August 2024

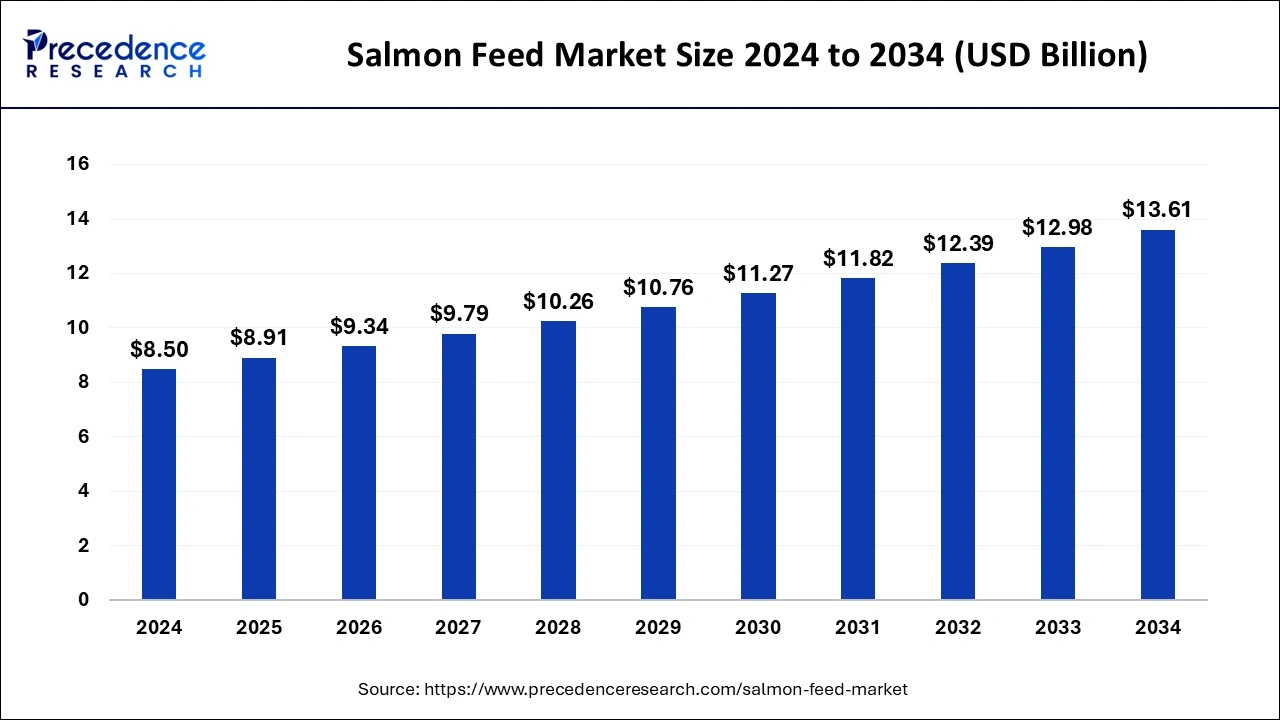

The global salmon feed market size is accounted at USD 8.91 billion in 2025 and is forecasted to hit around USD 13.61 billion by 2034, representing a CAGR of 4.80% from 2025 to 2034.

The global salmon feed market size was calculated at USD 8.50 billion in 2024 and is predicted to reach around USD 13.61 billion by 2034, expanding at a CAGR of 4.82% from 2025 to 2034. The demand for sustainable salmon feed has increased, leading to driving the growth of the global salmon feed market. growing concern for nutrition sufficient diets is contributing to the salmon feed productions. Additionally, the increased consumer demand for high-quality protein solutions is fueling the market expansion.

Artificial intelligence integration is making a significant impact on production capabilities, supply chain management, and market statistics robust to the salmon feed market. AI algorithms provide disease acknowledgment for fish and management solutions to the farmers by analyzing vast amounts of data and real-time monitoring. The leveraging sensors in aquaculture are helping farmers to advance culture as well as production capabilities and reduce labor costs and wastage, which is further helping to provide healthy raw materials for the development of salmon feed.

AI integration further helps to improve water quality management, maintain environmental sustainability, and improve harvesting and processing. AI-enabled IoT technologies like advanced sensors, cameras, and data analytics tools are playing a crucial role in improving aquaculture as well as the manufacturing of salmon feed.

Salmon is rich in omega-3 fatty acids and a highly nutritious protein source. The growth of the salmon feed market has been transforming due to increased demand for sustainable and high-quality protein sources. The rising prevalence of nutrition deficiency is a key factor driving demands for salmon feeds. The rising sustainability trends, as well as consumer demands for sustainable foods.

Government and regulatory initiatives and investments in the adoption of sustainable aquafarming and support for the manufacturing of sustainable feeds are shifting the market toward success. To comply with regulatory frameworks and satisfy consumer demands, major companies are promoting sustainable salmon feed, such as plant-based feed.

The integration of advanced technologies like machine learning, AI, deep learning, and Internet of Things (IoT) technologies in aquaculture is transforming farming methods and improving productivity. The increased focus on feed formulation and supply chain management has led to increased adoption of cutting-edge technologies in the salmon feed market. The market is projected to enhance dynamics due to advancing formulation methods by leveraging such technologies.

| Report Coverage | Details |

| Market Size by 2024 | USD 8.50 Billion |

| Market Size in 2025 | USD 8.91 Billion |

| Market Size in 2034 | USD 13.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.82% |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Types, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Sustainability concerns

Sustainability initiatives are playing a crucial role in driving the growth of the global salmon feed market. Regulatory initiatives and key companies’ investments in developing sustainable feed production methods to reduce waste are contributing to the market expansion. Key companies are adopting sustainable practices to comply with regulatory standards. The rising promotion of eco-friendly ingredients used by companies is emerging in the market.

Additionally, consumer awareness of environmental impacts is increasing demand for sustainable seafood products. The increased sustainable demands have driven innovations and developments of sustainable feed options, including plant-based proteins and insects. The adoption of eco-friendly production methods has risen. The company's commitment to gaining sustainable seafood labels and certifications such as ASC and MSC continuously enhances salmon feed market competition.

Regulatory compliance

The rising cost due to regulatory compliance and burdens can highly restrain the growth of the salmon feed market. The strict regulations on aquaculture practices, water quality, waste management, and sustainability cause challenges for feed manufacturers and salmon farmers. Moreover, regulatory compliance regarding food safety standards and labeling maximizes the cost of feed manufacturers. The regulations of stocking densities and feeding practices in animal welfare also increased cost investments for farmers.

Technology advancements

Technology advancements, like precision feeding systems to improve feed efficiency, reduce waste, and improve fish growth and health, are generating ways to improve the salmon feed market. The leverage of cutting-edge technologies for real-time monitoring, disease identifications, and growth optimizations is helping to advance farming strategies. Additionally, the adoption of technologies like sensors and cameras is a major contributor to improving fish health as well as farming methods. With the adoption of digitalization and automation in aquaculture and feed formulation, the efficiency and productivity of the salmon feeds have witnessed improvement.

The rising demands for sustainability have shifted manufacturers toward the adoption of plant-based protein extraction and algae production methods in the salmon feed market. The requirement to comply with regulatory standards and the utilization of recycling and upcycling technologies are seeking growth. Additionally, ongoing research and development for technologies to develop customized feed formulations are expected to boost the market growth in the forecast period.

The general feed segment accounted for the largest salmon feed market share in 2024 due to its wide availability and large production quantity of dry, wet, and live feeds. The segment growth is further attributed to the cost-effectiveness of general feeds compared to other specialized feeds. The ability of general feeds to balance the diet of salmon to comply with required nutrients has emerged for their wide production. With the rising sustainability goals among diets as well as aquaculture processes, as well as limited water and land resources, the general feeds are more complex with such requirements. The rising adoption of low-input aquaculture and the production of general feeds are highly driven.

The indirect sales segment led the global salmon feed market in 2024. The rising adoption of low-input aquaculture is the major factor driving the growth of the indirect sales segment. Manufacturers are seeking broader customers like small-scale farmers and hobbyists. The logistics support from wholesalers, distributors, and retailers is contributing to the segment's growth. As there is now a need for investments in direct sales manufacturers, indirect sales have become more affordable and effective by helping farmers improve their productivity.

North America dominated the global salmon feed market in 2024 due to the adoption of advanced technologies in aquaculture. Government support and companies’ investments in research & development are fueling innovations in salmon feed. Moreover, the growing focus on sustainability is driving the market expansion in the region. The United States is leading the regional market due to the presence of strong and advanced aquaculture industries, including West Coast salmon farming and Alaska’s salmon industry.

The increased demand for high-quality feeds is driving innovations that are leading to boosting the country's salmon feed market growth. Canada accounted for the fastest-growing country in the region's market due to increased consumer preference for sustainable consumption and healthy diets. Government initiatives, support for manufacturers, and investments in R&D and sustainability are rapidly fueling the country's market growth.

Europe will witness significant growth during the forecast period. The increased demand for consumption of healthy salmon is the key factor driving the growth of the salmon feed market in Europe. Strict environmental regulations for sustainability and animal welfare standards contribute to the region's market expansion.

The easy availability of raw materials like fish oils and fish meals and the growing investments in the production of high-quality salmon feeds are fueling regional salmon feed market growth. With government support and regional shifts toward sustainability, major companies are committed to investments in research and development, productivity, and infrastructure.

By Types

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

July 2024

August 2024