August 2024

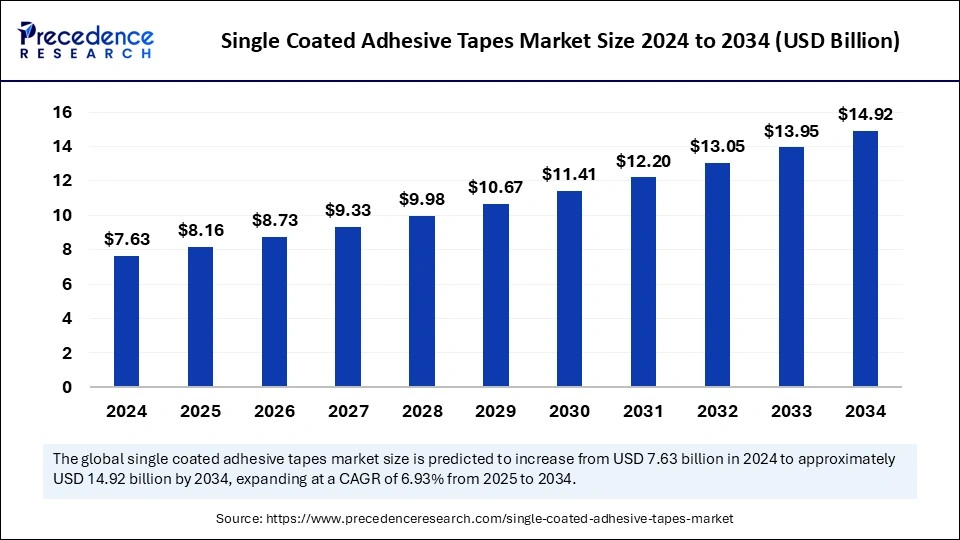

The global single coated adhesive tapes market size is calculated at USD 8.16 billion in 2025 and is forecasted to reach around USD 14.92 billion by 2034, accelerating at a CAGR of 6.93% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global single coated adhesive tapes market size was estimated at USD 7.63 billion in 2024 and is predicted to increase from USD 8.16 billion in 2025 to approximately USD 14.92 billion by 2034, expanding at a CAGR of 6.93% from 2025 to 2034. The demand for lightweight and flexible solutions is driving the single coated adhesive tapes market. The need for high-temperature and chemical-resistance solutions contributed to the adoption of single coated adhesive tapes. Additionally, the recent developments in sustainable packaging are boosting the market expansion.

Artificial Intelligence plays a crucial role in manufacturing procedures and supply chains. Thr single coated adhesive tapes market is no exception. AI optimization, predictive maintenance, and tailored performance improve manufacturing processes and efficient formulations. AI predictive maintenance not only optimizes the production process but also helps to improve equipment effectiveness and time consumption of the whole process. AI integration in quality control, supply chain optimization, and product development sheds significant light on the easy and effective production of single coat adhesive tapes.

The rising demand for lightweight, durable, and flexible solutions is essential for the adoption of AI in the process of improving overall product quality and efficiency. AI algorithms are spectacular for providing sustainable material selections to improve the stability, moisture resistance properties, and flexibility of single coated adhesive tapes. Additionally, the growing need for customized solutions is driving the importance of AI integration with the single coated adhesive tape manufacturing process.

Single coated adhesive tape, such as acrylic, rubber, or silicone, is made using paper, foils, cloths, polymeric films, and woven or nonwoven materials. The surge in the development of innovative and advanced adhesive solutions is shifting the world toward the adoption of the single coated adhesive tapes market. Single coated adhesive tapes are majorly preferred in various industries like automotive, packaging, healthcare, and electronics to improve their effectiveness and tear resistance properties. Government and regulatory support and investments in encouraging sustainable practices and the development of eco-friendly energy solutions are driving the need for specialized adhesive tapes, including single coated adhesive tapes.

Growing demand for recyclable, biodegradable, and non-toxic adhesive solutions is playing a favorable role in the growth of the single coated adhesive tapes market. Developments of advanced products like the utilization of polyester backing for thin gauge, high-temperature, and chemical-resistant applications are improving the effectiveness and convenience of single coated adhesive tapes. The rising need for lightweight, high-performance material solutions in automotive and aerospace industries is fueling the adoption of single coated adhesive temps to reduce weight and improve efficiency to enhance profit margins and reduce waste.

| Report Coverage | Details |

| Market Size by 2034 | USD 14.92 Billion |

| Market Size in 2025 | USD 8.16 Billion |

| Market Size in 2024 | USD 7.63 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.93% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Adhesive, Material, End-Use, Distribution Channel and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Demand for lightweight and durable solutions

Single coated adhesive tapes are lightweight and durable, which makes them ideal for weight-reduction applications and harsh environments. Their light weight and flexibility make them easy to apply and reduce time consumption as well as cost. The high bond strength makes them durable and provides a secure and reliable bond for products. Industries like automotive, aerospace, electronics, and medical are seeking lightweight, flexible, and durable adhesive tapes to reduce weight and improve fuel efficiency and performance. Lightweight and durable single coated adhesive tapes help to reduce carbon emissions and help companies meet environmental regulatory standards. The ability of single coated adhesive tapes to integrate with lightweight materials such as composites, plastics, and aluminum makes them more popular.

Volatility in raw material cost

The prices of adhesives like acrylic, rubber, and silicone are constantly fluctuating due to changes in demand and supply chains, which impact production costs and influence the profits of manufacturers. The cost volatility of materials, including foil, paper, and foam, impacts the overall procedure cost. The challenges of reducing margin, consumer cost, and supply chain distributions hamper the development of single coated adhesive tapes. Additionally, the high cost of crude oil further impacts the portability of manufacturing companies.

Sustainable strategy initiatives

Growing sustainability concerns are driving opportunities to expand innovation and the development of the single coated adhesive tapes market. The increased need for single coated adhesive tapes in various industries is driving the need for eco-friendly materials and manufacturing processes. Sustainable initiatives help to reduce waste and deliver energy-efficient process practices. The demand for sustainability is driving the development of biodegradable and recyclable adhesive tapes.

Growing sustainability concerns in the packaging industry are the major players encouraging the development of innovative biodegradability or compostability materials. As regulatory bodies promote eco-friendly standards, manufacturing companies are determined to develop and provide sustainable tape solutions to comply with regulatory standards and promote sustainability commitments.

The acrylic segment has held the largest single coated adhesive tapes market share in 2024 due to its strength and adaptability. The high bond strength of acrylic adhesives makes them ideal for application in automotive and construction. Acrylic adhesive is majorly used in windows, panels, and other structural applications to protect them from chemicals and UV rays. Acrylic adhesives have great temperature resistance properties in extreme environments and conditions. The need for high contamination resistance and control characteristics leads to prioritizing acrylic adhesive.

The rubber segment is anticipated to grow at a remarkable CAGR between 2025 and 2034 due to the growing adoption of adhesives due to their high strength, temperature resistance, flexibility, and reliability. The demand for highly durable adhesives leads to an increased preference for rubber adhesives. Natural rubbers are more durable compared to synthetic rubbers. The water and moisture resistance properties of rubber are shaping the segment growth. The rubber adhesive segment is witnessing further growth due to its conformability as well as cost-effectiveness.

The paper segment generated the largest single coated adhesive tapes market share in 2024. The segment growth is majorly attributed to growing sustainability concerns. Paper-based tapes are biodegradable and recyclable, which makes them an ideal example of environmentally friendly adhesive tapes. A wide range of applications, including packaging, sealing, labeling, and masking, are contributing to the segment expansion. Additionally, the user-friendliness and cost-effectiveness of paper adhesives make them popular. Furthermore, ongoing market compilation in innovations and developments of paper-based carrier material are surging segment growth.

On the other hand, the foil segment is expected to expand at the fastest CAGR over the projected period. The utilization of foil-based single coated adhesive tapes has increased due to their high barrier properties, which are suitable for applications requiring gas, vapor, and moisture protection. Foil materials provide excellent heat resistance, strong adhesion to various surfaces, especially for metal, and improved durability of adhesive in harsh environments. High-temperature resistance, chemical resistance, and conformability make it a priority to utilize and adopt foil-based single coated adhesive tapes.

The packaging segment accounted for the largest share of the single coated adhesive tapes market in 2024 because of various factors like expanding e-commerce and the use of single coated adhesive tapes for packing applications, including scaling, labeling, and bundling. Increased demand for secure packaging solutions is driving the adoption of single coated adhesive tapes in the packaging industry. The adoption of single coated adhesive tapes in various packaging materials like boxes, plastic containers, and envelopes is making them ideal for packaging end-use.

The automotive segment is projected to witness rapid growth in the forecast period. Automotive end-users are driving the adoption of single coated adhesive tapes for bonding, sealing, and insulation applications. The rising demand for lightweight, safe, and high-performance vehicles is driving the need for single coated adhesive tapes. The increased utilization of advanced materials like plastics and composites is driving the need for single coated adhesive tapes in automobiles. Automotive industries are trying to comply with regulatory standards and requirements of high quality and sustainability, which favors the adoption of single coated adhesive tapes. Furthermore, the surge for aestheticities is an emerging role in the segment expansion.

The offline segment generated the biggest single coated adhesive tapes market share in 2024 due to easier offline access to products for consumers. In offline distribution channels, single coated adhesive tapes are used to secure packages, wrap goods, and protect products in transportation and handling. Consumers prefer offline distribution channels regardless due to trust and loyalty. The texture and quality of adhesive tapes are crucial, which further becomes responsible for consumer preference for offline distribution channels. Offline channels provide real-time immediate support, making them more preferred.

However, the online segment is expected to expand at the fastest CAGR over the projected period. The segment growth is majorly attributed to the rising utilization of e-commerce platforms. Growing consumer reliance on secure, convenient packaging solutions is boosting the segment growth. Online channels provide a wide range of products with competitive pricing, making them convenient for the end-user. Additionally, the efforts in digital marketing allow companies to reach out to consumers more easily.

Asia Pacific led the global single coated adhesive tapes market in 2024 due to rising demands for high-performance tapes in various industries, including electronics, automotive, building & construction, and healthcare. Asian companies tend to focus on commodity and low-value tape production as well as exports. Expanding technology developments, government support, and investments in the technology sector are transforming the Asian market. Countries like China, India, Taiwan, South Korea, and Japan are drastically transforming the Asian market due to the rapidly expanding construction, electronics, healthcare, and automotive industries in those countries.

China is leading the regional market due to the country's vast production of electronics and healthcare products. Its ongoing determination to import low-value tapes and high-value single coated adhesive tape exports is causing the shafting countries' market to grow. Taiwan, India, and Japan are contributing a significant share in the regional market due to Taiwan's high export capabilities, Japan's high production value, and India's technological advancements and demands for single coated adhesive tapes in industries like building & construction, automotive, and electronics.

North America is estimated to expand the fastest CAGR in the single coated adhesive tapes market between 2025 and 2034 due to the region's high import of single coated adhesive tapes for various sectors of automotive, electronics, packaging, and healthcare. Additionally, factors like government and regulatory support and investments in sustainable materials and tape solutions are fueling the market expansion in North America.

The need for more convenient and durable tape and soft packaging solutions is majorly contributing to the market growth. The rising consumer demand for lightweight materials is driving the adoption of single coated adhesive tapes in the automotive industry. The United States is leading the regional market due to the country's vast manufacturing base. The presence of competitive landscapes and early adoption of advanced technology booming countries' markets.

By Adhesive Type

By Material Type

By End-Use

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

June 2024