August 2024

Transfer Membrane Market (By Product: Nitrocellulose, PVDF, Nylon; By Transfer Method: Wet or Tank Transfer, Semi-dry Electro Blotting, Dry Electro Blotting, Others; By Application, Northern Blotting, Southern Blotting, Western Blotting, Others; By End-User: Academic & Research Institutes, Pharmaceutical & Biopharmaceutical Companies, Diagnostic Labs) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

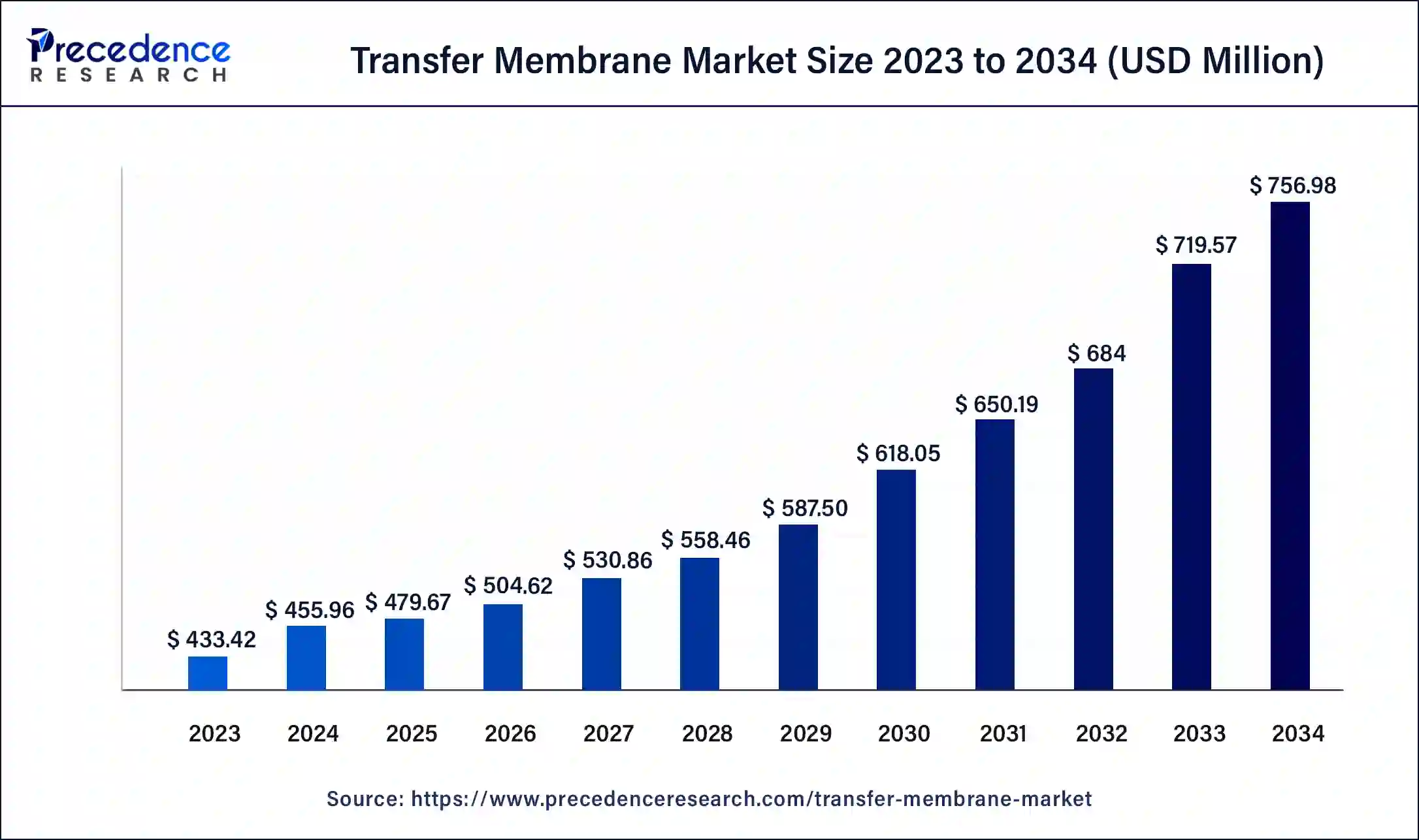

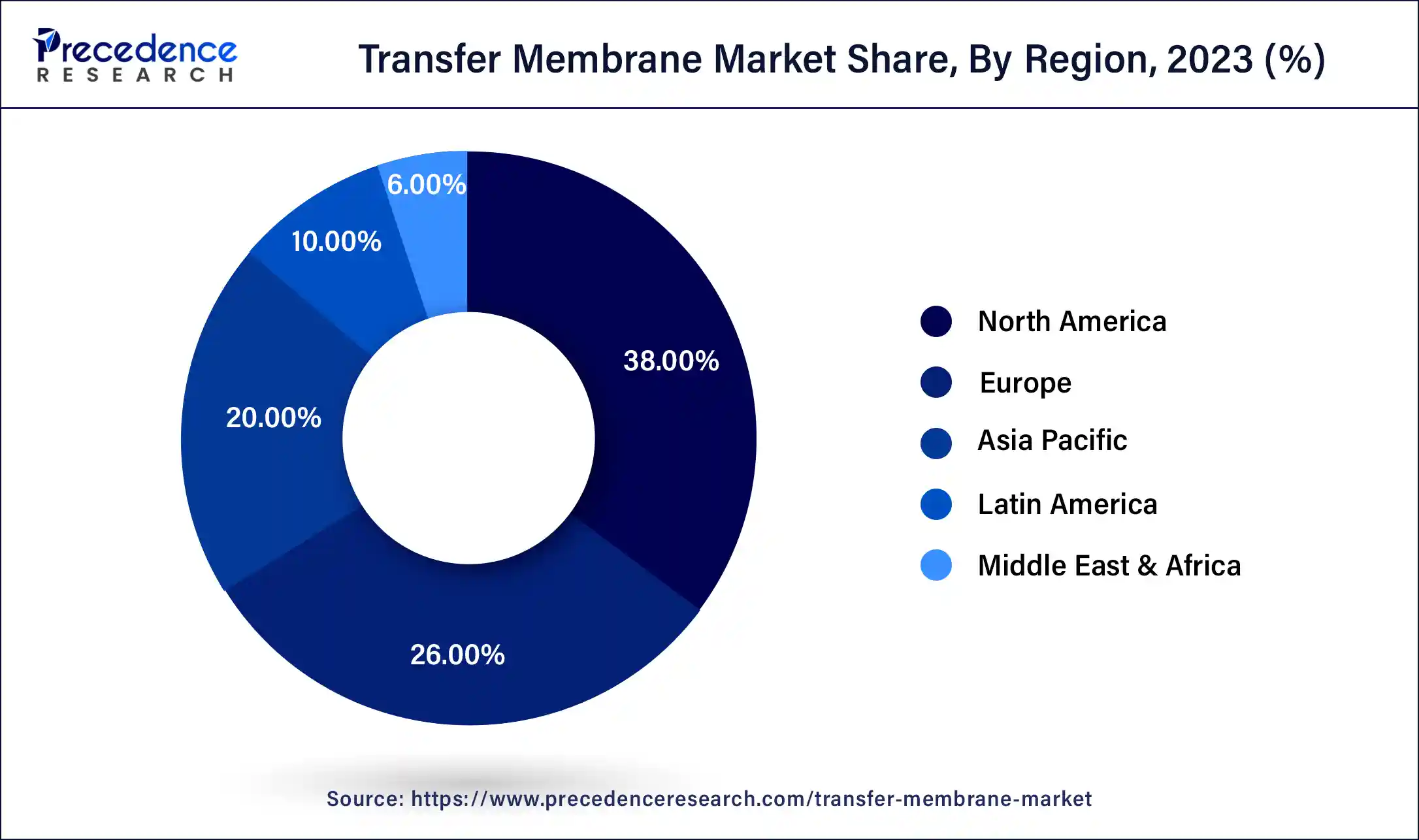

The global transfer membrane market size was USD 433.42 million in 2023, accounted for USD 455.96 million in 2024, and is expected to reach around USD 756.98 million by 2034, expanding at a CAGR of 5.2% from 2024 to 2034. The North America transfer membrane market size reached USD 164.70 million in 2023.

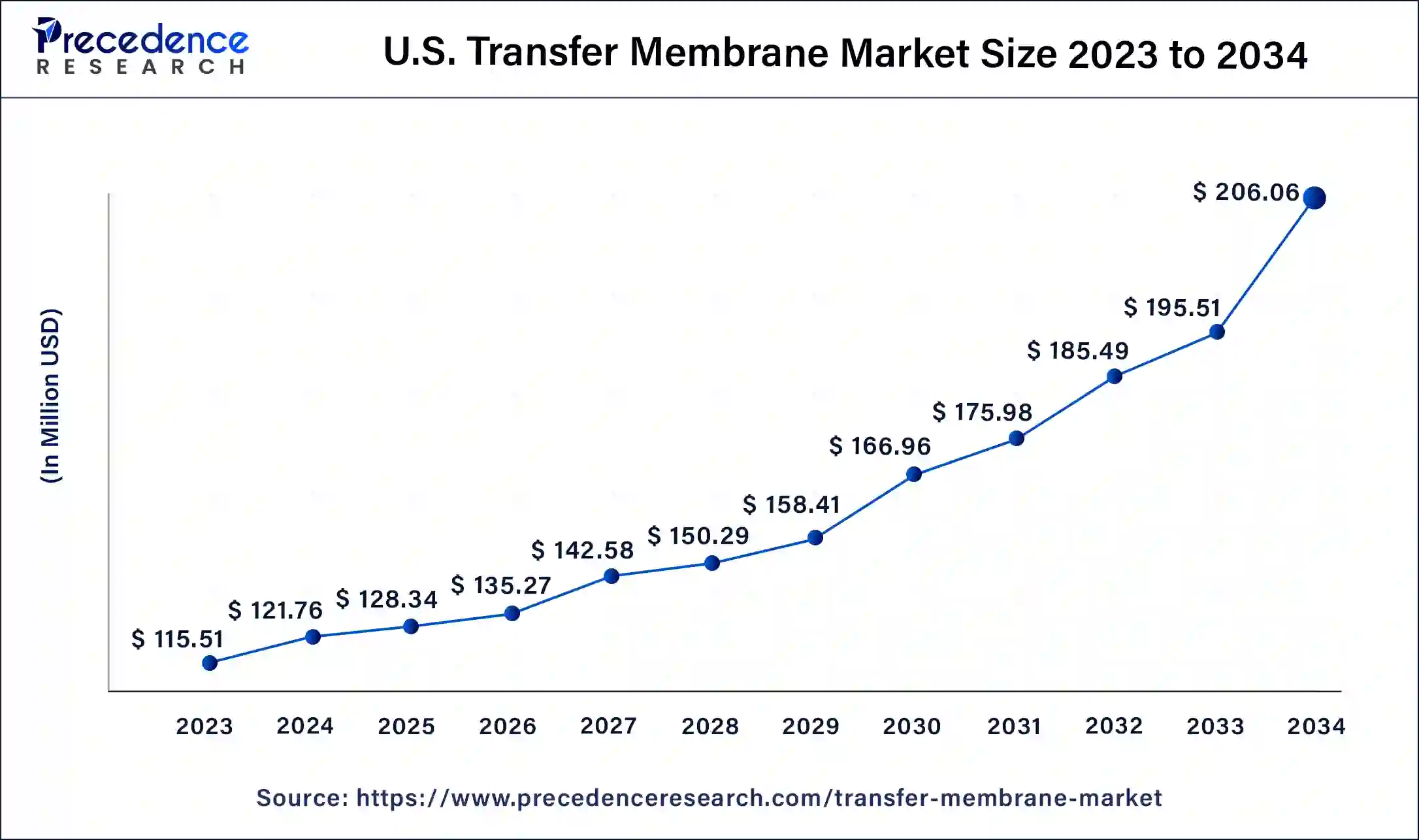

The U.S. transfer membrane market size was estimated at USD 115.51 million in 2023 and is predicted to be worth around USD 206.06 million by 2034, at a CAGR of 5.4% from 2024 to 2034.

North America dominates the transfer membrane market across the world. North America is the home ground for multiple universities and research institutes, with the increase in government funding for research and development, demand for personalized medicine, and expanding research in genomics and proteomics, particularly for chronic diseases such as diabetes, hypertension, etc., driving the transfer membrane market to grow. The region has a high prevalence of lifestyle-related diseases such as obesity, which further causes the demand for medications. Furthermore, North America is home to many major pharmaceutical companies, which has led to a significant investment in the research and development of new drugs.

This has resulted in the availability of a wide range of medications, including innovative treatments for complex diseases. The COVID-19 pandemic has also increased the demand for pharmaceuticals in North America, particularly for vaccines and treatments for the virus. North America's high drug demand will continue in the coming years.

The Asia Pacific region has a large and rapidly growing population, which creates a large market for goods and services. With a population of over 4.5 billion, the area has a significant consumer base driving economic growth. Many countries in the Asia Pacific region have undertaken economic reforms to promote growth and development. These reforms have included deregulation, privatization, and liberalization of trade and investment, which have helped to attract foreign investment and spur economic growth.

The transfer membrane market refers to the global market for various transfer membranes used in multiple applications, such as Western blotting, protein sequencing, and nucleic acid transfer. Transfer membranes are thin, porous sheets made of various materials such as nitrocellulose, polyvinylidene difluoride (PVDF), and nylon. They transfer proteins or nucleic acids from a gel or a blotting paper to solid support for analysis or detection.

The transfer membrane market includes products such as nitrocellulose membranes, PVDF membranes, nylon membranes, and other specialized membranes, as well as related accessories and consumables such as transfer buffers, filter papers, and pre-cut membranes. The increasing demand for transfer membranes in research and diagnostics applications and the growing use of transfer membranes in industries such as pharmaceuticals, biotechnology, and food testing drive the market.

The transfer membrane market is expected to grow due to the increasing demand for protein analysis in various fields, such as medical research, biotechnology, and pharmaceuticals. The development of new transfer membrane technologies, such as improved pore size, better binding capacity, and increased sensitivity, is expected to boost the growth of the transfer membrane market. The increasing use of western blotting for protein analysis and the rising demand for this technique in the biotechnology and pharmaceutical industries are expected to drive the growth of the transfer membrane market.

The growing research and development activities in genomics, proteomics, and drug discovery are expected to drive the demand for transfer membranes. The ever-increasing demand for diagnostic testing in the healthcare industry, including protein-based diagnostic tests, is expected to drive the growth of the transfer membrane market. The increasing investments in biotechnology and pharmaceutical industries across the globe are expected to create significant opportunities for the transfer membrane market.

The increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases is expected to drive the demand for transfer membranes in medical research. The growing trend toward personalized medicine and the increasing use of protein-based biomarkers for disease diagnosis and treatment are expected to drive the growth of the transfer membrane market. The rising demand for point-of-care testing and the development of portable diagnostic devices are expected to drive the growth of the transfer membrane market. The increasing adoption of transfer membranes in academic and research institutes for protein analysis is expected to fuel the development of the transfer membrane market.

| Report Coverage | Details |

| Market Size in 2023 | USD 433.42 Million |

| Market Size in 2024 | USD 455.96 Million |

| Market Size by 2034 | USD 756.98 Million |

| Growth Rate from 2024 to 2034 | CAGR of 5.2% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Transfer Method, By Application, By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Impact of COVID-19:

The COVID-19 pandemic has had a significant impact on the transfer membrane market. Transfer membranes are widely used in various applications, including western blotting, nucleic acid transfer, and protein sequencing. The demand for transfer membranes has been affected by the pandemic disrupting global supply chains and the shutdown of many industries. One of the significant impacts of the pandemic on the transfer membrane market has been supply chain disruption. The manufacturing of transfer membranes requires raw materials and chemicals, and with the pandemic causing widespread disruptions in transportation and logistics, the supply of these materials has been affected. This has led to a shortage of transfer membranes, resulting in higher prices and longer lead times for delivery.

The pandemic has also affected the demand for transfer membranes. Many research institutions and universities have been closed or operating at reduced capacity, leading to a slowdown in research activities that require transfer membranes. Furthermore, the economic impact of the pandemic has led to budget cuts in some industries, leading to a decrease in demand for transfer membranes. However, the pandemic has also created new opportunities for the transfer membrane market. With the focus on developing vaccines and treatments for COVID-19, there has been a surge in demand for transfer membranes for use in research and development. The use of transfer membranes in diagnostic testing for COVID-19 has also increased demand.

PVDF (polyvinylidene fluoride) is a type of polymer commonly used in the production of transfer membranes for transferring proteins and nucleic acids during Western blotting and other similar techniques. One of the critical reasons why PVDF is leading the transfer membrane market is its superior properties compared to different types of membranes. PVDF membranes offer high binding capacity, excellent protein retention, and low background noise, making them ideal for various applications in molecular biology and biotechnology research. Additionally, PVDF membranes are highly durable and resistant to chemicals and solvents, which means they can be used multiple times without compromising performance. They are also compatible with various detection methods, including chemiluminescence and fluorescent detection.

Nitrocellulose membranes have been widely used in protein blotting applications for many years and are well-suited for various detection methods. However, they can be brittle and tend to shrink during transfer, resulting in distortion of the protein bands.

The dry electro blotting segment holds the maximum share of the market. It is a technique used to isolate proteins on a micro-level. It also helps efficiently transfer the substance with a more incredible speed. The transfer speed is faster in dry electro-blotting than in wet transfer, as there is no need to equilibrate the buffer and the transfer membrane. The transfer is also more consistent, as the electric field is applied directly to the gel matrix, resulting in uniform transfer across the entire gel. Furthermore, dry electro-blotting does not require buffer solutions, which can be expensive and require special disposal procedures. This makes dry electro-blotting a more cost-effective and environmentally friendly option.

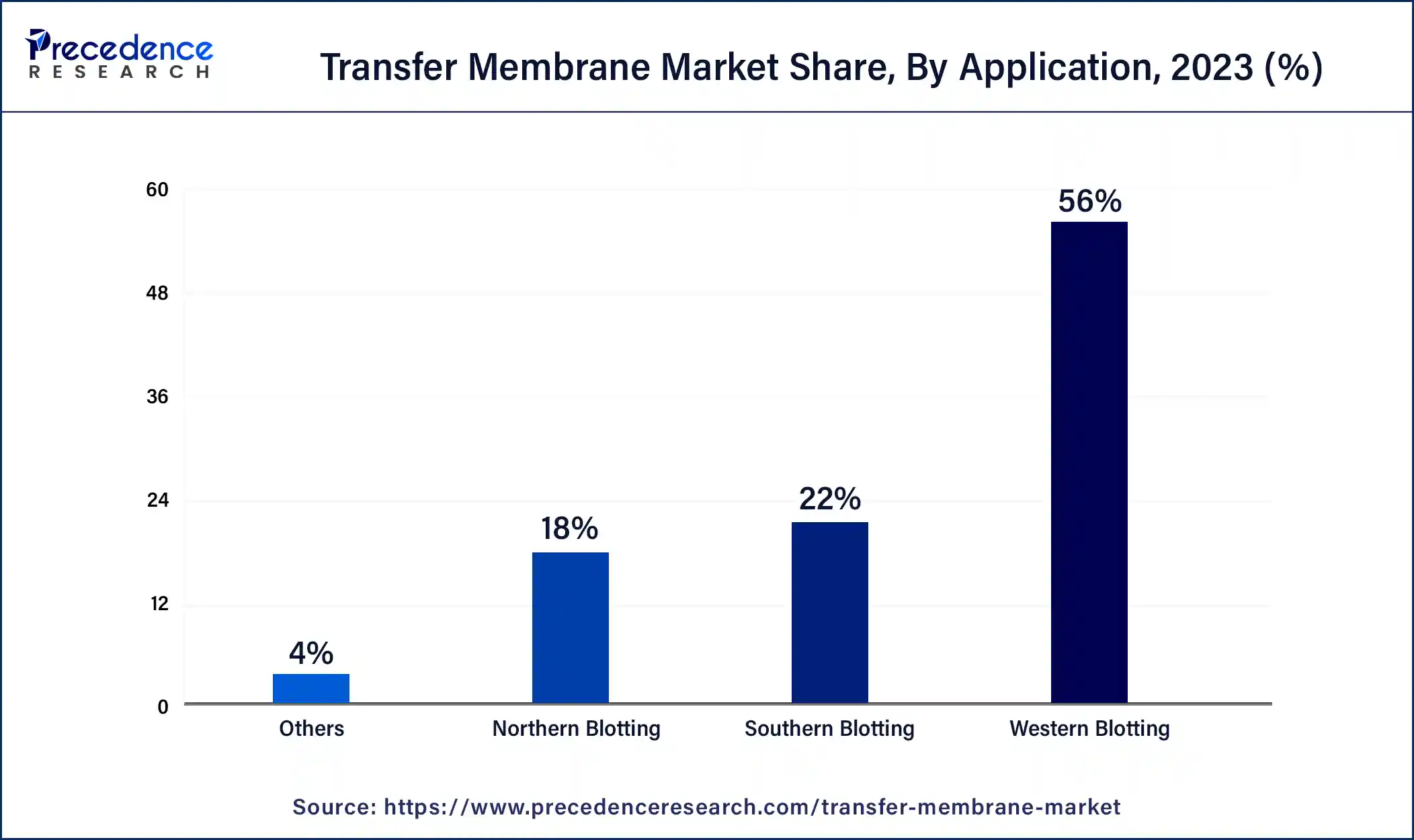

Western Blotting has accounted for the largest share of the market revenue. Transfer membrane, as it serves two purposes, i.e., its ease to access the target protein and the other is a good handling facility.

Pharmaceutical and Biopharmaceutical Companies have the largest market globally. Increases in infrastructure, globalization, research funding by public and private bodies, and technological advancements such as next-generation sequencing, protein sequencing, and RNA sequencing are enhancing market growth. The pharmaceutical and biopharmaceutical industries heavily invest in research and development to develop new drugs and therapies, which require a lot of experimentation and analysis. As a result, these industries have a high demand for transfer membranes, making them one of the largest markets for these products.

Segments Covered in the Report:

By Product

By Transfer Method

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

February 2025

July 2024