February 2024

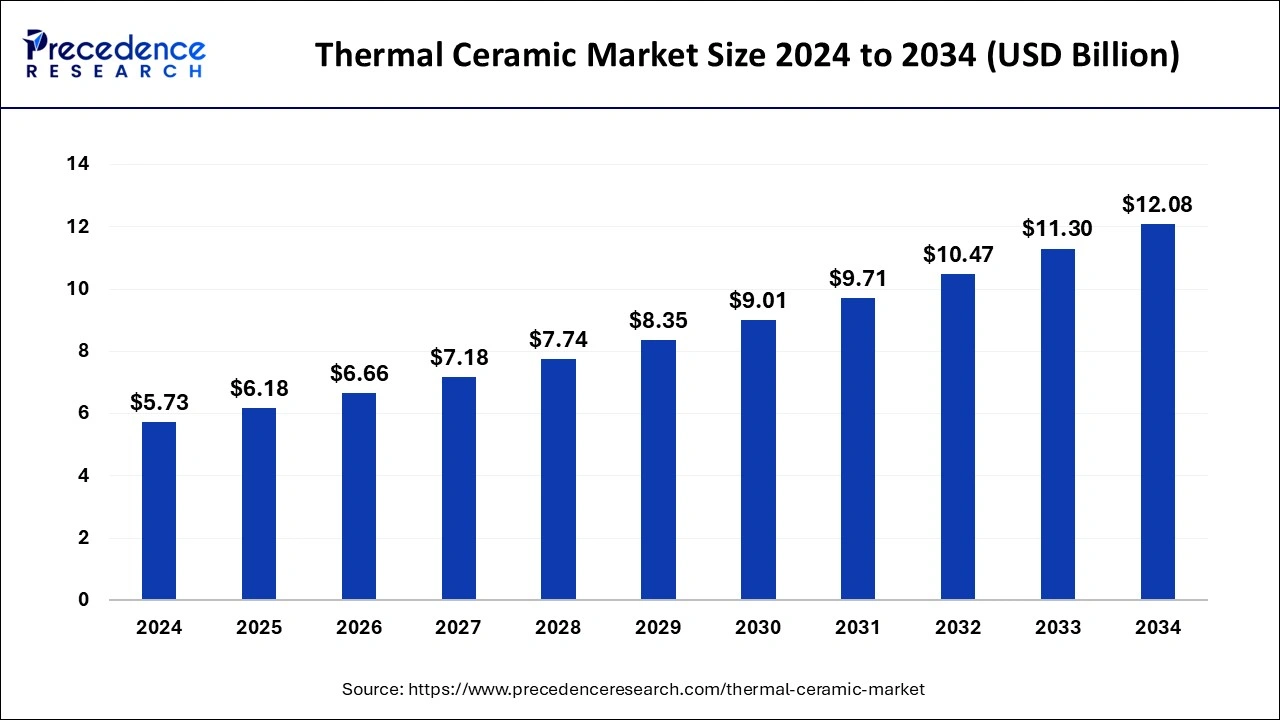

The global thermal ceramic market size is evaluated at USD 6.18 billion in 2025 and is forecasted to hit around USD 12.08 billion by 2034, growing at a CAGR of 7.74% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global thermal ceramic market size accounted for USD 5.73 billion in 2024 and is predicted to increase from USD 6.18 billion in 2025 to approximately USD 12.08 billion by 2034, expanding at a CAGR of 7.74% from 2025 to 2034. Thermal ceramics have outstanding insulating qualities, making them indispensable in fields such as manufacturing, aerospace, automotive, and energy, where temperature control is essential.

The thermal ceramic market is steadily expanding due to a number of causes, including rising demand from the manufacturing, automotive, and aerospace sectors. Thermal ceramics are appreciated for their capacity to tolerate high temperatures and offer insulation, making them crucial in a range of applications. Examples of these materials include ceramic fibers, insulating bricks, and coatings.

The thermal ceramic market is being driven by the growing industrial sector, especially in emerging economies. These materials are vital to the steel, aluminum, and glass industries because they regulate temperature and provide insulation. The need for thermal ceramics is increasing as a result of enterprises investing in thermal insulation solutions in response to stricter laws pertaining to environmental sustainability and energy efficiency.

The development of advanced thermal ceramics with better performance characteristics is the result of ongoing research and development activities, which is further driving the thermal ceramic market expansion. Automotive exhaust systems, engine parts, and catalytic converters all use thermal ceramics to improve efficiency and lower emissions. Applications for these materials can be found in aerospace parts, including heat shields and engine and spacecraft insulation.

Thermal ceramics are used in manufacturing operations to produce glass and ceramics, as well as for furnace insulation and kiln lining. Power plants and renewable energy systems are two examples of situations where thermal ceramics are essential to energy generation. Growth in the thermal ceramic market may be hampered by the high cost of thermal ceramics, especially for small and medium-sized businesses.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.74% |

| Market Size in 2025 | USD 6.18 Billion |

| Market Size in 2024 | USD 5.73 Billion |

| Market Size by 2034 | USD 12.08 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Innovations in material science

Thermal ceramics have been changed by the use of nanoparticles in ceramic matrices. While keeping their low density, nanoparticles, including carbon nanotubes, alumina, and silica, have been employed to improve mechanical strength and thermal conductivity. As a result, extremely effective and lightweight insulating materials have been developed. These composites, which are perfect for high-temperature applications in sectors like aerospace and automotive, show remarkable heat resistance due to the incorporation of fibers like carbon or silicon carbide into ceramic matrices.

FGMs are materials that have been created to have varying compositions, microstructures, or characteristics. FGMs in thermal ceramics can be engineered to exhibit a progressive shift in thermal conductivity, improving their ability to withstand thermal shocks and lowering thermal stresses in situations with elevated temperatures.

Supply chain disruptions

Alumina, zirconia, silica, and other refractory materials are among the raw materials used by the thermal ceramics industry. The thermal ceramic market goods may be immediately impacted by any shortfall or interruption in the supply of these raw materials. Transportation disruptions can impede the timely delivery of raw materials to manufacturing facilities and completed products to clients.

These disruptions might include delays, congestion, or stoppage in logistics networks. Transportation routes can be disrupted by things like labor strikes, port congestion, or natural calamities. Defects in finished goods or raw materials can cause quality control problems at any point in the production process, which can lead to replacement or rework expenses in addition to delays.

Industrial furnaces and kilns

The thermal ceramic market is heavily dependent on industrial furnaces and kilns. These are specialist tools that are used to heat, calcine, sinter, and melt a variety of materials, including ceramics, at high temperatures. For the thermal ceramics industry to produce advanced ceramics, bricks, tiles, refractories, and other ceramic goods utilized in the building, aerospace, automotive, electronics, and healthcare sectors, furnaces and kilns are necessary. To maintain temperature stability and uniformity throughout the heating cycle, industrial furnaces and kilns are outfitted with sophisticated temperature control systems, including thermocouples, pyrometers, and programmable logic controllers (PLCs).

The industrial segment dominated the thermal ceramic market in 2024. Because of their high-temperature resistance, insulating qualities, and thermal stability, thermal ceramics are used in a broad range of applications and sectors within the thermal ceramic market. Thermal ceramics are used as linings for furnaces, ladles, and crucibles to endure high temperatures and thermal shock in a variety of metallurgical processes, such as foundries, smelting operations, and metal casting. Thermal ceramics are used by chemical processing industries as insulation in reactors, kilns, and furnaces where high temperatures are necessary for material processing and chemical reactions. Thermal ceramics are used in cement kilns and other high-temperature machinery in the cement industry to endure the intense heat produced during the clinker production process.

The petrochemical & chemical segment is expected to witness the fastest growth in the thermal ceramic market. In the thermal ceramic industry, the petrochemical and chemical sector is quite important. In the chemical and petrochemical sectors, thermal ceramics—which include insulating materials, refractories, and other related goods—are essential for preserving the functionality and integrity of machinery and processes. Extremely high temperatures are frequently involved in chemical and petrochemical operations.

Refractories and other thermal ceramics are used to line reactors, furnaces, and other equipment so that they can survive these high temperatures without degrading and maintain operational safety. Since the materials used in chemical processes are often highly corrosive, they can be extremely harmful. By resisting corrosion from acids, alkalis, and other corrosive substances, thermal ceramics extend the life of equipment and lower maintenance costs.

Asia Pacific held the largest share of the thermal ceramic market in 2024 and is expected to grow further during the forecast period. Rapid industrialization is occurring throughout the region, especially in Southeast Asian, Chinese, and Indian nations. Thermal ceramics are used in a variety of industries, including electronics, steel, cement, and chemicals, as well as temperature control, lining, and insulation. Asia Pacific's construction sector is expanding due to population expansion, urbanization, and infrastructure development initiatives. Thermal ceramics are widely used in construction as insulation, particularly in industrial, pipeline, and building structures.

The automotive industry is a major consumer of thermal ceramics in nations including South Korea, China, Japan, and India. These materials contribute to the expansion of the automotive sector in the area by being utilized in automobiles for heat shielding, exhaust system insulation, and catalytic converters.

Europe is expected to experience the fastest growth in the global thermal ceramic market during the forecast period. Over the previous few years, Europe's thermal ceramic market has grown steadily. Materials known as thermal ceramics are made to resist high temperatures and still have certain qualities, such as insulation. They are used in many different industries, including energy, automotive, aerospace, and metallurgy. There are multiple drivers propelling the European thermal ceramic market's growth.

The growing need for energy-efficient solutions across industries is one of the main motivators. Thermal ceramics provide excellent thermal insulation qualities, which save energy costs and increase the efficiency of industrial processes. Furthermore, stricter laws pertaining to emissions and energy efficiency are encouraging the use of thermal ceramics throughout Europe.

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2024

November 2024

January 2025

August 2024