January 2025

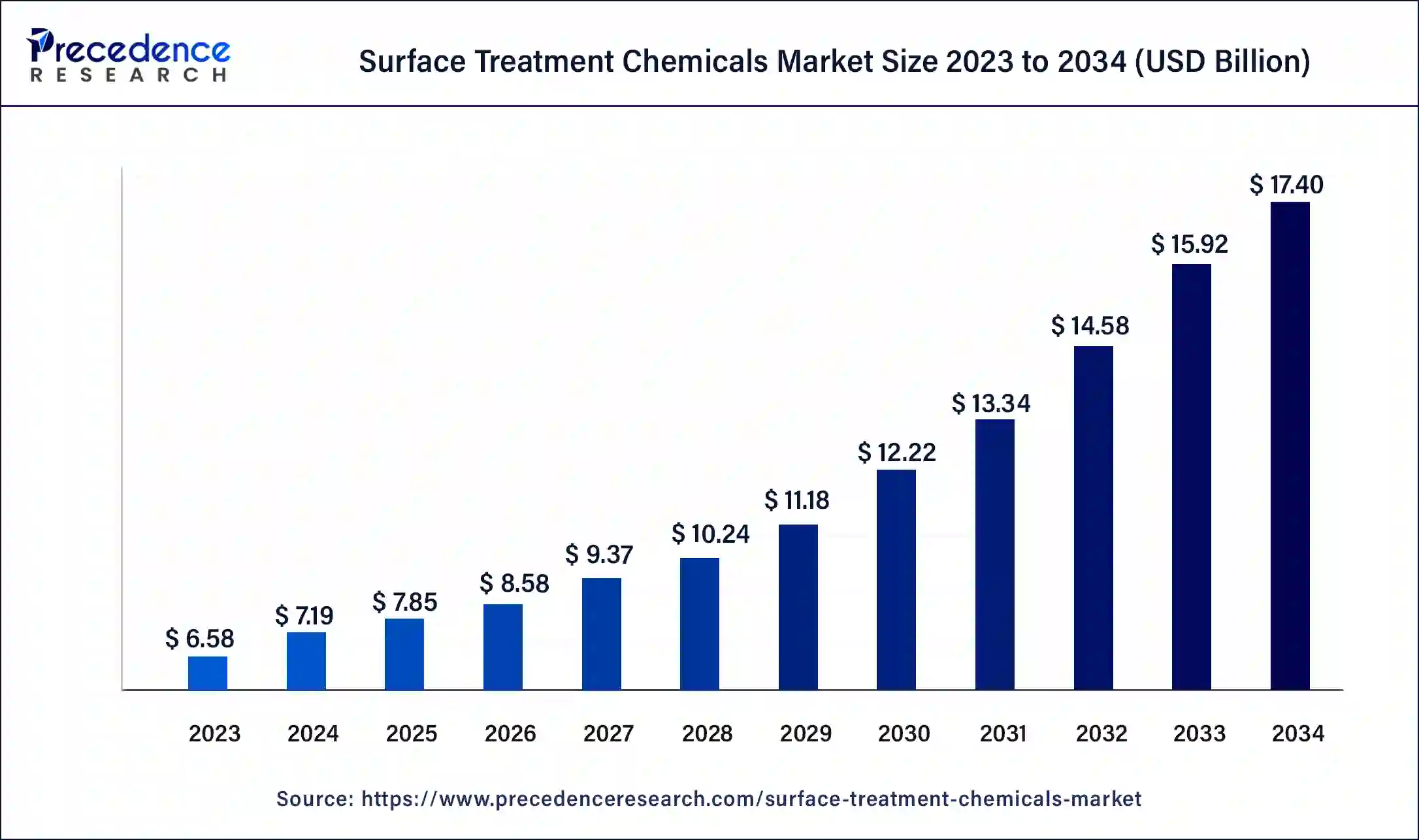

The global surface treatment chemicals market size surpassed USD 6.58 billion in 2023 and is estimated to increase from USD 7.19 billion in 2024 to approximately USD 17.40 billion by 2034. It is projected to grow at a CAGR of 9.24% from 2024 to 2034.

The global surface treatment chemicals market size is projected to reach around USD 17.40 billion by 2034 from USD 7.19 billion in 2024, at a CAGR of 9.24% from 2024 to 2034. The surface treatment chemicals market is driven by the increased need for items that can withstand abrasion and wear in sectors including construction, heavy machinery, and infrastructure.

Various chemical compounds known as surface treatment chemicals improve the surface qualities of different materials, including their adhesion, durability, appearance, and other functional traits. These compounds are applied to the surfaces of metals, polymers, glass, ceramics, and other materials to enhance performance in particular applications. Common surface treatment chemicals include cleaning agents, plating chemicals, conversion coatings, anodizing solutions, and etchants.

Paint, coating, and adhesive adhesion to surfaces are critical in the automobile, aircraft, and electronics sectors. Chemicals used in surface treatment prepare surfaces, guaranteeing maximum adhesion and avoiding coating and adhesive failure or delamination. By decreasing waste and the need for regular replacements, surface treatment chemicals can also help safeguard the environment.

How Can AI Help the Surface Treatment Chemicals Industry?

Artificial intelligence based technology is being integrated at several levels in the surface treatment chemicals market. AI-powered self-learning algorithms are currently being used to monitor pre-treatment processes where fluctuations in the materials or other parameters such as temperature can adversely affect surface treatment. For processes such as plasma coating, AI is being used to find correlations between light emission and surface properties, to better monitor and control the process.

Machine learning tools are proving useful in research and development ventures, helping discover and recognize molecules, creating new formulations and analyzing possible chemical interactions to predict durability of chemically treated surfaces. AI tools are also being deployed for quality control during production. Deep learning algorithms are being trained to detect foreign substances entering the production line, preventing contamination and accidents.

| Report Coverage | Details |

| Market Size by 2034 | USD 17.4 Billion |

| Market Size in 2023 | USD 6.58 Billion |

| Market Size in 2024 | USD 7.19 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.24% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Chemical Type, Base Material, Treatment Method, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing automotive industry

Automotive manufacturers are pressured to implement surface treatment procedures that comply with global environmental and safety norms as these regulations become increasingly stringent. Because they stop rust and corrosion, surface treatment chemicals are essential to vehicle components' long-term endurance and safety.

Creating and utilizing eco-friendly chemicals helps the automotive sector leave a smaller environmental impact. One aspect is the transition to low-VOC (volatile organic compound) and water-based coatings. This drives the growth of the surface treatment chemicals market.

Increased industrial activities

Growing urbanization and industrialization in developing nations fuel the demand for surface treatment chemicals. The demand for surface treatment solutions rises as new and current industries grow. Due to increased production capacity brought about by industrial growth, additional surface treatment chemicals are needed to manage higher product volumes while maintaining product quality and durability.

Stringent environmental regulations

The drive toward sustainability fuels the need for environmentally suitable substitutes. But there are difficulties with this change. Eco-friendly substitutes may be less efficient or unavailable for all applications. Higher production costs for green chemicals frequently translate into higher final product prices. This limits the growth of the surface treatment chemicals market.

Incorporation of nanomaterials in surface treatment chemicals

Surfaces coated with nanomaterials, including nano-ceramics and nano-polymers, can have much higher wear resistance and hardness. As a result, surfaces endure longer and require less upkeep. Nanocoatings can extend the life of metals and other substrates in abrasive settings by improving their barrier qualities. When surfaces are exposed to sunlight, nano-sized particles can provide better protection against UV radiation, avoiding surface deterioration and discoloration. This opens an opportunity for the growth of the surface treatment chemicals market.

The plating chemicals segment dominated the surface treatment chemicals market in 2023. Chemical plating is essential for preventing corrosion on metal surfaces. This is particularly crucial in the automotive, aerospace, and construction sectors, where materials are subjected to challenging conditions. In addition to improving a product's look with a glossy, polished surface, plating chemicals can have practical advantages such as increased lubricity, wear resistance, and electrical conductivity. Their dual benefits make them more appealing for a wider range of uses.

Businesses make significant R&D investments to develop more economical, ecologically friendly, and effective plating solutions. The segment's prominence depends on these improvements since they consistently fulfill changing client expectations and industry requirements.

The plastic segment dominated the surface treatment chemicals market in 2023. Plastics are widely employed in many industries, such as consumer products, automotive, electronics, packaging, and construction. Their cost-effectiveness, lightweight design, and versatility make them a well-liked option. The increasing use of plastics raises the need for chemicals made explicitly for surface treatment of plastic products.

The plastics industry has witnessed an increase in demand for surface treatment chemicals that can prolong the life of recovered plastics and enhance their performance due to the rising emphasis on sustainability and recycling. To assist the circular economy, surface treatments can help recycled plastics fulfill quality standards.

The chemical treatment segment held a significant share in the surface treatment chemicals market in 2023. Chemicals used in surface treatment improve a material's chemical and physical characteristics. They strengthen wear resistance, hardness, and corrosion resistance. By extending the lifespan of parts and structures, these treatments lower maintenance expenses and downtime. For instance, surface treatments are essential in the automotive sector to prevent rust and corrosion of metal components, guaranteeing the longevity and security of automobiles.

The electroplating segment shows a notable growth in the surface treatment chemicals market during the forecast period. Recent developments in electroplating technology have enhanced the effectiveness and caliber of surface treatments. Advancements, including alloy plating, pulse electroplating, and nanotechnology integration, are improving the plated materials' qualities and increasing their demand across various industries. The need for electroplating is driven by the requirement for printed circuit boards (PCBs) and high-performance connectors, and the downsizing of electronic components. The procedure is essential to obtaining conductivity and dependability in electronic devices.

The construction segment dominated the surface treatment chemicals market in 2023. The building sector is one of the most significant users of surface treatment chemicals. These chemicals are indispensable when treating different building materials, like metals, composites, concrete, and wood. Chemicals used in surface treatment extend the life and enhance the functionality of these materials by strengthening their resistance to corrosion, wear and tear, and environmental conditions. Improvements in surface treatment technologies have developed more specialized and efficient chemicals.

The use of surface treatment chemicals in construction has increased due to innovations like nanotechnology and eco-friendly formulations. These developments are essential to contemporary building methods because they offer improved performance and protection.

The automotive segment is observed to be the fastest growing in the surface treatment chemicals market during the forecast period.

Global car demand is rising, particularly in developing nations like China, India, and Brazil. The growth in demand requires more production, which raises the amount of chemicals used in surface treatment. A further motivator is the growing ubiquity of electric cars (EVs). Specialized coatings and treatments are needed for EVs to prevent corrosion, increase component durability, and guarantee effective operation.

Asia-Pacific dominated in the surface treatment chemicals market in 2023. Building activity has surged in Asia-Pacific nations due to rapid infrastructural development and urbanization. Chemicals used in surface treatment are crucial for guaranteeing the life and protection of construction materials. The construction of public buildings, and other infrastructure, together with government initiatives, has greatly increased the demand for surface treatment chemicals.

The Asia-Pacific region's growing environmental restrictions have prompted the use of sustainable and environmentally friendly surface treatment chemicals. Developing ecologically friendly surface treatment chemicals and an increasing emphasis on green chemistry have created new market prospects.

North America shows a significant growth in the surface treatment chemicals market during the forecast period. North America has a strong industrial foundation, especially in the US and Canada. Numerous automotive, electronics, aerospace, and heavy machinery sectors are expanding steadily in the region. In these industries, surface treatment chemicals are critical in enhancing metal components' corrosion resistance, durability, and aesthetic appeal.

Chemicals used in surface treatment are crucial in manufacturing electronic devices and components because they guarantee dependability and efficiency. The electronics sector, which is fueled by technological breakthroughs and rising consumer demand for electronic gadgets, is also expanding.

Segments Covered in the Report

By Chemical Type

By Base Material

By Treatment Method

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

February 2025

January 2025