January 2025

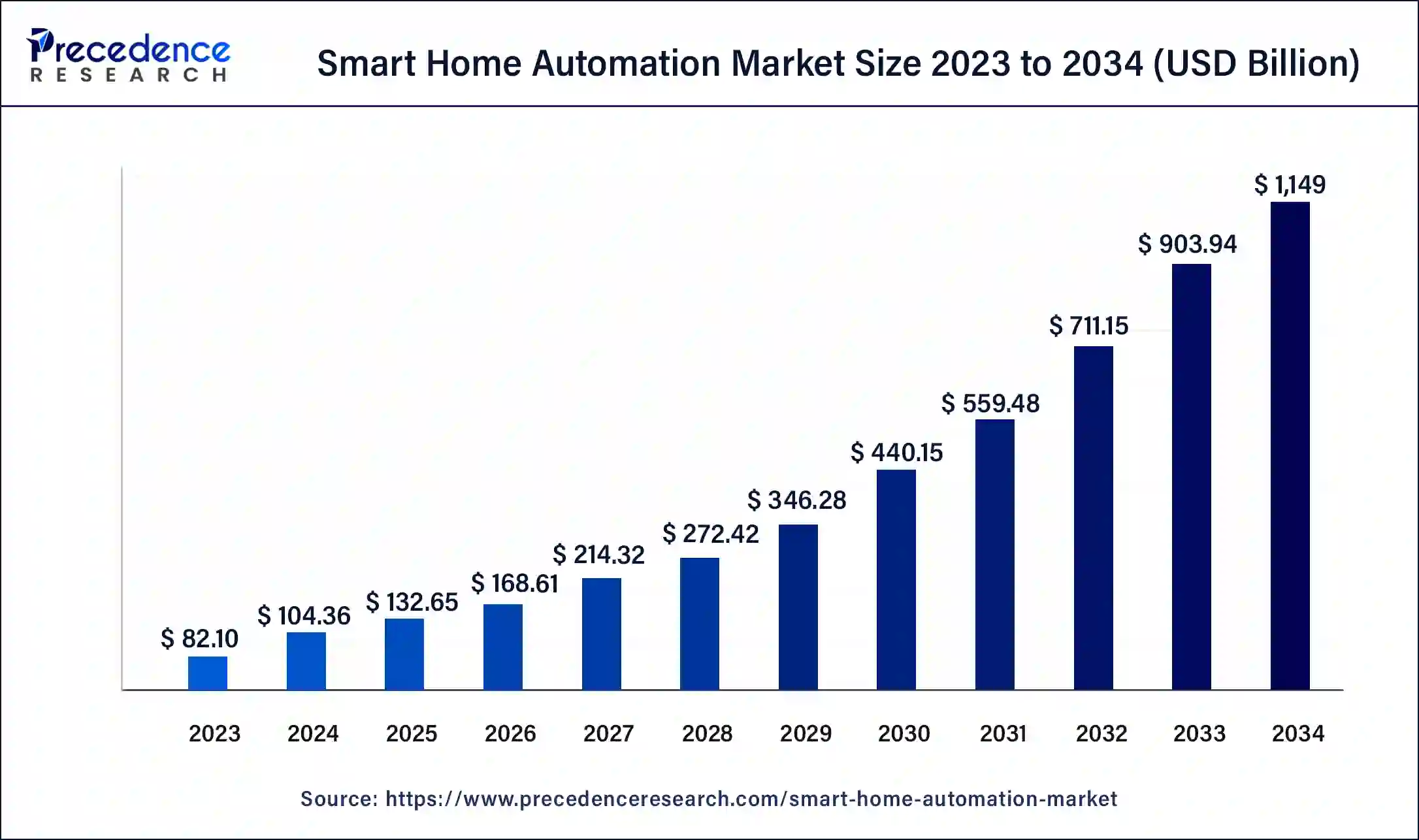

The global smart home automation market size was USD 82.10 billion in 2023, calculated at USD 104.36 billion in 2024 and is expected to be worth around USD 1,149 billion by 2034. The market is slated to expand at 27.11% CAGR from 2024 to 2034.

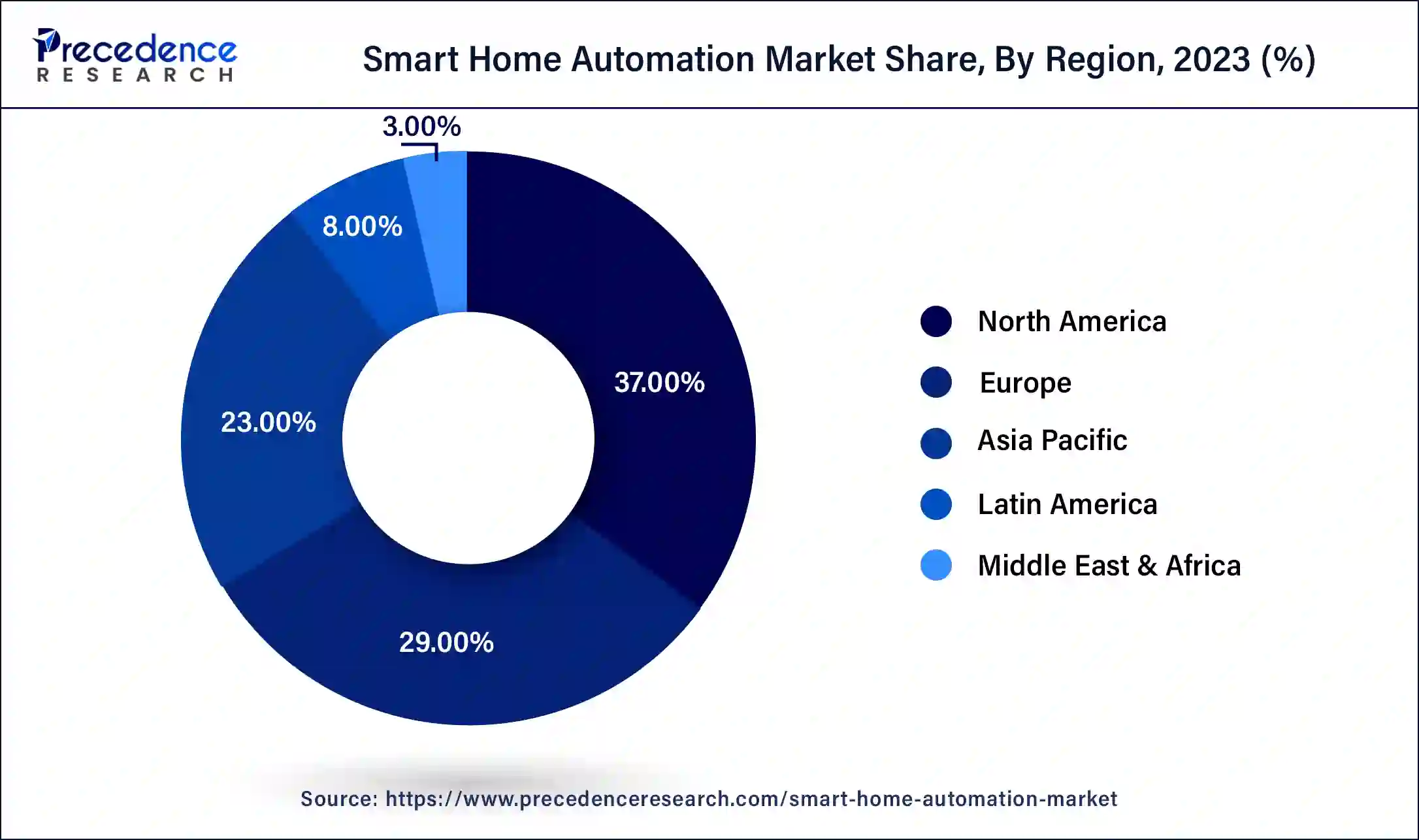

The global smart home automation market size is projected to be worth around USD 1,149 billion by 2034 from USD 104.36 billion in 2024, at a CAGR of 27.11% from 2024 to 2034. The North America smart home automation market size reached USD 30.38 billion in 2023. Increasing demand for convenience, energy efficiency, enhanced security, and overall quality of life is the key driver of the smart home automation market.

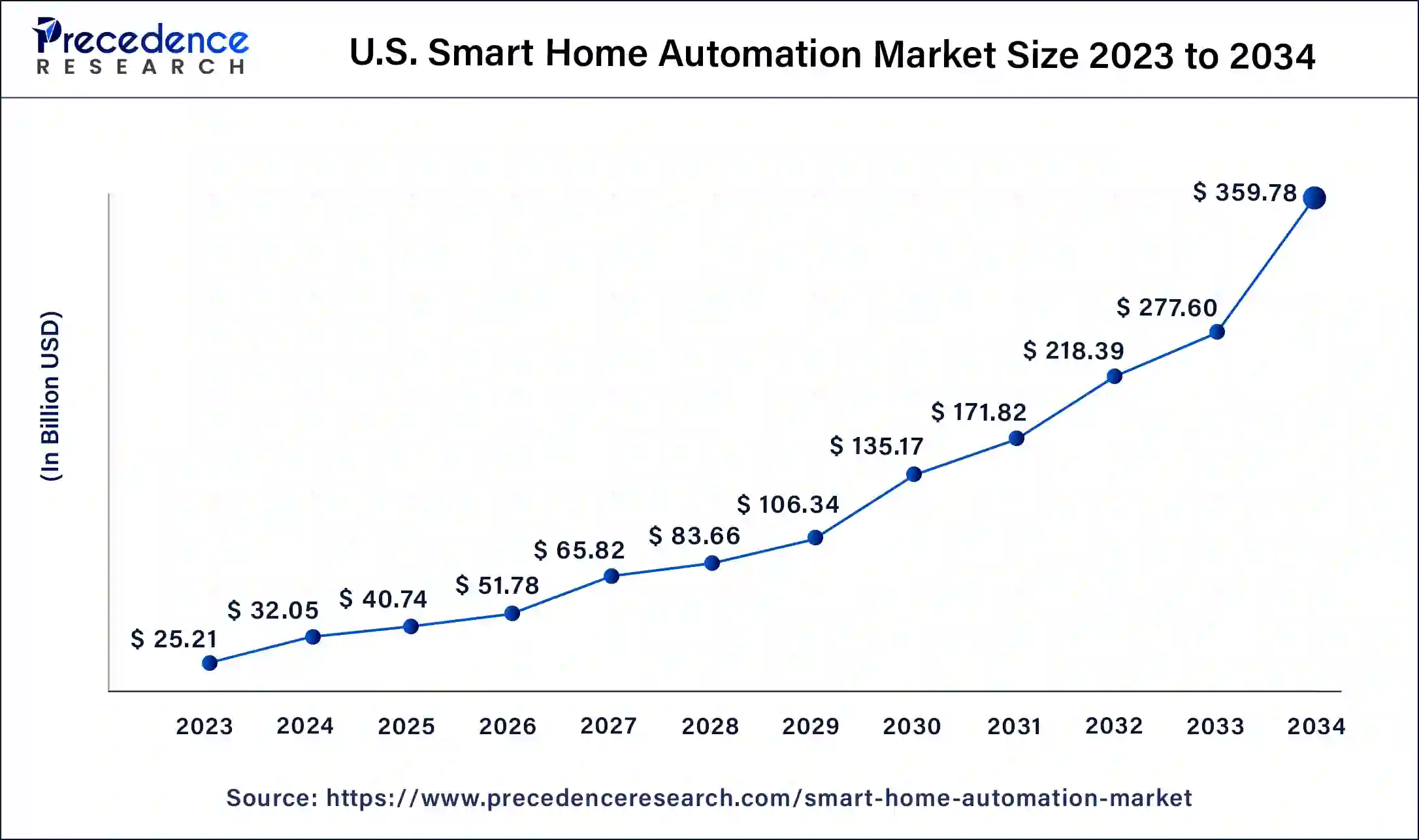

The U.S. smart home automation market size was exhibited at USD 25.21 billion in 2023 and is projected to be worth around USD 359.78 billion by 2034, poised to grow at a CAGR of 27.33% from 2024 to 2034.

North America led the global smart home automation market with the largest market share in 2023. The U.S. commands a large share of the market because of its infrastructure and a broad array of products, which result from a strong manufacturing base. The rise of the North American smart home market stems from the rising usage of IoT-based smart devices for home use and the provision of effective connectivity solutions.

Asia Pacific is expected to host the fastest-growing smart home automation market throughout the forecast period. The Asia Pacific smart technology industry has entered a phase of large-scale implementation, especially in recent years, in China, Japan, and India, among consumer awareness, rapid digitalization, high smartphone penetration, the growing need for energy consumption and emissions, and government initiatives are an essential factor to boosting the Asia Pacific market.

Growing the internet of things system offers a variety of applications such as device-to-device communication and control, all together providing an interactive environment with enhanced convenience, which has increased the adoption of smart home automation technology.

Smart home automation technology permits property holders to control and automate various home devices and systems using a central hub using smartphones, voice commands, and IoT. Home automation makes life more convenient and can even save you money on heating, cooling, and electricity bills. Home automation can also lead to greater safety with Internet of Things devices like security cameras and systems.

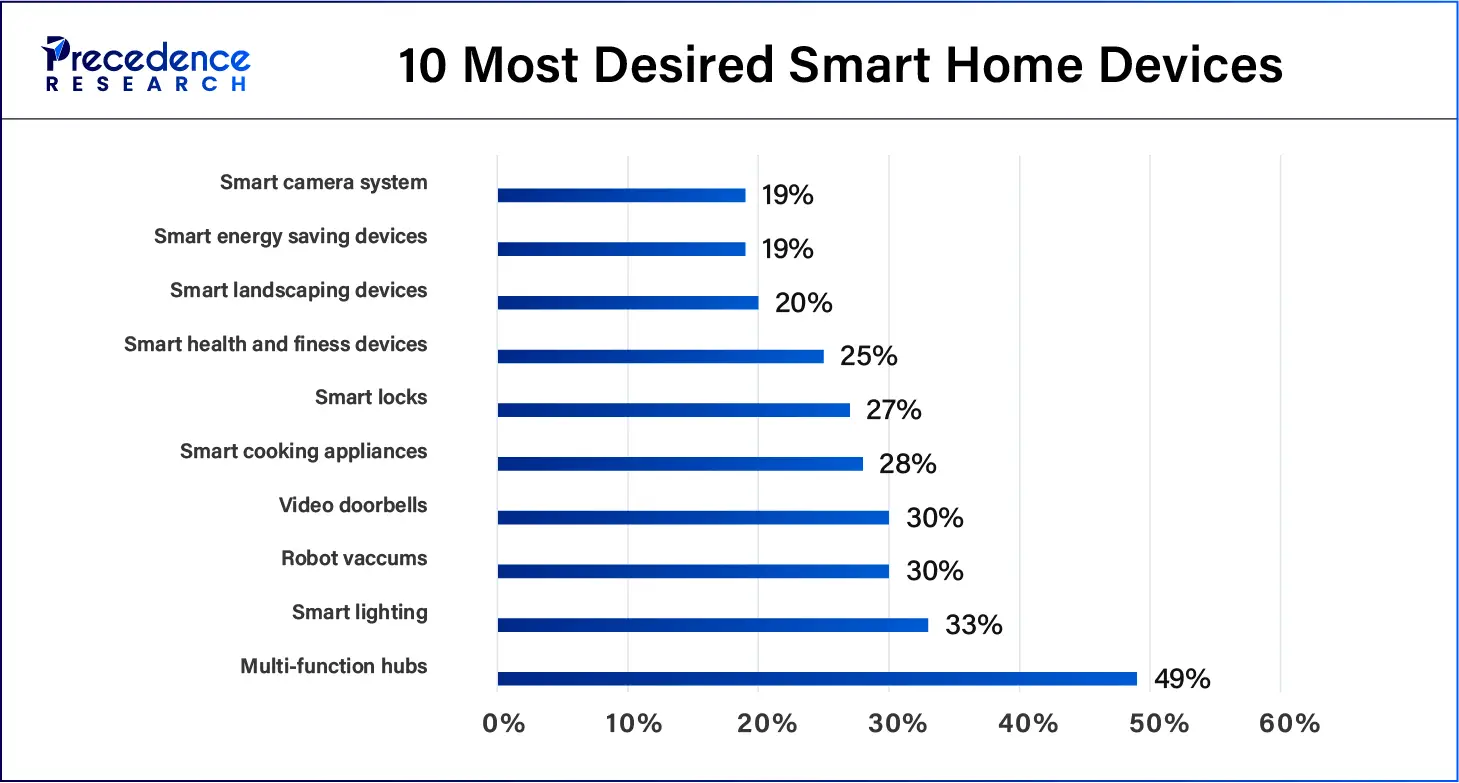

The smart home automation market typically includes equipment such as smart thermostats, smart lighting, smart locks, security systems, and entertainment systems. With the increasing prevalence of IoT, smart homes have become increasingly popular, and automation systems have emerged as a key technology for controlling and managing various home appliances and systems. Home automation is a technology that lets users create and trigger automatic functions for home devices.

| Home Automation Products | Application |

| Home automation controllers | They allow you to integrate and control security, heating and air, lighting, entertainment, and other home systems with simple convenience. |

| Lighting & appliance controls | Save valuable energy by automating the home's lighting and appliance controls. |

| Home automation sensors | Automation sensors are the eyes and ears of your home, informing you and other smart devices of changes in status 24/7. |

| Smart thermostats & ventilation controls | Notifications when temperatures reach a certain setpoint or monitor |

| Window opener systems | Open and close your windows and skylights remotely or automatically without interrupting activities with window opener systems. |

| Smart door locks | Increase the security, accessibility, and style of your front door or security checkpoint door with smart door locks. |

How is AI Changing the Smart Home Automation Market?

Recent progress in artificial intelligence (AI), particularly through machine learning and computer vision, has shown great promise in enhancing the performance of the smart home automation market. Technological trends, such as AI machine learning, computer vision, etc., are expected to stimulate demand for production in the market. Artificial intelligence will play a pivotal role in including grid data, smart meter data, weather data, and energy use information to study and improve building performance, optimize resource consumption, and increase comfort and cost efficiency for residents.

Beyond individual homes, AI can also help gather data from many buildings to enhance design and construction practices and inform urban planning policy. AI and ML integration allows smart home devices to offer sophisticated personalization and automation. Predictive analytics, Machine Learning (ML), and Natural Language Processing (NLP) tools will make these AI algorithms more intelligent in predicting & addressing end-user requirements.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,149 Billion |

| Market Size in 2023 | USD 82.10 Billion |

| Market Size in 2024 | USD 104.36 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 27.11% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Technology, Fitment, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The increasing aging population

The growing aging population severely increased safety and security concerns for senior citizens, making them strong drivers of the smart home automation market. Senior citizens are more susceptible to security threats such as robbery and accidents. The security technology comes in smart home systems like surveillance cameras, door locks, and alarms.

With the help of surveillance cameras, people can monitor indoor and outdoor areas in real-time, providing live feeds to family members or caregivers. These devices eliminate the dangers that come with regular keys by allowing entry through smartphones without letting unwanted strangers into their homes. The best home alarm systems are equipped with the ability to immediately alert homeowners and emergency services.

As the population ages, so is expected consumer demand to push smart home automation systems in favor of independent living. These are the technologies that meet some of their more pressing security and peace-of-mind needs, so they could be seen as an essential investment to improve elder lives or contribute a bit of mind-cover for those who care about them.

Increasing consumer demand

Growing consumer needs for convenience, comfort, energy efficiency, and security are one of the primary factors behind the growth in demand across the smart home automation market. From improved performance, greater power savings, and a smoother living experience to methods of controlling the key functions remotely (security system management, lighting control, etc.), as more homeowners move toward managing their domestic spaces with increasingly effective smart home systems can do all this.

However, the growth has been further accelerated by rapid advances in wireless communication technology, the Internet of Things (IoT), and artificial intelligence/machine learning technologies, allowing for quicker development of more sophisticated & integrated solutions.

High Initial Product Costs

The major downside challenged by the smart home automation market is the higher upfront cost related to these systems, from consumer hardware like smart thermostats, cameras, or lighting systems to professional installation services and control units. The cost of installation and maintenance is relatively high. Although the market as a whole is growing, concerns about costs being too high have been an obstacle to smart home technology adoption for some consumers.

Rising demand for voice-controlled assistants

The key opportunity in the smart home automation market is the growing demand for voice-controlled assistants. Within Smartphones and home speakers, software agents like Amazon Alexa, Microsoft Cortana, and Apple Siri in Google Assistant, devices can answer basic questions of information and arithmetic and, most importantly, control IOT devices, which makes the user more convenient in terms of understanding spoken language and executing commands.

These devices can be programmed to adjust thermostats, turn on lights, and play music, and they are also capable of sending messages (text only), emails, and phone calls. The increasing interest in voice-enabled technology represents a great chance to attract more smart home systems and promote the expansion of the market through seamless & simple user experience.

The hardware segment accounted for the biggest share of the smart home automation market in 2023. Common home automation devices include smart thermostats, smart lighting systems, network security cameras and analytics (VCA), digital door lock systems, home monitoring/connected life services, and connected plug devices. These devices allow for full control and monitoring of home features such as lighting, climate, entertainment systems, appliances, etc.

Furthermore, they frequently work in conjunction with home security implementations such as access and alarm systems to highlight the importance of hardware concerning achieving fully functional homes.

The services segment is expected to grow at the fastest rate in the smart home automation market during the forecast period. Increasing demand for installation, maintenance, and support-related services of home automation systems is the major growth enabler in this market. As smart home technology continues to advance, the more critical skills of in-service support (installation, configuration, and lifecycle management) become available for professional services, among many other types of IoT market transformations.

The hybrid segment has contributed the largest share of the smart home automation market in 2023. The combination of wired and wireless systems is advantageous. Integrating wired and wireless technologies allows for a harmonious merging of their strengths. By leveraging wired infrastructure for high-performance applications and incorporating wireless devices for flexibility and mobility, homeowners can create a smart home ecosystem that seamlessly balances reliability, convenience, and functionality.

The wireless technology segment is expected to show considerable growth in the smart home automation market over the forecast period. This is due to the rapid penetration of wireless technologies, including GSM, Bluetooth, ZigBee, and Wi-Fi in smart home systems, by providing direct access to voice-controlled assistants, sensors, programmable controllers, and other wireless accessories. Energy management, security management, entertainment management, cooling management, and other automation system applications are used in smart homes. Interoperability will allow for simple integration with the current internet of various smart gadgets.

The retrofit segment generated the highest share of the smart home automation market in 2023. The segment is attributed to the high number of already constructed homes. It involves the integration of home automation systems in existing homes with minimal damage to infrastructure. This improved energy efficiency while preserving the existing structure and improving the aesthetic of the home.

The new construction segment is expected to grow at the fastest rate in the smart home automation market during the forecast period. Home automation is being considered as a standard fitment in new homes. So, it can be projected that soon, the community of builders will be keen on popularising this component in the upcoming residential construction as standard fitment to improve comfort and provide energy savings.

The security & access segment accounted for the largest share of the smart home automation market in 2023. The segment is led by the growing interest of people in upgrading their home security with advanced technologies like surveillance cameras, smart locks, and alarm systems. These solutions offer a strong defense against out and emergency cases; thus, they are the main point of attention for people who want to be safer and have more control in their homes.

The smart kitchen segment is anticipated to witness significant growth in the smart home automation market over the studied period. The kitchen is the space that is most important in a home in terms of safety; it is necessary to address measures for risks such as gas leaks, uncontrolled fires, and excessive temperatures. Kitchen IoT technologies offer real-time monitoring and alerts, which are useful even at remote locations, as a way to make the kitchen safe.

The main goal of this study is to create a kitchen security model using both hardware and software components. On the hardware side, the system will use gas sensors, temperature sensors, humidity sensors, servo motors, Arduino UNO, and Node MCU. The software side will have a mobile monitoring app integrated with Node MCU to provide improvements in kitchen safety and efficiency.

Segments Covered in the Report

By Component

By Technology

By Fitment

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2024

April 2024