August 2024

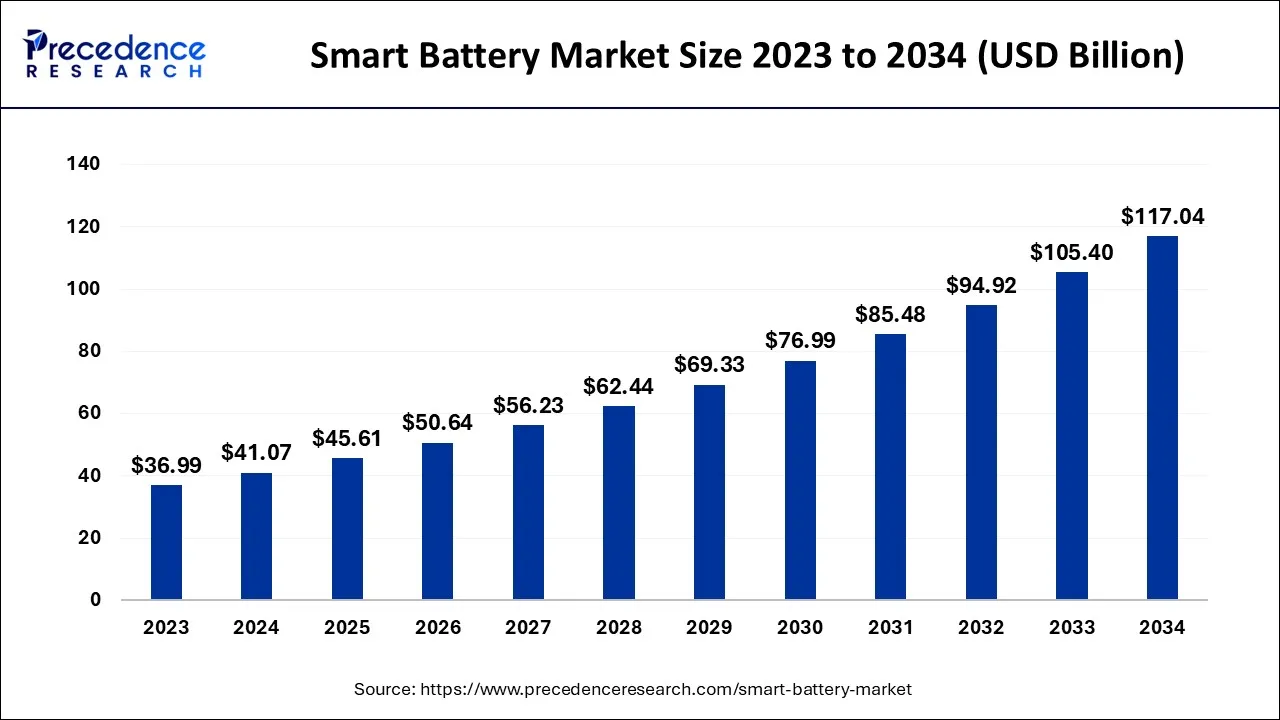

The global smart battery market size accounted for USD 41.07 billion in 2024, grew to USD 45.61 billion in 2025 and is expected to be worth around USD 117.04 billion by 2034, registering a CAGR of 11.04% between 2024 and 2034.

The global smart battery market size is calculated at USD 41.07 billion in 2024 and is projected to surpass around USD 117.04 billion by 2034, growing at a CAGR of 11.04% from 2024 to 2034.

The smart battery market refers to the market for advanced battery technologies that incorporate intelligent features, monitoring capabilities, and communication interfaces. Smart batteries are designed to provide real-time information about their performance, health, and remaining capacity, enabling users to optimize battery usage, enhance safety, and improve overall energy management.

Smart batteries go beyond traditional batteries by integrating technologies such as microprocessors, sensors, and communication modules. These components enable features like state-of-charge (SoC) and state-of-health (SoH) monitoring, battery diagnostics, predictive maintenance, and communication with external systems or devices.

The smart battery market encompasses a wide range of applications across various industries. Some key sectors that utilize smart batteries include consumer electronics, automotive (electric vehicles), renewable energy systems, industrial equipment, aerospace, and healthcare devices.

The growth of renewable energy and the decrease in carbon emissions are just two of the factors driving the growth of the smart battery market across the globe. By enforcing stringent laws and guidelines, the government is attempting to reduce carbon emissions. Smart batteries have become more popular as a result of rising consumer awareness of this need and supportive government laws. Growing consumer awareness of this need and favorable government regulations have contributed to the popularity of smart batteries. The growing use of consumer electrical products with batteries and the rising popularity of the Internet of Things (IoT) are both contributing to the growth of the market for smart batteries.

| Report Coverage | Details |

| Market Size in 2024 | USD 41.07 Billion |

| Market Size by 2034 | USD 117.04 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11.04% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type and By Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The rising demand for renewable energy is a key driver of growth in the smart battery market. The rising demand for renewable energy and the associated need for energy storage, grid stability, peak load management, and energy independence are driving factors in the growth of the smart battery market. Renewable energy sources such as solar and wind are intermittent by nature, meaning their energy generation fluctuates depending on weather conditions.

Smart batteries play a vital role in storing excess energy generated during peak production periods and releasing it when demand is high or when renewable sources are not producing electricity. This enables better integration of renewable energy into the grid and helps address the challenge of matching energy supply with demand, thereby driving the adoption of smart batteries. Smart batteries are essential components in microgrid and off-grid renewable energy systems. These systems provide localized and decentralized energy generation and storage solutions, often in remote or underserved areas.

Lack of standardization in the smart battery market

Lack of standardization in the manufacturing and even in the distribution process of smart batteries hamper the growth of the market. Standardization plays a crucial role in ensuring consistent performance and safety standards across different smart battery products. Without uniform guidelines and testing protocols, the quality, reliability, and safety of smart batteries may vary significantly. This lack of consistency can undermine consumer trust and confidence in smart battery technologies, impacting their widespread adoption in critical applications. The lack of standardized communication protocols and interfaces among different smart battery technologies and devices can hinder interoperability. This means that smart batteries from different manufacturers may have incompatible systems, making it difficult for consumers and businesses to integrate and utilize multiple smart battery products seamlessly. Interoperability issues can limit the flexibility and scalability of smart battery deployments.

Technological advancements in the market

Technological advancements play a crucial role in offering opportunities for growth and innovation in the smart battery market. Technological advancements have led to the development of batteries with higher energy density, allowing smart devices to operate for longer periods without recharging. Enhanced energy density enables smaller and lighter battery designs, making it possible to create more compact and portable devices while maintaining optimal performance. Advances in battery technology have resulted in the development of fast-charging solutions. Rapid charging capabilities enable users to recharge their devices quickly, enhancing convenience and productivity. This is particularly valuable in applications where downtime needs to be minimized, such as smartphones, electric vehicles, and wearable devices.

The proliferation of the Internet of Things (IoT) and connected devices has opened up new opportunities for smart batteries. Technological advancements have facilitated the integration of smart batteries with IoT ecosystems, enabling seamless communication, data exchange, and remote monitoring. This connectivity allows for enhanced battery management, predictive maintenance, and optimization of energy usage.

The lithium-ion segment by type dominated the global smart battery market in 2023. The segment will continue to grow at a noticeable rate with the rising demand for lithium-ion batteries from the automotive industry.

Lithium-ion (Li-ion) batteries are the most widely used type of smart batteries in various consumer electronics, portable devices, electric vehicles, and energy storage applications. They offer high energy density, long cycle life, and low self-discharge rates. Li-ion smart batteries are known for their efficiency, reliability, and ability to provide accurate battery status information.

On the other hand, the nickel-metal hydride battery segment will also experience significant demand during the forecast period, especially from the consumer electronics market. Nickel-metal hydride (NiMH) batteries are another type of smart batteries commonly used in consumer electronics, including cameras, toys, and portable devices. They offer a higher energy density compared to traditional nickel-cadmium (NiCd) batteries and are considered more environmentally friendly. NiMH smart batteries provide good performance, stable voltage output, and can be recharged multiple times.

The automotive segment of application dominated the global smart battery market in 2023, the segment will continue to grow at the fastest rate during the forecast period. The rising demand for electric vehicles is anticipated to supplement the growth of the segment. Smart batteries provide advanced features such as battery management systems (BMS), which monitor and optimize battery performance, enhance safety, and extend battery life. These features are crucial for the efficient operation and longevity of EVs.

The automotive industry's increasing focus on sustainability, energy efficiency, and advanced vehicle technologies has driven the demand for smart batteries. These batteries offer enhanced power management, safety features, energy efficiency, and improved performance, making them essential components for electric vehicles.

On the other hand, the consumer electronics segment will continue to grow at a significant rate owing to the rising demand for electronic devices across the globe. Consumer electronics such as smartphones, tablets, laptops, smartwatches, and wireless earphones heavily rely on battery power for their operation. Smart batteries offer enhanced performance, longer battery life, and improved energy efficiency, addressing the demand for extended usage time in portable devices. They can intelligently manage power consumption, optimize charging cycles, and provide accurate battery life estimates, enhancing the overall user experience.

Asia Pacific held a leading share of the smart battery market in 2023. The world's largest demand for smart batteries comes from the Asia-Pacific area. South Korea, China, Japan, and India will drive the regional market. Countries with large populations, developing economies, and rising urbanization are found in the Asia-Pacific area. All of this opens the way for increased demand for smartphones and enhanced telecommunications and data center infrastructures, which directly or indirectly increase the consumption of lithium-ion batteries. All consumer electronics, including mobile phones, laptops, tablets, power banks, and wearable technology, now come standard with lithium-ion batteries. The Indian telecommunications market has a chance to expand due to the rising penetration of telecommunications services.

The Indian government has started focusing on the development of electric vehicles, the plan focuses on transforming all government official vehicles into electric vehicles by 2030. This element will supplement the growth of the smart battery market in the Asia Pacific.

The market for smart batteries in Europe is anticipated to be the most attractive market. Europe is at the forefront of renewable energy adoption, with countries implementing ambitious targets for renewable energy generation. Smart batteries play a vital role in integrating renewable energy sources like solar and wind into the grid by storing excess energy and supplying it during periods of high demand or low generation. They help balance the intermittent nature of renewable energy and enhance grid stability and resilience.

The European market for electric vehicles (EVs) is growing rapidly, driving the demand for charging infrastructure. Smart batteries can be integrated into EV charging stations, enabling efficient management of charging and discharging cycles. They help optimize charging operations, balance the load on the grid, and provide backup power during grid outages.

Segments Covered in the Report:

By Type

By Applications

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

December 2024

November 2024

April 2025