December 2024

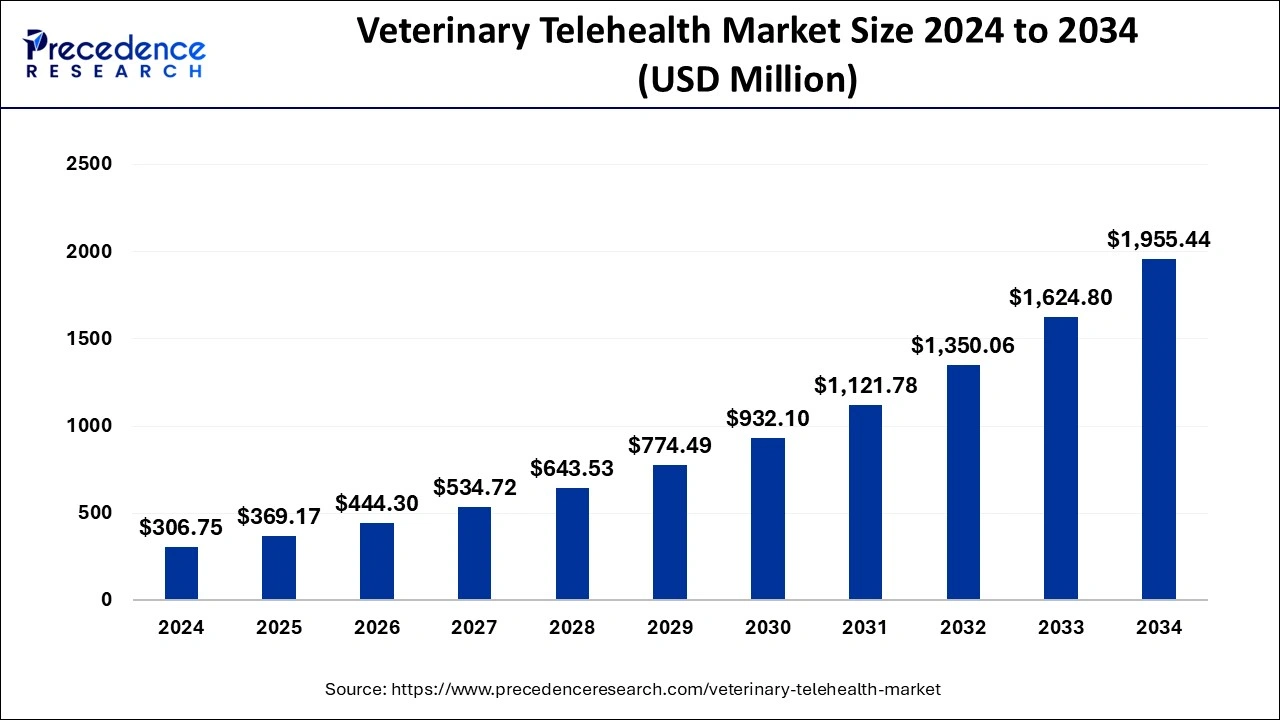

The global veterinary telehealth market size was estimated at USD 306.75 million in 2024, grew to USD 369.17 million in 2025 and is predicted to hit around USD 1,955.44 million by 2034, expanding at a CAGR of 20.35% between 2025 and 2034. The North America veterinary telehealth market size is evaluated at USD 131.90 million in 2024 and is expected to grow at a CAGR of 20.49% during the forecast year.

The global veterinary telehealth market size was calculated at USD 306.75 million in 2024 and is predicted to reach around USD 1,955.44 million by 2034, expanding at a CAGR of 20.35% from 2025 to 2034. The veterinary telehealth market is driven by the increasing demand for convenient and accessible pet care services.

Artificial intelligence systems help prevent errors by recommending treatment methods or pointing out overlooked patterns in pet health data. They examine patient histories, breed-specific information, and international veterinary research and offer recommendations that are supported by evidence. Image recognition algorithms examine pet photos to find obvious concerns like wounds, illnesses, or dental issues. AI models can help veterinarians make quicker choices during virtual consultations by matching symptoms to possible diagnoses.

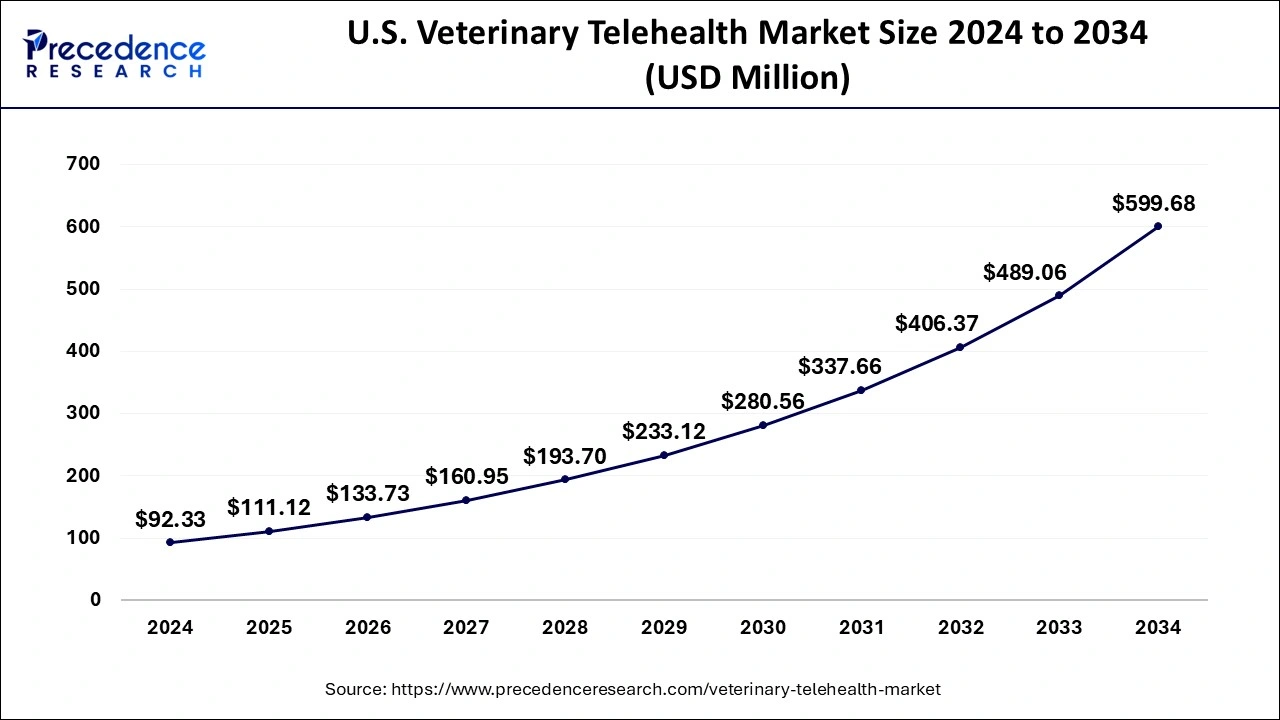

The U.S. veterinary telehealth market size was exhibited at USD 92.33 million in 2024 and is projected to be worth around USD 599.68 million by 2034, growing at a CAGR of 20.58% from 2025 to 2034.

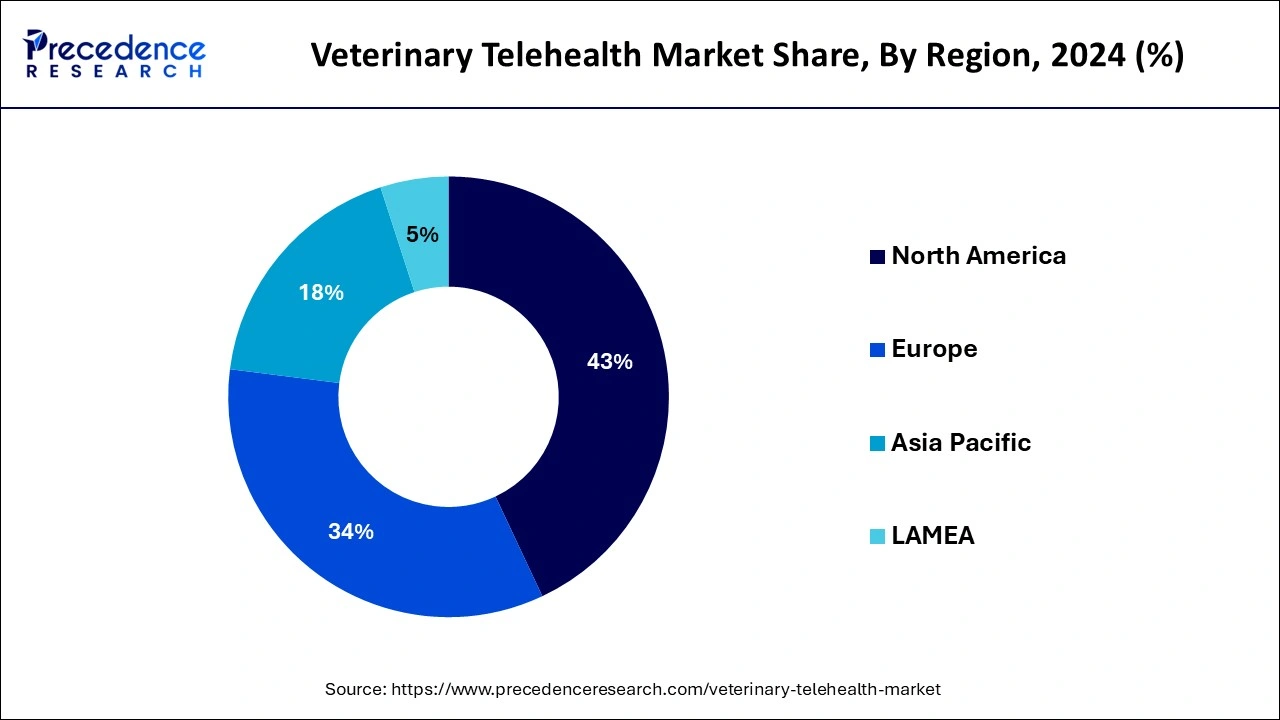

North America held the largest share in the veterinary telehealth market in 2024. The technological infrastructure of North America, especially the US and Canada, is highly advanced and supports digital healthcare and telecommunications systems. Accessing veterinarian telehealth services is made simpler for pet owners by the growing use of cellphones, high-speed internet usage, and user-friendly telehealth software platforms. The need for telemedicine solutions to fill the gap has grown dramatically due to the expanding veterinary manpower crisis.

Asia-Pacific shows a significant growth in the veterinary telehealth market during the forecast period. One of the main motivators is growing knowledge of the advantages of veterinary telemedicine services among livestock farmers and pet owners. In emerging nations where veterinary services may be limited in rural places, telehealth systems provide rapid access to professional veterinarian care, prompt diagnostics, and disease management. Both domestic and foreign companies have entered the market to provide veterinarian advice, online pharmacies, and virtual consultations.

Due to veterinary telemedicine, pet owners can obtain care more easily, especially in underserved or rural areas where there may not be many veterinarian facilities. It enhances general access to professional advice by enabling sessions with specialists who might not otherwise be geographically accessible. Through routine check-ins with veterinarians, telehealth makes it easier to manage chronic illnesses in pets, such as diabetes or arthritis.

This continuous support enhances the quality of life for pets with chronic medical needs. Telehealth systems can incorporate wearable technology and Internet of Things (IoT) devices for dogs to offer real-time diagnosis and health monitoring. This makes pet care more comprehensive and gives vets remote access to vital health information.

| Report Coverage | Details |

| Market Size by 2024 | USD 306.75 Million |

| Market Size in 2025 | USD 369.17 Million |

| Market Size in 2034 | USD 1,955.44 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.35% |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Animal Type, Delivery Mode, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing emphasis on veterinary telehealth and illness identification

Veterinary telehealth services have been made possible by advancements in telecommunications technologies, including mobile applications, high-speed internet, and video conferencing platforms. Improved connectivity allows veterinarians to examine, diagnose, and treat animals from a distance, enhancing accessibility and care quality. Pet owners, particularly those in remote or disadvantaged locations, can more easily obtain professional care thanks to the efficiency and affordability of virtual consultations. The demand for veterinary services is rising as more people own pets, especially in cities. Studies show that more individuals are adopting pets, and many view their animals as essential family members.

Regulatory and legal challenges

The license requirements for veterinarians frequently make veterinary telemedicine services difficult. Veterinarians must hold a license in the state or area where the patient (animal) resides in many jurisdictions. Telehealth services that wish to provide services to clients across state or national borders may encounter difficulties. The scalability of services may be limited by the requirement for veterinary telehealth providers to guarantee that their practitioners possess licenses in all pertinent jurisdictions.

Certain states have legislation about reimbursing telemedicine services that might not be compatible with veterinary care. This causes a lack of consistency and ambiguity in the adoption of telehealth, especially when various regions use different reimbursement schemes.

Increasing occurrence of IoT & AI among pet parents

IoT-enabled gadgets assist in identifying symptoms of illness or anxiety, halting the progression of emergencies. Real-time anomaly detection by AI systems can encourage pet parents to take immediate action, preventing expensive emergency room visits or hospital stays. Large volumes of health data gathered from IoT devices may be interpreted by AI technology, which facilitates the identification of patterns, detecting anomalies, and recommending interventions. Furthermore, pet owners can receive this information in an easy-to-use format, enabling them to make better decisions regarding the health of their animals.

The teleconsulting segment hold the largest share in the veterinary telehealth market in 2024. A licensed veterinarian can remotely advise pet owners or other veterinary experts through video, phone, or chat. This practice is known as teleconsulting. The main goal is identifying, addressing, or offering guidance regarding animal health issues without requiring in-person clinic visits. When handling complicated situations, it also enables general veterinarians to consult specialists. By bridging the gap between general practitioners and experts, teleconsulting allows for faster and better patient results.

The teleradiology segment is observed to be the fastest growing in the veterinary telehealth market during the forecast period. The demand for specialist veterinary care, especially diagnostic services like radiography, is expanding as the number of pets and animals worldwide rises. Imaging methods such as Magnetic Resonance Imaging (MRI), CT scans, ultrasounds, and X-rays are essential for identifying a variety of animal ailments, such as internal injuries, tumors, and fractures. Pet ownership is on the rise worldwide, especially in cities. High-quality medical treatment for their pets is becoming increasingly important to pet owners.

The canine segment held the largest share in the veterinary telehealth market in 2024. Dogs are susceptible to several illnesses, including long-term disorders such as diabetes, obesity, arthritis, and skin infections. More and more pet owners are prepared to invest money in their dogs' cutting-edge medical care. Telehealth solutions are increasingly being used for prompt and precise care due to the global trend toward premiumization in pet care.

The feline segment is observed to be the fastest growing in the veterinary telehealth market during the forecast period. Both cats and their owners may experience difficulties and trauma when being transported to clinics. Connecting with veterinarians from the comfort of your home is stress-free with telehealth. The secretive nature of cats frequently makes it more difficult to identify symptoms. Owners can discuss little but important pet behavioral changes during virtual consultations. Veterinarians can identify feline ailments early using tele-triage systems, video consultations, and innovative symptom assessment methods. Now, many platforms provide advisory services tailored to cats, fueling the market's expansion.

The cloud/app-based segment will hold the largest share of the veterinary telehealth market in 2024. The need for cutting-edge veterinary care solutions has grown as pet adoption has surged globally. Pet owners view their animals as family members, fueling the demand for quick, easy, high-quality medical treatment. Most cloud-based programs have a subscription-based cost structure, which makes them economical for veterinary clinics, especially small and medium-sized ones. Cloud infrastructure lowers operating expenses by eliminating the need for pricey physical IT infrastructure.

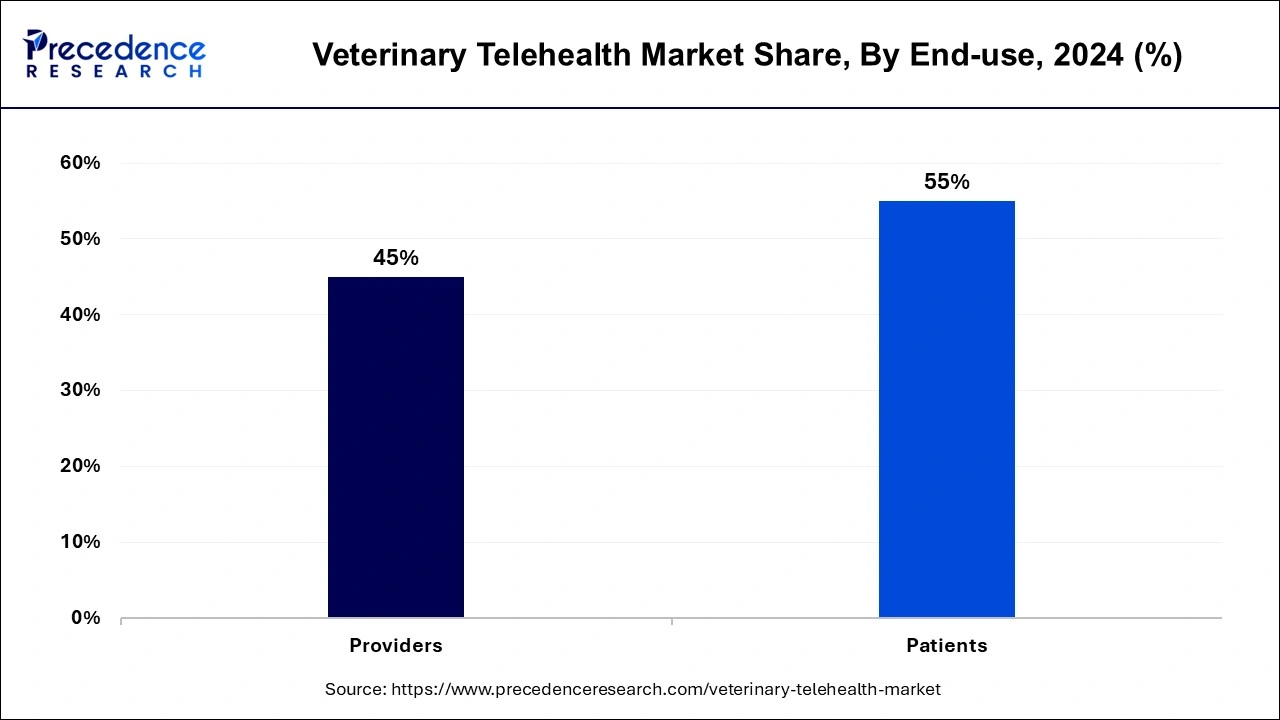

The patients segment dominated the veterinary telehealth market in 2024. Cats, dogs, and other small pets are examples of companion animals that have grown to be essential members of households. Pet owners prioritize the health and well-being of their animals, which fuels the need for regular examinations, tests, and continuing care. Pet owners benefit from veterinary telehealth since it allows consultations without the anxiety of in-person visits.

The providers segment shows a significant growth in the veterinary telehealth market during the forecast period. The need for top-notch veterinary care has increased due to the rising worldwide pet adoption rate and the growing humanization of animals. Telehealth services encourage providers to incorporate virtual care into their offerings by offering a practical and affordable substitute for consultations, check-ups, and follow-ups. The importance of telehealth in veterinary care is acknowledged by governments and regulatory agencies, who progressively encourage its use.

By Type

By Animal Type

By Delivery Mode

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

August 2024

November 2024