January 2025

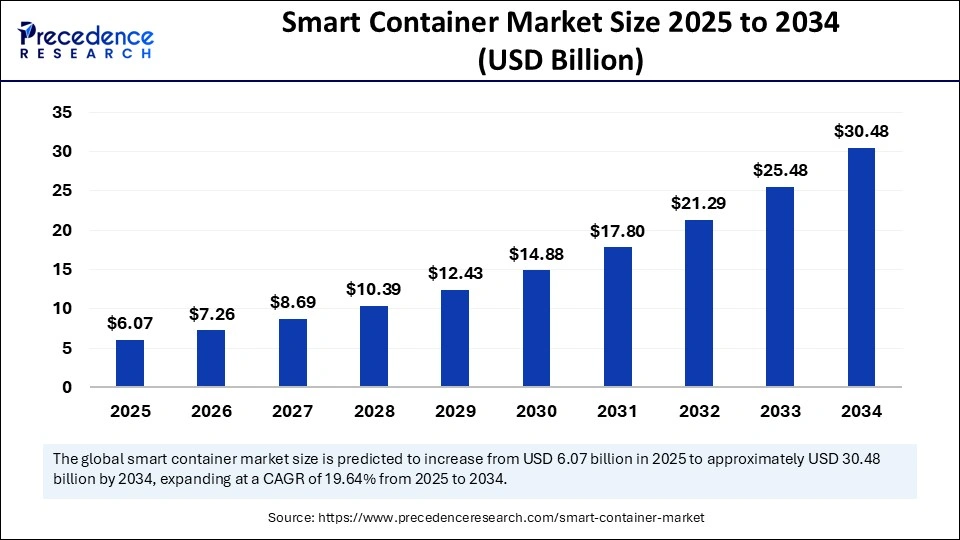

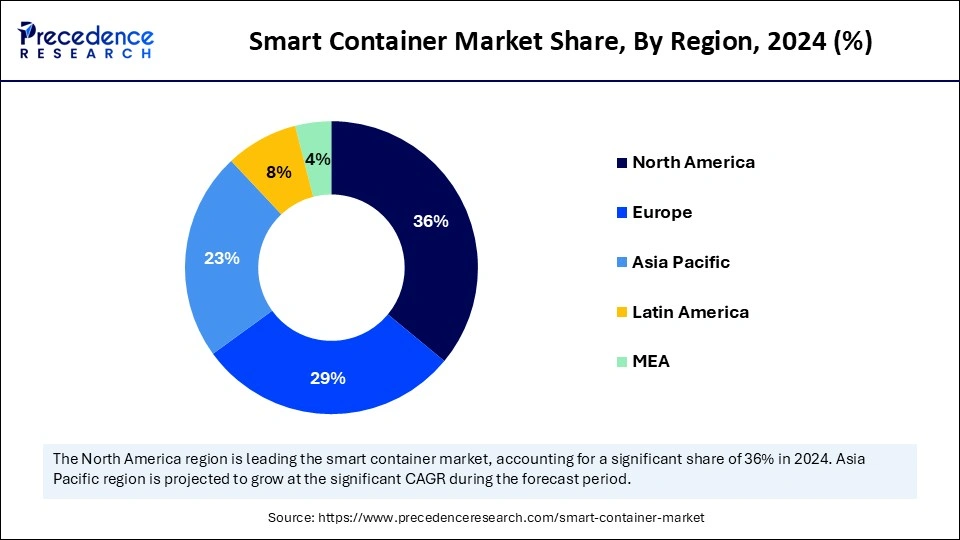

The global smart container market size is calculated at USD 6.07 billion in 2025 and is forecasted to reach around USD 30.48 billion by 2034, accelerating at a CAGR of 19.64% from 2025 to 2034. The North America market size surpassed USD 1.83 billion in 2024 and is expanding at a CAGR of 19.79% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global smart container market size accounted for USD 5.07 billion in 2024 and is predicted to increase from USD 6.07 billion in 2025 to approximately USD 30.48 billion by 2034, expanding at a CAGR of 19.64% from 2025 to 2034. The growth of the market is driven by the increasing global trade and the rising e-commerce activities.

Artificial Intelligence (AI) significantly impacts the smart container market. Integrating AI algorithms in smart containers allows for automated alerts and provides predictive insights. AI algorithms can analyze sensor data from smart containers to predict potential failures, enabling proactive maintenance and reducing downtime. This further increases supply chain transparency, lowers expenses, and ensures regulatory compliance. AI-driven containers analyze traffic data and weather conditions to decide the best route, reducing transportation costs and delivery times.

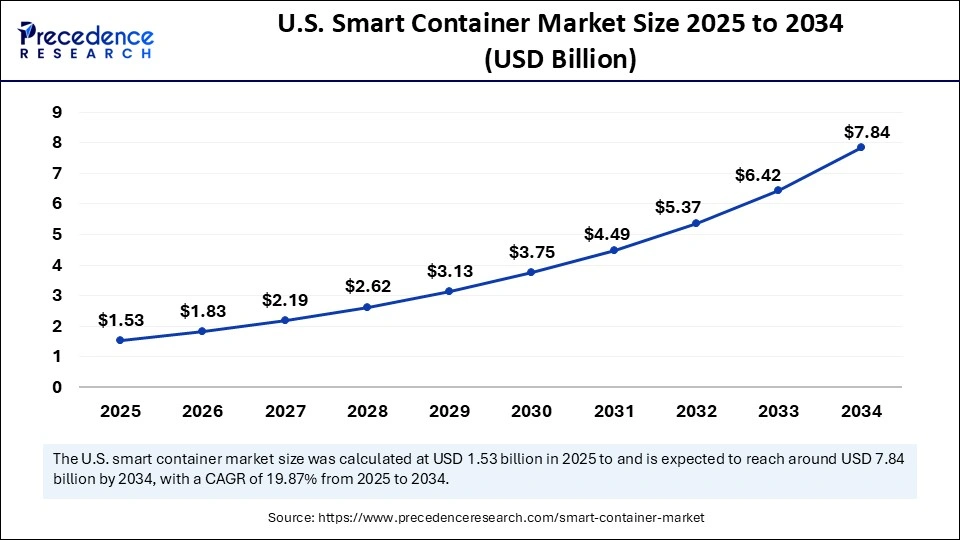

The U.S. smart container market size was exhibited at USD 1.28 billion in 2024 and is projected to be worth around USD 7.84 billion by 2034, growing at a CAGR of 19.87% from 2025 to 2034.

North America registered dominance in the smart container market by holding the largest share in 2024. This is mainly due to its modern logistic infrastructures, providing the foundation for smart containers. The increased adoption of cold chain logistics created novel opportunities for food shippers to reduce waste and costs. North American businesses prioritize supply chain security and visibility, boosting the growth of the market. The region’s well-established e-commerce and logistics sectors further bolstered market growth.

The U.S. is a major contributor to the North American smart container market. With the rising trade and cross-border shipment, the demand for enhanced supply chain transparency is increasing. This, in turn, boosts the adoption of smart containers. In addition, stringent regulations regarding the safety and efficacy of food and pharmaceutical items during transportation contribute to market growth.

Asia Pacific is anticipated to register the fastest growth during the forecast period. The growth of the smart container market in the region can be attributed to the rising e-commerce activities. Businesses across the region are investing in efficient logistics solutions to optimize the supply chain and ensure faster delivery. However, smart containers ensure faster delivery by monitoring weather and traffic conditions. There is a rising adoption of advanced technologies to enhance transparency in supply chains. In addition, the rising food trade activities contribute to regional market growth.

Europe is seen to grow at a notable rate in the foreseeable future. The growth of the market in the region can be attributed to the rising volume of cross-border shipments. The European government has imposed stringent regulations regarding the safety of goods being transported. There is a high need to improve supply chain transparency. In addition, the region’s well-established transportation network supports market growth.

The smart container market is growing rapidly due to the rising trade activities worldwide. Smart containers refer to shipping containers that are equipped with sensors, GPS, and real-time monitoring systems. These containers ensure the safety and security of goods during transit. Smart containers provide real-time data regarding the temperature and humidity of goods, reducing spoilage. Consumers can configure alerts in terms of container mishandling, which provide early warnings, helping to alleviate challenges. Smart containers comply with customs regulations. The rising demand for supply chain transparency is likely to boost the growth of the market. Providing visibility and control over what is happening to cargo enhances consumers' peace of mind during shipping.

| Report Coverage | Details |

| Market Size by 2034 | USD 30.48 Billion |

| Market Size in 2025 | USD 6.07 Billion |

| Market Size in 2024 | USD 5.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Technology, Application, End-Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing Demand for Enhanced Supply Chain Visibility and Security

The adoption of smart containers is rising as shippers are increasingly seeking greater control over their logistics assets regardless of location. Smart containers significantly reduce the risk of cargo loss, theft, or damage by providing real-time tracking and monitoring. The increasing integration of Internet of Things is facilitating data exchange across the entire supply chain. Smart containers provide real-time data on temperature, humidity, and location, enhancing supply chain visibility. Furthermore, smart containers provide precise data that not only supports shippers but also enables ports to optimize planning for cargo storage and distribution.

High Initial Investments

The growth of the smart container market is limited by the high initial investments required for obtaining smart containers. Since these containers are equipped with connectivity solutions, GPS, and sensors, they are costlier. This upfront cost is prohibitive to smaller shipping organizations. Moreover, smart containers require regular maintenance, such as updating software and replacing essential components, for smooth operation. This continuing upkeep raises operational costs, which limits market growth.

Rising Need to Optimize Supply Chain Efficiency

The rising need to optimize supply chain efficiency creates immense opportunities in the smart container market. Smart containers enhance cargo safety across the global logistic network. With the rise of AI, the vast amount of data generated by these containers facilitates real-time transparency and improves monitoring and predictive planning across the entire supply chain. Their integration into intermodal transportation brings a new level of efficiency and security, enabling ocean carriers and cargo to optimize routing, prevent delays, minimize losses, and significantly reduce the risk of theft, damage, or accident. As organizations prioritize resilient and intelligent logistic systems, the market is expected to grow.

The hardware segment held the largest share of the smart container market in 2024. Hardware such as sensors and GPS devices are crucial in smart containers, enabling real-time tracking and monitoring. Hardware provides accurate data on temperature and humidity within the container, ensuring the safety of transported goods and reducing spoilage. The rise in the need to enhance supply chain visibility further bolstered the segmental growth.

The software segment is projected to expand at the fastest rate during the forecast period. Software solutions enable real-time data monitoring, permitting more precise inventory management and tracking. Software solutions are particularly convenient for large-scale operations requiring continuous monitoring of containers throughout the supply chain.

The asset tracking & management segment dominated the smart container market in 2024 as smart containers allow precise location tracking, optimizing overall supply chain efficiency. This further reduces container repositioning. Evading this unnecessary shipment could drastically cut carbon emissions, making sustainable and affordable supply chain management. With real-time monitoring abilities, ocean cargo and carrier owners enhance routes, avoid delays, prevent losses, and lower the risk of damage, theft, or accidents.

The supply chain optimization segment is expected to grow at the fastest rate over the forecast period. Smart containers significantly optimize the supply chain by reducing delays in shipments. Smart containers lower deadstock, optimize carrier operations and improve the bottom line. Smart containers generate real-time data on container location and other parameters. By leveraging this data, businesses can optimize their supply chain operations.

The food & beverages segment dominated the market with the largest share in 2024. Smart containers are the best choice for transporting perishable goods, such as vegetables, fruits, and seafood. These containers ensure that perishable goods are in optimal condition during their journey. Stringent regulations regarding food safety encouraged food & beverages manufacturers to invest in smart containers to improve their supply chain. By monitoring temperature and moisture, manufacturers can reduce food spoilage during transportation.

The pharmaceuticals segment is projected to grow rapidly in the coming years. Pharmaceutical products often require precise temperature control during shipping. Healthcare authorities have imposed stringent regulations regarding the safety of pharmaceutical products. However, smart containers monitor the temperature of sensitive products in real-time, reducing spoilage and maintaining safety and efficacy.

By Offering

By Technology

By Application

By End-Use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

February 2025