January 2025

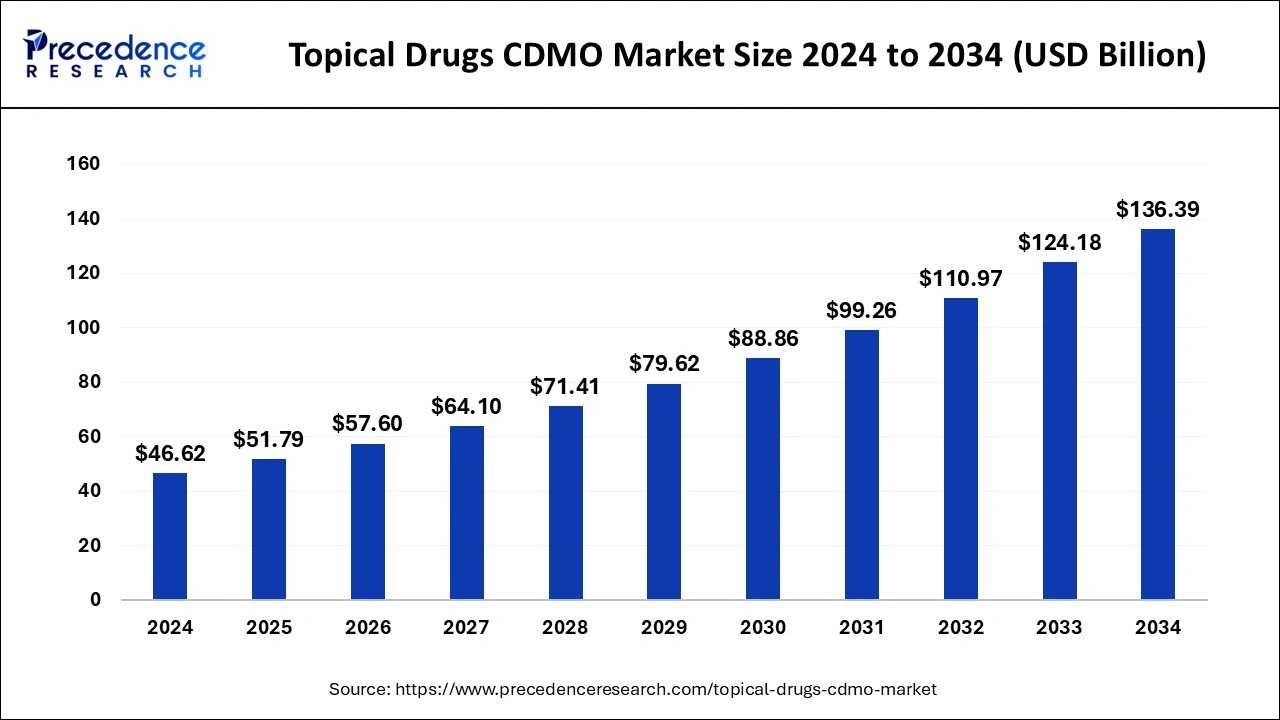

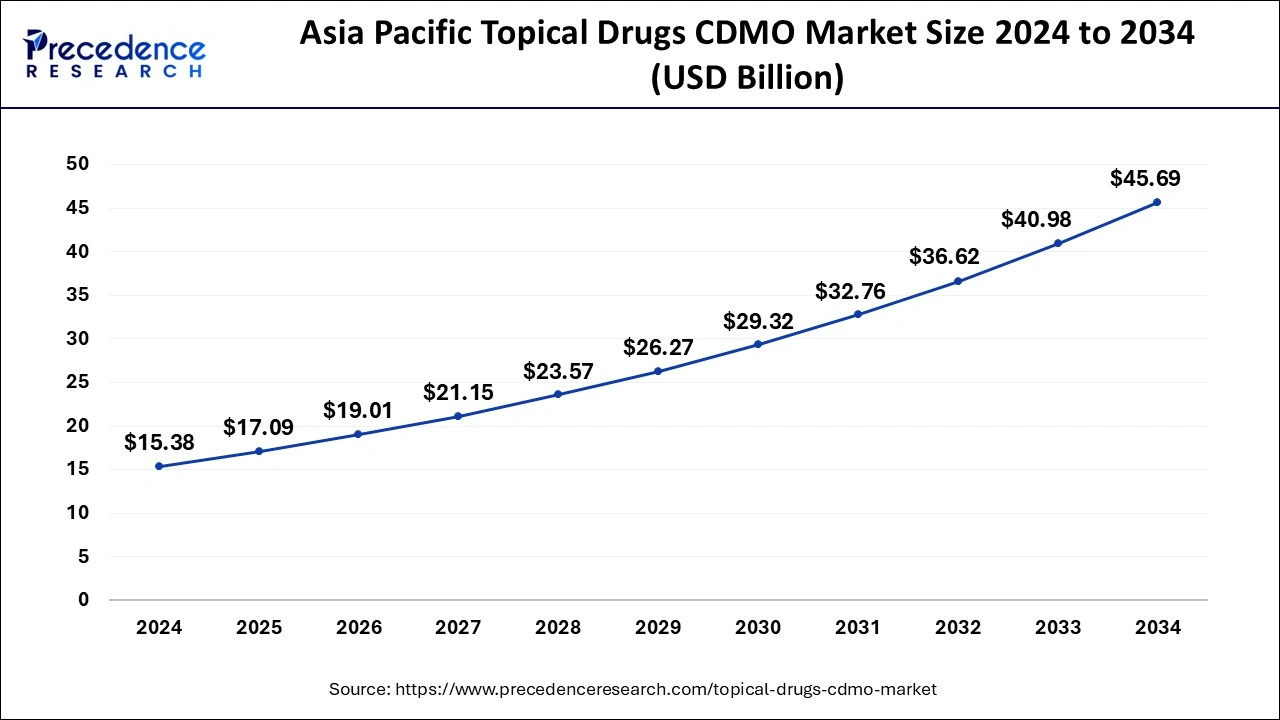

The global topical drugs CDMO market size is calculated at USD 51.79 billion in 2025 and is forecasted to reach around USD 136.39 billion by 2034, accelerating at a CAGR of 11.33% from 2025 to 2034. The Asia Pacific topical drugs CDMO market size surpassed USD 17.09 billion in 2025 and is expanding at a CAGR of 11.50% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global topical drugs CDMO market size was estimated at USD 46.62 billion in 2024 and is predicted to increase from USD 51.79 billion in 2025 to approximately USD 136.39 billion by 2034, expanding at a CAGR of 11.33% from 2025 to 2034.

The Asia Pacific topical drugs CDMO market size was estimated at USD 15.38 billion in 2024 and is anticipated to reach around USD 45.69 billion by 2034, growing at a CAGR of 11.50% from 2025 to 2034.

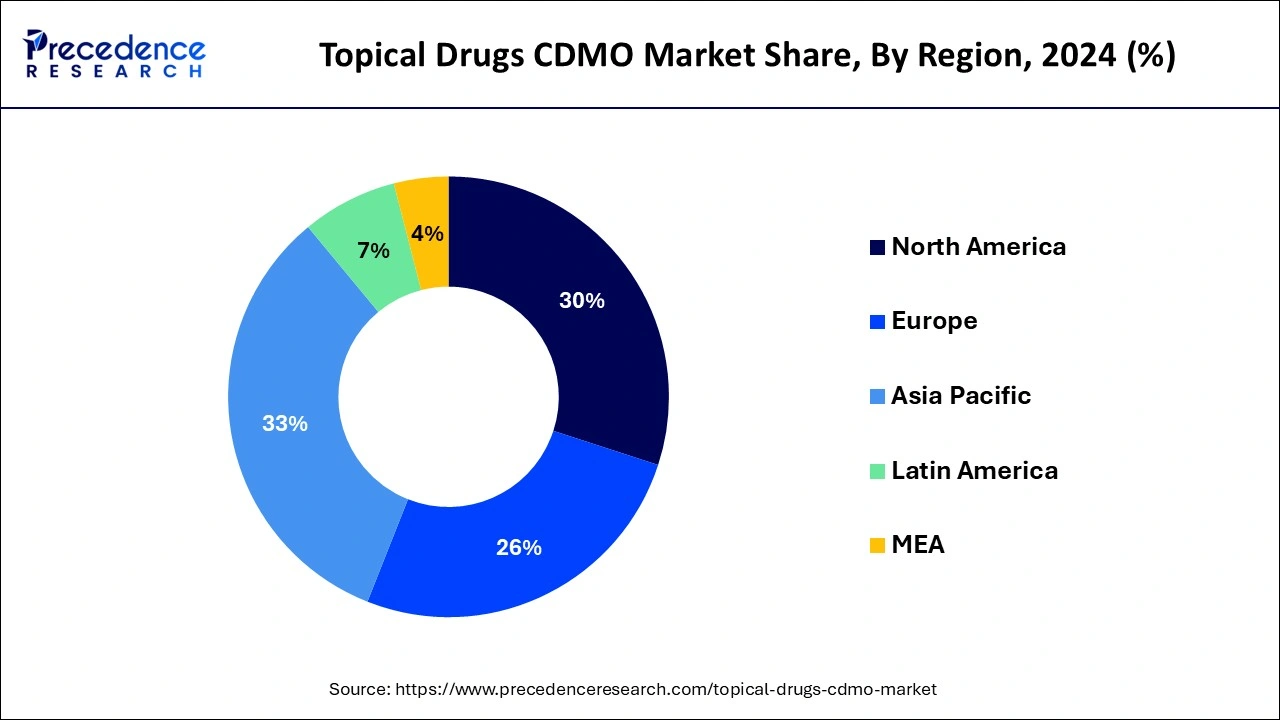

Asia-Pacific emerged as the dominating region while carrying 33% of the market share in 2024. The region's dominance is primarily attributed to cost efficiency, with countries like China and India providing cost-effective manufacturing solutions. The lower operational and labor costs in these countries make them attractive destinations for pharmaceutical companies seeking to outsource topical drug production to Contract Development and Manufacturing Organizations (CDMOs), resulting in substantial cost savings. Additionally, Asia Pacific hosts a rapidly expanding pharmaceutical drugs industry, marked by increasing demand for innovative medications and growing healthcare needs. This expansion has prompted pharmaceutical companies to seek reliable regional CDMO partners, further contributing to the region's lucrative growth.

Latin America is projected to experience a steady CAGR of 12.1% throughout the forecast period. Economic development in Latin America has led to increased disposable income, enabling more individuals to afford specialized cosmetic dermatological products and topical medications. Brazil, in particular, stands out for its robust beauty and cosmetic industry, witnessing significant demand for topical products for both cosmetic and therapeutic purposes. This rising demand is expected to contribute to the overall growth of the region.

The topical drugs CDMO market offers services tailored specifically for the development and manufacturing of topical pharmaceutical drugs. These CDMOs, which stand for Contract Development and Manufacturing Organizations, are specialized entities that cater to the needs of the pharmaceutical and biotechnology industries. They provide a range of services encompassing drug development, manufacturing processes, and, in certain cases, assistance with the commercialization of drugs. The surge in the aesthetic and cosmetic industry has generated a significant demand for topical drugs, thereby driving the need for contract development and manufacturing services. Products like skin-lightening agents, topical anti-aging creams, and scar reduction treatments are gaining popularity in the topical drugs CDMO market.

Additionally, topical drugs are now being developed for a broader range of indications, including pain management, systemic conditions, and wound healing, further contributing to their widespread adoption. The pharmaceutical sector has witnessed substantial innovations in the formulation of topical medications, resulting in better-tolerated and more effective treatments. These advancements have expanded the scope of conditions that topical drugs can address, leading to an increased requirement for outsourced development and manufacturing services.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 11.33% |

| Market Size in 2025 | USD 51.79 Billion |

| Market Size by 2034 | USD 136.39 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, By Service, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for data storage and processing

The treatment of targeted diseases is a significant driver for the topical drugs CDMO market. This trend involves the development of specialized formulations, precision medicine approaches, advanced drug delivery systems, and collaboration with pharmaceutical companies to address the unique requirements of patients with localized health conditions. CDMOs play a crucial role in ensuring regulatory compliance and have the capacity and flexibility to efficiently scale up production to meet the demands of the market for topical drugs targeting specific diseases.

The growth of the topical drugs market is primarily driven by increasing incidences of skin infections, such as eczema, psoriasis, and acne, along with other factors such as burn injuries, diabetes, and eye diseases. Topical antimicrobial agents play a crucial role in treating burn injuries, making them a major application area for topical drugs.

Various antimicrobial agents, including silver sulfadiazine cream, are utilized to treat wound infections in burn patients. The market is also influenced by the extensive use of topical drugs to address diabetic neuropathic pain and foot ulcers eventually leading to the growth of topical drugs CDMO market.

Regulatory scenarios and pricing pressure

In the topical drugs CDMO market, topical drugs are subject to strict regulatory oversight to ensure patient safety and product efficacy. Compliance with evolving regulatory standards and requirements can be complex and resource-intensive. Meeting the stringent demands of regulatory authorities and navigating through the approval processes for new topical drug formulations can lead to delays and increased costs hindering the growth of the market.

Additionally, manufactures in the market faces significant pricing pressures. Healthcare providers, insurers, and governments seek cost-effective solutions, putting pressure on pharmaceutical companies to reduce prices. This, in turn, affects the profit margins of CDMOs providing contract services for topical drug development and manufacturing. Intense competition and the push for affordable healthcare solutions contribute to pricing challenges restraining the future growth.

Advancements in the pharmaceutical industry

As pharmaceutical companies strive to capitalize on these innovations and bring diverse and improved topical treatments to the market, they increasingly rely on specialized Contract Development and Manufacturing Organizations (CDMOs) to provide expertise, infrastructure, and efficient solutions throughout the drug development and manufacturing processes. This trend underscores the critical role of CDMOs in supporting the pharmaceutical industry's quest for innovative and effective topical medications creating growth opportunities for the topical drugs CDMO market in the upcoming years.

The pharmaceutical industry's substantial innovations in the formulation of topical medications have spurred significant advancements in the efficacy and tolerability of topical treatments. These innovations have broadened the spectrum of conditions that can be effectively addressed through topical therapies. The increased complexity and sophistication of topical formulations have, in turn, fueled a growing demand for outsourced development and manufacturing services.

The semi-solid formulations segment dominated the topical drugs CDMO market with 67% of market share in 2024, encompassing creams, ointments, and gels. This dominance is attributed to the increasing approval of semi-solid topical drugs in recent years. The subsequent rise in approvals from regulatory bodies like the U.S. Food and Drug Administration (FDA) for semi-solid formulations has substantially increased the demand for outsourced services from topical drugs CDMOs.

The liquid formulations segment is projected to experience a substantial CAGR of 11.7% during the forecast period. Liquid formulations, including suspensions and solutions, are gaining prominence in the pharmaceutical pipeline due to their non-invasive and convenient drug delivery through the skin. These formulations are well-suited for various therapeutic indications. Increased research and development investments, innovative drug delivery technologies, and a growing interest in personalized medicine contribute to a rising pipeline of liquid formulation topical drugs. Consequently, pharmaceutical companies are seeking the services of topical drugs contract development and manufacturing organizations (CDMOs) to manage development costs, leading to significant growth in this segment.

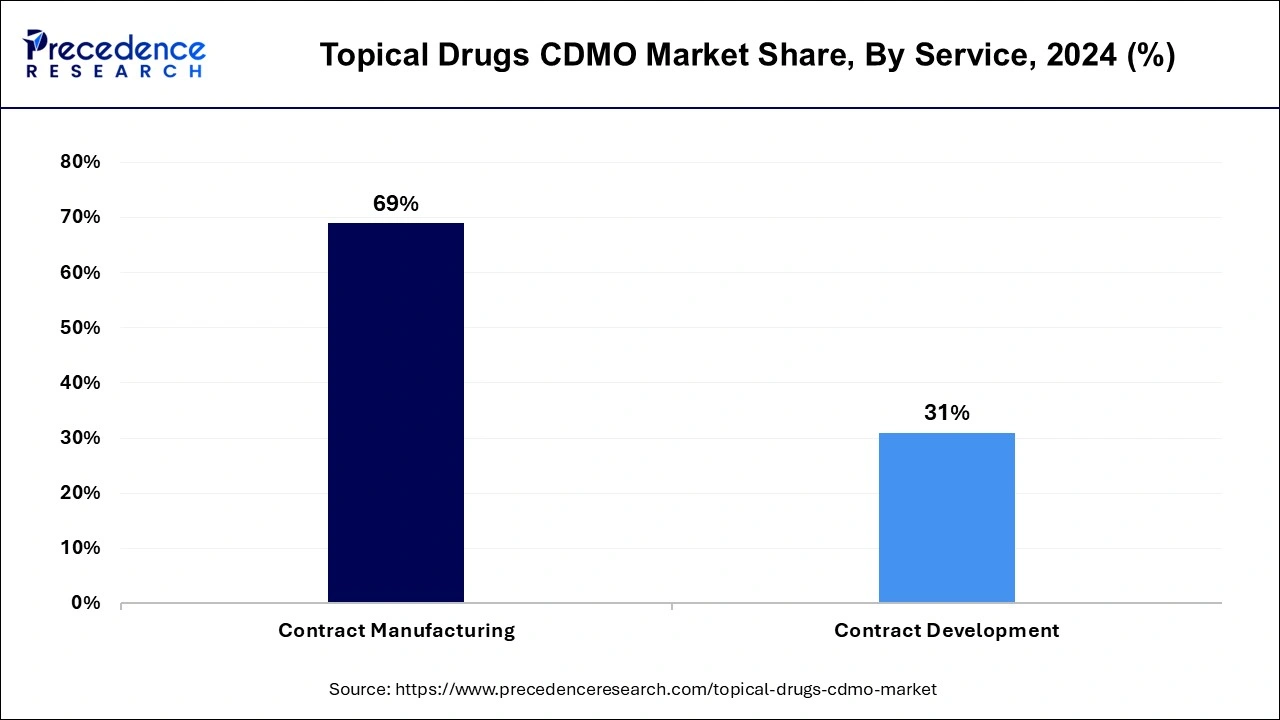

The contract manufacturing segment dominated the topical drugs CDMO market, securing the largest market share of 69% in 2024. This substantial share is primarily attributed to the growing influx of CDMOs into the industry of topical drugs CDMO. Contract manufacturing organizations bring specialized expertise and knowledge in the production and formulation of topical drugs, ensuring compliance with regulations and maintaining high-quality manufacturing processes. Outsourcing manufacturing to CMOs proves to be cost-effective for pharmaceutical companies, as CMOs can achieve economies of scale, reducing production costs. These factors are anticipated to continue supporting the significant market share of the contract manufacturing segment.

The contract development segment is expected to witness a substantial CAGR of 12.4% in the topical drugs CDMO market over the forecast period. The high growth in this segment is driven by the increasing demand for innovative expertise and technology in the development of topical drugs. Contract development organizations possess specialized knowledge in this regard, making them a preferred choice for drug development. Additionally, the rising investment in research and development for topical drugs is a substantial factor contributing to the robust growth of the contract development segment.

The pharmaceutical companies segment held the largest share of 41% in 2024. This is attributed to the increasing investments made by pharmaceutical companies in the development of innovative topical drugs. Furthermore, the rising rate of regulatory approvals for various topical products by pharmaceutical companies has contributed to an increased demand for outsourced services.

The biopharmaceutical companies' segment is expected to witness the fastest CAGR of 11.7% in the topical drugs CDMO market during the forecast period. This growth is driven by the growing number of biopharmaceutical companies investing in the development and production of topical drugs for diverse medical conditions. Factors such as the potential for reduced systemic side effects, targeted drug delivery, and the rising demand for non-invasive treatment options contribute to the attractiveness of these investments. The continued focus on topical formulations underscores their significance in the pharmaceutical industry, reflecting the increasing demand for effective and patient-friendly topical treatment options.

By Product Type

By Service

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

March 2025

March 2025