January 2025

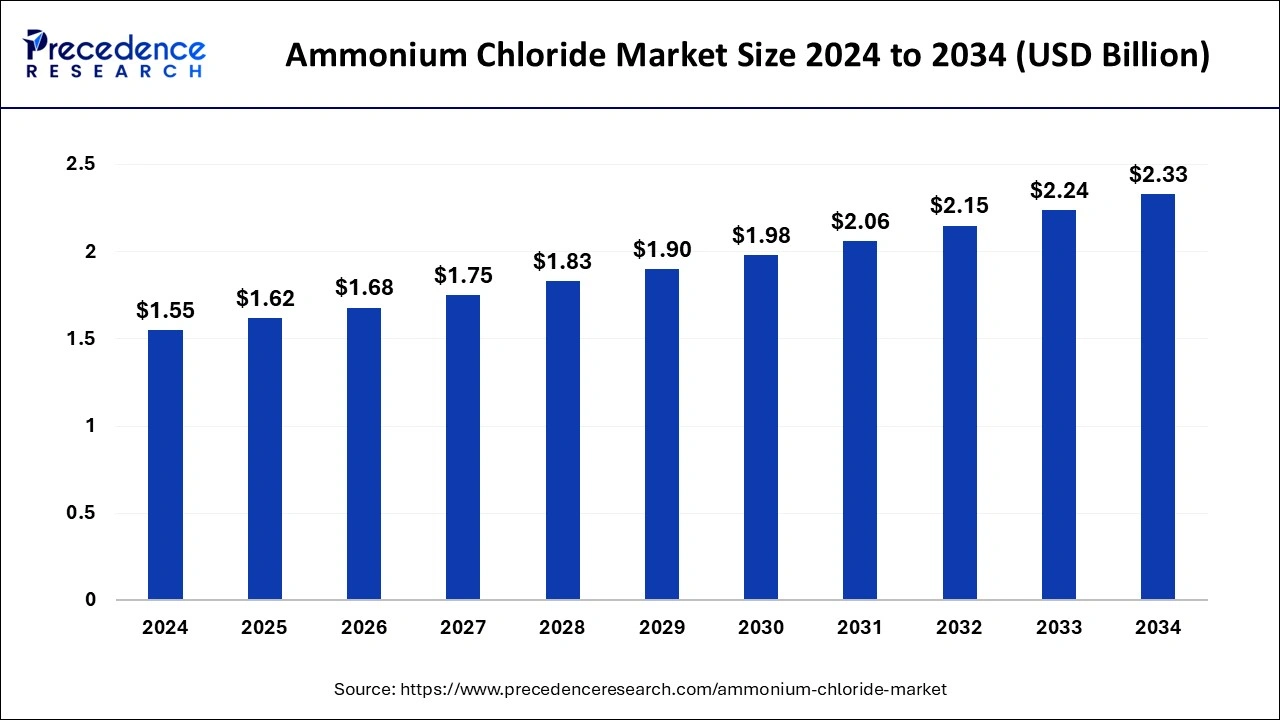

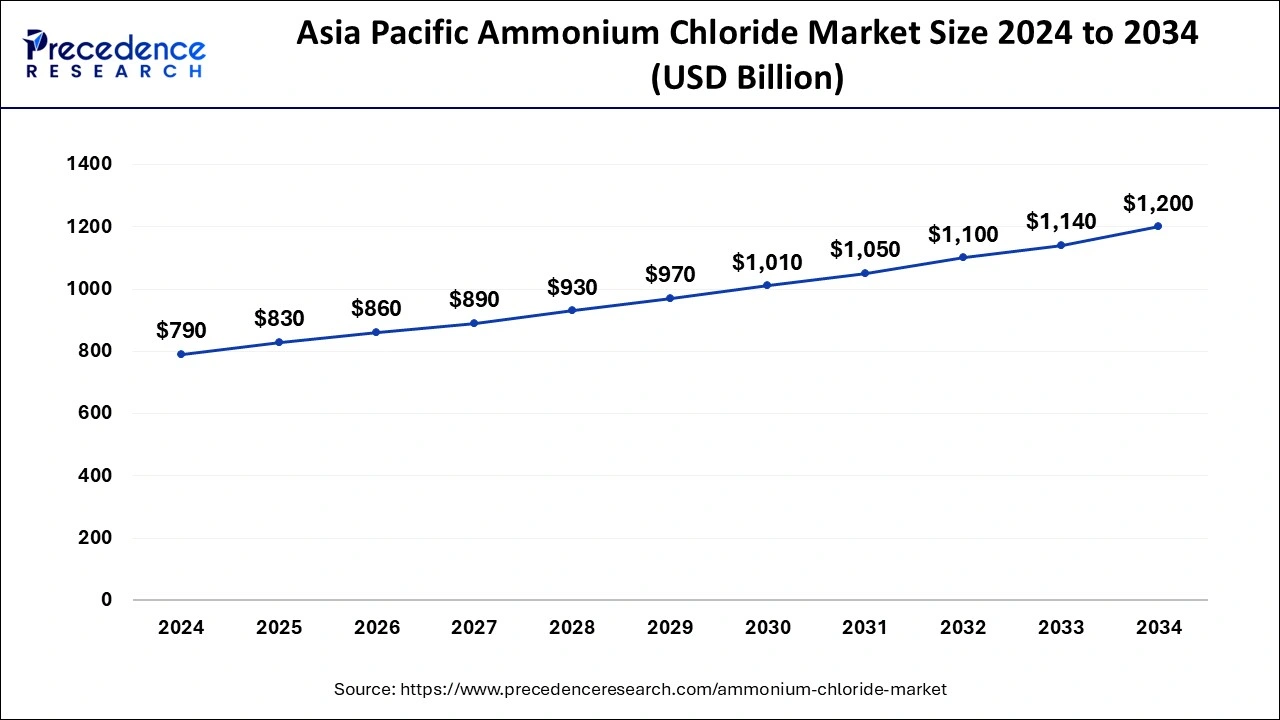

The global ammonium chloride market size is accounted at USD 1.62 billion in 2025 and is forecasted to hit around USD 2.33 billion by 2034, representing a CAGR of 4.16% from 2025 to 2034. The Asia Pacific market size was estimated at USD 790 million in 2024 and is expanding at a CAGR of 4.27% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global ammonium chloride market size was calculated at USD 1.55 billion in 2024 and is predicted to increase from USD 1.62 billion in 2025 to approximately USD 2.33 billion by 2034, expanding at a CAGR of 4.16% from 2025 to 2034.

The Asia Pacific ammonium chloride market size was exhibited at USD 790 million in 2024 and is projected to be worth around USD 1,200 million by 2034, growing at a CAGR of 4.27% from 2025 to 2034.

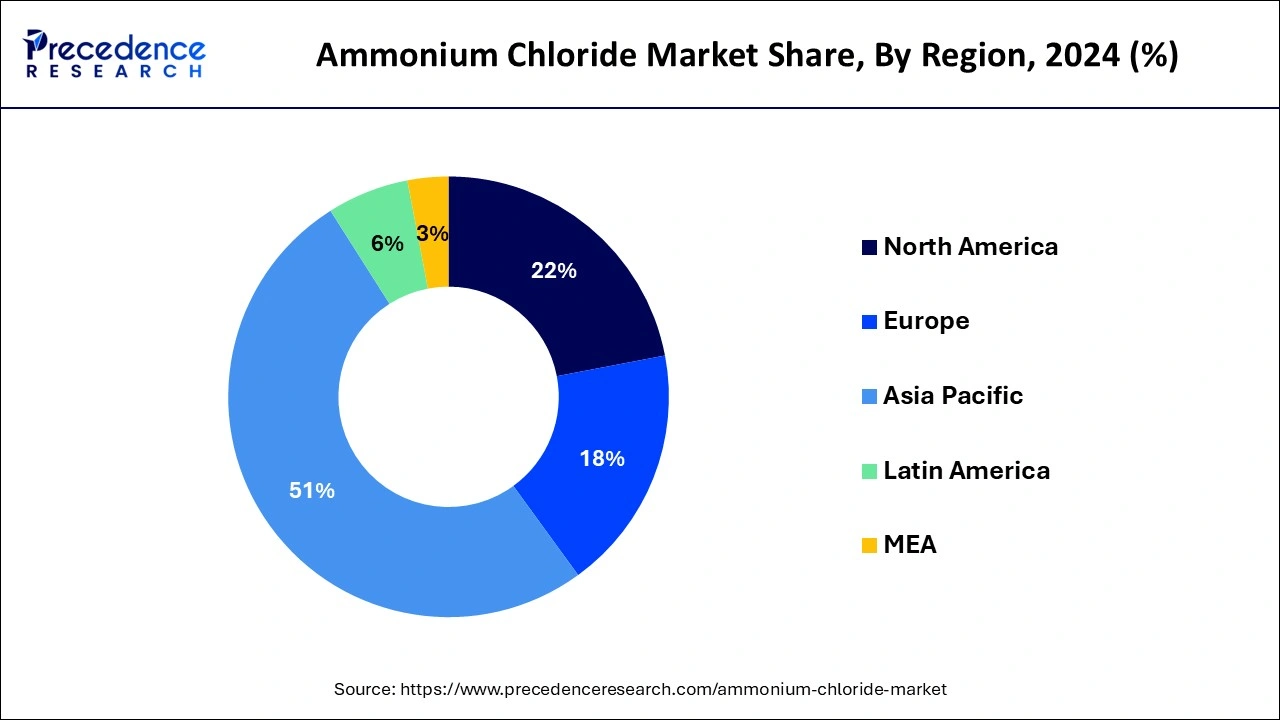

Asia Pacific held the largest share of the ammonium chloride market share of 51% in 2024. This growth is driven by the imperative for higher crop yields on diminishing arable land. With agricultural activities intensifying, particularly in rice and wheat cultivation across Asia, the necessity for nitrogen-rich fertilizers like ammonium chloride is escalating. Japan, for instance, has seen a notable uptick in the use of ammonium chloride as a nitrogen fertilizer, especially in paddy cultivation. Given its efficacy in bolstering rice cultivation and the region's increasing focus on agricultural productivity, the demand for ammonium chloride is anticipated to experience robust growth in the Asia Pacific during the forecast period.

North America is observed to sustain as a second position holder in the ammonium chloride market during the forecast period. This is due to its extensive agriculture industry and the substantial demand for processed and ready-to-eat food products among consumers in the region. The region's large-scale agricultural activities necessitate the use of ammonium chloride as a fertilizer and soil nutrient enhancer, further driving its demand. Additionally, the popularity of processed foods in North America contributes to the significant consumption of ammonium chloride as a food additive and preservative, solidifying the region's leading position in the market.

Ammonium chloride, with the chemical formula NH4Cl, is a versatile chemical compound widely employed across various industries and applications. In its solid form, it appears as a white crystalline salt composed of ammonium ions (NH4+) and chloride ions (Cl-). In agriculture, ammonium chloride serves as a valuable nitrogen source, contributing essential nutrients to soil and promoting healthy plant growth. Its application helps enhance crop yield and improve soil fertility, making it a popular choice among farmers and agricultural practitioners.

Furthermore, the ammonium chloride market offers materials for the pharmaceutical sector, particularly in cough medicines, where it acts as an expectorant. By facilitating the expulsion of mucus from the respiratory tract, it aids in alleviating congestion and promoting easier breathing for individuals suffering from respiratory conditions. In the food industry, ammonium chloride serves multiple functions, including pH regulation and flavor enhancement. It is often utilized as a pH regulator in various food processing applications and acts as a flavoring agent in certain culinary products.

Beyond agriculture and pharmaceuticals, ammonium chloride is indispensable in the chemical, metalwork, electronics, and textile industries. Its diverse applications range from serving as a flux in metalwork to facilitating chemical reactions and as an electrolyte in batteries. Moreover, it finds utility in textile printing processes and as a component in soldering fluxes used in electronics manufacturing. Hence, the multifaceted properties of ammonium chloride make it a valuable compound with widespread applications across numerous industries, contributing to various processes and products essential in modern-day living.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.62 Billion |

| Market Size by 2034 | USD 2.33 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.16% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Grade and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product usage in animal feed has increased

Ammonium chloride plays a vital role in animal nutrition as a feed additive, contributing to the overall health and productivity of livestock. As the global demand for animal-derived products such as meat, milk, and eggs continues to escalate due to population growth, urbanization, and changing dietary habits, the usage of ammonium chloride in animal feed is poised to increase significantly. One of the primary reasons for incorporating Ammonium chloride into animal feed is its role in providing essential nutrients to livestock, particularly ruminants such as cattle, sheep, and goats. Ammonium chloride serves as a valuable source of nitrogen, which is essential for the synthesis of amino acids, proteins, and other vital compounds necessary for animal growth and development.

Moreover, it helps maintain the acid-base balance in the rumen, ensuring optimal digestive function and nutrient absorption. In addition to its nutritional benefits, Ammonium chloride also serves as a urinary acidifier in ruminants, helping to prevent the formation of urinary calculi, a common health issue in male goats and sheep. By acidifying the urine, Ammonium chloride helps dissolve existing calculi and prevents their recurrence, thereby promoting urinary health and reducing the risk of urinary tract obstructions. Furthermore, Ammonium chloride supplementation in animal feed has been shown to improve feed efficiency and promote weight gain in livestock. This is particularly important in intensive livestock farming systems where maximizing productivity and minimizing production costs are paramount.

The increased focus on animal welfare and the growing trend towards sustainable and ethical livestock production practices also drive the demand for feed additives like ammonium chloride. By ensuring optimal nutrition and health outcomes for livestock, Ammonium chloride contributes to the overall well-being of animals and supports sustainable farming practices. Hence, the rising demand for animal-derived products and the increasing emphasis on animal health and welfare are expected to fuel the growth of the ammonium chloride market in the animal feed sector. As livestock producers seek to optimize productivity and meet consumer demands for high-quality animal products, the importance of ammonium chloride as a feed additive is likely to grow substantially in the coming years. Thereby, the increased use in animal feed is observed to act as a major driver for the ammonium chloride market.

Fluctuating raw material prices

Fluctuating raw material prices, particularly those of ammonia and hydrochloric acid, significantly impact the production cost and profitability of ammonium chloride. Ammonia, a key raw material in the production process, is primarily derived from natural gas or coal. The prices of natural gas and coal, which serve as feedstock for ammonia production, are subject to market fluctuations influenced by factors such as supply-demand dynamics, geopolitical tensions, and regulatory changes. Similarly, hydrochloric acid, another essential raw material used in the synthesis of ammonium chloride, is produced through the chlorination of hydrogen gas or as a byproduct of various industrial processes. The prices of hydrogen gas and chlorine, the precursors for hydrochloric acid production, can also vary due to factors like energy costs, transportation expenses, and regulatory requirements.

Fluctuations in raw material prices can disrupt production planning, inventory management, and pricing strategies for manufacturers of ammonium chloride. Sudden increases in raw material costs may lead to higher production expenses, reducing profit margins and competitiveness in the market. Conversely, decline in raw material prices can enhance profitability but may also trigger price wars and intensified competition among manufacturers. Such factors create a major restraint for the ammonium chloride market.

Moreover, the unpredictability of raw material prices makes it challenging for companies to forecast future costs accurately and plan investment decisions effectively. To mitigate the impact of fluctuating raw material prices, ammonium chloride manufacturers often engage in strategic sourcing, hedging strategies, and long-term supply agreements with raw material suppliers. Additionally, investments in research and development aimed at optimizing production processes and reducing raw material dependency can enhance cost-efficiency and resilience in the face of price volatility.

Increasing industrial uses, progress in technology, and new product developments

Ammonium chloride's versatility across multiple industries, including pharmaceuticals, food and beverages, textiles, and metal finishing, underscores its significant market potential. In the pharmaceutical sector, it serves as both an expectorant and a diuretic, aiding in respiratory health and fluid balance regulation. Meanwhile, its role as a food additive and yeast nutrient in the food and beverage industry underscores its importance in enhancing food quality and processing efficiency. The expanding industrial sectors and increasing adoption of ammonium chloride in diverse applications create fertile ground for market growth.

Continuous advancements in production technologies, such as membrane electrolysis and solvent extraction, promise enhanced production efficiency, higher yields, and reduced operational costs. These technological innovations enable manufacturers to meet growing demand while maintaining competitiveness in the market. Furthermore, ongoing research and development efforts focus on formulating new and improved ammonium chloride-based products with enhanced functionalities and sustainability features. These innovations not only cater to evolving consumer preferences but also open up new market segments, driving further growth opportunities.

Hence, the convergence of expanding industrial applications, technological advancements, and product innovations positions the global ammonium chloride market for sustained growth and development in the foreseeable future. Companies that capitalize on these trends stand to benefit from increased market share, improved profitability, and enhanced competitiveness in the ammonium chloride market.

The agriculture grade segment, in the ammonium chloride market held the highest market share of 28% in 2024, primarily attributed to its pivotal role as a fertilizer in enhancing crop growth and resilience. Apart from its function in promoting plant health and preventing pest infestations, agriculture-grade ammonium chloride serves as a crucial ingredient in nitrogen-rich fertilizers, contributing to improved soil fertility and yield outcomes in agricultural practices. Additionally, its utilization extends to the production of explosives and fireworks, where it acts as a key component, particularly as a stabilizer and oxidizing agent in certain explosive formulations. This multifaceted application spectrum underscores the versatility and indispensability of agriculture-grade ammonium chloride in various industries and sectors.

The food grade segment is anticipated to witness rapid growth at a significant CAGR of 4.9% during the projected period in the ammonium chloride market. Food grade ammonium chloride plays a crucial role in the food industry, meeting stringent regulatory standards and serving as a key ingredient in processed snacks, desserts, and other food products. It extends the shelf life of processed foods, enhances flavor profiles, and contributes to desired textures, making it indispensable in food processing. Widely used as a food additive and yeast nutrient during baking, its synergistic effects with other ingredients improve overall product quality. The rising consumption of processed and ready-to-eat foods, coupled with increased demand for flavor sweeteners in bakery and confectionery items, are driving market expansion. Additionally, the marketing of healthy food additives and growing consumer spending on nutritious food products are further fueling market growth.

The fertilizer segment has held a 24% market share in 2024 of the ammonium chloride market. Ammonium chloride is highly sought after in the fertilizer industry due to its chlorine content, which enhances plant resistance to pests and diseases. Particularly, farmers cultivating rice and other crops in low-lying areas benefit from fertilizers containing ammonium chloride. Its application leads to improved crop efficiency, thus driving market growth in the forecast period. The growing demand for food products has prompted increased fertilizer usage, especially nitrogenous fertilizers based on ammonium chloride. This compound provides essential minerals for plant growth, enhances soil fertility, and contributes to overall agricultural productivity, making it indispensable for modern farming practices and sustainable food production.

The medical/pharmaceutical segment is anticipated to witness rapid growth of 3.5% over the projected period in the ammonium chloride market, due to its widespread use in medications and drugs. Ammonium chloride serves as a systemic acidifier for patients with metabolic alkalosis induced by chloride loss from gastric suction, vomiting, gastric fistula drainage, or pyloric stenosis. It is also valuable in treating diuretic-induced chloride depletion. However, its medicinal application is complex due to potential patient side effects such as rash, EEG abnormalities, metabolic acidosis, and seizures. Despite its efficacy, careful consideration of these side effects is necessary to ensure safe and effective treatment outcomes in clinical settings.

By Grade

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2024

December 2024