January 2025

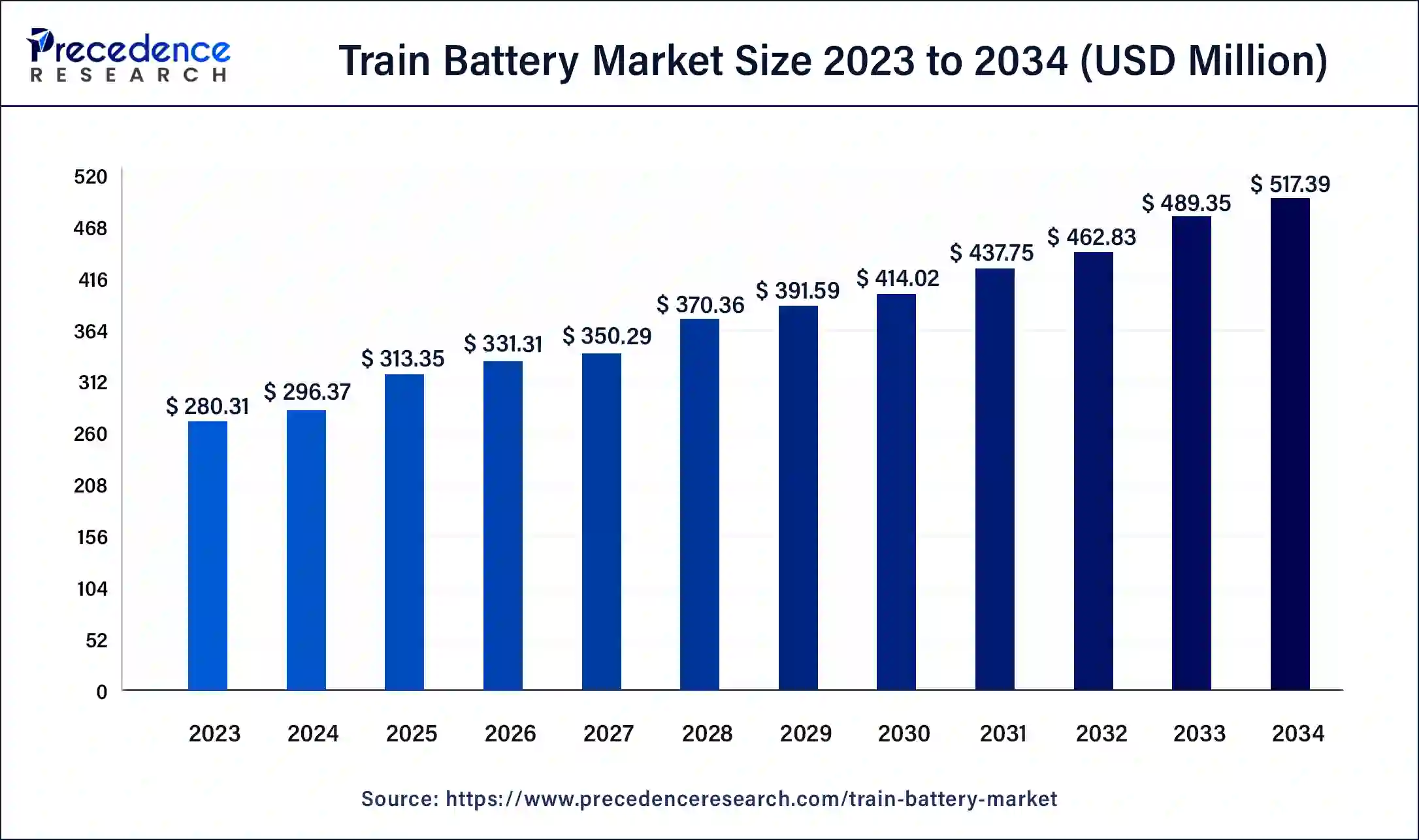

The global train battery market size was USD 280.31 million in 2023, calculated at USD 296.37 million in 2024 and is expected to be worth around USD 517.39 million by 2034. The market is slated to expand at 5.73% CAGR from 2024 to 2034.

The global train battery market size is worth around USD 296.37 million in 2024 and is anticipated to reach around USD 517.39 million by 2034, growing at a CAGR of 5.73% over the forecast period 2024 to 2034. The North America train battery market size reached USD 112.12 million in 2023. The rising adoption of electrification in the railway industry is the key factor driving the train battery market growth.

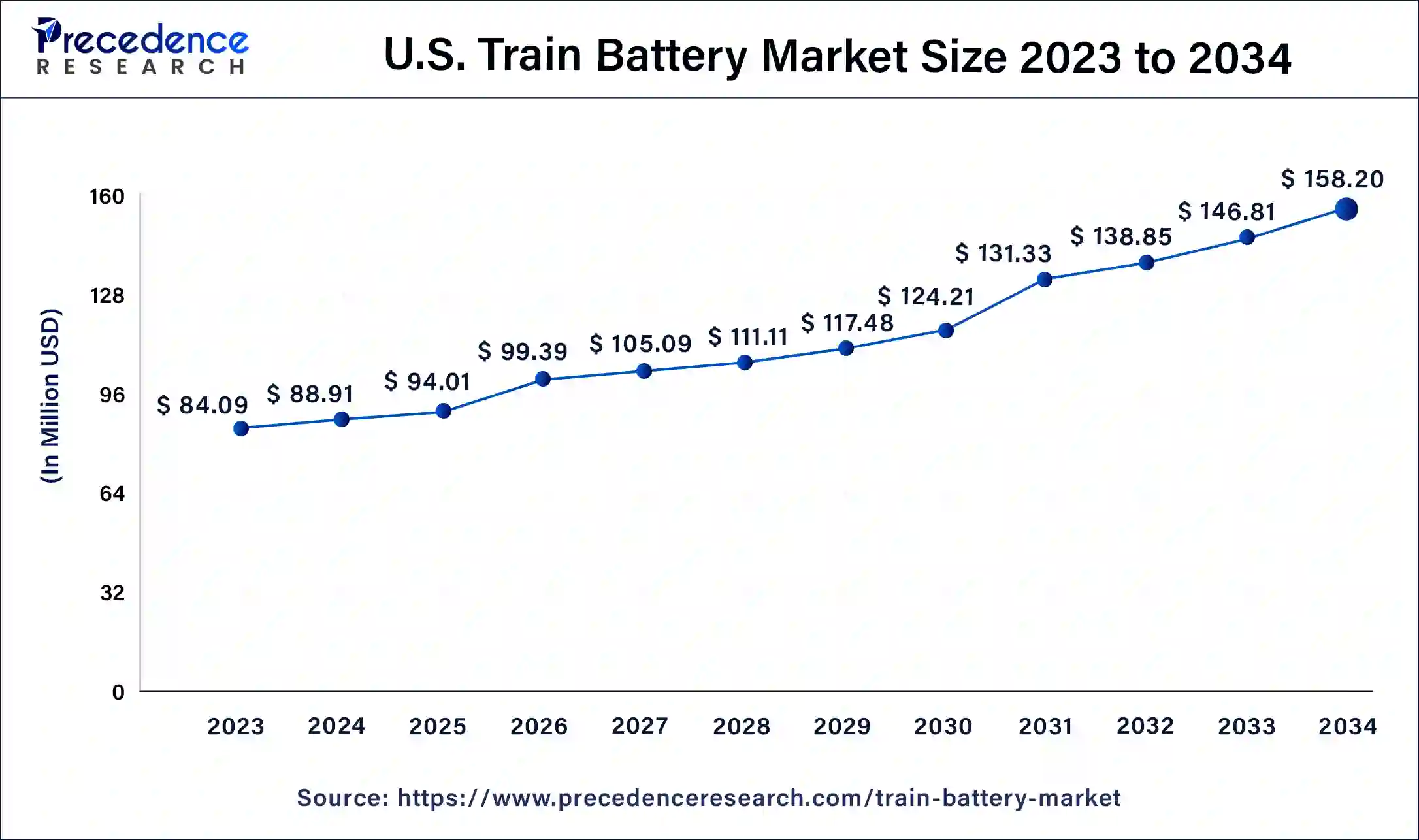

The U.S. train battery market size was exhibited at USD 84.09 million in 2023 and is expected to be worth around USD 158.20 million by 2034, poised to grow at a CAGR of 5.91% from 2024 to 2034.

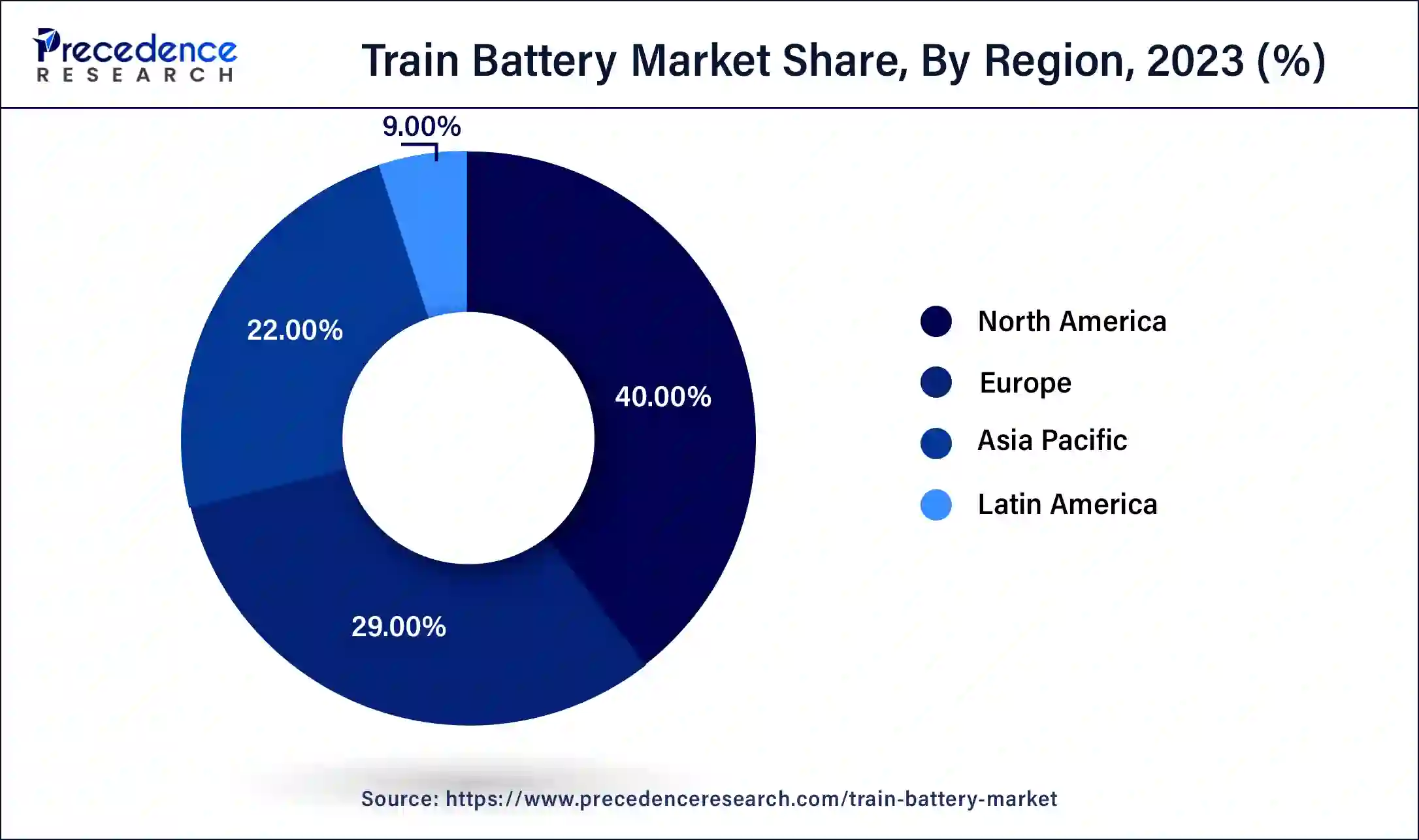

North America contributed the biggest market share of 40% in 2023. The dominance of the region can be attributed to the growing adoption of electric and hybrid trains, along with the increasing demand for reliable energy storage systems. Furthermore, lithium-ion batteries are especially preferred due to their high energy density and enhanced safety compared to other technologies. These batteries are utilized to power numerous electrical components in trains, such as lights, HVAC units, and communication systems.

Asia Pacific is anticipated to showcase notable growth in the train battery market during the forecasted years. The growth of the segment is driven by wide railway networks in nations like India, Japan, China, and South Korea. Moreover, the region is experiencing rapid urbanization along with substantial investments by market players in high-speed train systems.

Top 10 largest railway network in the world

| Rank | County | Network length in Km |

| 1 | United States | 224800 km |

| 2 | Russia | 295000 km |

| 3 | China | 87000 km |

| 4 | India | 86000 km |

| 5 | Canada | 46500 km |

| 6 | German | 42000 km |

| 7 | Australia | 38500 km |

| 8 | Argentina | 37000 km |

| 9 | France | 29500 km |

| 10 | Brazil | 29000 km |

Train batteries are specialized energy storage systems utilized in a train to give auxiliary power for different onboard functions. These batteries act as a backup power source to continue the operation of critical systems such as ventilation, communication, lighting, and control systems. Even when the train is detached from the main power supply, they are manufactured to withstand the hard conditions of rail travel, like temperature fluctuations, vibrations, and prolonged usage. Hence, train batteries play an important role in improving reliability, safety, and passenger comfort by providing an authentic source of power to maintain crucial functions throughout a train's journey.

Role of AI in the train battery market

AI techniques, like machine learning models (MLMs), are changing the train battery market. R&D teams are now using AI techniques for battery material discovery, manufacturing, and characterization. Furthermore, AI-based algorithms provide many advantages for EV battery technology over conventional methods. However, not all ML techniques are created utilizing the same framework. Some use different approaches while assessing the manufacturing process.

| Report Coverage | Details |

| Market Size by 2034 | USD 517.39 Million |

| Market Size in 2024 | USD 296.37 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.73% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing sustainability and electrification

The train battery market is fueled by a strong global focus on sustainable transportation solutions, pushing the electrification of rail networks. Governments globally are rapidly investing in electric train systems powered by batteries to promote cleaner mobility and reduce carbon emissions. Additionally, battery-powered trains give flexibility in operations by discarding the need for overhead wires, which makes them adaptable to travel rail routes. The combination of train batteries with electrified rail systems promotes the sustainability trend for the market.

Limited operational range of batteries

Battery-operated trains have a short range, and it is necessary to recharge them regularly to extend their range, which can increase transit times and cause discomfort to passengers. This factor can also negatively affect the train battery market in the future. Moreover, installing batteries in trains can incur significant costs for railway companies, which is hard to manage for an organization with a limited budget.

The increasing popularity of high-speed and autonomous railways

The railway sector, including metros and high-speed trains, consumes significant energy, which contributes to carbon emissions. To resolve these issues, energy storage systems like train batteries are installed using regenerative braking technology. Furthermore, developed nations are investing highly in the latest technology for the train battery market. Developing economies are following suit due to emission regulations and requirements for comfort and safety.

The lithium-ion battery segment dominated the train battery market in 2023. The dominance of the segment can be attributed to the increasing development of metros and high-speed trains along with the expansion of railway networks. Which is anticipated to increase the demand for energy storage systems like batteries. Additionally, these systems help deduct energy demand and operational costs.

Nickel-cadmium batteries segment is expected to grow at the fastest rate in the train battery market over the forecast period. The growth is mainly driven by their high-temperature resistance, long service life, and capability to withstand excess charging and discharging. However, Ni-Cd batteries are extensively utilized in various railway applications, such as emergency braking systems, backup power systems, and HVAC systems. Also, the Rising implementation of these batteries in renewable energy projects coupled with the growing requirement for reliable energy storage systems in modern trains will likely impact segment growth positively.

The valve regulated lead acid battery segment dominated the train battery market. VRLA batteries are extensively utilized in diesel locomotives to start engines and for auxiliary functions because of their ability to withstand different temperature changes and loads. The overall growth segment can be linked to their low maintenance requirements, reliability, and suitability for numerous railway applications.

The lithium titanate oxide batteries segment will show the fastest growth in the train battery market over the projected period. This is due to their unique high-power characteristics, which make them convenient for frequent and high-speed charging applications. Additionally, LTO batteries provide high power charging up to 20C, a life cycle of over 20,000 cycles, and low-temperature operation, which makes them suitable for intermittent catenary connections in several unit trains.

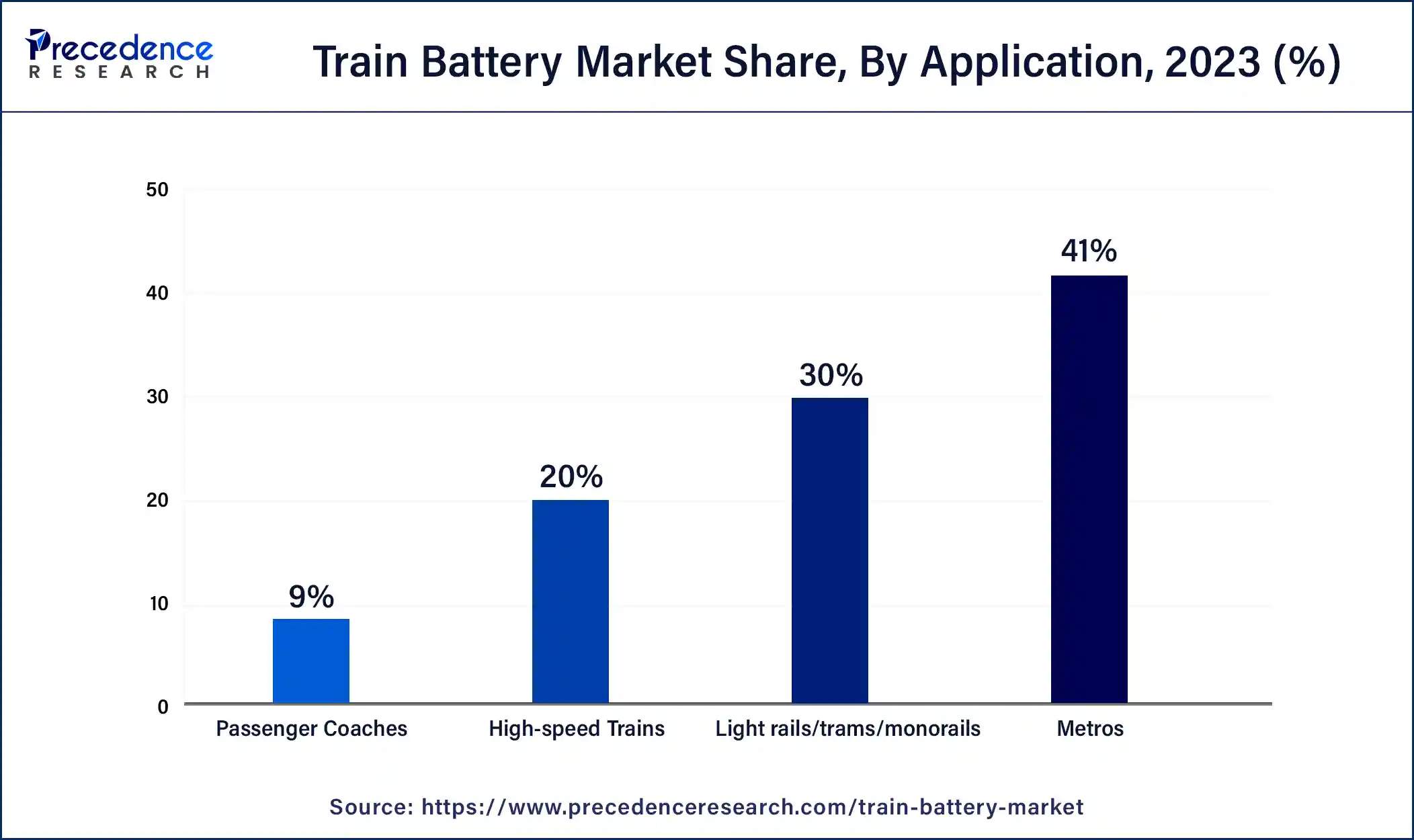

The metros segment led the global train battery market in 2023. The dominance of the segment can be credited to the rising adoption of high-capacity and high-speed metro systems. Lithium-ion batteries are particularly used in metro trains to power different electrical components such as lights, HVAC units, and communication systems. The countries in Asia Pacific, especially China, Japan, and South Korea, are estimated to drive the market growth because of the ongoing expansion of metro networks in the region.

The high-speed trains segment is projected to grow at a significant rate in the train battery market during the studied period. This is due to the growing adoption of these trains and the need for convenient energy storage systems. High-speed trains need substantial energy to operate, and batteries help reduce operational costs and energy consumption. Lithium-ion batteries are particularly preferred in high-speed trains due to their high energy density and enhanced safety compared to other batteries.

Segments Covered in the Report

By Type

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

November 2024

November 2024