July 2024

Testing as a Service Market (By Test Type: Functionality, Performance, Compatibility, Security, Compliance, Others; By End-use: IT & telecommunication, Healthcare, BFSI, Automotive, Manufacturing, Retail & Consumer Goods, Energy & Utilities, Others; By Deployment Type: Public, Private, Hybrid) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

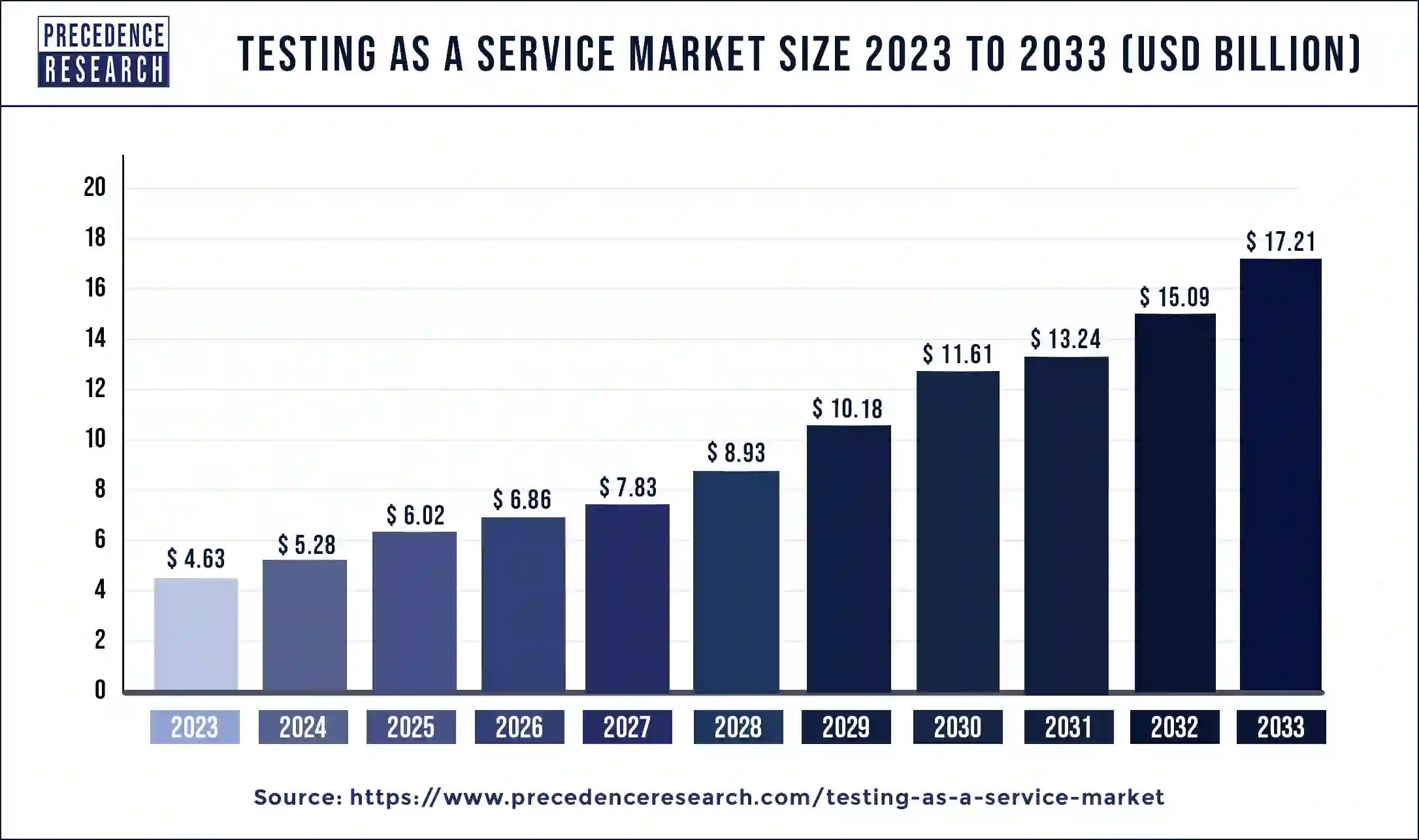

The global testing as a service market size was valued at USD 4.63 billion in 2023 and is anticipated to reach around USD 17.21 billion by 2033, growing at a CAGR of 14.03% from 2024 to 2033. The rising complexity of software development, involving functionalities and dependencies, necessitates comprehensive testing approaches, driving the demand for testing as a service.

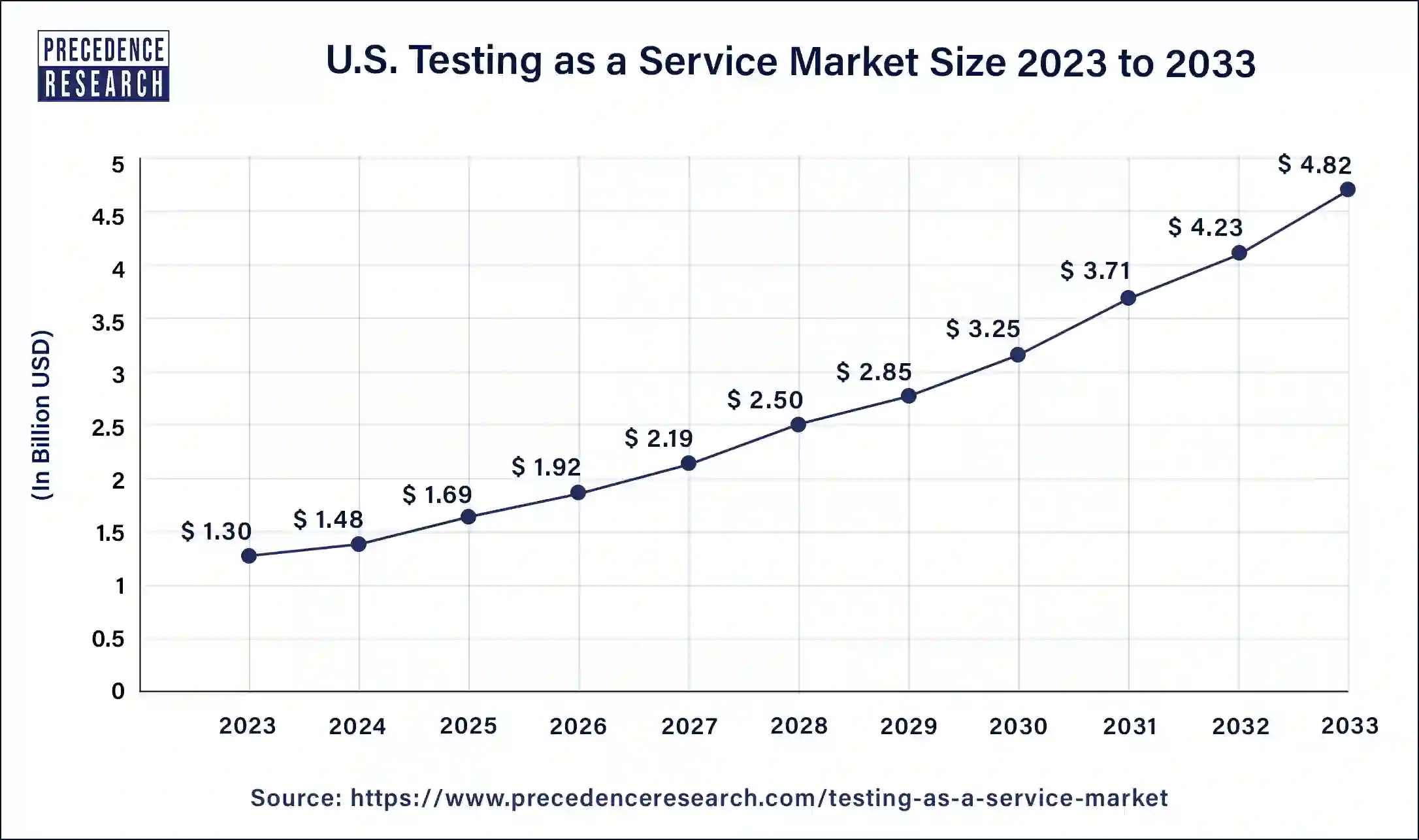

The U.S. testing as a service market size was estimated at USD 1.30 billion in 2023 and is projected to surpass around USD 4.82 billion by 2033 at a CAGR of 14.10% from 2024 to 2033.

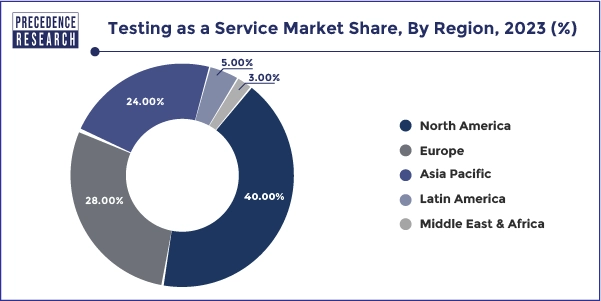

North America led the testing as a service market, holding a 39.2% share in 2023. This was because of the region's thriving software development industry, which demands top-notch quality assurance (QA) services, thus driving the growth of the TaaS market. Moreover, North America boasts major TaaS providers like Infosys Limited and Cognizant, which are known for their top-quality testing services. These companies also offer advanced testing tools and methods, such as AI and ML-based testing, to make their services more efficient and effective.

Asia Pacific is expected to witness significant growth during the forecast period. This was largely due to the region's increased use of cloud computing, which boosted the demand for TaaS. Businesses in the region are also realizing the advantages of outsourcing testing tasks, such as saving money, enhancing quality, and speeding up processes. Government efforts in countries like China and Japan to encourage cloud computing and digital technology adoption are further driving the demand for testing as a service market in the region.

Testing as a Service Market Overview

Testing as a service (TaaS) means hiring outside experts to test applications in real-life situations to find problems. These experts, usually third-party providers, offer different testing services like checking if the app works well, runs fast, and stays safe. TaaS is handy for companies that can't do testing themselves. It lets them save time and money by using experts from outside.

TaaS providers offer various functional, performance, security, and compatibility tests. TaaS is great for companies looking to improve their testing. It lets them use outside experts and resources, which takes some pressure off their testing teams. Plus, they get access to the latest testing tools and methods. TaaS can be adjusted to fit each project, so it works well for all kinds of companies.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.03% |

| Global Market Size in 2023 | USD 4.63 Billion |

| Global Market Size by 2024 | USD 5.28 Billion |

| Global Market Size by 2033 | USD 17.21 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Test Type, By End-use, and By Deployment Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

The simple operational process of TaaS

Using testing as a service (TaaS) goes hand in hand with Agile and DevOps approaches, which emphasize quick development cycles. TaaS's flexibility speeds up feedback, improves product quality, and gets products to market faster in today's fast-paced business world, where innovation and speed matter; TaaS makes testing easier by providing skilled testers and automated tools. This helps companies focus on innovating and launching products faster, keeping customers happy, and staying ahead of the competition.

Restraint

Struggle to provide specific services

Testing as a service market might struggle with tailoring testing services to specific industries and their unique needs. While TaaS providers offer a wide range of testing solutions, they may not always understand the specific requirements of industries like healthcare or aerospace. These industries need specialized testing due to their complex regulations and standards. As a result, organizations in these sectors may find it hard to match their needs with the general testing services provided by TaaS providers, limiting the usefulness of the testing as a service market in certain industries.

Opportunities

Easy to be adopted by different sectors

Industries like healthcare, manufacturing, and government, which have been slow to adopt modern software testing practices, are now realizing the advantages of testing as a service market. They see TaaS to enhance software reliability, security, and compliance. With these industries transitioning to more software-dependent operations, there's a rising demand for testing services tailored to their specific needs. Testing as a service market player can seize this opportunity by providing specialized testing solutions tailored to each industry, becoming valued partners in improving software quality and compliance in these sectors.

AI and ML

Test automation has gained substantial traction driven by the advantages of high efficiency, coverage in software testing, and faster feedback. AI and ML are revolutionizing the testing industry through the auto-generation of intelligent test case prioritization, test scripts, and self-healing. According to one survey, about 40% of organizations use Artificial Intelligence in testing nowadays. Moreover, the rise in the adoption of test automation can further create widespread opportunities for software testers and service providers.

The functionality segment dominated the testing as a service market in 2023. Businesses prioritize delivering software with strong and user-friendly features, leading to a focus on functionality testing. They aim for top-notch performance, reliability, and improved user experience, which drives the emphasis on testing core software features. The adoption of agile and DevOps methods further boosts functionality testing, fitting well with frequent releases and continuous integration/continuous delivery (CI/CD) pipelines. This encourages the use of automated testing tools. As software applications get more complex, TaaS providers become essential. They offer expertise in handling intricate features and customize testing methods to ensure thorough coverage, preventing critical issues in core functionalities.

The security segment is expected to grow the fastest during the forecast period. With the rise in cyberattacks, organizations are realizing the importance of strong security measures. They're becoming more aware of vulnerabilities and the potential damage of data breaches. The evolving IT landscape, with more cloud technologies, IoT devices, and complex software, brings new security challenges. Traditional testing methods may not be enough to address these challenges effectively. Strict data privacy laws like GDPR and HIPAA are pushing organizations to prioritize data security and adopt comprehensive security testing. They often turn to TaaS providers for specialized expertise.

The public segment held a significant share of the testing as a service market in 2023. This is attributed to the pay-as-you-go model of the public cloud, which eliminates the necessity for large investments in expensive software and hardware, which is especially advantageous for small enterprises and startups. The wide accessibility of testing tools from remote areas with an internet connection can further contribute to market growth.

The private segment is poised to grow at a significant rate during the forecast period, which is linked to an increase in concerns over data and security concerns, majorly in industries like finance, healthcare, and government, which will drive the growth of private clouds because they assist businesses with confidential data. Furthermore, the rise in customization and control offered by private clouds is more beneficial to various organizations with complicated applications, which can boost market growth soon.

The IT & telecommunication segment led the testing as a service market. The growing need for digital transformation in IT pushes companies to adopt new technologies constantly. TaaS steps in as a solution by providing access to a skilled team of testing professionals and resources, saving companies from having to invest heavily in their testing infrastructure. With IT systems becoming more complex, TaaS providers play a crucial role by offering specialized expertise and tools to test intricate systems effectively, which can be difficult and costly to do in-house.

The healthcare segment is expected to grow the fastest during the forecast period. In modern healthcare, there's a heavy reliance on complex IT systems, including electronic health records and telehealth platforms. TaaS offers a flexible solution for healthcare organizations, ensuring thorough testing to safeguard patient safety, data security, and operational efficiency. Strict regulations like HIPAA and GDPR drive the demand for TaaS providers specializing in compliance testing to help organizations meet privacy and security standards and avoid penalties. Moreover, TaaS supports precision medicine and personalized care by providing specialized testing to analyze patient data accurately and ensure the reliability of healthcare technologies, including AI, robotics, and wearable devices.

Segments Covered in the Report

By Test Type

By End-use

By Deployment Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

February 2025

February 2025

April 2025