October 2024

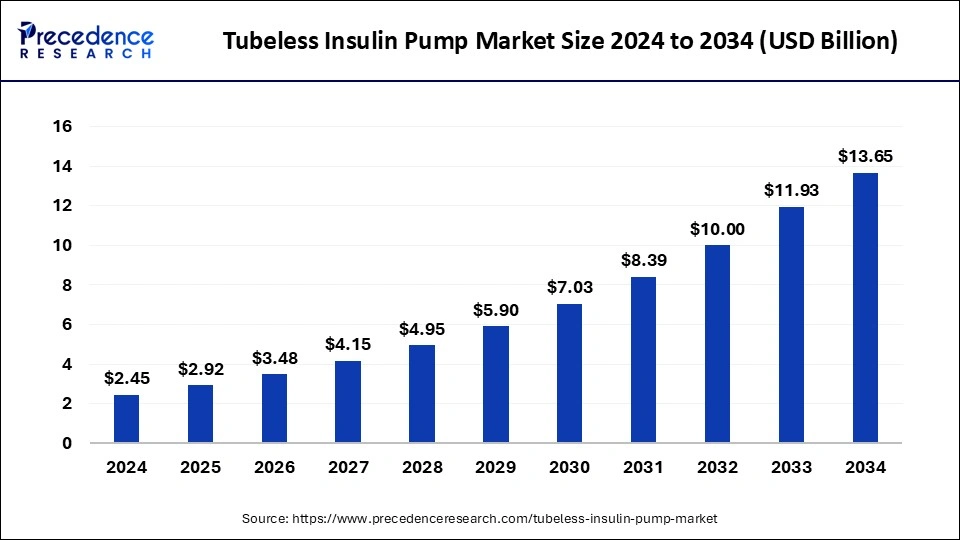

The global tubeless insulin pump market size accounted for USD 2.92 billion in 2025 and is forecasted to hit around USD 13.65 billion by 2034, representing a CAGR of 18.74% from 2025 to 2034. The North America market size was estimated at USD 1.35 billion in 2024 and is expanding at a CAGR of 18.82% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global tubeless insulin pump market size accounted for USD 2.45 billion in 2024 and is predicted to increase from USD 2.92 billion in 2025 to approximately USD 13.65 billion by 2034, expanding at a CAGR of 18.74%.

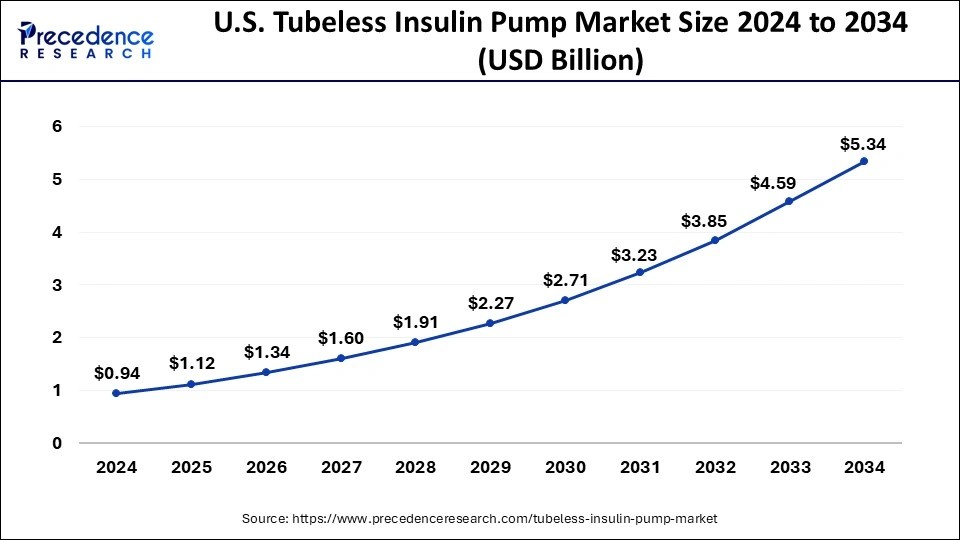

The U.S. tubeless insulin pump market size was exhibited at USD 0.94 billion in 2024 and is projected to be worth around USD 5.34 billion by 2034, growing at a CAGR of 18.97%.

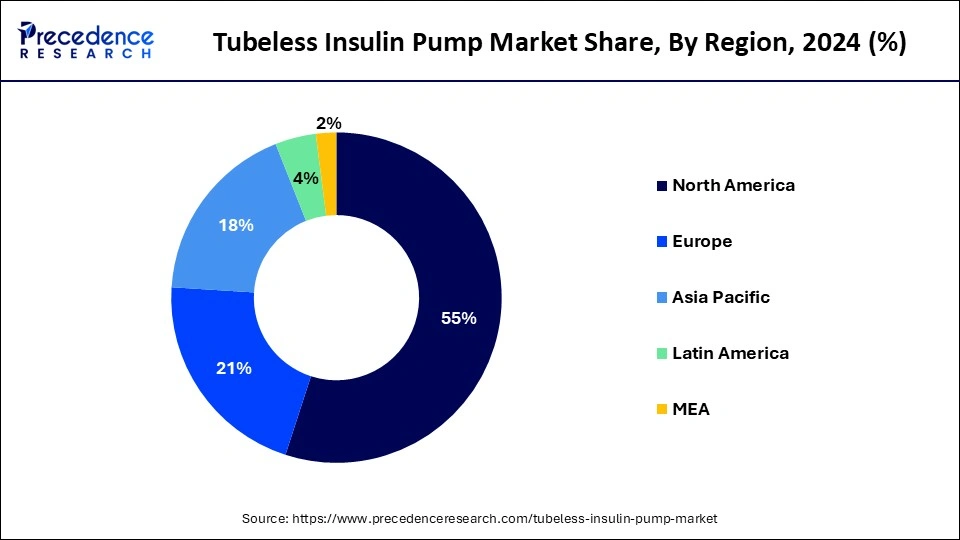

North America led the global market with the highest market share of 55% in 2024. The region is observed to sustain the position throughout the forecast period. The presence of prominent market players drives the region's growth focused on developing tubeless insulin pumps, rising healthcare expenditure, rising burden of diabetes, increasing government awareness of diabetes campaigns, growing need for portable devices, presence of sophisticated healthcare facilities, rising research and development activities, rapid improvements in technology, and rising adoption of tubeless insulin pumps.

The United States is the major contributor to the tubeless insulin pump market due to various reasons, including the increasing introduction of innovative and compact diabetes devices, the increasing number of patients who prefer tubeless insulin pumps, rising product approvals by various regulatory organizations, technological advancement in diabetic management products, rising geriatric population, rising disposable income, and increasing prevalence of diabetes.

Asia Pacific’s tubeless insulin pump market is expected to grow at the fastest pace during the forecast period. The region’s growth is expected to expand with increasing cases of diabetes, rising government initiatives to spread awareness regarding diabetes and increasing investment in the healthcare infrastructure. Furthermore, the market is observed to grow with the rising acceptance of advanced technology, significant economic growth, and rising strategic initiatives and product innovations. Such factors are expected to fuel the demand for the tubeless insulin pump in the region. China and India are the leading marketplaces for tubeless insulin pumps.

The tubeless insulin pump market offers handheld device that is designed to control the blood glucose level. Tubeless insulin pumps are lightweight, tiny, and unobtrusive. These devices are cost-effective and are easy to use on the human body. These are widely used to decrease the need for regular injections. It includes components, namely pod/patch and remote, and accessories such as reservoirs, batteries, and others. The pump tubeless insulin inserts through a device and enters the skin at the push of a button. An individual can also wear it on their body. Patients with diabetes prefer tubeless insulin pumps to manage their disease by delivering a consistent supply of insulin to the body without the need for traditional insulin injections.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 18.74% |

| Market Size in 2025 | USD 2.92 Billion |

| Market Size by 2034 | USD 13.65 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Component, and End-users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of diabetes

The rising prevalence of diabetes across the globe is expected to accelerate the adoption of tubeless insulin pump systems for the management of disease, driving the growth of the tubeless insulin pump market. Diabetes is a common and lifelong disease. Type 1 diabetes is becoming more common globally. At the regional level, the highest rate is 9.3 percent in North Africa and the Middle East, and that number is anticipated to increase to 16.8 percent by 2050. The rate in Latin America and the Caribbean is anticipated to increase to 11.3 percent. Major market players emphasize developing innovative technologies incorporated into tubeless insulin pump devices, which can be easily used at home with accurate results and are anticipated to fuel the market’s revenue during the forecast period.

High cost

The high cost associated with tubeless insulin pumps is anticipated to hamper the market's growth. The high cost of tubeless insulin pumps discourages individuals from purchasing and less product accessibility in middle and lower-income countries. In addition, the lack of healthcare services in low-income countries may restrict the expansion of the global tubeless insulin pump market.

Rising concerns over obesity

The rising obesity and geriatric population are anticipated to offer lucrative opportunities for the expansion of the tubeless insulin pump market during the forecast period as the obese and aging populations are more susceptible to Diabetes. Tubeless insulin pumps are small, lightweight, portable, and effective to use in aging diabetic patients, and type 1 diabetes patients highly use them. The increasing number of diabetes cases in the aging population increases the demand for diabetes management devices. The burden of obesity is critical because it is associated with various chronic diseases, including type 2 diabetes, stroke, heart disease, arthritis, some cancers, and others. Therefore, the rise in the obesity and geriatric population led to an increasing acceptance of tubeless insulin pumps.

The insulin patch pump segment held the largest share of the tubeless insulin pump market in 2024. The segment is also projected to continue its dominance over the forecast period. Patch pumps are small, directly attached to the skin, require less supervision, and have built-in innovative technology. Patch pumps are connected to the body for blood glucose management. Insulin patch pumps are more effective devices than traditional pumps as they are easy to use, cost-effective, and relatively smaller. Traditional via-syringe combinations are gradually being replaced by advanced technology developments, such as insulin patch pumps. Such supportive factors are expected to drive the tubeless insulin pump market’s revenue during the forecast period.

The pod or patch segment held the largest share of the tubeless insulin pump market in 2024, which is expected to sustain the position throughout the forecast period. Rapid technological advancement and continuous improvement in function and pod size have occurred. The innovative design to control pump functions is tubeless and has a remote control. In addition, pumps are integrated with calculators that assist in determining the exact insulin dosage patients require, which reduces the overdosage of insulin. On the other hand, the accessories segment is expected to grow significantly during the forecast period.

The hospital segment stood as a dominating share in 2024 for the tubeless insulin pump market due to the accessibility of well-skilled medical staff and healthcare professionals, which assists in establishing better interaction with the patient and the easy availability of tubeless insulin pumps. The availability of huge patient-base at hospitals that require continuous treatment for diabetes opens up a sustained opportunity for the segment to continue its growth.

The e-commerce segment is expected to grow at a notable rate during the forecast period. The robust growth of the e-commerce sector is facilitated by highly attractive economic benefits offered to customers by these channels rather than purchases through the offline channels. The market has witnessed a rising customer preference to make purchases from e-commerce channels due to the wide range of product availability and offers of attractive discounts and various other associated benefits.

By Type

By Component

By End-users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

December 2024

August 2024

January 2025