February 2025

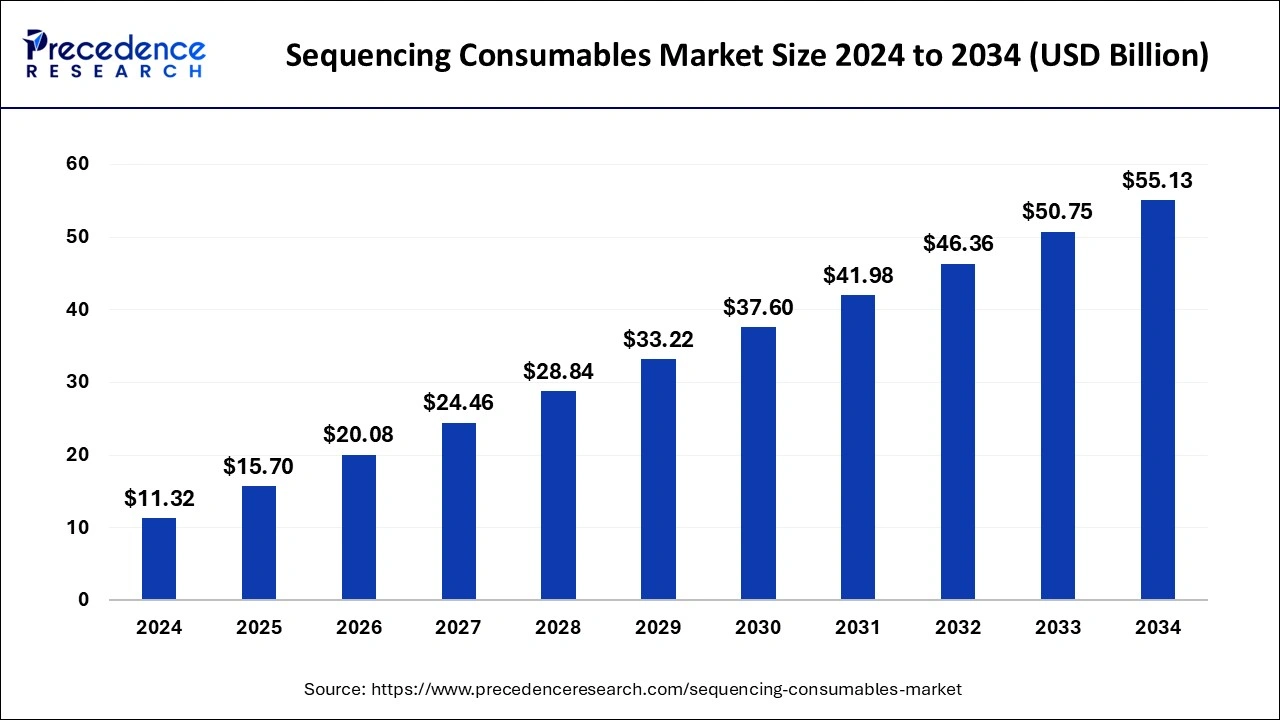

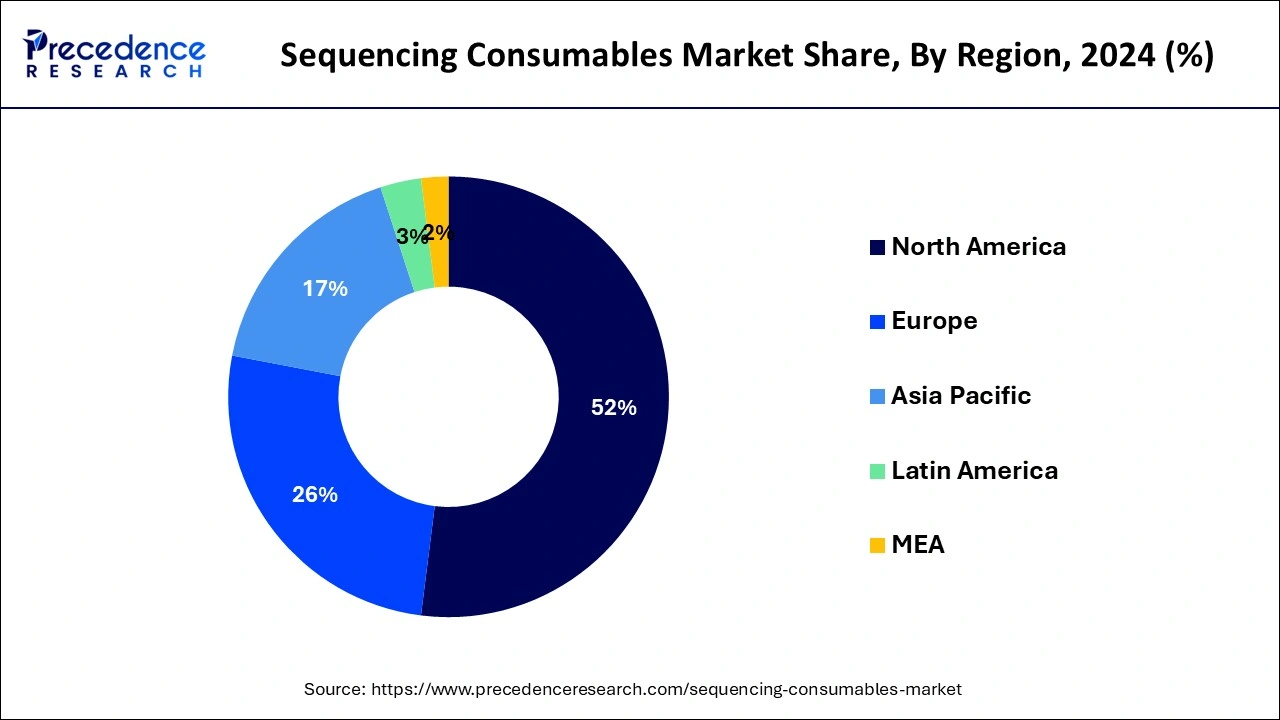

The global sequencing consumables market size is evaluated at USD 15.70 billion in 2025 and is forecasted to hit around USD 55.13 billion by 2034, growing at a CAGR of 17.15% from 2025 to 2034. The North America market size was accounted at USD 5.89 billion in 2024 and is expanding at a CAGR of 17.18% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global sequencing consumables market size accounted for USD 11.32 billion in 2024 and is predicted to increase from USD 15.70 billion in 2025 to approximately USD 55.13 billion by 2034, expanding at a CAGR of 17.15% from 2025 to 2034.

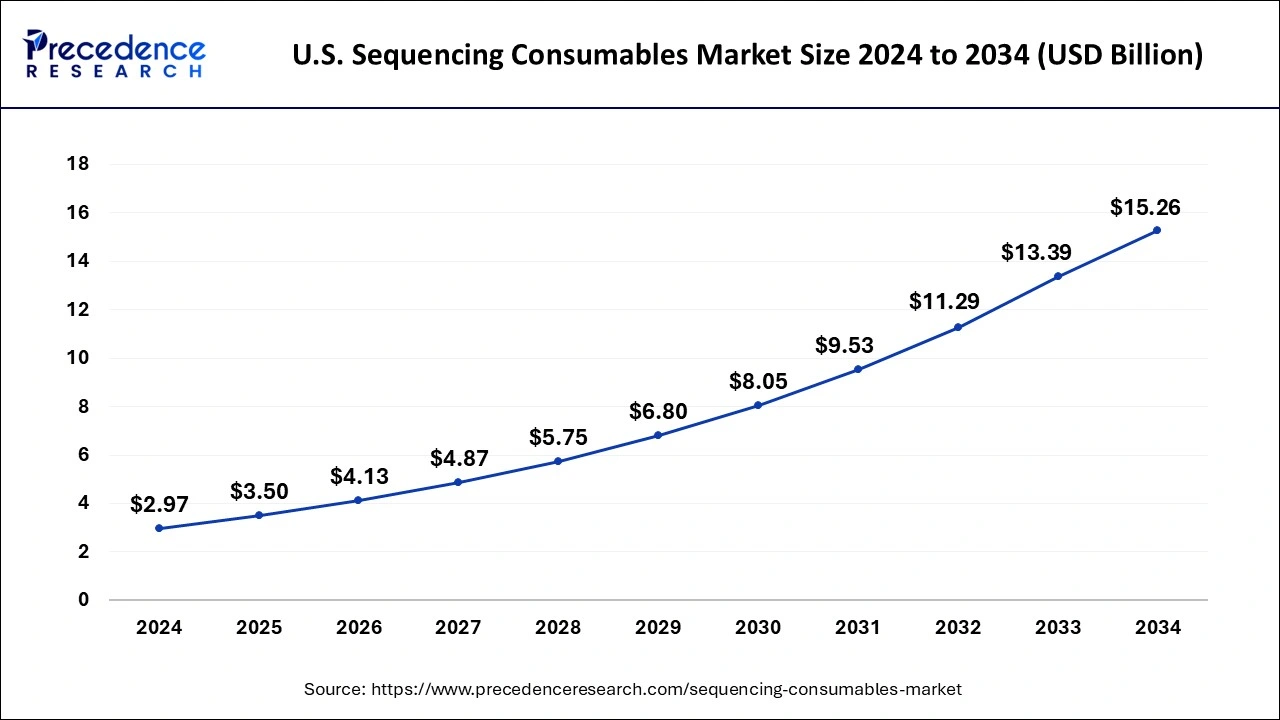

The U.S. sequencing consumables market size was exhibited at USD 2.97 billion in 2024 and is projected to be worth around USD 15.26 billion by 2034, growing at a CAGR of 17.78% from 2025 to 2034.

North America dominates the sequencing consumables market due to its advanced healthcare infrastructure, robust research and development activities, and significant investments in genomics. The region houses major biotechnology and pharmaceutical companies, renowned research institutions, and hosts large-scale genomics projects.

Additionally, favorable government initiatives, such as the Precision Medicine Initiative in the United States, drive demand. The well-established presence of key market players and a high adoption rate of advanced sequencing technologies contribute to North America's major share in the global sequencing consumables market.

Asia-Pacific is poised for rapid growth in the sequencing consumables market due to expanding genomics research, increasing healthcare investments, and a rising focus on precision medicine. With a CAGR of approximately 15%, the region is a hotspot for market expansion. Countries like China and Japan drive this growth with significant investments in genomics, large-scale research initiatives, and a burgeoning biotechnology sector. Additionally, rising awareness, evolving healthcare infrastructure, and government support contribute to the Asia-Pacific position as the fastest-growing market for sequencing consumables.

Meanwhile, Europe is growing at a notable rate in the sequencing consumables market to increasing investments in genomics research, expanding applications in healthcare, and a surge in precision medicine initiatives. In 2020, the European genomics market was valued at over $9 billion. Factors such as collaborative research projects, advancements in healthcare infrastructure, and a rising focus on personalized medicine contribute to this growth. The region's commitment to large-scale genomics initiatives and a supportive regulatory environment positions Europe as a key contributor to the expanding global sequencing consumables market.

The sequencing consumables market encompasses a diverse range of products essential for DNA sequencing processes, including reagents, kits, and other consumables used in various sequencing technologies. The demand for these consumables has surged with the continuous evolution of genomics and advancements in sequencing techniques. Next-generation sequencing (NGS) technologies, in particular, have witnessed widespread adoption in research, clinical diagnostics, and personalized medicine, driving the need for specialized consumables. The market is characterized by key players offering a variety of products designed to support different sequencing platforms. As genomics plays an increasingly integral role in biomedical research and healthcare, the sequencing consumables market is expected to experience sustained growth, influenced by technological innovations, expanding applications, and the global push towards more personalized and precise approaches in genomics.

Sequencing Consumables Market Data and Statistics

MGI Tech announced a successful Series D funding round, securing an impressive $400 million. This substantial funding infusion is earmarked to propel MGI Tech's Research and Development (R&D) initiatives, further advancing its capabilities in genomics and molecular sequencing technologies.

In September 2023, Roche Diagnostics made a significant move by acquiring GenMark Diagnostics for $1.8 billion, marking a strategic expansion in the field of infectious disease diagnostics. This acquisition enhances Roche's capabilities in molecular diagnostics and strengthens its position in addressing infectious diseases through advanced diagnostic technologies.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 18.14% |

| Market Size in 2024 | USD 6.94 Billion |

| Market Size by 2034 | USD 50.75 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Platform, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Advancements in sequencing technologies

Advancements in sequencing technologies are propelling the sequencing consumables market, driving substantial growth. The continuous evolution of next-generation sequencing (NGS) has significantly impacted the genomics landscape. The decreasing cost of sequencing, exemplified by Illumina achieving the $1000 genome milestone in 2014, has democratized genomic research. This accessibility fuels demand, contributing to market expansion. NGS technologies, known for their speed and accuracy, have found applications in diverse fields, including clinical diagnostics, agriculture, and pharmaceuticals. Moreover, initiatives like the All of Us Research Program, aiming to sequence a diverse population, showcase the increasing integration of genomics into healthcare. As a result, the sequencing consumables market is poised for sustained growth, driven by the transformative impact of technological advancements on genomic research and its expanding applications.

Data analysis challenges

Data analysis challenges pose a significant restraint on the growth of the sequencing consumables market. The high-throughput nature of next-generation sequencing generates massive volumes of complex genomic data. Interpreting and analyzing this data require sophisticated bioinformatics tools and skilled personnel, contributing to increased operational costs. Additionally, the shortage of bioinformatics expertise can hinder effective data interpretation, leading to potential errors and delays in research outcomes. The complexity of data analysis also acts as a barrier for smaller research institutions and clinical laboratories, limiting their ability to fully leverage sequencing technologies. Addressing these challenges requires ongoing investment in bioinformatics infrastructure, training programs, and standardization efforts, impacting the overall market expansion by creating barriers to seamless data interpretation and utilization.

Renewable energy targets

Increased funding for genomic research is a key driver of opportunities in the sequencing consumables market.

This surge in funding supports large-scale genomic studies, pushing the boundaries of research in areas such as disease genetics, precision medicine, and population genomics. The demand for sequencing consumables rises in tandem with the expansion of these ambitious research projects, creating opportunities for market growth. Research funding enhances technological innovation, enabling the development of advanced sequencing technologies that, in turn, boost the consumption of related consumables. The collaborative nature of funded projects also drives partnerships between research institutions and sequencing consumable providers, fostering innovation and fueling the market's expansion.

The kits segment dominated the sequencing consumables market in 2024; the segment is observed to continue the trend throughout the forecast period. In the sequencing consumables market, the "kits" segment refers to packaged sets of consumables essential for DNA sequencing processes. These kits typically include reagents, enzymes, buffers, and other necessary components, streamlining the sequencing workflow.

A notable trend in the kits segment is the increasing demand for user-friendly and comprehensive kits that cater to various sequencing applications. Market players are focusing on developing kits that offer convenience, accuracy, and cost-effectiveness, meeting the diverse needs of researchers and laboratories engaged in genomics research and applications.

On the other hand, the reagents segment is expected to grow at a significant rate throughout the forecast period. In the sequencing consumables market, reagents constitute a crucial segment, encompassing chemical substances essential for DNA and RNA sequencing processes. These include buffers, enzymes, primers, and nucleotides required for DNA amplification, purification, and sequencing reactions. A notable trend in reagents for sequencing consumables involves continuous advancements to enhance sequencing accuracy and efficiency. Manufacturers focus on developing high-performance reagents, optimizing reaction conditions, and ensuring compatibility with evolving sequencing platforms, reflecting a commitment to driving the overall improvement of sequencing technologies in genomics research and diagnostics.

The second-generation sequencing consumables segment is observed to hold the dominating share of the sequencing consumables market during the forecast period. The second-generation sequencing consumables segment refers to materials used in next-generation sequencing (NGS) platforms, including technologies like Illumina sequencing. These consumables encompass reagents, kits, and cartridges required for high-throughput DNA sequencing. Trends in this segment include a continuous focus on enhancing sequencing accuracy, reducing costs per base pair, and improving turnaround times. Advancements in library preparation kits, sequencing-by-synthesis chemistry, and the development of novel sequencing platforms contribute to the dynamic landscape of second-generation sequencing consumables, meeting the evolving demands of genomics research, clinical diagnostics, and personalized medicine applications.

On the other hand, the third-generation sequencing consumables segment is expected to generate a notable revenue share in the market. Third-generation sequencing consumables cater to platforms that utilize advanced technologies, offering long-read sequencing capabilities. These consumables are designed for emerging platforms like Pacific Biosciences (PacBio) and Oxford Nanopore Technologies. The third-generation sequencing segment is witnessing increased demand due to the advantages of longer reads, which enhance genome assembly and aid in resolving complex genomic structures. As the field of genomics evolves, third-generation sequencing consumables are expected to play a pivotal role in enabling more accurate and comprehensive genomic analyses, contributing to the overall growth of the sequencing consumables market.

The cancer diagnostics segment is observed to hold the dominating share of the sequencing consumables market during the forecast period. The cancer diagnostics segment in the sequencing consumables market pertains to the utilization of sequencing technologies for analyzing genomic data in cancer cells. This involves identifying genetic mutations, variations, and biomarkers associated with different types of cancer. Trends in this segment include a growing emphasis on liquid biopsy methods, enabling non-invasive detection, and monitoring of cancer through the analysis of circulating tumor DNA. Additionally, advancements in bioinformatics tools enhance the precision of cancer diagnostics, driving the demand for sequencing consumables in oncology research and personalized medicine applications.

On the other hand, the pharmacogenomics segment is expected to generate a notable revenue share in the market. Pharmacogenomics, a pivotal segment in the sequencing consumables market, involves studying how an individual's genetic makeup influences their response to drugs. This field aims to optimize medication selection and dosage based on genetic factors. A notable trend is the integration of pharmacogenomic data into clinical decision-making, enhancing precision medicine initiatives. As genetic insights become more accessible, the demand for sequencing consumables in pharmacogenomics rises, facilitating the analysis of patient genomes for personalized drug therapy, minimizing adverse reactions, and optimizing treatment efficacy.

By Product

By Platform

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2023

January 2025

October 2024