September 2024

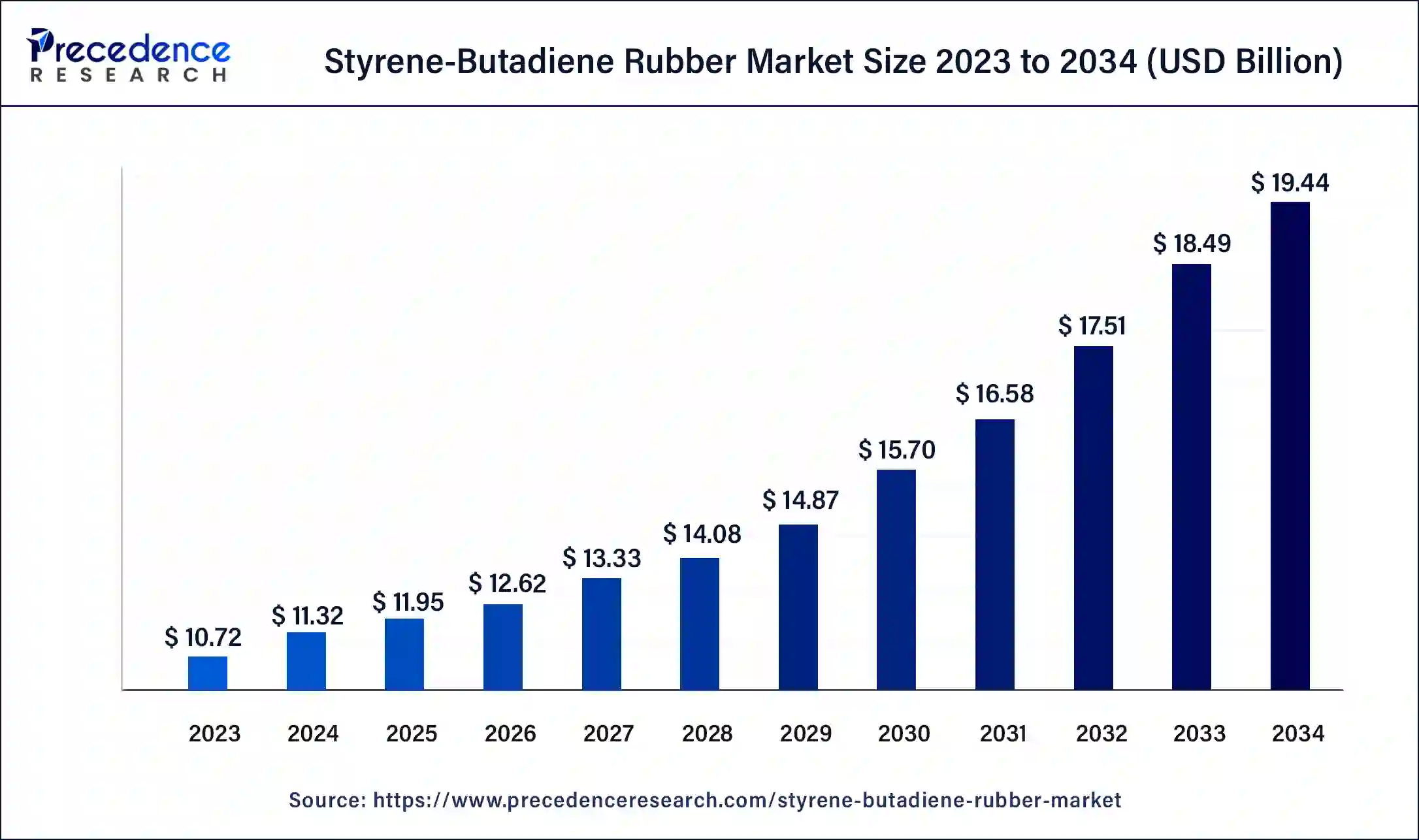

The global styrene-butadiene rubber (SBR) market size was USD 10.72 billion in 2023, estimated at USD 11.32 billion in 2024 and is anticipated to reach around USD 19.44 billion by 2034, expanding at a CAGR of 5.55% from 2024 to 2034.

The global styrene-butadiene rubber (SBR) market size accounted for USD 11.32 billion in 2024 and is predicted to reach around USD 19.44 billion by 2034, growing at a CAGR of 5.55% from 2024 to 2034.

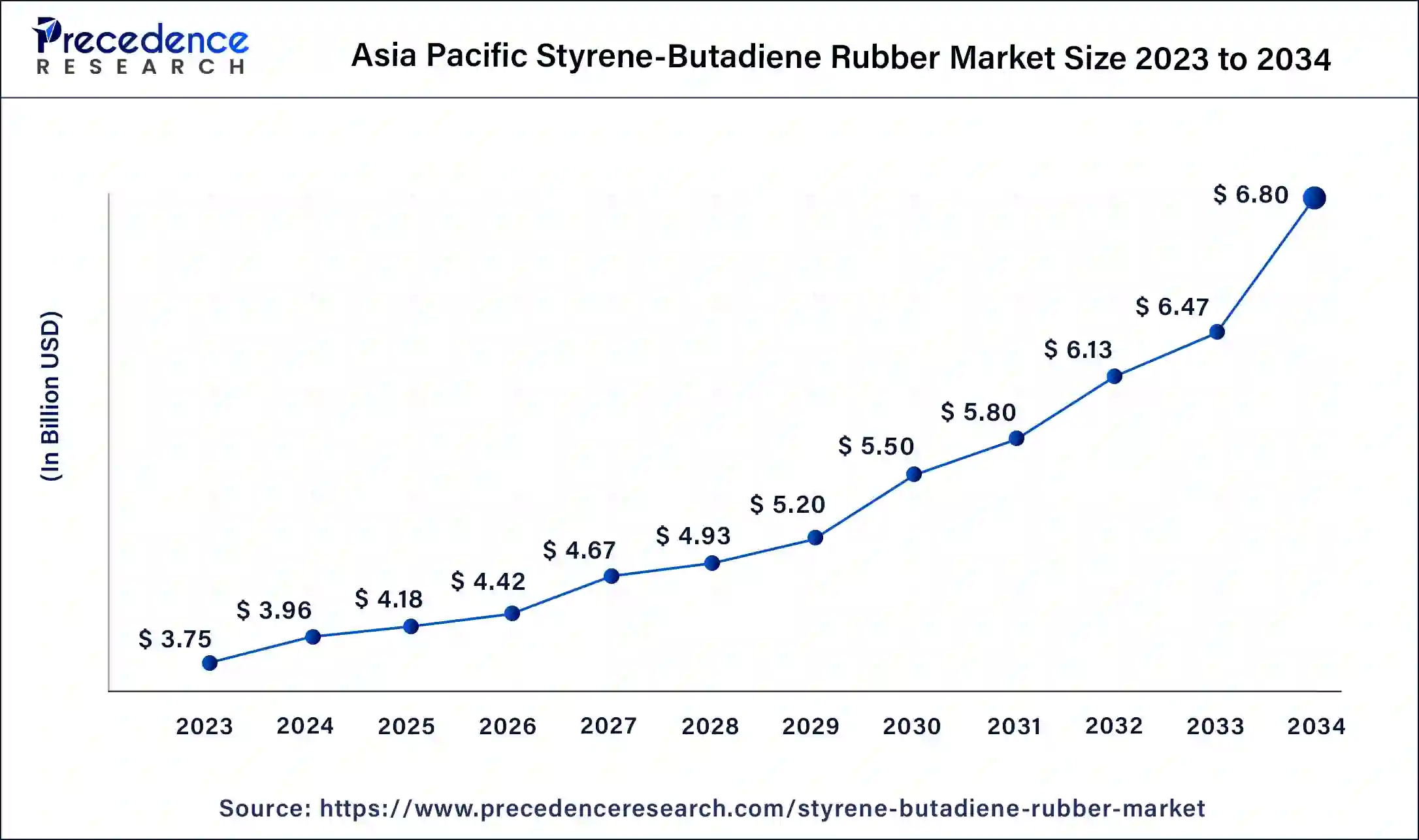

The Asia-Pacific styrene-butadiene rubber market size was valued at USD 3.75 billion in 2023 and is expected to be worth around USD 6.80 billion by 2034, rising at a CAGR of 6% from 2024 to 2034.

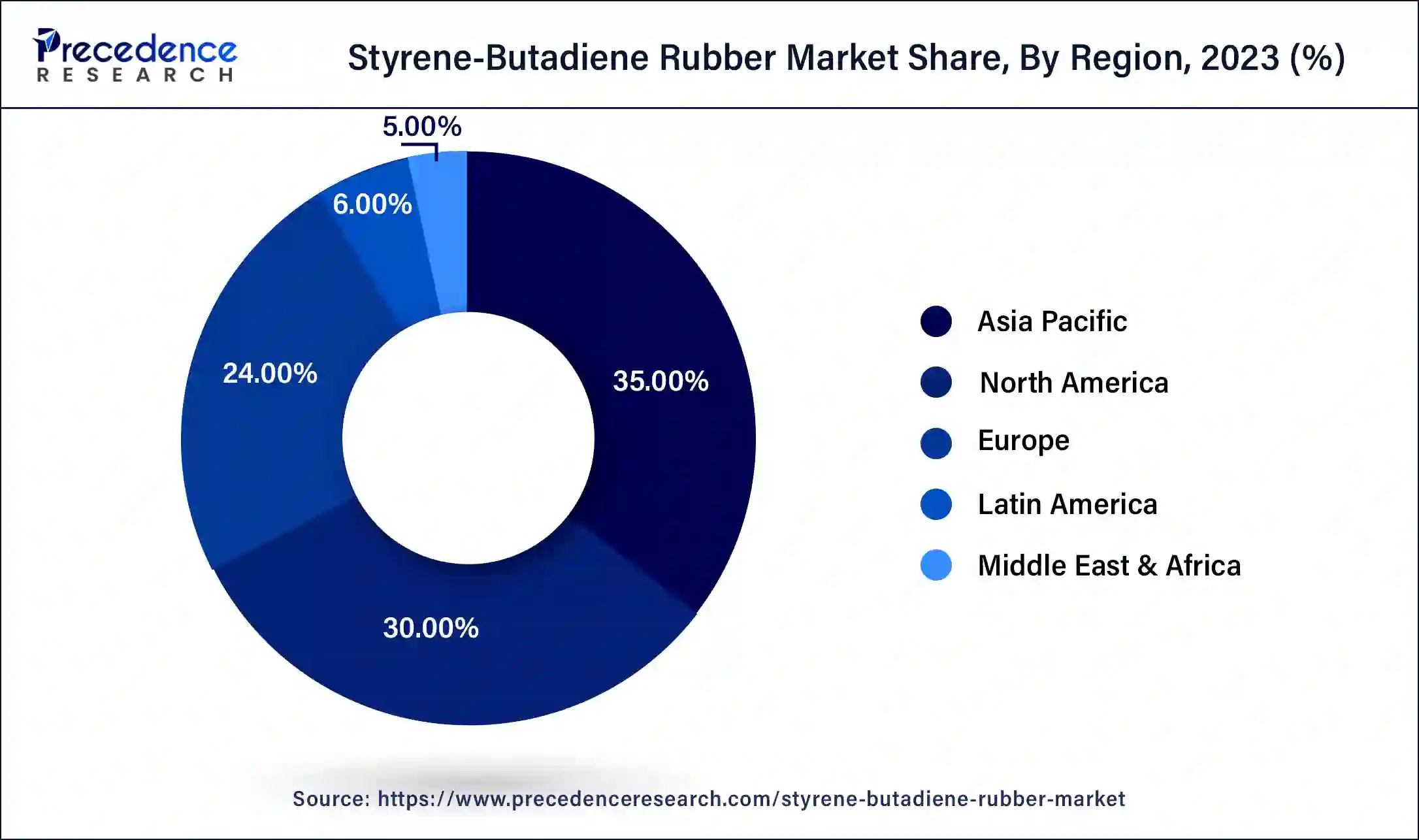

Asia-Pacific has held largest revenue share of 33% in 2023. Asia-Pacific dominates the styrene butadiene rubber (SBR) market due to robust industrialization, rapid urbanization, and a thriving automotive sector. The region's strong manufacturing base, particularly in countries like China and India, drives substantial demand for SBR in tire production, construction, and consumer goods manufacturing.

Additionally, the region's economic growth fosters increased consumer spending on automobiles and infrastructure projects, sustaining the demand for SBR. The strategic positioning of Asia-Pacific as a global manufacturing hub solidifies its significant share in the styrene butadiene rubber market.

North America is estimated to observe the fastest expansion. North America holds a major growth in the styrene butadiene rubber market due to robust demand across key industries. The region's well-established automotive sector, continuous infrastructure development, and the demand for consumer goods contribute to high SBR consumption.

Moreover, stringent quality and safety standards in industries such as automotive drive the preference for SBR. Additionally, ongoing research and development activities and a focus on sustainable practices enhance the competitiveness of North American SBR manufacturers, further solidifying the region's prominent position in the global market.

Styrene-butadiene rubber is a synthetic elastomer derived from the copolymerization of styrene and butadiene monomers. This versatile rubber is widely used in the production of tires, automotive parts, and various industrial and consumer goods. SBR exhibits excellent abrasion resistance, durability, and resilience, making it a preferred choice in tire manufacturing, where it enhances traction, tread wear, and overall tire performance. Its cost-effectiveness and ability to be blended with natural rubber further contribute to its widespread adoption in the rubber industry.

Beyond tires, SBR finds application in conveyor belts, footwear, adhesives, and coated fabrics due to its favorable balance of properties, including good aging resistance and moderate heat resistance. The copolymerization process allows for tailoring the material's characteristics, making SBR adaptable to different manufacturing requirements. However, it is important to note that SBR may not excel in extreme temperature or oil resistance compared to other synthetic rubbers, but its affordability and well-rounded performance make it a key player in various industries that rely on durable and cost-effective rubber materials.

| Report Coverage | Details |

| Market Size in 2023 | USD 10.72 Billion |

| Market Size in 2023 | USD 11.32 Billion |

| Market Size by 2034 | USD 19.44 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.55% |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Construction industry expansion and consumer goods manufacturing

The expansion of the construction industry and the growth in consumer goods manufacturing significantly surged the market demand for styrene butadiene rubber. In the construction sector, SBR is sought after for its durability and resilience, making it a key component in various construction materials such as sealants, adhesives, and coatings. As infrastructure projects and urbanization efforts continue globally, the demand for these construction materials rises, driving the need for SBR.

Simultaneously, the consumer goods manufacturing sector heavily relies on SBR for products like footwear, sporting equipment, and various household items. SBR's desirable properties, including abrasion resistance and flexibility, make it a preferred material for the production of these goods. As consumer spending increases and markets expand, the demand for SBR in consumer goods manufacturing experiences a considerable upswing, contributing to the overall growth and sustainability of the styrene butadiene rubber market.

Storage and retrieval challenges

The limited heat and oil resistance of Styrene Butadiene Rubber (SBR) represents significant constraints on its market growth. In applications where high-temperature resistance is crucial, such as in the automotive and industrial sectors, SBR may face limitations compared to alternative synthetic rubbers with superior heat-resistant properties. The restricted ability of SBR to withstand exposure to certain oils also hampers its adoption in applications requiring resistance to lubricants and fuels. These limitations impact the potential applications of SBR in critical industries, limiting its use in environments with elevated temperatures and exposure to oil-based substances. As industries continually seek materials with broader performance capabilities, the constraints related to heat and oil resistance place constraints on the overall market expansion for SBR, prompting manufacturers to explore and develop alternative formulations or collaborate with end-users to find suitable substitutes for specific applications.

Green technology adoption

Green technology adoption is creating significant opportunities in the Styrene Butadiene Rubber (SBR) market. Manufacturers can capitalize on the growing demand for sustainable practices by developing and promoting eco-friendly SBR formulations. The incorporation of bio-based or recycled content in SBR aligns with environmental initiatives, meeting the preferences of environmentally conscious industries and consumers. This shift towards greener alternatives positions SBR as a more sustainable choice in various applications, enhancing its market appeal.

Furthermore, as regulatory pressures for environmentally friendly materials increase, the development and promotion of green SBR variants provide manufacturers with a competitive edge. Collaborations and partnerships within the industry to advance sustainable practices can foster innovation and open doors to new markets where eco-friendly solutions are increasingly prioritized, contributing to the long-term growth and viability of the styrene butadiene rubber market.

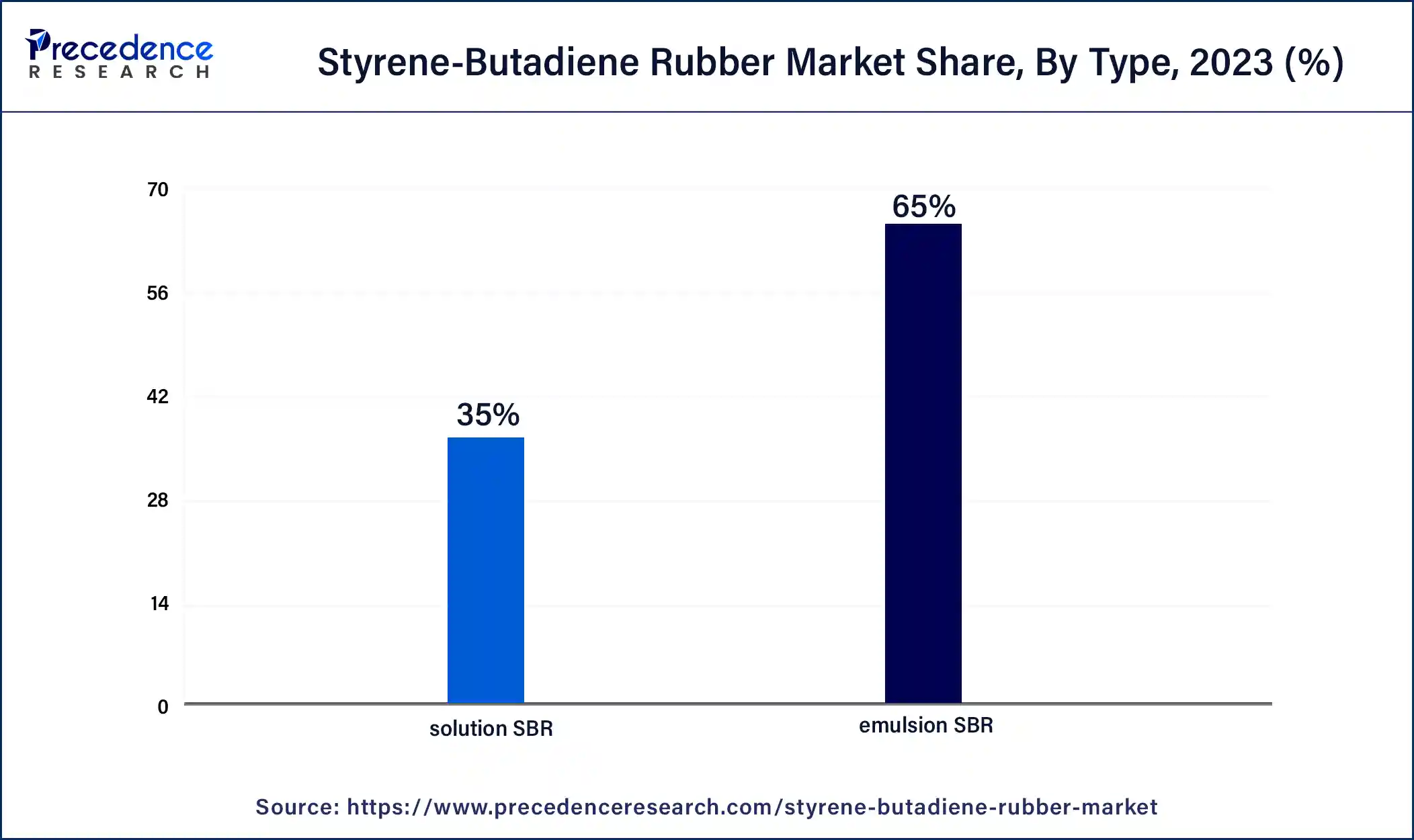

In 2023, the emulsion SBR segment had the highest market share of 65% on the basis of the type. Emulsion styrene butadiene rubber (ESBR) is a type of SBR produced through emulsion polymerization, resulting in a polymer with enhanced properties like improved abrasion resistance, flexibility, and heat build-up characteristics. ESBR is widely used in tire manufacturing due to its ability to improve tire performance and fuel efficiency. In the styrene butadiene rubber market, the ESBR segment is witnessing a trend towards increasing demand, driven by its advantages in tire technology. The automotive industry's focus on developing high-performance and fuel-efficient tires contributes to the growing prominence of ESBR in the market.

The solution SBR segment is anticipated to expand at a significant CAGR of 6.5% during the projected period. Solution Styrene Butadiene Rubber (S-SBR) is a type within the styrene butadiene rubber market, characterized by its production through a solution polymerization process. S-SBR exhibits superior performance characteristics, particularly in the production of high-performance tires, due to its controlled microstructure. The market trend for S-SBR includes a growing demand for high-performance tires in the automotive industry, driven by increased emphasis on fuel efficiency and tire performance. This segment's prominence is expected to continue as tire manufacturers seek materials that enhance overall tire performance and contribute to sustainability initiatives.

According to the application, the tire segment has held 31% revenue share in 2023. In the styrene butadiene rubber market, the tire segment refers to the use of SBR in tire manufacturing. SBR is a key component in tire formulations, enhancing tread wear, providing abrasion resistance, and contributing to overall tire performance. Trends in the SBR tire segment include a shift towards high-performance and fuel-efficient tires, driven by automotive industry advancements. Additionally, the demand for eco-friendly or "green" tires, incorporating sustainable materials like bio-based or recycled content SBR, reflects the industry's response to environmental concerns and evolving consumer preferences.

The footwear segment is anticipated to expand fastest over the projected period. In the styrene butadiene rubber market, the footwear segment refers to the application of SBR in the manufacturing of shoes and related products. SBR's widespread use in the footwear industry is driven by its desirable properties, including flexibility, abrasion resistance, and cost-effectiveness. Trends in this segment include a growing emphasis on sustainable footwear production, leading to the development of eco-friendly SBR formulations.

Additionally, innovations in SBR technologies contribute to the production of high-performance and durable footwear, meeting evolving consumer demands for both comfort and environmental responsibility.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

July 2024

July 2024