November 2024

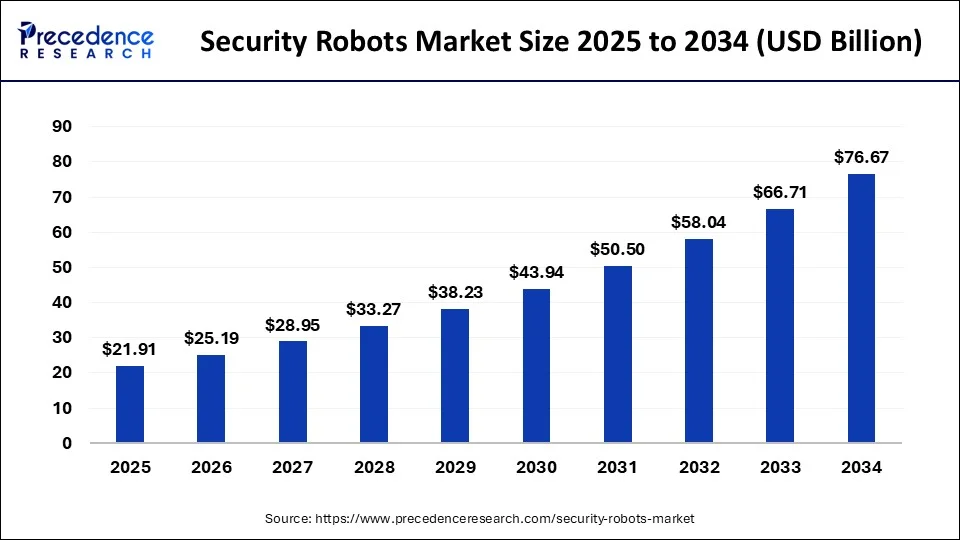

The global security robots market size surpassed USD 16.59 billion in 2023 and is estimated to increase from USD 19.07 billion in 2024 to approximately USD 76.67 billion by 2034. It is projected to grow at a CAGR of 14.93% from 2024 to 2034.

The global security robots market size is anticipated to reach around USD 76.67 billion by 2034 from USD 19.07 billion in 2024, at a CAGR of 14.93% from 2024 to 2034. The security robots market is driven due to heightened safety concerns and advancements in robotic technology.

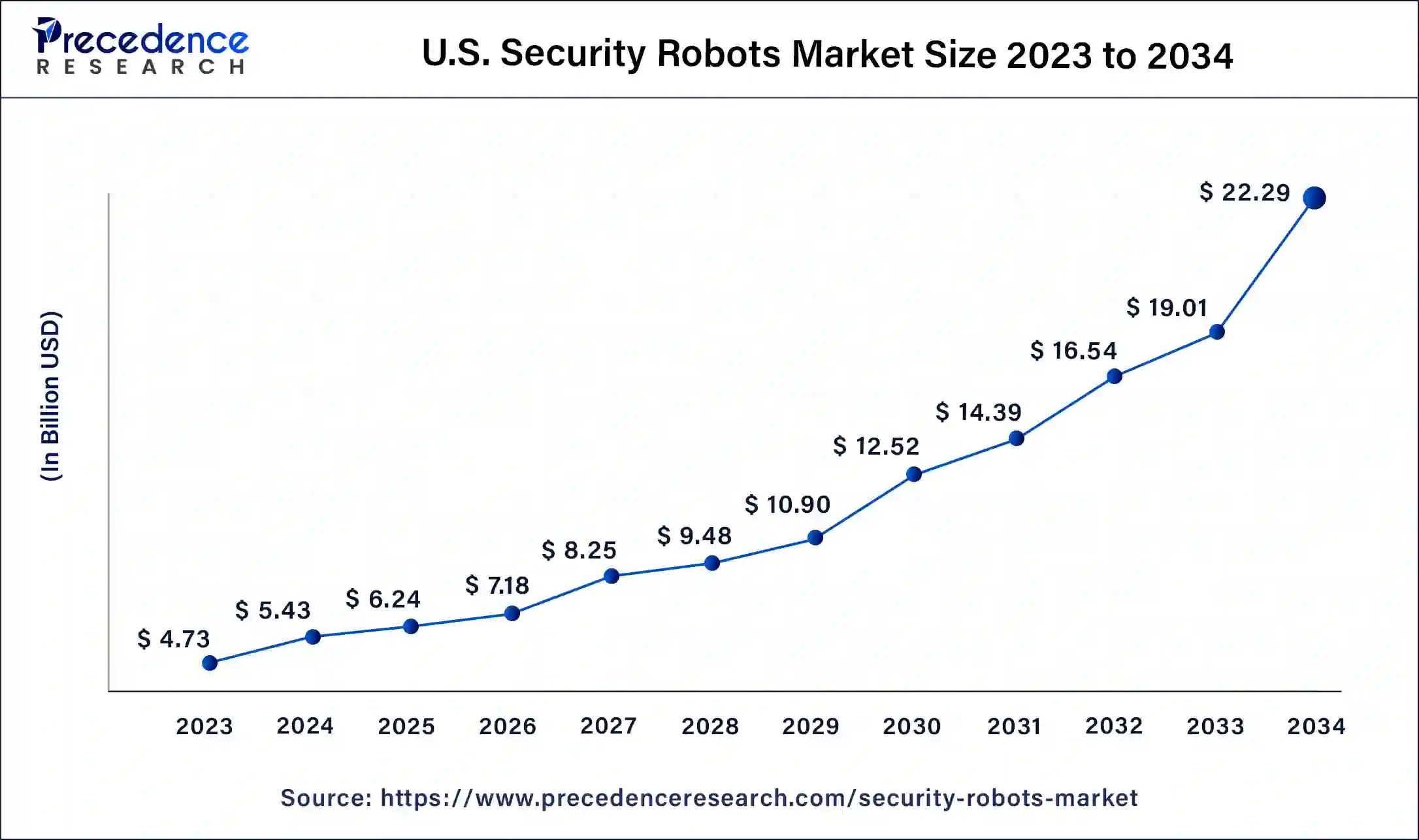

The U.S. security robots market size was exhibited at USD 4.73 billion in 2023 and is projected to be worth around USD 22.29 billion by 2034, poised to grow at a CAGR of 15.13% from 2024 to 2034.

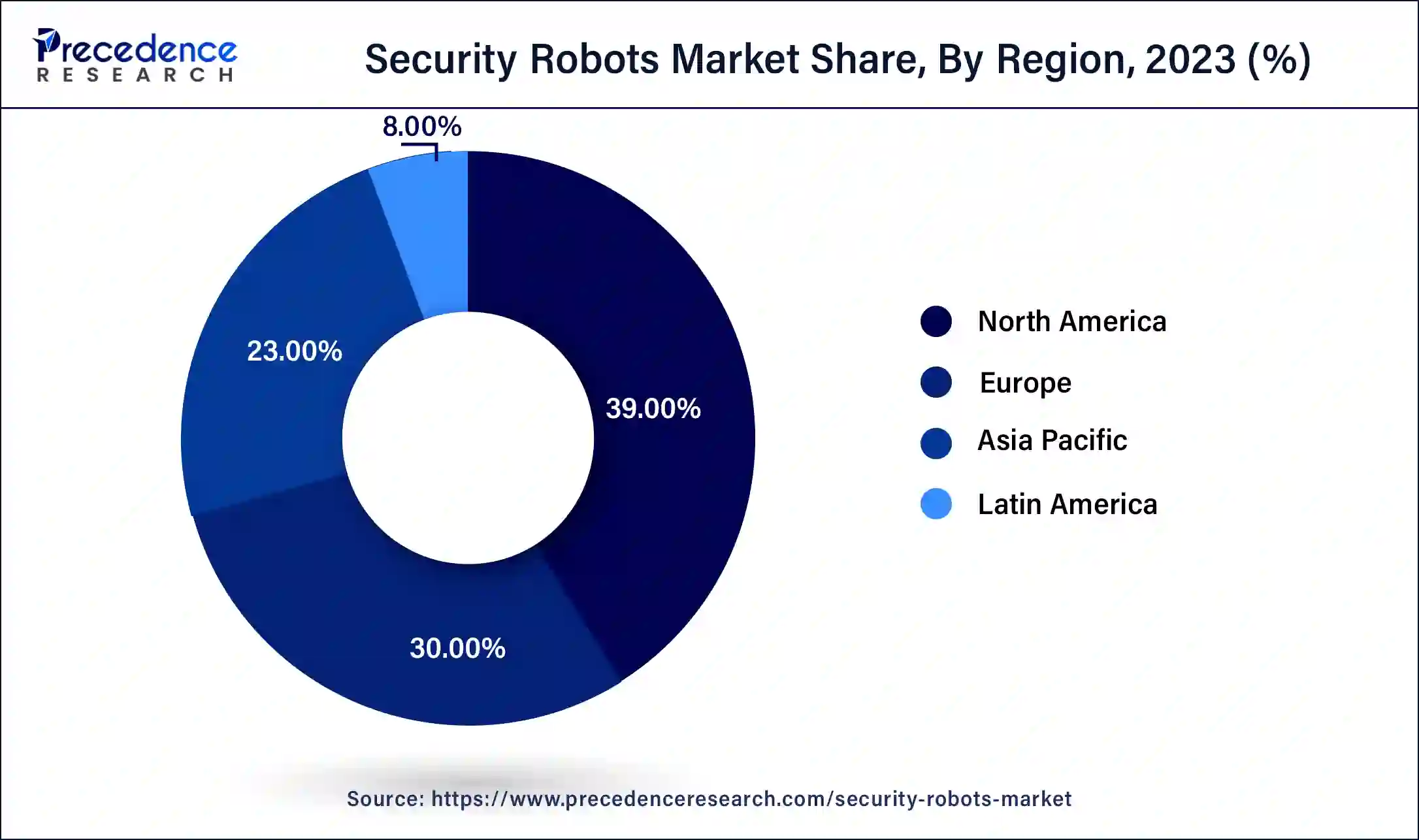

North America held the dominating share of the security robots market in 2023 and the region is observed to remain significant during the forecast period. With the support of a favorable regulatory environment and significant investment, the region is a hub for leading businesses and research institutes that propel advancement. The market’s expansion is further aided by high adoption rates, both commercial and non-commercial.

The National Robotics Initiative (NRI) has been utilized by the federal government of the United States to enhance domestic robotics capabilities. The National Research Institute (NRI) funds fundamental research to accelerate the creation and widespread application of human-assisted collaborative robots (co-robots). These variables make North America a definitive center for security robot progressions.

Asia Pacific is expected to grow at a the fastest rate in the security robots market during the forecast period. Due to rising urbanization, rising security concerns, and advancements in robotics technology, the region’s security robots market is expanding rapidly. By 2030, India intends to become a global robotics leader in the manufacturing, healthcare, agriculture, and national security sectors.

As a component of its more extensive vision, the Public System on Advanced Mechanics expects to improve the financial and socio-specialized benefits of automated innovation while tending to and relieving related dangers and difficulties. The Chinese government is devoted to encouraging mechanical advancement and propelling the mechanical technology area.

Security robots address a significant advancement in the field of safety systems, evolving to satisfy the emerging needs for upgraded well-being and proficiency. These autonomous devices are intended to help and increase conventional safety efforts as opposed to supplanting human security staff completely. Their capacities include region observation, patrolling, threat detection, and even threat response, offering a cost-effective solution for boosting security operations.

By reducing the dependence on human staff and providing a higher level of security at a lower cost, robots, particularly when used outdoors, stand to transform security procedures for larger facilities. This innovative advancement sets new industry guidelines and elevates the overall effectiveness of securing people and property.

AI Integration in the Security Robots Market

Integration of artificial intelligence (AI) in the security robots market artificial intelligence is improving the capabilities of security tools, making it possible for them to carry out more difficult tasks and make decisions on their own. Simulated intelligence oversees fluctuation and unconventionality in outer conditions by empowering robots to gain information and improve their exhibition after some time.

Security robots outfitted with computer-based intelligence influence cameras, sensors, and different advancements to execute security assignments. Even though AI integration has significantly enhanced robotics system functionality, these systems are susceptible to various security threats, including adversarial attacks, data breaches, and system manipulations, which can compromise functionality, safety, and reliability. Thus, the security of AI-powered robotics remains a critical area of ongoing research and development.

| Report Coverage | Details |

| Market Size by 2034 | USD 76.67 Billion |

| Market Size in 2023 | USD 16.59 Billion |

| Market Size in 2024 | USD 19.07 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.93% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing security concerns

A guard robot, also known as a surveillance robot, patrol robot, or robotic security guard, is intended for checking and safeguarding regions. The security robots market products can be adjusted for indoor, outside, or joined conditions, given safety prerequisites. Independent portable robots are changing the security and investigation industry. Retailers and organizations utilize these robots to get premises, distinguish robbery, and improve general well-being. In different areas, mechanical security frameworks are reshaping border security, giving a trustworthy and high-level way to deal with reconnaissance and safety efforts.

Their precision, dependability, and trend-setting innovation empower them to convey exceptional reconnaissance, working persistently. This developing accentuation on security concerns is driving the extension of the security robots market.

Impact of high costs on robotic adoption

A significant obstacle to the security robots market is their high cost. Scaling production and achieving cost efficiencies are difficult because many robotic applications necessitate individualized solutions that are tailored to specific environments and requirements. Different software, parts, and manufacturing processes may be needed for each robot, which could cost a lot. Additionally, the process of incorporating robotics into supply chains can be time-consuming and costly. Both introductory and progressing upkeep costs can make mechanical technology restrictively costly for small and medium-sized undertakings.

The complexity of the security robots market products, with their various parts and subsystems, maintenance, and repairs, expands administration expenses and time. India’s high import dependence and limited domestic production capacity further raise costs, making them less affordable. The continuous appearance of security concerns, problems, vulnerabilities, and threats has led to the misuse of robots through cyber-attacks, resulting in severe injuries and even the loss of human life.

Advancements in 3D printing robotics

Product design is speeded up, costs and waste are reduced, and more complex designs are possible with additive manufacturing, also known as 3D printing. Late headways in 3D printing of delicate and adaptable materials have been significant for growing delicate robots, which offer more prominent security and versatility in different conditions. Delicate mechanical technology, an extending field, includes a robot that is delicate and deformable, empowering adaptable cooperation in testing and capricious circumstances. 3D printing improves the complex and work-escalated manufacture of delicate robots, taking into consideration more multifaceted plans and speedier creation. These factors drive the growth of the security robots market.

The unmanned aerial vehicle (UAV) segment held the dominating share of the security robots market in 2023. Automated ethereal vehicles, regularly known as robots, have turned into a far and wide and fundamental piece of current life. Aerial photography, precision agriculture, forest fire monitoring, environmental tracking, infrastructure inspection, and other uses go far beyond security. They are utilized in economic, commercial, military, academic, and other applications.

Progresses in innovation have made UAVs safer, lightweight, powerful, open, and practical. These developments in charge, scaling down, and computerization have empowered robots to succeed in errands, for example, getting to war zones, giving quick portability, and directing airborne missions.

Sagar Defence Engineering, a defense manufacturing company based in Pune, was given a contract in June 2024 from the Defense Research and Development Organization (DRDO) and the Navy to create an underwater-launched unmanned aerial vehicle.

The unmanned underwater vehicle UUV) segment is expected to grow at a notable rate in the security robots market during the forecast period. The vehicles known as UUVs are made to operate underwater without the presence of humans. They are used to observe underwater environments from afar, whether for wreckage inspection or environmental monitoring. Without a tether to the surface for monitoring and inspection, autonomous underwater vehicles and unmanned underwater vehicles carry out underwater tasks. At the same time, AUV offers a financially savvy option in contrast to conventional vessels.

The patrolling segment accounted for the biggest share of the security robots market in 2023. An area is monitored by a patrolling robot, which makes use of sensors and internet connectivity to detect and report suspicious activities to improve safety and security. Furnished with cameras, mouthpieces, and movement indicators, the robot can notice its environmental elements and recognize likely dangers.

It can notify authorities of unusual activity thanks to its internet connection. The robot follows a foreordained course and can be modified to examine peculiarities, raise cautions, or contact specialists if important. This computerized video observation offers cost-adequacy, takes on new security drifts, and guarantees fast handling.

The rescue operations segment is expected to witness considerable growth in the security robots market over the forecast period. National security becomes increasingly crucial as the population grows. There is a possibility that surveillance robots can solve this problem. In rescue operations, including the detection of bombs, the identification of suspected terrorists, and the response to fire incidents, robots play a crucial role. They are necessary for tasks like rescue, security, and surveillance.

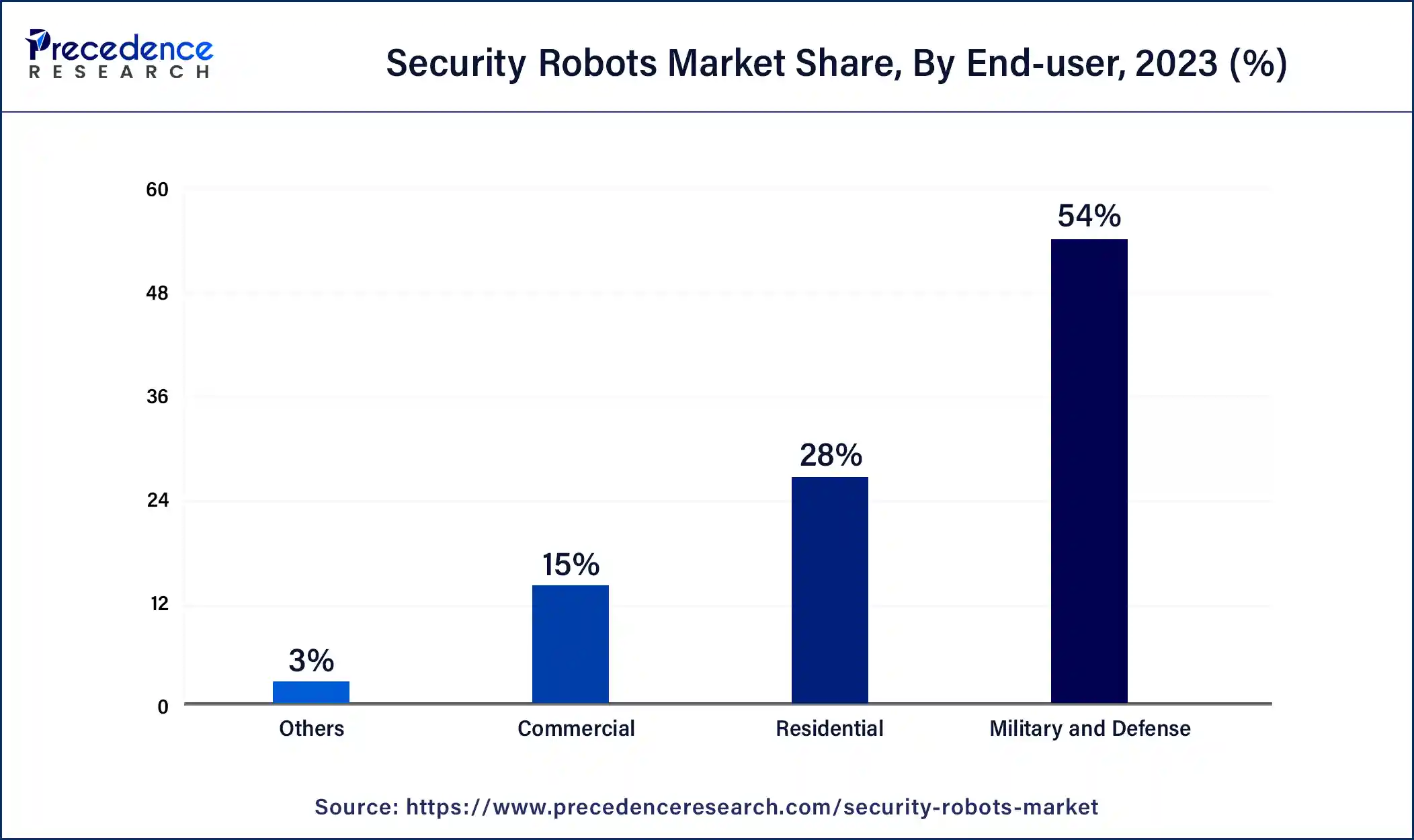

The military & defense segment held the largest share of the security robots market in 2023. A critical improvement in this space is the multifunction military robots, which are flexible frameworks intended to do a wide variety of guard and security errands. This robot incorporates progressed versatility, sensors, powerful control frameworks, and secure correspondence interfaces, making it appropriate for different tasks. Upgrade military capacities, limit dangers to the work workforce, and meet different mission necessities. To enable the robot to carry out activities like bomb disposal, surveillance, and reconnaissance, components and technologies are carefully selected.

The commercial segment is expected to grow at the fastest rate in the security robots market during the forecast period. Administration robots, which incorporate cleaning robots for public regions, conveyance robots for workplaces and medical clinics, putting out fires robots, recovery robots, and careful robots, are progressively used for different business undertakings and worked via prepared staff. Surveillance robots have become essential in industrial applications for monitoring critical infrastructure and enhancing safety by detecting leaks, thermal overloads, and unauthorized access. As a result, they provide valuable commercial solutions.

Segments Covered in the Report

By Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

October 2024

July 2024

August 2024