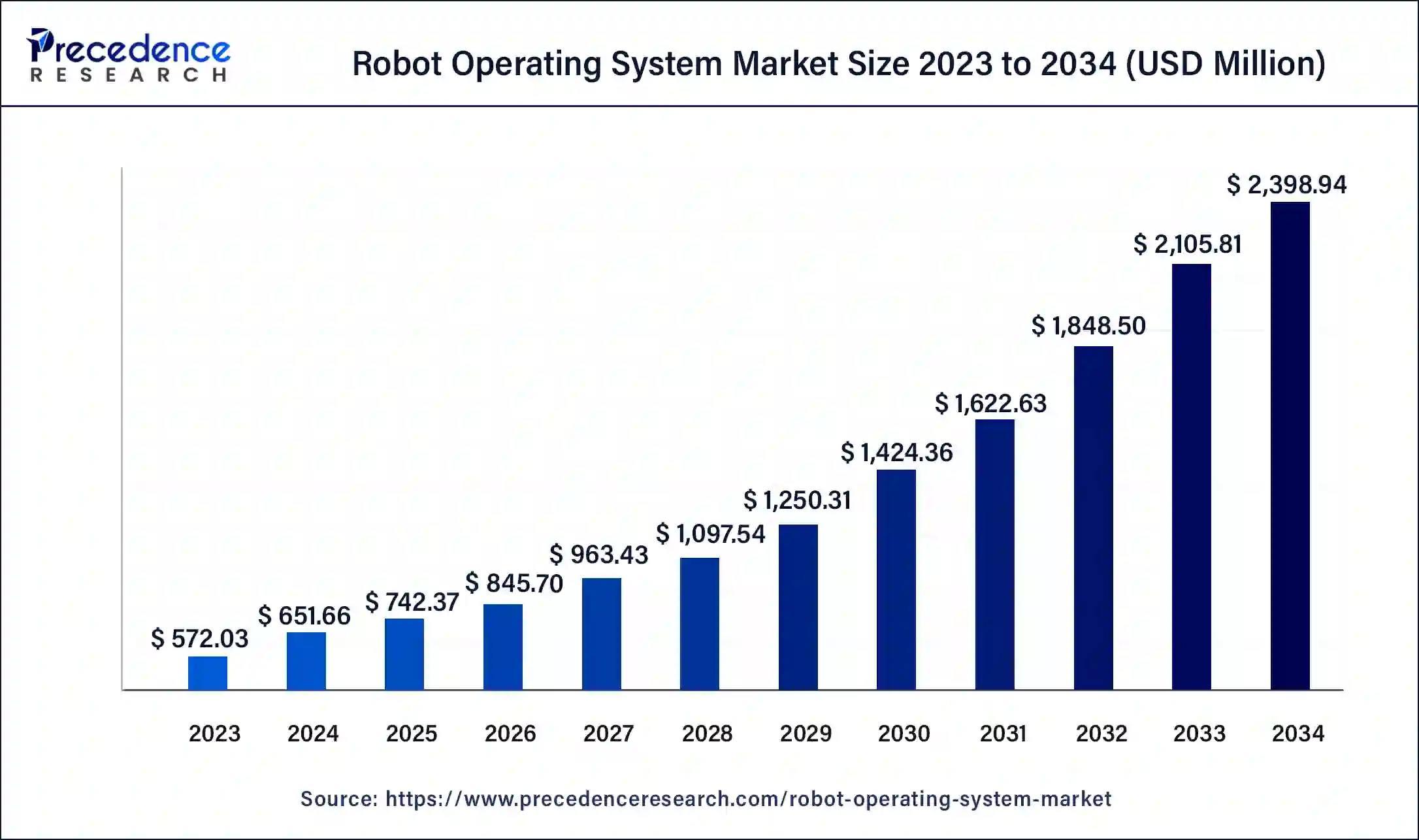

The global robot operating system market size surpassed USD 572.03 million in 2023 and is estimated to increase from USD 651.66 million in 2024 to approximately USD 2,398.94 million by 2034. It is projected to grow at a CAGR of 13.92% from 2024 to 2034.

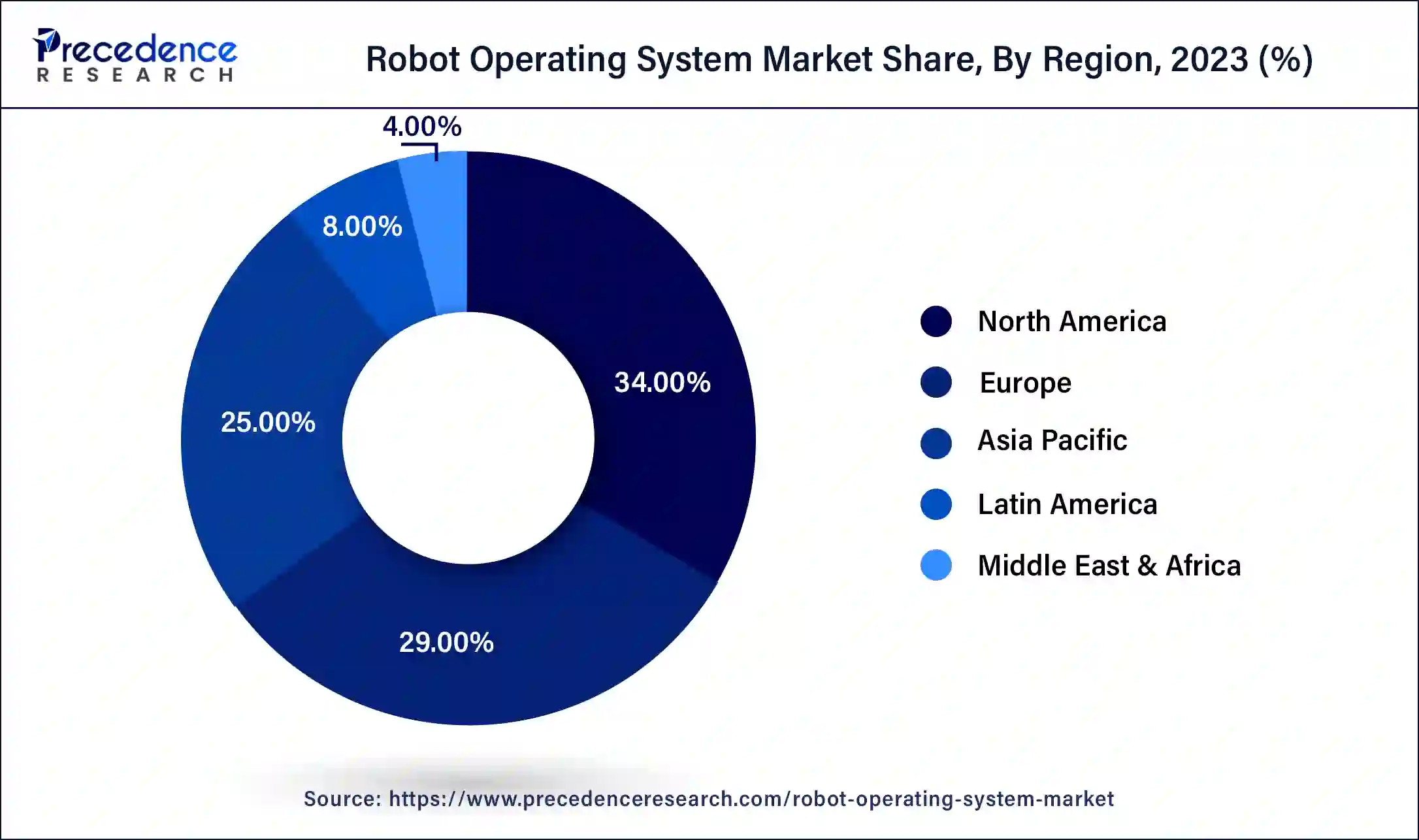

The global robot operating system market size is projected to be worth around USD 2,398.94 million by 2034 from USD 651.66 million in 2024, at a CAGR of 13.92% from 2024 to 2034. The North America robot operating system market size reached USD 194.49 million in 2023. The increasing automation and robotics workflow in the industries are driving the growth of the market.

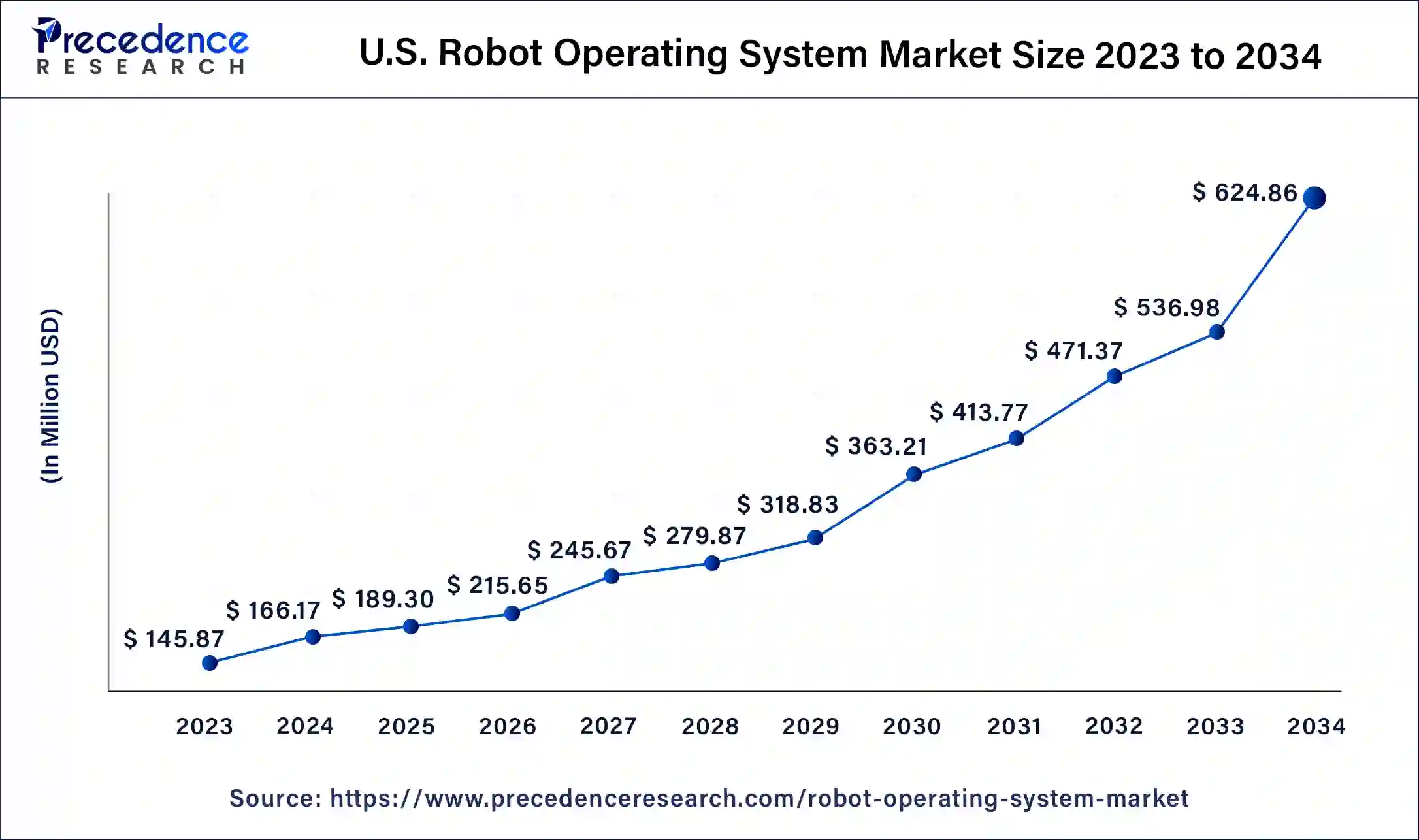

The U.S. robot operating system market size was exhibited at USD 145.87 million in 2023 and is projected to be worth around USD 624.86 million by 2034, poised to grow at a CAGR of 14.14% from 2024 to 2034.

North America is expected to grow at the fastest rate during the forecast period. The growth of the market is attributed to the presence of well-developed industrial infrastructure and the early adoption of technologies in every industry field, which drives the growth of robotics. The rising adoption of robotics in various industries such as automotive, electronics, consumer home appliances, healthcare, and others is driving the growth of the robot operating system. The rising investments in technological advancements drive the growth of the robot operating system market in the region.

Asia Pacific is expected to show significant growth during the forecast period. The growth of the market is expected due to the rising economic standards in the regional countries, and the rising industrialization is driving the growth of the robot operating system market across the region. Asia had 168 units of robots per 10,000 employees in the manufacturing industry. At the global level, economies like Singapore, Japan, mainland China, Chinese Taipei, and Hong Kong are all covered in the top 10 countries with the highest density of industrial robots.

The robot operating system is the platform that helps developers create robust robotics applications. It provides the set of tools that help the development and design of complex robotics systems or devices for a number of industries. The robot operating system provides modularity, and the creation of code helps the software to develop the robotic system for a number of functions or applications. The robot operating system is designed to perform various robot management tasks, such as controlling the robot's hardware, such as sensors and motors, which are used to make high-level decision-making processes. The increasing installation of robotics and automation by a number of end-use industries are driving the growth of the robot operating system market.

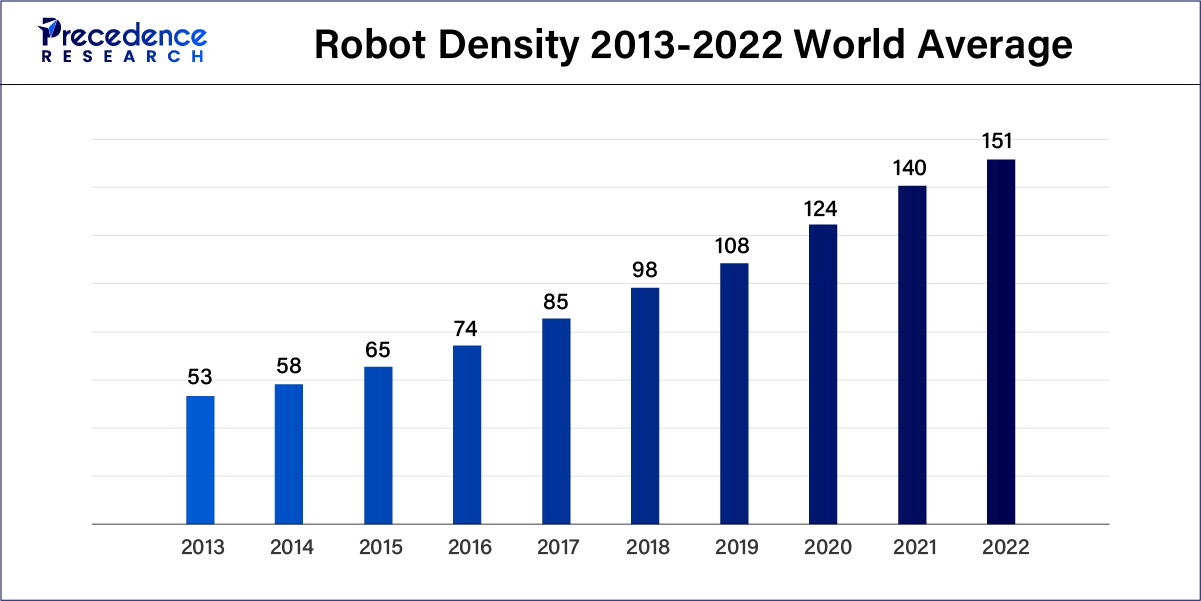

In January 2024, according to the Robot Density Data by the International Federation of Robotics, robot installation reached another level of height with a new record of 3.9 million operational robotics installations in 2022. Here are some of the top countries having the highest number of robotics in operations:

The Republic of Korea (1,012 robots per 10,000 employees)

How can AI impact the Robot Operating System?

The integration of artificial intelligence and machine learning in the robot operating systems revolutionizes advanced robotics applications. AI and the robot operating system are two of the most advanced technologies that are rapidly evolving. The integration of these two technologies can be beneficial for the number of industrial applications with more accuracy and efficiency.

The integration helps in several ways, such as improving the decision-making process and providing the insights to make informed decisions on the basis of collected data. Enhanced automation and perception can automate the tasks that traditionally require human interventions and increase the perception quality of robots to capture the work environment, increase efficiency, and reduce costs.

It also helps improve the safety of the work environment with a better understanding of the workplace, which reduces accidents and enhances safer decision-making. Thus, the AI and robot operating system could revolutionize many industrial operations.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,398.94 Million |

| Market Size in 2023 | USD 572.03 Million |

| Market Size in 2024 | USD 651.66 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 13.92% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Including robotics operations in automobile and other industrial applications

The rising demand for robotics by the various end-use industries in their various industrial application, from manufacturing to logistics and transportation, is driving the growth of the robot operating system market. The increasing adoption of robotics in the automobile industry is boosting the demand for the robot operating system.

The evaluation in the automobile industry, such as autonomous cars or self-driving cars, are driving the adoption of technological advancements such as IoT, sensors, AI, and machine learning in the manufacturing of self-driving cars for making informed decisions while navigating, accessing traffic conditions, and safety of passenger and driver. Thus, the rising use of robot operating systems in the automotive industry for the development of autonomous cars and advanced driver assistance systems drives the growth of the robot operating system market.

High cost

The increased cost of the installation of the robot operating system and robotics operations in the industries are not affordable for small and medium enterprises due to the technology and maintenance costs that restrain the adoption of the robot operating system market.

Rising investment in automation and robotics

The continuous rise in investment in research and development activities in the innovation and further advancements in the robotic sector by the leading technology players are driving the growth of the robot operating system market. The rising investment in the expansion and the adoption of robotics in the number of high-volume manufacturing units and strategic collaboration between the leading companies are emerging as opportunities in the growth of the robot operating system market.

The autonomous mobile robots segment is expected to show the fastest growth in the robot operating system market during the forecast period. The growth of the segment is attributed to the rising demand for efficient and highly advanced automated systems by various industries such as automobile, warehouse and logistics, healthcare, agricultural business, and others that drive the demand for the autonomous mobile robots segment. Autonomous mobile robots are totally different from the traditional type of robots that need a predefined system that relies on the tracks and requires the operator to operate.

These types of robots understand and adapt to the environment as required. These robots are equipped with several advanced technologies such as artificial intelligence, sensors, IoT (Internet of Things), machine learning, and others that drive the enhanced services provided by autonomous mobile robots (AMRs). It has cameras and sensors installed, which help them overcome and navigate unnecessary obstacles in the working environment. Thus, the higher efficiency of the AMRs is driving the adoption of the segment.

The home automation and security segment is anticipated to showcase significant growth in the robot operating system market during the forecast period. The increasing demand for smart home applications and digitization by the population in every field of lifestyle boosts the demand for the home automation and security segment. The rising economic conditions in the developed and developed countries drive the per capita income and result in higher spending on lifestyle and demand for technologically advanced consumer electronics in the household and the rising demand for advanced security systems for households that boosts the growth of the segment. The increasing intervention of the major technology players in the production and innovations in consumer electronics boosts the growth of the segment.

The healthcare segment is expected to have significant growth in the robot operating system market during the predicted period. The globally rising population and the increasing burden of chronic illness are driving the demand for well-developed healthcare infrastructure, which is driving the growth of the segment. The rising healthcare infrastructure and the integration of technologies revolutionize the services and the operation of the healthcare industry.

The advancements in robotics in the healthcare industry are positively impacting the various medical facilities and services and automation in the various procedures. Robots perform various functions, including interacting with patients, handling and operating various critical patient conditions, and pharmaceutical applications such as drug innovations and discovery. Thus, all the benefits are driving the adoption of robotics in the healthcare industry.

Segments Covered in the Report

By Type

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

July 2024

April 2025

August 2024