May 2024

U.S. Hospital Services Market (By Hospital Type: State-owned Hospital, Private Hospital, Public/ Community Hospital; By Service Type: Outpatient Services, Inpatient Service; By Service Areas: Cardiovascular, Acute Care, Cancer Care, Diagnostics, and Imaging, Neurorehabilitation & Psychiatry Services, Gynecology, Others) - Regional Outlook and Forecast 2025 to 2034

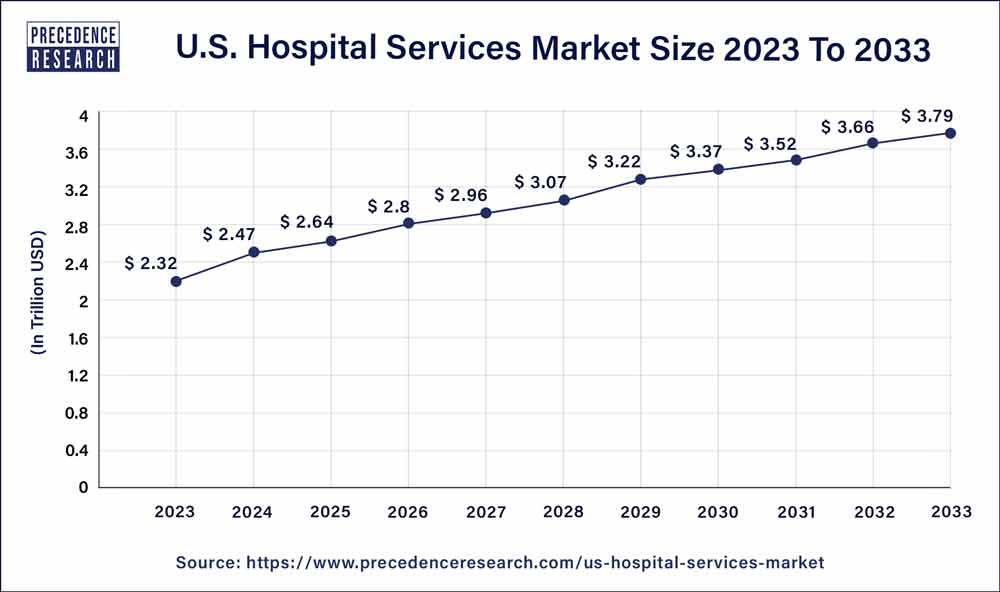

The U.S. hospital services market size was estimated at USD 2.32 trillion in 2023 and is projected to hit around USD 3.79 trillion by 2033, growing at a CAGR of 4.85% from 2024 to 2033.

U.S. Hospital Services Market Overview

Hospitals are a vital part of the healthcare business and a major source of funding for the whole thing, which supports research and development in the area. To promote their goods and services among hospitals, several healthcare product manufacturers engage in substantial marketing and sales initiatives. Through different internet and telecommunication networks, private hospitals are more likely to offer high-quality outpatient services in terms of consultation, diet/medication analysis, and health monitoring.

Because of this, the standard of outpatient treatment has been steadily rising, and in the future, it is anticipated that demand for these services will surpass that of inpatient care. Supplies and auxiliary services are included in the cost of hospital services, although the services of healthcare professionals account for the majority of the expenditures. In addition to payroll costs, hospital disinfection service revenue and asset maintenance expenditures such as building maintenance, repairs, and infrastructure are included in healthcare expenses. They have considerable negotiating power with suppliers, service providers, and distributors because of the potential impact of their strategic decisions on other segments of the healthcare sector.

Modern medical technology has made it possible to conduct trials for the treatment of fatal diseases like cancer as well as for earlier and better disease diagnosis. Since it plays a major role in the U.S. hospital services market's expansion, rising affordability and public awareness are predicted to propel the US medical services industry, which is already evident in many other nations.

Health insurance programs have been put in place in many industrialized nations due to the growing expense of healthcare.

In the upcoming years, demand is anticipated to increase due to its appeal among consumers and the general public. The aging population, rising rates of chronic disease, rising disposable income, and rising health insurance penetration are major factors influencing hospital treatment.

| Report Coverage | Details |

| U.S. Market Size in 2023 | USD 2.32 Trillion |

| U.S. Market Size by 2033 | USD 3.79 Trillion |

| Growth Rate from 2024 to 2033 | CAGR of 4.85% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Hospital Type, By Service Type, and By Service Areas |

Driver

Prevalence of chronic disease

The rising incidence of chronic diseases, such as diabetes, cardiovascular diseases, and respiratory disorders, increases the need for ongoing medical care and specialized services while promoting the growth of the U.S. hospital services market. Hospitals play a crucial role in managing and treating these chronic conditions. For instance, according to the American Hospital Association, More and more Americans are dealing with chronic illnesses, which are persistent and typically incurable. Nearly half of all Americans, or 133 million people, are estimated to be suffering from at least one chronic ailment today, including arthritis, heart disease, and hypertension. That number is projected to rise to 170 million by 2030, which is 15 million more than it was just ten years ago. In addition, as per the data published by CDC

Restraint

Technological and regulatory challenges

Hospitals must constantly update and incorporate new systems due to the rapid pace of technology improvements in the healthcare industry. However, the expense of putting new technology into place and keeping it up to date may be a big barrier, especially for smaller or less well-funded healthcare institutions. Hospitals also have to follow stringent regulatory regulations and compliance standards, which may be complicated. Policies and regulations about healthcare may change, requiring expensive adjustments to operations and infrastructure to stay compliant. Thus, this is expected to hamper the growth of the U.S. hospital services market.

Opportunity

Digital transformation

Digital technology may be used by hospitals to increase patient involvement, expedite administrative procedures, and boost overall operational efficiency. The quality of treatment may be improved, and resource usage optimized by using electronic health records (EHRs), data analytics, and other digital technologies. Furthermore, hospitals now have more opportunities to grow their virtual healthcare services due to the growing usage of telemedicine during the COVID-19 pandemic. Especially in rural or remote locations, hospitals may access a larger patient population by investing in telemedicine technologies. Thus, the digital transformation in the hospital is expected to offer enormous potential for U.S. hospital services market development during the forecast period.

The public/ community hospital segment held the largest share of 53% in 2023. The majority of patient beds are found in community hospitals, which also provide a broad range of treatment areas through various services. These are crowd-funded societies, enterprises, and charitable groups that support these non-profit organizations that provide services to the public.

Besides, the state-owned hospital segment also captured the largest revenue share over the projected period. Patients in need of acute care, particularly infection control and accident/trauma situations, are the main focus of state-owned hospitals. Federal hospitals are crucial in helping patients who have little access to high-quality healthcare. There were 206 federal hospitals in the United States as of 2021, according to the AHA.

The outpatient services segment held the largest share of 52% in 2023. The advent of new technology, such as telemedicine, telemonitoring, and diagnostic procedures has led to shorter patient stays, since physicians may administer treatment remotely, which, in turn, decreases overhead expenses and patient fees. In addition, patients' preferences have gradually shifted in recent years toward outpatient or daycare procedures.

The growth of childcare surgeries has been made feasible by less invasive procedures. This is anticipated to accelerate the expansion of the outpatient services market. Besides, the inpatient service segment also holds a significant share over the forecast period because hospital stays are becoming more common and inpatient treatment is more expensive. Osteoarthritis, pneumonia, septicemia, heart failure, and diabetes with complications were the top five reasons for hospital admissions in the United States in 2022, according to the Centers for Disease Control and Prevention (CDC).

The cardiovascular segment held the largest share of 22% in 2023. The United States is seeing an increase in the prevalence of obesity as a result of growing sedentary lifestyle adoption, which raises the risk of heart disease. Sedentary lifestyles, poor dietary habits, and high levels of stress contribute to the development of cardiovascular diseases. The prevalence of desk jobs limited physical activity, and diets high in processed foods and added sugars can increase the risk of conditions like obesity and hypertension.

The cancer care segment is expected to grow at the fastest rate over the forecast period. After CVDs, cancer is the second most common cause of death in the United States. The HCUP estimates that 2.8 million hospitalizations for cancer occurred in 2017. Of them, 1.7 million hospital admissions had cancer as a secondary diagnosis and about 1.0 million hospitalizations had cancer as the primary diagnosis.

The primary drivers of the anticipated growth in the U.S. hospital services market are the rising expenses associated with cancer treatment, the expansion of oncology departments and specialists, and the favorable reimbursement environment.

Segments Covered in the Report

By Hospital Type

By Service Type

By Service Areas

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

May 2025

November 2024

February 2025