April 2025

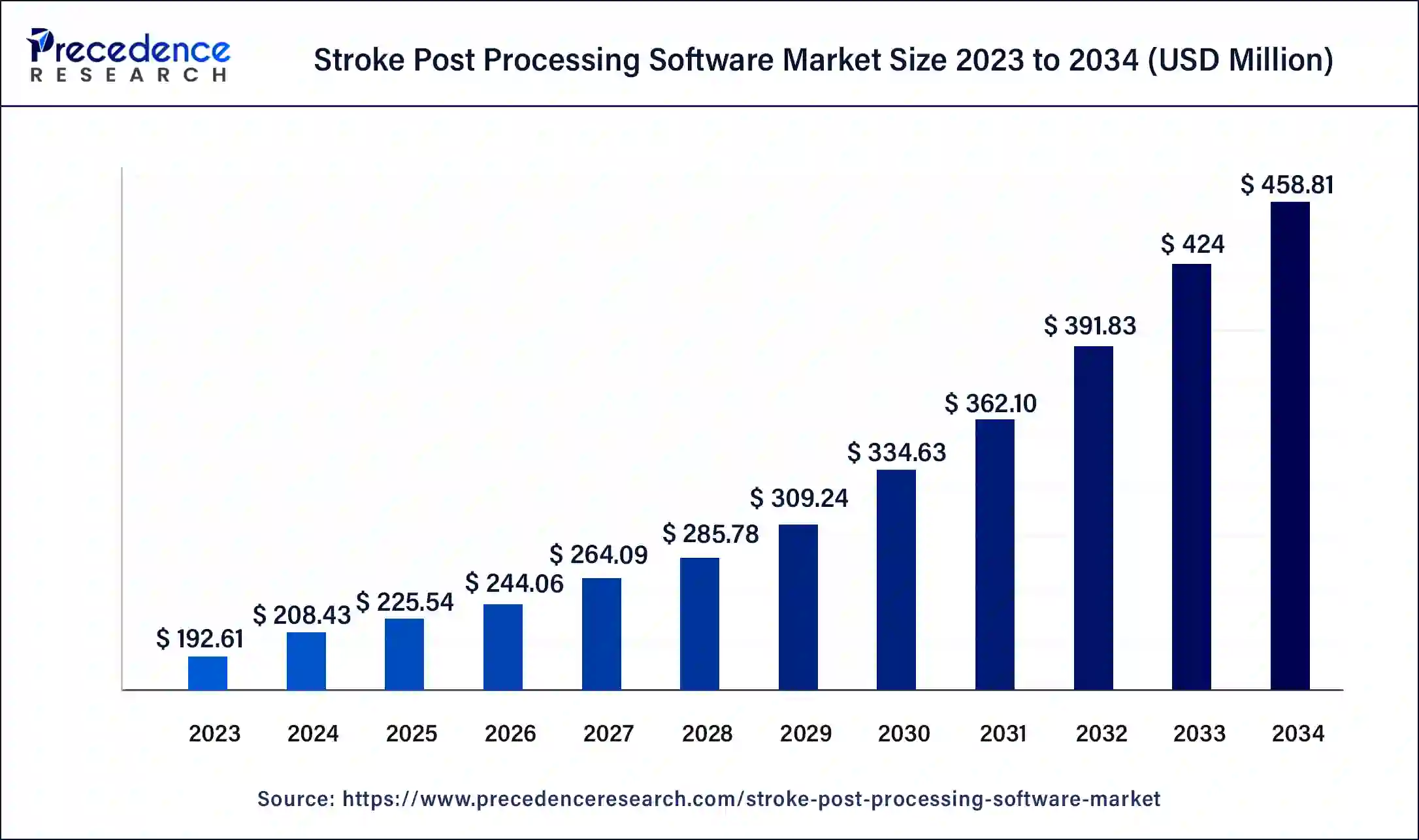

The global stroke post processing software market size surpassed USD 192.61 million in 2023 and is estimated to increase from USD 208.43 million in 2024 to approximately USD 458.81 million by 2034. It is projected to grow at a CAGR of 8.21% from 2024 to 2034.

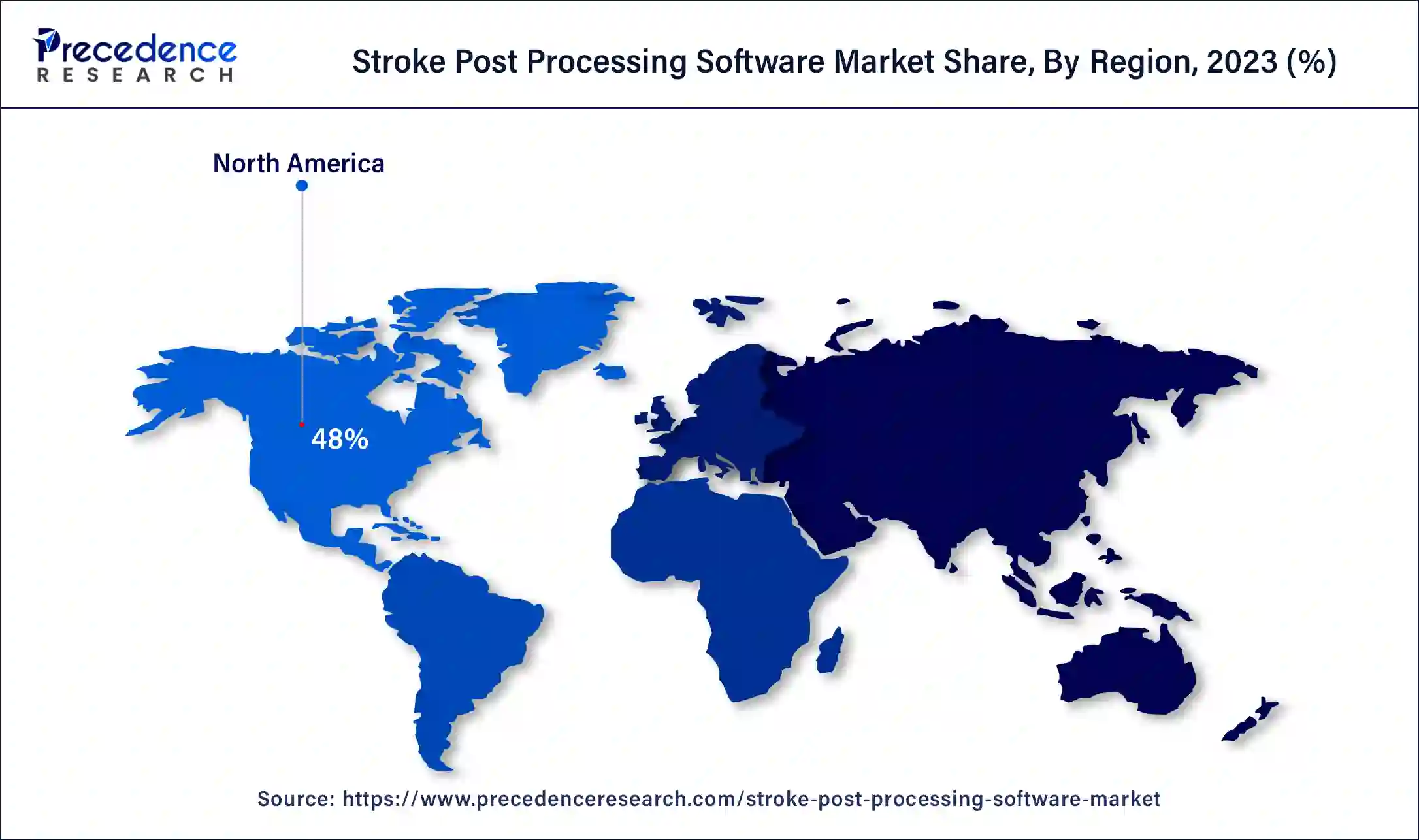

The global stroke post processing software market size is expected to be worth USD 208.43 million in 2024 and is anticipated to reach around USD 458.81 million by 2034, growing at a solid CAGR of 8.21% over the forecast period 2024 to 2034. The North America stroke post processing software market size accounted for USD 97.96 million in 2024. The rising demand for healthcare software across the world is driving the growth of the stroke post processing software market.

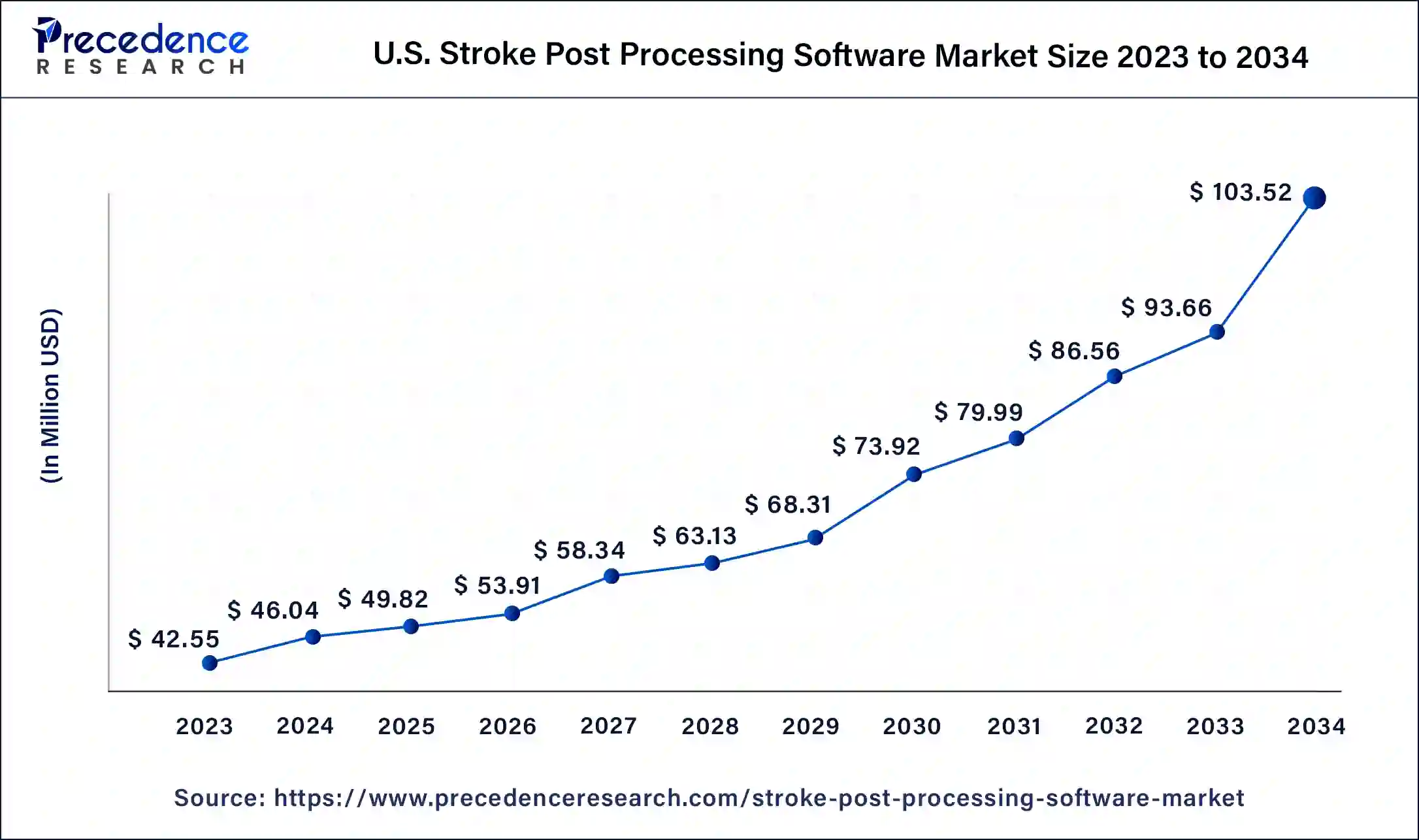

U.S. Stroke Post Processing Software Market Size and Growth 2024 to 2034

The U.S. stroke post processing software market size was exhibited at USD 42.55 million in 2023 and is projected to be worth around USD 103.52 million by 2034, poised to grow at a CAGR of 8.41% from 2024 to 2034.

North America held the largest share of the stroke post processing software market in 2023. The growth of the market in this region is mainly driven by the rising demand for stroke post-processing software from several famous hospitals that deal in the treatment of stroke, such as Cleveland Clinic, St Jude Children's Research Hospital, UC Davis Health, Johns Hopkins Medicine, Mayo Clinic Scottsdale AZ and some others. The growing developments in the healthcare industry in countries such as the U.S. and Canada, along with rising government investments to develop the IT industry and AI sector across this region, have boosted the market growth to some extent.

Moreover, presence of several local market players in stroke post-processing software, such as viz.ai, ISchemaView, Inc, CerebraAI, and some others, are continuously engaged in developing advanced stroke post-processing software for stroke detection and adopting several strategies such as partnerships, collaborations, and business expansions, which in turn drives the growth of the stroke post processing software market in this region.

Asia-Pacific is expected to be the fastest-growing region during the forecast period. The rising developments in the medical devices industry, along with superior healthcare facilities across the region, boost the market growth. Moreover, the presence of several renowned hospitals in countries such as India, China, Japan, South Korea, and some others that are engaged in stroke diagnosis and treatment has increased the demand for stroke post processing software in hospitals for use in MRI and CT scanners, which in turn is driving the market growth.

Additionally, various local companies of stroke post-processing software, such as Aidoc, Qure.ai, Infervision, and some others, are developing advanced software to fulfill the demand from hospitals treating stroke patients across the Asia Pacific region, which in turn is expected to drive the growth of the stroke post processing software market in this region.

The stroke post processing software market is one of the important industries in the healthcare sector. This industry mainly deals with the development of stroke post-processing software around the globe. This software can be installed on desktop and mobile phones & tablets. It is developed for various modalities, including MRI and CT scans. This software finds application in the detection of various kinds of strokes, including ischemic stroke, hemorrhagic Stroke, and some others. There are several end-users of the stroke post processing software industry that mainly include hospitals & clinics and specialty centres & others. This industry is expected to grow exponentially with the growth in the IT and healthcare industries.

| Report Coverage | Details |

| Market Size by 2034 | USD 458.81 Million |

| Market Size in 2023 | USD 192.61 Million |

| Market Size in 2024 | USD 208.43 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.21% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Installation, Modality, Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for advanced medical software

Rapid developments are taking place in the healthcare industry. The integration of modern technologies has changed the landscape of the diagnosis and treatment methodologies for various diseases. The cases of different types of strokes are increasing daily in various parts of the world, and they require proper diagnosis and treatment to be cured. With the rising cases of strokes, hospitals and other treatment centers require superior devices that are accurate and efficient so as to diagnose and treat all patients in a shorter period of time. This, in turn, increases the demand for advanced stroke post-processing software, thereby driving the market growth.

The stroke post processing software market is a consolidated industry. There are a few dominating players, along with several new entrants in the market. Some of the prominent market players include Brainomix, Aidoc, RapidAI, Viz.Ai, Inc., CerebraAI, and others that are continuously engaged in developing advanced software for stroke detection and adopting several strategies to maintain their dominance in the industry.

Restraint

Security-related issues and malfunctioning

The applications of stroke post processing software have increased due to several advantages it provides. Although there are several benefits associated with this software, it comes with several disadvantages. Firstly, the health details of the patients can be gathered by hackers, thereby leading to security breaches. Secondly, this software may sometimes bring out incorrect results that may lead to wrong treatments. Thus, security breaches, along with malfunctioning of the software, are expected to restrain the market growth during the forecast period.

Opportunity

AI-based stroke detection software to reshape the industry

Advancements in science and technologies related to the development of software have gained traction at present. Nowadays, software developers are developing advanced stroke post processing software that is integrated with modern technologies such as AI and ML to deliver superior performance and results. Thus, the growing application of AI-enabled stroke detection software is expected to create ample growth opportunities for market players in the future.

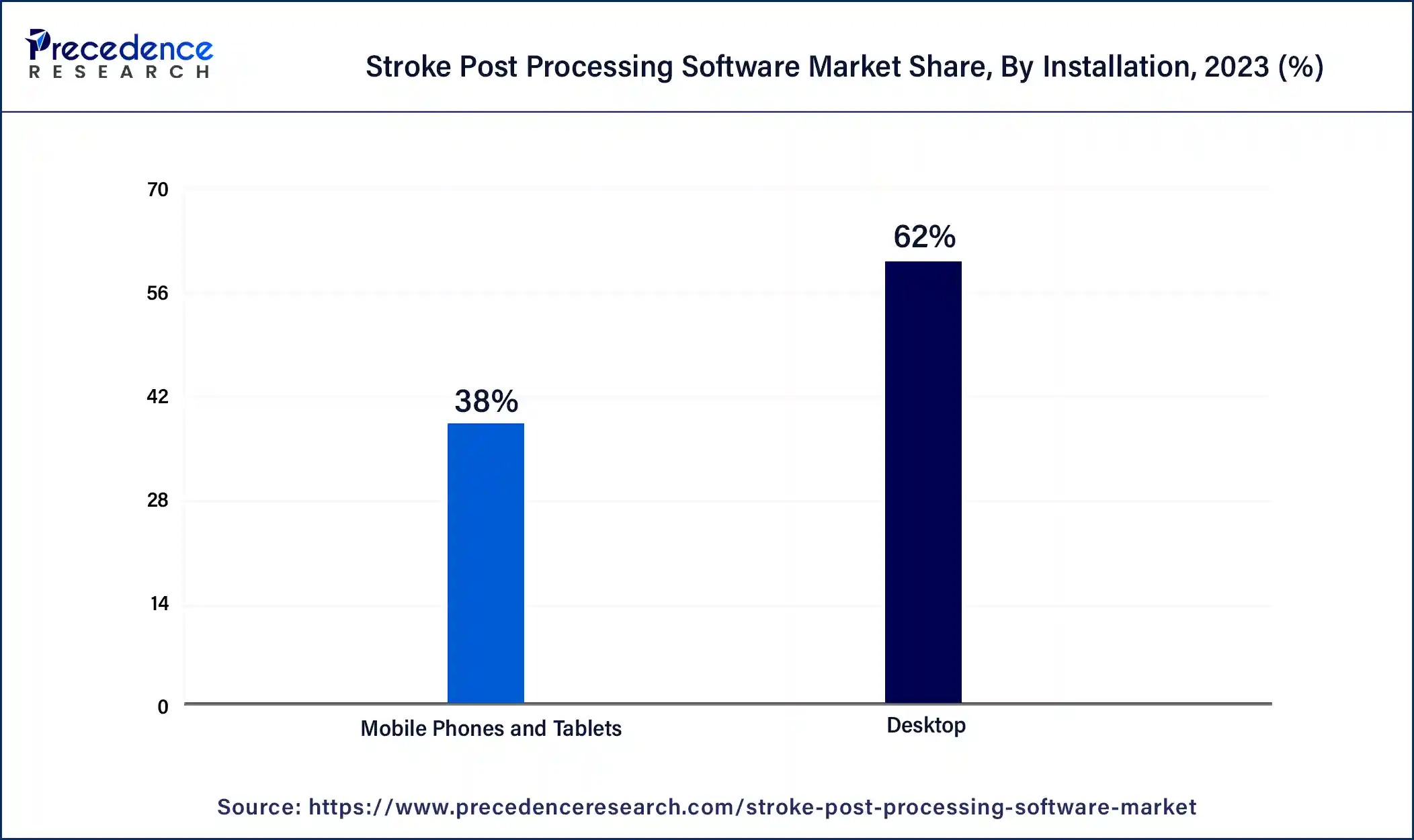

The desktop segment held the largest market share in 2023. The rise in the number of hospitals across the world has increased the number of desktop installations for diagnostics and treatment purposes, thereby driving market growth. Also, desktops provide data storage and real-time tracking, as well as large storage space to store large amounts of data along with remote access to other devices, which is likely to boost market growth. Moreover, the development of advanced desktop-based stroke post processing software for the delivery of efficient and superior results is expected to propel the growth of the stroke post processing software market during the forecast period.

The mobile phones and tablets segment is expected to grow with the highest compound annual growth rate during the forecast period. The growing advancement in 5G technologies, coupled with the rising proliferation of smartphones across the world, is driving the market growth. Also, the portability offered by mobile phones and tablets, along with the rapid demand for virtual care services, has boosted the development of this industry. Moreover, the rising development in the IT sector has led software developers to design stroke post processing software for mobile phones and tablets, which is likely to drive the growth of the stroke post processing software market.

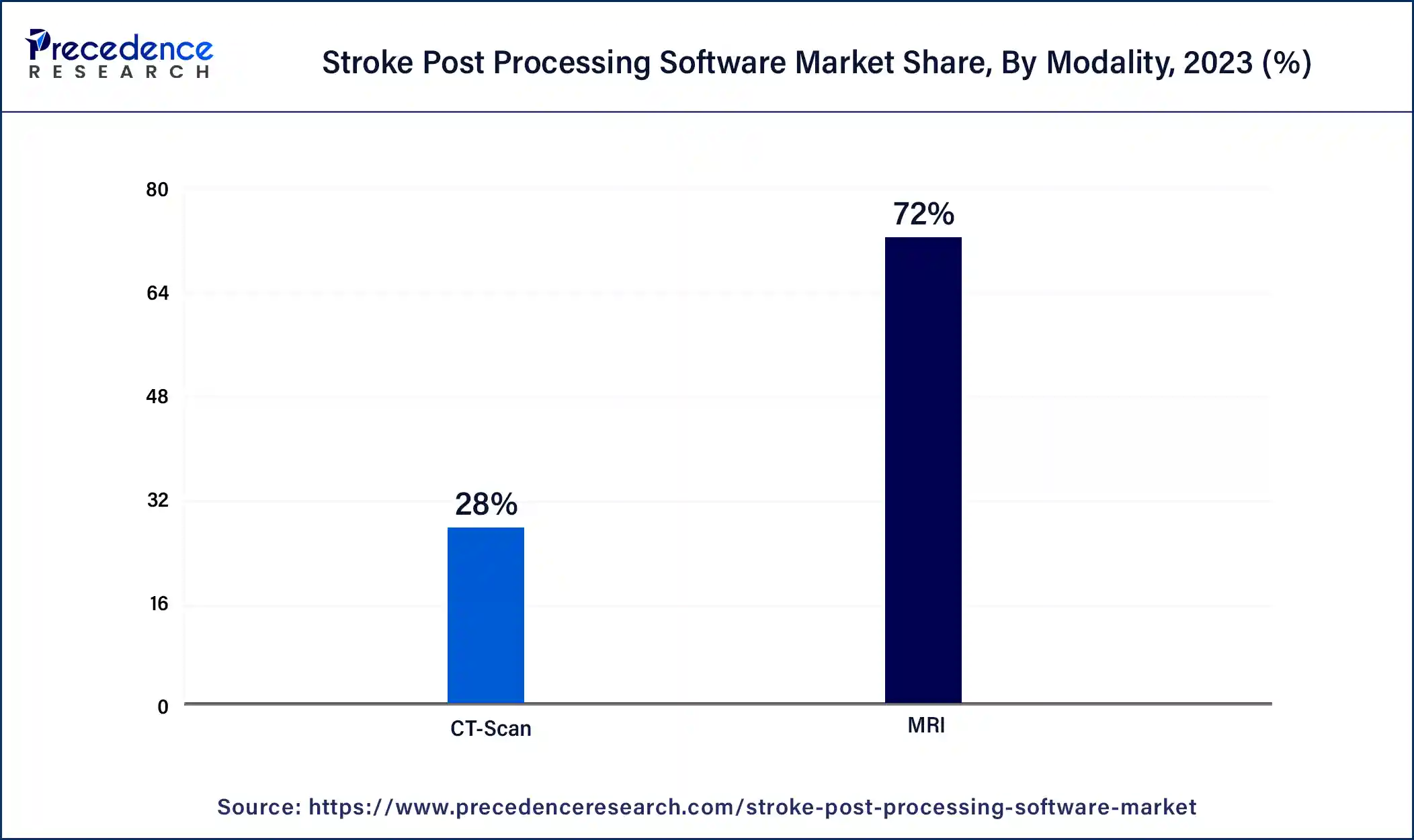

The MRI segment held a dominant share in 2023. The growing demand for magnetic resonance imaging machines in stroke detection applications due to their ability to provide accurate images of brains and arteries has driven the market growth. Also, the rising application of MRI scanners for the diagnosis and management of acute ischemic strokes has increased the demand for software associated with it, thereby driving the market growth. Moreover, the increasing demand for advanced MRI software for stroke diagnosis in hospitals is boosting the growth of the stroke post processing software market during the forecast period.

The CT scan segment is expected to attain the fastest CAGR during the forecast period. The rising application of CT scanners due to their ability to visualize the damage to the brain cells or bleeding in the brain from stroke attacks drives the market growth. Also, the diagnosis of stroke in humans can be made much more quickly in CT scanners than in MRI machines, which increases the demand for CT scan-based software, thereby driving market growth. Moreover, the rising development in the healthcare software industry related to the development of stroke post processing software has fostered the growth of the stroke post processing software market during the forecast period.

The ischemic stroke segment dominated the market in 2023. The growing number of government hospitals treating ischemic stroke has increased the demand for stroke post processing software, thereby driving the market growth. Moreover, the rising prevalence of ischemic stroke among people across the world has increased the demand for MRI and CT scanners for detection and treatment, thereby increasing demand for stroke post processing software associated with it, which in turn is expected to boost the growth of the stroke post processing software market during the forecast period.

The hemorrhagic stroke segment is estimated to grow with the highest CAGR during the forecast period. The rising advancements in MRI machines for detecting hemorrhagic stroke have increased the demand for MRI-based stroke detection software, thereby driving market growth. Also, the rising cases of hemorrhagic stroke across the world have increased the demand for early stroke detection software and hardware technologies that, in turn, drive the growth of the stroke post processing software market during the forecast period.

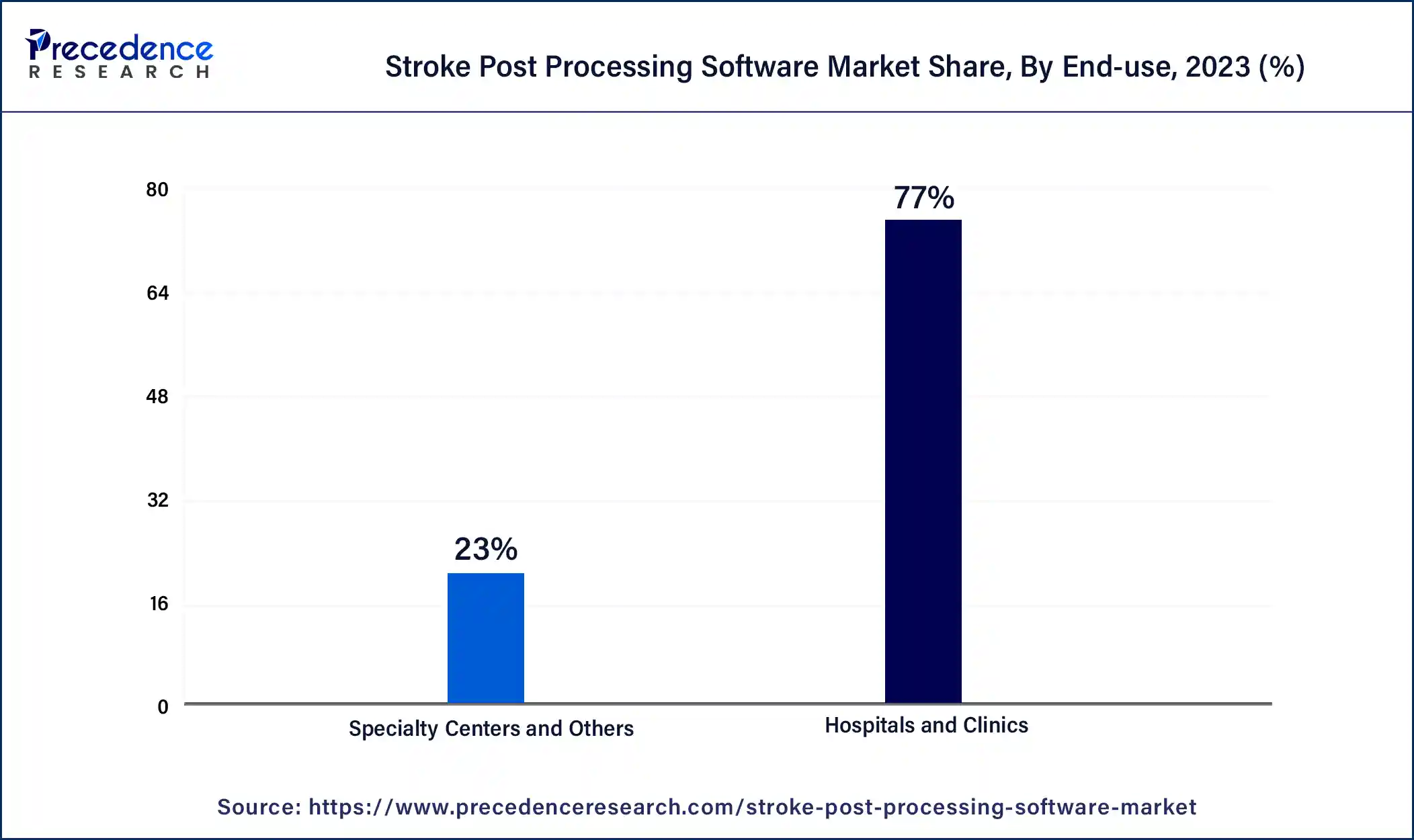

The hospitals and clinics segment held the largest share of the market in 2023. The rise in the number of public and private hospitals around the world that deal with the treatment of strokes has increased the demand for stroke post processing software, thereby driving market growth. Moreover, the increasing investment from the governments of several countries in strengthening the medical devices industry has boosted market growth. Additionally, the growing integration of technologies in diagnostic systems, such as computed tomography scanners and MRI systems, that are implanted in hospitals is driving the growth of the stroke post processing software market during the forecast period.

The specialty centers and other segments are expected to be the fastest growing segment during the forecast period. The rise in the number of specialty centers related to the treatment of ischemic stroke across the world is driving the market growth. Moreover, the growing trend of specialty centers due to their mobility and availability in remote places that help in diagnosing and treating stroke patients has boosted the growth of the stroke post processing software market during the forecast period.

Segments Covered in the Report

By Installation

By Modality

By Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

November 2024

November 2024

November 2024