January 2025

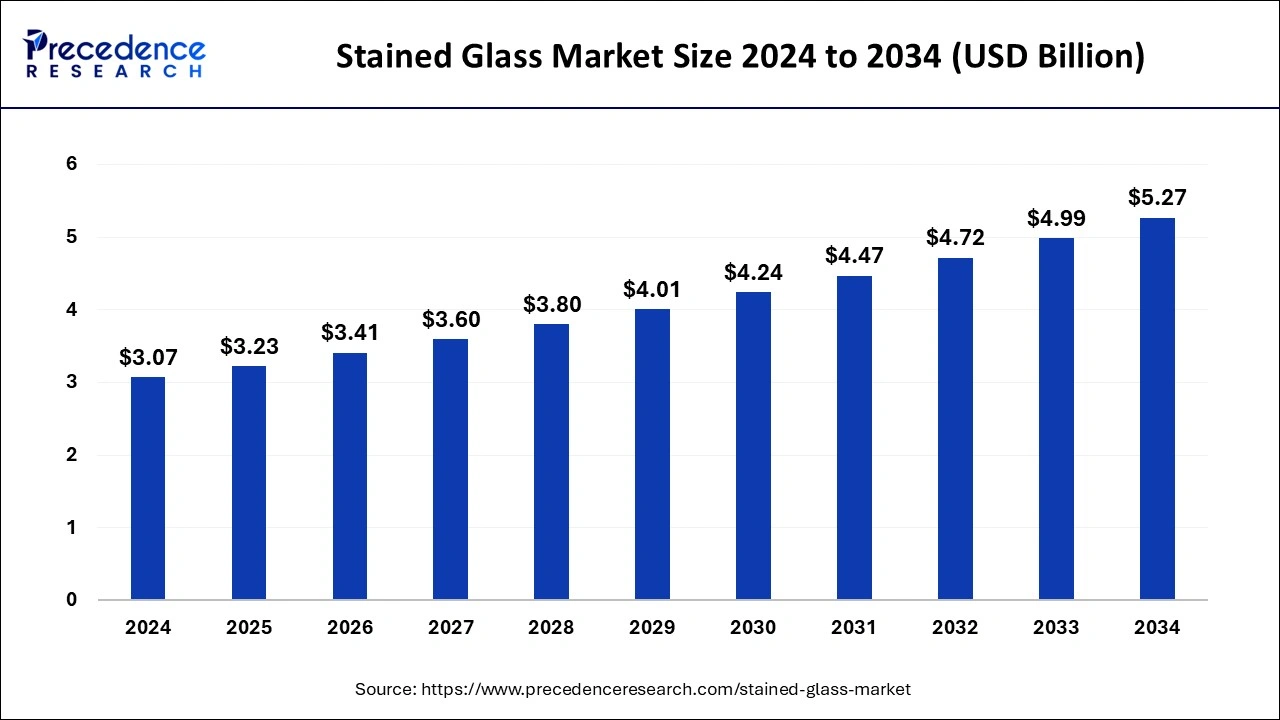

The global stained glass market size is calculated at USD 3.23 billion in 2025 and is forecasted to reach around USD 5.27 billion by 2034, accelerating at a CAGR of 5.56% from 2025 to 2034. The Asia Pacific stained glass market size accounted for USD 1.36 billion in 2025 and is expanding at a CAGR of 5.67% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global stained glass market size accounted for USD 3.07 billion in 2024, grew to USD 3.23 billion in 2025 and is projected to surpass around USD 5.27 billion by 2034, representing a healthy CAGR of 5.56% between 2024 and 2034. The stained-glass market is driven by the rising demand for environmentally friendly and energy-efficient building supplies.

The Asia Pacific stained glass market size reached USD 3.07 billion in 2024 and is anticipated to reach around USD 5.27 billion by 2034, growing at a CAGR of 5.56% from 2024 to 2034.

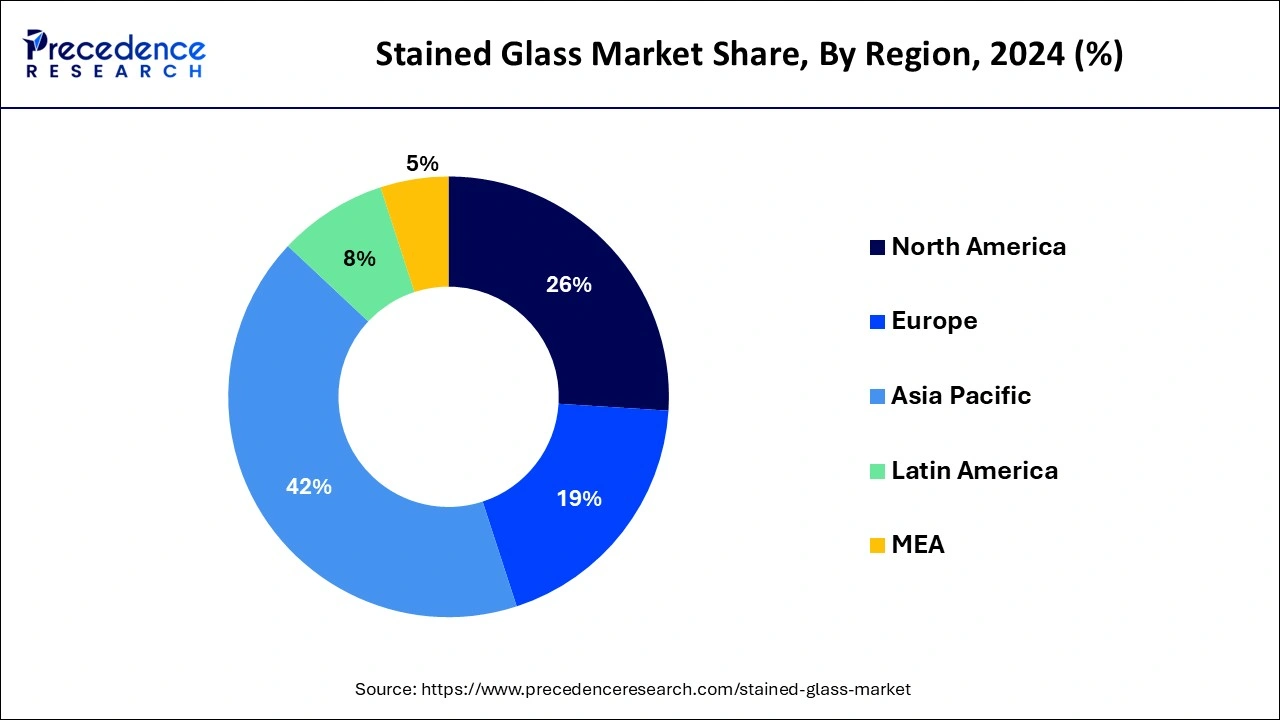

Asia- Pacific dominated the stained glass market with the largest share in 2024. Stained glass products were in high demand in the region due to significant infrastructure development projects and urbanization, especially in China and India. Higher consumer expenditure on luxury and ornamental goods, such as stained glass, was also influenced by rising disposable incomes and the expansion of the middle class in Asia-Pacific. Demand was also fueled by the historical relevance of stained glass art and the region's rich cultural legacy.

The rapid pace of urbanization and construction activities in Asia Pacific countries has created significant opportunities for the stained glass market. Increasing urbanization, population growth, and infrastructure development have led to a rising demand for architectural glass products, including stained glass windows, doors, partitions, and facades, in residential, commercial, and institutional buildings. The Asia Pacific region boasts a rich tradition of skilled artisans and craftsmen with expertise in glassmaking, painting, and traditional crafts. Artisans in countries such as China, India, Thailand, and Indonesia have mastered the intricate techniques of stained glass fabrication, hand-painted glass design, and glass mosaic artistry, producing high-quality, custom-made stained glass products that cater to diverse aesthetic preferences and architectural styles.

The manufacture, distribution, and installation of stained glass panels and goods are all in the worldwide market. Stained glass window restoration and renovation in churches, synagogues, and other places of worship continue to be important applications. Moreover, modern stained glass designs are being incorporated into new architectural projects. Stained glass gives establishments like eateries, lodging facilities, and retail stores a distinctive touch that improves ambiance and forges a lasting brand identity.

Green initiatives, such as using recycled glass and energy-efficient production techniques, are becoming more popular. While maintaining traditional artistry, computer-aided design (CAD) and laser cutting allow for precise and elaborate designs. Stained glass is now more accessible to a broader range of people thanks to more economical materials and procedures.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.27 Billion |

| Market Size in 2024 | USD 3.07 Billion |

| Market Size in 2025 | USD 3.23 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.56% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing usage in residential and commercial buildings

Stained glass improves the ambience and attractiveness of commercial and residential areas by adding a distinctive and eye-catching element. It allows architects and designers to customize them to specific themes or customer preferences by providing a variety of modification possibilities for colors, designs, and patterns. Due to stained glass's historical and cultural significance, many residential and commercial structures want to include it, giving the area a feeling of tradition and heritage.

Cultural and artistic revival

The rich history of stained glass is ingrained in religious and cultural customs. Stained glass is in high demand for restoration projects and new installations as societies see a resurgence of interest in honoring and conserving their past. Architects and designers often use stained glass to combine historical elements with cutting-edge styles in contemporary buildings. People looking for distinctive artistic expressions and cultural purists are drawn to this combination of ancient and new trends.

Educational institutions and community organizations play a crucial role in fostering a resurgence of the arts and culture. They ensure the continued relevance of traditional crafts, such as stained glass, by promoting interest among new generations through workshops, classes, and educational outreach activities.

Limited technological integration

Production of stained glass frequently depends on age-old handicraft methods that have been passed down through the centuries. Reluctance or a delayed acceptance of contemporary technologies might reduce output and efficiency. It can be very complicated and detailed, requiring exact construction and cutting. Artisans could need to use technology tools like computer-aided design (CAD) software or sophisticated cutting machines to work on making complex designs come to life.

Specialized skill requirement

Stained glass-making calls, very precise handiwork, and creative abilities. However, the demand for skilled artisans with the requisite training is high, making it difficult for stained glass companies to attract and keep talented employees. Stained glass artistry is highly professional; thus, businesses find it challenging to increase. Finding and training more qualified personnel is necessary to increase production capacity, but this process can be laborious and time-consuming.

Stained glass crafting is a precise technique that requires focus and accuracy. Because each piece requires much time from skilled artisans, production cycles are lengthier, and project timeframes may be delayed.

Technological developments in glassmaking

Cutting-edge methods like digital printing, laser cutting, and computer-aided design (CAD) make it easier to develop complex and accurate designs, increasing the range of artistic expression options. Stained glass installations are now more long-lasting and environmentally friendly thanks to advancements in the glass manufacturing industry that have produced more robust, more resilient glass materials. In addition, because stained glass offers improved thermal insulation and light transmission capabilities, improvements in energy-efficient glass coatings and manufacturing techniques contribute to the increased demand for stained glass in architectural and interior design applications.

Growing popularity in interior design

Stained glass has become more popular as people look for distinctive and artistic features to improve their living spaces because of its ageless beauty and capacity to give any space character and elegance. This trend enables producers and artists working with stained glass to meet the growing demand for architectural installations, ornamental panels, and custom-made items. Stained glass's adaptability also makes it possible to incorporate it into various design aesthetics, from traditional to contemporary, which increases its allure and market potential in the interior design sector.

The plate glass segment held the largest share in stained glass market in 2023. The growing need for plate glass for windows, building facades, and interior partitions in homes, businesses, and factories is fueled by the construction sector, which is increasing, especially in emerging nations. Architects and developers are becoming increasingly partial to plate glass products that are high-quality, energy-efficient, lightweight, and generated through innovations in glass manufacturing methods. An increasing number of people use sustainable building materials as environmental concerns grow. Eco-conscious individuals and companies are increasingly choosing plate glass because of its recyclability and potential for energy efficiency if used in insulated glazing modules.

The special glass segment shows notable growth during the forecast period. Technological developments in the glass industry have created specialty glass with improved qualities, including strength, durability, and transparency, meeting the demands of diverse industries. Modern architectural designs use special glass for windows, facades, and interior décor. Global infrastructure development and urbanization are happening at a quick pace, which is driving up demand for creative glass solutions and expanding the market.

Because of its inert qualities, chemical resistance, and sterilizability, specialized glass is used in pharmaceutical packaging, medical devices, and laboratory apparatus. The development of biotechnology and healthcare infrastructure drives the need for special glass in these industries.

The construction segment is observed to grow at the fastest rate in the stained glass market during the forecast period. Stained glass windows and other architectural features are becoming increasingly popular in residential and commercial building projects. Architects and designers use stained glass elements to give structures a distinctive look. Stained glass is now more widely available and reasonably priced thanks to technological developments, allowing for its use in a broader range of building projects. These covers creating fresh methods for producing stained glass and advancements in installation practices.

Stained glass is also being preserved and restored in existing buildings due to rising respect for its historical and cultural relevance. The need for trained artists and artisans in the stained-glass market's building sector is partly fueled by this development.

The automotive segment held a notable share of the stained glass market in 2024. Automakers take advantage of stained glass's aesthetic appeal and its practical benefits, such as improving seclusion and filtering sunlight by putting it into features like sunroofs, windows, and interior panels. This integration improved cars' overall looks and helped to fuel a spike in the market for stained glass goods.

In the context of future automotive trends towards sustainability and eco-friendliness, stained glass panels could potentially be developed using innovative, environmentally friendly materials or production methods. In high-end or custom vehicles, stained glass could be used as a unique and luxurious interior design element, adding a touch of elegance and individuality to the vehicle's cabin.

By Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

January 2025