What is the U.S. Dental Services Market Size?

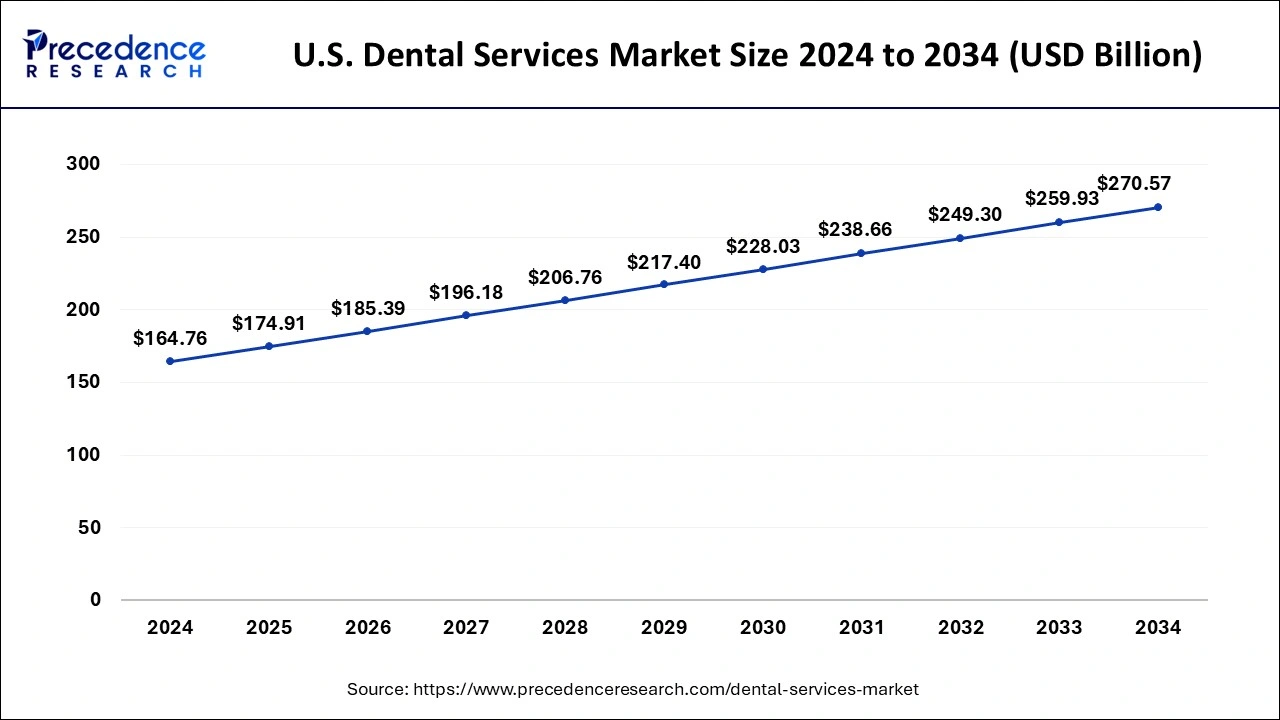

The US dental services market size is estimated at USD 174.91 billion in 2025 and is predicted to increase from USD 185.39 billion in 2026 to approximately USD 281.20 billion by 2035, growing at a CAGR of 4.86% between 2026 to 2035. The growing pool of the aging population is the key factor driving market growth.

Market Highlights

- By Services, Endodontic Procedures segment has accounted 26.52% revenue share in 2025.

- By Services, Diagnostic and Preventive Services has captured revenue share of 18.97% in 2025.

- By Application, Corrective segment has generated revenue share of around 54.40% in 2025.

Market Overview

The U.S. dental services industry is projected to grow steadily between 2026 to 2035, driven by rising awareness of oral health, expanding insurance coverage, and increasing adoption of digital and cosmetic dentistry. An ageing population, greater focus on preventive care, and growing demand for aesthetic and minimally invasive treatments are further fueling market expansion. General dentistry and orthodontic services dominate the sector, while implantology and cosmetic procedures are rapidly gaining traction among both independent practices and Dental Support Organizations (DSOs).

Market Outlook

- Digital Transformation Trends: Digitalization is reshaping dental services, with intraoral scanners, chairside CAD/CAM systems, 3D printing, and AI-assisted diagnostics becoming mainstream. Cloud-based practice management systems are also increasingly adopted. Companies like Align Technology and Dentsply Sirona are enhancing digital workflows for improved treatment accuracy and efficiency. DSOs such as Pacific Dental Services and Heartland Dental are investing heavily in AI-powered patient experience technologies and predictive analytics to optimize care delivery and operational efficiency.

- Market Consolidation and Expansion: The U.S. dental services market is witnessing rapid consolidation, with independent practices being acquired by DSOs and private equity firms to achieve scale, operational efficiency, and broader geographic coverage. Leading DSOs, including Aspen Dental, Heartland Dental, and Smile Brands, are expanding into underserved suburban areas, leveraging digital infrastructure and flexible financing solutions. This trend is expected to improve patient access, streamline operations, and accelerate the transition toward group practice models.

- Major Investors: The industry is attracting significant attention from private equity and institutional investors due to its recurring revenue streams, high-margin specialty services, and economic resilience. Firms such as KKR, Blackstone, and Carlyle Group are investing strategically in DSOs and dental technology startups with scalable care networks and digital integration. Their investments are fueling innovations in AI diagnostics, teledentistry, and patient engagement platforms.

- Startup Ecosystem: The dental technology startup ecosystem is expanding rapidly, particularly in AI-based imaging, digital orthodontics, and 3D-printed restorations. Companies like Overjet, Pearl AI, and Formlabs Dental are leading with FDA-cleared AI algorithms and next-generation manufacturing equipment. Emerging players such as VideaHealth and Carbon are merging data science with dental care to enhance diagnostic accuracy, speed up treatments, and reduce clinical costs in the U.S. market.

Dental Service Organization (DSO) Market Trends

- Non-dentist investors who desire to invest in the dentistry business can also own DSOs. Non-dental investors are sometimes able to provide more profitable options than licensed dentists, resulting in higher rates of return. DSOs also enable succession planning if the owner dentists pass away, become disabled, or lose their license.

- Separating the nonclinical from the clinical minimizes overhead and boosts reimbursement rates in general. Instead of dealing with all of the management and operations of the dental office, which may become detailed and time demanding, the dentist can focus on treating patients, which enhances the grade of treatment. Dentists might also practice dentistry as they see fit and concentrate completely on their practice.

- Furthermore, DSOs have superior management skills to dentists who attended dental school rather than business or management school. By entrusting the management and nonclinical aspects of the dental practice to a DSO, the dentist is delegating authority to an expert in that sector.

- Allowing business specialists who specialize in hiring and maintaining staff, negotiating leases with landlords, and handling reimbursement rates and insurance contracts, for example, to do their jobs will help the practice grow. Professional nonclinical components of a dental practice can be handled by these business management experts, allowing dentists to focus on and build their expertise and practice.

- DSOs also give its dentists and doctors more opportunities to network. DSOs help dentists learn and explore new things while also introducing them to new technology. Small dental practicesthat join DSOs gain access to cutting-edge technology that allows them to deliver better care to their patients. A DSO's first goal is proper patient care, and many DSOs support continuing education programs for its dentists as well as good mentoring opportunities.

- DSOs do not want to be associated with practices that do not give their patients the best possible care and safety. As a result, DSOs will ensure that their dentists are well-cared for and receive the most up-to-date information and educational opportunities, including mentorships. Dentists can connect with more dentists by joining a DSO. Young dentists who are members of a DSO are frequently able to seek mentorship and guidance from other, more experienced dentists in the DSO.

- Additionally, DSOs allow dentists to achieve a better work-life balance. Dentists can attain a better work-life balance than solo practitioners since they no longer have to control the managerial and nonclinical components of their practice. Dentists that work with DSOs have more time to focus on other things while still being able to practice dentistry without having to worry about the ins and outs of the dental office's operations.

- Third, DSOs make dental practices more efficient and comply with the law. DSOs establish a consistent and standardized approach throughout all of their dental clinics. Regardless of the location, the patient is aware of the level of care and expectations that can be expected when visiting one of the DSO's facilities. This standardization also includes standardized regulatory compliance and the potential for practitioners to discover best practice procedures.

- Regulations must be followed by all dental practices, and they must have a corporate structure that prioritizes regulatory compliance. Small practices, especially those looking to grow across state lines, may find this difficult. If a dental practice is trying to establish distinct practices across the country, a DSO can help ease some of the stress of having various laws in each state.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 281.20Billion |

| Market Size in 2026 | USD 185.39 Billion |

| Market Size in 2025 | USD 174.91 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.86% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Services, Application |

Market Dynamics

Drivers

The aging population drives the demand for dental services

According to statistics, the senior population in the United States increased by 15% between 2000 and 2010. By the year 2060, there are predicted to be 92 million senior people as people become older, their mouths shrink causing issues such as loose dentures, edentulism, dry mouth cavities, periodontal disease, and even oral cancer. In reality, most patients diagnosed with oral cancer are 62 years old on average.

Population changes influencing the future workforce

Dentist demand will rise in the future as the population grows, along with the possibility that people will keep their teeth and require more care later in life. Aside from population growth, population demographics will shift, with baby boomers retiring and the population skewing younger. The younger population, which has benefited from water fluoridation, preventive dental education, and improved dental insurance coverage, suggests that the number of dental visits per person will decrease in the future, as will the efficiency of appointments.

Preventive interventions that have been widely available for decades, such as fluoride, combined with rising standards for oral health have had a significant impact on oral health advancements during the last 50 years and will help shape the field's future. These gains in oral health are essential variables in reducing the amount of time it takes to maintain the average patient's oral health.

Between 2015 and 2040, large aggregate differences will result from different dental health experiences among birth cohorts. The variation in the size of the birth cohorts will accentuate these discrepancies. The baby-boom generation, those born between the end of WWII and 1964, suffered considerably higher levels of deterioration as children than any other birth group since.

The dental industry has faced enormous challenges in maintaining and repairing these massive numbers of highly repaired teeth during the last several decades. Since then, the birth groups have had significantly less damage to their dentitions as children and young adults, and as a result, they require less intense treatment per capita and in aggregate. By 2040, each dentist will be able to maintain the dental health of a greater number of these healthier people in less time.Dentists will need to spend less time per patient on the average American adult in 2040 as younger, healthier cohorts replace older cohorts with more demanding care demands.

Mandatory pediatric dental coverage in private health insurance plans is another trend affecting the future of the dentistry workforce. Although expanding pediatric dental coverage has fueled current demand for pediatric providers, that need will level off as more children are covered. Opportunities for pediatric dentists to care for at-risk and underserved groups will continue to exist, but it is unclear if an updated payer model will be beneficial in better supporting these patients.

Restraints

Staffing shortages and workforce strain

Dental practices located in the U.S. often struggle to hire and maintain sufficient personnel for roles like dental assistants, hygienists, and front-desk roles. When the dental practitioners can't hire personnel, patients will either wait too long for an appointment or receive divided attention during the visit. It complicates providing quality care and organized dentistry when assistants are overworked, too. Not only do doctors invest time in paperwork and training new hires, but the staff may already be engaged in feverish visits to get everything done. This will also slow staff time for patients suffering, and delays will allow small anguish to become larger problems.

Regulatory burdens and compliance complexity

Dentists in the U.S. have a series of rules and regulations imposed on them by the federal and state governments. The requirements could include employee training, patient privacy, billing requirements, licensing requirements, and policies regarding how clinics are structured or operated. These rules and regulations can become complex and conflicting when DSOs (Dental Service Organizations) operate clinics in various states. DSOs must balance methods that deliver quality patient care with compliance with conflicting laws. This requires that employees spend time learning and studying the regulations and rules of the profession instead of focusing on their patients in the clinic. When the rules and regulations vary so much within regions, practices bear the burden of continually adjusting their systems on a constant basis. While the rules are increasingly getting more complex, dental practices are moving and doing their day-to-day, but imposing regulations significantly slows growth. For example, DSOs have to manage patient privacy and billing practices, and anticompetitive considerations while also delivering high-quality care.

Opportunities

With the rise of teledentistry, technology has allowed for remote dental assessments and recommendations. As AI is used for image analysis of photos or scans submitted by patients, dentists can consult on cases without the patient coming into the office. This is a tremendous benefit in rural or underserved localities. Teledentistry promotes easier access for patients to quickly understand their oral health and allows clinics to see an increased volume of patients. The use of AI provided the ability to review images, indicate issues, and highlight cases that required real visits. The ADA affirmed this premise by noting that AI tools were able to analyze oral photos remotely and communicate patient changes in health to the dental team.

Segments Insights

Service Insights

The Endodontic Procedures segment dominated the U.S. dental services market because many people had decayed teeth and infected dental pulp, which resulted in needing to have a root canal treatment to save the natural teeth. This was evident from people seeking treatments to preserve their teeth as opposed to having them extracted.

U.S. Dental Services Market, By Services, 2022-2024 (USD Billion)

| By Services | 2022 | 2023 | 2024 |

| Cosmetic Dentistry | 14.71 | 15.88 | 17.10 |

| Endodontic Procedures | 39.38 | 41.09 | 42.80 |

| Periodontal Dentistry | 16.07 | 16.95 | 17.85 |

| Orthodontic and Periodontic Services | 19.77 | 20.80 | 21.85 |

| Diagnostic and Preventive Services | 26.89 | 29.39 | 32.04 |

| Oral and Maxillofacial Surgery | 20.80 | 22.39 | 24.07 |

| Others | 7.87 | 8.45 | 9.06 |

By Application Insights

The US corrective dental service market was the largest revenue generating segment as of 2025. According to a survey, over 40% of individuals had oral pain in the last year, and over 80% people are expected to have minimum one cavity by 34 years of age. Each year, the US governmentexpends over USD 124 billion on dental treatments. Furthermore, dental crises necessitate unscheduled care, resulting in a loss of approximately 34 million school hours and over USD 45 billion in productivity each year.

- Preventive dental service

Oral diseases are more common among populations disproportionately affected by coronavirus disease 2019 (COVID-19), and dental health and oral health care inequities are more common. COVID-19 has resulted in the closure of dental practices and a reduction in their hours of operation, except emergency and urgent treatments, limiting routine care and preventive. Aerosol-generating procedures used in dentistry can promote viral transmission. The pandemic presents a chance for the dentistry profession to transition away from surgical procedures and toward nonaerosolizing, prevention-focused methods to care.If regulatory barriers to oral health care access were removed during the pandemic, it could have a positive impact in the future.

The American Dental Association (ADA), the country's biggest dental organization, suggested that dental clinics postpone elective dental operations until April 6, 2020, and provide emergency-only dental services to avoid overcrowding in hospital emergency rooms on March 16, 2020. Due to an increase in infections, the ADA modified their guideline on April 1, 2020, advising offices to close all but urgent and emergency procedures until April 30 at the earliest.As a result, dental treatment became much more difficult to obtain. According to an ADA Health Policy Institute poll conducted during the week of March 23, 2020, 76% of dental offices were closed but treating emergency patients exclusively, 19% were fully closed, and 5% were open but seeing a decreased volume of patients.

- Corrective dental services

Dental anomalies that affect the position or alignment of teeth can have a significant impact on a smile's appearance and usefulness. Orthodontic treatment, which includes braces, retainers, and clear aligners, corrects crowded or crooked teeth, overbite (when top teeth extend beyond bottom teeth), underbite (when bottom teeth are too far forward or upper teeth are too far back), inappropriate jaw posture, and jaw-joint abnormalities.

When the upper and lower jaws do not connect properly, resulting in an unequal bite, orthodontic treatment may be required (malocclusion). Uneven bites can lead to a temporomandibular joint problem if they aren't treated properly (TMJ).

Teeth that protrude, are crowded or are unevenly spaced, and jaw disorders may be inherited. Accidents (dental damage), not using protective gear like mouth guards during physical activity, and premature tooth loss, as well as thumb sucking and tongue pushing, may all contribute to orthodontic issues requiring treatment.

Braces can cost anything from $2,500 to $7,000. Many dental insurance policies cover orthodontic treatments, which are typically considered restorative. Transparent aligners (e.g., Invisalign and ClearCorrect) and other types of orthodontic treatment may be covered by dental insurance; the cost of clear aligners is comparable to or higher than the cost of braces.

More than 40% of individuals say they've had oral pain in the recent year, and more than 80% of people will have had at least one cavity by the age of 34. Each year, the United States spends more than $124 billion on dental treatment. Each year, dental crises necessitate unscheduled care, resulting in the loss of nearly 34 million school hours and more than $45 billion in productivity.

U.S. Dental Services Market, By Application, 2022-2024 (USD Billion)

| By Application | 2022 | 2023 | 2024 |

| Preventive | 34.77 | 37.84 | 41.10 |

| Corrective | 79.95 | 84.29 | 88.71 |

| Therapeutic | 30.78 | 32.83 | 34.95 |

- Therapeutic dental services

Minnesota became the first state to license dental therapists in 2009, to improve dental health for underprivileged people. A dental therapist is a trained oral health practitioner who works as part of a dental team to provide patients with educational, clinical, and therapeutic services. Under the guidance of a dentist, dental therapists perform the basic preventive and restorative treatment to children and adults, as well as extractions of primary (baby) teeth. Dental therapists primarily operate in settings that assist low-income, uninsured, and underserved populations, or in areas where there is a shortage of dental health professionals.

A licensed Dental Therapist (DT) and a certified Advanced Dental Therapist (ADT) were formed by Minnesota legislation (ADT). These two sorts of providers have relatively similar scopes; the main variation is the level of supervision.

"Reforming America's Healthcare System Through Choice and Competition" was released in 2018 by the US Departments of Health and Human Services (HHS), Treasury, and Labor, in partnership with the US Federal Trade Commission and White House Presidential Departments. The paper includes policy recommendations for state and federal governments to promote healthcare choice and competition. “Emerging healthcare occupations, such as dental therapy, can enhance access and bring down prices for consumers while still providing safe care,” according to the paper.Unnecessary statutory and regulatory barriers to the creation of such new occupations should be avoided at all costs." "States should review growing healthcare occupations, such as dental treatment, and identify ways in which their licensure and scope of practice can enhance access and lower consumer prices while still assuring safe, effective care," the research suggests.

Dental therapy is currently legal in the following states: Minnesota, Maine, Vermont, Arizona, Michigan, New Mexico, Nevada, and Connecticut. Dental therapists are also permitted to practice on tribal grounds in Washington, Idaho, and Montana. In Alaska, dental therapists also provide services on indigenous grounds. The state of Oregon has established a pilot program to allow dental therapists, and the legislature is anticipated to approve permanent authorization in 2021.

As we look ahead to the state legislative sessions of 2021, we expect nine states to consider dental therapy legislation. Florida, Kansas, Massachusetts, New York, North Dakota, Oregon (for permanent authorization), Washington (for the entire state), and Wisconsin are among these states.

- The preventive application segment is expected to reach around USD 73.11 billion by 2033 with a CAGR of 6.80% from 2024 to 2033.

- The corrective application will hit around USD 129.44 billion by 2033 and growing at a CAGR of 4.38% from 2024 to 2033.

- The Therapeutic application will account USD 55.15 billion by 2033 and expanding at a CAGR of 5.32% over the forecast period.

State-Wise Insights

Aesthetic Enhancements Increase Demand for Dental Services in California

California is a major contributor to the U.S. dental services market. The presence of a large population and a growing number of specialists and general dentists helps in the market growth. The growing preference for advanced and cosmetic dental treatments increases demand for dental services. The growing demand for aesthetic enhancements, dental implants, and veneers in the area fuels demand for dental services.

The high presence of specialty services, dental providers, and advanced facilities in major cities & suburban areas helps the market growth. The growing innovation in dental procedures & technology, and the presence of advanced treatments like clear aligners, dentistry, and same-day crown drives the market growth. The availability of dental insurance plans like PPOs supports the overall growth of the market.

New York Dental Services Market Trends:

New York is growing in the U.S. dental services market. The presence of high-concentration dental providers helps in the market growth. The presence of advanced dental technologies and efficient dental services drives market growth. The growing demand for implant dentistry and cosmetic dentistry in urban and suburban areas increases the demand for dental services. The well-established healthcare system and larger demand for various dental services drive the market growth. The presence of the Medicaid program with adult dental benefit service increases demand for dental services. Additionally, a strong focus on preventive dental care supports the overall market growth.

The Growing Population in Texas Surges Demand for Dental Services

Texas is significantly growing in the U.S. dental services market. The rapid population growth in the area increases demand for dental services. The availability of various dental services like implant dentistry and cosmetic dentistry helps in the market growth. The low-cost environment for dental services drives market growth. The growing demand for dental care in urban & suburban areas increases demand for various dental services. The growing advancements in dental technologies like laser dentistry drive the overall growth of the market.

U.S. Dental Services Market – Value Chain Analysis

- Dental Product & Equipment Manufacturing - The foundation of the dental services ecosystem begins with the production of dental materials, instruments, imaging systems, implants, and digital tools. These include restorative materials, CAD/CAM systems, diagnostic imaging devices, and dental chairs.

Key Players: Dentsply Sirona, 3M Oral Care, Align Technology, Envista Holdings (KaVo Kerr, Nobel Biocare), Straumann Group, Planmeca, Ivoclar Vivadent, GC Corporation, Carestream Dental. - Supply & Distribution Networks - Distributors and dental supply companies ensure the timely and regulated delivery of products, instruments, and consumables to clinics, laboratories, and hospitals. They also support software and IT integration for dental practices.

Key Players: Henry Schein Inc., Patterson Companies, Benco Dental, Burkhart Dental Supply, Darby Dental Supply. - Dental Practice Management & Support Organizations - Dental Support Organizations (DSOs) and independent practice networks provide non-clinical support, including HR, finance, marketing, procurement, and compliance services to dental practices. This segment drives operational efficiency and scalability.

Key Players:Heartland Dental, Aspen Dental Management Inc., Pacific Dental Services, Smile Brands, Western Dental & Orthodontics, DentalCorp. - Clinical Service Delivery (Dental Practices & Specialists) - At the core of the value chain are general and specialty dental care providers — including orthodontists, periodontists, prosthodontists, endodontists, and oral surgeons. They provide preventive, restorative, cosmetic, and surgical treatments using evidence-based protocols and digital tools.

Key Participants: Independent Dental Clinics, DSO-Affiliated Practices, University Dental Hospitals, Specialty Centers (Orthodontic & Implant Clinics). - Digital Technology, Diagnostics & AI Integration -Digital transformation enhances clinical accuracy, patient experience, and workflow efficiency. This stage includes digital imaging, AI-based diagnostics, intraoral scanning, 3D printing, tele-dentistry, and electronic health record integration.

Key Innovators: Align Technology, Dentsply Sirona, Philips Oral Healthcare, Formlabs Dental, Carbon, SprintRay, Pearl AI, Overjet, Planmeca Digital. - Insurance, Financing & Reimbursement - Insurance providers and third-party payers facilitate patient access through coverage plans, financing options, and reimbursement models. Public and private insurers shape utilization patterns and the affordability of dental care services.

Key Players:Delta Dental, DentaQuest, MetLife Dental, Aetna Dental, Cigna Dental, UnitedHealthcare Dental, Guardian Life. - Education, Training & Research Institutions -Dental schools, research centers, and professional associations contribute to workforce development, clinical research, and evidence-based guidelines that influence market standards and innovation.

Key Institutions: AmeriDental Association (ADA), ADA Health Policy Institute (HPI), AmeriDental Education Association (ADEA), National Institute of Dental and Craniofacial Research (NIDCR), Harvard School of Dental Medicine, UCSF School of Dentistry, NYU College of Dentistry.

U.S. Dental Services Market Companies

- Smile Brands Inc.: Operates a network of dental offices across multiple states, providing general, cosmetic, and specialty dental services through DSO-backed infrastructure.

- Aspen Dental: Expands access to general and restorative dentistry in suburban and underserved areas with a strong focus on patient financing and digital integration.

- InterDent (Gentle Dental): Provides comprehensive general and specialty dental services via a network of affiliated practices, emphasizing patient-centric care and operational efficiency.

- Coast Dental: Offers scalable dental services through a DSO model, combining general dentistry with orthodontics and cosmetic procedures to underserved regions.

- Pacific Dental Services: Partners with private dental practices, delivering operational support, technology adoption, and AI-driven solutions to enhance patient care.

- Heartland Dental: Supports affiliated dental offices with management, marketing, and technology solutions, enabling expansion and standardized high-quality care.

- Affordable Care: Focuses on accessible general dentistry services with patient-friendly financing solutions to increase treatment uptake.

- Great Expressions Dental Centers: Delivers comprehensive dental care with a focus on preventive, cosmetic, and restorative services across a broad network of locations.

- Western Dental: Provides affordable dental services to diverse communities, emphasizing preventive care, general dentistry, and specialty procedures.

- Dental Care Alliance: Manages a large network of dental practices, enhancing operational efficiency, patient experience, and adoption of digital dental technologies.

Recent Developments

- In June 2025, Dezy was recognized as one of the Top 100 Technology Pioneers of 2025 by the World Economic Forum for leading the way in AI-powered diagnostic dental care that increased accessibility and affordability for those needing dental care. The healthtech startup from Bengaluru was recognized for its innovative approach to tackling oral healthcare while harnessing scalable technology.

[Source: https://ehealth.eletsonline.com] - In May 2025, the Utah Air National Guard deployed to Anzi, Morocco, during African Lion 2025 and provided much-needed dental care within a field hospital established by U.S. and Moroccan forces. In conjunction, Maj. Kyle Sansom and medical personnel extracted teeth and provided treatment to local nationals during the humanitarian civic assistance mission between the U.S. and Morocco, enhancing military-civilian relations and overall military readiness.

[Source: https://www.dvidshub.net] - In May 2025, Dogwood Health Trust awarded East Carolina University's community dental clinics in Sylva and Spruce Pine a three year US$593,000 grant. The grant funded over US$85,000 for patient care and over US$425,000 for staff salaries. The investment was intended to increase access to dental care for uninsured rural residents and to increase their staffing capacity.

[Source: https://news.ecu.edu/2025/05/01] - In May 2025, according to a report from CareQuest Institute, about 27% of U.S. adults, approximately 72 million people, did not have dental insurance. This was three times more than the number of adults without general health coverage (9.5%). The results also revealed serious disparities correlated to income, age, and education throughout the population, which included broad differences in dental insurance.

[Source: https://www.businesswire.com] - In March 2025, while treating NATO partner troops, the 10th Special Forces Group (Airborne) dentistry team was able to help those who suffered from dental pain and had no access to care, addressing their pain and improving their confidence levels. Lt. Col. Jesse Thietten, 10th Group commander, explained how dental care received from the 10th Group gave service members qualified dental care that improved their quality of life, that also is essential for combat readiness for their partner forces who were training in very remote locations, lacking access to basic dental care.

[Source: https://www.dvidshub.net]

Segments Covered in the Report

By Services

- Cosmetic Dentistry

- Endodontic Procedures

- Periodontal Dentistry

- Orthodontic and Periodontic Services

- Diagnostic and Preventive Services

- Oral and Maxillofacial Surgery

By Application

- Preventive

- Corrective

- Therapeutic

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting