What is the Ophthalmology Market Size?

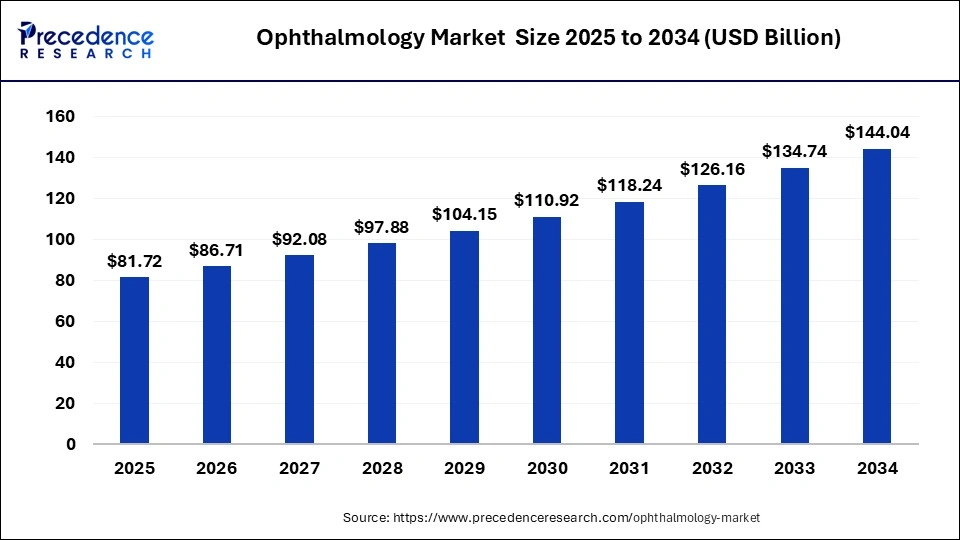

The global ophthalmology market size is valued at USD 81.72 billion in 2025 and is predicted to increase from USD 86.71 billion in 2026 to approximately USD 144.04 billion by 2034, growing at a CAGR of 6.4% from 2025 to 2034.

Ophthalmology Market Key Takeaways

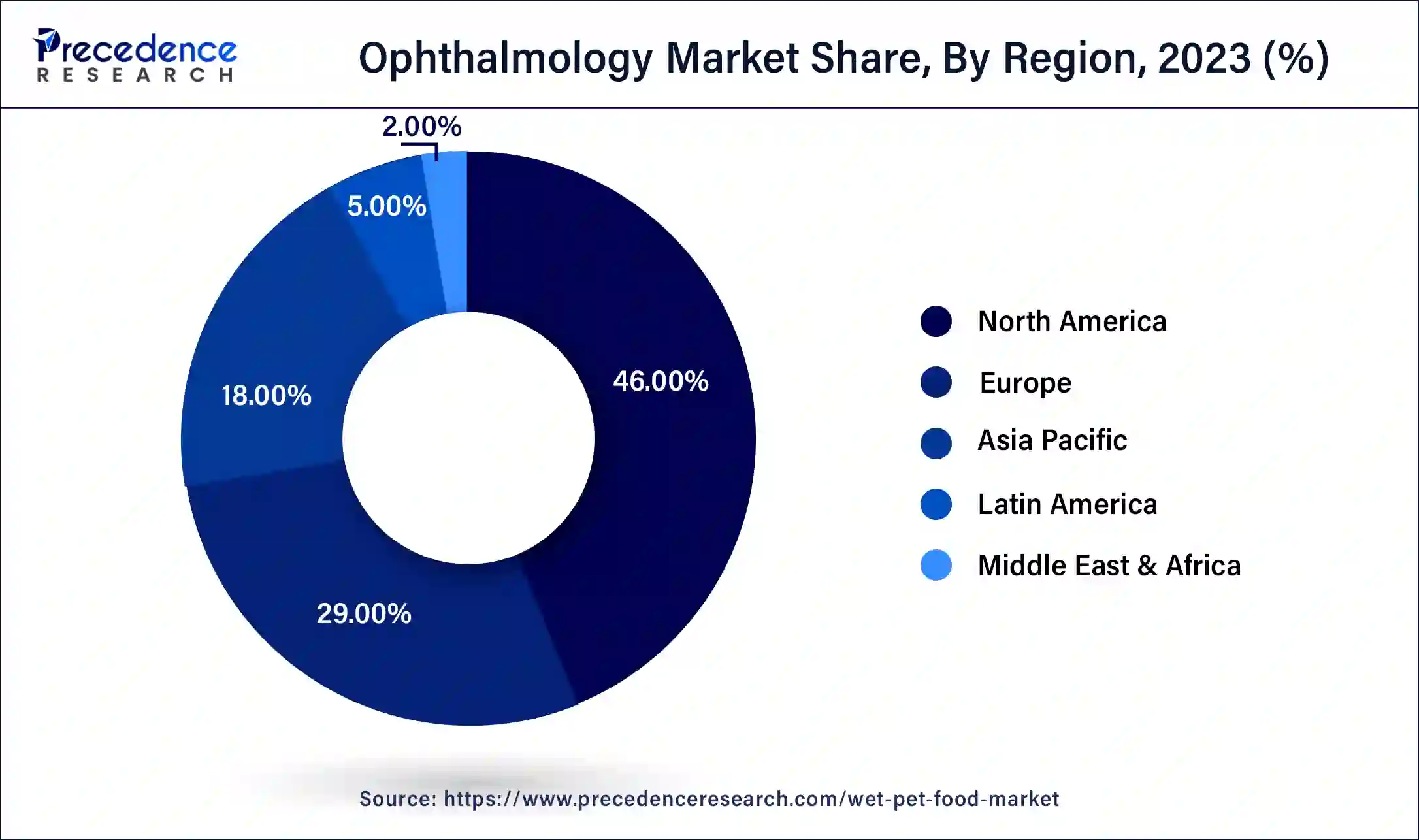

- North America contributed more than 46% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By product, the device segment has held the largest market share of 48% in 2024.

- By product, the drugs segment is anticipated to grow at a remarkable CAGR of 5.5% between 2025 and 2034.

- By disease, the glaucoma segment generated over 31% of revenue share in 2024.

- By disease, the cataract segment is expected to expand at the fastest CAGR over the projected period.

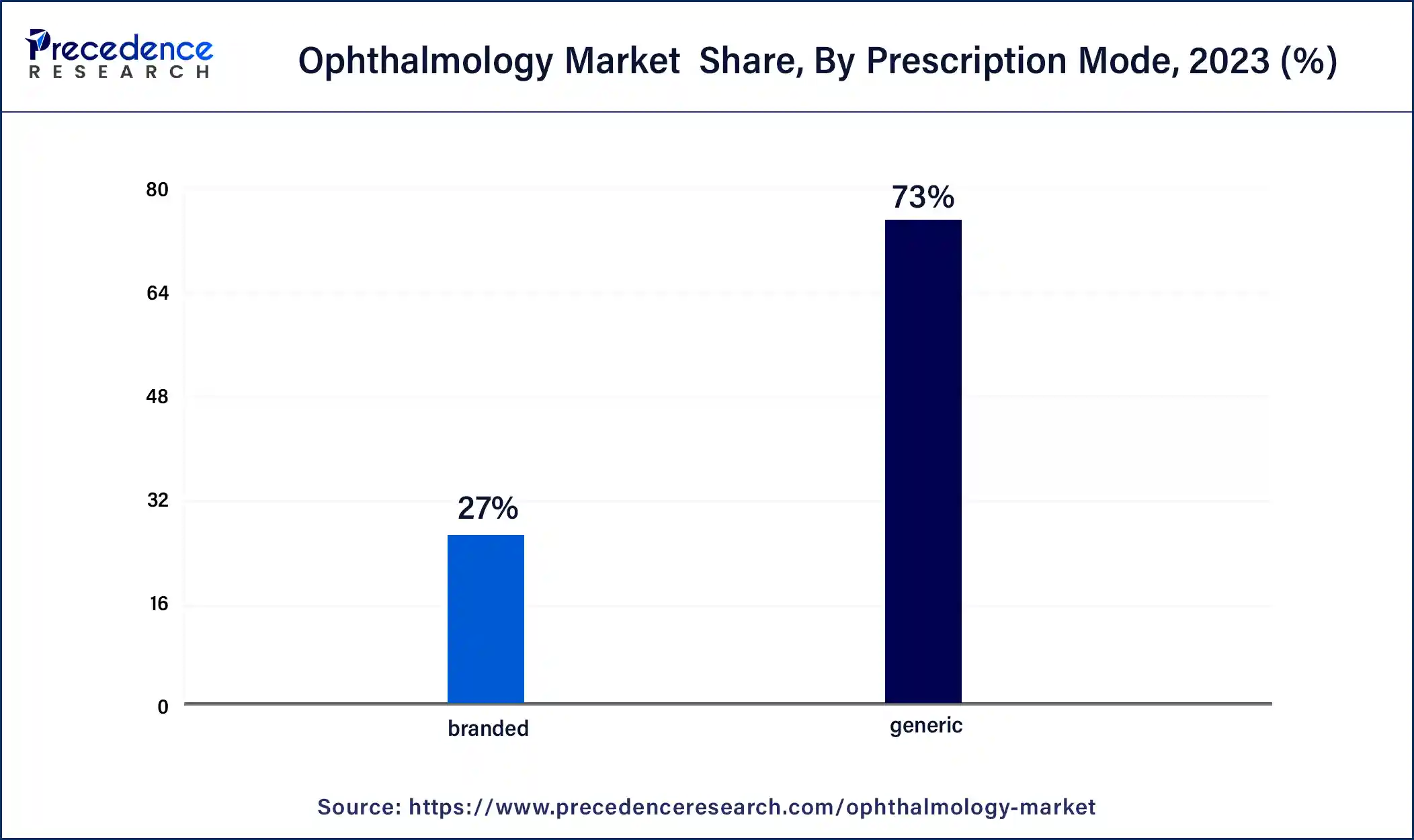

- By prescription mode, the generic segment had the largest market share of 73% in 2024.

- By prescription mode, the branded segment is expected to expand at the fastest CAGR over the projected period.

- By distribution channel, the direct tender segment generated over 42% of revenue share in 2024.

- By distribution channel, the retail sales segment is expected to expand at the fastest CAGR over the projected period.

- By end user, the hospitals segment generated over 51% of revenue share in 2024.

- By end user, the clinics segment is expected to expand at the fastest CAGR over the projected period.

The Visionary Move: Ophthalmology Market Overview

The ophthalmology market is a comprehensive sector dedicated to the study, diagnosis, and treatment of eye disorders and diseases. It encompasses a range of medical specialties, including optometry, ophthalmic surgery, and research in vision science. With a focus on visual health and well-being, the market addresses conditions such as cataracts, glaucoma, refractive errors, and retinal diseases. Advancements in surgical techniques, diagnostic technologies, and pharmaceutical interventions contribute to improving patient outcomes. The market plays a vital role in preserving and restoring vision, enhancing quality of life, and preventing vision-related complications through ongoing research, innovation, and medical care.

The ophthalmology market is characterized by continuous advancements in surgical procedures, diagnostic tools, and therapeutic interventions. It actively contributes to the preservation and enhancement of vision, addressing a spectrum of eye disorders, from common refractive errors to complex conditions requiring specialized medical attention. As an integral part of healthcare, the market is dedicated to improving patient outcomes, promoting visual health, and adapting to evolving technologies and treatment modalities.

Ophthalmology Market Growth Factors

- The growing incidence of eye disorders, including refractive errors and glaucoma, fuels the demand for ophthalmic treatments and services.

- The rise of telemedicine opens avenues for remote consultations and diagnostic services, especially in underserved regions.

- Tailoring treatments based on genetic and individual factors presents opportunities for personalized and more effective eye care.

- Strategic collaborations between pharmaceutical companies, healthcare providers, and research institutions foster innovation and market expansion.

- Untapped markets in developing regions offer potential for growth, supported by increasing awareness and affordability of eye care services.

- The incorporation of AI-driven solutions in diagnostics and treatment planning enhances efficiency and accuracy in ophthalmic care.

- Advancements in regenerative medicine, including stem cell therapy and tissue engineering, open new possibilities for treating various eye conditions and promoting tissue repair.

- The development of wearable devices for remote monitoring of eye health enables continuous tracking and early detection of changes, contributing to proactive eye care.

- The shift towards patient-centric care models emphasizes improved patient outcomes, experience, and engagement, fostering a more comprehensive and individualized approach to eye health.

- Collaborative efforts and initiatives focused on addressing preventable blindness and eye health disparities on a global scale contribute to sustainable market growth.

- Increasing awareness of the impact of environmental factors on eye health, such as digital screen exposure and pollution, drives demand for preventive measures and specialized eye care products.

Ophthalmology Market Outlook: Shaping The Future

- Industry Growth Overview: Increasing eye disorders, technological advancements, and an aging population are contributing to the industrial growth of the market.

- Major Investors: Venture capital firms, private equity firms, and strategic corporate investors are the major investors in the market.

- Startup Ecosystem: The startup ecosystem is focusing on the development of minimally invasive techniques, smart wearable devices, remote patient monitoring platforms, and advanced technologies for early disease diagnosis.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.4% |

| Market Size in 2025 | USD 81.72 Billion |

| Market Size in 2026 | USD 86.71Billion |

| Market Size by 2034 | USD 144.04 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Disease, By Prescription Mode, By Route of Administration, By Distribution Channel, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Prevalence of eye disorders and increasing healthcare awareness

The ophthalmology market is experiencing a surge in demand due to the confluence of two critical factors, the prevalence of eye disorders and the increasing healthcare awareness among the global population. As eye disorders such as myopia, diabetic retinopathy, and dry eye syndrome become more prevalent, individuals are seeking proactive and comprehensive eye care solutions.

The heightened healthcare awareness contributes to early diagnosis and treatment-seeking behavior, driving the demand for ophthalmic interventions and therapeutic solutions. Patients are increasingly recognizing the importance of regular eye check-ups and are inclined towards adopting advanced ophthalmic procedures. This growing awareness not only aids in the early management of eye conditions but also fuels the adoption of innovative technologies and treatments, propelling the overall growth of the ophthalmology market.

As a result, the market is witnessing an upsurge in demand for advanced diagnostics, surgical procedures, and pharmaceuticals, reflecting a positive trajectory in addressing and managing a spectrum of eye-related health issues.

Restraint

Shortage of skilled ophthalmologists and stringent regulatory processes

The ophthalmology market grapples with significant restraints, notably high treatment costs and stringent regulatory processes. Ophthalmic treatments and surgeries are often associated with substantial expenses, ranging from diagnostic procedures to surgical interventions. These high costs can pose a formidable barrier to accessibility, limiting the ability of certain patient demographics to afford essential eye care services. Affordability concerns may result in delayed or neglected treatments, impacting patient outcomes and restricting the overall market growth.

Stringent regulatory processes add another layer of complexity to the ophthalmology market. The approval and commercialization of new ophthalmic products, devices, and treatments involve navigating intricate regulatory frameworks. Compliance with these regulations demands substantial investments of time and resources, leading to prolonged development timelines and increased operational costs. This, in turn, may impede innovation and the timely introduction of advanced ophthalmic solutions to the market. The interplay of high treatment costs and stringent regulations creates challenges for market players, influencing both the availability and accessibility of cutting-edge ophthalmic technologies and therapies.

Opportunity

Rising geriatric population, global outreach and teleophthalmology

The rising geriatric population globally contributes significantly to the surge in demand for the ophthalmology market. As the elderly demographic expands, the prevalence of these eye-related issues rises, creating a growing market for ophthalmic treatments, surgeries, and innovative solutions to address age-related visual impairments. This demographic trend underscores the need for advanced technologies and therapies to cater to the specific eye care requirements of the elderly population.

Global outreach and teleophthalmology represent another crucial factor driving the market demand. Teleophthalmology initiatives enable remote diagnostics, monitoring, and consultations, breaking geographical barriers and providing access to eye care services in underserved regions. The integration of technology allows healthcare professionals to reach patients in remote areas, enhancing early diagnosis, preventive care, and overall eye health management on a global scale. This expansion of eye care services beyond traditional healthcare infrastructure contributes to the market's growth and aligns with the broader trend of leveraging technology for accessible and comprehensive healthcare solutions.

Product Insights

According to the product, the device segment has held a 48% revenue share in 2024. Ophthalmology devices cover a broad spectrum of tools and equipment utilized for diagnostics, surgical procedures, and vision correction. The current trends in ophthalmic devices revolve around technological breakthroughs, prominently theintegration of artificial intelligence for enhanced diagnostics heightened surgical precision, and the creation of devices that are more user-friendly and efficient, catering to the evolving needs of both practitioners and patients in the ophthalmology field.

The drugs segment is anticipated to expand at a significant CAGR of 12.8% during the projected period. Ophthalmic drugs play a crucial role in managing various eye conditions, from infections and inflammation to glaucoma and age-related macular degeneration. Trends also include a growing emphasis on developing targeted therapies, exploring gene therapies for inherited eye diseases, and enhancing the efficacy of existing drugs. The pharmaceutical segment of the ophthalmology market continually evolves to address diverse eye conditions through novel drug formulations and treatment modalities.

Disease Insights

Based on the disease, the glaucoma segment held the largest market share of 31% in 2023. Glaucoma is a group of eye conditions that damage the optic nerve, often due to elevated intraocular pressure. In the Ophthalmology Market, trends indicate a growing focus on early detection and intervention for glaucoma. Advancements in diagnostic tools, including innovative imaging technologies and pressure monitoring devices, enable ophthalmologists to detect glaucoma at earlier stages, fostering better management and preventing irreversible vision loss.

On the other hand, the cataract segment is projected to grow at the fastest rate over the projected period. Cataract refers to the clouding of the eye's lens, leading to vision impairment. In the ophthalmology market, trends highlight a surge in cataract surgeries, driven by an aging population and technological advancements in surgical techniques. The shift towards minimally invasive procedures, such as phacoemulsification, contributes to shorter recovery times and improved patient outcomes. Additionally, the use of premium intraocular lenses (IOLs) with advanced features, such as multifocality, gains traction for enhanced postoperative vision.

Prescription Mode Insights

In 2023, the generic segment had the highest market share of 73% on the basis of the prescription mode. Generic drugs are identical to their branded counterparts in terms of active ingredients, dosage, strength, and intended use. They often enter the market after the expiration of the branded drug's patent, providing cost-effective alternatives. The trend in the ophthalmology market reflects an increasing preference for generic medications, driven by their affordability and equivalent therapeutic efficacy. This shift fosters competition, lowering overall treatment costs and widening patient access to essential eye care medications.

The branded segment is anticipated to expand at the fastest rate over the projected period. Branded prescription medications in ophthalmology often represent innovative and proprietary formulations introduced by pharmaceutical companies. Branded drugs may feature unique delivery systems, formulations, or combinations of active ingredients, providing a competitive edge.

Trends in the market show a continuous focus on research and development by pharmaceutical companies to introduce novel branded medications with enhanced therapeutic benefits. While branded drugs can be more expensive than generics, they cater to specific patient needs and contribute to ongoing advancements in ophthalmic treatment options. The market dynamic involves a balance between the accessibility of generic drugs and the innovative offerings brought by branded medications.

Distribution Channel Insights

Based on the distribution channel, the direct tender segment held the largest market share of 42% in 2024. In the ophthalmology market, direct tender refers to the procurement process wherein healthcare providers, institutions, or government bodies invite bids from suppliers for the bulk purchase of ophthalmic products or services. This method aims to secure cost-effective deals, especially for essential items like diagnostic equipment or surgical instruments.

The trend in direct tenders involves increasing collaboration between healthcare institutions and manufacturers to negotiate favorable terms, streamline procurement processes, and ensure a reliable supply of ophthalmic products.

On the other hand, the retail sales segment is projected to grow at the fastest rate over the projected period. Retail sales in the ophthalmology market pertain to the distribution of eye care products directly to consumers through various outlets, such as optical stores, specialty eye care centers, and online platforms. A notable trend in retail sales involves the integration of technology, with online platforms offering virtual try-on services, personalized recommendations, and easy accessibility, enhancing the overall consumer experience in the ophthalmic retail sector.

End User Insights

Based on the distribution channel, the hospitals segment held the largest market share of 51% in 2024. Hospitals, equipped with specialized ophthalmic departments and surgical facilities, play a pivotal role in providing comprehensive eye care services, including surgeries and specialized treatments. The trend in hospitals involves the integration of advanced technologies like laser surgeries, robotic-assisted procedures, and teleophthalmology services to enhance precision, efficiency, and accessibility in eye care.

On the other hand, the clinics segment is projected to grow at the fastest rate over the projected period. Clinics, ranging from independent ophthalmic practices to specialized eye care clinics, contribute to the decentralization of eye care services.

The trend in clinics revolves around adopting modern diagnostic tools, personalized treatment plans, and patient-centric care approaches. Many clinics also focus on preventive eye health, emphasizing routine eye check-ups and early detection of conditions. Both hospitals and clinics are witnessing trends that prioritize a multidisciplinary approach, fostering collaboration between ophthalmologists, optometrists, and other healthcare professionals to provide holistic and specialized eye care services.

U.S. Ophthalmology Market Size and Growth 2025 To 2034

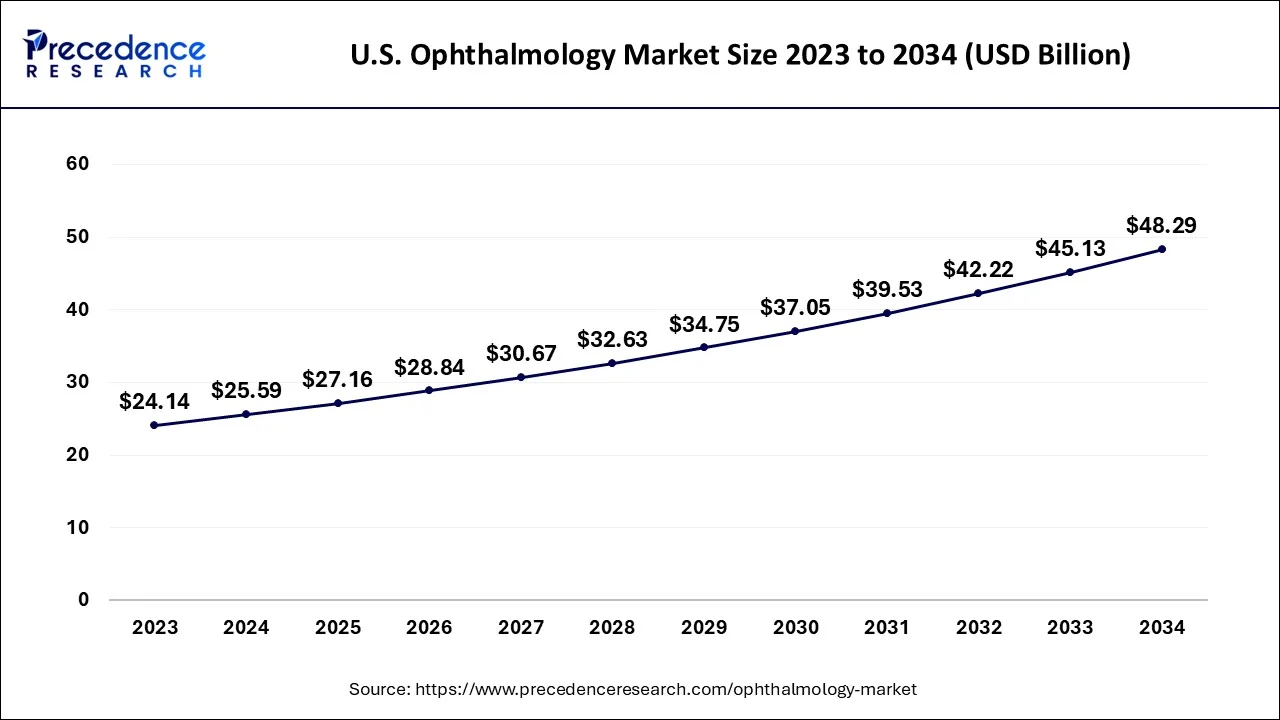

The U.S. ophthalmology market size is valued at USD 27.16 billion in 2025 and is expected to be worth around USD 48.29 billion by 2034, at a CAGR of 6.6% from 2025 to 2034.

North America has held the largest revenue share 46% in 2024. In North America, the ophthalmology market experiences a robust trend driven by advanced healthcare infrastructure, technological innovations, and high healthcare spending. The region boasts a significant prevalence of eye disorders, particularly age-related conditions, leading to a strong demand for ophthalmic diagnostics and treatments. Moreover, a proactive approach to healthcare and a well-established regulatory framework fosters the adoption of novel therapies and surgical interventions, positioning North America as a key player in the global ophthalmology market.

Asia-Pacific is estimated to observe the fastest expansion. In the region, the ophthalmology market is marked by a growing emphasis on eye health, driven by increasing awareness, rising disposable incomes, and improving healthcare access. The prevalence of eye diseases, including myopia and cataracts, is notable in this region, creating a substantial patient pool. The adoption of advanced ophthalmic technologies and treatments is on the rise, supported by expanding healthcare infrastructure and collaborations with global players. Additionally, teleophthalmology gains traction in remote areas, addressing accessibility challenges and contributing to the overall growth of the market.

Eye Diseases Fuel the U.S.

The increasing incidence of eye disorders is driving the use of ophthalmic care in the U.S. The presence of advanced healthcare provides a wide range of medications, diagnostics, and telehealth services, which is attracting patients. The growing technological innovations are also increasing the diagnostic and treatment options.

Expanding Healthcare Boosts India

India is experiencing an expansion in the healthcare sector, which is increasing the specialty ophthalmic hospitals, enhancing access to patients. The growing eye disorders due to the geriatric population and diabetes are also increasing their demand. Growing awareness and government initiatives are also increasing the use of their services.

Europe Leads with Advanced Healthcare

Europe is expected to grow significantly in the ophthalmology market during the forecast period, due to the presence of advanced healthcare infrastructure, which is providing advanced diagnostic and treatment services. The growing surgeries, reimbursement policies, and online platforms are enhancing the patient reliance on them. The increasing disorders and technological innovations are also contributing to the market growth.

Geriatric Population Driving UK Opportunities

The growth in the geriatric population is driving the market in the UK, increasing the demand for ophthalmic diagnostics and treatment options. Additionally, the growing outpatients and technological innovations are also increasing the use of various ophthalmic procedures and enhancing their advancements, respectively.

Ophthalmology Market Value Chain Analysis: Uncovering Opportunities

- R&D

The R&D of ophthalmology focuses on the development of sustained drug delivery systems, novel therapeutics, and AI integration with diagnostics.

Key players: Novartis AG, Carl Zeiss Meditec AG, Alcon, Inc. - Clinical Trials and Regulatory Approvals

The clinical trial and regulatory approval of ophthalmology require the demonstration of the safety and efficacy of the products.

Key players: Alcon, Inc., Novartis AG, Bausch Health Companies Inc. - Patient Support and Services

Eye health patient education, genetic counselling, and financial assistance are provided in the patient support and services of ophthalmology.

Key players: Alcon, Inc., Novartis AG, Bausch Health Companies Inc.

Key Players' Offering

- Alcon, Inc.: Calreon, PanOptix, Vivity, and AcrySof are provided by the company.

- Bausch Health Companies Inc.: The company offers products supporting vision care, surgeries, along with infections, allergies, and glaucoma medications.

- Carl Zeiss Meditec AG: Diagnostic equipment and surgical requirements are offered by the company.

- Johnson & Johnson Vision Care, Inc.: Acuvue and other surgical products are provided by the company.

- Novartis AG: The company provides products for retinal disorders and macular degeneration.

Ophthalmology Market Companies

- Essilor International S.A.

- Haag-Streit AG

- NIDEK CO., LTD.

- STAAR Surgical Company

- Topcon Corporation

- Ziemer Ophthalmic Systems AG

- Hoya Corporation

- Lumenis Ltd.

- Optovue, Inc. (A Subsidiary of Carl Zeiss Meditec AG)

- Iridex Corporation

Recent Developments

- In 2022, Regeneron Pharmaceuticals, Inc. received a positive development as the U.S. FDA accepted the Priority Review for the supplemental Biologics License Application (sBLA) of EYLEA (aflibercept) Injection. This acceptance, aimed at treating Retinopathy of Prematurity (ROP) in preterm infants, contributes to enhancing Regeneron's brand image in the competitive ophthalmology market.

- In 2022, Reichert, Inc. introduced its revamped refractometers and analytical instruments website, promising a significantly enhanced user experience. The redesign reflects the company's commitment to providing users with an improved interface and accessibility when exploring its range of refractometry and analytical solutions.

Segments Covered in the Report

By Product

- Device

- Drugs

- Others

By Disease

- Glaucoma

- Cataract

- Age-Related Macular Degeneration

- Inflammatory Diseases

- Refractive Disorders

- Others

By Prescription Mode

- Generic

- Branded

By Route of Administration

- Oral

- Topical

- Injectable

- Local Ocular

- Others

By Distribution Channel

- Direct Tender

- Retail Sales

- Others

By End User

- Hospitals

- Clinics

- Home Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344