January 2025

The global aluminum alloys market size was USD 133.78 billion in 2023, calculated at USD 142.09 billion in 2024 and is expected to be worth around USD 259.54 billion by 2034.The market is slated to expand at 6.21% CAGR from 2024 to 2034.

The global aluminum alloys market size is expected to worth USD 142.09 billion in 2024 and is anticipated to reach around USD 259.54 billion by 2034, growing at a CAGR of 6.21% over the forecast period 2024 to 2034.The aluminum alloys market growth is attributed to the increasing demand for lightweight, high-strength materials across the automotive, aerospace, and construction industries.

Recent advances in 3D printing and AI automation in the manufacturing industries have extended the development of lighter and more sophisticated aluminum alloys. These advancements facilitate production mode and cut down material and energy use of the product, hence improving the quality of the product. The need for continuously improving manufacturing technologies is expected to support the growth of the aluminum alloys market due to increasing demand for advanced high-performance and green materials. Such continuous advancement in technology is expected to contribute towards the growth of the market and innovation in aluminum alloy technology.

Impact of Artificial Intelligence on the Aluminum Alloys Market

AI helps to increase the productivity of manufacturing processes in the aluminum alloys market by improving the material’s characteristics, minimizing the usage of additional materials, and assessing the probable composition of alloys with given performance characteristics. AI is combined with analytics facilitating the manufacturing industries to predict demand patterns and thus optimize supply. This results in a reduction of costs and time taken to deliver products. In addition, the use of artificial intelligence in the fabrication of alloys eradicates one hundred percent human error, which affects the quality of the end product.

| Report Coverage | Details |

| Market Size by 2034 | USD 259.54 Billion |

| Market Size in 2023 | USD 133.78 Billion |

| Market Size in 2024 | USD 142.09 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.21% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing demand from the automotive industry

Growing demand for lightweight materials in the automotive industry is anticipated to drive the aluminum alloys market. Automotive companies are using aluminum alloy parts, as they are light, hence improving fuel efficiency and reducing pollution. Aluminum alloys enable high strength-to-weight ratios and high durability to seal against corrosion, thus being used for engine parts, body frames, and structural parts.

The further shift towards environmentally friendly and highly energy-efficient vehicles will create demand for aluminum alloys over the next years. The U.S. Department of Energy also points out that the use of lightweight materials such as aluminum helps increase the fuel economy of vehicles by as much as one-fifth. Furthermore, the growing global car sales are observed.

The International Energy Agency IEA pointed out that electric vehicle sales increased by 60% in 2022 to stress increasing EV adoption across the world.

Hamper competition from alternative materials

Competition from alternative materials is likely to hamper the aluminum alloys market growth. High-strength plastic and advanced composites, especially in the automotive and aerospace industries, are anticipated to decrease the utilization of aluminum alloys. These alternative materials provide comparable or even superior strength-to-weight ratios and corrosion strength. Carbon fiber composites are being increasingly used in applications where shedding mass is highly appropriate.

Carbon fiber composites are 50% lighter and stronger than aluminum. Thus, the U.S. Department of Energy states their use in high-performance vehicles and airplanes. Additionally, these alternatives, entailing innovation in material science and cost control, are expected to lead to a lowered application of aluminum alloys, especially in the areas where performance and cost are critical factors.

Spurring technological advancements in manufacturing

Spurring technological advancements in manufacturing processes are likely to create immense opportunities for the players competing in the aluminum alloys market. Technological advancements, including 3D printing and the specificity of automation, produce innovations that allow the provision of a blend of alloys appropriate to certain industries. These technologies contribute to faster production and help decrease the wastage of material, thus improving the quality of the finished products.

IoT facilitates monitoring systems integration in alloy production plants to enhance the efficiency of processes that consequently lead to productivity gain and reduced cost for manufacturers in the aluminum alloys market. The growth of industries manufacturing complex products is expected to enhance the sales of aluminum alloys due to the introduction of new products.

The automotive & transportation segment held a dominant presence in the aluminum alloys market in 2023 due to the increased demand for lightweight materials, increasing fuel efficiency and thereby curbing emissions. The trend towards EVs and the general tightening of greenhouse emission standards are behind the push to lighten vehicles while reducing the amount of material used in their construction. Aluminum alloys have the ability to support high strength, corrosion resistance, and good energy-absorbing properties, making them suitable for use in the manufacture of vehicular parts like engine blocks, body panels, and wheels. Additionally, the automotive industry, with sustainability and performance demand for aluminum alloys.

The construction segment is expected to grow at the fastest rate in the aluminum alloys market during the forecast period of 2024 to 2034. Rising levels of construction and infrastructure in APAC & the Middle East are expected to propel the demand for aluminum alloys in buildings & structures. The lightweight metallic alloys that are gaining the popularity of construction engineers are aluminum, as they are highly durable and immune to corrosion and erosion. The International Building Code has also included provisions for the use of sustainable materials in construction, and since aluminum is a material that is recyclable and has the least impact on the environment, it has received a boost in usage. Furthermore, the growing demand for sustainable and replicable metal building materials further boosts the market.

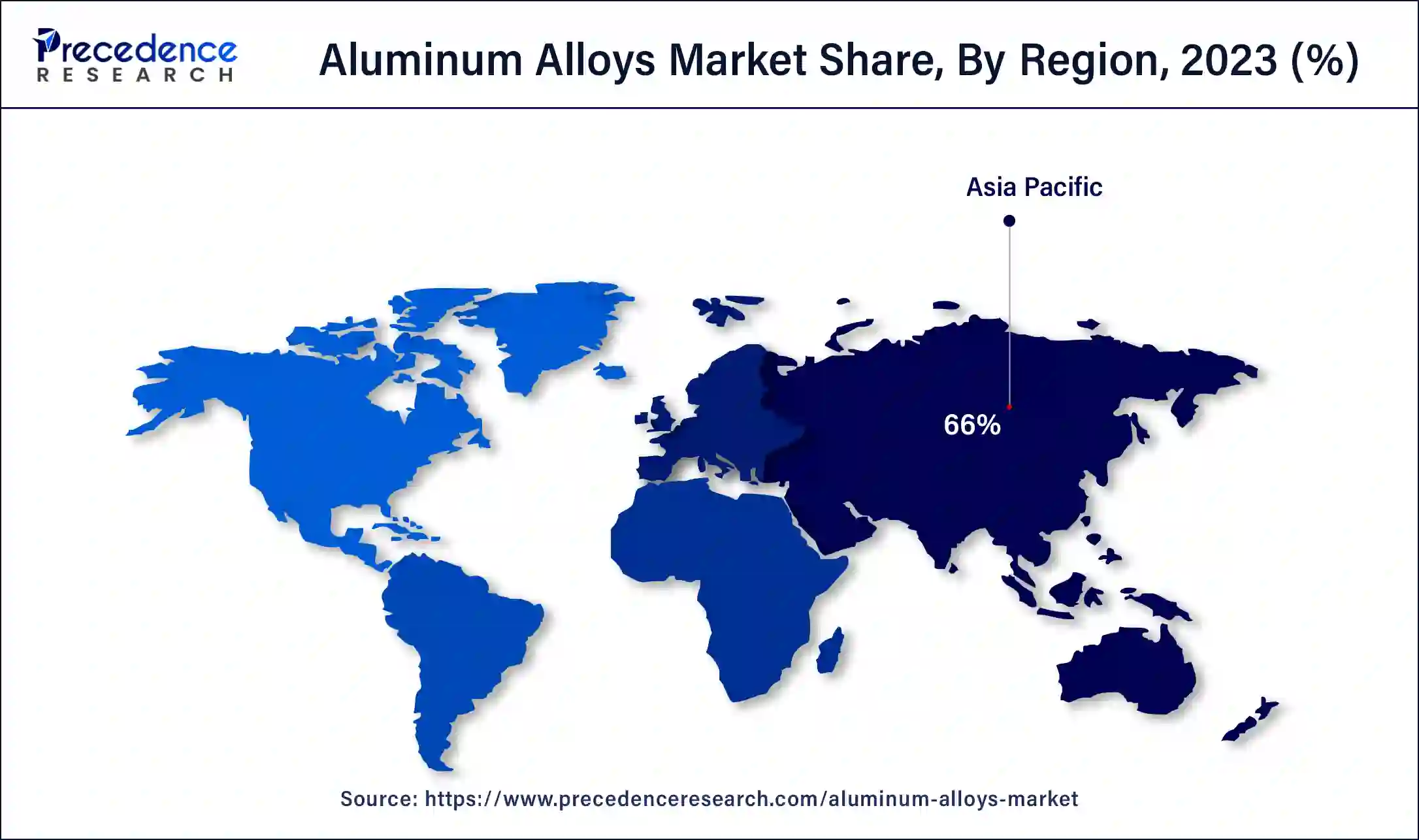

Regional Insights

Asia Pacific dominated the global aluminum alloys market in 2023 due to the increasing industrialization, urbanization, and infrastructural development. In countries such as China and India, industries, including road bridges and tall buildings, have made significant investments in infrastructure development, resulting in increased use of aluminum alloys.

The automotive industry of Asia Pacific is one of the largest in the world, creating demand for aluminum in vehicle construction to conform to new emission standards. Moreover, extensive use of technological improvements and environment-friendly measures are expected to create a higher demand for aluminum alloys in the region in the future.

North America is projected to host the fastest-growing aluminum alloys market in the coming years, owing to the presence of the large car industry and the aircraft manufacturing industries, which are leading consumers of aluminum alloys. The United States has experienced a rise in the production of electric vehicles and aerospace engineering, thus escalating demand for light and strong materials.

Increased demand for aluminum alloys is estimated by the Biden Administration’s infrastructure plan, which encompasses sustainable transportation as well as green infrastructure, among others. The U.S. Environmental Protection Agency (EPA) also underscores the fact that aluminum plays a part in the reduction of vehicle emissions, and the improvement of fuel efficiency supports the U.S. environmental policy. Additionally, the technological development of aluminum alloy products and environmental consciousness.

Segments Covered in the Report

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2024

November 2024