January 2025

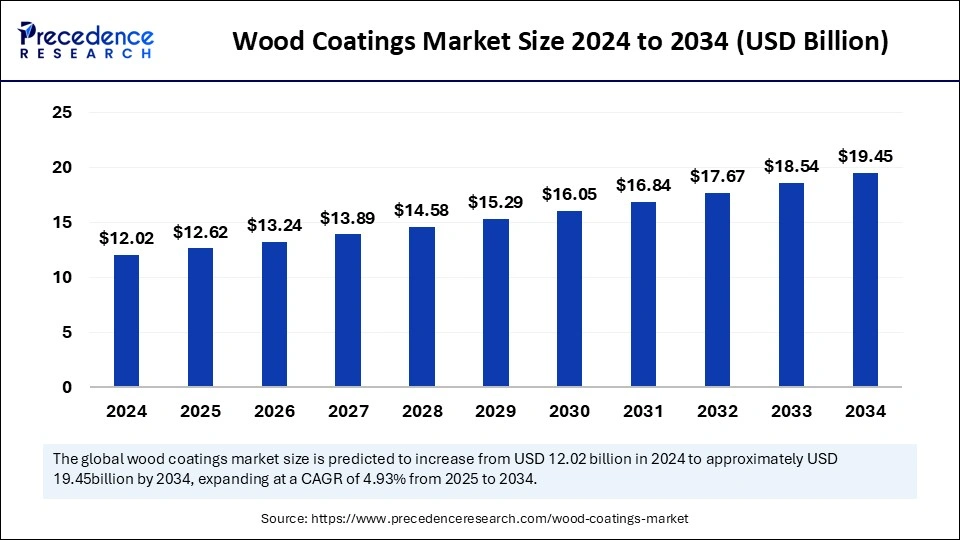

The global wood coatings market size is calculated at USD 12.62 billion in 2025 and is forecasted to reach around USD 19.45 billion by 2034, accelerating at a CAGR of 4.93% from 2025 to 2034. Asia Pacific market size surpassed USD 5.65 billion in 2024 and is expanding at a CAGR of 5.04% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global wood coatings market size was estimated at USD 12.02 billion in 2024 and is predicted to increase from USD 12.62 billion in 2025 to approximately USD 19.45 billion by 2034, expanding at a CAGR of 4.93% from 2025 to 2034. The growth of the wood coatings market is driven by the increased demand for household furniture and consumer preference for aesthetics.

The incorporation of artificial intelligence in the wood coatings market has ushered in a transformative era, revolutionizing everything from manufacturing processes to the overall consumer experience. Cutting-edge AI algorithms are now capable of analyzing high-resolution images of wooden products in real-time, effectively detecting imperfections like knots, cracks, and signs of insect infestation. This advanced technology not only helps ensure that the products meet elevated quality standards but also substantially reduces material waste, achieving a level of consistency that traditional human inspections can not. Moreover, AI systems provide precise measurements, significantly minimizing the likelihood of errors and ensuring that the finished goods conform to strict specifications. With instant feedback from these intelligent systems, manufacturers can make timely adjustments during production, preventing substandard products from reaching consumers.

AI's capabilities extend to optimizing coating formulations by analyzing extensive datasets, resulting in enhancements in durability, aesthetic appeal, and overall product performance. This analytical prowess facilitates the swift development of innovative coatings tailored to meet evolving market demands. Furthermore, AI-driven predictive maintenance tools can foresee when machinery requires servicing, thus reducing operational downtime and bolstering efficiency throughout the production line. In addition to streamlining manufacturing and quality control processes, AI also plays a critical role in distribution and sales. By diving deep into customer data and market trends, AI aids manufacturers in creating bespoke furniture and coatings that cater to specific consumer needs and preferences. AI supports the creation of vivid, realistic virtual models of furniture utilizing advanced 3D visualizations, which enhance the design process.

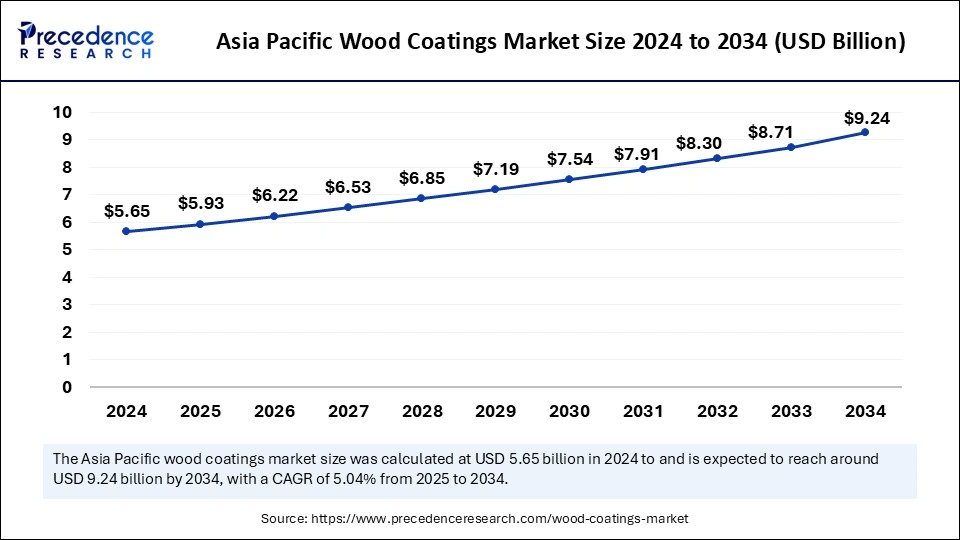

Asia Pacific wood coatings market size was exhibited at USD 5.65 billion in 2024 and is projected to be worth around USD 9.24 billion by 2034, growing at a CAGR of 5.04% from 2025 to 2034.

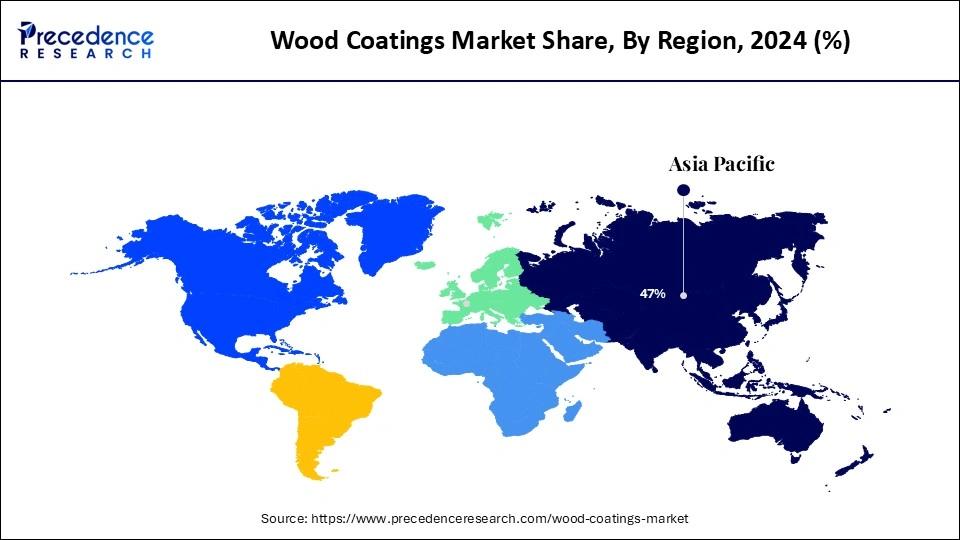

Asia Pacific dominated the wood coatings market with the largest share in 2024. This is mainly due to the increased adoption of aesthetic furniture in emerging economies, combined with an expanding middle-class population. Advancements in material science and application techniques have improved product performance and accessibility, thereby appealing to a broader range of consumers. In addition, a significant increase in construction activities and stringent regulations for the paints & coatings industry bolstered the regional market growth. For instance, China's "GB 18581-2020" standard limits volatile organic compounds (VOCs) in coatings and adhesives and encourages eco-friendly formulations. Japan's Chemical Substances Control Law (CSCL) requires thorough checks of chemical substances to ensure paints and coatings' safety and environmental compatibility.

The market in Europe is estimated to expand at the highest CAGR in the coming years. This is mainly due to changing consumer preferences toward environmentally friendly coatings that reduce the environmental impact and boost circular economy. There is a high emphasis on sustainable practices, encouraging the construction and furniture industry to adopt bio-based, low-VOC coatings.

The wood coatings market is a vibrant and rapidly changing industry, influenced by numerous factors such as construction activity, furniture manufacturing rates, and shifting consumer preferences. A surge in residential and commercial construction projects and an increasing need for stylish and functional furniture are driving forces behind market expansion. Renovation and remodeling activities are rising, fueling the growth of the market. As homeowners and businesses alike seek to renovate their spaces, the demand for high-quality wooden finishes increases.

Protective coatings that guard against environmental challenges such as moisture, UV radiation, and physical scratches are now highly sought after. There is also a notable trend toward eco-friendly products, leading to increased demand for coatings with low volatile organic compound (VOC) emissions. Water-based coatings, renowned for their reduced environmental footprint compared to solvent-based options, are gaining immense traction. Continued research and innovative development endeavors are paving the way for the introduction of advanced coatings that deliver superior performance and resilience. UV-curable coatings, which offer rapid curing times alongside enhanced durability, are also gaining popularity.

| Report Coverage | Details |

| Market Size by 2034 | USD 19.45 Billion |

| Market Size in 2025 | USD 12.62 Billion |

| Market Size in 2024 | USD 12.02 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.93% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Resin Type, Technology, Application and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Construction Activities and Hospitality Sector’s Growth

The wood coatings market is experiencing significant growth due to various factors. Firstly, the construction industry is experiencing a surge in activity, encompassing both residential and commercial projects. This uptick in construction activities is boosting the demand for furniture. Secondly, increasing disposable incomes, especially in developing regions with an expanding middle-class population, further support market growth. The hospitality sector's rapid growth is also boosting the adoption of furniture as hotels and restaurants seek to create attractive and sophisticated environments. There is a notable shift towards aesthetically pleasing and durable furniture, with consumers prioritizing long-lasting quality over fleeting trends.

Stringent Regulations

Despite the growth potential, the industry faces challenges such as stringent regulations concerning volatile organic compounds (VOCs), which limit the use of solvent-based coatings. Manufacturers are under increasing pressure to transition to eco-friendly alternatives that meet both regulatory standards and consumer expectations. Additionally, fluctuations in the prices of raw materials can pose significant risks, potentially driving up production costs and squeezing profit margins. Competition from alternative materials, including plastics and composites, can hinder the growth of the wood coatings market, as these alternatives offer cost-effective solutions. Economic downturns can also impact consumer spending on furniture, leading to reduced demand for wood coatings.

Demand for Bio-based Coatings

The rising demand for low VOC and bio-based coatings presents an avenue for innovation and market growth. There is a growing focus on developing cutting-edge water-based and UV-curable technologies that align with sustainability trends. Rapid urbanization and industrialization in developing regions and emerging markets provide substantial opportunities for expansion and market penetration. Moreover, there is a high awareness and preference for sustainable and eco-friendly products, which prompts manufacturers to develop innovative sustainable coatings. Personalization is another prominent trend, with consumers increasingly opting for bespoke furniture. Continued research and development in advanced coating technologies will likely uncover new possibilities and propel the wood coatings market growth.

The polyurethane segment dominated the wood coatings market by capturing the largest share in 2024. This is primarily because most wooden furniture manufacturers opt for polyurethane as their preferred coating material. This preference stems from the ready availability of polyurethane and its myriad benefits, which include outstanding durability, excellent chemical resistance, protection against ultraviolet light, and extended product longevity. Its superior performance makes it a staple in furniture production.

The nitrocellulose segment is anticipated to expand at the fastest growth rate during the forecast period.

Nitrocellulose is widely recognized as one of the most prevalent resin types utilized in the wood coating sector. The ease of application positions nitrocellulose coatings as a favored choice among do-it-yourself enthusiasts and small-scale woodworkers. Users appreciate its versatility, as the coatings can be effortlessly sprayed, brushed, or wiped onto wood surfaces, making them accessible to a wide range of applications.

The solvent-borne segment dominated the wood coatings market with the largest share in 2024. These coatings are highly regarded for their ease of application and ability to deliver a superior finish. Their performance characteristics often surpass those of water-based coatings, providing excellent durability, strong adhesion, and exceptional resistance to wear and environmental factors, including chemicals.

The water-borne segment is projected to witness the fastest growth over the studied period. The appeal of water-borne coatings lies in their lower volatile organic compounds (VOCs), which classify them as more environmentally friendly than solvent-borne alternatives. Additionally, water-borne coatings are known for their milder odor. This feature not only enhances the working conditions for applicants but also contributes to reducing indoor air pollution, making them increasingly popular among consumers who prioritize health and environmental considerations.

The furniture segment accounted for the largest market share in 2024. This is mainly due to the increase in demand for furniture, driven by several factors such as a surge in urbanization, the expansion of residential living spaces, the rise in the number of nuclear families, and an enhanced consumer emphasis on home décor and aesthetics. Both developed and developing economies are experiencing high demand for furniture, indicating that the furniture industry is poised for significant growth, boosting the segment’s growth.

The flooring and decking segment is projected to witness substantial growth throughout the forecast period. This is mainly due to a growing consumer preference for eco-friendly flooring solutions. The rising popularity of sustainable materials is anticipated to open new avenues for market expansion, particularly within the wooden decking sector. As the focus on sustainability increases, so does the demand for water-borne coatings for flooring and decking purposes.

By Resin Type

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2022

January 2025

February 2025