January 2025

Surface Treatment Market (By Chemical Type: Cleaners, Plating Chemicals, Conversion Coatings; By Material: Metals, Plastic, Others; By End-use: Transportation, Construction, Oil & Gas Pipeline, Industrial Machinery, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

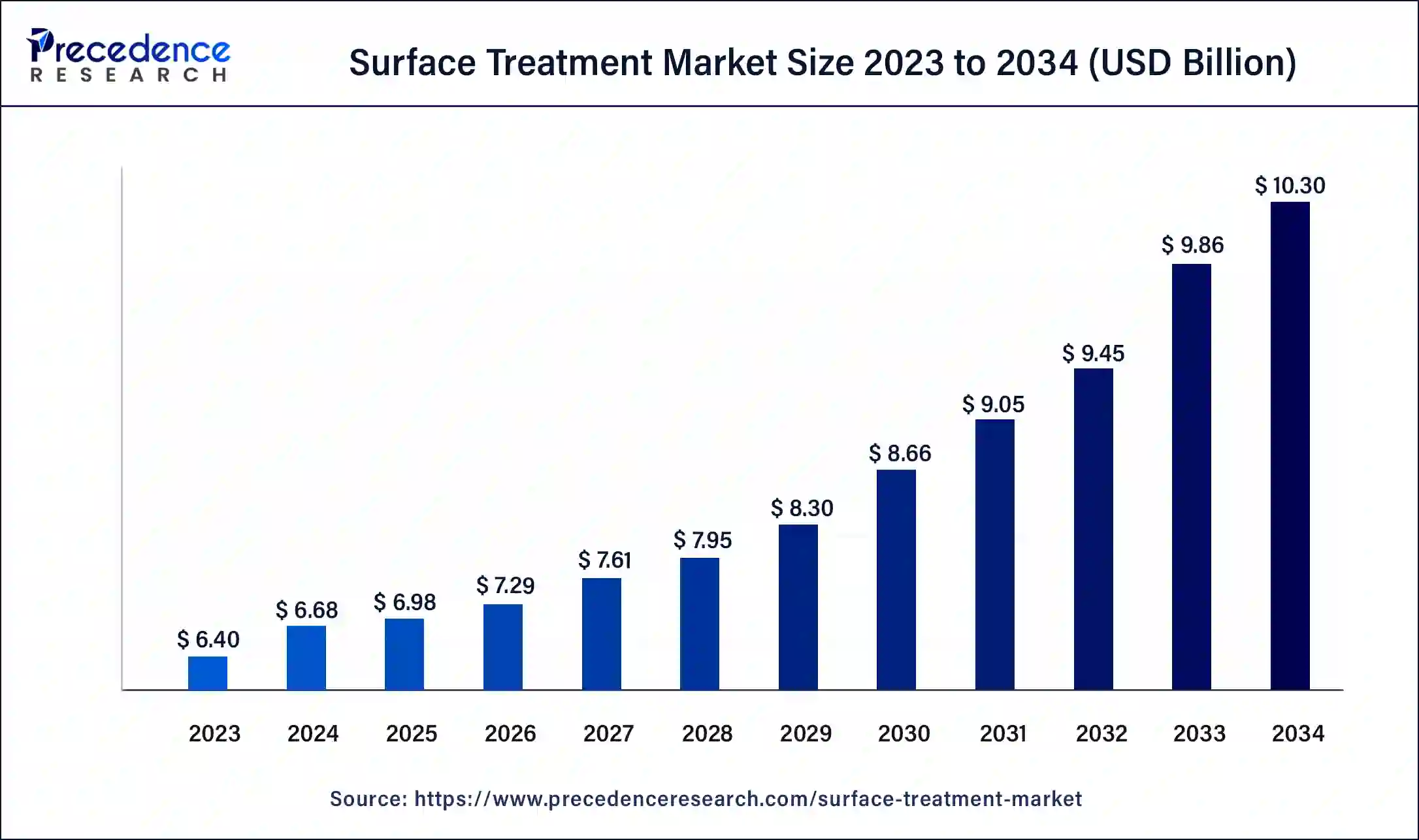

The global surface treatment market size was USD 6.4 billion in 2023, calculated at USD 6.68 billion in 2024 and is expected to reach around USD 10.30 billion by 2034, expanding at a CAGR of 4.42% from 2024 to 2034. The performance and durability of treated surfaces are being enhanced by advances in surface treatment technologies, such as nanotechnology and sophisticated coating methods. This drives the surface treatment market.

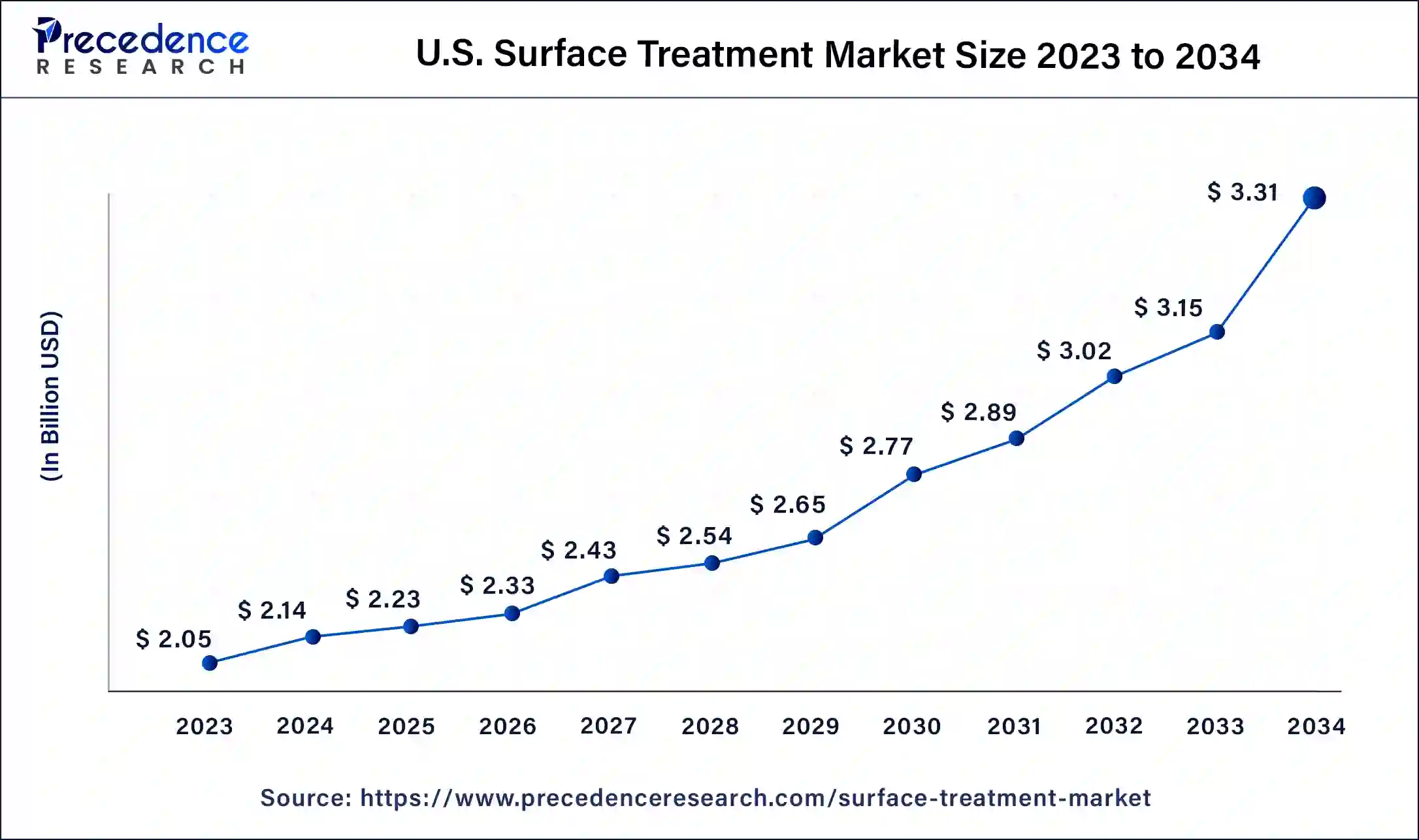

U.S. Surface Treatment Market Size and Growth 2024 to 2034

The U.S. surface treatment market size was exhibited at USD 6.40 billion in 2023 and is projected to be worth around USD 10.30 billion by 2034, poised to grow at a CAGR of 4.42% from 2024 to 2034.

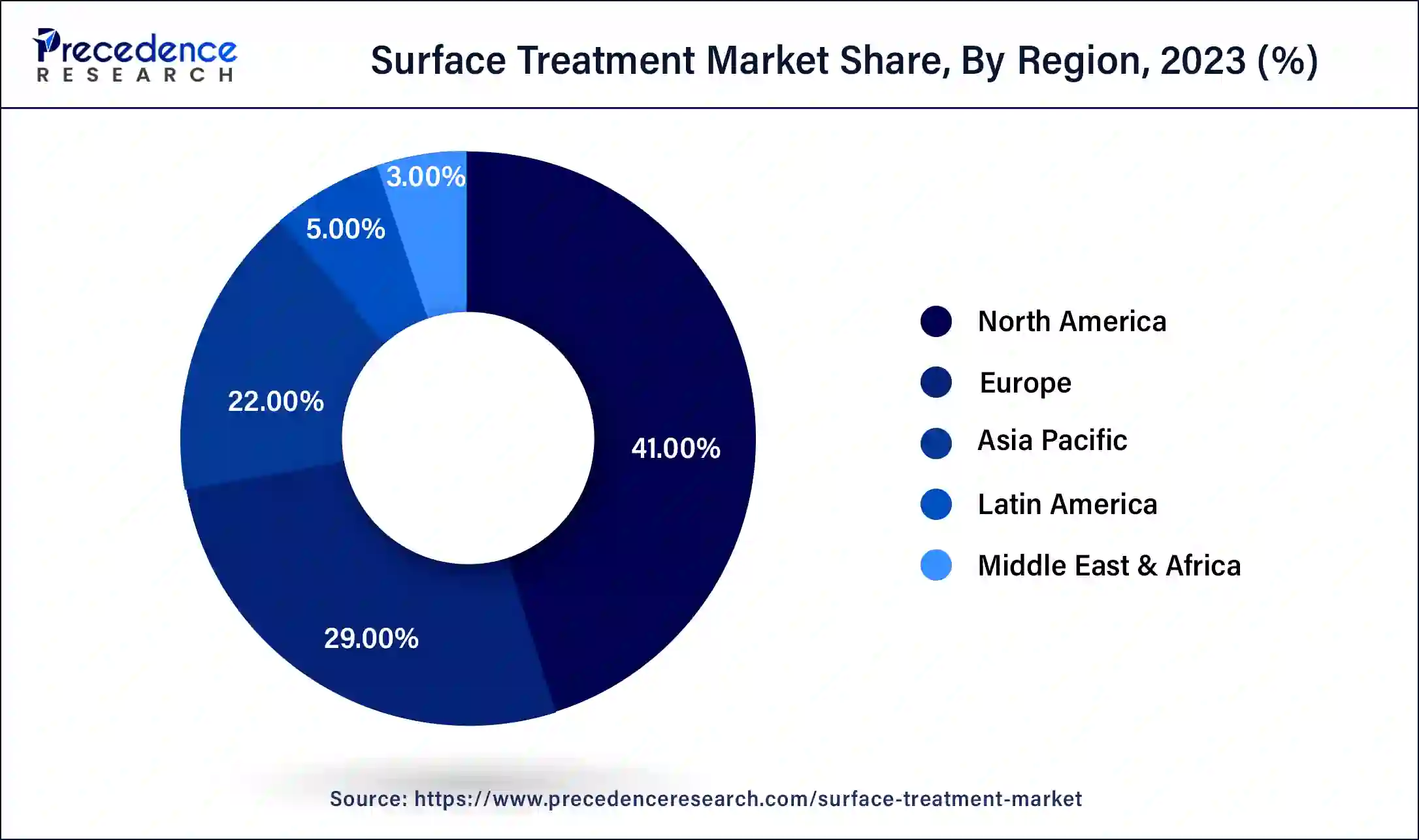

North America held the largest share of the surface treatment market in 2023. The need for surface treatment solutions is fueled by the growing industrial base in industries including manufacturing, aerospace, and automobiles. These treatments provide corrosion protection, wear resistance, and better aesthetics, which increase the components' performance and durability.

Market expansion is being aided by developments in surface treatment technology, such as improved coatings and procedures. Eco-friendly treatments and nanocoatings are two emerging technologies. Surface treatment technologies find extensive use in the automotive industry, where they are applied to anything from engine components to body elements. Demand is also being driven by the growth of electric vehicles and cutting-edge automotive technologies. High-performance surface treatments are necessary for components exposed to harsh environments in the aerospace and defense industries. This increases the need for specialist therapies that guarantee dependability and safety.

Asia Pacific is expected to host the fastest-growing surface treatment market during the forecast period. Rapid industrial growth is increasing the need for surface treatments to improve the performance and longevity of goods used in a variety of industries, especially in nations like China and India. Surface treatment solutions are used to improve vehicle parts' functionality, corrosion resistance, and appearance. The automobile industry is one of the biggest users of these goods.

Surface treatments are crucial for preserving and enhancing the performance of electrical and electronic components as their use grows. To guarantee high performance and safety standards, the aircraft industry requires advanced surface treatments for parts and components. Advances in surface treatment technologies, like nanotechnology and sophisticated coating techniques, are driving the market's expansion by providing enhanced effectiveness and performance.

The industry that uses different methods and substances to alter a material's surface properties is known as the surface treatment market. This may involve giving them a more appealing appearance, increasing their robustness, or offering particular features. Materials such as metals, polymers, ceramics, and others frequently undergo surface treatments. Coating, painting, plating, anodizing, and heat treatment are typical procedures. Specific goals, such as corrosion resistance, wear resistance, or aesthetic enhancement, are the focus of each technique. Trends that impact the market include the growing need for high-performance materials, laws governing the environment that encourage the use of eco-friendly treatments, and improvements in technology that boost the efficacy and efficiency of treatments.

The market for surface treatment is broad, with a range of technologies and techniques targeted at enhancing surface qualities for distinct uses. The need for innovative surface treatment solutions is driven by the expansion of industries such as aerospace, automotive, and construction. The industry is growing thanks to advancements in coating technologies such as nanocoating and sophisticated polymers. Heightened awareness of sustainable and environmentally friendly surface treatment methods. Dominates the market as a result of robust automotive and aerospace industries and advanced manufacturing sectors.

The growing use of surface treatments is a result of expanding industrial and infrastructure sectors. Adoption may be hampered by the high costs of new and sophisticated treatment technology. Growing need for specialized surface treatment products to satisfy particular industry standards.

| Report Coverage | Details |

| Market Size by 2034 | USD 10.30 Billion |

| Market Size in 2023 | USD 6.40 Billion |

| Market Size in 2024 | USD 6.68 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.42% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Chemical Type, Material, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Demand for customized solutions

The surface treatment market is required in different ways by different sectors. For instance, the aerospace industry might prioritize lightweight and corrosion-resistant treatments, whereas the automotive industry might need treatments to improve durability and aesthetics. Specialized surface treatments that take into account new materials and methods are becoming more and more necessary as technology advances.

Tailored strategies that take advantage of the most recent developments in the surface treatment market can be obtained through customized solutions. Performance traits, including heat stability, corrosion resistance, and wear resistance, can all be optimized with customized surface treatments. Optimizing solutions for particular use cases can improve overall performance. A growing focus on sustainability allows for the design of tailored surface treatments that lessen their impact on the environment. This includes cutting waste, increasing energy efficiency, and utilizing environmentally friendly materials.

Decreasing demand in some sectors

A decline in industrial output during an economic downturn may result in a decline in the demand for the surface treatment market. The employment of conventional surface treatment procedures may decline as a result of emerging technology replacing them. Tighter environmental laws may restrict the use of specific chemicals and procedures, which may have an impact on industries that significantly depend on these treatments.

The surface treatment market may decline as a result of shifts in customer tastes, such as a rise in the desire for environmentally friendly solutions. The saturation of surface treatment technologies in certain developed markets may result in a decline in the desire for novel applications. The demand in conventional sectors may be impacted by the creation and uptake of novel materials that do not require surface treatment.

Automotive industry growth

Demand for the surface treatment market is being driven by advancements in surface treatment technology, such as sophisticated coatings and finishes. These innovations improve the longevity, performance, and visual appeal of vehicles. The increased use of surface treatments to create distinctive patterns and finishes is a result of consumer preferences for individualized and customized automobiles.

The adoption of innovative surface treatments that are compliant with environmental legislation and safety standards for vehicle emissions is encouraged. Automotive parts surface treatments that increase their toughness and resistance to corrosion are becoming more and more crucial, especially in areas with harsh weather. The surface treatment market is being impacted by the automobile industry's drive towards sustainability, which is putting more of a focus on low-VOC (volatile organic compound) and environmentally friendly coatings.

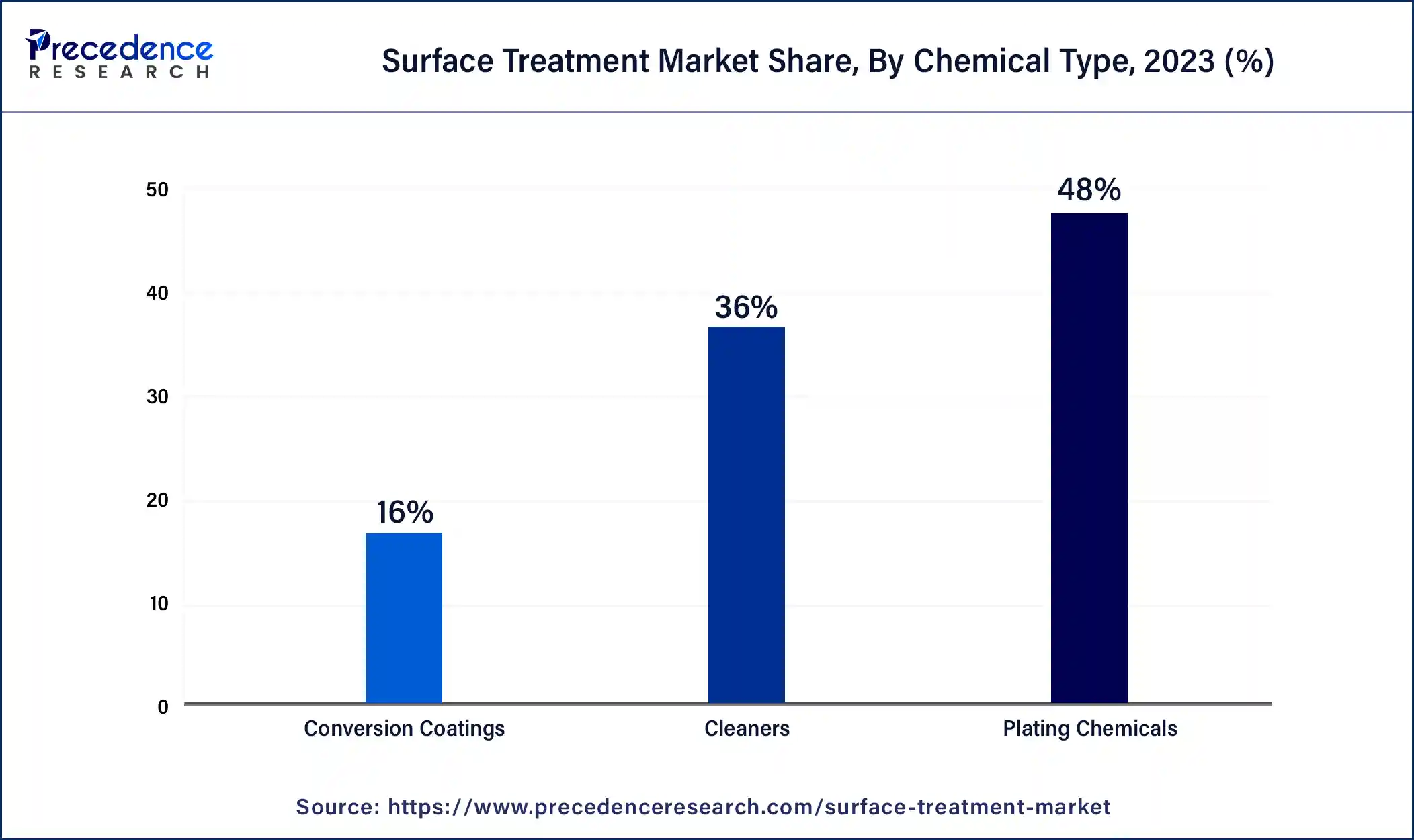

The plating chemicals segment dominated the surface treatment market in 2023. This section covers a variety of chemicals that are used to deposit metal coatings on surfaces during the electroplating and electroless plating processes. These substances contribute to the improvement of attributes like attractiveness, wear resistance, and corrosion resistance. These include plating solutions for chromium, nickel, gold, and silver, which are used in the electroplating process. These substances are employed in copper-tin and nickel-phosphorus solutions during electroless plating procedures. Plating chemicals are used because long-lasting, corrosion-resistant coatings are required. The need for plating chemicals is increased by the expansion of these sectors. The cost of plating chemicals might fluctuate depending on the price of raw ingredients.

The cleaners’ segment is expected to grow at the fastest rate in the surface treatment market over the studied period. The cleaners section of the surface treatment market specializes in goods made to get surfaces ready for additional processing or treatment. These cleansers are necessary to get rid of pollutants, grease, oils, and other impurities that can interfere with the adherence or efficacy of later treatments.

It is good for eliminating oils and greases, but because it contains volatile organic compounds, it might be harmful to the environment and human health. Specialized for particular kinds of surface impurities, alkaline cleaners are used for oils and fats, whereas acidic cleaners are frequently used to remove scale and rust. Metal surfaces are cleaned in order to get them ready for coating, painting, or other processing.

The metal segment held the largest share of the global surface treatment market in 2023. Within the surface treatment market, the metal segment focuses on several treatments that are used on metal surfaces to improve their characteristics, toughness, and look. Enhancing the natural oxide layer's thickness on metal surfaces primarily aluminum in order to increase wear and corrosion resistance. Apply a dry powder that is heated to cure it and produce a strong, long-lasting finish. Chemical coatings, such as phosphate coating, are applied to metal surfaces in order to provide a protective layer. High-performance coatings are needed in these industries to achieve strict criteria. The desire for improved performance and aesthetics in a variety of applications is what drives the metal section of the market, and continuing developments and regulatory changes are influencing its progress.

The plastic segment is expected to grow at the fastest rate in the surface treatment market over the studied period. Within the surface treatment market, the plastic segment focuses on several technologies and methods intended to improve the characteristics and appearance of plastic materials. Different kinds of coatings are applied to plastic surfaces in order to enhance their appearance, scratch resistance, or durability. Paints, varnishes, and protective films are common coatings. To improve strength, conductivity, or attractiveness, metal layers can be deposited on plastic surfaces using electroplating or other plating techniques.

The rising need for high-performance plastics across a range of industries, including consumer products, automotive, electronics, and packaging, is fueling this segment's expansion. By making it possible to provide more intricate and personalized solutions for plastic materials, developments in surface treatment technologies are also fueling the expansion of the market.

The transportation segment led the surface treatment market in 2023. This comprises applying coatings on the outside, inside, and components of vehicles to improve their resilience to deterioration and UV rays, as well as their longevity and aesthetic appeal. Aircraft surface treatments are used to increase resistance to wear, corrosion, and severe temperatures. This covers composite materials and metal coatings. This section's treatments are aimed at prolonging the life of maritime components like hulls and shielding vessels from corrosion caused by saltwater. To ensure lifetime and safe operation, surface treatments are done to train components to prevent rust and wear. This covers the maintenance of the appearance and functionality of buses, trams, and other public transportation vehicles under intense use.

The construction segment is expected to grow at the fastest rate in the surface treatment market over the studied period. These consist of fire-retardant coatings, weather-resistant coatings for external surfaces, and anti-corrosion coatings for metal structures. They assist in prolonging the life of materials and shield buildings from environmental degradation.

Concrete surfaces can be made more resilient to wear, moisture, and chemical exposure by using products such as sealers, hardeners, and curing chemicals. Epoxy coatings, polyurethane finishes, and polished concrete are examples of surface treatments for flooring that are intended to improve appearance while also offering practical advantages, including easy maintenance and slip resistance. Treatments such as different kinds of paint, cladding systems, and weatherproofing solutions enhance the longevity and aesthetic appeal of building facades.

Segments Covered in the Report

By Chemical Type

By Material

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

August 2024

January 2025