September 2024

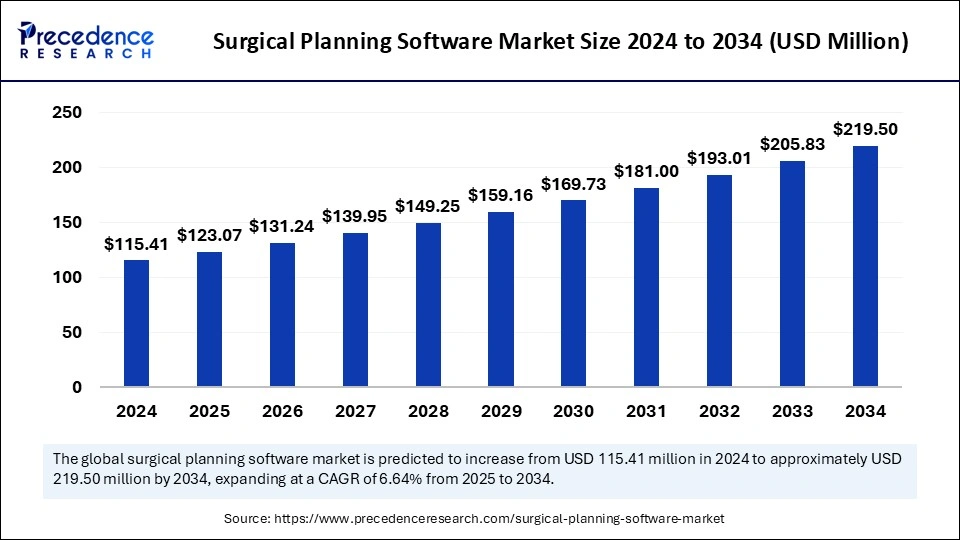

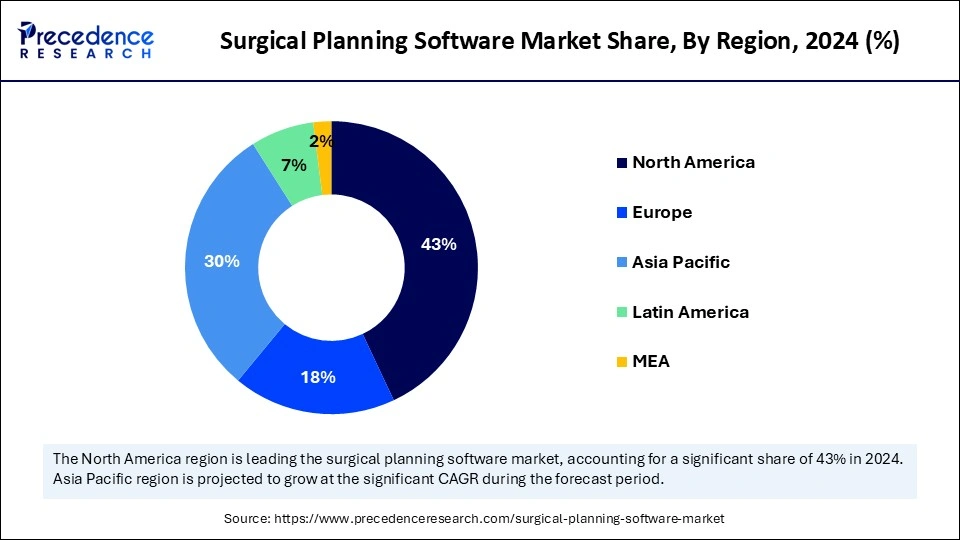

The global surgical planning software market size is accounted at USD 123.07 million in 2025 and is forecasted to hit around USD 219.50 million by 2034, representing a CAGR of 6.64% from 2025 to 2034. The North America market size was estimated at USD 49.63 million in 2024 and is expanding at a CAGR of 6.76% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global surgical planning software market size was calculated at USD 115.41 million in 2024 and is predicted to increase from USD 123.07 million in 2025 to approximately USD 219.50 million by 2034, expanding at a CAGR of 6.64% from 2025 to 2034. The increased demand for cloud-based platforms is the major driver of the global surgical planning software market. The demand for personalized medicine and minimally invasive surgical procedures has increased; as a result, the adoption of surgical planning software has expanded.

Artificial Intelligence is the modern version of improving healthcare infrastructure. AI integration with medical devices and software is a game-changing platform for healthcare infrastructure. The integration of AI with surgical planning software has enhanced its decision-making ability to improve predictive analytics, surgical planning accuracy, personalized recommendations based on patient data, and prediction of patient outcomes based on their history reports.

The major reason behind increased AI leverage in the surgical planning software market software is the rising knowledge of digitalization, automation, and increased demand for personalized medicines and non-invasive surgeries. It can detect specific medicines or treatment solutions for patients according to their genetic experience by analyzing a vast amount of data. AI algorithms in surgical devices and software are not only saving time but also allowing access to cost-effective services. Furthermore, the rapid surge in the development of healthcare IT infrastructure is likely to scale up the adoption and use of AI and Machine Learning in healthcare services.

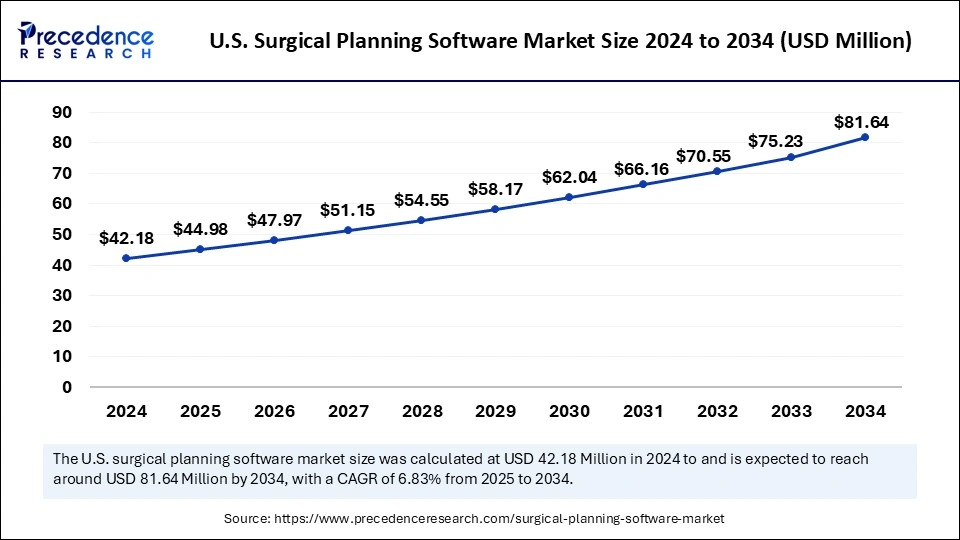

The U.S. surgical planning software market size was evaluated at USD 42.18 million in 2024 and is projected to be worth around USD 81.64 million by 2034, growing at a CAGR of 6.83% from 2025 to 2034.

North America led the surgical planning software market with the largest share in 2024, majorly due to the region's well-established healthcare sector, the presence of competitive landscapes, and the early adoption of cutting-edge technologies. The demand for cloud-based solutions in countries like the U.S. and Canada is a major factor in the surging growth of the North American market.

The United States leads the regional market with the implementation of advanced digital healthcare solutions. The adoption of advanced technological tools to reduce surgical risk factors and improve outcomes has taken rapid take in countries, hospitals, and surgical centers. Canada, on the other hand, is anticipated to witness significant growth in the forecast period due to the country's high adoption of digitalization in the healthcare sector and government initiatives to promote healthcare IT integration.

Asia Pacific is projected to host the fastest-growing surgical planning software market in the coming years due to the growing geriatric population and investments in healthcare infrastructure. Growing emphasis on Asia to develop and provide access to well-established healthcare facilities for developing or rural areas is playing a crucial role in improving regional market conditions in the upcoming time. Rising awareness of advanced technologies and government initiatives and investments in the healthcare sector are highly contributing to market share.

Countries such as China and Japan are significantly driving the growth of the Asian surgical planning software market. China is taking the lead in this regional market, largely due to increased healthcare spending. Meanwhile, Japan has also experienced substantial growth, thanks to its strong foundation in advanced technology and a rapidly aging population. The Government of Japan (GOJ) is actively working to enhance the regulatory review process for medical devices, particularly standalone software designed for medical purposes, known as Software as a Medical Device (SaMD). Initiatives from the Ministry of Health, Labour, and Welfare (MHLW) are fostering the commercialization of SaMD products, which is having a notable impact on innovation and the development of advanced technologies within Japan's healthcare sector, including surgical planning software.

The surgical planning software is an advanced tool designed to help surgeons make precise decisions and plan intricate procedures. It provides strategic planning by analyzing patient data obtained from medical imaging technologies such as computed tomography (CT) and magnetic resonance imaging (MRI), creating an accurate 3D representation of the patient's anatomy. The surgical planning software market applications is especially common in orthopedic surgeries. Moreover, there is an increasing demand for patient-specific surgical planning software that enables the exploration of unique 3D anatomies, moving away from reliance on standardized models in the healthcare IT landscape.

The increased demand for personalized medicine has shifted healthcare to the addition of preoperative surgical planning software, which helps healthcare professionals by enabling them to create customized surgical plans. The rapid growth in the development of orthopedic surgery and cloud computing technology is providing room for the expansion of preoperative surgical planning software adoption as well as developments. Furthermore, government initiatives, regulatory support, and approvals for novel, cutting-edge technologies and implementations are emerging markets.

| Report Coverage | Details |

| Market Size by 2034 | USD 219.5 Million |

| Market Size in 2025 | USD 123.07 Million |

| Market Size in 2024 | USD 115.41 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.64% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End use, Application, Delivery and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Technology advancements

Recent advancements in technologies, including medical imaging, virtual reality, artificial intelligence, minimally invasive surgery devices, and cloud computing & data analytics, are the major drivers of the global surgical planning software market. The increased emphasis of healthcare professionals on integrating seamless technology into hospitals' information systems is enabling efficient communication between professionals, making it easier for surgery planning and performance.

Cloud-based software is gaining popularity due to its flexibility, secure data storage, collaboration, insights-driven decision-making ability, and cost-effectiveness. Additionally, leveraging AI and VR provides more accuracy and convenience in surgical planning. Technological advancements in CT scans and MRI scans are enabling customized surgical modules and implants. The advanced guidance and accuracy of advanced technology integration with surgical planning software are raising their popularity and preference among healthcare professionals.

Data security concerns

The surgical planning software market faces critical challenges regarding data security concerns. Handling sensitive patient data requires protection from unauthorized access. The risk of data breach reputation damage, financial loss, and the need to meet regulatory standards significantly hinder the adoption of surgical planning software. Additionally, the utilization and innovations of this software are being influenced by the high risk of cyber threats and strict regulations.

Reduce surgical cost

The high cost of surgeries is a major challenge for patients. However, the adoption of the surgical planning software market is providing significant solutions to the cost emphasis. Surgical planning software can reduce surgical costs by providing an accurate plan and reducing complications. This software can help hospitals to optimize resource allocation to minimize waste and enhance efficiency. The driving demand for personalized patient care solutions can also be fulfilled by adapting surgical planning software to make surgical procedures cost-effective. Well-defined planning helps surgeons to lay out more efficient surgeries, improve patient outcomes, and reduce complex procedures and expenses.

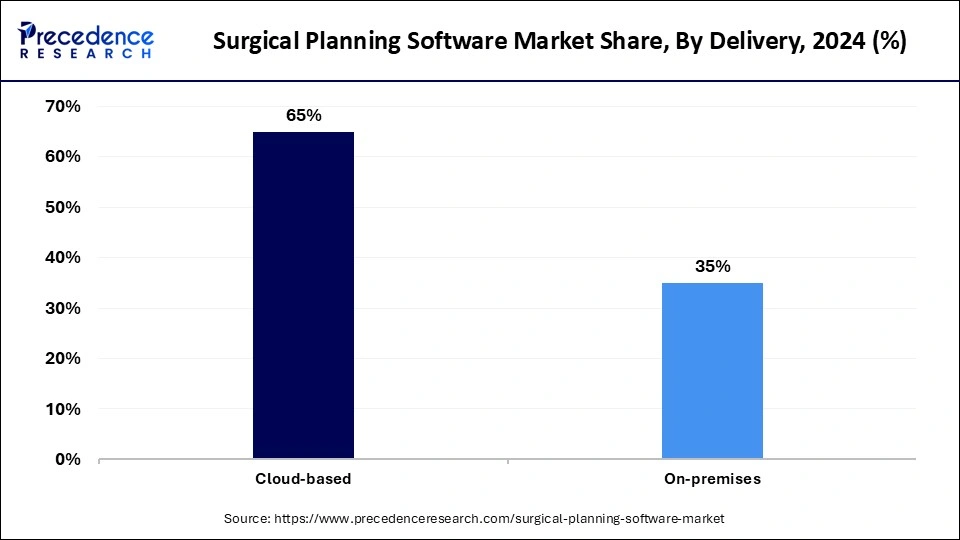

The cloud-based segment held a major share of the surgical planning software market in 2024. The segment growth is mostly attributed to the rising demand for cloud-based solutions to enhance remote access and collaborations. The scalability and cost-effectiveness of cloud-based solutions help to reduce upfront capital expenditure. The surge of healthcare to adopt digitalization highly supports cloud-based integrations with surgical planning software. Additionally, a lack of trained healthcare professionals is driving the shift to cloud-based solutions.

The on-premises segment is expected to grow fastest over the forecast period due to high concerns about data privacy and security. The risk of cyber threats and regulatory companies requiring the adoption of on-premises surgical planning software. On-premises software controls data security and provides less reliability on internet connectivity, making them ideal for unstable connection areas. Additionally, on-premises enables healthcare organizations to meet regulatory standards, reduce compliance, and enhance patient outcomes.

The orthopedic surgery segment accounted for a considerable surgical planning software market share in 2024 due to the rising geriatric population and injuries. The risk of osteoporosis, osteoarthritis, and injuries is high in the elderly population, which raises the demand for surgical planning software. The high demand for orthopedic surgeries like hip replacements and knee replacements is high among all surgical procedures. Additionally, advancements in surgical planning software, including cloud-based solutions, AI, ML integration, and patient-specific planning, are making surgical software planning more popular for orthopedic surgeries.

On the other hand, the neurosurgery segment is anticipated to grow with the highest CAGR during the studied years. The adoption of surgical planning software for neurosurgery has witnessed significant growth in recent years, majorly due to technology advancements like the development of software to improve surgical outcomes using VR and AR technologies. The implementation of cutting-edge technologies to improve accuracy, efficiency, and patient outcomes is driving the adoption of this software for neurosurgery. Furthermore, with an ongoing focus on expert innovations and advancements in surgical planning software, the growth of the neurosurgery segment is likely to boost further.

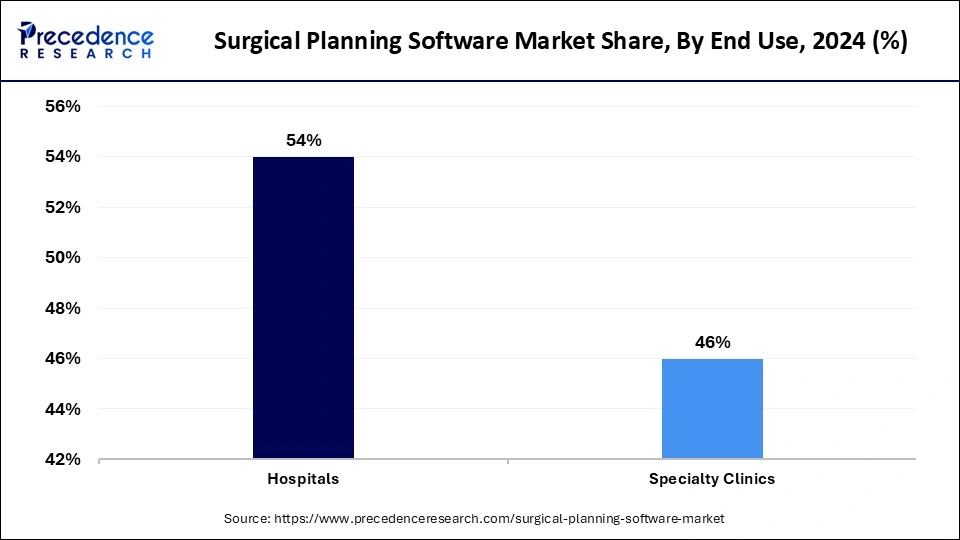

The hospitals segment led the global surgical planning software market in 2024. The segment growth is attributed to a large patient volume in the hospitals. Hospitals can perform complex surgical procedures, which require advanced planning and navigation, making it essential for the adoption of surgical planning software in hospitals. The presence of resources and infrastructure for investments in advanced technologies plays a favorable role for the segment. The rising adoption of cutting-edge technologies and government emphasis on the development of healthcare IT infrastructure are driving the segment to expand.

However, the specialty clinics segment is projected to expand rapidly in the coming years. Specialty clinics provide customized and patient-centric surgical procedures, which makes it essential to adopt surgical planning software to ensure accurate and effective surgical procedures. The increased demand for specialized surgical procedures such as orthopedic, neurosurgery, and cardiovascular surgeries is shifting patient preference toward specialty clinics.

By Delivery

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

January 2025