May 2024

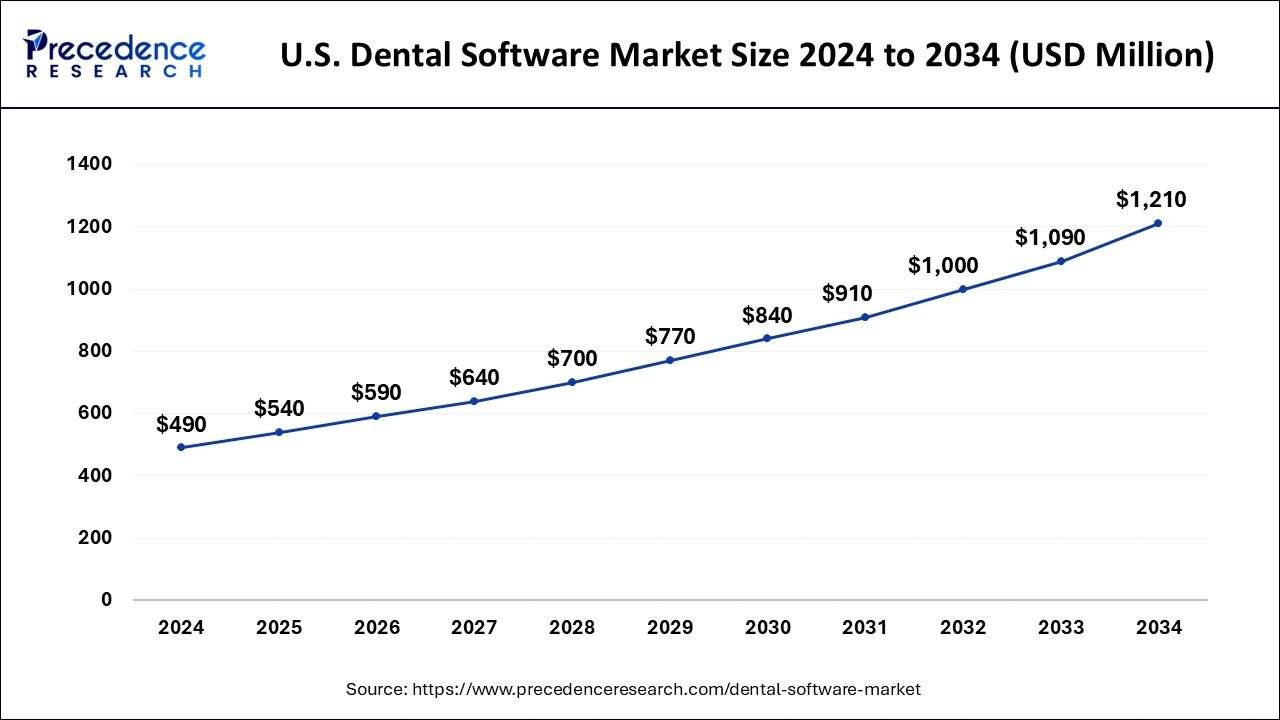

The U.S. dental software market size is evaluated at USD 540 million in 2025 and is forecasted to hit around USD 1,210 million by 2034, growing at a CAGR of 9.46% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. dental software market size was calculated at USD 490 million in 2024 and is predicted to increase from USD 540 million in 2025 to approximately USD 1,210 million by 2034, expanding at a CAGR of 9.46% from 2025 to 2034. Growing due increasing adoption of digital solutions for efficient practice management and improved patient care.

In the United States, intelligent technology is reshaping the dental software landscape by enhancing diagnostic accuracy, streamlining administrative workflows, and improving patient engagement. Through sophisticated image analysis machine learning-powered tools now help dentists identify early indicators of oral health problems greatly lowering human error and enhancing treatment planning.

These developments are particularly beneficial in fast-paced environments where accuracy and efficiency are essential. With smart systems automating billing insurance verification and appointment scheduling administrative tasks are also benefiting. This not only reduces manual labor but also minimizes delays and errors in practice management. U.S.-based dental service organizations that manage multiple locations are increasingly adopting such tools to maintain consistency and optimize operations across their networks.

Dentists can now use decision support tools to analyze patient behavior and history to create individualized treatment plans. Both large dental groups and private practices are adopting this strategy to enhance patient relationships and achieve better results. Practices are using secure platforms that allow for real-time collaboration while safeguarding sensitive data in response to the stringent HIPAA regulations the future of the United States is being shaped by intelligent software as digital adoption increases. U.S. dental care by improving its efficiency, connectivity, and patient-centeredness.

The U.S. dental software market is evolving rapidly, propelled by the increasing digitization of dental practices and the growing demand for integrated cloud-based solutions. To improve patient care and operational efficiency dental offices are implementing all-inclusive platforms that integrate imaging billing analytics and electronic health records (EHR).

Leading businesses at the vanguard of this change include Henry Schein One and NextGen Healthcare. Henry Schein One, a joint venture between Henry Schein and Internet Brands, provides integrated dental technology solutions including cloud-based practice management software like Dentrix Ascent.

The market is also seeing a surge in demand for advanced analytics and artificial intelligence tools which allow practices to optimize decision making and improve patient outcomes. Before this NextGen Healthcare was founded as a dental software company but it has since expanded its offerings to include EHR and practice management systems. As more dental offices adopt digital transformation in the U.S. the market for dental software is expected to continue growing and innovating.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,210 Million |

| Market Size in 2025 | USD 540 Million |

| Market Size in 2024 | USD 490 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.46% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Deployment, End User, and Regions |

Technological Advancements in Dental Care

Innovations like intraoral cameras and AI-based radiograph analysis tools are now integrated with dental software. Invasive procedures are less necessary thanks to these integrations which aid in earlier and more accurate diagnosis. Even small companies are investing in technology as it becomes more affordable. To keep up with the rapidly changing dental technology software companies need to continuously update their interfaces and compatibility. Smart dental chairs and voice-activated software are also starting to increase clinic efficiency and ergonomics. Patients are having a more comfortable and engaging experience thanks to these innovations which are also improving clinical outcomes.

Regulatory Compliance and Security Needs

To guarantee data security dental software providers are now incorporating multi-factor authentication and cutting-edge encryption techniques. Automated documentation assistance and compliance checks lower the chance of audits and fines. Accountability is enhanced by features like consent tracking audit logs and access monitoring. Secure software is a top priority for practices that will better address patients' growing concerns about data privacy.

To avoid human error, which continues to be one of the most frequent reasons for data breaches, organizations are also implementing cybersecurity training for employees. In addition to reducing legal risks, this proactive approach to compliance and security builds patient trust.

In March 2025, the Centers for Disease Control and Prevention (CDS) initiated a national campaign to raise awareness about oral health, emphasizing the importance of regular dental visits and the adoption of digital tools in practice management. The campaign aims to educate both providers and patients about the benefits of modern dental solutions.

Complexity and Training Requirements

Staff members may find it difficult to learn dental software particularly when it incorporates several features like scheduling billing and patient management. Because of their complexity, these systems frequently have a steep learning curve which can cause operations to lag during the transitions.

Errors, inefficiencies, and even mistakes in patient care can result from inadequate training or inappropriate system use. Employees may also be resistant to change, especially if they are accustomed to using simpler older techniques. To ensure optimal usage ongoing training and assistance are necessary but this may lengthen the time and cost required for systems adoption in its entirety.

Ongoing Maintenance and Updates

Even cloud-based dental software needs regular upkeep to function properly. Optimal functionality requires regular software updates, security patches, and troubleshooting. Updates, however, can occasionally cause operational disruptions by necessitating installation downtime which may impact patient appointments or billing cycles. Additionally, software defects or malfunctions may cause problems for dental offices impeding their ability to function. Premium support or updates may come with additional fees depending on the software provider. These expenses can mount up quickly, particularly for smaller practices with limited funding.

Integration with Wearable Devices

Dental software has a great chance to integrate with wearable health technology which is becoming more and more popular. Fitness trackers and smart toothbrushes are examples of wearable technology that can offer useful information about a patient's oral health practices. Dental offices can provide more individualized guidance, monitor patient progress, and promote improved oral hygiene habits by incorporating this data into dental management systems. Wearable technology and dental care are combining to form a new industry with enormous growth potential.

Mobile and Cloud Solutions

The demand for cloud-based and mobile software solutions is rising as dental offices continue to modernize. Flexible tools that enable them to track patient records, manage appointments, and perform administrative duties remotely are becoming more and more sought after by practices. Mobile applications that let dentists update treatment plans interact with patients from a distance and access patient data while on the go are becoming more and more important. Additionally, cloud-based solutions are scalable so businesses can expand without being constrained by on-premise software.

By Type

Practice management software segment dominated the U.S. dental software market with the largest share in 2024 because of its vital role in daily administrative and clinical operations it unifies essential tasks like scheduling appointments billing treatment planning and reporting onto a single platform it is essential for both solo practices and major dental groups. Because of its capacity to optimize processes, lower manual error rates, and boost overall practice productivity, it is the preferred option nationwide.

Growing industry consolidation in the dental sector where dental service organizations are looking for standardized and scalable solutions is another factor driving demand. Furthermore, cloud-based access and dashboard customization are now available on many platforms improving flexibility and remote management. Because of its fundamental role in operations, this segment is anticipated to continue to lead as more practices shift to digital-first models.

Patient communication software segment is expected to grow at the fastest rate in the market motivated by the growing demand for real-time personalized interaction. Practices can now manage two-way messaging, collect feedback, schedule virtual consultations, and automate appointment reminders thanks to these solutions. Communication tools that improve accessibility and satisfaction are becoming more widely used as a result of the shift to a more patient-centric care model and the pervasive use of smartphones and digital platforms.

Dental offices are using these tools to increase patient loyalty and lower no-show rates in an increasingly cutthroat market. These days a lot of platforms have functions like online review requests, treatment, recall messages, and automated post-visit follow-ups. Communication-focused solutions are increasingly becoming an essential component of the contemporary dental experience as patients continue to demand transparency and convenience.

By Deployment

Web-based segment dominated the U.S. dental software market with the largest share in 2024 because of its widespread compatibility with current IT infrastructure and ease of use. Because they offer simple installation and maintenance and don't require large hardware investments web-based solutions are preferred by many dental practices. By enabling practitioners to manage records appointments and billing from any internet-enabled device these platforms frequently offer centralized control. Because of their dependability, strong data security and intuitive user interfaces they are a preferred option for mid to large-sized practices. Additionally, web-based systems provide easier integration with third-party programs such as insurance processing platforms prescriptions, and imaging tools which increase their usefulness in high-volume settings.

Cloud-based segment is expected to grow at the fastest rate in the market with an increased need for remote accessibility, scalability, and flexibility. As tele dentistry and hybrid work have become more prevalent these platforms enable practitioners to access patient record treatment plans and analytics from any location. These systems are cost-effective for startups and small clinics, as they don't require in-house servers or ongoing IT maintenance.

The provider usually takes care of data backup software upgrades and security procedures relieving the practice of continuous technical burdens. Furthermore, real-time collaboration across locations is supported by cloud solutions which is especially helpful for DSO overseeing several branches. As the healthcare industry undergoes a rapid digital transformation cloud adoption for dental software is anticipated to increase rapidly.

By End-user

Hospital segment dominated the U.S. dental software market with the largest share There is a high demand for comprehensive dental software solutions due to their extensive operations intricate patient databases and requirements for integrated systems. To facilitate seamless departmental communication these institutions usually invest in cutting-edge technologies that support multidisciplinary care including dental services.

Additional hospitals place a high priority on interoperability data security and regulatory compliance all of which increase the use of enterprise-level dental software. Newer digital tools can be integrated more quickly thanks to their increased financial resources. Furthermore, research institutes and teaching hospitals frequently take the lead in implementing innovation which strengthens this segment’s dominant position.

Dental clinics segment is expected to grow at the fastest rate in the market. The need for scalable affordable digital solutions is being fueled by the growth of private practices, growth of private practices, growth dental chains, and community-focused clinics. Cloud-based and mobile-friendly platforms are being adopted by these clinics more and more to improve patient experience, streamline operations, and stay competitive. The need to automate administrative processes to better manage patient relationships and provide contemporary services like online booking and teledentistry are additional factors driving technological adoption. Furthermore, several software providers are customizing their products for small to medium-sized clinics allowing them to use digital tools without having to invest in a large IT infrastructure or overhead. This segment’s growth is being accelerated by its accessibility.

Country-level Analysis

Considering a major shareholder in the overall healthcare sector, the United States is seen to sustain its dominance in the dental category in the upcoming period. This continued dominance is subscribed to the nation’s sophisticated healthcare system, the presence of major industry participants, and the ongoing adoption of cutting-edge technologies like artificial intelligence and cloud-based dental practices.

The nation's competitive advantage is further strengthened by growing dental insurance coverage, improved oral health awareness, and supportive government regulations. As funding for patient-centered care and digital transformation increases the U.S. Strategic and steady growth is anticipated in the dental software market.

Further driving innovation in practice management systems are the consolidation of dental service organizations (DSOs) and the move to value-based care. Additionally, strategic partnerships between dental providers and technology companies are improving patient engagement and optimizing operations. The U.S. market keeps establishing international standards and establishing itself as a pioneer in the rapidly changing field of dental technology.

By Type

By Deployment

By End User

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

April 2025

April 2025

February 2025