November 2024

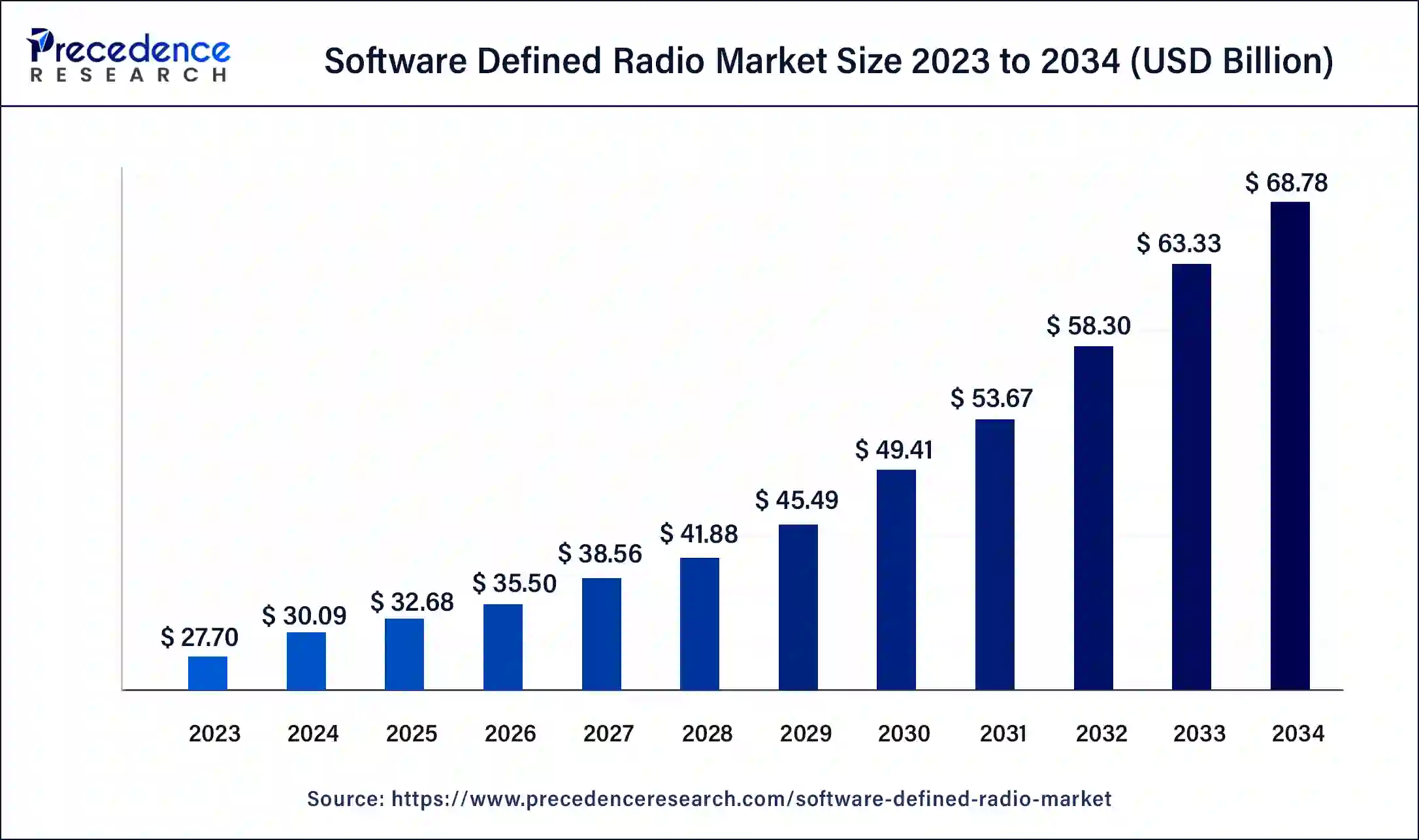

The global software defined radio market size was USD 27.70 billion in 2023, calculated at USD 30.09 billion in 2024 and is expected to be worth around USD 68.78 billion by 2034. The market is slated to expand at 8.62% CAGR from 2024 to 2034.

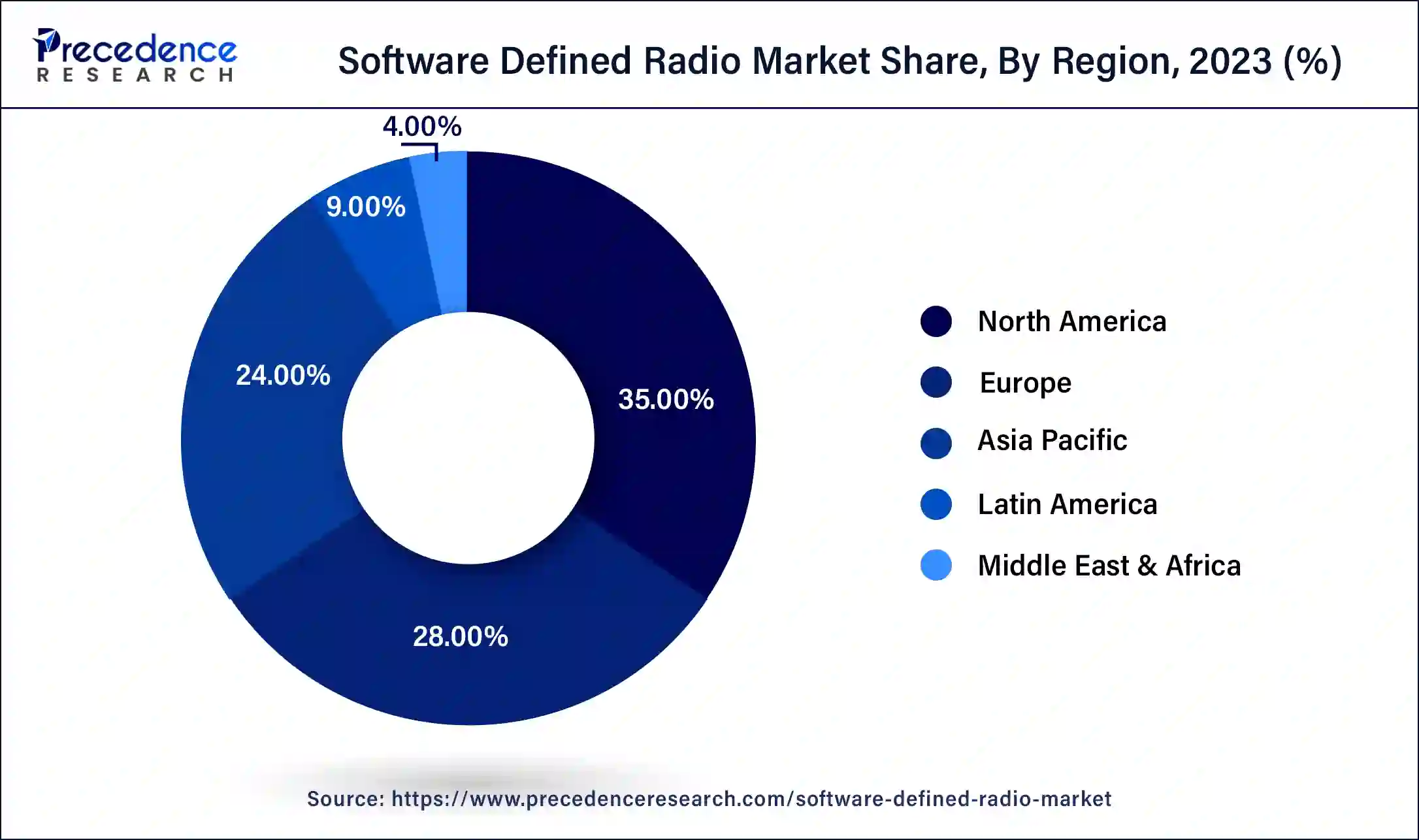

The global software defined radio market size is expected to be valued USD 30.09 billion in 2024 and is anticipated to reach around USD 68.78 billion by 2034, growing at a solid CAGR of 8.62% over the forecast period 2024 to 2034. The North America software defined radio market size reached USD 9.70 billion in 2023. High demand for precise communication with secure data transmission in diverse sectors, world widely propelling the software defined radio market growth.

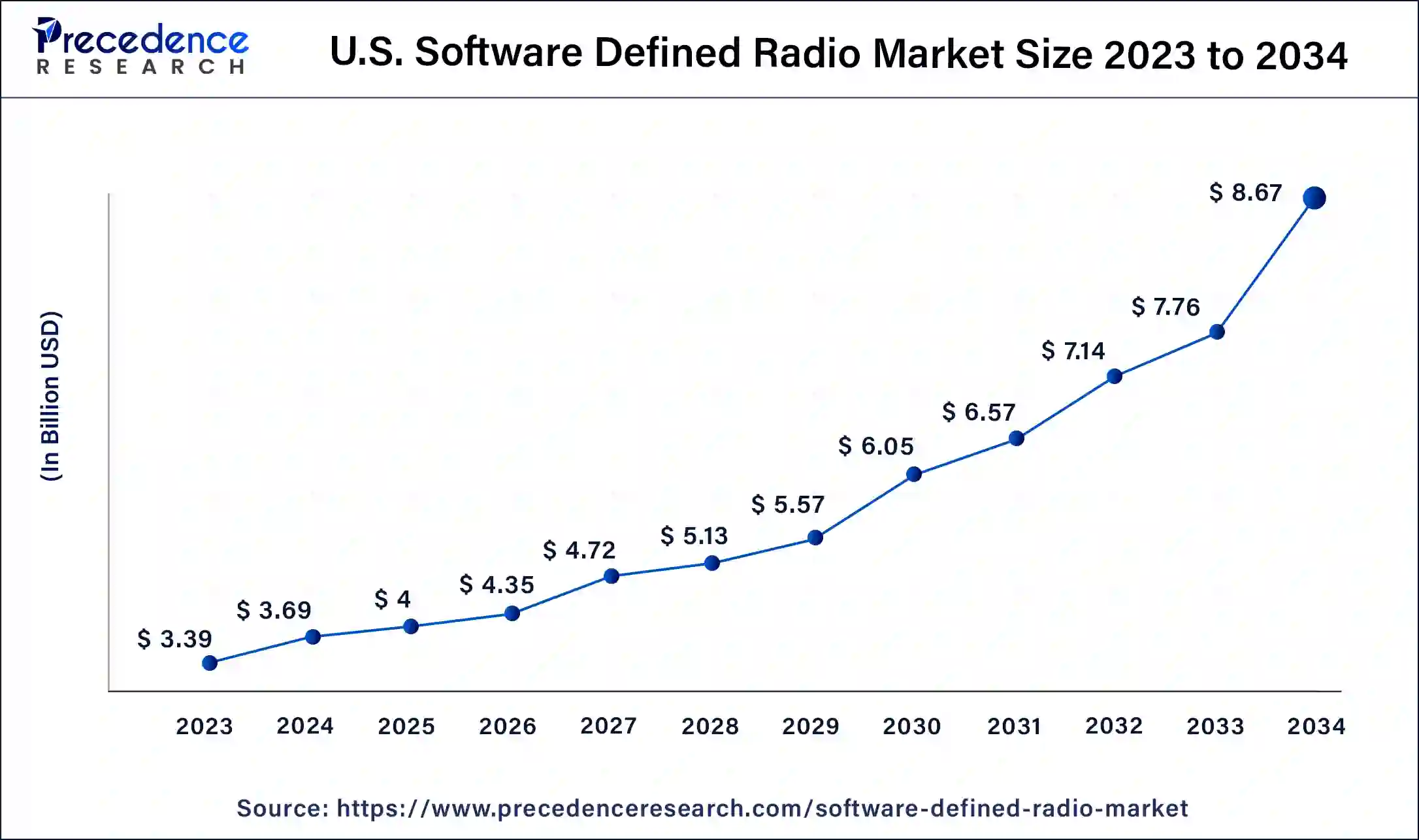

The U.S. software defined radio market size was exhibited at USD 3.39 billion in 2023 and is projected to be worth around USD 8.67 billion by 2034, poised to grow at a CAGR of 8.91% from 2024 to 2034.

North America accounted for the largest share of the software defined radio market in 2023. The dominance can be attributed to several key factors and contributions from its leading countries. The region's early adoption of SDR technologies in defense and telecommunications has established it as a global leader, setting standards and driving market trends worldwide. Collectively, North America benefits from a mature industrial base, robust research infrastructure, and a supportive regulatory environment conducive to technological innovation.

The U.S. leads in SDR innovation and deployment across both military and commercial sectors. Major defense contractors and technology firms such as Lockheed Martin, Raytheon, and Northrop Grumman are pivotal in developing advanced SDR solutions. Government initiatives, including significant defense budgets and research grants, drive continuous advancements in SDR technology. The country's proximity to the U.S. software defined radio market facilitates efficient production and distribution networks, supporting the overall ecosystem.

Canada is Known for its strong telecommunications industry; Canada contributes to the market through research and development initiatives focused on enhancing communication capabilities. Canadian companies like General Dynamics Canada and C3P provide specialized SDR solutions for defense applications, bolstering regional expertise and market presence. Moreover, strategic partnerships among key players in the North American region also foster the region's growth in the software defined radio market.

Asia Pacific is experiencing rapid growth in the global software defined radio market due to several factors. China, Japan, South Korea, and India are among the key contributors driving this expansion. The region's early adoption of SDR technologies in defense and telecommunications has established it as a global leader, setting standards and driving market trends worldwide.

China is a leading country in the defense sector and has significant investments in telecommunications infrastructure. China is a major consumer and producer of SDR technology. The country's focus on military modernization and rapid industrial growth propels its demand for advanced communication solutions in the software defined radio market.

Japan is known for its technological prowess, and it leads in the software defined radio market’s research and development. Japanese companies are at the forefront of developing next-generation SDR platforms, catering to both defense and commercial applications.

A hub for electronics manufacturing and telecommunications innovation in South Korea, which plays a crucial role in the supply chain of SDR components and systems. Its advanced network infrastructure and emphasis on cutting-edge technologies contribute to the software defined radio market growth.

With a growing defense sector and increasing adoption of the software defined radio market in civilian applications, India presents significant opportunities for market expansion. The country's focus on indigenous manufacturing and technological self-reliance further boosts demand for SDR solutions.

The software defined radio market is experiencing significant growth due to its versatile applications across various industries, including defense, telecommunications, and public safety. software defined radio (SDR) technology, which allows radios to support multiple communication standards through software updates, is driving innovation and efficiency. The rise in demand for advanced communication systems, coupled with the increasing need for military modernization, is propelling market expansion.

Additionally, the integration of SDR in smartphones and IoT devices is contributing to its widespread adoption. North America and Europe are leading the software defined radio market due to substantial investments in research and development. However, Asia Pacific is emerging as a lucrative region owing to rapid technological advancements and expanding defense budgets. The market's future is poised for continued growth, driven by ongoing advancements and increasing application areas.

| Country name | Company name | Product they provide as SDR |

| U.S. | Ettus Research (National Instruments) | USRP (Universal Software Radio Peripheral) Series |

| Germany | Rohde & Schwarz | R&S®SDTR (Software Defined Tactical Radio) |

| U.S. | Flex-Radio Systems | FLEX-6000 Signature Series |

| France | Thales Group | SYNAPSE-H |

| UK | BAE System | Phoenix™ Software Defined Radio |

The artificial intelligence allows for fast and easy information transmission and receiving by the end users. Data is used to train deep neural networks to optimize power consumption, and assist in preventative maintenance. AI technologies assist with signal search, signal detection, and classification automating these time-consuming steps. Applying artificial intelligence technology to the software defined radios can greatly improve the security of network channels and network infrastructure enabling and ensure quicker response times, for better responses to possible threats and incidents.

| Report Coverage | Details |

| Market Size by 2034 | USD 68.78 Billion |

| Market Size in 2023 | USD 27.70 Billion |

| Market Size in 2024 | USD 30.09 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.62% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Radio Type, Radio Component, Frequency Band, Radio Platform, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Evolving digital signal processing field

Continuous innovations in digital signal processing and software technology are propelling the software defined radio market. These advancements enable SDRs to support multiple communication standards and protocols, enhancing flexibility and efficiency. Improved processing power and miniaturization of components make SDRs more versatile, allowing for the integration of more features and applications.

The ability to upgrade and reconfigure SDRs through software updates reduces the need for new hardware, leading to cost savings and increased adoption across industries. As these technologies evolve, they expand the potential use cases for SDRs, driving market growth and expanding their role in communication networks.

Rising technological advancement in military operations

The need for advanced, reliable, and secure communication systems in military operations is a major driver for the software defined radio market. SDRs offer the flexibility to adapt to different communication standards and frequencies, which is crucial for modern, multi-domain operations. They support secure and encrypted communication, which is essential for maintaining operational security. Modernization programs and increased defense budgets worldwide are investing heavily in upgrading communication systems, with SDRs being a key component. Their ability to be reprogrammed and upgraded through software makes them ideal for long-term use, ensuring that military forces remain equipped with the latest communication technologies.

Integration of cutting-edge technologies to SDR

The expansion of high-speed communication networks, such as 5G and the Internet of Things (IoT), is significantly driving the software defined radio market. SDR technology enables seamless integration and upgrades of new communication standards, making it ideal for telecommunications infrastructure. The flexibility of SDRs allows for efficient spectrum management and the ability to switch between different communication protocols, meeting the diverse needs of modern communication networks. As demand for higher data rates and more reliable communication continues to grow, SDRs provide a cost-effective solution for network operators to enhance their infrastructure and maintain competitive advantage.

Restraint

Complex system

One of the major restraints hindering the growth of the software defined radio market is the high initial cost and complexity associated with implementing SDR systems. Developing and deploying SDR technology requires substantial investment in advanced hardware components, such as high-performance field-programmable gate arrays (FPGAs) and digital signal processors (DSPs). Additionally, the software development necessary to optimize these systems involves significant resources and expertise. The initial financial outlay can be prohibitive for small and medium-sized enterprises, limiting widespread adoption.

Furthermore, the integration of SDR technology into existing communication infrastructure poses technical challenges. It demands skilled professionals to manage the complexities of software integration, system configuration, and maintenance. The steep learning curve and need for specialized training can deter organizations from transitioning to SDR solutions. Compatibility issues with legacy systems and the necessity for ongoing updates and support also add to the overall cost and complexity. These factors collectively create a barrier to entry, slowing down the software defined radio market growth and limiting its potential reach.

Fostering global economise

The growing economies in regions such as Asia Pacific, Latin America, and Africa present significant opportunities for the software defined radio market. These regions are rapidly advancing their telecommunications and defense infrastructures, seeking modern, flexible, and cost-effective communication solutions. As governments and private sectors invest in upgrading their communication networks, SDRs can play a crucial role due to their adaptability and reconfigurability.

Moreover, the increasing penetration of mobile internet and the rise of smart city initiatives in these regions further bolster the demand for advanced communication technologies. This expansion provides a lucrative market for SDR manufacturers and solution providers, encouraging innovation and competitive pricing strategies to capture these emerging opportunities.

The dominance of AI in software-defined radio systems

The convergence of the software defined radio market with next-generation technologies like 5G, IoT, and artificial intelligence (AI) offers substantial growth opportunities. SDRs can enhance the flexibility and efficiency of 5G networks by allowing dynamic spectrum allocation and seamless integration of various communication standards. In IoT applications, SDRs can support diverse device communication requirements, enabling better connectivity and interoperability.

Additionally, incorporating AI in SDRs can optimize performance, automate frequency management, and improve security features. This integration can lead to the development of smarter, more resilient communication systems, addressing the growing demand for high-speed, reliable, and intelligent connectivity in various sectors, including smart cities, healthcare, and industrial automation.

The joint tactical radio system segment accounted for the largest share of the software defined radio market in 2023. Joint tactical radio systems (JTRS) several benefits, including enhanced interoperability, secure communications, and scalability. It supports multiple waveforms and frequencies, ensuring compatibility across various military branches and allied forces.

JTRS's software-defined nature allows for updates and adaptability to new technologies without needing hardware changes. Its dominance in the software-defined radio market is due to these capabilities, combined with its ability to meet rigorous military standards and its broad adoption by defense organizations globally, making it a critical component of modern military communications.

The cognitive radio segment is expected to witness the fastest growth in the software defined radio market during the forecasted years. Cognitive radio is a fast-growing segment in the software-defined radio market due to its ability to dynamically adapt to the environment, optimize spectrum use, and enhance communication efficiency. It improves spectrum management by detecting unused frequencies and adjusting transmission parameters in real time. This adaptability makes cognitive radio ideal for addressing the increasing demand for wireless communication, enhancing network performance, and supporting advanced applications in various sectors.

The hardware segment registered the largest share of the global software defined radio market in 2023. The hardware segment is essential for running complex software applications efficiently. This segment includes critical components like transceivers, amplifiers, and antennas, which are fundamental for ensuring reliable and secure communications. Additionally, ongoing advancements in hardware technology enhance the overall capabilities of software-defined radios, making them more versatile and powerful across various applications.

The services segment is anticipated to witness substantial growth in the software defined radio market during the foreseeable future. The service segment has an increased need for support in installation, maintenance, and upgrades. As SDR technology becomes more complex and widespread, organizations require expert services to ensure optimal performance and security. Additionally, the shift towards software-centric solutions necessitates continuous software updates and customization. The rise of managed services and consultancy further drives growth, helping businesses to effectively integrate and utilize SDR systems in their operations.

The HF band segment accounted dominated the global software defined radio market in 2023. The high-frequency band segment dominates the software-defined radio market due to its ability to support high-data-rate communication over long distances, which is crucial for military, commercial, and emergency services. High-frequency bands offer enhanced signal clarity and reduced interference, making them ideal for reliable, secure communication in challenging environments.

This segment's dominance is also driven by the growing demand for high-speed data transmission in applications like satellite communication, aviation, and maritime operations. Additionally, advancements in high-frequency technology have improved spectrum efficiency and bandwidth utilization, further cementing its importance. The adaptability and scalability of high-frequency bands ensure they remain a critical component in modern communication systems.

The UHF segment is anticipated to register the fastest growth in the software defined radio market during the forecasted period. This is due to its capability to provide reliable, high-quality communication over moderate distances and through obstacles like buildings and terrain. UHF's suitability for mobile and handheld devices makes it ideal for military, public safety, and commercial applications. The increasing demand for advanced communication solutions in urban and densely populated areas, along with the expansion of wireless infrastructure, further drives the growth of the UHF segment in the market.

The ground segment is estimated to hold the largest share of the software defined radio market in 2023. The growth of this segment is attributed to the diverse range of tactical communication systems primarily used in military operations. Ground station sensitivity and design need to be optimized so that it can work at its fullest potential, which is provided by the SDR system. In satellite communication, SDR plays a vital role as it enhances sensitivity to provide clearer communication without noise.

The airborne segment is expected to witness significant growth in the software defined radio market in the upcoming years. The growth of this segment is attributed to the wide use of airborne software-defined radio systems as they provide high-speed data transmission and, therefore, are used in both civil and military operations. Major Tech giants in the aerospace sector embrace this technology, which results in cost-effective and secure operations with mission-critical systems.

The aerospace & defense segment held a substantial share of the software defined radio market in 2023. The growth of this sector is owing to the enhanced software capabilities and processing power due to the continued development of software-defined radio systems. These developments are crucial in terms of updating with emerging threats and evolving with communication standards. Safety and security are prominent in this sector, which is provided by SDR systems precisely.

The commercial segment is anticipated to witness rapid growth in the software defined radio market in the upcoming years. Commercial segments like automotive and transportation are fostering due to the higher demand for SDR and its applications in a spectrum of operations. Also, automotive radios should work on both digital and analog signals, which is one of the key factors that propel the growth of the market widely. Along with this, SDR systems are also being adopted in UAVs to provide precise control, command, and navigation systems. All these are major factors driving this segment exponentially on a global scale.

Segments Covered in the Report

By Radio Type

By Radio Component

By Frequency Band

By Radio Platform

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

January 2025

October 2024