What is the Serverless Architecture Market Size?

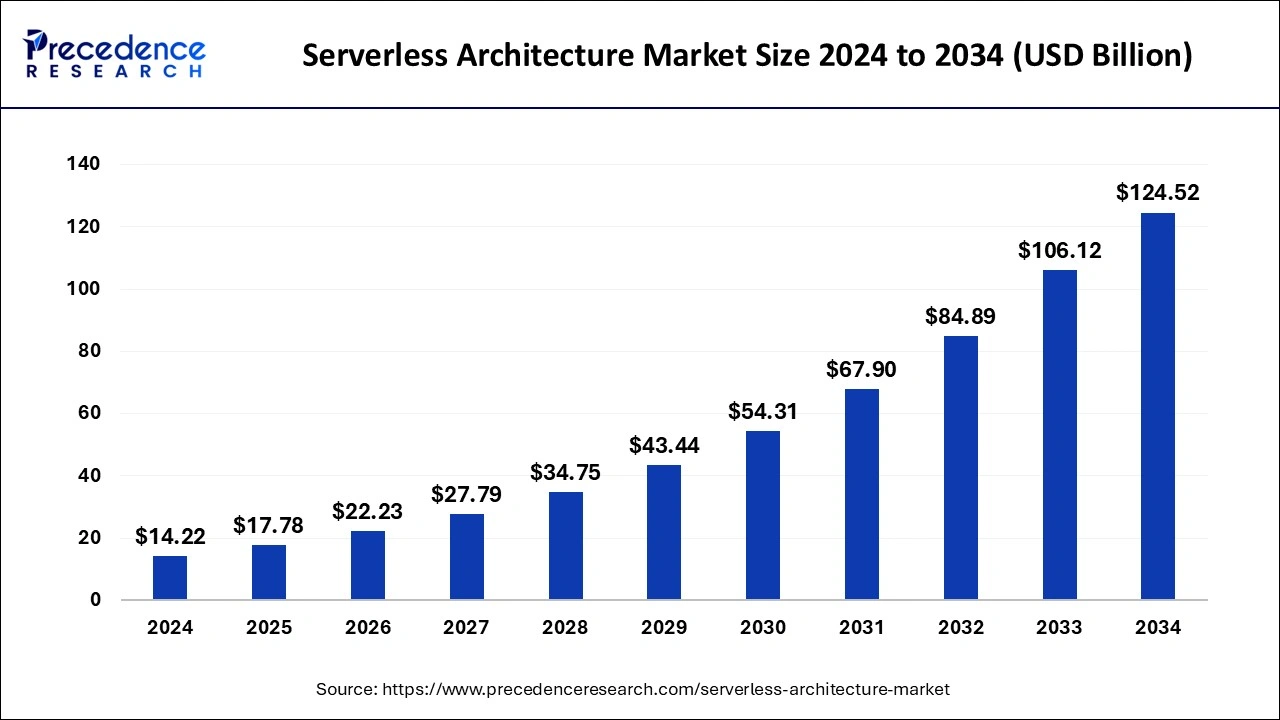

The global serverless architecture market size is calculated at USD 17.78 billion in 2025 and is predicted to increase from USD 22.23 billion in 2026 to approximately USD 124.52 billion by 2034, expanding at a CAGR of 24.23% from 2025 to 2034. The increasing adoption of software-based technologies in industries is driving the growth of the market.

Serverless Architecture Market Key Takeaways

- The global serverless architecture market was valued at USD 14.22 billion in 2024.

- It is projected to reach USD 124.52 billion by 2034.

- The market is expected to grow at a CAGR of 24.23% from 2025 to 2034.

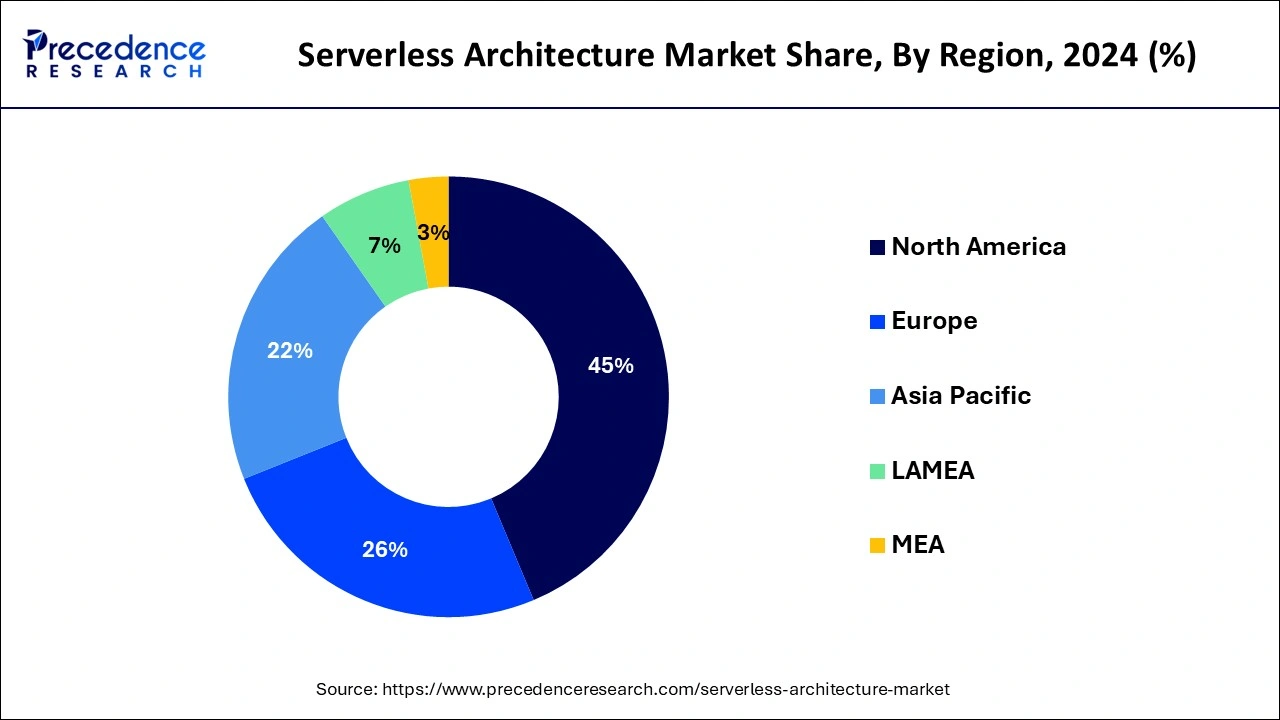

- North America led the market with the largest market share of 45% in 2024.

- By service, the automation and orchestration segment has held the major market share of 23% in 2024.

- By deployment model, the private deployment segment is projected to have the highest growth during the forecast period.

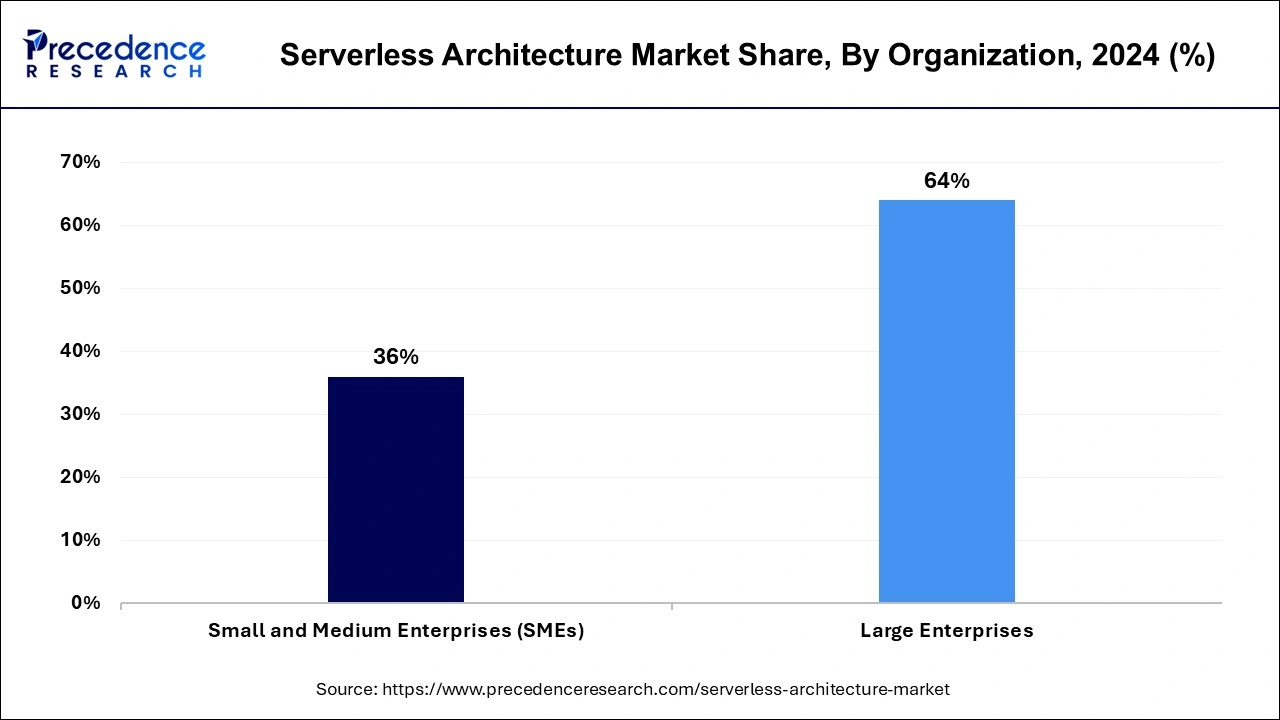

- By organization size, the large enterprise segment has contributed more than 64% in 2024.

- By application, the healthcare segment dominated the market in 2024.

What is Serverless Architecture?

The serverless architecture market provides serverless services, which is a type of software design that allows developers to design and build services without managing the primary infrastructure. Serverless architecture allows the designer to deploy code and the cloud provider provisions to run their applications, storage, and databases at any scale. Function as a Service (FaaS) is one of the most popular serverless architectures. In recent times, most developers have also used AWS Lambda to build serverless applications. Google and Microsoft also have their own FaaS offering, such as Google has Google Cloud Functions (GCF) and Microsoft has Azure Functions, respectively.

The serverless architecture market refers to the industry surrounding the development, deployment, and use of serverless computing technologies and services. Serverless architecture, also known as Function as a Service (FaaS), is a cloud computing model where the cloud provider dynamically manages the allocation and provisioning of servers. In this model, developers focus on writing and deploying code (functions) without needing to manage the underlying infrastructure such as servers, scaling, or maintenance.

Serverless Architecture Market Growth Factors

- The increasing adoption of serverless architecture by the leading tech giants and other IT industries is driving the growth of the serverless architecture market.

- The serverless architecture has properties like reduced operational cost, and the higher process agility is driving the market demand.

- Rising awareness about the adoption of serverless architecture in the organization can effectively manage the additional operational costs and time-consuming processes such as purchasing hardware components, configuration, installing, and troubleshooting that drive the growth of the market.

- The technological adoption of artificial intelligence, machine learning, and IoT in organizational operations is fueling the demand for serverless architecture.

- The increasing investment by the leading players in the research and development activities for innovations in technologies is boosting the growth of the serverless architecture market.

Serverless Architecture Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to grow significantly due to the rapid investment by market players for enhancing research and development of technologies coupled with increasing awareness about serverless architecture in developed nations.

- Major Investors: Several market players and strategic investors are actively entering this industry, drawn by collaborations, service launches and business expansions. Various technology providers such as Dynatrace, Fiorano Software, Inc., Galactic Fog IP, Inc., Google LLC, IBM Corporation and some others have started investing rapidly for developing serverless architecture to enhance the capabilities of app developers across the world.

- Startup Ecosystem: Various startup brands are engaged in providing serverless architecture to the end-user industries. The crucial startup brands dealing in serverless architecture consists of Vendia, Azion, Garden and some others.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 24.23% |

| Market Size in 2025 | USD 17.78 Billion |

| Market Size in 2026 | USD 22.23 Billion |

| Market Size by 2034 | USD 124.52 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service, By Deployment Model, By Organization Size, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand from organizations

There are several benefits associated with the serverless architecture in organizational operations; it can help to manage and streamline operations, reduce costs, and increase the agility of business operations. In serverless architecture, organizations only pay for the actual processing time of code uses, which can directly reduce infrastructural costs. It automatically scales the applications to the incoming traffic response. The adoption of serverless architecture allows developers to be more focused on writing codes and less on managing servers, which can increase productivity and efficiency and allow faster time to the market. It is the organic fit for the microservices architecture; it enables each function to be scaled and deployed independently. Serverless architecture can reduce latency and enhance user experience. Thus, all these factors drive the growth of the serverless architecture market.

Restraint

Lack of expertise

The relative complexities in serverless architecture, the lack of skilled technological expertise in the field of serverless architecture, and the risk associated with serverless architecture are restraining the growth of the serverless architecture market.

Opportunity

Rising adoption of technologies

The increasing adoption of technologies like web and mobile applications, IoT (Internet of Things), and real-time data processing. Serverless architecture is a well-suited technology for web and mobile applications, and developers focus on designing the functions and features without being pressured by server management. The server architecture allows developers to develop and deploy faster and enables organizations to deliver scalable and responsive applications for end users. In IoT devices, the serverless architecture enables the major solution for handling real-time data processing and device integration. Serverless architecture is also used in real-time data processing. Thus, the rising technological adoption will contribute to the expansion of the serverless architecture market in the upcoming period.

Service Insights

The automation and orchestration segment dominated the market in 2024. The increasing implementation of the serverless architecture in the automation and orchestration services to streamline operations drives the demand for the segment. Automation allows the execution of various tasks without any human intervention. Orchestration helps the automation process maintain and manage workflow systematically. The rising industrialization and the rapid growth in the large database and workflow requirements are driving the demand for higher efficiency solutions to reduce latency and increase efficiency in operations, driving the demand for serverless architecture in automation and orchestration. Additionally, the rising adoption of automation and orchestration in the IT industry is enhancing the growth of the serverless architecture market.

Deployment Model Insights

The private deployment segment is expected to grow at the fastest rate during the forecast period. The growth of the segment is increasing due to the rising adoption of private deployment of serverless architecture and the flexibility offered by private deployment. Private deployment provides more security to projects or applications. Organizations can host private deployment on-premises or manage it by third-party service providers.

Organization Insights

The large enterprise segment dominated the serverless architecture market in 2024. The growth of the segment is attributed to the benefits of serverless architecture offered to large enterprises, which drives the growth of the segment. The serverless architecture provides more flexibility and efficiency in operations and reduces the processing cost of the organizations.

Serverless architecture also provides advantages to applications such as data processing and real-time web applications, and the increasing focus on reducing or eliminating server management is boosting the growth of the market. The increasing competition in large enterprises and government interventions is accelerating the growth of the market.

Application Insights

The healthcare segment dominated the serverless architecture market in 2024. The growth of the segment is attributed to the higher adoption of technologies in the healthcare industry, which is driving the expansion of serverless architecture in the healthcare sector. The rising adoption of technological evaluations such as telehealth, telemedicine, and remote healthcare services enhance the health IT infrastructure that drives the demand for efficient solutions for the efficient workflow that drives the growth of the market.

The serverless architecture offers high-end solutions for the effective operation of high-traffic telehealth apps and other healthcare platforms. The increasing investments in the expansion of the healthcare industry and technological evaluation in healthcare applications are contributing to the expansion of the market.

The IT and telecom segment is observed to witness a significant rate of growth during the forecast period. IT and telecom companies often deal with fluctuating workloads and spikes in demand. Serverless architecture allows them to scale their applications dynamically based on demand without worrying about managing server infrastructure. This scalability is crucial for handling large volumes of data and user traffic that are common in these industries. By offloading server management tasks to cloud providers, IT and telecom companies can focus more on developing and improving their core products and services. This allows them to innovate more rapidly and stay competitive in a fast-paced industry.

Regional Insights

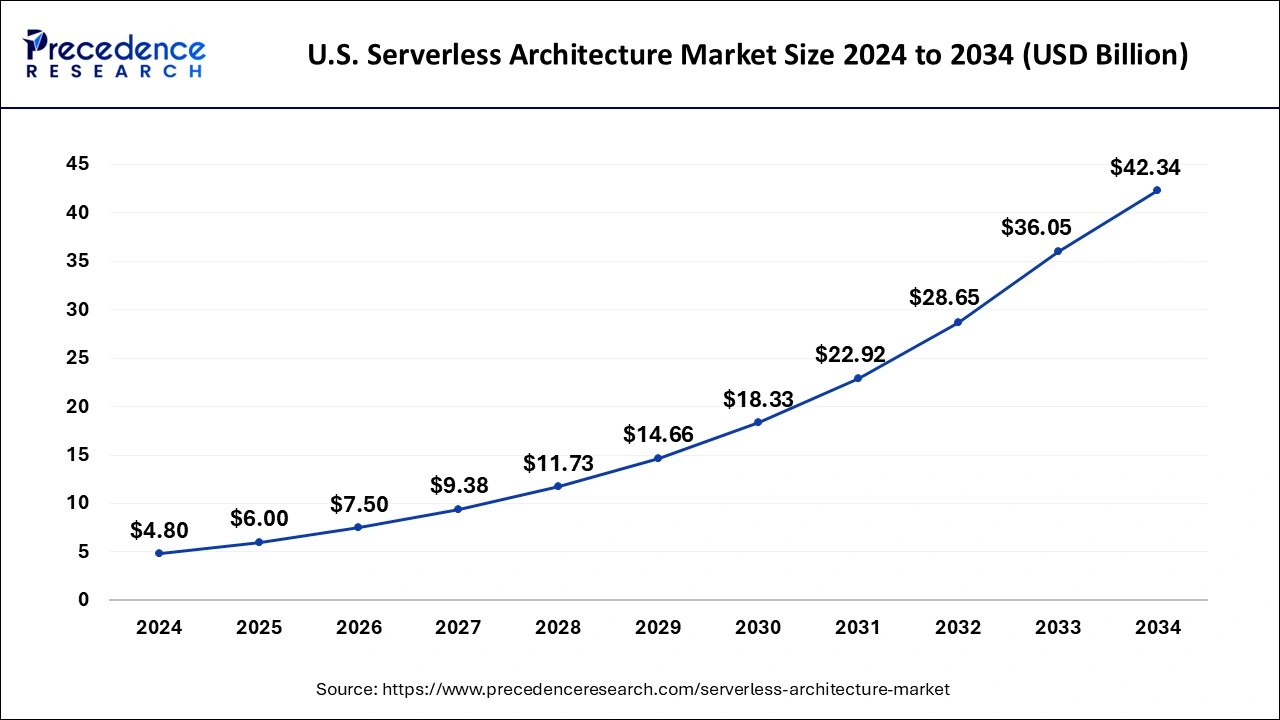

U.S.Serverless Architecture Market Size and Growth 2025 to 2034

The U.S. serverless architecture market size is estimated at USD 6.00 billion in 2025 and is predicted to be worth around USD 42.34 billion by 2034, at a CAGR of 24.32% from 2025 to 2034.

North America led the serverless architecture market, with the largest market size in 2024. The growth of the market in the region is increasing due to the rising IT infrastructure, and the increasing demand for scalable solutions in server management is driving the growth of the market. The increasing presence of leading tech giants like Amazon, Google, and Microsoft in the United States is contributing to the expansion of the market. Additionally, the rising technological adoption in various industrial applications is also boosting the growth of the market. The rising investments in infrastructural development in the United States and Canada and investments in research and development activities for product launches are driving the growth of the market across the region.

Asia Pacific is observed to witness the fastest rate of expansion in the serverless architecture market during the forecast period. The rapid growth of serverless architecture in the Asia Pacific region reflects the increasing adoption of cloud computing technologies and the need for scalable and cost-effective solutions. As businesses in the region strive to innovate and remain competitive, they are turning to serverless computing to streamline their operations, reduce infrastructure management overhead, and improve agility. Additionally, the proliferation of mobile devices and internet connectivity in the Asia Pacific region further drives the demand for scalable and responsive cloud services, making serverless architecture an attractive option for businesses looking to meet the needs of their customers efficiently.

What led Europe to hold a significant share of the industry?

Europe held a significant share of the market. The increasing emphasis of the BFSI sector to adopt cloud-platforms in numerous countries such as France, Germany, Italy, UK and some others has boosted the market expansion. Additionally, the presence of various market players coupled with rise in number of corporate offices is expected to boost the growth of the serverless architecture market in this region.

Why Latin America held a considerable share of the market?

Latin America held a considerable share of the industry. The growing adoption of serverless architecture by the healthcare sector in Argentina, Brazil, Peru and some others has driven the market growth. Also, rapid expansion of the manufacturing sector coupled with increase in number of SMEs is expected to drive the growth of the serverless architecture market in this region.

What made Middle East & Africa to hold a notable share of the industry?

The Middle East & Africa held a notable share of the market. The rising focus of large organizations to adopt serverless architecture for managing day-to-day operations has driven the market expansion. Also, partnerships among tech companies and AI developers to deploy advanced cloud-solutions in the e-commerce sector is expected to propel the growth of the serverless architecture market in this region.

Key Players: Providing cloud-based solutions to app developers

- Oracle Corporation: Oracle Corporation is a multinational technology company that develops and sells enterprise software, cloud services, and hardware. It was founded in 1977 and is a leading provider of cloud-based solutions such as enterprise resource planning (ERP) and database management systems, including its flagship Oracle Database.

- Platform9 Systems, Inc.: Platform9 Systems is a company that provides a SaaS-based managed platform for private and edge clouds, simplifying the deployment and management of virtual machines and containers. The company emphasizes operational efficiency and cost control through its Always-on Assurance model.

- Rackspace Inc.: Rackspace Technology Inc. is a multi-cloud, end-to-end hybrid cloud and AI solutions company headquartered in San Antonio, Texas, that designs, builds, and operates cloud environments for customers across all major technology platforms. Its services include managed hosting, private and public cloud management, and professional services for areas like data modernization and security.

- TIBCO Software Inc.: TIBCO Software Inc. is a US-based company providing integration, analytics, and event-processing software, with its solutions designed to connect applications and data for real-time insights. The company offers a wide range of deployment options, including on-premises and cloud, and serves various industries such as finance, healthcare, and telecommunications.

- Tarams Technologies: Tarams Technologies is a product engineering company specializing in technology consulting and software development for digital transformation. This company was founded in 2005 and provides numerous services including AI/GenAI, data and intelligence, experience design, and quality assurance, using a cloud-native and mobile-first approach.

- Twistlock: Twistlock is a cloud-native security platform that protects containerized applications across their entire lifecycle, from build to runtime. The platform provides security features such as automated policy creation, vulnerability scanning, compliance management, and runtime defense.

Serverless Architecture Market Companies

- Amazon Web Services, Inc.

- Alibaba Cloud

- CA Technologies

- Dynatrace

- Fiorano Software, Inc.

- Galactic Fog IP, Inc.

- Google LLC

- IBM Corporation

- Joyent Inc.

- Microsoft Corporation

- ModuBiz Ltd.

- Manjrasoft Pty Ltd.

- NTT Data

- Realm

Recent Developments

- In February 2024, KT Corp, a South Korean operator, is re-establishing itself as an AICT company and has collaborated with AWS for GenAI and private 5G development.

- In March 2024, DBOS, Inc., a leading player in developing the first cloud-native operating system, announced the launch of the DBOS Cloud, a transactional serverless application development platform that makes cloud applications rapidly and easily available for development, security, and deployment. DBOS raised seed funding of $8.5 million from Construct Capital, Engine Ventures, GutBrain Ventures, and Sinewave.

- In February 2024, the governing body of Fluence, Fluence DAO, and the first of the decentralized serverless computing network announced the launch of FLT and network on Ethereum Mainnet with the Fluence Platform which deployed on the InterPlanetary Consensus (IPC), which makes Fluence's “Cloudless” computing platform available for the first time.

- In October 2025, CoreWeave launched a serverless platform. This serverless platform is designed for the large organizations to enhance reinforcement learning.

(Source: https://www.techzine.eu ) - In August 2025, Oracle launched serverless distributed exadata database. This serverless service is designed for synchronizing data among different data centers.

(Source: https://www.techzine.eu ) - In February 2025, Solodev launched Keycloak Serverless and Managed Keycloak. These two cloud-based solutions are designed to help organizations in scaling authentication and access security with superior ease and flexibility.

(Source: https://www.globenewswire.com )

Segments Covered in the Report

By Service

- Automation and Orchestration

- API Management

- Monitoring

- Security

- Support and Maintenance

- Training and Consulting

By Deployment Model

- Private

- Public

- Hybrid

By Organization

- Large Enterprises

- Small And Medium Enterprises

By Application

- Healthcare

- Telecom and IT

- BFSI

- Government and Public

- Media and Entertainment

- Retail and E-commerce

- Manufacturing

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting