April 2025

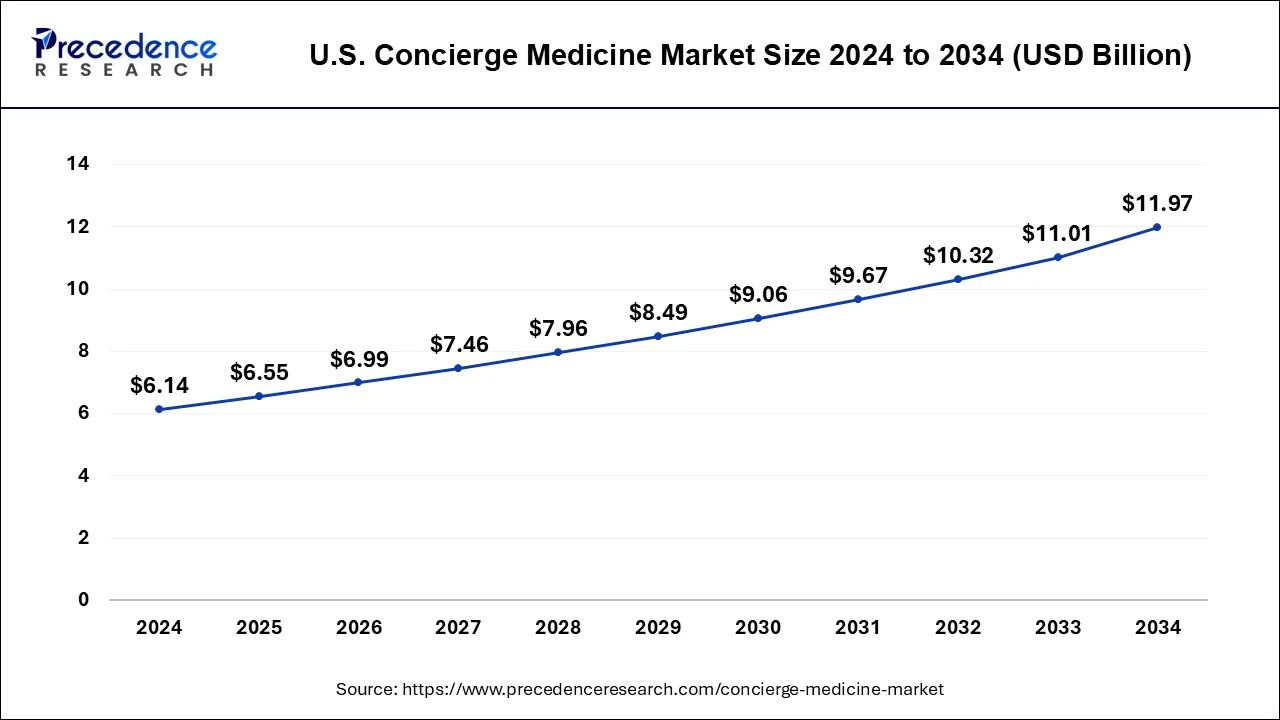

The U.S. concierge medicine market size is calculatd at USD 6.55 billion in 2025 and is predicted to surpass around USD 11,97 billion by 2034, expanding at a CAGR of 6.88% between 2024 and 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. concierge medicine market size surpassed USD 6.14 billion in 2024 and is predicted to be worth around USD 11,97 billion by 2034, growing at a CAGR of 6.88% from 2025 to 2034.

Concierge medicine, also known as personalized healthcare, refers to a healthcare model in which patients pay a fee, typically an annual or monthly retainer, to access enhanced medical services and personalized care from their primary care physicians. This model is an alternative to the traditional fee-for-service or insurance-based healthcare system. Concierge medicine fosters a closer, more direct relationship between physicians and patients. This can lead to better communication, improved patient satisfaction, and a more thorough understanding of individual health needs.

The integration of technology is reshaping the U.S. concierge medicine market. Many practices leverage telemedicine, mobile apps, and electronic health records to streamline communication between patients and their concierge physicians, enhancing overall healthcare delivery.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.88% |

| U.S. Market Size in 2024 | USD 6.14 Billion |

| U.S. Market Size by 2034 | USD 11.97 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Application and By Ownership |

Rising cases of diabetes in the United States

Diabetes requires ongoing management and personalized care. Concierge medicine allows for a more individualized approach to patient care, enabling healthcare providers to tailor treatment plans, monitor patients closely, and provide proactive interventions, all of which are crucial for managing diabetes effectively. Patients with diabetes often require regular check-ups, monitoring of blood sugar levels, and access to healthcare professionals for timely advice. Concierge medicine typically offers extended and convenient access to physicians, ensuring that patients can receive prompt attention and guidance, which is particularly important in chronic conditions like diabetes.

Managing diabetes often involves coordination among various healthcare specialists. Concierge medicine services often provide better care coordination, with physicians closely monitoring patients' health and facilitating communication with other specialists as needed. This comprehensive and coordinated approach can be beneficial for individuals with complex health conditions like diabetes. Thereby, the prevalence of diabetes in the area is observed to act as a major driver for the growth of the U.S. concierge medicine market.

Shortage of physicians

According to the CNBC report, approximately one-third of physicians working in the United States are observed to reach their retirement age by 2032. Meanwhile, the Association of American Medical Colleges also states that the country may witness a shortage of 122,000 primary care physicians by 2032.

With an overall shortage of physicians, there may be fewer doctors available to transition into concierge medicine practices. The model of concierge medicine typically involves a smaller patient panel to provide more personalized care, and the shortage may limit the number of physicians willing to adopt this model. Concierge medicine relies on providing a more accessible and personalized healthcare experience.

However, if there is a shortage of concierge physicians, it may lead to challenges in meeting the demand for such services, particularly in areas where the shortage is more acute. This can limit accessibility to concierge medical care for certain patient populations.

Emergence of health and wellness programs

The United States government recently issued a wellness program to promote the well-being of government employees. The newly issued program by the U.S. government aims to reduce the stigma associated with seeking treatment for mental and behavioral health problems. Such health and wellness programs are observed to offer a significant opportunity for the U.S. concierge medicine market.

Health and wellness programs often emphasize a holistic approach to well-being, encompassing not only medical care but also lifestyle factors such as nutrition, fitness, and stress management. Concierge medicine, with its focus on personalized and comprehensive care, aligns well with this holistic perspective. The increasing emphasis on patient-centric care in health and wellness initiatives aligns with the core principles of concierge medicine. The model prioritizes longer appointment times, enhanced physician-patient relationships, and a focus on patient satisfaction, which resonates with individuals seeking a more personalized healthcare experience.

Health and wellness programs often include a range of services beyond traditional medical care, such as nutrition counselling, fitness programs, and stress management. Concierge medicine providers can collaborate with wellness programs to offer a more comprehensive suite of services, providing patients with a one-stop-shop for their health needs.

The other segment dominated the market in 2024, the segment is observed to sustain the position during the forecast period. The others segment includes urology, ophthalmology, neurology, orthopedic surgery and gynaecology. Urology and gynaecology often involve sensitive and personal health issues. Patients may prefer a more personalized and private healthcare experience, which concierge medicine can offer. Patients in concierge medicine practices often enjoy greater access to their healthcare providers. This can be particularly beneficial for conditions that require prompt attention, such as certain urological and gynaecological issues.

In 2024, the primary care segment stood as the second largest segment in the U.S. concierge medicine market. Primary care concierge models allow for the creation of customized healthcare plans tailored to individual patient needs. This personalized approach can contribute to better health outcomes and patient satisfaction. Concierge primary care often includes enhanced accessibility to healthcare services. Patients may have 24/7 access to their primary care physicians through phone, email, or virtual consultations, ensuring timely and convenient healthcare support.

On the other hand, the cardiology segment will witness a significant rate of growth during the forecast period. Cardiovascular diseases are a leading cause of morbidity and mortality in the United States. The high prevalence of heart-related conditions creates a significant demand for specialized and personalized healthcare services, making cardiology a prominent segment within concierge medicine.

Concierge medicine emphasizes preventive care and a proactive approach to health management. Cardiology services align well with this approach, as they can offer preventive screenings, lifestyle counselling, and early detection of cardiovascular risk factors.

The pediatric segment is another lucrative segment growing at a robust pace in the U.S. concierge medicine market. Concierge medicine often includes a focus on preventive care and wellness. For pediatric patients, this could mean comprehensive well-child visits, vaccinations, and proactive health monitoring. Parents who prioritize preventive care for their children may find concierge medicine aligns with these values.

The group segment held the dominating share of the market in 2024; the segment is expected to sustain its position throughout the forecast period. The regulatory environment, including state-specific healthcare laws in the United States influence the group ownership structures of concierge medicine practices. Group practices often include a diverse range of healthcare professionals with different specialties. This can provide patients with a comprehensive healthcare experience, as they can access a variety of services within the same practice.

Group ownership can provide economies of scale, allowing practices to pool resources and share expenses. This can lead to cost efficiencies in terms of administrative support, marketing, technology, and other operational aspects.

The independent ownership segment is expected to witness growth at a robust pace during the predicted timeframe. Independent ownership allows physicians to have direct relationships with their patients without the interference of large healthcare organizations. This direct connection can contribute to increased patient satisfaction.

By Application

By Ownership

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

April 2025

April 2024