September 2024

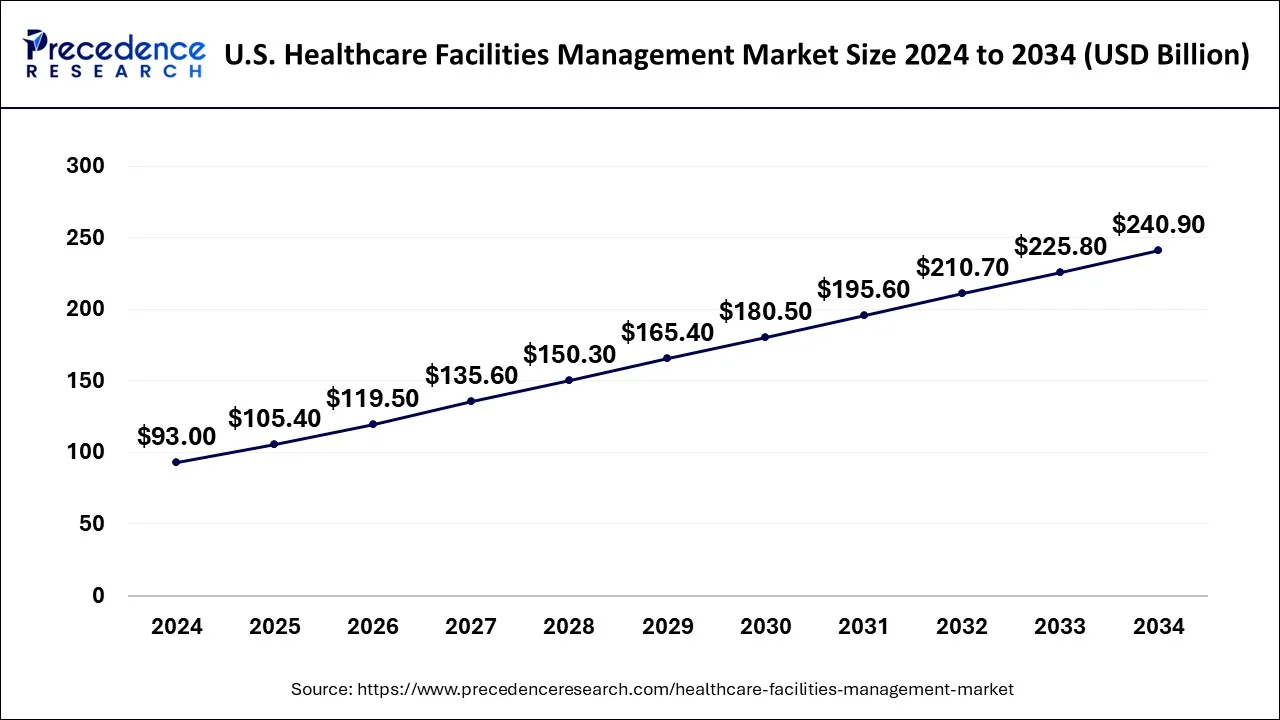

The U.S. healthcare facilities management market size is calculated at USD 105.4 billion in 2025 and is forecasted to reach around USD 240.9 billion by 2034, accelerating at a CAGR of 9.89% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. healthcare facilities management market size was estimated at USD 93 billion in 2024 and is projected to reach USD 240.9 billion by 2034, growing at a CAGR of 9.99% from 2025 to 2034. The growing incidence of long-term illnesses drives the US healthcare facilities management market.

The US healthcare facilities management market offers services associated with upkeeping and supervising the healthcare facility's construction, security, and operations. For medical facilities to continue operating without interruption, it is essential to guarantee that service requests are fulfilled effectively.

For best results and regulatory compliance, healthcare institutions must efficiently manage their assets, medical equipment, infrastructure, and technology. Facility management systems facilitate resource allocation, maintenance scheduling, and asset tracking. The administration of healthcare institutions is making decisions based on data analytics more and more. Using advanced analytics technologies, facilities managers can use data from several sources to optimize resource allocation, boost operational effectiveness, and improve patient outcomes.

Around 1 billion individuals globally are in danger of becoming impoverished due to having to pay for their healthcare with 10% or more of their household's income.

The integration of artificial intelligence in facility management system

Facilities management solutions with AI capabilities can automate repetitive processes like inventory control, maintenance scheduling, and energy efficiency. Automation increases efficiency by saving time and effort while doing these chores manually. Artificial intelligence (AI)-powered solutions can improve patient flow and reduce wait times by optimizing facility layouts and resource allocation. Furthermore, chatbots and virtual assistants driven by AI can give patients timely information and support, increasing their level of satisfaction. thereby, the integration of such technologies is observed to offer a significant driver for the US healthcare facilities management market.

Adoption of telemedicine

Patients no longer need to physically visit healthcare institutions to receive healthcare treatments due to telemedicine. By being more accessible, healthcare services can now reach underprivileged communities and populations. Telemedicine can help healthcare institutions manage patient flow more effectively and reduce overcrowding in clinics and hospitals, which will optimize resource allocation. Better use of the current workforce and infrastructure may result from this.

Rising costs and pressure to control expenses

Healthcare facilities face ongoing pressure to provide high-quality care while keeping costs down. Financial resources are under pressure due to rising labor, equipment, and utility expenses, making it difficult to set aside enough money for facility management. The aged infrastructure of many American healthcare facilities raises the expense of upkeep and repairs. Such expenses create a significant challenge for the US healthcare facilities management market to grow.

The need for significant investment to retrofit antiquated systems to meet contemporary healthcare standards exacerbates cost concerns. Due to industry competition and the specialized nature of healthcare facility management, finding and hiring qualified facility management staff in the healthcare sector can take time and effort. Operational inefficiencies and higher labor expenses may result from this.

Utilizing IoT sensors and AI-powered analytics

IoT sensors can continuously monitor several features of healthcare facilities, including patient movement, equipment status, temperature, humidity, and air quality. This real-time data collection makes proactive maintenance and effective resource allocation possible. IoT sensors can monitor and regulate HVAC systems, lighting, and other energy-consuming equipment to maximize energy use in healthcare facilities. AI algorithms can analyze the data gathered by these sensors to find areas where money and energy might be saved.

Focusing on sustainability and patient-centric design

Over time, sustainable techniques like waste minimization, water conservation, and energy-efficient technologies can save money and lower operating costs for healthcare institutions. Patient-centric design aims to create spaces that support comfort, safety, and healing for patients. Better results and more excellent rates of patient retention can result from incorporating natural lighting, green areas, and soothing aesthetics. These elements can also improve patient happiness and the overall experience. Such rising focus on sustainability and patient-centric design is observed to offer an opportunity for the US healthcare facilities management market.

In addition to reaping immediate rewards, investing in patient-centric design and sustainability measures helps ensure healthcare institutions' long-term durability and viability. These strategies support healthcare operations' sustainability and long-term viability by lowering resource consumption, minimizing environmental effects, and fostering healing environments.

The soft services segment dominated the US healthcare facilities management market in 2024. Soft services directly affect how happy and satisfied patients are in medical institutions. Patient impressions of the quality of treatment are significantly influenced by aspects such as cleanliness, comfort, and food service quality. Soft service providers frequently contribute specialized knowledge and technology to increase the efficacy and efficiency of waste management, infection control, and dietary management. Soft services guarantee adherence to healthcare rules and hygienic practices, safety, and cleanliness requirements. Reputation and accreditation maintenance depend on meeting these requirements.

The hard services segment shows notable growth in the US healthcare facilities management market during the forecast period. Technological developments have raised the requirement for complex infrastructure and equipment in healthcare institutions, necessitating specialized hard services such as medical gas, HVAC, and electrical systems. Many American healthcare facilities' old infrastructure must be updated and maintained. This includes bringing HVAC, electrical, and plumbing systems up to date to increase energy efficiency and comply with regulations.

The in-house segment dominated the US healthcare facilities management market in 2024. Numerous healthcare facilities discovered that using outside suppliers for outsourcing may only sometimes be more affordable than handling services internally. They could more effectively control costs if they directly controlled the infrastructure and services. Healthcare institutions had more customization and flexibility possibilities with in-house administration. Customizing services to fit individual requirements and preferences could improve alignment with business priorities and goals. Healthcare businesses could easily combine facilities management with other essential operations, such as patient care and administrative tasks if they managed their facilities internally. Throughout the company, this integration frequently resulted in increased coordination and efficiency.

The outsourced segment held a significant share in 2024, and it has been observed to sustain growth at a notable rate during the forecast period. For firms, outsourcing is frequently more economical than internal operations. Businesses that outsource specific tasks, like manufacturing, customer service, and IT services, can save money on personnel and infrastructure. It enables companies to swiftly scale up or reduce operations in response to shifting market dynamics or organizational requirements. This flexibility is beneficial in fast-paced fields where success depends on one's capacity to adapt.

The hospitals and clinics segment dominated the US healthcare facilities management market in 2024. Hospitals and clinics run on a bigger scale than other healthcare establishments like assisted living homes or outpatient clinics. Their size enables them to use economies of scale and better use their resources. It makes significant money from various medical treatments, services, and patient admissions. Due to their financial ability, they may invest in cutting-edge facilities management services and technologies to improve patient happiness and operational effectiveness.

The long-term healthcare facilities segment is expected to witness significant growth in the US healthcare facilities management market and is also observed to sustain growth at a notable rate during the forecast period. The need for long-term healthcare institutions to meet the demands of older adults who need specialized care and support is growing as the world's population ages. The quality of care offered at long-term institutions is improved by technological advancements in healthcare, such as telemedicine, electronic health records, and remote monitoring tools. This increases the facilities' appeal to patients and caregivers. Many would rather receive care in a setting that feels more like home than a hospital. Long-term care facilities provide a more comfortable and individualized option if you require longer-term care.

By Service Type

By Business Model

By End-user

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

February 2024

June 2024

January 2025