March 2025

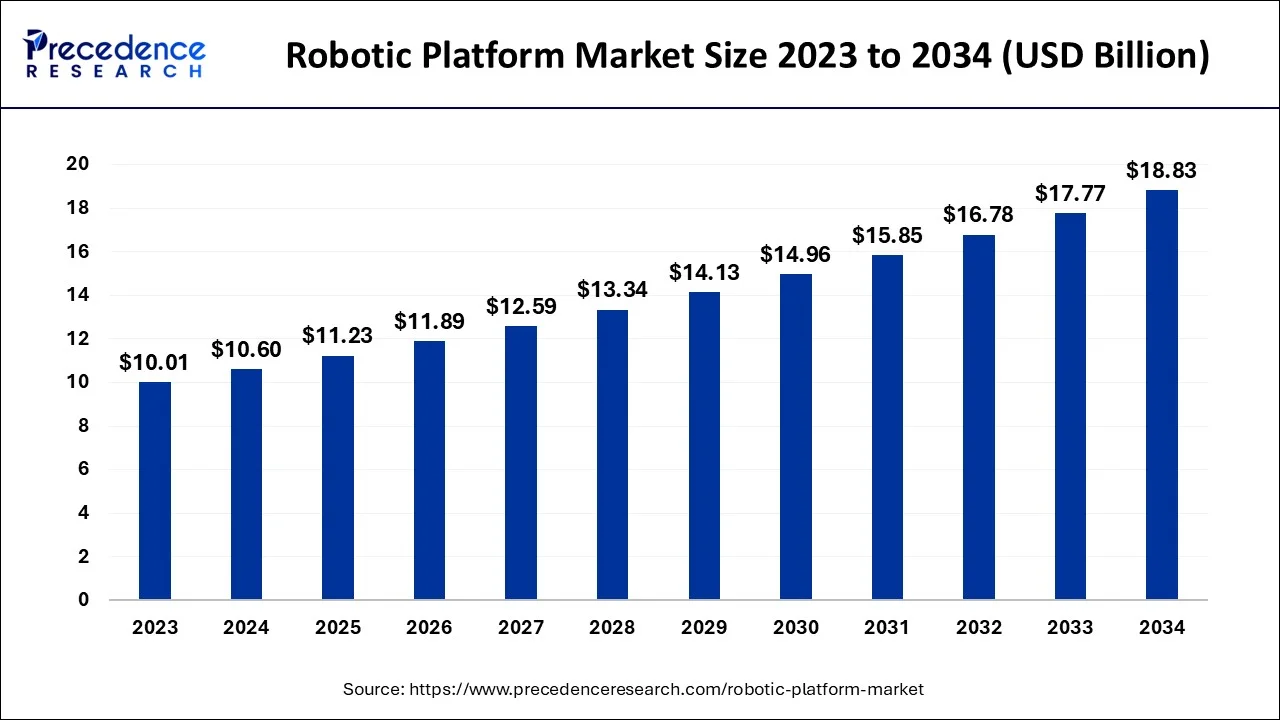

The global robotic platform market size accounted for USD 10.60 billion in 2024, grew to USD 11.23 billion in 2025 and is projected to surpass around USD 18.83 billion by 2034, representing a CAGR of 5.91% between 2024 and 2034. The North America robotic platform market size is calculated at USD 3.82 billion in 2024 and is expected to grow at a fastest CAGR of 6.05% during the forecast year.

The global robotic platform market size is calculated at USD 10.60 billion in 2024 and is projected to surpass around USD 18.83 billion by 2034, expanding at a CAGR of 5.91% from 2024 to 2034. The increasing need for industrial automation, advancements in technology, rising adoption of IoT, and growth of e-commerce boost the market growth.

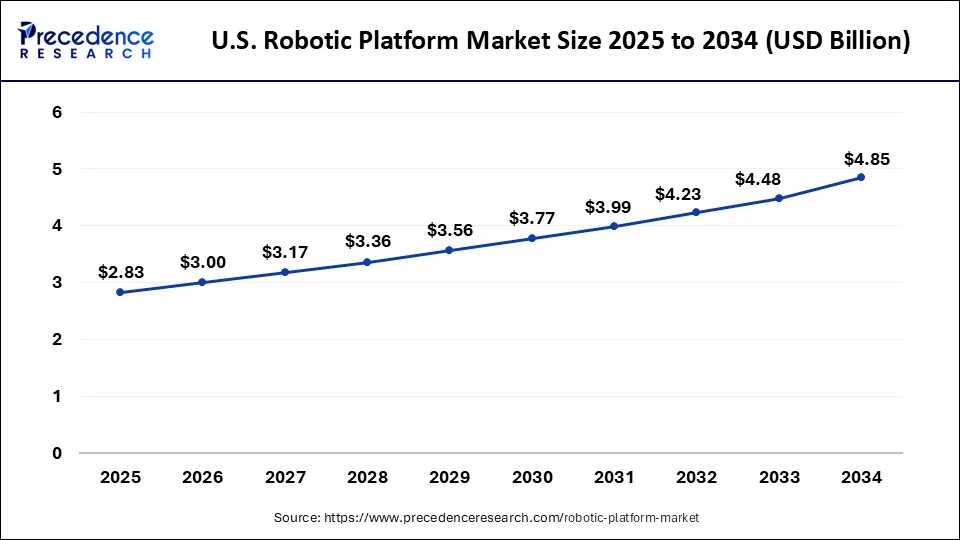

The U.S. robotic platform market size was exhibited at USD 2.67 billion in 2024 and is projected to be reach around USD 4.85 billion by 2034, poised to grow at a CAGR of 6.13% from 2024 to 2034.

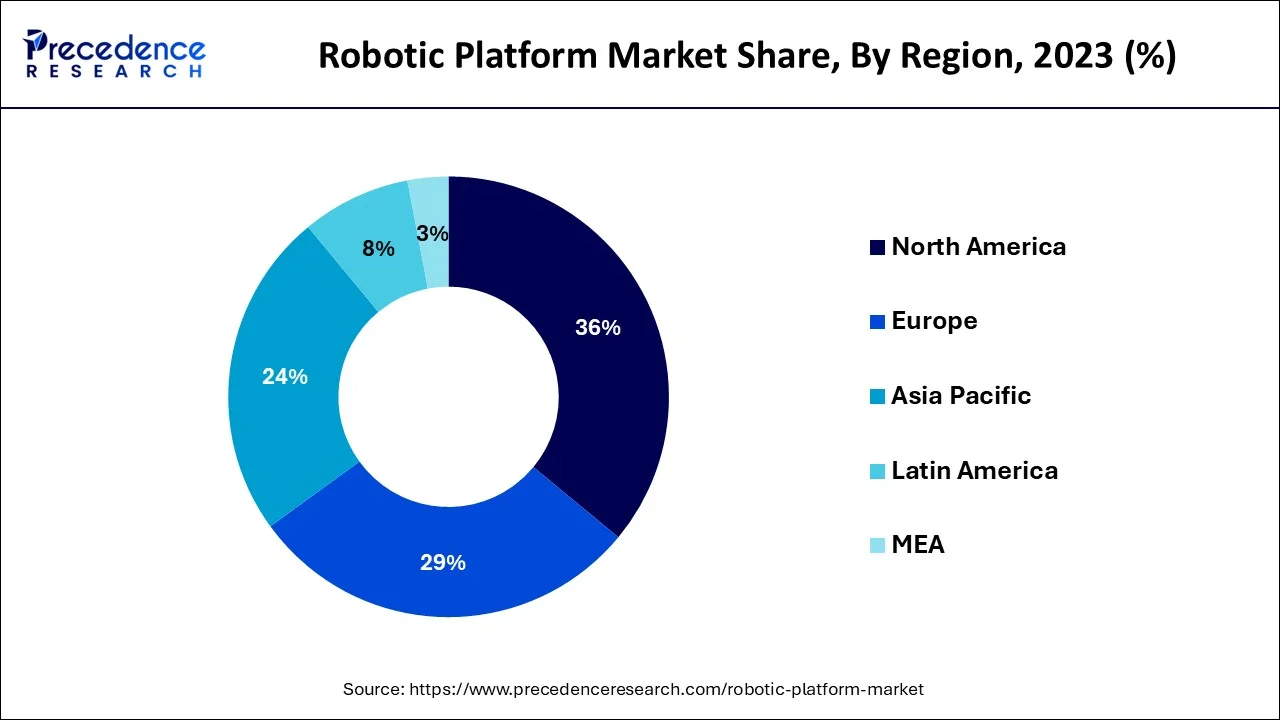

North America dominated the robotic platform market with the largest share in 2023. This is primarily due to the high adoption of new technologies and the rising focus on automation in many industries, such as healthcare, defense, manufacturing, and transportation. Robotic platforms increase productivity and efficiency in industrial procedures by reducing possible errors. Countries such as the U.S. and Canada are investing heavily in robotics research and development. In addition, there is a great demand for robots in the region's healthcare and defense sectors.

Asia Pacific is expected to witness the fastest growth in the market in the upcoming period due to factors such as growing industrialization, rising use of robotics in manufacturing industries, rising adoption of AI technologies, and the increasing need for automation. China, Japan, India, and South Korea have been at the forefront of using advanced robotic platforms. Several manufacturing industries in the region, especially electronics, automobile, and logistics, have recognized the importance of robotics in automation, thus contributing to the market growth.

A robotic platform is a system on which frameworks are built to support the functions and activities of robots. The platform's proficiencies and limitations are determined by its design, R&D, and manufacturing. The robotic platform market is expanding rapidly due to the rising need for automation across various industries, such as healthcare, transportation, and manufacturing, to improve efficiency and flexibility and reduce labor expenses.

Platforms used to build and test robotics applications:

| Platforms | Application |

| Google ROBEL | ROBEL is an open-source platform of cost-effective robots designed to aid research and development of hardware in the real world |

| Microsoft AirSim | This platform captures data for models from wheeled robotics and aerial drones to static IoT devices |

| Microsoft AirSim | This platform captures data for models from wheeled robotics and aerial drones to static IoT devices |

| Apollo Baidu | This open and secure software platform enables the development of autonomous driving systems through on-vehicle and hardware platforms |

| NVIDIA Isaac | It is a cloud-based robotics integrated development platform, which allows developers to develop, test, and deploy robotics applications and build intelligent robotics functions |

AI Impact on the Robotic Platform Market

Integrating artificial intelligence (AI) algorithms into robots enables them to learn from experience, make decisions on the basis of data, and adapt to new situations. Machine learning, natural language processing, and computer vision are fundamental to smart robotic systems. These AI technologies analyze data and recognize patterns, leading to enhanced capabilities and improved robot performance over time.

| Report Coverage | Details |

| Market Size by 2034 | USD 18.83 Billion |

| Market Size in 2024 | USD 10.6 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.91% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Robot Type, Deployment, Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rapid adoption of robots

Robot adoption can be referred to as integrating robotics into various facets of industries, ranging from manufacturing to supply chain. Labor safety issues, automation requirements, and rising labor and energy costs are major factors boosting the adoption of robots in various industries. However, robots support process automation, eliminate errors, and enhance production speed, thus improving quality, increasing accuracy and production scalability, and reducing labor costs.

Data security and increasing cyberattacks

The increasing risk of cyberattacks poses a significant threat to the robotic platform market. Robots gather and stream confidential information among various components. This makes them susceptible to cyber threats. Robots also expose organizations to hacking if hackers control them. Therefore, it is crucial to mitigate these risks through more stringent security regimes, constant updates, as well as testing software.

Government initiatives

Government and private entities are collaborating to develop innovative solutions. In addition, government entities are investing heavily in robotics research and development to maximize the potential applications. This financial backing from the government also encourages tech companies to innovate by introducing advanced robots that minimize the possibility of errors.

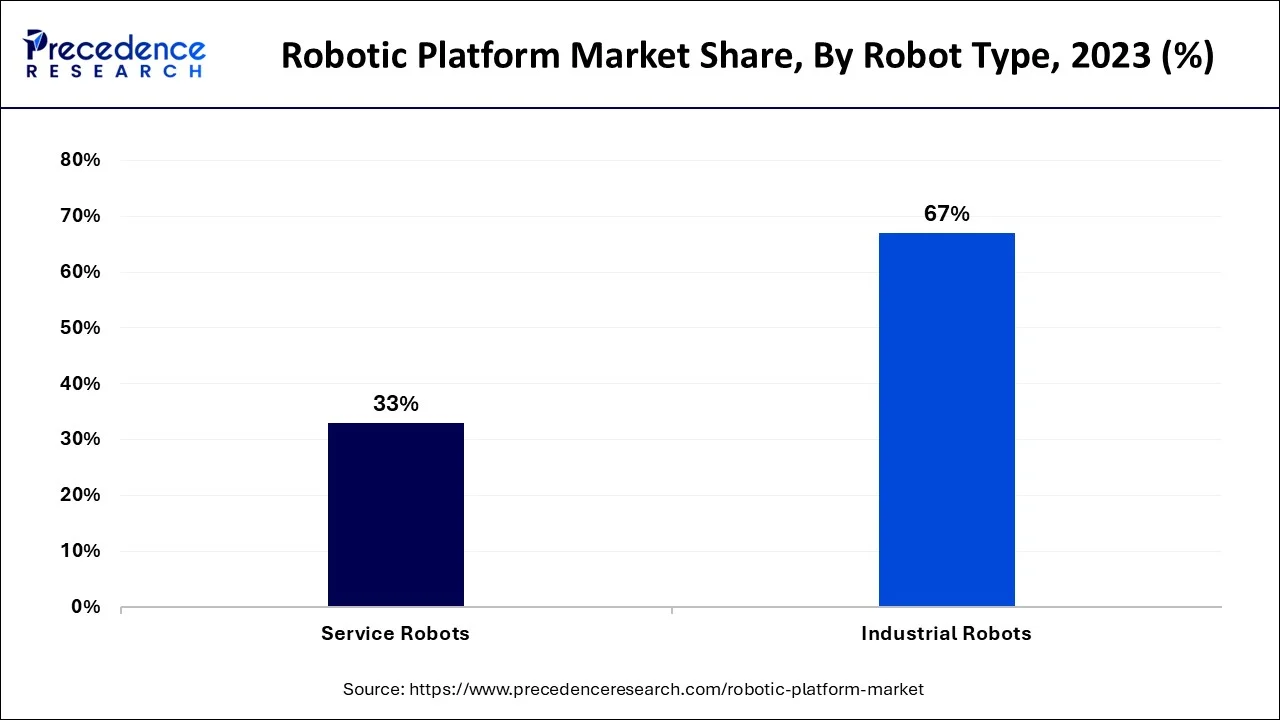

The industrial robots segment accounted for the largest share of the market in 2023. This is mainly due to their enhanced functionality, effectiveness, and adaptability in a range of industrial applications. These robots have the ability to handle complex tasks across several industries, from the production line in manufacturing industries to the inspection of the quality of drugs in the pharmaceutical industry.

They help in assembly lines, surgeries, warehouse management, crop monitoring, planetary exploration, streamlining processes, enhancing efficiency, and performing tasks in hazardous or challenging environments. Industrial robots are automated, programmable, and can move on three or more axes. The rising industrialization worldwide is further boosting the usage of robots.

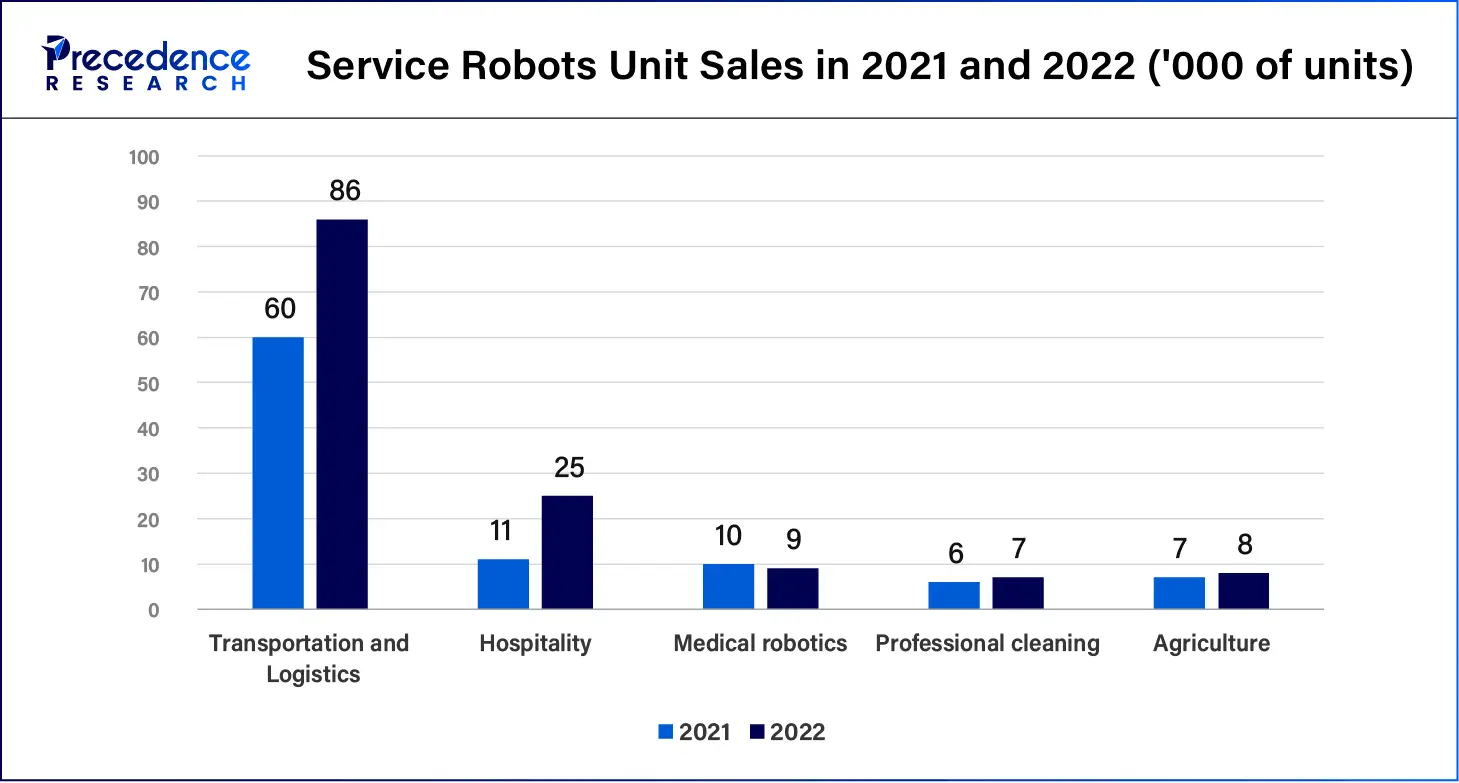

The service robots segment is expected to expand at the fastest growth rate in the robotic platform market during the forecast period. A service robot is a robot used for carrying out useful activities for people or equipment. These robots handle complex functions more efficiently, such as navigating dynamic environments or cooperating with customers in real-time. Service robots support human beings by performing dirty, dull, distant, dangerous, or repetitive jobs. They can assist individuals with disabilities, promoting greater independence and inclusion.

The on-premises segment dominated the robotic platform market with the largest share in 2023. On-premise robots can be mounted within an organization and managed onsite rather than being in the shared cloud or both. The benefit of on-premises systems is that they do not depend on the Internet, which eliminates the possibility of Internet failures or slow connections affecting the robot's work. On-premises robots are fitted at the client location and controlled through a network connection for each machine. Robots can perform repetitive tasks more efficiently than humans, increasing output and reducing costs.

The cloud segment is expected to grow significantly in the coming years. Cloud robotics combines applications of cloud computing, cloud storage, and other over-the-internet technologies relevant to robotics. The advantage is the opportunity to deliver significantly large amounts of data directly to the robotic devices without embedding it within the built-in memory.

Predictive analytics, which is made possible through cloud integration, helps companies predict maintenance needs, reducing downtime and repair costs. They can also use cameras and sensors to identify defects and adjust manufacturing processes. They can also be remotely monitored and controlled.

The stationary segment led the robotic platform market with the largest share in 2023. Robots that are fixed to the ground, ceiling, or some other surface are known as stationary robots. These robots cannot move. They are frequently used as robotic arms mainly for operations such as picking and placing, sorting, assembling, welding, and finishing. Stationary robots are highly valued for their precision and consistency, making them ideal for the automotive, electronics, and pharmaceutical industries. Such robots are designed to complete tasks with minimal deviation, ensuring quality control in mass production.

The mobile segment is projected to register the fastest growth during the foreseeable period. This is due to the rising adoption of autonomous mobile robots (AMRs) in logistics, warehouses, and e-commerce. A mobile robot is a mechanical and electrical apparatus that works through software and hardware to detect its operating setting and navigate the environment. These robots have the ability to move and explore, transport payloads or revenue-creating cargo, and complete complex tasks via an onboard system and corresponding robotic arms.

The manufacturing segment dominated the robotic platform market with the largest share in 2023. Sustainability and energy efficiency are becoming important to manufacturers. However, robotics plays a key role in maintaining sustainability. Robots are being developed to use less power and minimize resource wastage during manufacturing. In manufacturing industries, robotics is typically employed in fabricating, finishing, transferring, and assembly of elements. Robots automate repetitive tasks to reduce errors and enable workers to focus on more productive areas of the operation, allowing them to upskill and offer more job satisfaction.

The healthcare segment is expected to expand at a significant pace throughout the forecast period. Robotics is gaining popularity in the healthcare industry. Many hospitals are using robots for patient assistance, especially in areas like elderly care and rehabilitation. Robots also help surgeons in operations, reducing the physical strain on surgeons.

Robotic exoskeletons support rehabilitation and help patients recover mobility post-injury. Telemedicine robots permit remote consultations, which are crucial in areas with limited medical access. Robots also assist in drug dispensing, surgeries, and precise needle placement. Moreover, they have the ability to carry out repetitive and tedious nursing functions.

Segments Covered in the Report

By Robot Type

By Deployment

By Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

December 2024

October 2024