February 2025

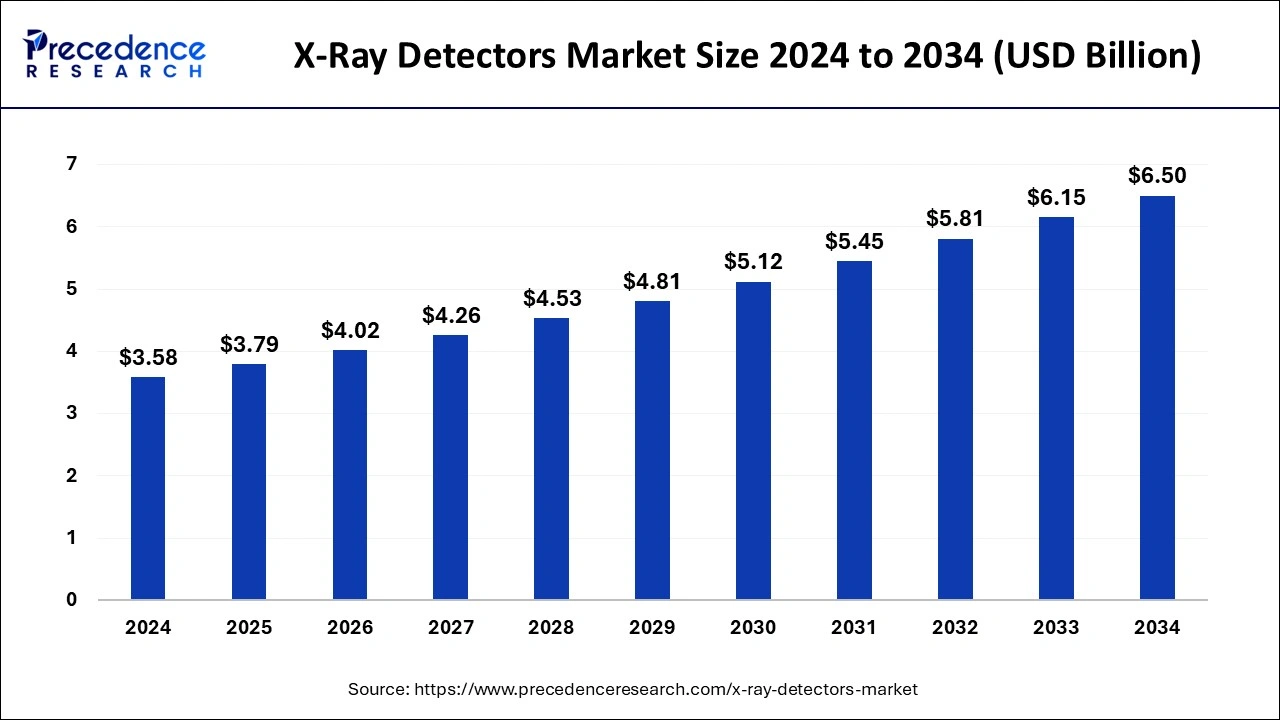

The global X-ray detectors market size is accounted at USD 3.79 billion in 2025 and is forecasted to hit around USD 6.50 billion by 2034, representing a CAGR of 6.15% from 2025 to 2034. The North America market size was estimated at USD 1.40 billion in 2024 and is expanding at a CAGR of 6.14% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global X-ray detectors market size was calculated at USD 3.58 billion in 2024 and is predicted to increase from USD 3.79 billion in 2025 to approximately USD 6.50 billion by 2034, expanding at a CAGR of 6.15% from 2025 to 2034.

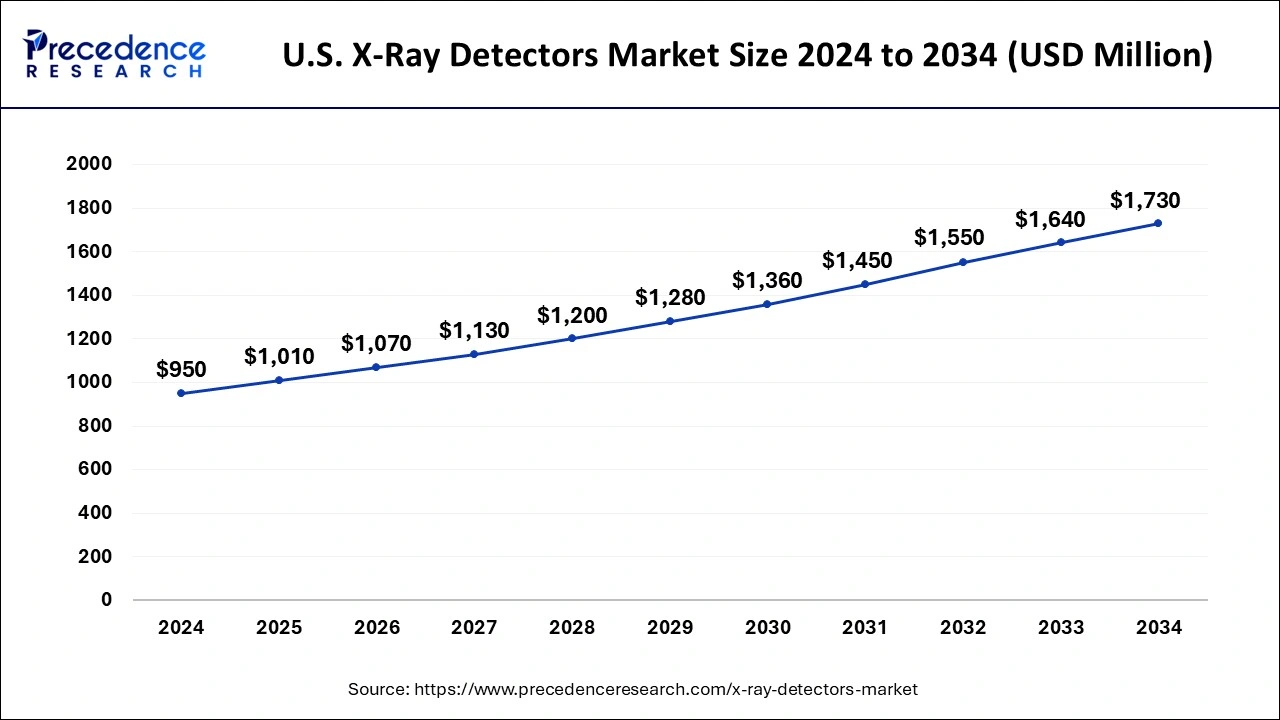

The U.S. X-ray detectors market size was exhibited at USD 950 million in 2024 and is projected to be worth around USD 1,730 million by 2034, growing at a CAGR of 6.18% from 2025 to 2034.

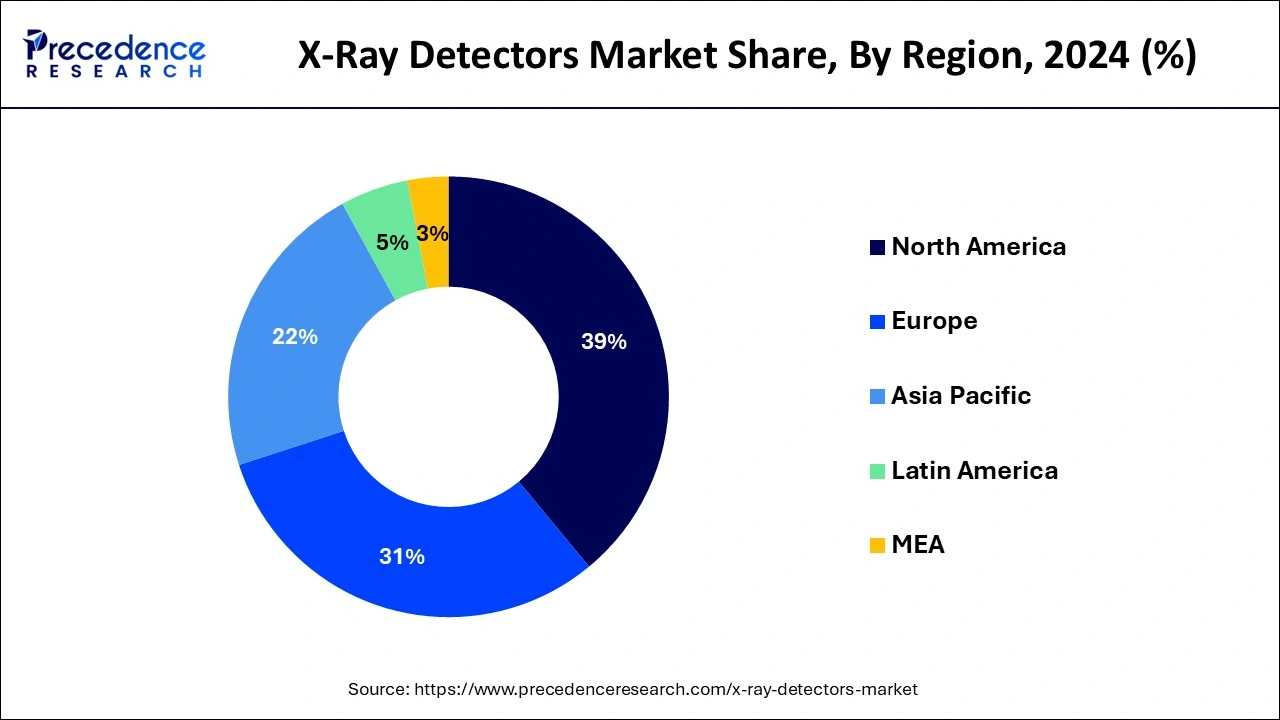

North America has held the largest revenue share 39% in 2024. North America holds a major share in the X-ray detectors market due to robust healthcare infrastructure, high healthcare expenditure, and early adoption of advanced medical technologies. The region benefits from a well-established regulatory framework and significant investments in research and development. Moreover, the presence of key market players contributes to technological advancements. The demand for diagnostic imaging in various medical disciplines, coupled with a proactive approach toward integrating innovative solutions, positions North America as a leader in the X-ray detectors market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific dominates the X-ray detectors market due to factors such as rapid technological advancements, a burgeoning population, and increased healthcare infrastructure investments. The region's growing aging population contributes to heightened medical imaging needs, boosting the demand for X-ray detectors.

Additionally, expanding economies, rising awareness of advanced diagnostic technologies, and supportive government initiatives further propel the market. The increasing prevalence of chronic diseases in the region also drives the adoption of X-ray detectors for efficient diagnostics, solidifying Asia-Pacific's significant share in the global market.

X-ray detectors are essential tools in medical imaging and security screening. They play a key role in converting X-ray radiation into visible images or electronic signals. These detectors are crucial in medicine for visualizing internal body structures, aiding healthcare professionals in diagnosis. Two main types of X-ray detectors are commonly used in medical imaging: scintillation detectors, which use crystals emitting light when exposed to X-rays, and digital radiography detectors, directly converting X-ray photons into electrical signals to produce high-resolution digital images.

Beyond healthcare, X-ray detectors are vital in security systems, particularly in airports for baggage screening. They contribute to safety by identifying potential threats or prohibited items. Ongoing technological advancements in X-ray detectors focus on increasing sensitivity, efficiency, and overall performance, leading to improved image quality and faster imaging processes in both medical and security applications.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.15% |

| Market Size in 2025 | USD 3.79 Billion |

| Market Size by 2034 | USD 6.50 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Panel Size, Portability, Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing medical imaging demand and prevalence of chronic diseases

The growing need for medical imaging services, combined with an uptick in chronic illnesses, is fueling a heightened demand for X-ray detectors. As the global population expands and ages, there is a heightened requirement for diagnostic imaging to identify and monitor various health conditions. X-ray detectors, being crucial in this context, enable accurate and prompt diagnoses.

The prevalence of chronic diseases, such as heart conditions and cancer, further underscores the importance of advanced diagnostic tools like X-ray detectors, given their role in early detection and continuous monitoring. With their capability to provide detailed images of internal structures, X-ray detectors empower healthcare professionals to make well-informed decisions about treatment strategies, contributing to better patient outcomes.

As healthcare systems globally aim for improved diagnostic capacities, the demand for X-ray detectors is on the rise, addressing the increasing requirements for medical imaging in an aging and health-conscious population.

Data security and privacy concerns

Data security and privacy concerns represent significant hurdles to the growth of the X-ray detectors market. As healthcare systems increasingly transition to digital platforms, the digitization of X-ray images raises apprehensions about the protection of sensitive patient information. The potential for unauthorized access or breaches poses a risk to patient privacy, making healthcare providers and institutions cautious about fully embracing digital X-ray detector systems. Adhering to stringent data protection regulations adds complexity to the implementation of secure storage, transmission, and access protocols for X-ray data.

This concern not only impacts the adoption rate among healthcare providers but also influences patient confidence in undergoing X-ray procedures. To foster market growth, industry stakeholders must prioritize robust data security measures, invest in encryption technologies, and advocate for stringent compliance standards to allay concerns surrounding the confidentiality and integrity of medical imaging data.

Opportunity

Diversification into non-medical sectors

Diversification into non-medical sectors is a strategic move that creates significant opportunities in the X-ray detectors market. Beyond traditional medical applications, X-ray detectors find use in industrial and security sectors, presenting avenues for market expansion. In industrial settings, X-ray detectors are vital for quality control in manufacturing processes, material analysis, and non-destructive testing. The demand for robust security systems has led to the incorporation of X-ray detectors in baggage and cargo screening, enhancing threat detection capabilities.

Manufacturers capitalizing on these non-medical applications can tap into a broader market base, reducing dependency on the healthcare sector alone. Moreover, the versatility of X-ray detectors in diverse industries fosters innovation, encouraging the development of specialized detectors tailored to the unique requirements of each sector. By exploring and investing in these non-medical applications, X-ray detector manufacturers can enhance revenue streams and ensure sustained growth in an evolving market landscape.

In 2024, the flat panel detectors segment had the highest market share of 44% based on the type. Flat panel detectors (FPDs) in the X-ray detectors market refer to digital imaging devices that directly capture X-ray images. These detectors offer advantages over traditional methods by providing real-time imaging, improved image quality, and reduced radiation exposure.

A trend in the FPD segment involves the increasing adoption of amorphous silicon (a-Si) and amorphous selenium (a-Se) technologies, enhancing sensitivity and resolution. The demand for portable and lightweight FPDs is also on the rise, catering to the need for flexibility in various medical and non-medical applications.

The mobile detectors segment is anticipated to expand at a significant CAGR of 7.5% during the projected period. The mobile detectors segment in the X-ray detectors market refers to portable and mobile X-ray systems designed for on-the-go imaging applications. These detectors offer flexibility and convenience, particularly in emergency medical services, bedside diagnostics, and field environments.

A trend in this segment involves the development of lightweight, compact, and easy-to-maneuver mobile X-ray detectors. Advancements in battery technology, wireless connectivity, and image processing contribute to the growing popularity of mobile detectors, enabling healthcare professionals to conduct imaging procedures efficiently outside traditional healthcare settings.

According to the panel size, the small area segment has held 54% revenue share in 2024. In the X-ray detectors market, the small panel size segment typically refers to detectors with dimensions suitable for imaging specific anatomical areas, such as extremities or dental applications. This niche segment is witnessing a growing trend as healthcare providers increasingly value specialized imaging solutions for focused diagnostics. Compact panel sizes allow for targeted and efficient imaging, contributing to reduced radiation exposure and enhanced patient comfort. The demand for small-area X-ray detectors is driven by the emphasis on precision diagnostics and the need for tailored solutions in specific medical and dental procedures.

The large area segment is anticipated to expand fastest over the projected period. The large area segment in the X-ray detectors market refers to detectors with expansive panels, typically used in applications requiring extensive coverage, such as full-body imaging and industrial inspections. This segment is witnessing a trend towards larger panel sizes, driven by the demand for higher-resolution imaging and improved efficiency. The adoption of larger panels enables enhanced diagnostic capabilities in medical imaging while catering to the growing needs of industrial sectors for comprehensive and detailed inspections, contributing to the overall growth and diversification of the X-ray detectors market.

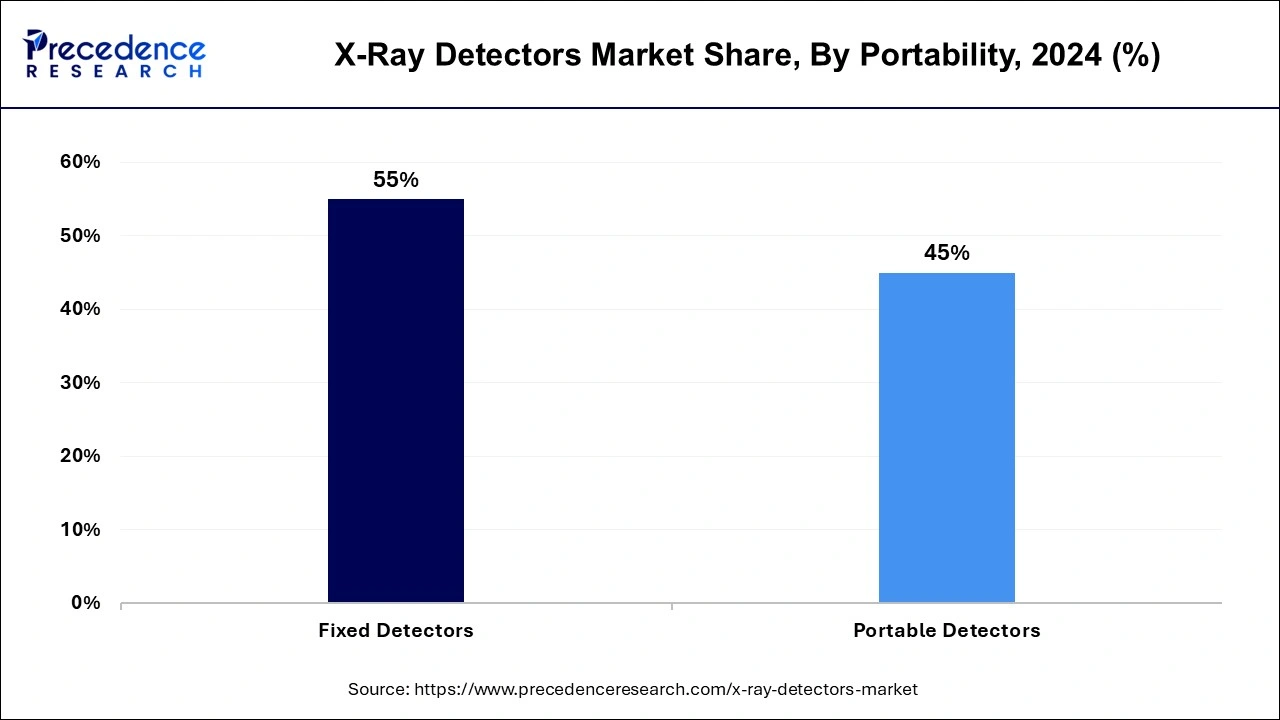

According to the portability, the fixed detectors segment has held a 55% revenue share in 2024. In the X-ray detectors market, fixed detectors refer to stationary imaging devices typically installed in dedicated locations within healthcare facilities. These detectors are integral to traditional radiography and fluoroscopy setups, providing stable and consistent imaging. A notable trend in this segment involves continuous advancements in technology, enhancing the resolution and efficiency of fixed X-ray detectors. Despite the rise of portable options, fixed detectors maintain significance in comprehensive medical imaging systems, ensuring reliable and high-quality diagnostic capabilities within established healthcare infrastructures.

The portable detectors segment is anticipated to expand fastest over the projected period. The portable detectors segment in the X-ray detectors market refers to compact, mobile devices that offer flexibility in medical imaging. These detectors enable point-of-care diagnostics, allowing healthcare professionals to perform X-ray examinations at the patient's bedside or in remote locations.

A notable trend in this segment is the increasing demand for lightweight and user-friendly portable X-ray detectors, driven by the growing emphasis on mobile healthcare solutions. Advancements in battery technology and the development of wireless connectivity further contribute to the rising popularity of portable X-ray detectors for their convenience and efficiency in various healthcare settings.

According to the application, the medical imaging segment has held a 35% revenue share in 2024. In the X-ray detectors market, the medical imaging segment involves the use of detectors for capturing detailed images of the human body, aiding in diagnostics. A key trend in this segment is the increasing demand for digital radiography detectors, offering higher image quality and faster processing. The transition from traditional film-based systems to digital solutions continues, driven by the advantages of improved workflow efficiency and the ability to store and transmit digital images. This trend reflects a broader industry shift towards advanced technology adoption for enhanced diagnostic accuracy in medical imaging.

The industrial application segment is anticipated to expand fastest over the projected period. In the X-ray detectors market, the industrial application segment involves the use of X-ray detectors for quality control, material analysis, and non-destructive testing in manufacturing settings. A key trend in this segment is the increasing adoption of digital X-ray detectors for improved imaging precision and efficiency in industrial processes. These detectors aid in identifying defects, ensuring product quality, and enhancing overall manufacturing reliability. As industries prioritize advanced technology for quality assurance, the industrial application segment is witnessing a surge in demand for cutting-edge X-ray detector solutions.

By Type

By Panel Size

By Portability

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

July 2024