March 2025

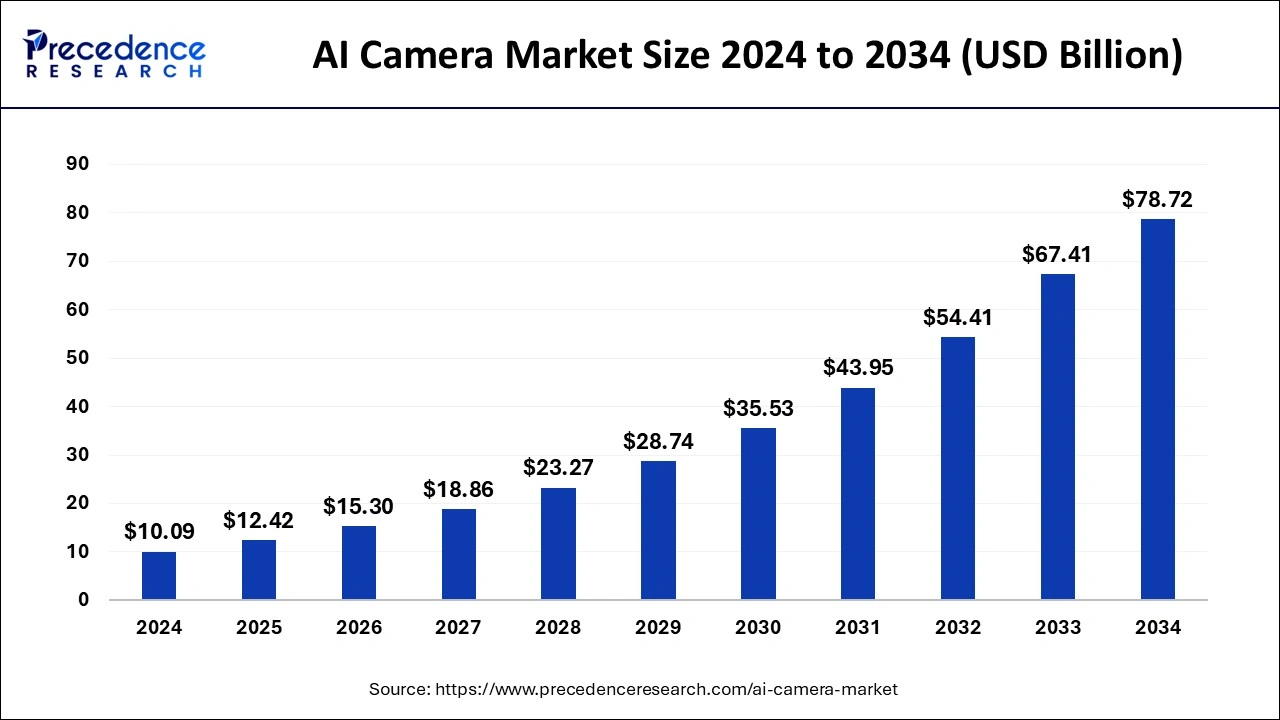

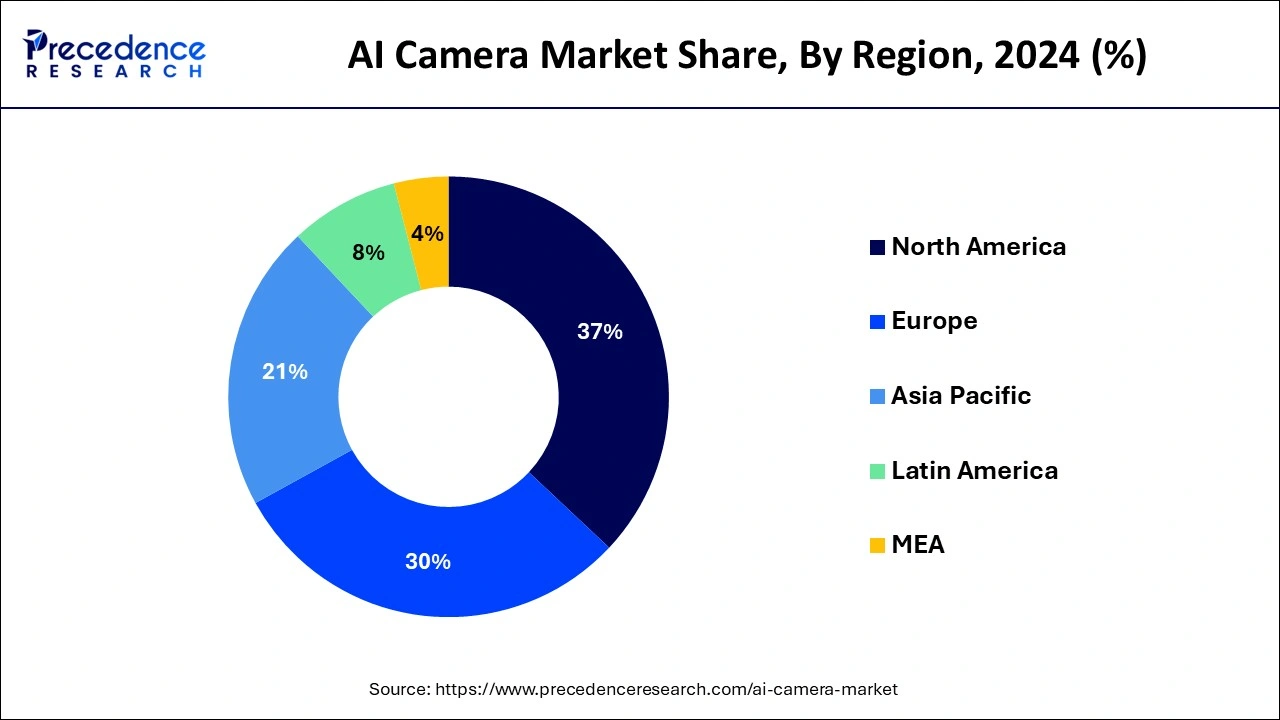

The global AI camera market size is calculated at USD 12.42 billion in 2025 and is forecasted to reach around USD 78.72 billion by 2034, accelerating at a CAGR of 22.81% from 2025 to 2034. The North America AI camera market size surpassed USD 3.73 billion in 2024 and is expanding at a CAGR of 22.82% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global AI camera market size was estimated at USD 10.09 billion in 2024 and is predicted to increase from USD 12.42 billion in 2025 to approximately USD 78.72 billion by 2034, expanding at a CAGR of 22.81% from 2025 to 2034.

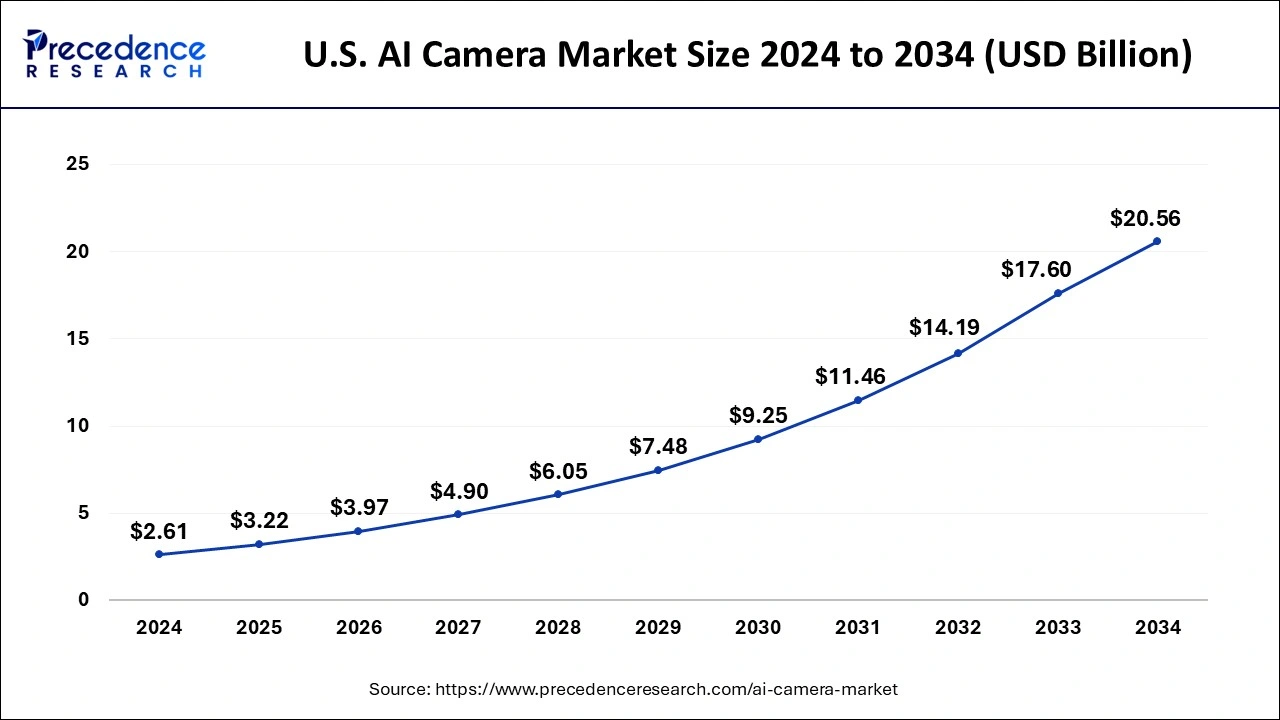

The U.S. AI camera market size was valued at USD 2.61 billion in 2024 and is projected to reach around USD 20.56 billion by 2034, growing at a CAGR of 22.92% from 2025 to 2034.

North America held the largest market share of 37% in 2024 in the AI camera market. The US has served as a center for technical innovation in North America. The area is home to numerous top businesses, AI camera manufacturers, and academic organizations. Advanced artificial intelligence camera technologies have been partly developed because of this clustering of creative minds. The availability of venture financing and other investment forms has facilitated the proliferation of AI camera firms in North America. Due to financial assistance, these businesses can expand their operations, carry out more in-depth research, and introduce cutting-edge items to the market.

North America AI camera market: Government initiatives

Asia-Pacific is observed to witness the fastest rate of expansion during the forecast period. Security is becoming more and more critical as technology advances and urbanization increases. AI cameras that recognize faces and analyze behavior are essential for solving security issues. The adoption of smart technology, including security and surveillance systems, is increasing. The market for cameras with AI capabilities is projected to grow as AI becomes a crucial component of these systems. Among them are developing nations with an increasing middle class. Increasing disposable incomes lead to a greater emphasis on modernizing infrastructure and integrating cutting-edge technologies.

Asia-Pacific AI camera market: Government initiatives

Consumers may now buy AI cameras because of the decreasing cost of AI processors and software. Fears of theft, crime, and terrorism drive demand for security and surveillance cameras. Compared to ordinary cameras, AI cameras provide several benefits, like automatically recognizing and following objects and people. Artificial intelligence cameras are critical in the increasingly popular smart home and city systems. AI cameras can monitor security threats and manage HVAC, lighting, and air conditioning. Companies are searching for methods to increase production and efficiency more and more. AI cameras can help businesses save time and money by automating processes, tracking inventories, and monitoring manufacturing lines.

In the upcoming years, it is anticipated that the market for AI cameras will keep growing. AI cameras will become increasingly commonplace as the technology advances and gets more reasonably priced. AI cameras can completely transform various industries and become increasingly integral to our daily lives.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 22.81% |

| Market Size in 2025 | USD 12.42 Billion |

| Market Size by 2034 | USD 78.72 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Type, By Technology, By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for surveillance solutions

Businesses, governments, and individuals are actively looking for sophisticated and intelligent surveillance systems to monitor and safeguard their assets as worries about security and safety continue to escalate. Artificial intelligence (AI) cameras provide several benefits over conventional surveillance systems. Because of their advanced image and video analysis capabilities, these cameras can instantly recognize and react to occurrences or anomalies. Features like object detection, behavior analysis, and facial recognition are made possible by incorporating AI into cameras, improving the overall effectiveness and precision of surveillance systems.

Artificial intelligence (AI) cameras are becoming more widely used in various industries, including retail, transportation, critical infrastructure, and smart cities, due to the growing demand for preventive security measures and technological breakthroughs. These cameras lessen the workload for human operators by increasing the efficacy of surveillance and automating some operations.

Potential to improve industrial automation

Artificial intelligence (AI) cameras with sophisticated computer vision skills allow for predictive maintenance, quality control, and real-time analysis of manufacturing processes. As a result, industrial settings see higher production, decreased downtime, and increased efficiency. For this reason, AI cameras are an essential part of the automation revolution.

Potential security vulnerabilities and hacking risks

AI cameras frequently gather and handle private information. If these data are not sufficiently safeguarded, there is a serious risk associated with their transfer and storage. Legal repercussions and privacy violations may arise from unauthorized access to personal data. AI cameras are vulnerable to cyber security risks as they grow networked and integrated into the Internet of Things (IoT). Cybercriminals may utilize camera software, firmware, or communication protocol weaknesses to obtain illegal access, alter data, or initiate cyberattacks.

Dependence on stable internet connectivity

AI cameras need a steady and strong internet connection to execute sophisticated images and video analysis in real-time. Any disruptions in connectivity could make it more difficult for them to digest data quickly, impairing the camera's responsiveness and overall functionality. With the help of remote monitoring and control capabilities, many AI cameras let users view live feeds and change settings from any location with an internet connection. The ease and efficacy of these functions are restricted by unreliable connectivity, which interferes with the remote capability.

Integration of AI cameras in healthcare

AI-powered cameras can accurately and quickly evaluate medical images, assisting in diagnosing and identifying a wide range of medical disorders. This improves patient outcomes and increases the effectiveness of healthcare providers. Integrating AI cameras facilitates telemedicine by offering superior visual data for virtual consultations. This is particularly helpful in emergencies or places where access to medical facilities is restricted. AI cameras can help detect possible health issues and enable preventive actions by continuously monitoring and analyzing patient data. In the long run, this move toward preventative healthcare can lower healthcare expenditures and enhance patient well-being.

Wide application in retail analytics

AI cameras analyze foot traffic, dwell periods, and popular shopping areas to help retailers better understand customer behavior. Businesses can use this data to increase consumer satisfaction, product positioning, and store layout optimization. AI camera data can be utilized by retailers to target their marketing campaigns. Businesses can improve sales and customer loyalty by customizing promotional campaigns and offers to target specific consumer segments based on their understanding of client demographics, preferences, and purchase history. AI cameras are used in the post-pandemic era to monitor social distancing policies and health precautions in retail settings. This guarantees adherence to safety protocols and fosters a more secure retail atmosphere for patrons and employees.

Canon Inc.

Canon Inc. is a multinational firm based in Japan that specializes in producing photographic and optical equipment. The brand is well-known for its imaging-related products, which include printers, photocopiers, cameras, and camcorders. Artificial intelligence (AI) was being actively developed and integrated by Canon Inc. into several imaging devices, including cameras. But since then, the specifics of Canon's artificial intelligence (AI) camera capabilities might have changed.

In late January 2024, Canon Inc. stated that it would release the "Video Enhancement Software Edition 1.0" as software for its ultra-high-sensitivity camera series. This software increases video visibility through AI-powered noise reduction processing.

LG Electronics

Multinational electronics corporation LG Electronics is based in South Korea and offers a range of consumer goods, mobile phones, and home appliances. Among the many electronic devices that LG Electronics has created and manufactured are cameras and cell phones. However, since businesses regularly upgrade their product lines, the precise specifications of LG Electronics' AI camera capabilities and features may change over time.

By integrating AI technologies into its products, LG has improved image processing, scene identification, and camera performance. Artificial Intelligence (AI) has camera applications that include scene-based optimization, image quality enhancement, and the activation of several intelligent features.

In November 2022, as a team, Altair, a leading worldwide supplier of AI and computational science solutions, and LG Electronics (LG) created an AI validation platform that improves the reliability testing of automotive components. By incorporating this advancement in digital technology into the design process, LG can offer worldwide automakers the most sophisticated and dependable infotainment solutions.

The hardware segment captured a revenue share of around 55% in 2024 in the AI camera market. AI algorithms need much processing power and sophisticated learning models for image recognition and analysis. AI camera applications can be made faster and more efficiently using sophisticated hardware elements like Graphics Processing Units (GPUs) and specialized AI accelerators. The AI camera market's hardware category includes sensor technology improvements as well. Improved image quality is made possible by high-resolution image sensors and advanced image processing hardware, which allows for more precise AI-driven analysis.

The software segment is expected to grow at a significant rate during the forecast period. As a result of ongoing advancements in AI software and algorithms, complex apps that significantly improve the functionality of AI cameras have been developed. This covers enhanced security protocols, predictive maintenance, and real-time analytics. Unlike hardware changes, software-based solutions can provide enterprises with a more affordable option. Because AI camera software is so inexpensive, businesses are encouraged to invest in it to enhance their analytics and surveillance capabilities without making major infrastructure upgrades.

The surveillance cameras segment held the largest market share of 33% in 2024 in the AI camera market. Advanced AI-powered analytics are built into surveillance cameras to enable functions like object detection, behavior analysis, and facial recognition. This improves the functionality of conventional surveillance, increasing its intelligence and efficacy. AI camera systems are scalable and flexible, enabling users to tailor features to meet their unique requirements.

AI cameras can be customized to satisfy the needs of various surroundings, regardless of the company's size. A broader spectrum of consumers may now buy AI-powered security cameras because of the technology's rising affordability. These systems are widely used in many different sectors and businesses because they are cost-effective.

The digital cameras segment is expected to grow at a faster rate during the forecast period. Artificial intelligence-enabled digital cameras can process and improve photos instantly. AI systems may automatically modify parameters like exposure, focus, and color balance to enhance image quality. Firmware updates that enable continuous learning can help AI-capable digital cameras. This enables producers to improve functionality, add new features, and adjust to changing customer demands.

AI-enabled digital cameras are excellent at tracking and recognizing objects. They make capabilities like autofocus and subject tracking in photography and videography possible by recognizing and monitoring subjects within the frame.

The image/face recognition segment held the largest market share of 32% in 2024 in the AI camera market. Camera security and surveillance are improved by image and facial recognition. They make it possible to identify and follow certain people, which aids in investigating and preventing security breaches. AI cameras are used more often in businesses and educational institutions to track attendance automatically through facial recognition.

As a result, there is less need for manual recording, and the attendance process is streamlined. Artificial intelligence (AI) cameras employ facial recognition for access management and identification in public spaces, smart homes, and offices. Limiting access to specific locations to authorized personnel enhances security in general.

The computer vision segment is expected to expand at a significant rate during the forecast period. Computer vision algorithms can extract significant information such as object recognition, recognizing faces, and scene analysis from photos. Applications such as industrial automation, smart cities, and surveillance depend on this. The Internet of Things (IoT) expansion has led to a surge in demand for smart devices, such as AI cameras.

These cameras add to a networked ecosystem by offering useful information and data for various uses. A wide range of industries, including healthcare (medical imaging), automotive (autonomous vehicles), retail (automated checkout systems), and entertainment (virtual and augmented reality), can benefit from computer vision.

The consumer electronics segment captured a revenue share of around 21% in 2024 in the AI camera market. Artificial intelligence is becoming increasingly integrated into consumer gadgets like smartphones and smart cameras. Numerous consumer gadgets now come equipped with AI-powered functions like image enhancement, scene identification, and facial recognition as standard features, which improve functionality and user experience. It places high value on user-friendly interfaces, opening access to more people for AI-powered camera functions. The user-friendly nature of AI-driven features encourages people to experiment and rely on them.

Moreover, it is frequently a component of more enormous technological ecosystems that facilitate smooth device interaction and data exchange. Because data can be used across devices for more advanced AI applications, such as intelligent photo organizing and cloud-based image processing, this ecosystem integration improves the entire AI experience.

By Component

By Type

By Technology

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

November 2024

January 2025

March 2025