January 2025

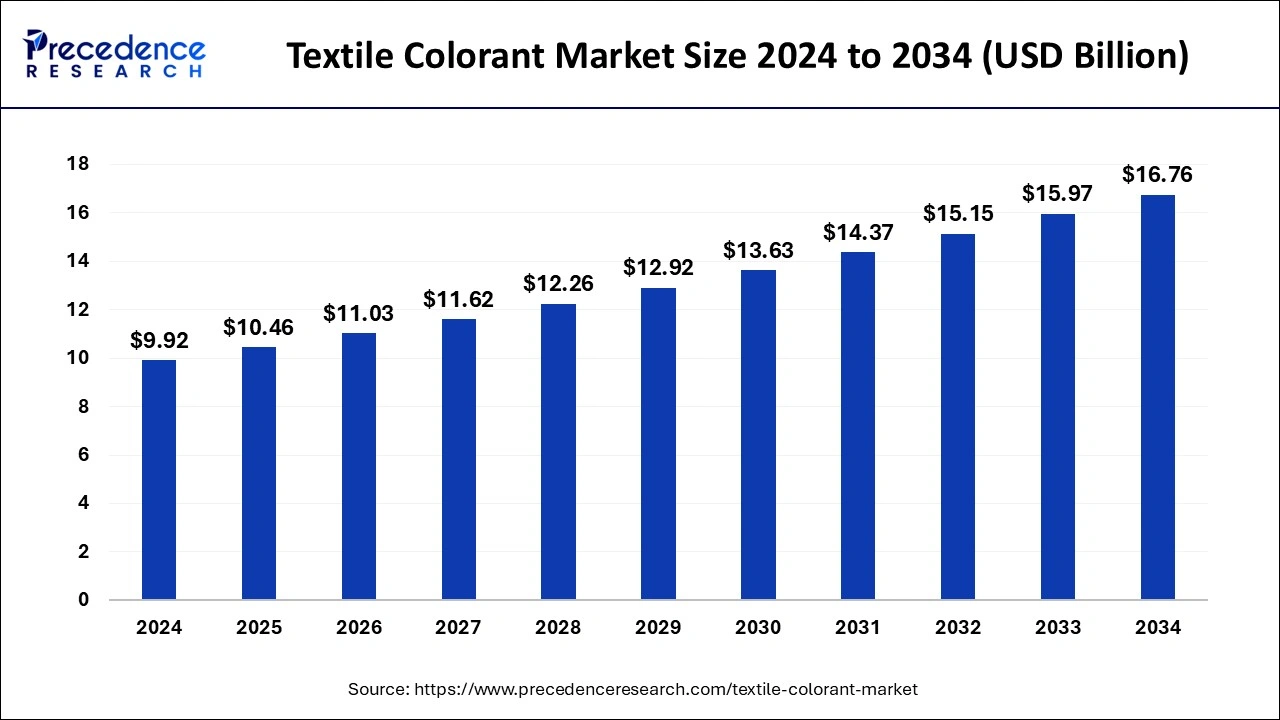

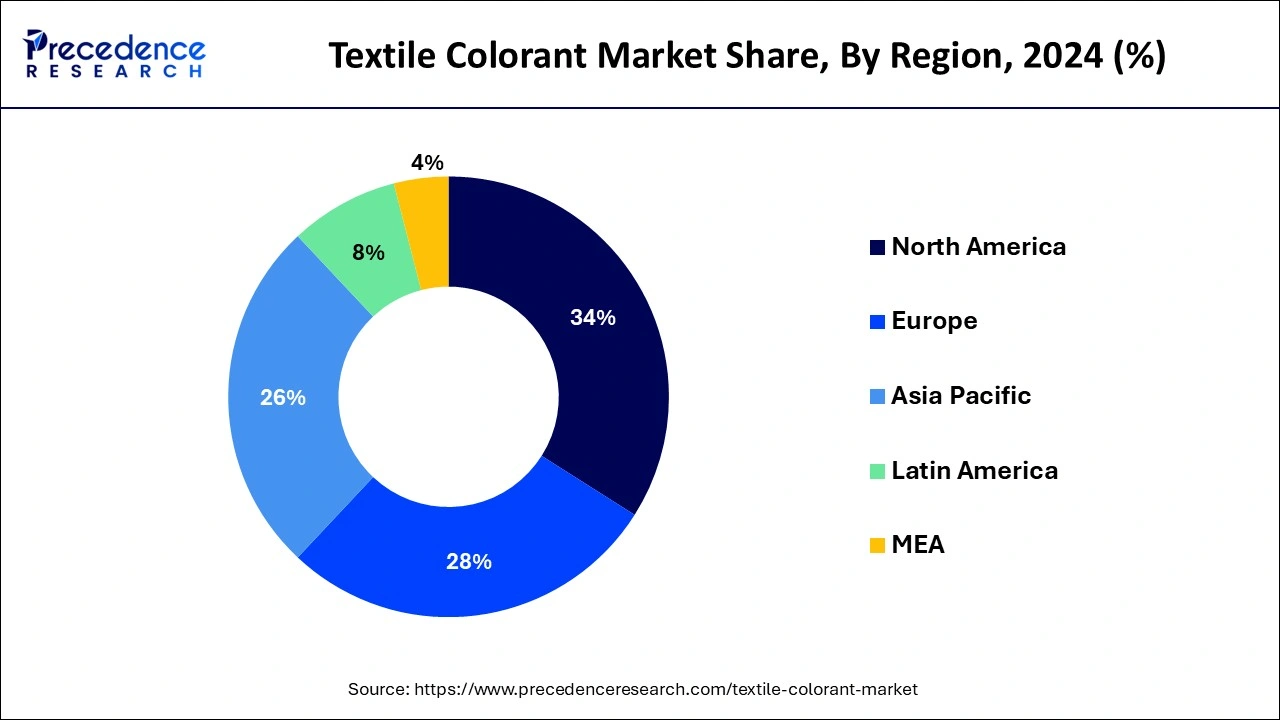

The global textile colorant market size is calculated at USD 10.46 billion in 2025 and is forecasted to reach around USD 16.76 billion by 2034, accelerating at a CAGR of 5.38% from 2025 to 2034. The North America textile colorant market size surpassed USD 3.67 billion in 2024 and is expanding at a CAGR of 5.54% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global textile colorant market size was estimated at USD 9.92 billion in 2024 and is predicted to increase from USD 10.46 billion in 2025 to approximately USD 16.76 billion by 2034, expanding at a CAGR of 5.38% from 2025 to 2034. Beyond traditional clothes and accessories, textile colorants are used in technological textiles, automotive textiles, and home furnishings.

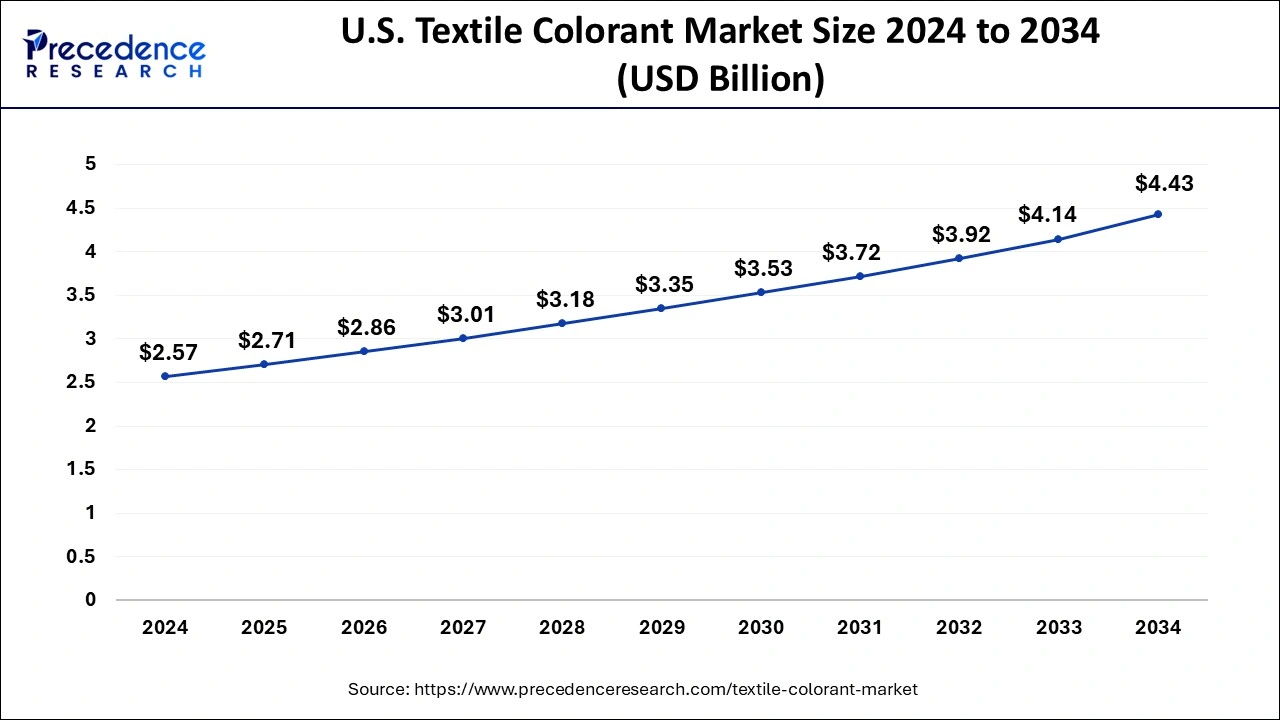

The U.S. textile colorant market size was estimated at USD 2.57 billion in 2024 and is predicted to be worth around USD 4.43 billion by 2034 at a CAGR of 5.60% from 2025 to 2034.

North America dominated the global textile colorant market and is expected to continue this dominance during the forecast period. The need for sustainable and environmentally friendly textile colorants has increased as people's knowledge of environmental issues has grown. The main priorities of manufacturers are the development of natural and bio-based dyes, together with the use of waste- and water-saving production techniques. Textile colorants possessing attributes like improved resilience, lightfastness, and washability are much sought after, especially for uses where color preservation is crucial, such as sportswear, outdoor textiles, and automobile textiles. The increasing need for textile colorants that provide distinctive designs and color variations might be attributed to consumer preferences for personalized and customized items. In the home textiles and fashion industries, this trend is especially noticeable.

Asia Pacific is expected to grow significantly during the forecast period. The expanding textile industries in China, India, Bangladesh, Vietnam, and Indonesia have resulted in a notable expansion of the textile colorant market in Asia Pacific. The demand for textiles has been driven by the region's vast population, rising disposable incomes, and changing lifestyles, which has helped to expand the market for textile colorants. The textile manufacturing industry, which includes clothing, home textiles, technical textiles, and industrial textiles, is the main driver of the need for textile colorants in Asia Pacific. Textile colorants come in a variety of forms, such as pigments and dyes. The textile business uses a lot of dyes, including reactive, dispersion, and vat dyes, to color both natural and synthetic fibers.

In the textile colorant market, environmental rules and concerns have led to a rise in the demand for sustainable and eco-friendly compounds. The use of natural dyes and other environmentally friendly colorants is growing as consumers become more aware of how textile production affects the environment. Technological breakthroughs in the textile colorant business have resulted in the development of novel and high-performing colorants. For example, the development of colorants with enhanced qualities, such as greater wash fastness and color retention, has been made possible by nanotechnology. Manufacturers of textiles are highlighting the significance of colorants that provide exceptional performance and longevity.

The textile colorant market has been utilizing digital printing technologies more and more because of their benefits, which include the capacity to create intricate designs, lower water use, and shorter lead times. The market for digital textile colorants has grown as a result of this. Distinct locations have distinct needs for textile colorants due to things like customer preferences, regulatory frameworks, and economic development. The need for colorants has been driven by the substantial expansion in textile production in emerging economies in Asia-Pacific, including Bangladesh, India, and China. The COVID-19 pandemic had an impact on the textile industry, particularly the colorant segment. Supply chain interruptions and lower consumer spending had an effect on market dynamics.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.38% |

| Market Size in 2025 | USD 10.46 Billion |

| Market Size by 2034 | USD 16.76 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Dye Type, By Pigment Type, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Global fashion trends

Within the textile colorant market, the fashion business was seeing a surge in the adoption of sustainable and environmentally friendly procedures. Natural and organic dyes, as well as products derived from recycled or upcycled materials, were becoming more and more popular among consumers. Earthy browns, greens, and blues, neutral hues derived from nature—were popular choices for textile and fashion colorants. The yearning for sincerity, simplicity, and a connection to nature was represented in these tones.

Technological advancements in digital printing are revolutionizing the textile colorant market. When comparing digital printing to traditional dyeing methods, more flexibility, personalization, and efficiency were available. A vibrant tapestry of colors and patterns resulted from the interpretation and incorporation of traditional textile techniques and themes from various places and civilizations into modern designs.

Consumer preferences and trends

The textile colorant market for sustainable and environmentally friendly textile colorants is expanding. Customers are becoming more aware of how the goods they buy affect the environment. Earthy tones, which include different tones of green, brown, and beige, have become more and more popular because people like colors that make them feel peaceful and connected to the natural world. These hues express a wish to be in harmony with the environment and go hand in hand with the sustainability movement. The need for individualized textiles, such as those that may be printed or dyed with unique patterns and hues, has increased as a result of this. Customers can express their individual style choices with customization possibilities.

Digital printing

The demand for customized and on-demand textile products, environmental concerns about traditional textile printing methods, and technological advancements in digital printing have all contributed to the significant growth of the textile colorant market in recent years. Manufacturers may now affordably generate bespoke patterns or small batches of goods thanks to digital printing, meeting the increasing demand for personalized textile products. Because digital printing does not require the laborious setup procedures that come with traditional printing methods, it enables faster turnaround times from design to production. Digital printing technologies have improved print quality, allowing for the replication of fine details, vivid colors, and complex designs on a variety of textiles.

The dispersed dye segment held a considerable share of the textile colorant market. The need for synthetic fibers, fashion trends, and industrial uses are some of the variables that impact the size of the dispersed dye market. Disperse dyes are used in clothing, home textiles, automotive textiles, and technical textiles, among other areas of the textile industry. They are especially well-liked for dying polyester textiles, which are frequently utilized in apparel, upholstery, and other textile goods. Disperse dyes provide various benefits, including superior color fastness against heat, light, and washing, all of which are essential for preserving the appearance and robustness of textiles that have been dyed. Additionally, they work well with synthetic fabrics, resulting in consistent dyeing outcomes.

The goal of ongoing research and development is to enhance dispersed dyes' functionality and sustainability. This covers the creation of environmentally friendly dyeing procedures, such as the application of low-temperature dyeing methods, as well as the creation of renewable or biobased raw materials for the dyeing process. The need for dispersed dyes is influenced by trends in the textile industry, such as the rising need for eco-friendly and sustainable fabrics. A growing number of manufacturers are concentrating on creating environmentally friendly dyeing solutions in order to satisfy changing consumer demands. Disperse dyes are in demand in different areas for diverse reasons, including the existence of textile manufacturing businesses, consumer preferences, and prevailing economic situations.

The inorganic pigment segment dominated the textile colorant market in 2024 and is expected to grow over the forecast period. Inorganic pigments are important because they give textile goods stability, durability, and a broad color spectrum. These pigments are renowned for their exceptional lightfastness, chemical resilience, and thermal stability. They are made up of inorganic substances, frequently metal oxides or salts. Because of their superior chemical stability, strong color strength, and great lightfastness, iron oxide pigments are widely utilized in the textile industry. They provide a flexible palette for dying textiles because they are available in different tones of red, yellow, and black. Titanium dioxide is mainly utilized as a white pigment, but it's also used in textile colorants to create pastel or lighter hues. It gives the textile substrates outstanding brightness and opacity.

Originating from complicated minerals known to contain sulfur, sodium aluminum silicate, ultramarine pigments provide vivid blue hues that exhibit remarkable stability across a range of processing settings. They are frequently utilized in textiles, particularly in the dying of denim. The exceptional colorfastness and resilience to heat, light, and chemicals of chromium oxide pigments are well-known. They are employed in textile colorants to produce green hues. Cadmium pigments are valued for their strong and stable hues, especially bright yellows, oranges, and reds, but they are less prevalent due to environmental concerns. They are occasionally employed in specific textile uses. Cobalt-based pigments are a useful option for textile dyeing, particularly for applications that call for deep blues, because they provide a spectrum of blue colors with good stability and resistance to fading.

The textile and apparel industry segment held the dominant share of the textile colorant market in 2024. The need for colorants to create a wide variety of colored textiles and clothing is growing along with the textile and apparel industries. Colorants for textiles are essential for adapting to shifting fashion trends. In order to satisfy customer preferences and maintain their competitiveness in the market, designers and manufacturers frequently require access to a wide variety of hues and tones. There is growing pressure on the textile sector to implement sustainable practices, such as using eco-friendly dyeing and colorants. As a result, eco-friendly substitutes for conventional colorants have been created, including low-impact synthetic dyes and natural dyes.

Global trade dynamics, such as adjustments to trade agreements, tariffs, and regulations, have an impact on the textile colorant business. Changes in manufacturing sites and supply chain configurations can also impact the demand for textile colorants in various areas. The textile and garment business is continuously driven by innovation due to advancements in colorant technology, which include the creation of novel dye formulas and application techniques. This covers the application of colorants based on nanotechnology and digital printing technologies. There are many competitors in the textile colorant business, ranging from large chemical corporations to tiny producers of specialty dyes. Businesses compete on the basis of things like price, technical support, environmental sustainability, and product quality.

By Dye Type

By Pigment Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

September 2024

March 2025