December 2024

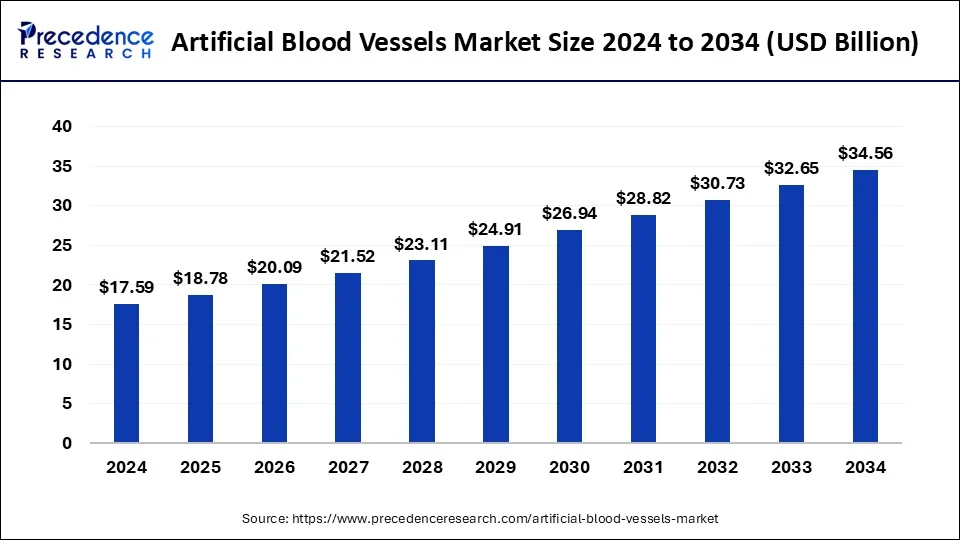

The global artificial blood vessels market size is calculated at USD 2.35 billion in 2025 and is forecasted to reach around USD 3.75 billion by 2034, accelerating at a CAGR of 5.34% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global artificial blood vessels market size was estimated at USD 2.23 billion in 2024 and is predicted to increase from USD 2.35 billion in 2025 to approximately USD 3.75 billion by 2034, expanding at a CAGR of 5.34% from 2025 to 2034. The demand for the artificial blood vessels market is primarily being boosted by the rising prevalence of various cardiovascular diseases coupled with a rapidly growing geriatric population.

AI can analyze vast datasets to predict the performance of artificial blood vessels under different physiological conditions. This helps in designing more effective and durable vessels by simulating how they will behave in the human body before actual physical testing. AI algorithms can identify the most suitable materials for artificial blood vessels by analyzing their properties and predicting their interaction with human tissues. This accelerates the development of biocompatible materials that minimize the risk of rejection and complications.

AI can assist in creating personalized artificial blood vessels tailored to individual patients. By analyzing patient-specific data, such as imaging scans and physiological parameters, AI can help design vessels that match the exact size, shape, and mechanical properties needed for each patient.

Artificial blood vessels, or synthetic tubes, are employed to restore blood circulation. These vessels are crafted from biosynthetic materials such as polydioxanone and polyethylene terephthalate and are known for their excellent conductivity, high oxygen permeability, and strong chemical and water resistance. Hemoglobin-based oxygen carriers are commonly used as artificial blood vessels to deliver oxygen molecules to the heart vessels from the bloodstream by aiding in the restoration of normal heart function.

Recently, silk was introduced into the production of these artificial vessels. Cardiovascular diseases can involve various pathophysiological mechanisms like stenosis, occlusion, or severe dysfunction of blood vessels. Conditions affecting the aorta include abdominal aortic aneurysm, aortic coarctation, and chronic hemodialysis access, among others.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.75 Billion |

| Market Size in 2025 | USD 2.35 Billion |

| Market Size in 2024 | USD 2.23 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.34% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Polymer Type, End-users, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise in aortic diseases

The artificial blood vessels market is set to expand due to the increasing incidence of aortic diseases globally. As the largest blood vessel in the body, the aorta is vulnerable to various disorders, with aortic aneurysms being the most frequently reported condition. Additionally, Other factors impacting the aortae include atherosclerosis, genetic disorders, hypertension, connective tissue diseases, and physical injury. The rising prevalence of these conditions is expected to drive the growth of the market for artificial blood vessels.

Limited long-term data

There may be a shortage of extensive data regarding the durability and efficacy of artificial blood vessels over extended periods. This absence of thorough information can lead to apprehensions among both healthcare providers and patients about the reliability and lifespan of these devices. Moreover, patients might choose alternative treatments, such as conventional vascular surgeries or medications, in place of artificial blood vessels. This competition from other therapeutic approaches can influence the demand within the artificial blood vessels market.

TEVGs technic

A major trend in the artificial blood vessels market is the development of next-generation tissue engineered vascular grafts (TEVGs). Cardiovascular diseases (CVDs), which include conditions like stenosis or blood vessel occlusion, are a leading cause of death worldwide. These conditions often require vascular interventions such as minimally invasive direct coronary artery bypass (MEDICAL) or coronary artery bypass grafting (CABG). Furthermore, conventional surgical methods utilize autologous vessels, such as saphenous veins and internal thoracic arteries, or prosthetic grafts like polyester vascular grafts and hybrid vascular grafts. This innovative technique can create market opportunities for the future.

The polyethylene terephthalate segment dominated the artificial blood vessels market in 2024. These biostable polymers are currently the standard biomaterials used for vascular grafts in various clinical settings, including polyethylene terephthalate (PET). PET, which is widely utilized in textile manufacturing and as packaging for food and beverages, accounts for approximately 10% of the synthetic plastic polymers produced globally. Although many enzymes capable of degrading PETs have been identified, their activity is relatively low. The most promising enzyme-producing species for PET degradation discovered to date is Ideonella sakaiensis.

The polydioxanone segment is expected to show notable growth in the artificial blood vessels market over the forecast period. Introduced as the first mono-filament synthetic absorbable suture, polydioxanone offers several advantages. Its monofilament design facilitates smoother passage through tissues, reduces tissue reactivity, and lowers the risk of wound infection. However, this design also results in reduced handling and knot strength due to its lower coefficient of friction. Compared to Polyglactin 910 or polyglycolic acid, polydioxanone exhibits lower initial tensile strength.

The aortic disease segment led the artificial blood vessels market in 2024. The increasing prevalence of numerous medical conditions and diseases that can damage the aorta and pose serious health risks to patients is a major concern. Aortic dissection is characterized by a rupture in the intima, the aorta's innermost layer. However, this rupture allows blood to enter the media, forming a dissection flap filled with blood. This flap can extend in either direction along the aortic long axis, either forward (antegrade) or backward (retrograde).

The hemodialysis segment is expected to show notable growth in the artificial blood vessels market over the forecast period. Hemodialysis is a procedure that purifies blood using a dialysis machine and a dialyzer, often referred to as an artificial kidney. The effectiveness of dialysis can be influenced by several factors, including the type of vascular access, the kind of filter used, the device employed, and the dosage and route of erythropoietin-stimulating agents (ESA). Hemodialysis effectively clears small-molecular-weight toxins and corrects imbalances in electrolytes and acid-base levels.

The hospital's segment led the artificial blood vessels market in 2024. This can be attributed to the rise in heart surgery in hospitals. Technological advancements can greatly enhance hospital development by increasing efficiency, lowering expenses, and improving patient outcomes. Important technological approaches include electronic health records (EHR), which include upgrading or adopting EHR systems to improve data management and patient care coordination.

The ambulatory surgical centers segment is expected to experience the fastest growth in the artificial blood vessels market during the forecast period. These centers are intended to assess and address conditions that are not critical enough to need hospital emergency department care but still require treatment outside of typical physician office hours or before an available physician appointment. Ambulatory surgery centers (ASCs) offer cost-efficient services in a more relaxed setting compared to many hospitals, which can often be more stressful. These factors can lead to segment growth.

North America dominated the artificial blood vessels market in 2024. The rising incidence of aortic diseases in the region is expected to drive market growth. In North America, the U.S. is anticipated to hold the largest market share due to its advanced healthcare infrastructure and technological innovations. Additionally, the increasing number of smokers, who are at a higher risk for aortic conditions, contributes to this trend.

This growing burden of aortic diseases is likely to enhance the demand for artificial blood vessels. The well-established healthcare system in the United States fosters research and development, attracting global players to enter the market. The presence of numerous international companies in the U.S. and Canada is helping meet the high and rising demand for these products. Hence, the artificial blood vessels market is projected to continue expanding in the region.

Asia Pacific is expected to show the fastest growth in the artificial blood vessels market over the forecast period. This is due to the rise in awareness, which has led to the emergence of smaller players in the region, contributing to market growth. Companies are leveraging strategies such as mergers and acquisitions, expansions, investments, new service launches, and collaborations to explore new market opportunities. By entering new geographies through these strategies, they aim to gain a competitive edge through combined synergies. Furthermore, companies from the Asia-Pacific region will drive substantial growth in the global artificial blood vessels market throughout the forecast period.

By Polymer Type

By End-users

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

September 2024

April 2025

December 2024