September 2024

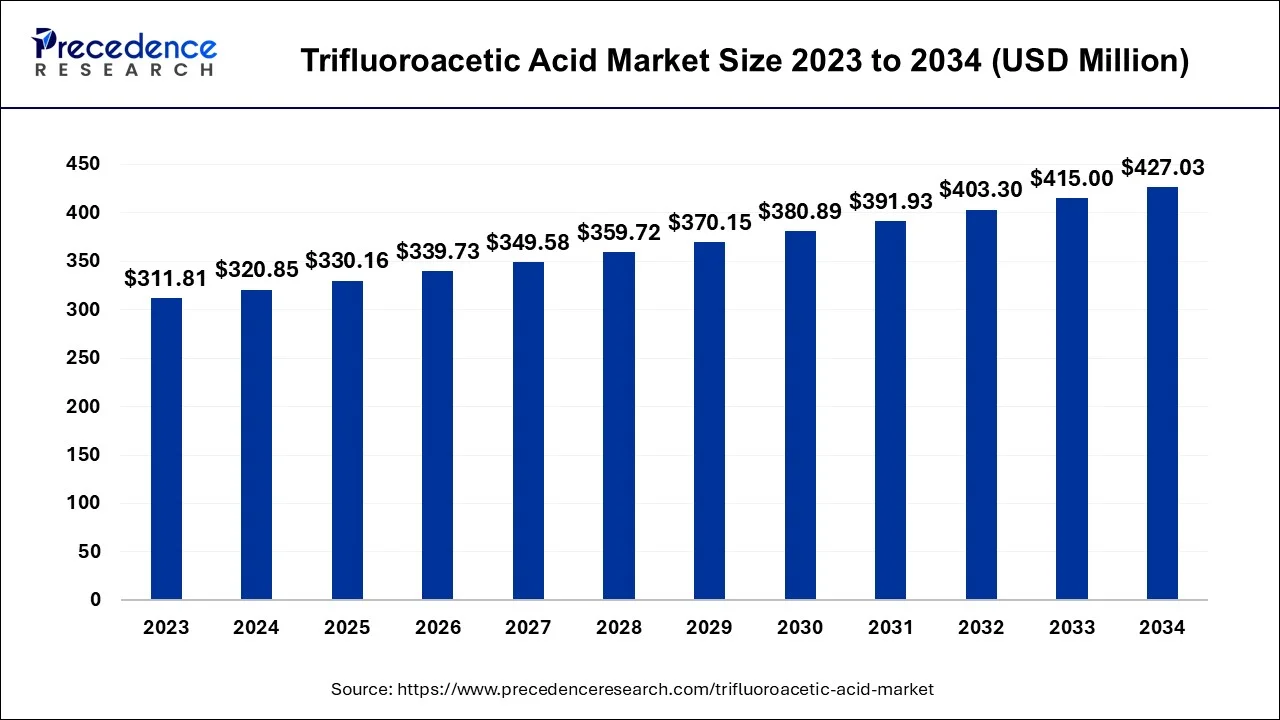

The global trifluoroacetic acid market size accounted for USD 320.85 million in 2024, grew to USD 330.16 million in 2025 and is projected to surpass around USD 427.03 million by 2034, representing a healthy CAGR of 2.90% between 2024 and 2034. The North America trifluoroacetic acid market size is calculated at USD 128.34 billion in 2024 and is expected to grow at a fastest CAGR of 3% during the forecast year.

The global trifluoroacetic acid market size ie estimated at for USD 320.85 million in 2024 and is anticipated to reach around USD 427.03 million by 2034, rising at a CAGR of 2.90% between 2024 and 2034.

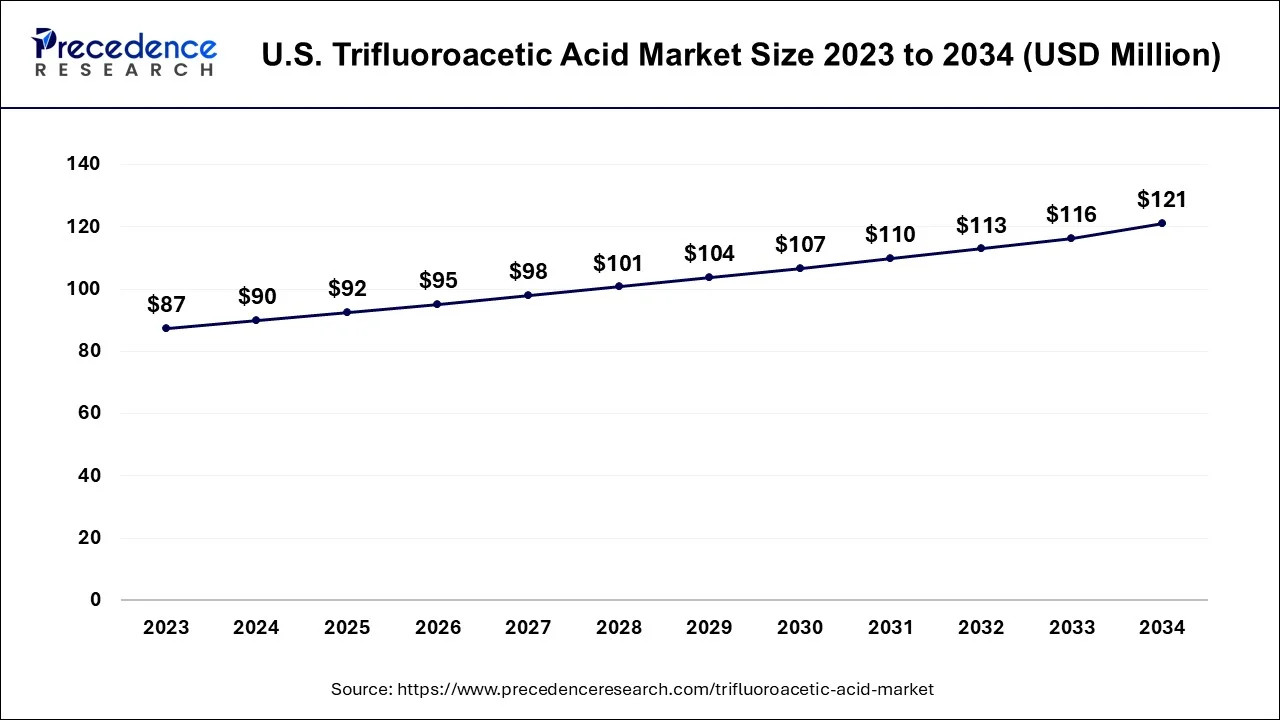

The U.S. trifluoroacetic acid market size accounted for USD 89.84 million in 2024 and is expected to reach USD 121.06 million by 2034, poised to grow at a CAGR of 3.03% from 2024 to 2034.

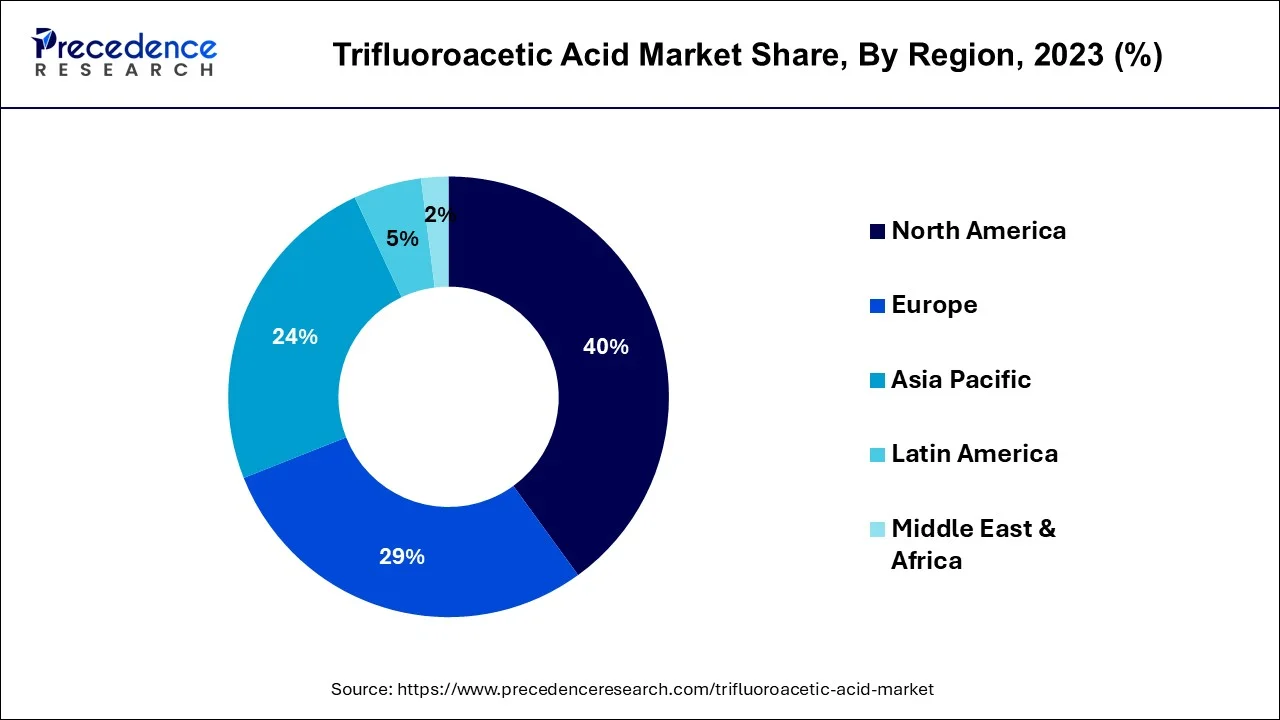

North America has held the largest revenue share of 40% in 2023. North America's prominence in the trifluoroacetic acid (TFA) market can be attributed to several factors. First, the region is a hub for pharmaceutical and chemical industries, which are significant consumers of TFA. The United States, in particular, hosts numerous pharmaceutical companies and research institutions, driving substantial demand for TFA in drug development and manufacturing.

Moreover, North America's stringent environmental regulations have encouraged the adoption of TFA as a safer alternative in various applications. Its well-established infrastructure, technological advancements, and strong research and development activities further solidify its leading position in the TFA market.

Asia Pacific is estimated to observe the fastest expansion. The region commands a substantial share in the trifluoroacetic acid (TFA) market due to several key factors. This region's dominance is attributed to its robust pharmaceutical and chemical industries, which are significant consumers of TFA. The expanding population, coupled with increasing healthcare needs, drives the demand for pharmaceuticals, while agricultural and industrial growth bolsters the agrochemical and chemical sectors. Additionally, cost-effective TFA production facilities in Asia Pacific and its role as a global manufacturing hub further enhance the region's market position. The region's economic growth and evolving industrial landscape make it a pivotal player in the TFA market.

The trifluoroacetic acid (TFA) market pertains to the global sector focused on trifluoroacetic acid, a potent organic acid widely applied in pharmaceuticals, agrochemicals, and chemical synthesis. TFA's strong acidity and versatile chemical attributes make it a crucial component in various industries. Market size is primarily influenced by demand from these sectors and ongoing research and development endeavors. Growth in the pharmaceutical industry and the expansion of chemical synthesis processes play pivotal roles in shaping market trends. TFA is typically available in diverse forms, such as solutions or solids, and market stakeholders encompass chemical manufacturers, distributors, and end-users who rely on TFA for their production needs.

| Report Coverage | Details |

| Market Size in 2024 | USD 320.85 Million |

| Market Size by 2034 | USD 427.03 Million |

| Growth Rate from 2024 to 2034 | CAGR of 2.90% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pharmaceutical industry demand

The pharmaceutical industry stands as a paramount driver behind the remarkable growth of the market. This sector is intrinsically reliant on TFA due to its indispensable role in drug development, manufacturing, and research. TFA's exceptional attributes as a reagent, solvent, and catalyst are vital in various pharmaceutical applications, facilitating the synthesis of intricate compounds, pharmaceutical intermediates, and active pharmaceutical ingredients (APIs).

The ever-expanding pharmaceutical landscape, driven by factors such as an aging global population and the unceasing quest for innovative drugs, continuously amplifies the demand for TFA. The pharmaceutical industry is characterized by dynamic research and development initiatives, with TFA playing a pivotal role in the optimization of chemical reactions, thereby contributing to the discovery of novel drugs. Its versatility positions it as an enabler for innovative pharmaceutical solutions, supporting the development of therapeutic agents, which cater to the ever-evolving healthcare needs of society. In essence, the symbiotic relationship between the pharmaceutical industry and the TFA market ensures that the latter thrives as an essential component in the pharmaceutical innovation ecosystem.

Stringent regulatory oversight

Rigorous regulatory scrutiny exerts a pronounced constraint on the burgeoning trifluoroacetic acid (TFA) market. This stringent oversight emanates chiefly from environmental concerns and the global resolve to combat the detrimental impacts of certain chemicals on the Earth's delicate ecosystems and the precarious balance of the ozone layer. TFA and its various derivatives have cast a shadow of environmental apprehension, particularly concerning their potential to participate in ozone depletion and contribute to the ongoing challenges of global warming.

Consequently, a multitude of international accords and protocols, most notably the montreal protocol, have been enacted to stringently control and confine the use of ozone-depleting substances, encompassing specific TFA-related compounds. These regulatory strictures not only curtail the production and application of select TFA derivatives but also usher in a paradigm shift in favor of more eco-friendly chemical alternatives.

Moreover, to comply with these stringent regulations, TFA manufacturers must invest significantly in process modifications and eco-centric protective measures, escalating their operational expenditures. This, in turn, augments the cost structure of TFA, influencing its competitive edge and market dynamics. While these regulatory measures undoubtedly play a pivotal role in safeguarding the environment, they unquestionably constitute a formidable impediment to the unbridled expansion of the TFA market by virtue of their constrictive constraints and fiscal implications.

Custom synthesis services

Custom synthesis services have emerged as a pivotal catalyst for creating lucrative opportunities within the trifluoroacetic acid (TFA) market. These bespoke services cater to the specific needs of various industries, fostering a symbiotic relationship between TFA manufacturers and diverse market segments. By tailoring TFA solutions to the unique requisites of customers, custom synthesis services extend the applicability of TFA into previously unexplored niches. This flexibility allows TFA to become a versatile and indispensable chemical in an array of applications, from pharmaceuticals and agrochemicals to materials science and beyond.

Furthermore, custom synthesis services facilitate collaborative endeavors and innovations. TFA manufacturers can partner with research institutions and industrial players to co-create novel TFA-based products and processes, expanding the market's boundaries and capitalizing on uncharted opportunities. This customer-centric approach not only broadens the utility of TFA but also bolsters its market position, making it an essential component in the chemical toolbox of numerous industries. It leverages adaptability and collaboration to unlock the full potential of TFA in a dynamic and evolving market landscape.

Impact of COVID-19

According to the type, the 99.5% trifluoroacetic acid segment has held a 55% revenue share in 2023. The 99.5% trifluoroacetic acid (TFA) segment holds a major share in the TFA market due to its high purity and versatile applications. This ultra-pure form of TFA is crucial in the pharmaceutical industry for synthesizing pharmaceutical intermediates and active ingredients, where impurities are intolerable. Its remarkable purity also makes it valuable in high-precision research and development. Moreover, stringent quality requirements in pharmaceuticals and other industries drive the demand for this highly purified TFA, ensuring its dominant market position as a preferred choice for critical applications.

The 99.9% trifluoroacetic acid segment is anticipated to expand at a significant CAGR of 3.8% during the projected period. The 99.9% trifluoroacetic acid (TFA) segment commands a significant share of the TFA market due to its exceptional purity and versatility. Its high purity makes it ideal for critical applications in pharmaceuticals, where even trace impurities can be detrimental. TFA of this grade is a crucial reagent in drug development and manufacturing. Moreover, it finds use in other precision industries like electronics and materials science. Its reputation for reliability and performance positions the 99.9% TFA segment as a cornerstone in the TFA market, underpinned by stringent quality requirements in various sectors.

The medical intermediates segment is held the largest market share of 32% in 2023. The medical intermediates segment commands a substantial growth in the trifluoroacetic acid (TFA) market due to its critical role in pharmaceutical and healthcare applications. TFA is a pivotal reagent in the synthesis of pharmaceutical intermediates, enabling the production of essential drugs and therapies. With the pharmaceutical industry's continuous growth and increasing demand for novel medicines, TFA remains in high demand.

Its use in pharmaceutical research and development, coupled with the evolving healthcare landscape, solidifies the medical intermediates segment's dominance, as TFA is integral to the development of life-saving drugs and medical solutions, making it an indispensable component of the pharmaceutical value chain.

The others segment is projected to grow at the fastest rate over the projected period. The other segment's dominance in the market can be attributed to its extensive market share, driven by the multifaceted utility of TFA in applications that defy categorization into well-defined sectors. TFA's exceptional attributes, including its potent acidity and dissolving capabilities, render it adaptable for a multitude of specialized applications spanning diverse industries like advanced materials, specialty chemicals, and cutting-edge electronics. This comprehensive array of uses, complemented by bespoke synthesis services, positions TFA as a versatile solution to address a myriad of unique and evolving demands, thus underscoring the preeminence of the segment within the TFA market.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

March 2025

December 2024

August 2024