January 2025

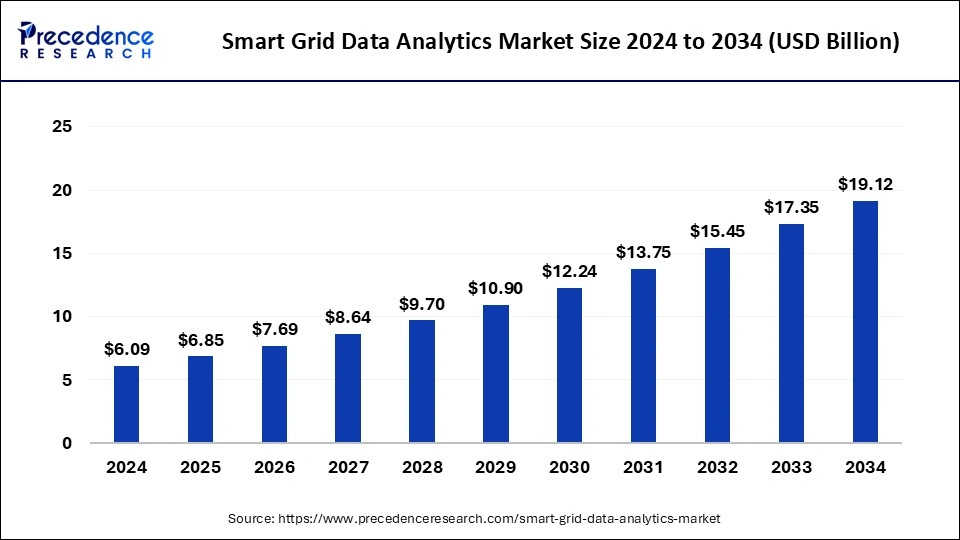

The global smart grid data analytics market size is calculated at USD 6.85 billion in 2025 and is forecasted to reach around USD 19.12 billion by 2034, accelerating at a CAGR of 12.12% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global smart grid data analytics market size was estimated at USD 6.09 billion in 2024 and is predicted to increase from USD 6.85 billion in 2025 to approximately USD 19.12 billion by 2034, expanding at a CAGR of 12.12% from 2025 to 2034. Policies made by the government to improve the electric grids and enhance their operational efficiency led to the rising adoption of technologically advanced systems to support smart grids and precise data collection, fuelling the expansion of the global smart grid data analytics market.

The smart grid data analytics market is experiencing substantial growth due to the rising adoption of smart grid technologies and the growing demand for energy efficiency and reliability. With the integration of advanced metering structures, utilities are generating vast amounts of data, which further needs sophisticated analytics to derive actionable plans and insights. The market is propelled due to the government's initiatives and regulatory mandates aimed to modernize electric grids, reduce carbon emissions to enhance energy management.

Smart grid data analytics market has some key trends which includes deployment of AI machine learning particularly for predictive analytics enabling proactive maintenance and real-time decision making. Utilities are leveraging these technologies to optimize operations of grids, to reduce wastages helps in improving consumer service and experience as well. The rise of renewable energy sources and distributed energy sources needs advanced predictive analytics for overall integration and management.

Region-wise, North America currently leads the smart grid data analytics market due to the early adoption of cutting-edge technologies and significant advancements in smart grid projects, followed by Europe and the Asia Pacific. Major players in the market are aiming to make strategic partnerships, mergers, and acquisitions to expand their portfolio on a global scale.

| Report Coverage | Details |

| Market Size by 2034 | USD 19.12 Billion |

| Market Size in 2025 | USD 6.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.12% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Advancement in metering infrastructure

A significant driver for the smart grid data analytics market is advancements in smart metering infrastructure (AMI). Smart meters are equipped with digital communication technology to provide real-time data on electricity consumption, power quality, and voltage level with time, which enables both providers and consumers to manage and monitor energy usage effectively. Such real-time data collection is critical for the deployment of smart grid analytics, which transforms raw data into useful insights to improve grid reliability, efficiency, and sustainability.

AMI system extends beyond smart meters and facilitates robust infrastructure support for remote meter reading, data collection and analysis, peak in demand, and its management without failure in provision. The precise data provided by AMI allows utilities to actively address issues before they arise, reducing downtime and saving the overall operational cost.

Additionally, the continuous evolvement in AMI systems incorporated with advanced technologies like IoT and cloud computing again boosts the capabilities of smart grid analytics. These advancements drive the smart grid data analytics market exponentially on a larger scale.

Lack of awareness

Despite the significant advancements in smart meters and advanced metering infrastructure, a major restraint for the smart grid data analytics market is the lack of awareness among consumers and some utility companies. Many consumers are not fully aware of the benefits that smart grid technologies can offer, such as improved energy efficiency, cost savings, and enhanced reliability of electricity supply. This lack of awareness can lead to resistance or reluctance to adopt smart meters and participate in demand response programs.

Similarly, smaller utility companies, especially in developing regions, may lack the knowledge and resources to implement and utilize advanced metering infrastructure and data analytics effectively. These utilities might be unaware of the potential return on investment or the long-term operational benefits that smart grid analytics can provide. Additionally, the perceived complexity and cost of deploying AMI systems and integrating sophisticated analytics tools can be a hindrance for utilities with limited budgets and technical expertise. This gap in awareness and understanding hampers the widespread adoption of smart grid technologies, slowing down market growth.

Addressing this challenge requires concerted efforts in education and outreach by industry stakeholders, including governments, utility companies, and technology providers, to demonstrate the value proposition and benefits of smart grid data analytics to both consumers and utilities.

Hybrid deployment model

The hybrid deployment model presents a significant opportunity for the smart grid data analytics market. This approach combines the best aspects of on-premises and cloud-based solutions, offering a flexible and scalable option for utilities seeking to optimize their grid operations without compromising on security and control. With a hybrid model, utilities can manage sensitive data and critical infrastructure on-premises, ensuring compliance with regulatory requirements and maintaining high levels of security. At the same time, they can leverage the cloud for processing large volumes of data and advanced analytics, benefiting from the cloud's scalability, cost-effectiveness, and ease of access to the latest technological advancements.

This model also supports utilities in managing peak loads and enhancing disaster recovery capabilities. During normal operations, utilities can rely on their on-premises infrastructure, but during peak demand or unforeseen events, they can seamlessly shift some of their data processing and analytics workloads to the cloud. This flexibility helps maintain continuous operations and minimize downtime.

Hybrid models facilitate a gradual transition to cloud technologies, enabling utilities to modernize their infrastructure incrementally without significant upfront investments. This reduces the financial and operational risks associated with full-scale cloud adoption. As utilities increasingly recognize the benefits of a hybrid deployment model, the demand for smart grid data analytics solutions that support this flexible approach is expected to grow, driving innovation and expansion in the market.

The solution segment held the largest share of the smart grid data analytics market in 2024. The growth rate of the solution segment is increasing owing to the numerous benefits provided by the solution segment, like enhanced grid reliability, enhanced security, regulatory compliance, and improved energy maintenance by forecasting it. Real-time data analysis enables utilities to optimize energy distribution and effectively aid in balancing supply and demand. It also ensures adherence to regulatory standards to maintain the reliability and authenticity of the solutions provided. Advanced analytics solutions are a boon for every sector, including the smart grid data analytics market, as it has a proactive approach to safeguard a system from a cyber threat before it collapses completely. These benefits propel the growth of the smart grid data analytics market globally.

The cloud-based segment is expected to grow at the fastest rate in the smart grid data analytics market during the forecast period. The growth factors of this segment include cost effectiveness, high scalability, and precise outcomes by advanced analytics methods. Cloud-based deployment helps reduce further capital expenditures, such as hardware and maintenance costs. Cloud-based deployment enables real-time data analysis and access to it, which improves efficiency and decision-making. Additionally, the advancement in smart grid technologies generates massive amounts of data that needs to be analyzed effectively; hence, data analytics has emerged as a key factor for analyzing and visualizing the data, which further propels the growth of cloud-based segment by deployment insight, fuelling the smart grid data analytics market exponentially.

The advanced metering segment is expected to grow at a significant rate in the smart grid data analytics market in the upcoming period. Advanced metering has completely transformed the smart grid data analytics market due to several key factors like predictive maintenance, load forecasting, anomaly detection, and demand response optimization. Advanced metering infrastructure data provides precise information on the consumption of energy and its patterns. By analyzing these patterns, operators can gain valuable insight, such as peak time for demand and how to optimize supply according to it. Moreover, advanced metering is fostered due to its ability to detect anomalies, such as spurs in energy consumption or sudden drops, which helps to avoid equipment failure and ensures efficient energy distribution.

The large enterprise segment dominated the smart grid data analytics market in 2024. Large enterprises have significant financial capabilities, which allows them to invest heavily in advanced technologies with robust infrastructure to support smart grid analytics. They offer a skilled manual workforce to manage and operate complex grid networks and optimize their operations effectively. Moreover, large enterprises are often involved in strategic partnerships and alliances with other firms, which propels the growth of the market further at a significant rate.

The small & medium enterprise segment is projected to register the fastest growth in the smart grid data analytics market during the forecast period 2024 to 2033. The major reason behind the proliferation of small and medium enterprises in a market is government support for start-ups and policies offered by authorities to propel the business further. Also, cloud-based solutions are increasingly becoming affordable, which makes SMEs purchase them and implement these data analytics solutions into the business model, fuelling the SME's growth, notably in the smart grid data analytics market.

North America dominated the smart grid data analytics market in 2024. The region’s early adoption of advanced technologies and substantial investments in grid modernization projects laid a strong foundation for market leadership. The United States and Canada have been at the forefront of implementing smart meters, AMI, and other smart grid technologies, generating vast amounts of data that necessitate sophisticated analytics.

Government initiatives and regulatory mandates significantly contributed to market dominance. Policies aimed at enhancing energy efficiency, reducing carbon emissions, and improving grid reliability drove utilities to adopt smart grid solutions. Programs like the U.S. Department of Energy’s Smart Grid Investment Grant Spurred extensive deployment of smart grid technologies across the country. Technological innovation and the presence of key market players also played a vital role. North America is home to numerous leading technology firms and solution providers specializing in smart grid analytics, offering cutting-edge tools and services. These companies continuously drive advancements in AI, machine learning, and big data analytics, further strengthening the market.

Additionally, high consumer awareness and acceptance of smart grid benefits, coupled with the increasing demand for reliable and efficient energy management, boosted market growth. These combined factors ensured that North America remained the dominant force in the smart grid data analytics market in 2023.

Asia Pacific is poised to be the fastest-growing smart grid data analytics market in the coming years. The growth of this region has several key factors, including rapid urbanization and industrialization in countries like China, India, and Japan, which are driving the need for more efficient and reliable energy management systems. These nations are heavily investing in smart grid technologies to address the increasing demand for electricity and to modernize their aging grid infrastructures.

Government initiatives and regulatory frameworks are also playing a significant role. Numerous policies and programs aimed at reducing carbon emissions, enhancing energy efficiency, and promoting renewable energy sources are encouraging the AMI and smart grid solutions. For instance, China’s ambitious plans for grid modernization and India’s smart city projects are significant contributors to market growth.

Technological advancements and increasing investments from both public and private sectors further support this trend. The integration of Internet of Things (IoT) devices and advancements in AI and machine learning for predictive analytics are enhancing the capabilities of smart grid systems in the region. Additionally, the growing awareness of the benefits of smart grid analytics among utilities and consumers is accelerating adoption. These combined factors make Asia Pacific the fastest-growing market for smart grid data analytics in the foreseeable future.

By Component

By Deployment

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2024

April 2024