What is Specialty Chemicals Market Size?

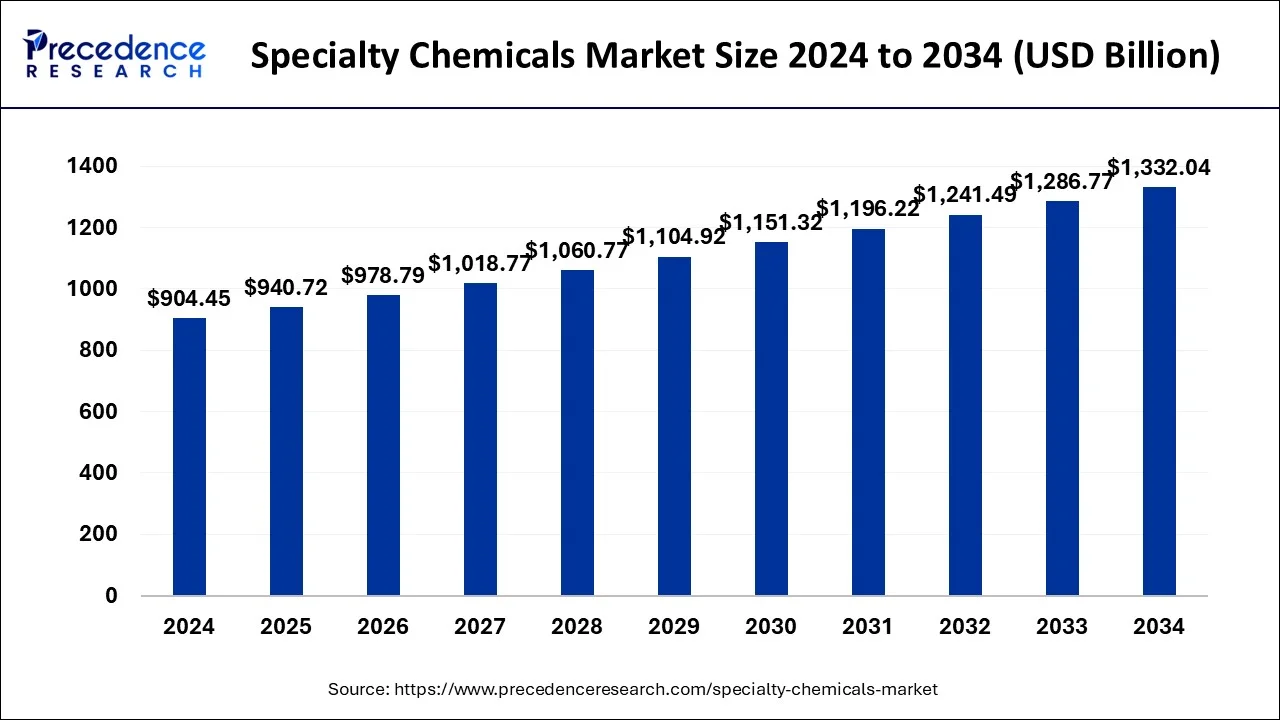

The global specialty chemicals market size is valued at USD 940.72 billion in 2025 and is predicted to increase from USD 978.79 billion in 2026 to approximately USD 1,377.32 billion by 2035, expanding at a CAGR of 3.54% from 2026 to 2035

Market Highlights

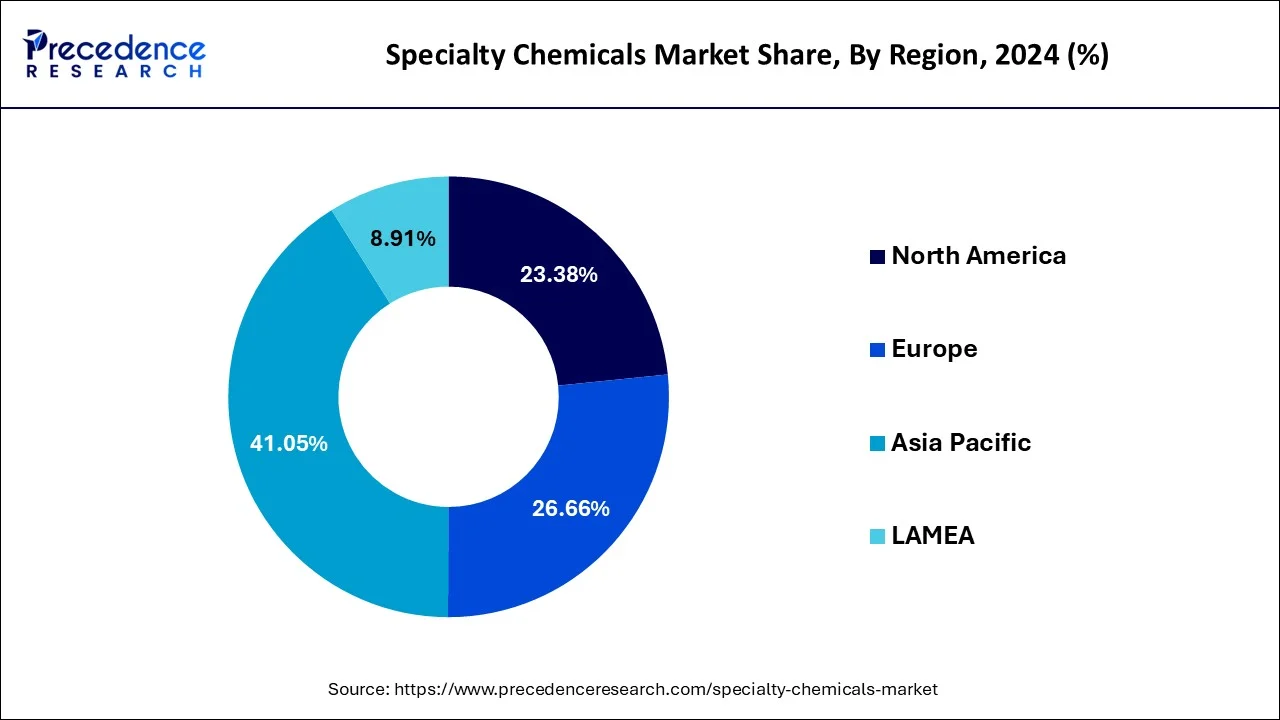

- Asia Pacific dominated the global market with the largest share of 41.05% in 2025.

- North America is expected to grow at a significant CAGR during the forecast period.

- By product, the construction & infrastructure chemicals segment registered its dominance over the market shar of 28% in 2025.

- By End-Use Industry, the construction & infrastructure segment held the largest share of the market at 31% in 2025.

- By Form, the liquid segment held the largest market share of 45% in 2025.

- By Sales Channel, the direct sales segment held the largest share at 67% in 2025.

Market Overview

Specialty chemicals are typically low-volume, high-value, ultra-high purity chemicals utilized in the wide area of end users. Specialty chemicals offer a broad range of products and applications they are used in. Specialty chemical materials are utilized based on their performance and their function. These chemicals are also referred to as performance chemicals, and used as components in completed products as well as enhance production procedures.

The increased utilization of specialty chemicals in various industries is the key factor driving the growth of the market. The rising urbanization and population have enhanced the need for high-performance materials among the industries. As the demands have increased, the industries have shifted their preference for the high-value materials to enhance their production as well as profit margins. The growing middle-class population and availability of disposable income, allowing spending on customized and specialized products, have resulted in the demand for high-performance chemicals reaching the top in the commercial industries, resulting in witnessing rapid growth in the specialty chemicals production each year.

- For instant, in November 2024, the American Chemistry Council (ACC) projects global chemical production to rise by 3.4% in 2024 and 3.5% in 2025, which was just 0.3% in 2023.

Additionally, another major relevant factor for the market growth is growing global shift toward sustainability. The increased awareness about environmental impacts and the balance of sustainability is holding market potential for innovation and developments of cutting-edge solutions. Moreover, the increased awareness of health and wellness has boosted the customer spending on healthcare and personal care products. The industries like pharmaceuticals, medical devices, and personal care are the major adopters of the specialty chemicals. With growing government investment in research & developments and adoption of alternative raw materials, the market growth in the emerging market is significantly transforming.

How AI technologies are benefiting the Specialty Chemicals Market

Artificial intelligence has become a pivotal enabler in the specialty chemicals industry, transforming research and development, manufacturing, and supply chain operations. AI-powered formulation tools accelerate the discovery of new compounds by analysing vast chemical datasets, enabling faster, more targeted innovation in coatings, adhesives, and specialty polymers. In production environments, machine learning models support predictive maintenance and real-time process monitoring, which minimize downtime through these strategies.

Quality control systems powered by AI detect defects and anomalies early, assuring consistent product quality and reducing waste. Furthermore, AI-driven supply chain analytics optimize inventory, forecast demand accurately, and strengthen their logistics resilience as demonstrated by Evonik and Dow adopting these tools to trim costs and improve reliability.

Specialty Chemicals Market Growth Factors

- Increased demand of specialty chemicals among various industries: A few of the major factors driving the growth of this market are surge in demand of green or bio-based specialty chemicals, increasing demand from pharmaceutical industry, increasing demand from personal care products industry, and increasing demand from construction & building industry.

- Technology developments: One of the trends of the specialty chemicals is that companies operating in the market are growingly adopting open innovation models to get speedy access to technology improvements. Companies within this space have made a belief that they need to develop in-house technologies, but have got to realize that taking an advantage of technologies from inventive newcomers can considerably aid them understand their internal objective of decreasing cost as well as deploying more effective and structured processes of the production.

- Sustainability concerns: Another ongoing trend of this market is to go green. Many of the manufacturers of specialty chemicals are implementing sustainable initiatives. Using bio-alternatives, more selective and energy effective methods of separation like crystallization, and readily available chemical substances are some of the common practices done. The demand for bio-based or green chemicals is increasing, and manufacturers of these chemicals are competing directly with their fossil-based predecessors.

- Research & developments: Increased research and development of the specialty chemical products with advanced and optimum features is the major factor that drives the market growth. Increasing demand from ASEAN countries such as China and India due to rapid industrialization has uplifted the specialty chemicals market growth.

- Growing construction & infrastructures: Construction and infrastructure projects have significantly grown over the past few years in the Asia Pacific region. This makes the region as the most preferred destination for the manufacturers of specialty chemicals, thereby propelling the market growth. Whereas, stringent government regulations along with fluctuation in the price of raw materials projected to hamper the market growth for specialty chemicals.

Market Trends

- The shift toward bio-based feedstocks, biodegradable polymers, and eco-friendly formulations is accelerating, driven by regulatory mandates and consumer demand for sustainability.

- Adoption of Industry 4.0 tools as AI, IoT, digital twins, and predictive maintenance, is enhancing efficiency and enabling flexible, high-precision production.

- Industries increasingly demand specialty additives and materials such as specialty polymers and adhesives with anti-microbial, self-healing, or lightweight properties tailored to specific application needs.

- Companies are moving toward nearshoring and diversifying supplier networks to reduce disruptions and improve logistics transparency.

- Demand is surging for green solutions, such as recycled plastics, safe-by-design chemistries, and enzymatic or catalytic processes that lower environmental impact.

- Bioanalysis and nanotechnology are enabling new material functionalities and greener production processes, especially for fine and specialty chemicals.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 940.72 Billion |

| Market Size in 2026 | USD 978.79 Billion |

| Market Size by 2035 | USD 1,377.32 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.54% |

| Dominant Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Products, and Region |

Market Dynamics

Drivers

Growing demand for high-performance materials

The increased demand for high-performance materials among industries like automotives, electronics, food & beverages, construction, and pharmaceuticals is driving the significant growth of the specialty chemicals market. The need for lightweight and fuel-efficient chemicals in the automotive industry is the reason behind the increased adoption of the advanced polymers and coatings. Additionally, the rising demand for high-performance materials like biocompatible polymers is driving the adoption of specialty chemicals in the medical devices industry. The high-performance materials with advanced composites, high-temperature properties, conductive materials, and biocompatible materials are trending in the market due to their high demand in various industries. The rapidly expanding automotive, energy, and electronics industries are likely to continuously boost such demand, which will influence the market expansion.

Restraint

Volatility of raw material prices

One critical obstacle is the mounting burden of environmental and safety regulations across major markets like the U.S. and Europe. Compliance with frameworks such as REACH in the EU and TSCA in the U.S. requires extensive testing, dossier submission, and ongoing reporting. For instance, REACH mandates risk evaluation of thousands of substances; 74% of dossiers submitted failed to meet data standards, triggering revaluation and delays. Regulatory changes such as proposed PFAS bans also force rapid product reformulations and supply chain disruptions.

Specialty chemical manufacturers face significant pressure from fluctuating raw material prices and geopolitical trade disruptions. Tariffs and trade tensions have distorted logistics and cost structures, with some essential inputs now subject to duties of up to 25%. Regions like Europe suffer from depressed capacity utilization and margin erosion due to competition from producers in the U.S> and the Middle East, where feedstock is cheaper. As a result, profitability is squeezed, making it difficult to invest in innovation or expansion.

Demand for green chemistry

The rising concern about environmental impact and challenges occurs due to the utilization of various chemicals that has transformed the shift toward adoption of sustainability and green chemistry. Moreover, the environmental regulation has been pressuring for innovation and developments of green chemistry solutions in recent years. The rising consumer preference for maintaining sustainability and cost-effectiveness of solutions is driving a surge in developments of green chemistry. The manufacturing of sustainable specialty chemicals, like bio-based, sustainable solvents, green catalysts, algae, and fossil-based alternative raw materials, is emerging in the market. The unstoppable shift of sustainability has projected to provide various opportunities in research and developments of the novel innovative specialty chemicals in the future.

Specialty Chemicals Market Segment Insights

Product Insights

Why did the construction & infrastructure chemicals segment dominate the specialty chemicals market?

The construction & infrastructure chemicals segment dominated the market with a 28% share in 2025. This is because of increased urbanization, extensive infrastructure projects, and the use of materials that improve performance, like sealants, waterproofing chemicals, and concrete admixtures. The demand for these chemicals has increased due to the emphasis on sustainability, durability, and quicker construction schedules. The use of these chemicals is further supported by the growing adoption of green building standards.

The electronics & semiconductor chemicals segment is expected to grow at the fastest rate in the upcoming period, driven by their vital role in the production of advanced electronic components, PCBs, and chips. Increasing complexity of semiconductor nodes, rising demand for high-purity chemicals, and ongoing investments in fabrication facilities have strengthened the segment's market position. Additionally, strict quality and contamination-control regulations require specialized chemical formulations to ensure reliable and defect-free production.

By End Use Industry

What made construction & infrastructure the dominant segment in the specialty chemicals market?

The construction & infrastructure segment dominated the market, holding the largest share of 31% in 2025. This is because of the high demand for concrete admixtures, coatings, sealants, and waterproofing chemicals used in large-scale building projects and infrastructure development. Rapid urbanization, government-funded infrastructure initiatives, and rising real estate construction in both developed and emerging economies have further fueled consumption. Additionally, specialty chemicals in construction enhance durability, performance, and sustainability of structures, making them essential for modern construction practices.

The electronics & semiconductors segment is expected to grow at the fastest CAGR in the market during the forecast period, driven by growing manufacturing of consumer electronics, electric cars, and data center infrastructure. Specialty chemicals are vital throughout the semiconductor value chain because they are necessary for surface treatment, precision manufacturing, and contamination control. Long-term supplier relationships and high switching costs support this industry's consistent demand.

By Form

What made liquid the leading segment in the specialty chemicals market?

The liquid segment led the market with a 45% share in 2025, driven by easier handling, precise dosing, and compatibility with automated processing systems. Growing demand from electronics, water treatment, and industrial manufacturing is accelerating the shift toward liquid formulations. Additionally, liquid chemicals enhance operational efficiency by reducing processing times and minimizing waste.

The dispersion / emulsion segment is expected to grow at a rapid pace over the projection period. This is mainly due to its ability to provide consistent performance while adhering to safety and environmental regulations, which further encourages its widespread use. Additionally, these formulations provide better compatibility with low VOC and water-based systems.

By Sales Channel

Why did the direct sales segment dominate the specialty chemicals market?

The direct sales segment dominated the specialty chemicals market with a 67% share in 2025 and is expected to grow at the fastest rate in the coming years. This is because large industrial customers often prefer direct engagement with manufacturers for customized formulations, technical support, and long-term supply agreements. This channel enables better quality control, cost efficiency, and closer collaboration across end-use industries. It also allows manufacturers to gather real-time feedback for product optimization.

Specialty Chemicals Market Regional Insights

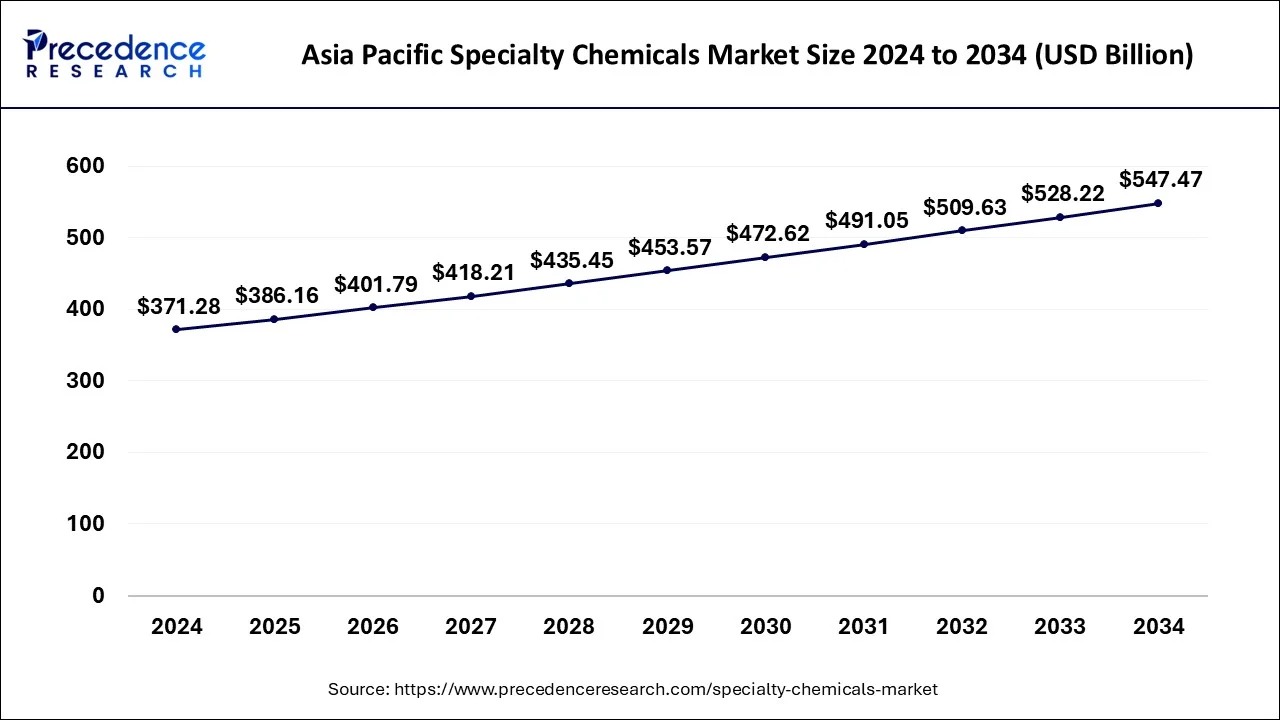

The Asia Pacific specialty chemicals market size is evaluated at USD 386.16 billion in 2025 and is predicted to be worth around USD 566.28 billion by 2035, rising at a CAGR of 3.96% from 2026 to 2035

What is the Asia Pacific Specialty Chemicals Market Size?

Asia Pacific dominated the specialty chemicals market with the largest market share of 41.05% in 2024. In the Asia Pacific region specialty chemicals are used for various applications such as water treatment,paints & coatings, electronics, personal care ingredients & cosmetics, agriculture, and many other applications.

China held the leading market position in the Asia-Pacific region due to increased government investments in research & developments. Rapidly growing industrialization and adoption of advanced technologies are fueling the Chinese market. India followed China due to rising government and non-government organization investments for the country's domestic manufacturing. The government support and investment in chemical sectors are projected to open novel doors for the Indian market expansion.

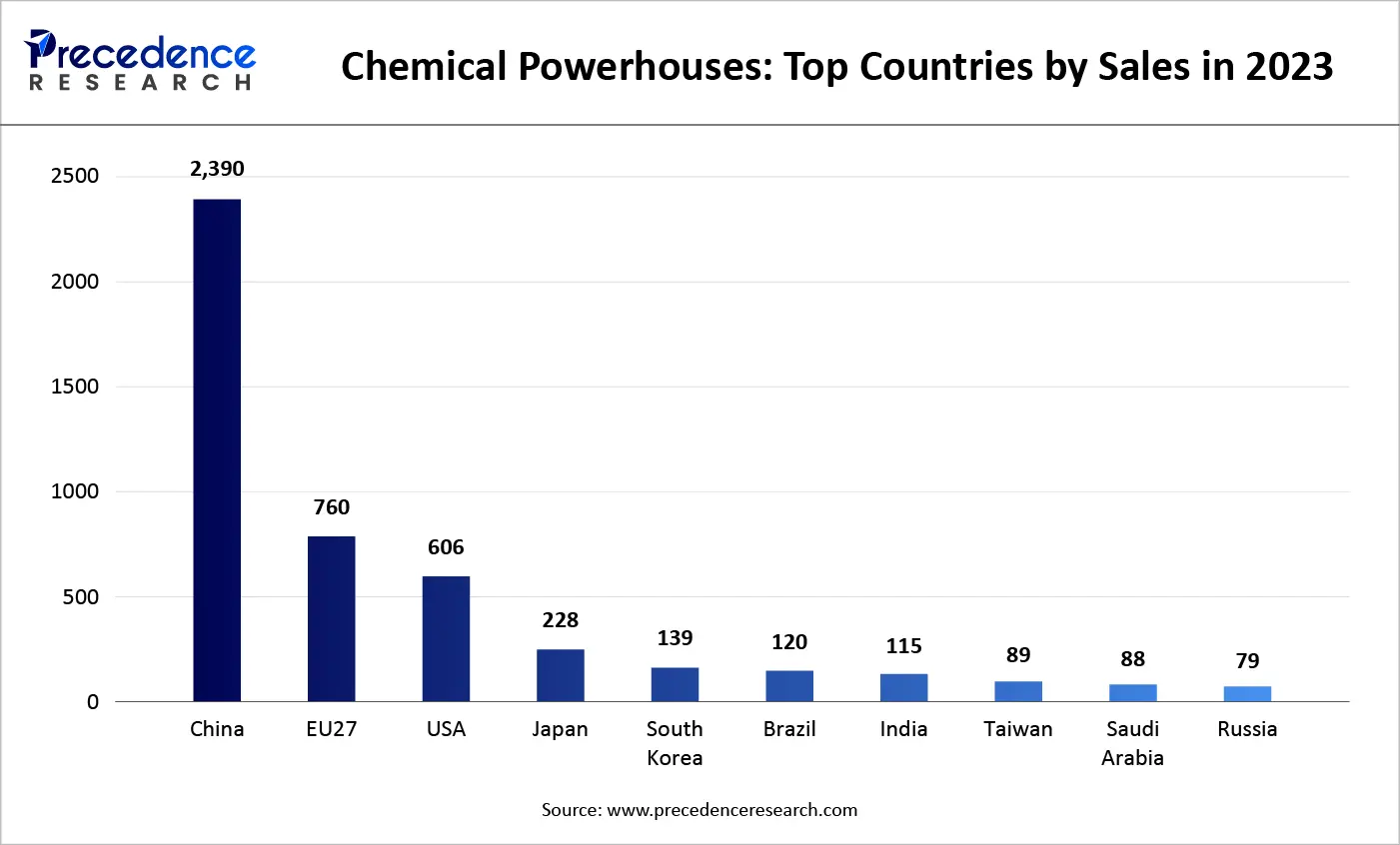

According to the 2023 report from the European Chemical Industry Council (CEFIC), India has established itself as one of the largest chemical markets globally. In fact, the country is ranked 7th in the world and 4th in Asia in terms of chemical sales for 2023. This position highlights the significant role India plays in the global chemical industry, showcasing the country's rapidly growing industrial and economic sectors.

In 2022, India's chemical sales were valued at €115 billion, a substantial figure within the broader context of the global chemical market, which reached a total value of €5,434 billion. This demonstrates India's strong presence within the industry, especially given its expanding manufacturing capabilities.

To put India's chemical market in perspective, here is a breakdown of the top ten countries in global chemical sales for 2022:

As seen from this list, China dominates the global market with a massive €2,390 billion in chemical sales, followed by the EU, the U.S., and Japan. India ranks 7th, trailing behind Brazil and South Korea but ahead of Taiwan, Saudi Arabia, and Russia. This ranking highlights India's growing influence and its potential to expand further within the global chemical sector, especially considering the country's expanding industrial base and increasing focus on sustainability and innovation in manufacturing processes.

India's chemical industry is poised for continued growth, bolstered by domestic demand, export potential, and investment in new technologies. With its favorable demographic trends and ongoing industrial development, the country's role in the global chemical market is likely to become even more significant in the coming years.

China

China's position as the largest market for specialty chemicals in the Asia-Pacific region is due to the large amount of industrial output and economies of scale associated with its manufacturing capabilities. Key industries contributing to the growth of the specialty chemicals market include construction, electronics, automotive and renewable energy. In addition, ongoing investment in specialty chemicals and functional coatings/chemicals along with investment into advanced processing capability has helped to maintain China's competitive advantage and promote its continued leadership position within the region.

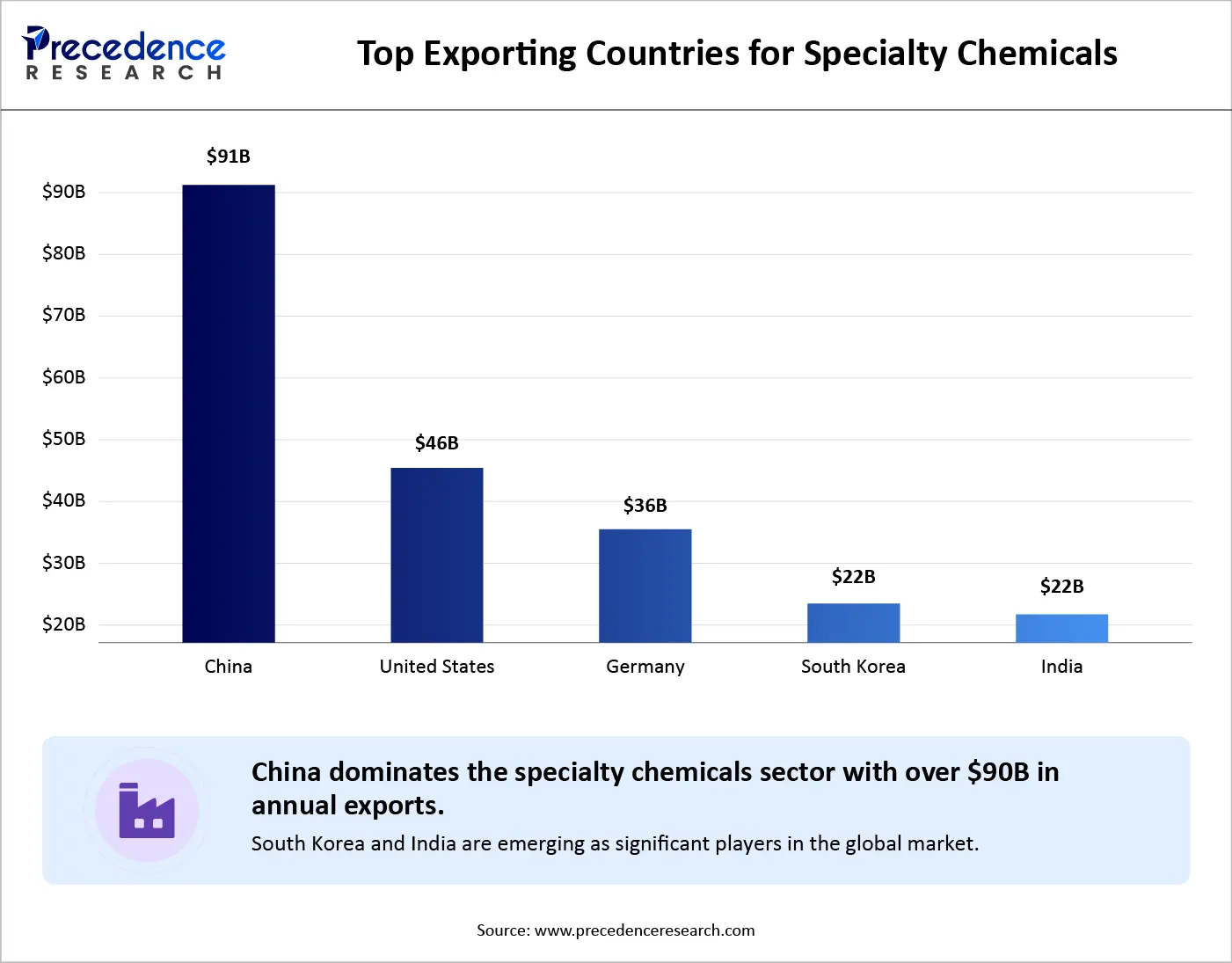

Top Exporting Countries for Specialty Chemicals in 2024

In 2024, China solidified its position as the leading exporter of specialty chemicals, with exports exceeding USD 90 billion. The United States follows as the second-largest exporter, contributing over USD 45 billion, supported by advanced manufacturing and innovation capabilities. Germany maintains a strong foothold in the European market, exporting approximately USD 35 billion worth of specialty chemicals. South Korea and India also play significant roles, with exports valued at USD 22 billion and USD 20 billion respectively, driven by growing industrial sectors and expanding chemicalmanufacturing infrastructure. This data highlights the global distribution of specialty chemical production and the competitive export landscape shaping the industry.

Why is North America the fastest-growing region in the specialty chemicals market?

North America is observed to be the fastest growing region in the specialty chemicals market due to increased demand for the construction chemicals. The market has witnessed significant growth in North America due to several factors like rising sustainability concerns, growing government investments in research & development sectors, rapidly growing industrialization, demands for advanced materials, and increased utilization of specialty chemicals in the recycling industry.

Why is the United States leading the specialty chemicals market in North America?

The United States is leading the regional market due to the presence of well-established end-user industries in the country. Additionally, strict environmental regulations have encouraged the adoption rate of specialty chemicals in various industries. Canada is the second-largest country driving growth of the market in North America due to increased adoption in mining industries.

What Influences the Market Within Europe?

The specialty chemicals market in Europe is influenced by stringent environmental and safety regulations, which drive demand for sustainable, low-emission, and high-performance chemical solutions. Growing industrialization across sectors such as automotive, construction, pharmaceuticals, and personal care further fuels demand for tailored specialty chemicals. Additionally, technological innovations, the adoption of bio-based and green chemicals, and the shift toward circular economy practices are shaping market growth and competitiveness in the region.

Germany

Germany has the largest market for specialty chemicals in Europe based on its sophisticated industrial infrastructure and significant investments in research and innovation. There is also significant demand for specialty chemicals from Germany's automotive, engineering, and industrial sectors. Furthermore, Germany's commitment to precision chemicals, sustainable production methods, and advanced material technologies contribute to its dominant position in Europe.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is witnessing an opportunistic rise in the specialty chemicals market due to increasing industrialization, expanding manufacturing sectors, and growing demand from industries such as automotive, construction, agriculture, and personal care. Rising investments in infrastructure, urbanization, and the adoption of advanced chemical solutions for efficiency and sustainability further drive market growth. Additionally, government initiatives promoting industrial modernization and foreign direct investment are creating new opportunities for specialty chemical players in the region.

Brazil

Brazil leads the specialty chemicals market in Latin America due to the high level of demand for specialty chemicals from the agricultural, construction, and consumer sectors. The large size of the country's domestic market and increased emphasis on value-added chemicals in Brazil has resulted significant uptick in chemical consumption. New investments in industrial development and increased production of specialty chemicals in Brazil will likely continue to help strengthen the country's role as the primary growth driver in the region.

What Drives the Specialty Chemicals Market in the Middle East & Africa?

The market in the Middle East & Africa is driven by rapid industrialization, expanding oil & gas, construction, and automotive sectors, and the increasing demand for high-performance and sustainable chemical solutions. Investments in infrastructure development, water treatment, and agrochemicals further support market growth. Additionally, government initiatives promoting industrial diversification, technological innovation, and environmentally friendly products are fueling the adoption of specialty chemicals across the region.

Saudi Arabia

Saudi Arabia has the dominant position in the specialty chemicals market within the Middle East and Africa as a result of the country's expanding economy and ongoing efforts to diversify industries. Strong investment in construction and energy transition projects, as well as downstream chemical processing, is helping to support growing levels of demand for specialty chemicals. In addition, emphasis on value-added manufacturing and advanced material development by the Kingdom of Saudi Arabia further ensures that it will maintain its leadership position within the region.

Value Chain Analysis for Specialty Chemicals Market

- Suppliers of Raw Materials: Raw materials consist of primary feedstocks or components like minerals, biomass, and petrochemicals used to produce specialty chemicals. Raw materials ensure consistency of quality, supply, and pricing for companies that purchase them to produce downstream chemicals.

Key Players: BASF SE, Dow Chemical Co., Saudi Aramco, ExxonMobil, and LyondellBasell Industries. - Specialty Chemicals Manufacturers: Manufacturers create specialty chemicals from raw materials through research and development, synthesis, and formulation to meet the required performance criteria for specific applications. Manufacturers also use innovative processes and techniques to produce specialty chemicals.

Key Players: Clariant AG, Galaxy Surfactants Ltd., Solenis, Arkema S.A., and Heubach Colorants India Ltd. - Formulation and Development: Some manufacturers take specialty chemicals and combine them with other specialty chemicals to produce a custom blending or formulation for niche applications such as coatings, oilfield additives, or pharmaceuticals, which are all areas where technical expertise should be used to determine the correct approach to create value.

Key Players: Evonik Industries AG, Croda International plc, Dow Performance Silicones, Albemarle Corporation, and Solvay SA. - Logistics and Distribution: The logistics companies act as intermediaries between manufacturers and customers, providing warehouse and transportation/storage solutions, and supply chain services, and providing regulatory compliance support to ensure timely delivery of specialty chemicals to customers.

Key Players: Helm AG, Univar Solutions Inc., Brenntag AG, Azelis Holding S.A., and ICC Chemicals. - End Users: Final customers consist of companies or industries that utilize specialty chemicals either by using them in their final product or as a component of their final goods, such as in consumer products, construction, and agriculture. Specialty chemicals improve the functionality and value of the end products.

Specialty Chemicals Market Companies

- Lanxess AG: A global specialty chemicals company known for its high-performance plastics, additives, and intermediates, crucial for various industries including automotive and electronics.

- Evonik Industries AG: One of the world's largest specialty chemicals companies, recognized for its innovative products that enhance sustainability and efficiency across multiple sectors.

- Clariant AG: A specialty chemicals company that develops sustainable solutions and high-performance products, playing a vital role in agriculture, automotive, and personal care industries.

- Solvay SA: An advanced materials and specialty chemicals global leader, driving innovation in sectors like healthcare, electronics, and energy while emphasizing sustainability.

Other Major Key Players

- BASF SE

- Bayer AG

- Dow, Inc.

- Albemarle Corporation

- Huntsman International LLC

- Sumitomo Chemical Company

- Nouryon

- Ashland LLC.

- Merck & Co., Inc.

- Henkel Ag & Co. KGAA

- Sasol Limited

- 3M

- PPG Industries Inc.

- Koninklijke DSM N.V.

- B. Fuller

Leaders' Announcements

- In December 2024, Zhigang Miao, Clariant's Global Head of Polymer Solutions, Additives Polymer Solutions, talked about the company's partnership with Beijing Tiangang Auxiliary Co., Ltd;

"The company is thrilled to collaborate with Beijing Tiangang to the next level by starting on a second production line in Cangzhou today."

- In September 2024, Andrea Jara, Global Commercial Director at Rhodia, made a statement on the company's collaboration with MCassab Group;

"The company is excited about this collaboration, which focuses on the company's goals of getting closer to the pet care industry. Both Augeo Clean Multi and Hexylene Glycol solvents are already known brands in the globe in the home and personal care firms, and the company is sure that both of the solvents will bring spectacular advantages to the well-being of pets."

Recent Developments

- June 13, 2025- DCM Shriram Industries announced the acquisition of Hindusthan Speciality Chemicals for 375 crores (approximately US$45 million), marking its strategic entry into the advanced materials and specialty chemicals segment. This move enhances DCM's footprint in specialty chemical manufacturing and facilities expansion into high-value products such as specialty intermediates and polymers. The deal is expected to drive innovation, diversify revenue streams beyond agrochemicals and fertilizers, and strengthen the company's long-term position in a competitive market.

- Swiss specialty chemicals company Clariant delivered better-than-expected financial results in Q2 2025. With adjusted EBITDA rising 3% year over year to CHF 169 million, outperforming analyst projections of CHF 164 million. This growth was largely driven by strong performance in its catalysts and additives division, which offset weakness in the care chemicals segment. Clariant reiterated its profit margin guidance of 17-18% for full year 2025, although it lowered its sales growth outlook to 1-3% in local currency, citing macroeconomic headwinds and trade uncertainties. The results underscore the resilience of specialty chemicals demand in industrial applications and Clairiant's strategic focus on value-added verticals.

Specialty Chemicals Market Segments Covered in the Report

By Product Type

- Construction & Infrastructure Chemicals

- Concrete Admixtures

- Waterproofing Chemicals

- Sealants & Adhesives

- Protective & Decorative Coatings

- Repair & Rehabilitation Chemicals

- Flooring Chemicals

- Automotive & Transportation Chemicals

- OEM & Refinish Coatings

- Automotive Adhesives & Sealants

- Lubricant Additives

- Fuel Additives

- Rubber & Plastic Processing Chemicals

- Surface Treatment Chemicals

- Electronics & Semiconductor Chemicals

- Semiconductor Process Chemicals

- Electronic Specialty Gases

- Photoresists & Ancillaries

- PCB Chemicals

- Display Panel Chemicals

- Electronic Cleaning & Etching Chemicals

- Industrial Manufacturing Chemicals

- Industrial Adhesives

- Industrial Coatings

- Metal Treatment Chemicals

- Corrosion Inhibitors

- Industrial Cleaning Chemicals

- Process Chemicals & Catalysts

- Oil & Gas Chemicals

- Drilling & Completion Chemicals

- Production Chemicals

- Refining Chemicals

- Pipeline & Flow Assurance Chemicals

- Enhanced Oil Recovery (EOR) Chemicals

- Agrochemical Specialties

- Crop Protection Formulations

- Adjuvants & Surfactants

- Soil Treatment Chemicals

- Seed Treatment Chemicals

- Specialty Nutrient Formulations

- Pharmaceutical & Healthcare Chemicals

- Active Pharmaceutical Ingredient (API) Intermediates

- Pharmaceutical Excipients

- Bioprocess Chemicals

- Diagnostic Reagents

- Medical Device Coatings & Chemicals

- Personal Care & Cosmetics Ingredients

- Emollients & Conditioning Agents

- Surfactants & Cleansing Agents

- Active Cosmetic Ingredients

- Fragrances & Aroma Chemicals

- Preservatives & Stabilizers

- Food & Beverage Specialty Ingredients

- Food Additives

- Flavor Enhancers

- Food Preservatives

- Processing Aids

- Nutraceutical Ingredients

- Water & Wastewater Treatment Chemicals

- Coagulants & Flocculants

- Biocides & Disinfectants

- Scale & Corrosion Inhibitors

- pH Control Chemicals

- Membrane Treatment Chemicals

- Textile & Apparel Chemicals

- Dyeing & Printing Chemicals

- Finishing Chemicals

- Textile Auxiliaries

- Fiber Treatment Chemicals

- Performance Enhancement Chemicals

- Pulp, Paper & Packaging Chemicals

- Pulping Chemicals

- Bleaching Chemicals

- Paper Coating Chemicals

- Wet-End Chemicals

- Packaging Barrier & Functional Coatings

- Mining & Mineral Processing Chemicals

- Flotation Chemicals

- Grinding Aids

- Extractants & Solvent Reagents

- Dust Suppression Chemicals

- Tailings Treatment Chemicals

- Energy & Power Generation Chemicals

- Boiler Water Treatment Chemicals

- Cooling Water Treatment Chemicals

- Fuel Treatment Chemicals

- Emission Control Chemicals

- Turbine & Equipment Protection Chemicals

- Specialty Polymers & Additives

- Performance Polymers

- Plastic Additives

- Rubber Additives

- Polymer Modifiers

- Specialty Resins

By End-Use Industry

- Construction & Infrastructure

- Automotive & Transportation

- Electronics & Semiconductors

- Industrial Manufacturing

- Oil & Gas

- Agriculture

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Food & Beverage

- Water & Wastewater Management

- Textiles & Apparel

- Pulp, Paper & Packaging

- Mining & Metals

- Power & Energy

- Home, Institutional & Commercial

By Form

- Liquid

- Solid

- Powder

- Granules

- Paste / Gel

- Dispersion / Emulsion

By Sales Channel

- Direct Sales

- In-Direct Sales

By Regional

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting