August 2024

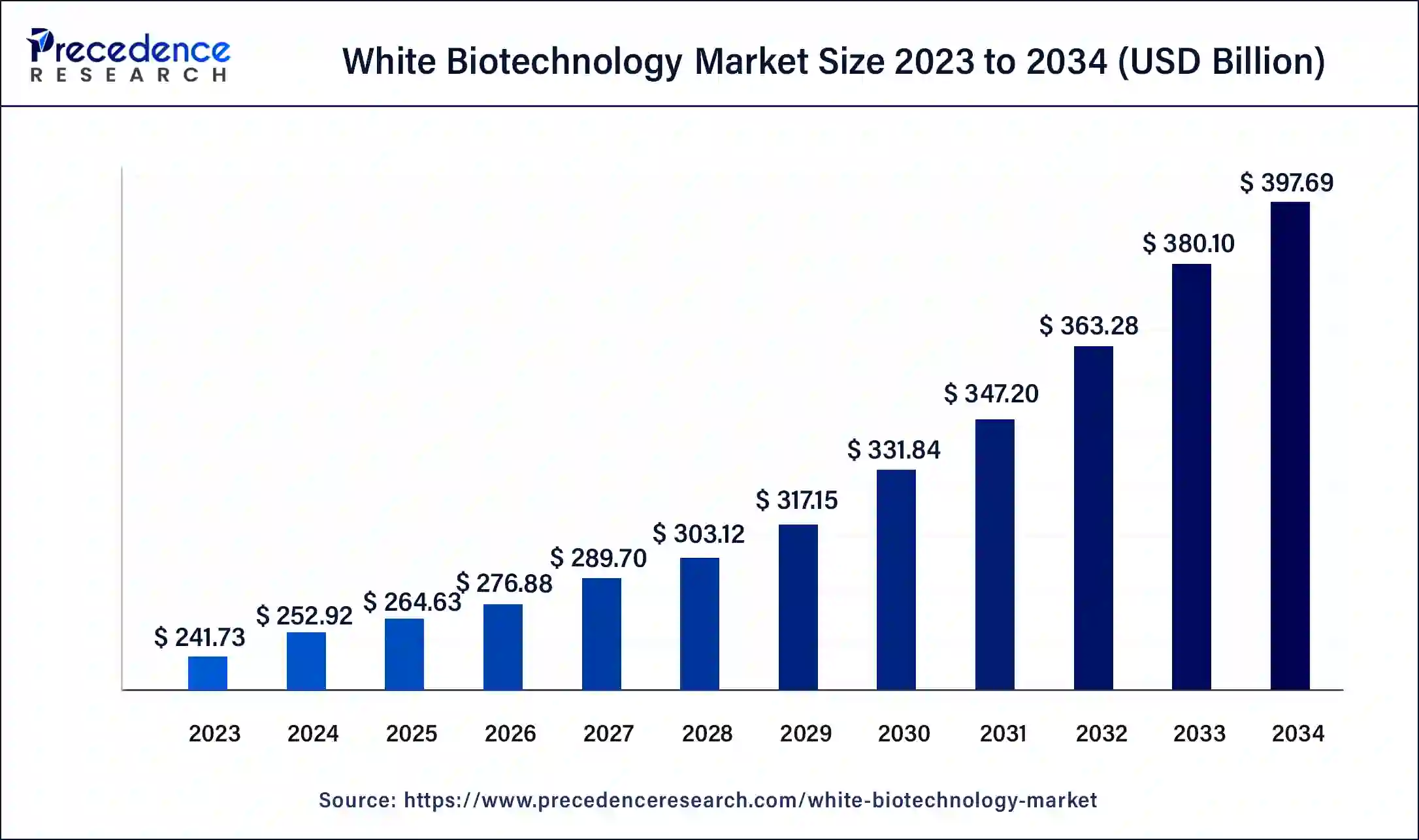

The global white biotechnology market size was USD 241.73 billion in 2023, calculated at USD 252.92 billion in 2024 and is expected to be worth around USD 397.69 billion by 2034. The market is slated to expand at 4.63% CAGR from 2024 to 2034.

The global white biotechnology market size is worth around USD 252.92 billion in 2024 and is anticipated to reach around USD 397.69 billion by 2034, growing at a CAGR of 4.63% over the forecast period 2024 to 2034. The North America white biotechnology market size reached USD 89.44 billion in 2023.

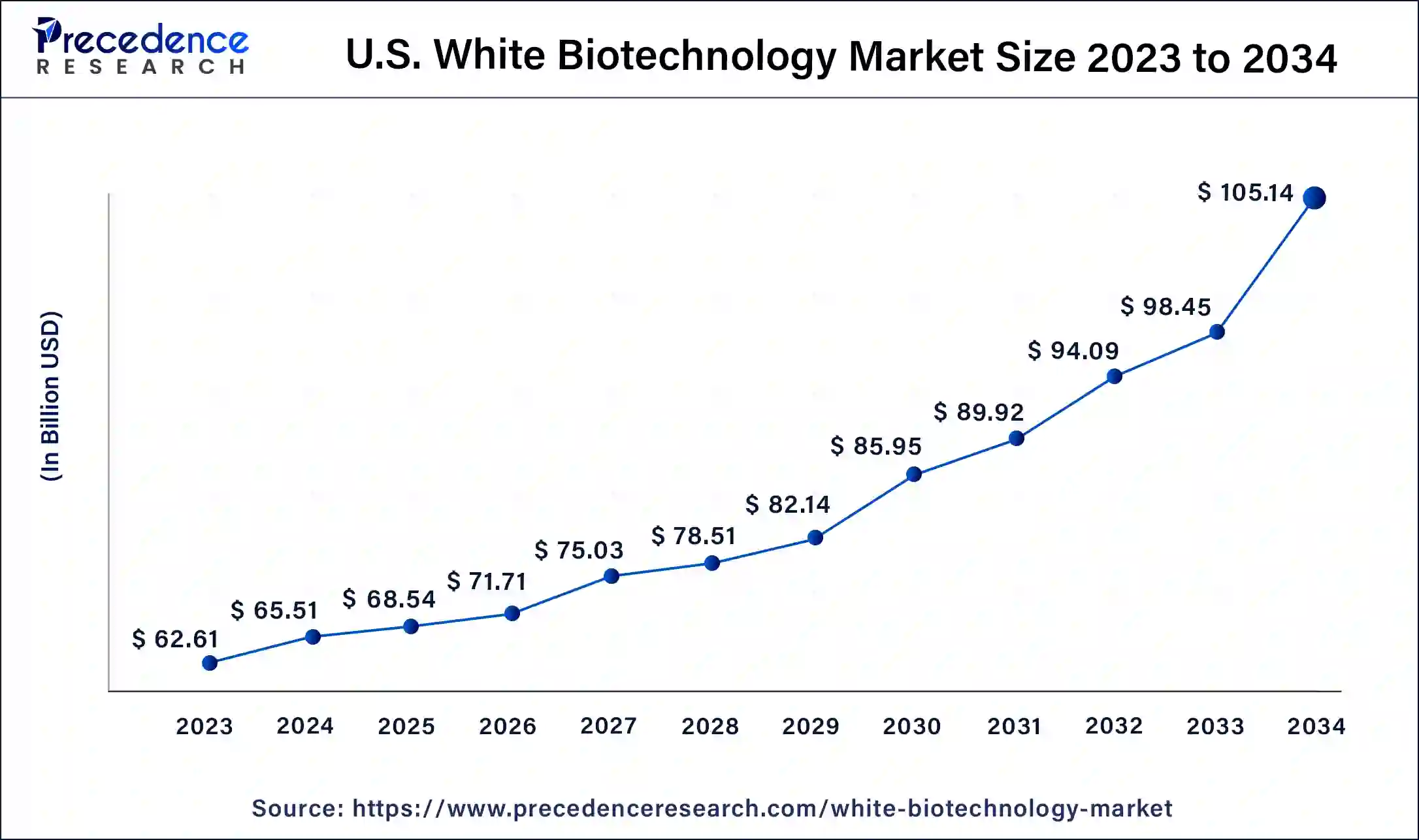

The U.S. white biotechnology market size was exhibited at USD 62.61 billion in 2023 and is projected to be worth around USD 105.14 billion by 2034, poised to grow at a CAGR of 4.82% from 2024 to 2034.

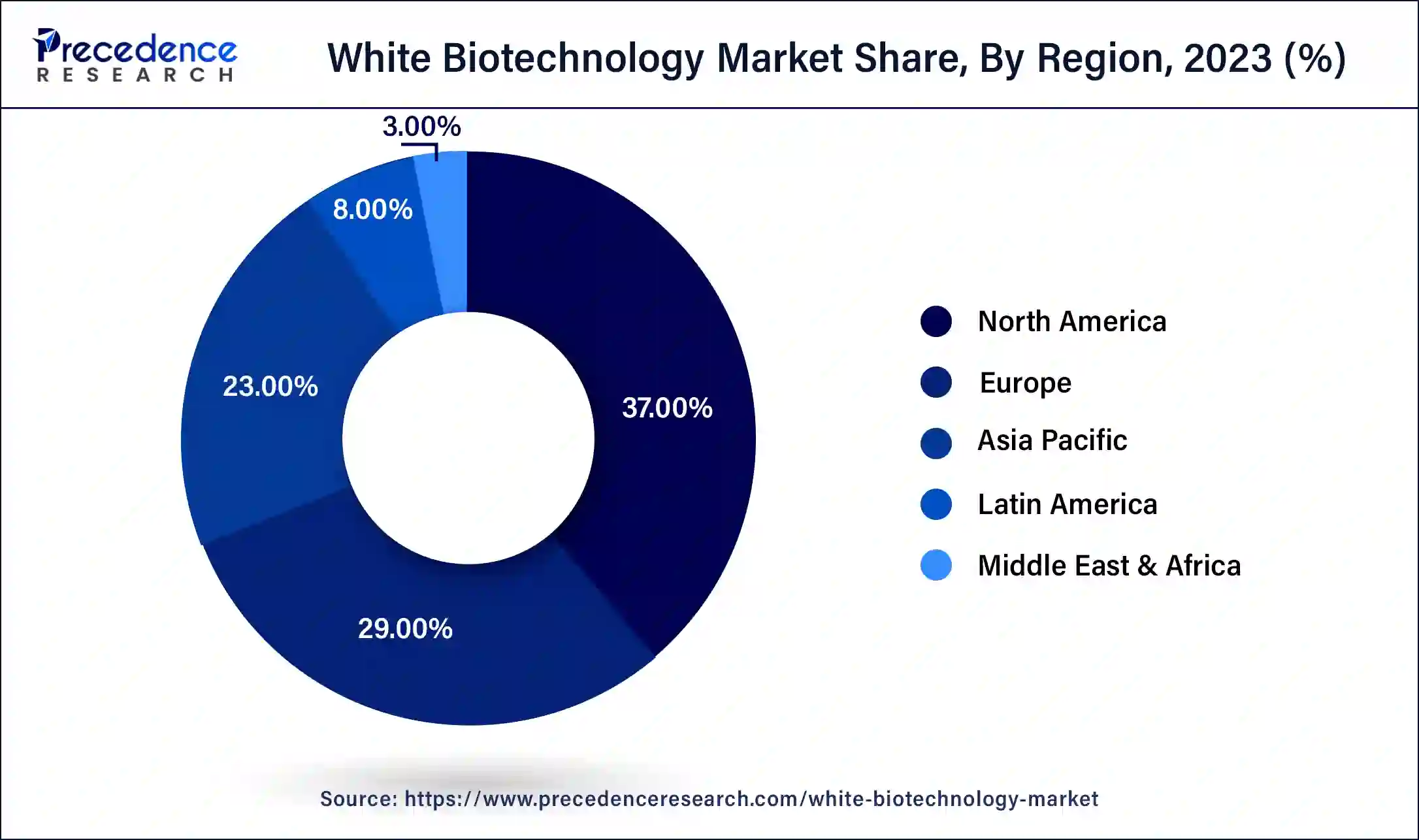

North America led the market with the highest market share of 37% in 2023. North America has a robust research and innovation ecosystem that accelerates advancements in white biotechnology. The region holds a wide industrial base and a continuous focus on sustainability and environmental safety, which increases the adoption of eco-friendly solutions. The growing demand from diverse industries to meet the ongoing consumer demand for sustainable and eco-friendly products coupled with the rising need to address several environmental issues aligns is anticipated to increase the popularity of white biotechnology in the North American Region.

A significant rise in Government initiatives and policies promoting bio-based products, clean or renewable energy, and focusing on minimizing carbon emissions is expected to strengthen the white biotechnology market’s expansion in the coming years. Furthermore, both governments and corporations are heavily investing in bio-based alternatives and environmentally conscious practices, which serve as a driving force in shaping a greener and sustainable future.

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The region’s growth is attributed to the rising environmental concerns, increasing consumer preference for sustainable products, increasing population, growing focus to reduce carbon emissions, rising production of bio-products, increasing awareness regarding the benefits of biofuels, rising investment in R&D for green products, growing popularity of energy-efficient industrial products, and supportive government regulations and incentives.

Over the years, the biotechnology sector has grown significantly in China. The country’s strong emphasis on environmental protection, sustainability, and rapid technological improvements is anticipated to bolster the growth of the market during the forecast period. Moreover, several market players are adopting business strategies such as collaboration or partnership, acquisition, and investment in local companies to expand their market share. Therefore, these factors are likely to positively impact the white biotechnology market and can cause an increase in substantial growth in the region.

White biotechnology is gaining immense attention in industrial processes and manufacturing. The white biotechnology market is also known as industrial biotechnology industry. This branch of biotechnology uses enzymes and microorganisms to produce a wide range of value-added chemicals from renewable sources. White Biotechnology is one of the prominent applications of biotechnology for the processing and production of materials, chemicals, and energy. It uses microorganisms like bacteria, yeast, mold, and fungi to make sustainable and eco-friendly products in sectors including chemistry, paper and pulp, food and feed, textiles, and energy.

How is Artificial Intelligence Transforming the Biotechnology Sector?

In the white biotechnology market, AI algorithms can predict how different compounds will interact with biological targets, significantly speeding up the initial stages of drug discovery. This reduces the need for trial-and-error experimentation, saving time and resources. AI also enables the virtual screening of vast libraries of compounds to identify potential drug candidates. Machine learning models can analyze data from previous experiments to predict the efficacy and safety of new compounds.

| Report Coverage | Details |

| Market Size by 2034 | USD 397.69 Billion |

| Market Size in 2023 | USD 24.73 Billion |

| Market Size in 2024 | USD 252.92 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.63% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for sustainable products

The rising demand for sustainable products is expected to accelerate the growth of the white biotechnology market. The evolving consumer attitudes and preferences have increased the demand for sustainable products that have minimal environmental impact. Consumers around the world are looking for transparency regarding the production processes and materials, which in turn encourages businesses to adopt bio-based solutions to meet these expectations.

Integrating white biotechnology allows industries to create greener and more sustainable products. The evolving consumer demand and the increasing offerings of the white biotechnology industry reinforce the massive shift toward sustainable products and propel industries to emphasize environmentally friendly practices in their operations. Therefore, the rising acceptance of sustainable products contributes to the white biotechnology market expansion during the forecast period.

High initial investment

The high initial investment is anticipated to restrain the white biotechnology market expansion during the forecast period. High initial investment acts as a big for the white biotechnology sector. Financial resources are required to develop and deploy bio-based processes and technologies, which often restrict the entry of potential firms due to budget constraints.

White biotechnology's upfront costs are high due to the rising research and development expenses. Initial stage investments are required for a bio-based product or process to be feasible and competitive in the market. In addition, Despite the various benefits associated with white biotechnology, it often faces competition from established chemical production methods, particularly in markets less inclined towards eco-friendly practices, which may restrict the expansion of the global white biotechnology market.

Rising environmental concerns coupled with government regulations and incentives

The rising environmental concerns, coupled with government regulations and incentives, are projected to offer immense growth opportunities to the white biotechnology market in the coming years. The increase in global environmental problems, including climate change and resource depletion, increases the popularity of white biotechnology globally. White biotechnology focuses on making energy-efficient industrial products. White biotechnology strongly represents a best-suited alternative to petroleum-based chemical production. It not only assists in reducing reliance on fossil fuels but also generates less waste, utilizes less energy, and is capable of creating biodegradable products that are sustainable and environmentally friendly.

Several governments worldwide are implementing policies and offering attractive incentives that significantly increase the adoption of the white biotechnology market. Incentives include tax credits, grants, and subsidies to promote the deployment of sustainable solutions. Supportive government regulatory frameworks encourage the use of renewable resources and bio-based products and create a favorable environment for industries to embrace white biotechnology. Thus, such factors ensure a regulatory framework that drives sustainable industrial practices and accelerates the transition to greener alternatives.

The biofuel segment accounted for the dominating share of the white biotechnology market in the year 2023 and is also projected to continue its dominance over the forecast period. The demand for biofuel like bioethanol and biodiesel has substantially increased owing to the rising preference for sustainable energy solutions. Biofuels are derived from biological processes, offering a suitable renewable alternative to fossil fuels. The rising use of biofuels assists in reducing greenhouse gas emissions and lowers the dependency on fossil fuel resources. Several government-supported policies aimed at reducing carbon emissions drive the growth of the segment. Therefore, the rising adoption of biofuel helps in the transition towards cleaner and more sustainable energy sources.

The biochemicals segment is expected to witness considerable growth in the white biotechnology market over the forecast period. This segment’s growth is attributed to the growing demand for environmentally friendly chemicals and the increasing adoption of sustainable manufacturing practices. The rapid improvements in bioprocessing technologies enable the cost-effective production of eco-friendly and high-quality biochemicals. Biochemicals provide greener alternatives over conventional petrochemical-based products and assist in meeting the evolving consumer and industrial demands for sustainable solutions. The increasing demand for bio-based chemicals reduces carbon footprints and contributes to a more sustainable future, as well as shapes industries towards accepting eco-friendly practices. Thereby driving the growth of the market.

The bioenergy segment held the largest share of the white biotechnology market in 2023 and is expected to sustain its position throughout the forecast period. Bioenergy plays a critical part in the global white biotechnology market. White biotechnology provides sustainable solutions to produce energy from renewable natural sources and promote a sustainable energy transition. White biotechnology offers lucrative opportunities for the production of biofuels and bioenergy through the use of agricultural residues, biomass, and other organic materials. Bioenergy plays a significant role in addressing global environmental concerns by offering sustainable and cleaner energy alternatives that contribute to lower greenhouse gas emissions. Several emerging economies are heavily investing in clean energy, using white biotechnology to meet the ongoing demands and reduce reliance on fossil fuels. Such factors are driving the growth of the segment during the forecast period.

The food & beverages segment is expected to grow significantly in the white biotechnology market during the forecast period, owing to the rising consumer demand for healthier and more sustainable food options. White biotechnology aids in improving safety, food quality, and shelf life. Microorganisms play an integral role in the production of food and beverages. Vitamins, polyunsaturated fatty acids, essential amino acids, flavor enhancers (monosodium glutamate), flavoring compounds (methyl-ketones), thickening or gelling agents, and acids (lactic acid) are substances widely used in the food industry that are mainly derived from microbial fermentation from microbes rather than synthetic nutrients which are derived from chemical processes. Thus bolstering the segment's growth.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

March 2024

July 2024

July 2024