July 2024

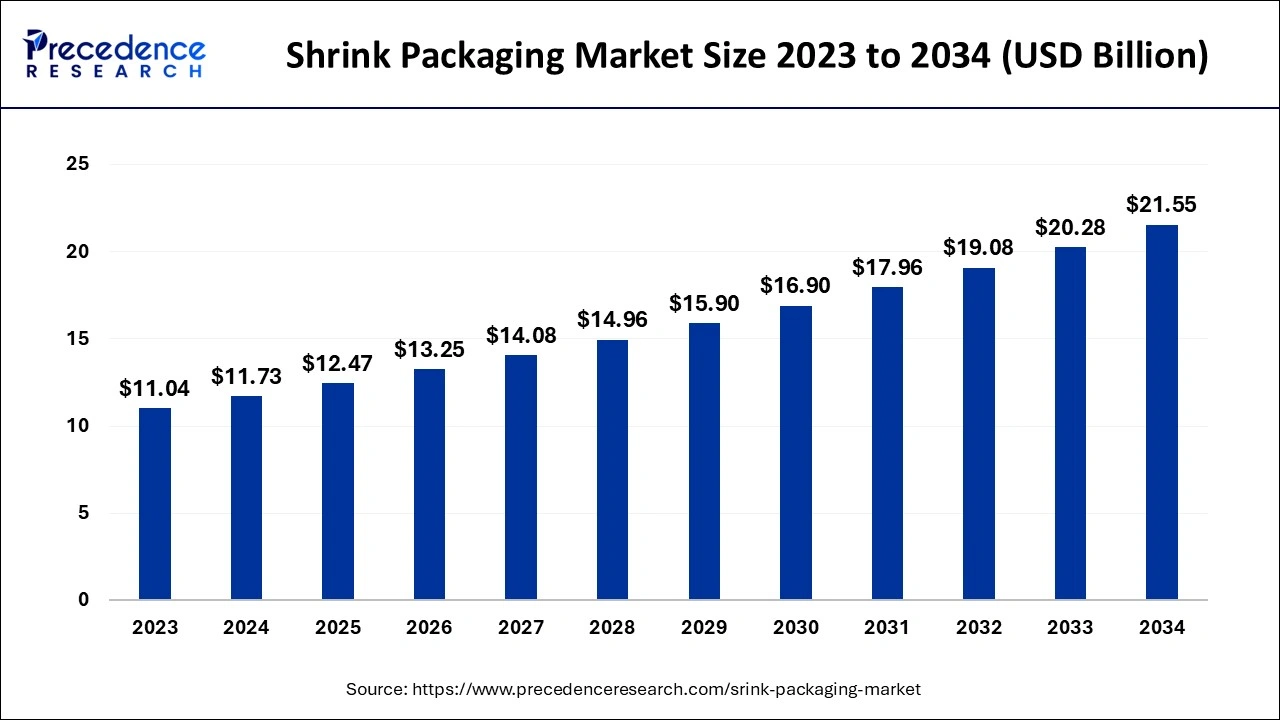

The global shrink packaging market size accounted for USD 11.73 billion in 2024, grew to USD 12.47 billion in 2025 and is expected to be worth around USD 21.55 billion by 2034, registering a CAGR of 6.27% between 2024 and 2034.

The global shrink packaging market size is worth around USD 11.73 billion in 2024 and is predicted to hit around USD 21.55 billion by 2034, growing at a CAGR of 6.27% from 2024 to 2034. Rapid industrialization and urbanization in developing countries are the key factors driving the shrink packaging market growth. Also, rising disposable income coupled with changing lifestyle preferences can fuel market growth further.

In the packaging industry, artificial intelligence is significantly transforming customer experiences in the shrink packaging market by offering smart packaging solutions. By using consumer data AI creates packaging solutions with textual and visual content which is personalized for each customer. Furthermore, packaging companies are increasingly implementing AI-driven customer support solutions to enhance consumer satisfaction and also to gain notable insights into their behavior.

The shrink packaging market involves the manufacturing and utilization of shrink-wrap materials for the purpose of packaging a variety of products. The industry uses thermal energy to shrink a plastic film tightly around a good, giving tamper resistance, protection, and aesthetic appeal to the product. In addition, shrink packaging offers a sophisticated and cost-effective solution compared to other packaging options. The overall process of applying this wrap is more rapid and straightforward.

Top 5 consumer goods companies of 2023

| COMPANY | 2023 NET REVENUE (USD billion) |

| L’Oréal | 44.572 |

| Heineken Holding N.V.* | 39.857 |

| Imperial Tobacco Group | 39.847 |

| Haier Smart Home Co., LTD.* | 36.529 |

| Mondelez International | 36.016 |

| Report Coverage | Details |

| Market Size by 2034 | USD 21.55 Billion |

| Market Size in 2024 | USD 11.73 Billion |

| Market Size in 2025 | USD 12.47 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.27% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Materials, Products, Applications, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising popularity in the retail sector

The growing popularity of shrink packaging market solutions in the retail sector is due to the effectiveness and aesthetic appeal provided by it. This packaging generally uses materials such as polyethylene which gives retailers a convenient way to safeguard their products from tampering, damage, and spoilage. In addition, it also offers a tightly sealed and protective covering that protects the product by giving it aesthetic appeal.

Compatibility concerns

Compatibility issues while packaging can occur when the used shrink material and the product about to be packaged do not interact well during the whole process. In the shrink packaging market, this concern can arise in many ways such as uneven shrinkage, inadequate shrinkage, and damage to the product because of improper sealing or excessive heat. Moreover, fluctuations in the distribution of heat or sealing techniques can cause improper results that affect the overall appearance and quality of the product.

Increasing focus on tamper resistance and product protection

The shrink packaging market is in high demand due to its ability to wrap products tightly, which keeps them safe from moisture, dust, and damage. It also protects the product from tampering or opening it without permission. That makes consumers feel safer and more confident regarding the product's safety. Furthermore, shrink packaging fulfills the demand of consumers who want to make their packaging safer. And it also keeps products in better condition during transport and storage.

The Polyethylene (PE) segment dominated the shrink packaging market in 2023 and is expected to grow at the fastest rate over the forecast period. The dominance and growth of the segment can be attributed to the increasing use of polyethylene for the packaging of medical, food & beverages, and many bulky and heavy products within these industries. Additionally, polyethylene has flexible and lightweight properties which can be beneficial in the packaging of heavy goods. It is also resistant to water and moisture making it the ideal packaging material.

The films & wraps segment led the global shrink packaging market in 2023. The dominance of the segment can be credited to the ability of films& wraps to offer significant protection levels as compared to regular films. Also, the versatility, durability, and water-resistance properties of this segment can expand their usage in various end-user industries, leading to the segment's growth in the market further. In the packaging industry films &wraps are popular due to their reflectivity, transparency, and high tensile strength.

The sleeves & labels segment is anticipated to grow at the fastest rate in the shrink packaging market during the projected period. The dominance of the segment can be driven by the increasing use of this product for the packaging of non-alcoholic beverages like water bottles and other food products. Furthermore, shrink sleeves can adhere tightly to the product shape giving a tamper-evident seal by fixing product integrity during transport and storage.

The food segment led the shrink packaging market. The dominance of the segment is due to the rising use of shrink wrap & films in the food industry to prevent the oxidation of food products and safeguard them from getting rancid. Furthermore, the shrink-wrap packaging provides a convenient barrier against external contaminants and improves the product's appearance and presentation on the shelves. Recent developments in shrink packaging technology have emphasized more on enhancing sustainability by using thinner films.

The consumer goods segment is estimated to show the fastest growth in the shrink packaging market during the forecast period. The growth of the segment can be credited to the growing use of sleeves, hoods, and labels in the packaging of consumer goods to ensure their safety. In addition, the key characteristics of shrink wrap packaging can protect consumer goods from the environment as well as from the mechanical or handling hazard, driving segment growth further.

Asia Pacific dominated the global shrink packaging market in 2023. The growth of the region can be credited to the strong presence of well-established pharmaceutical and healthcare infrastructure in developing countries like China and India. Furthermore, government regulations in the Asia Pacific play an important role in improving the market in the region.

North America is anticipated to grow at the fastest rate in the shrink packaging market over the projected period. The dominance of the region can be attributed to the rising demand for shrink ramps among the consumer goods and food & beverage sector. Shrink packaging provides benefits such as tamper resistance, product protection, and improved shelf appeal, which is appealing in regions like North America. Moreover, the surge of the e-commerce industry and online platforms has boosted.

By Materials

By Products

By Applications

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

January 2025

January 2025

January 2025