January 2025

Soft Tissue Repair Market (By Product: Synthetic, Allograft, Xenograft, Alloplast; By Application: Breast Reconstruction, Hernia, Dermatology, Orthopaedics, Dental Problems, Vaginal Sling, Others; By End-user: Hospitals, Ambulatory Surgical Services, Clinics) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

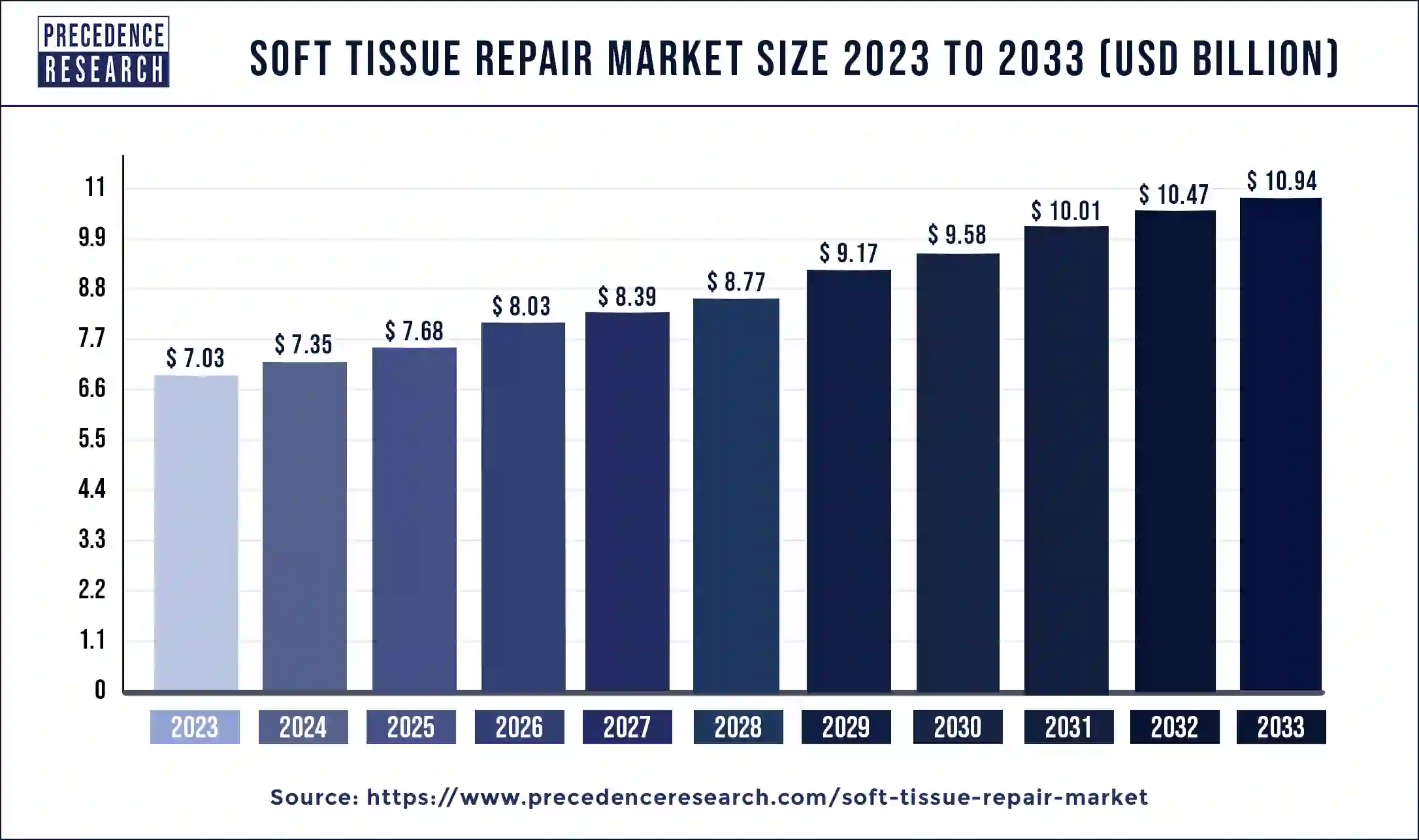

The global soft tissue repair market size was valued at USD 7.03 billion in 2023 and is anticipated to reach around USD 10.94 billion by 2033, growing at a CAGR of 4.52% from 2024 to 2033. Orthopedic solutions account for a sizeable percentage of the tissue repair industry due to the availability of a range of treatments.

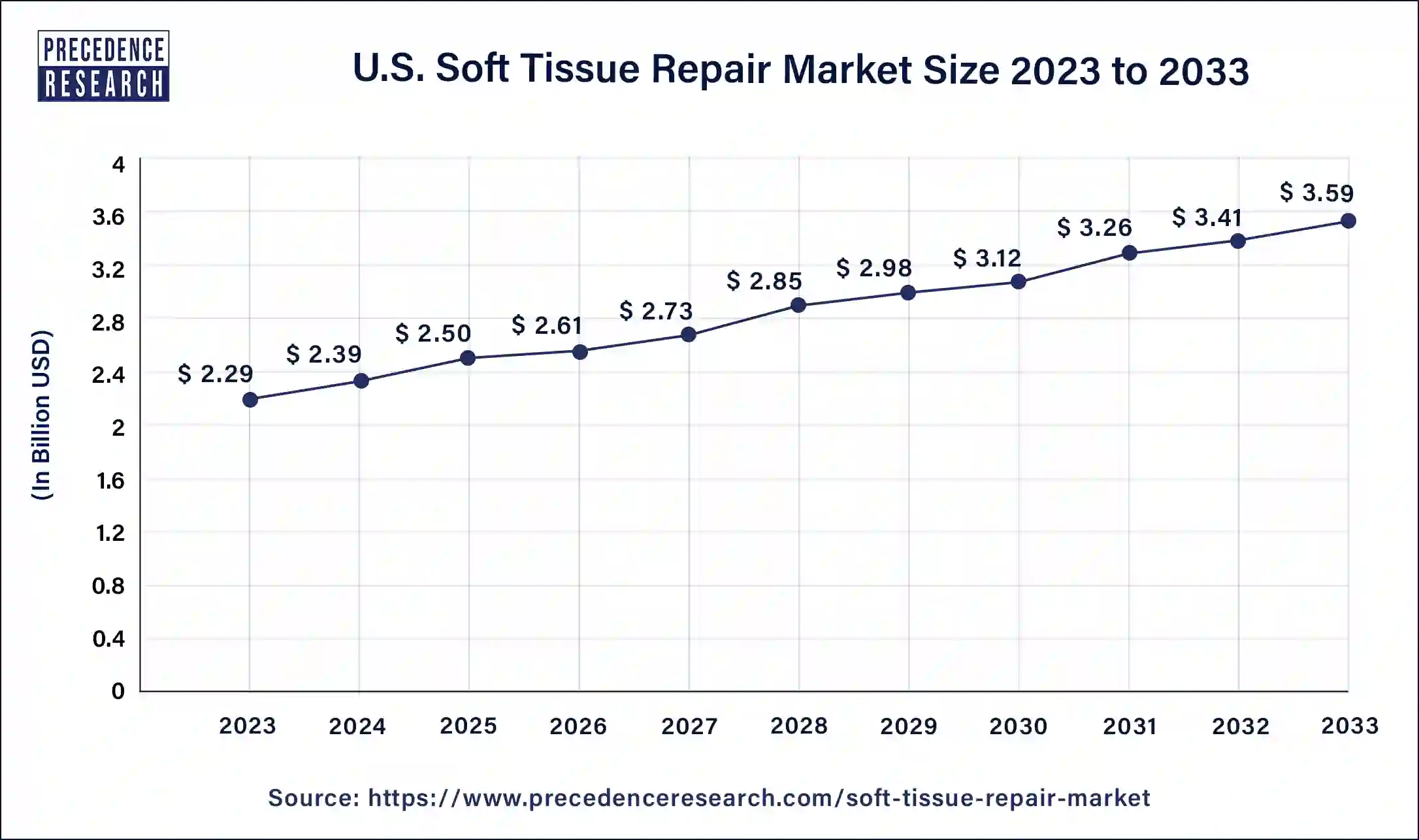

The U.S. soft tissue repair market size was estimated at USD 2.29 billion in 2023 and is predicted to be worth around USD 3.59 billion by 2033 with a CAGR of 4.58% from 2024 to 2033.

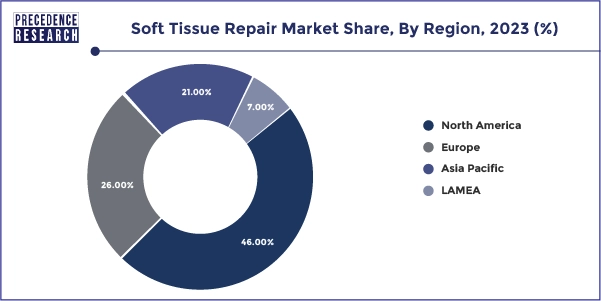

North America dominated the soft tissue repair market in 2023. The need for soft tissue repair treatments is driven by the rising prevalence of obesity, chronic illnesses including hernias and arthritis, and sports-related injuries in North America. The high rate of engagement in sports and fitness activities, along with an active lifestyle, greatly increases the demand for these medical procedures. The area is home to a highly developed healthcare infrastructure that includes state-of-the-art hospitals, innovative medical equipment, and highly qualified medical staff. Soft tissue injury diagnosis, treatment, and post-operative care are made possible by this infrastructure.

The United States and other countries in North America serve as centers for medical research and development. Advances in soft tissue repair technologies, such as minimally invasive surgical procedures, regenerative medicine, and advanced bio-materials, have been made possible by significant investments in research and development by both public and commercial entities.

Asia Pacific is expected to grow at a significant CAGR in the soft tissue repair market during the forecast period. The upcoming enormous growth is attributed to the rising disposable income in this region; thus, people's willingness to spend more on soft tissue repair treatment is growing. Moreover, continuous growth in research in this field is also projected to dominate the market expansion. Several key players in Asia Pacific are taking advantage of the region's expanding market potential due to their governments' commitments to launching steps to improve their healthcare systems.

The Asia Pacific soft tissue repair market size was calculated at USD 1.48 billion in 2023 and is projected to expand around USD 2.35 billion by 2033, poised to grow at a CAGR of 4.73% from 2024 to 2033.

| Forecast Year | Market Size in USD |

| 2023 | $ 1.48 Billion |

| 2024 | $ 1.54 Billion |

| 2025 | $ 1.61 Billion |

| 2026 | $ 1.69 Billion |

| 2027 | $ 1.76 Billion |

| 2028 | $ 1.84 Billion |

| 2029 | $ 1.93 Billion |

| 2030 | $ 2.01 Billion |

| 2031 | $ 2.10 Billion |

| 2032 | $ 2.20 Billion |

| 2033 | $ 2.35 Billion |

Soft Tissue Repair Market Overview

The soft tissue repair market refers to the biological and medicinal procedure used to restore the body’s soft tissues after harm. These tissues, which are vulnerable to rips, strains, sprains, and cuts, include muscles, tendons, ligaments, skin, and fascia. While soft tissue healing can sometimes happen on its own, other times, it requires surgical assistance to speed up the process. Physical therapy, medicine, surgery, or regenerative therapies such as steam cell therapy and platelet-rich plasma (PRP) injection might be used as treatments.

The soft tissue repair market is fragmented by multiple small-scale and large-scale players, such as B. Braun Melsungen AG, Baxter, C. R. Bard, Inc., Smith & Nephew, Johnson & Johnson Services Inc., Stryker, Medtronic, Acera Surgical Inc., Arthrex Inc., Integra LifeSciences, ACELITY L.P. Inc., AROA BIOSURGERY LIMITED, Becton, Dickinson, and Company, CONMED, Human Regenerative Technologies, LLC, BioCer Entwicklungs-GmbH, Betatech Medical.

| Report Coverage | Details |

| Soft Tissue Repair Market Size in 2023 | USD 7.03 Billion |

| Soft Tissue Repair Market Size in 2024 | USD 7.35 Billion |

| Soft Tissue Repair Market Size by 2033 | USD 10.94 Billion |

| Soft Tissue Repair Market Growth Rate | CAGR of 4.52% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver: Rising incidence of soft tissue injuries

The rising incidence of soft tissue injuries can grow the soft tissue repair market. Sports injuries, accidents, and other soft tissue-related injuries are common as people age and continue to be active, which results in the increasing demand for soft tissues, which may grow the soft tissue repairing market.

Restraint: Lack of awareness about soft tissue repairing

The lack of awareness about soft tissue repair may slow down the soft tissue repair market. Awareness of the advantages of soft tissue repair is essential for doctors and patients. Also, there is no awareness of soft tissue repairing solutions in rural areas due to a lack of education about healthcare relating to soft tissue repairing solutions, which may slow down the soft tissue repairing market.

Opportunity: Technical Advancement in soft tissue repairing

Technical advancements in soft tissue repair may be an opportunity to grow the soft tissue repair market. Advancements in technology that expand the market include the development of innovative biomaterials, safer surgical techniques, and enhanced healing methods, which are driving the market.

The allograft segment dominated the soft tissue repair market in 2023. The tissues from donors of the same species that are transplanted as allografts usually have a high level of bio-compatibility. This indicates that they blend in well with the tissues of the receiver, lowering the possibility of rejection and enhancing the course of recovery. Allografts are widely available for repairing different types of soft tissues, such as cartilage, ligaments, and tendons. They are a flexible choice for both patients and doctors due to their availability and diversity.

The synthetic segment is expected to grow at the highest CAGR in the soft tissue repair market during the forecast period. The developments that more closely replicate the characteristics of natural tissues have been made possible by advancements in synthetic material technology. This advanced material is for a variety of soft tissue repair applications because it provides enhanced strength, flexibility, and bio-compatibility.

The risk of disease transmission from donor tissues is reduced with synthetic material as compared to biological grafts. This benefit is especially significant in lowering the possibility of infection and other health-related issues to biological materials. Since synthetic materials can be produced to the highest standards, performance and quality are sure to be constant. For both patients and doctors, this predictability is essential because it produces more dependable results from soft tissue repair surgery.

The orthopedics segment dominated the soft tissue repair market in 2023. The dominance of orthopedics in the soft tissue repair market is due to the wide range of therapies needed, the high incidence and level of musculoskeletal disorders, and the developments in both surgical and non-surgical approaches. The disorders include osteoporosis, rheumatoid arthritis, osteoarthritis, and other kinds of fractures, and soft tissue injuries are common. The need for orthopedic therapies is increased by the aging of the world’s population, which also makes these disorders more common. The orthopedic solutions account for a sizeable percentage of the tissue repair industry due to the range of treatment choices available.

The breast reconstruction segment is expected to grow at the highest CAGR in the soft tissue repair market during the forecast period. Breast reconstruction operations are in high demand due to the increasing global frequency of breast cancer. A growing number of women are having mastectomies and then choosing reconstruction operations to restore their breast look as early diagnosis and awareness of breast cancer increase. Improving implants, autologous tissue restoration, and less invasive procedures are just a few of the technological advances in breast reconstruction techniques that have improved results and shortened recovery periods. Improved efficacy and visual appeal are also outcomes of biomaterials and tissue engineering innovations.

The hospitals segment dominated the soft tissue repair market in 2023. The advanced medical facilities and tools required to carry out intricate soft tissue repair treatments are usually found in hospitals. Hospitals are the ideal location for these procedures because they have the most advanced imaging technology, specialist operating rooms, and surgical equipment available. Specialized healthcare workers with experience performing soft tissue repair treatments, such as surgeons, anesthesiologists, and other medical personnel, are more frequently employed in hospitals. More patients are drawn to hospital settings because of their competence, which guarantees better patient outcomes and higher success rates.

The pre-operative evaluations, surgical intervention, and post-operative care are all included in the complete treatment that hospitals offer. The hospitals are the best option for these treatments because of their comprehensive approach, which is essential to patients' effective recovery during soft tissue repair.

The clinic's segment is expected to grow to at the highest CAGR in the soft tissue repair market during the forecast period. Outpatient operations are becoming more and more popular since they are more affordable, less time spent in the hospital, and more convenient. The clinics are a desirable alternative for patients since they can handle a variety of soft tissue repair operations as outpatients.

The advancements in less invasive surgical methods have enabled soft tissue repair treatments to be carried out in clinical settings. Due to the fact that these methods frequently lead to reduced discomfort, problems, and recovery times, clinics are a good substitute for hospitals. Generally speaking, clinics are less expensive than hospital treatments, which is a big deal for patients, especially those with large deductibles or no insurance. More people are seeking treatment in clinic settings due to the cost-effectiveness of these treatments.

Segment Covered in the Report

By Product

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

September 2024

February 2025