May 2024

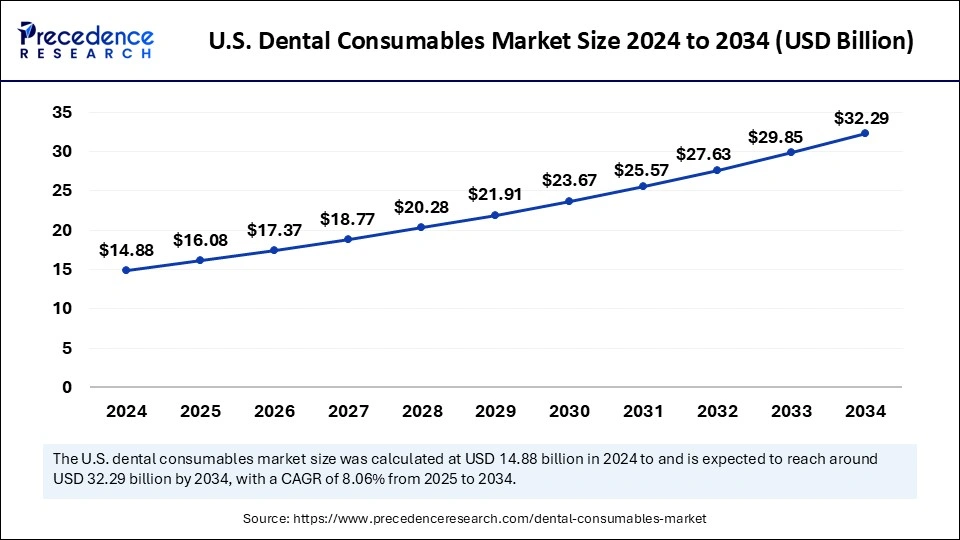

The U.S. dental consumables market size is calculated at USD 16.08 billion in 2025 and is forecasted to reach around USD 32.29 billion by 2034, accelerating at a CAGR of 8.06% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. dental consumables market size was estimated at USD 14.88 billion in 2024 and is predicted to increase from USD 16.08 billion in 2025 to approximately USD 32.29 billion by 2034, expanding at a CAGR of 8.06% from 2025 to 2034. The demand for dental consumables in the country is increasing due to the rising prevalence of dental disorders, leading to advancements in dental solutions.

The United States of America is widely popular for its technological infrastructure, which is being used in various industries, including healthcare. The rise of Artificial Intelligence has been playing an influential role in improving imaging like Cone-beam computed tomography (CBCT) scans, intraoral imaging, and others, which help to detect oral diseases. The use of AI is also being implemented in predictive modelling which helps in aligning treatments that would reduce the treatment duration and costs too. Additionally, the growing demand for personalized medicine is anticipated to boost the growth of the U.S. dental consumables market, which will allow AI to plan treatment plans for patients based on their profile and medical history.

Dental consumables are products and materials designed for dental procedures during patient treatments. There are various types of products like fluoride gels, varnishes, pastes, fillings, and many others that are used in various dental procedures. The U.S. dental consumables market is growing rapidly due to the rising demand for dental treatments, which help citizens maintain their oral health.

| Report Coverage | Details |

| Market Size by 2034 | USD 32.29 Billion |

| Market Size in 2025 | USD 16.08 Billion |

| Market Size in 2024 | USD 14.88 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.06% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End-User. |

Rising aging population

In 2023, the population of people in the United States aged 65 and older accounted for 59.2 million, which is an increase of 9.4% from 2020. This population is most likely to develop diseases like edentulism, i.e., tooth loss, tooth decay, and others. This is playing a crucial role in developing the demand for implants, dentures, and other consumables, which will boost the growth of the U.S. dental consumables market.

Companies in the U.S. are also focused on improving healthcare facilities for the geriatric population, which will boost advancements in technologies like CAM, CAD, and others. The population is anticipated to grow more rapidly which is witnessing more advancements in the market, creating more opportunities in the coming years.

Increasing oral health awareness

The growing digitalization in the country is playing an influential role in educating the youth and the adult population regarding oral health. Awareness plays a crucial role in communicating the benefits of oral health which would help in the prevention of severe diseases like oral cancer and other systemic diseases too. This is leading to increasing visits to dental clinics and hospitals, which would require consumables regularly. The U.S. dental consumables are growing more rapidly due to the rise of remote healthcare, where patients are more likely to visit professionals for various treatments like antimicrobial mouthwashes and many others.

Higher costs of dental care

The dental industry in the United States is anticipated to face several challenges that could affect its growth due to many factors, which include limited coverage for dental care. Dental procedures in the country, like implants, bridges, and others, are higher in cost and are financially unaffordable for the low-income population. The clinics in the country also charge more due to the higher investments in equipment, technologies, and labor, which also adds up as a restraint in the U.S. dental consumables market. Additionally, the emergence of technologies like 3D imaging and others will also require higher costs, affecting growth.

Rising disposable incomes

The U.S. market is considered the fastest growing due to many factors like rising employment rates in the country which would increase the healthcare expenditure of the individuals. The U.S. dental consumables market is anticipated to grow rapidly due to the rising influence of social media platforms which is creating several opportunities in cosmetic dentistry. This is creating several opportunities for the professionals, too, which would help the infrastructure expansion. The market is anticipated to witness a rapid boost in private dental institutions which would mainly focus on dental hygiene and dental aesthetics. The rising spending capabilities are also anticipated to create a business environment for premium products.

The presence of leading organizations like the FDA is playing a crucial role in enhancing reliability in the healthcare sector. The U.S. dental consumables market is anticipated to grow more rapidly due to the increasing focus of these organizations, which would promote the use of biocompatible products. The states are also focusing on expanding the user base through improvements in preventive care. Additionally, the U.S. government is anticipated to spend on employment and research which would help in creating more professionals in the coming years.

The dental implants segment accounted for the highest revenue share in 2024. The production process aims to develop artificial teeth using titanium or zirconia and others, which are used as additional support for patients facing tooth loss. The U.S. dental consumables market is growing rapidly due to the aging population in the country, which faces regular cases of tooth loss. Additionally, the rising number of accidents and other injuries also contribute to the rising demand for implants. The U.S. is also witnessing advancements that would help patients benefit from permanent dental solutions. The rise of personalized medicine is anticipated to attract more patients which would help in improving patient satisfaction. The insurance companies in the country are also anticipated to expand their coverage in dental issues which would help towards more growth in the coming years.

The retail dental care essentials segment is expected to grow fastest during the forecast period. The growth of this segment is attributed to several factors: improved awareness of oral health, a higher prevalence of dental caries and other periodontal disorders, and an increase in awareness campaigns conducted by key companies and government agencies. Awareness of oral care can be largely credited to the efforts of dentists. Innovations in product technology have led to the creation of advanced and user-friendly oral care products, including electric toothbrushes, artificial intelligence-enabled toothbrushes, and vibrating toothbrushes. The technological advancements in toothbrushes play a crucial role in driving market growth.

The dental hospitals and clinic segment stood the dominant by contributing to the largest revenue share in 2024. The dominance of the segment is attributed to the high patient volume of these clinics due to the availability of advanced dental consumables. The growing number of dental clinics around the country is anticipated to boost the growth of the U.S. dental consumables market in the upcoming years. The growing number of dental professionals in the country will help in improving dental solutions in the country. The increasing investments by the leading healthcare organizations in the country are anticipated to boost growth due to the emergence of advanced imaging and many more.

The dental laboratory segment is expected to grow the fastest during the forecast period. Periodontal disease and dental caries are the most common oral health issues worldwide, affecting over half of the population. Various governments and organizations, including the World Health Organization (WHO), are implementing initiatives to improve oral health across the globe. Dental consumables are widely used in laboratories to discover and develop new products. Rapid advancements in dental laboratory technologies, such as the use of bone morphogenic proteins and hydroxyapatite coatings in implant materials, have significantly transformed oral procedures. Extensive research is being conducted to facilitate the launch of new products in the dental consumables market.

By Product

By Material

By End User

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

February 2024

April 2025

April 2025