January 2025

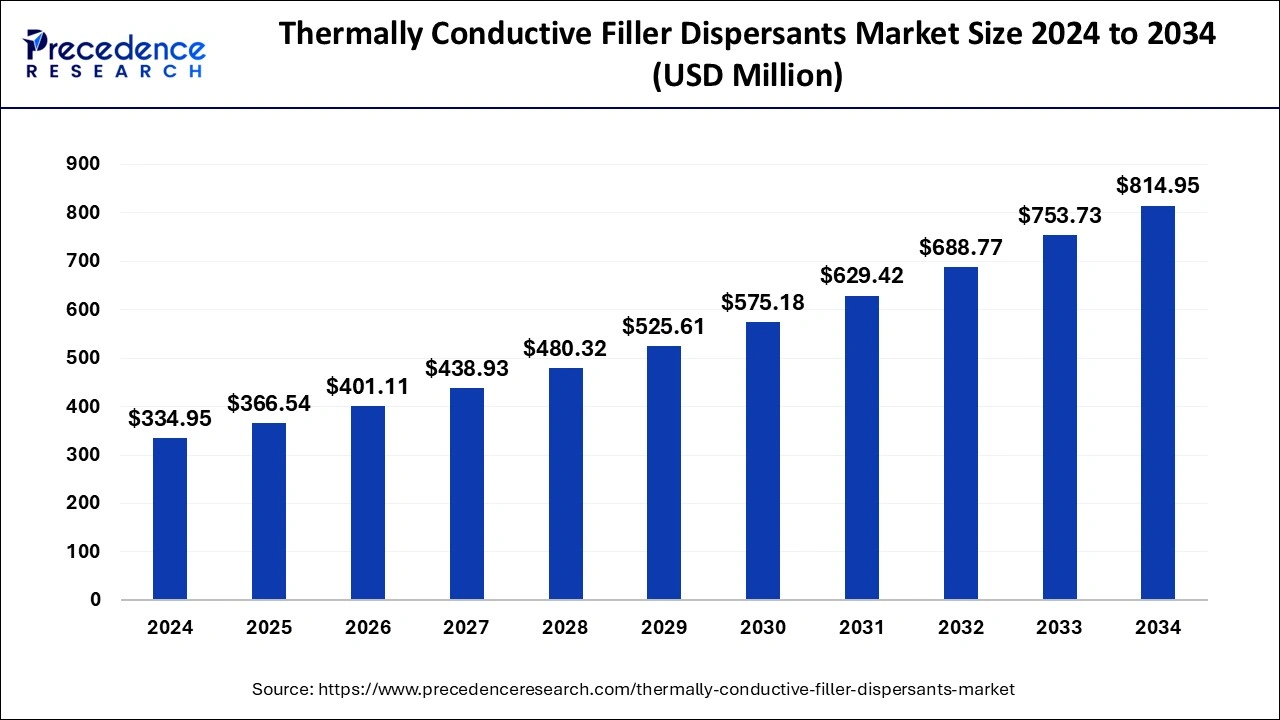

The global thermally conductive filler dispersants market size is calculated at USD 366.54 million in 2025 and is forecasted to reach around USD 814.95 million by 2034, accelerating at a CAGR of 9.30% from 2025 to 2034. The Asia Pacific thermally conductive filler dispersants market size surpassed USD 135.62 million in 2025 and is expanding at a CAGR of 9.48% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global thermally conductive filler dispersants market size was estimated at USD 334.95 million in 2024 and is predicted to increase from USD 366.54 million in 2025 to approximately USD 814.95 million by 2034, expanding at a CAGR of 9.30% from 2025 to 2034. The thermally conductive filler dispersants market is being driven by the increasing requirement for efficient thermal management solutions due to the increased demand for electronics such as laptops, tablets, and smartphones.

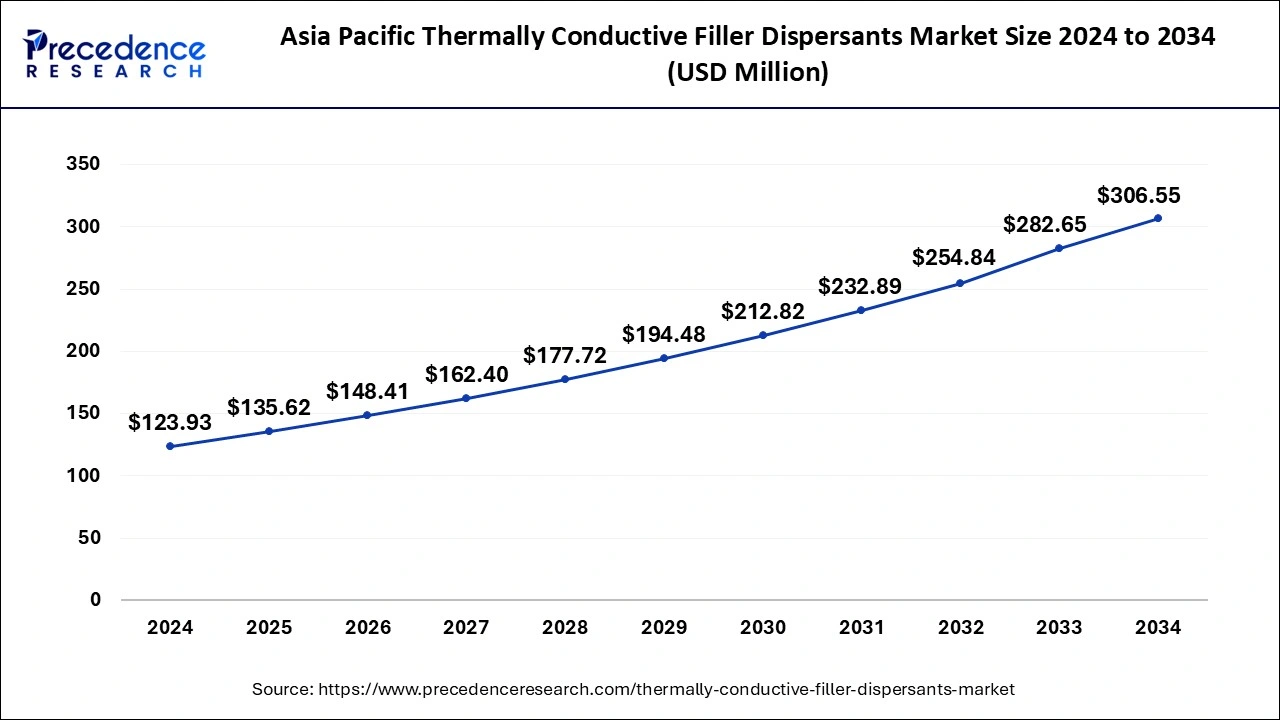

The Asia Pacific thermally conductive filler dispersants market size reached USD 123.93 million in 2024 and is expected to attain around USD 306.55 million by 2034, poised to grow at a CAGR of 9.48% between 2025 and 2034.

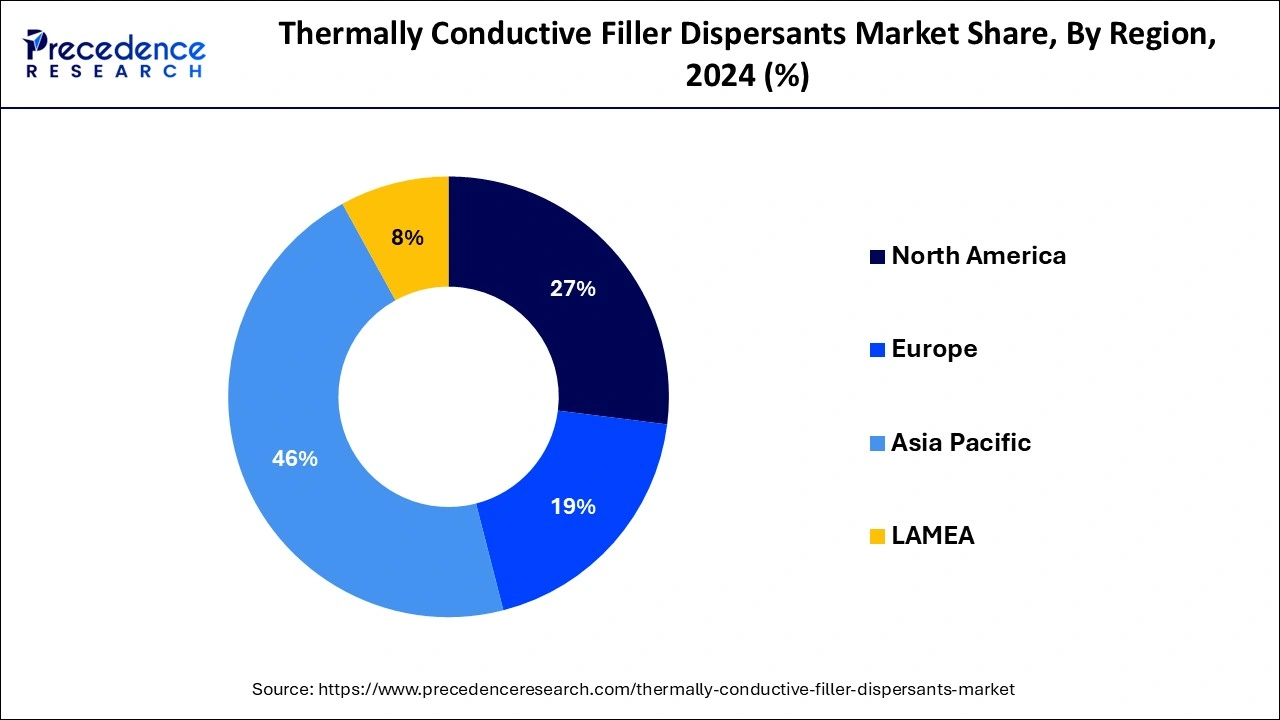

Asia Pacific holds the largest share in the thermally conductive filler dispersants market. Manufacturing of semiconductors, consumer electronics, and automotive electronics is concentrated in this area. In these industries, thermally conductive filler dispersants are essential for boosting heat dissipation as well as the functionality and dependability of electronic components. Taiwan, South Korea, Japan, and China are just a few of the nations with established manufacturing capacities in the electronics and automobile industries. In order to meet the strict thermal management requirements of contemporary electronic devices, this infrastructure supports the demand for thermally conductive materials, including filler dispersants. Asia Pacific's market for thermally conductive filler dispersants is expected to rise in the future due to developments in technology, industry expansion, and growing consumer awareness of the significance of thermal management in electronic products.

North America is anticipated to grow at the fastest rate in the thermally conductive filler dispersants market over the studied period. There are a number of supply and demand-related factors that affect the thermally conductive filler dispersant market in North America. The utilization of thermally conductive filler dispersants is imperative in augmenting the thermal conductivity of diverse materials. This is especially consequential in sectors like electronics, automotive, aerospace, and construction. Energy efficiency and sustainability are becoming more and more important in the construction business. Better insulation and energy conservation in buildings are made possible by materials with increased thermal conductivity. The thermally conductive filler dispersants market is anticipated to expand gradually in North America due to growing applications in a variety of sectors and technological advances.

Materials known as thermally conductive filler dispersants are used to increase the thermal conductivity of composites and polymers. They are essential in sectors including electronics, automotive, aerospace, and energy that demand effective heat dissipation. The requirement for materials with effective heat dissipation is expanding due to the complexity and shrinking of electronic systems.

The demand for thermally conductive filler dispersants market can withstand increased thermal loads is being driven by the development of internal combustion engines and electric vehicles (EVs), which is pushing the market for thermally conductive filler dispersants. Improved thermal management also benefits renewable energy technologies like wind turbines and solar panels, increasing demand. Because of their large surface area and exceptional thermal characteristics, nanomaterials are being used more and more as thermally conductive fillers.

Businesses in the thermally conductive filler dispersants market are concentrating on creating dispersants that are suited to particular polymer matrices and application needs. A common approach among market leaders is to concentrate on innovation, form alliances with end users, and expand geographically. The market for thermally conductive filler dispersants is anticipated to rise gradually due to advances in technology, rising electronics demand, new developments in automobiles, and sustainable energy sources. Future developments in materials science and nanotechnology will probably be very important in determining the direction the market takes. Improved thermal management also benefits renewable energy technologies like wind turbines and solar panels, increasing demand.

| Report Coverage | Details |

| Market Size by 2034 | USD 814.95 Million |

| Market Size in 2025 | USD 366.54 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.30% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising importance of heat dissipation

The concentration of heat in small areas rises with the size and power of electronic gadgets. Reliability and the avoidance of overheating depend on efficient heat dissipation. Energy savings are facilitated by efficient heat dispersion since it lessens the requirement for active cooling systems, which use more energy. This is especially crucial for applications like renewable energy systems and electric vehicles, where energy efficiency is a top concern.

The demand for thermally efficient materials that enable compliance with environmental requirements is driven by increasingly rigorous laws governing energy usage and electronic waste management. Thermally conductive materials that can effectively dissipate heat in compact designs are becoming more and more popular as a result of emerging technologies like wearable electronics, 5G telecommunications, and Internet of Things devices.

Performance limitations

High filler loading is frequently necessary to achieve high thermal conductivity. However, this can also result in problems like the substance being more viscous, which might impact processing and application compatibility. To achieve the necessary thermal conductivity, the thermally conductive fillers must be evenly distributed throughout the matrix material. Inadequate dispersion can cause thermal contact resistance, which lowers efficiency all around.

For long-term stable performance, it is imperative that the filler material and matrix be compatible. Reliability problems like delamination or cracking can result from the filler and matrix having different coefficients of thermal expansion (CTE). The market acceptance of some thermally conductive fillers may be impacted by the presence of hazardous elements or by the environmental issues they may cause when disposed of or recycled.

Miniaturization trends

A growing need for materials that can effectively disperse heat in smaller electronic devices is reflected in the industry trends toward miniaturization in thermally conductive filler dispersants. Controlling heat generation becomes essential to guaranteeing peak performance and lifespan as electronic components get smaller and more potent.

In order to improve the thermal conductivity of polymers and other materials used in electronics and allow for efficient heat transfer and dissipation, thermally conductive filler dispersants are essential. The demand for thermally conductive materials that can effectively disperse heat in small spaces is rising due to the widespread use of smartphones, tablets, wearable technology, and Internet of Things devices. Materials that can sustain thermal management without increasing bulk are in high demand due to miniaturization.

The metal-based fillers segment held the largest share of the thermally conductive filler dispersants market in 2024. Because of their superior thermal conductivity, metal-based materials are important players in the thermally conductive filler dispersant market. These substances are employed as fillers in a variety of products, including industrial equipment, automobile parts, and electronics, where heat dissipation is essential.

To create a composite material that is thermally conductive, these ingredients are usually mixed together inside a polymer matrix. In order to provide the best possible mechanical and thermal qualities, the dispersants utilized in these formulations aid in ensuring uniform dispersion of the fillers. The market for thermally conductive filler dispersants is dominated by metal-based compounds, including copper, silver, and aluminum, which help with better thermal management in a variety of industrial applications.

The ceramic-based fillers segment is expected to grow at the fastest rate in the thermally conductive filler dispersants market. These substances are prized for their superior heat conductivity, which makes them perfect fillers to improve the thermal control characteristics of different resins and polymers. Ceramic-based fillers are chosen in applications where heat dissipation is crucial, like electronics, automotive components, and LED lighting, because of their effective heat-dissipating properties. The efficiency and dependability of contemporary electrical and automotive systems are greatly enhanced by ceramic-based fillers, which are essential to the advancement of thermal management solutions across a broad spectrum of industries.

The screen printing segment dominated the global thermally conductive filler dispersants market in 2024. In fact, screen printing has a number of uses in the thermally conductive filler dispersants (TCFD) industry that are associated with production procedures and uses. Thermally conductive materials, such as TCFDs, can be deposited via screen printing onto substrates like circuit boards or heat sinks. It guarantees consistency and homogeneity by enabling exact control over the quantity and placement of the material applied.

In the process of developing thermal solutions, screen printing allows for rapid prototyping and customization. By modifying the screen-printing process parameters, engineers can quickly iterate designs in order to achieve the desired thickness of the applied materials and thermal conductivity.

The dispensing segment is expected to grow at the fastest rate in the thermally conductive filler dispersants market during the forecast period, "dispensing" usually means the act of delivering or dispersing thermally conductive filler components inside a medium, like an adhesive or polymer. In this industry, materials' thermal conductivity is greatly increased by thermally conductive filler dispersants. This is vital for a variety of industries, including electronics, automotive, aerospace, and others where heat dissipation is necessary. Applying or incorporating thermally conductive filler dispersants into different substrates by the use of automated devices, syringes, or dispensing machines is known as dispensing. This guarantees that the filler material is distributed and placed precisely.

The electronics & electrical segment held the largest share of the thermally conductive filler dispersants market in 2024. The fields of electrical and electronic engineering are vital to the thermally conductive filler dispersion industry. These dispersants are additives used in electrical and electronic devices that are intended to increase the thermal conductivity of materials like adhesives, sealants, and encapsulants. When operating, electronic gadgets produce heat, which, if not properly handled, can shorten their lifespan and performance. Materials such as potting compounds and thermal interface materials (TIMs) can increase their thermal conductivity by adding thermally conductive filler dispersants. Dispersants are commonly used in resin systems such as silicones, epoxies, polymers, and others to improve thermal conductivity without compromising other desired characteristics like chemical resistance, mechanical strength, or electrical insulation. Their adaptability renders them appropriate for an extensive array of technological uses.

The industrial machinery segment is expected to grow at the fastest rate in the thermally conductive filler dispersants market during the projected period. Dispersers, homogenizers, and mixers are examples of industrial equipment needed to evenly distribute heat-conductive fillers into different matrices (such as polymers or resins). To achieve uniform thermal conductivity in the finished product, these machines make sure that fillers are distributed properly.

Additionally essential is industrial equipment for measuring heat conductivity. This can comprise instruments for determining the heat transfer coefficient, thermal conductivity, and other pertinent factors. Automation and robots are crucial to the handling and processing of materials in modern industry. Thermally conductive fillers can be precisely and efficiently mixed, dispensed, and handled by automated systems, increasing production rates and product uniformity.

By Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

July 2024

October 2024