What is the Single-use Consumables Market Size?

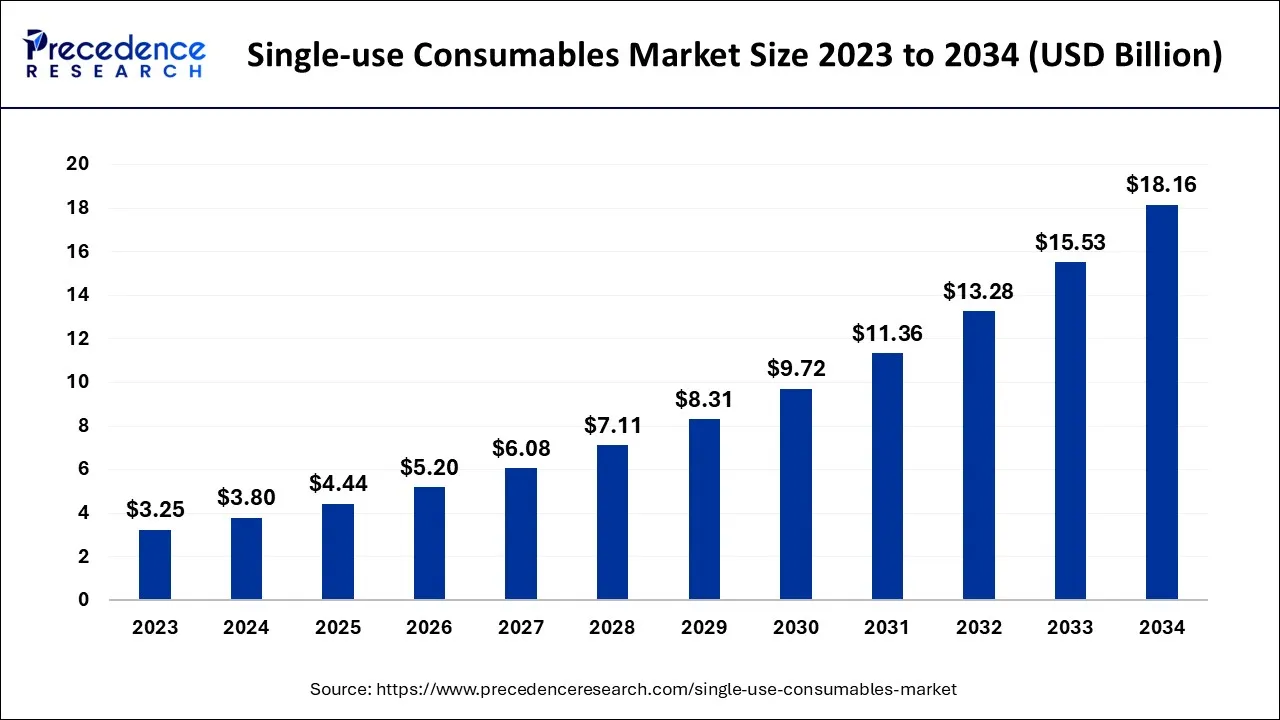

The global single-use consumables market size is calculated at USD 4.44 billion in 2025 and is predicted to increase from USD 5.2 billion in 2026 to approximately USD 20.54 billion by 2035, expanding at a CAGR of 18.55% from 2026 to 2035.

Single-use Consumables Market Key Takeaways

- North America is predicted to dominate the market between 2026 to 2035.

- The Asia-Pacific region is expected to expand at a remarkable CAGR between 2026 to 2035.

- By Product, the predicted disposable capsule filter segment generates the largest market share between 2026 to 2035.

- By Application, the sampling segment expected is to record the highest market share between 2026 to 2035.

- By End-user, the pharma companies segment is predicted is capture the biggest market share between 2026 to 2035.

Market Overview

Single-use consumables market refers to a segment of the healthcare and biopharmaceutical industry that produces disposable products used in various processes, such as cell culture, filtration, chromatography, and mixing. Single-use consumables are used in bioprocessing, which develops biological products like vaccines, monoclonal antibodies, and cell and gene therapy. Single-use consumables are designed to be used once and then discarded, as opposed to traditional equipment and systems that require cleaning and sterilization after each use.

Single-use consumables include bags, filters, tubing, connectors, and other components used in bioprocessing applications. The benefits of single-use consumables include reduced risk of contamination, improved flexibility, faster processing times, and cost savings due to reduced cleaning and sterilization requirements.

Furthermore, The global single-use consumables market is anticipated to grow considerably, driven by the increasing demand for biologics and personalized medicines. Biologics are complex biological products that require specialized manufacturing processes, and using single-use consumables can help improve efficiency and reduce the risk of contamination in the manufacturing process.

The shift towards outpatient care and home healthcare has increased the demand for smaller, more portable medical devices compatible with single-use consumables. Outpatient care has become more popular as healthcare providers seek to reduce costs and improve patient outcomes. Single-use consumables are often more convenient and cost-effective in these settings, as they do not require cleaning, sterilization, or maintenance.

However, environmental concerns and consumer-limited product capabilities are anticipated to impede the market growth. Single-use consumables contribute to the growing problem of medical waste and can have a significant environmental impact. Some healthcare facilities and consumers are increasingly concerned about the environmental impact of single-use devices and are seeking more sustainable alternatives. This demanded the need for continued innovation in the single-use consumables market and education and collaboration between healthcare providers, manufacturers, and regulatory bodies to ensure that these devices are used effectively and responsibly.

The COVID-19 pandemic have accelerated demand for single-use consumables such as personal protective equipment (PPE), masks, gloves, gowns, and other medical supplies such as syringes and IV sets. Healthcare facilities have had to increase their use of these products to prevent the spread of the virus and protect healthcare workers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.44 Billion |

| Market Size in 2026 | USD 5.2 Billion |

| Market Size by 2035 | USD 20.54 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 18.55% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

Reduced risk of cross-contamination in the healthcare industry to brighten the market prospect

Cross-contamination occurs when harmful bacteria or viruses are transferred from one patient to another or from a contaminated surface to a patient and can lead to the spread of infectious diseases. The use of single-use consumables can significantly reduce the risk of cross-contamination. It is designed to be used once and then disposed of, eliminating the need for cleaning and sterilization between uses.

This helps to prevent the spread of infectious agents that may be present on a previously used device. Also, using single-use consumables can help improve infection control in healthcare settings by reducing the risk of contamination from surfaces and devices. This can help protect patients and healthcare workers from infectious agents, improving patient outcomes and reducing healthcare costs.

In addition, single-use consumables are manufactured to strict quality standards and are designed to provide consistent and reliable performance. This can help ensure that each patient receives the same level of care, without the risk of variability due to using a previously used device. Furthermore, they are typically packaged and labeled for easy identification and use, reducing the risk of errors or confusion that can lead to cross-contamination. Additionally, healthcare providers do not need to be trained on these devices' cleaning and sterilization processes, which can further reduce the risk of errors. Thus, the reduced risk of cross-contamination is a significant driver of the demand for single-use consumables in the healthcare industry.

Cost-effectiveness

Cost-effectiveness is a major driver of the demand for single-use consumables in the healthcare industry. These devices are typically less expensive than reusable medical devices. Reusable medical devices require frequent cleaning and sterilization, which can be costly and time-consuming. Single-use consumables eliminate the need for these processes, which can result in significant cost savings. Also, single-use consumables can improve efficiency in healthcare settings by eliminating the need for staff to prepare and clean reusable devices. This can save time and reduce labor costs, ultimately leading to cost savings for healthcare providers.

Using single-use consumables can eliminate the need for costly capital expenditures on reusable medical devices and associated equipment, which can be particularly beneficial for smaller healthcare providers with limited budgets. Thus, the cost-effectiveness of single-use consumables is a significant factor driving their adoption in the healthcare industry. While there may be higher initial costs associated with using single-use consumables, the potential cost savings in cleaning and sterilization, infection control, and improved efficiency can make them a more attractive option in the long run.

Key Market Challenges

Environmental concerns are causing hindrances to the market

The use of single-use consumables in the healthcare industry is often criticized for its negative environmental impact. This has led to concerns among healthcare providers and consumers and may act as a restraint on demand for single-use consumables. Single-use consumables are designed to be used only once and then discarded, which can result in significant waste generation. This waste can contribute to landfills and pollute the environment, particularly if the materials used in the devices are not biodegradable or recyclable. In addition, the production and disposal of single-use consumables can result in greenhouse gas emissions and other forms of pollution.

Some healthcare providers and manufacturers are exploring ways to reduce the environmental impact of single-use consumables. For instance, some manufacturers are developing products made from more sustainable materials or are implementing recycling programs to reduce waste. Healthcare providers may also implement waste reduction strategies, such as reducing unnecessary use of single-use consumables or recycling programs.

Key Market Opportunities

Technological advancements

The single-use consumables market is experiencing technological advancements that are creating new opportunities for growth. Some of these technological advancements include 3D printing, smart single-use technologies, advanced materials, and automation. These technological advancements offer significant opportunities for the single-use consumables market. For example, the development of new materials offers the potential for better performance and increased sustainability.

3D printing offers the potential for customized single-use consumables and reduced lead times. Smart single-use technologies offer the potential for better process control and reduced risk of process failures. Automation offers the potential for increased efficiency and reduced lead times. Technological advancements are expected to drive growth in the single-use consumables market by offering new and innovative products that meet the changing needs of various industries.

Customization and personalization

The demand for customized and personalized single-use consumables is increasing across various industries, creating new opportunities for growth in the market. Customization and personalization of single-use consumables allow for better performance, improved efficiency, and reduced waste.

One area of growth in customization and personalization is in the medical and pharmaceutical industries, where there is a need for single-use consumables that are tailored to the specific needs of patients. For example, customized syringes can be produced to deliver specific doses of medication to patients with specific requirements.

Additionally, growth is in the food and beverage industry, where there is a need for single-use consumables that can be customized for specific products. For example, customized single-use packaging can be developed for food products that require specific conditions such as temperature or humidity control.

Increasing home healthcare

The increasing trend towards home healthcare is creating new opportunities for growth in the single-use consumables market. As more patients choose to receive healthcare services in the comfort of their own homes, the demand for single-use consumables that can be easily used and disposed of is increasing. Single-use consumables such as disposable syringes, needles, and catheters are increasingly being used in home healthcare settings as they offer convenience, safety, and reduce the risk of infection. Patients who require regular injections or infusions can benefit from the use of single-use consumables, as they eliminate the need for time-consuming sterilization processes and reduce the risk of contamination.

Segment Insights

Product Insights

On the basis of product, the single-use consumables market is divided into connectors, valves, adaptors, tubing, disconnectors, sensors, and disposable capsule filter, with the segment accounting for most of the market due to the filtration of biopharmaceuticals is a critical step in the manufacturing process. Single-use capsule filters often ensure the final product meets strict quality standards. Valves, tubing, and sensors are significant product categories within the single-use consumables market. They are used in a various range of bioprocessing applications to control the flow of fluids and monitor various process parameters.

Driving factors for the growth of the single-use consumables market include the increasing demand for biologics and biosimilars, the need for cost-effective solutions in the healthcare industry, and the growing demand for disposable products in various industries. Additionally, the increasing focus on patient safety and the need for strict regulations and guidelines for product safety and quality are also driving the growth of the single-use consumables market.

Application Insights

On the basis of the application, the single-use consumables market is divided into sampling, cell culture, storage, and filtration, with the sampling accounting for most of the market. Biopharmaceutical manufacturing often uses single-use consumables such as syringes, needles, and sampling bags to collect samples for analysis and testing. These products are designed to be sterile, easy to use, and maintain sample integrity.

Driving factors for the growth of the single-use consumables market in the application segment include the need for cost-effective and efficient solutions, the growing demand for personalized medicine and better patient outcomes, and the increasing focus on safety and quality in various industries. Additionally, the increasing investments in research and development for new and innovative products and the growing adoption of single-use technologies in various industries are also driving the growth of the single-use consumables market.

End-User Insights

On the basis of end-user, the single-use consumables market is divided into contract manufacturing organizations (CMOS), original equipment manufacturers (OEMs), and pharma companies, with the pharma companies accounting for most of the market because single-use technologies enable pharma companies to quickly adapt to changing market conditions and production needs. They can easily switch between products and manufacturing processes without costly and time-consuming cleaning and validation procedures. Also, they are designed to be sterile and disposable, which reduces the risk of cross-contamination between different batches of products. Thus, pharma companies invest heavily in single-use technologies, driving demand for many single-use consumables, including bags, filters, tubing, and connectors.

Regional Insights

Why Did North America Dominate the Single-use Consumables Market?

On the basis of geography, North America dominates the market, primarily driven by the presence of a large biopharmaceutical industry in the region. The U.S. is the leading market in North America, and it is expected to continue to drive demand for single-use consumables in the coming years. They are utilized in various biopharmaceutical manufacturing processes, including cell culture, fermentation, purification, and storage. Furthermore, demand for single-use consumables in North America is driven by their advantages, such as increased flexibility, reduced risk of contamination, and lower capital & operating costs.

U.S. Single-Use Consumables Market Analysis

The U.S. dominates the North American market due to its robust biopharmaceutical manufacturing sector, high demand for biologics and vaccines, and advanced R&D infrastructure. The rapid adoption of innovative bioprocessing technologies, coupled with supportive regulatory frameworks, enables efficient, scalable, and contamination-free production in both the biopharma and healthcare sectors.

What Makes Europe a Significant Market?

Europe is also a significant market for single-use consumables, with countries such as Germany, France, and the United Kingdom having a well-established biopharmaceutical industry. The region is expected to see continued growth in the coming years due to increasing investment in biopharmaceutical R&D. The demand for single-use consumables in Europe is driven by the increasing adoption of single-use technologies in biopharmaceutical manufacturing, as well as the advantages that they offer. These advantages include increased flexibility, reduced risk of contamination, and lower capital and operating costs.

UK Single-Use Consumables Market Analysis

The UK market is expected to grow significantly due to its strong biopharmaceutical R&D, increasing focus on biologics and cell and gene therapy development, and the rising adoption of advanced bioprocessing technologies. Supportive regulatory frameworks and growing investments in life sciences manufacturing and healthcare infrastructure further contribute to the market's expansion.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

The region in Asia-Pacific is anticipated to have the greatest CAGR. The growing biopharmaceutical industry primarily drives this growth in countries such as India, Japan, and China. The region also sees increasing investment in biopharmaceutical R&D, expected to drive demand for single-use consumables further. China is the Asia-Pacific region's largest market for single-use consumables, followed by Japan and India. The growing demand for personalized medicines and the increasing use of single-use technologies in biopharmaceutical manufacturing processes drive the demand for single-use consumables in the region.

India Single-Use Consumables Market Analysis

India's market is expected to grow rapidly, driven by expanding biopharmaceutical manufacturing, increased production of vaccines and biosimilars, and rising healthcare investments. The country's cost-efficient manufacturing capabilities, growing adoption of single-use bioprocessing technologies, and strong government support for domestic biologics and life sciences innovation are also key factors fueling this growth.

What Drives the MEA Single-Use Consumables Market?

The Middle East & Africa single-use consumables market is growing due to rapid development in pharmaceuticals, biotechnology, and healthcare infrastructure. Government investments in local drug production, vaccine manufacturing, and biologics, particularly in Saudi Arabia and the UAE, are boosting demand for sterile, contamination-free products. Additionally, increasing adoption of bioprocessing technologies and stricter regulatory frameworks are driving the use of disposable consumables in hospitals and laboratories.

Why Is the Latin American Single-use Consumables Market Emerging Rapidly?

The Latin American single-use consumables market is rapidly growing, driven by expanding pharmaceutical production, biotechnology research, and healthcare modernization in countries like Brazil, Mexico, and Argentina. Rising demand for biologics, biosimilars, and vaccines is encouraging the use of single-use systems to enhance operational flexibility and reduce contamination risks. Additionally, the growth of CMOs and CROs, along with increased life sciences investment, is accelerating the adoption of disposable consumables for scalable, cost-efficient, and compliant manufacturing.

Value Chain Analysis

- Raw Material Suppliers

Raw material suppliers provide high-quality polymers, plastics, filters, and sterilized materials essential for manufacturing single-use consumables.

Key players: Sartorius AG, Merck KGaA, and Thermo Fisher Scientific. - Component Manufacturers

Component manufacturers convert raw materials into critical consumable parts such as tubing, bioreactors, connectors, and filtration units used in bioprocessing.

Key players: GE Healthcare Life Sciences, Pall Corporation, and Eppendorf AG. - Distributors / Channel Partners

Distributors ensure the timely delivery of single-use consumables to pharmaceutical, biotechnology, and healthcare facilities worldwide, facilitating global market reach.

Key players: Fisher Scientific, VWR International, and Cole-Parmer. - End Users (Biopharmaceutical & Healthcare Companies)

End users employ single-use consumables in clinical trials, biologics production, and laboratory research to maintain sterile, contamination-free processes.

Key players: Pfizer, Johnson & Johnson, Novartis, Roche.

Single-use Consumables Market Companies

- Lonza: It offers bioprocessing buffers, reagents, and support services for protein, cellular, and viral therapeutics, enhancing downstream processing and overall biomanufacturing efficiency.

- Infors AG: It manufactures advanced bioreactor and shaker systems used in cell culture and fermentation processes, supporting scalable, high-performance upstream bioprocessing workflows.

- PBS Biotech, Inc.: it provides single-use bioreactor platforms designed to improve mixing, oxygen transfer, and cell culture performance for biologics and vaccine production.

- Entegris, Inc.: It offers a comprehensive portfolio of single-use bags, tubing, fittings, and filtration solutions for upstream, downstream, and fill/finish bioprocessing applications.

- Kuhner AG: It supplies laboratory and bioprocessing equipment, including shakers and fermentation systems, supporting efficient cell growth and culture for research and production.

- Meissner Filtration Products, Inc.: It specializes in single-use filtration solutions, including capsule filters and membrane products, enhancing sterile fluid handling and purification in biomanufacturing.

- Rentschler Biopharma SE: It provides contract development and manufacturing services with integrated single-use bioprocessing solutions, enabling biologics and therapeutic production from concept to commercialization.

Other Major Key Players

- Sartorius AG

- Danaher Corp.

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Avantor, Inc.

- Eppendorf SE

- Corning Inc.

- Boehringer Ingelheim International GmbH

Recent Developments

- In May 2025, Hyderabad-based Wadi Surgicals launched India's first accelerator-free nitrile gloves under its Enliva brand, offering skin-safe, allergy-free hand protection.

(Source: .biospectrumindia.com) - In April 2025, INTCO Medical launched its patented Syntex Synthetic Disposable Latex Gloves globally, offering enhanced quality, safety, and performance. Tested under EN455 and EN374, they meet FDA and EU CE standards for reliable use in healthcare, food processing, and industrial applications.

(Source: prnewswire.com) - In April 2025, INTCO Medical launched the Syntex patented Synthetic Disposable Latex Gloves, offering improved safety, comfort, and durability over natural latex. The gloves passed EN455 and EN374 tests and comply with FDA and EU CE standards for healthcare, food processing, and industrial use.

(Source: www.prnewswire.com) - In April 2025, Thermo Fisher Scientific launched the 5L DynaDrive Single-Use Bioreactor, designed for faster and more efficient bioprocess development. The system offers scalable production from 1 to 5,000 liters, enabling cost-effective bench-to-commercial scale operations.

(Source: www.businesswire.com) - In May 2025, Wadi Surgicals launched Enliva, India's first accelerator-free nitrile gloves, addressing skin allergy concerns among healthcare staff. This innovation provides safe, hypoallergenic hand protection for medical facilities.

(Source: www.biospectrumindia.com) - In October 2020, Sartorius AG announced the acquisition of a majority stake in Biological Industries, a leading provider of cell culture media and sera, to expand its portfolio of single-use consumables and strengthen its presence in the biopharmaceutical industry.

- In December 2020,GE Healthcare announced a partnership with Germfree Laboratories to develop a modular, flexible, and mobile facility for manufacturinggene therapyand vaccines using single-use technologies.

- In March 2021,Merck KGaA announced the launch of its new single-use fluid management system, which offers increased efficiency and reliability in biopharmaceutical manufacturing processes.

- In June 2021,Danaher Corporation announced the acquisition of Aldevron, a leading provider of plasmid DNA, mRNA, and other biologics for gene andcell therapy, to expand its capabilities in developing and manufacturing biologics and gene therapies using single-use technologies.

Segments Covered in the Report

By Product

- Connectors

- Valves

- Adaptors

- Tubing

- Disconnectors

- Sensors

- Disposable Capsule Filter

By Application

- Sampling

- Cell Culture

- Storage

- Filtration

By End-User

- Contract Manufacturing Organizations (CMOs)

- Original Equipment Manufacturers (OEMs)

- Pharma Companies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344