April 2025

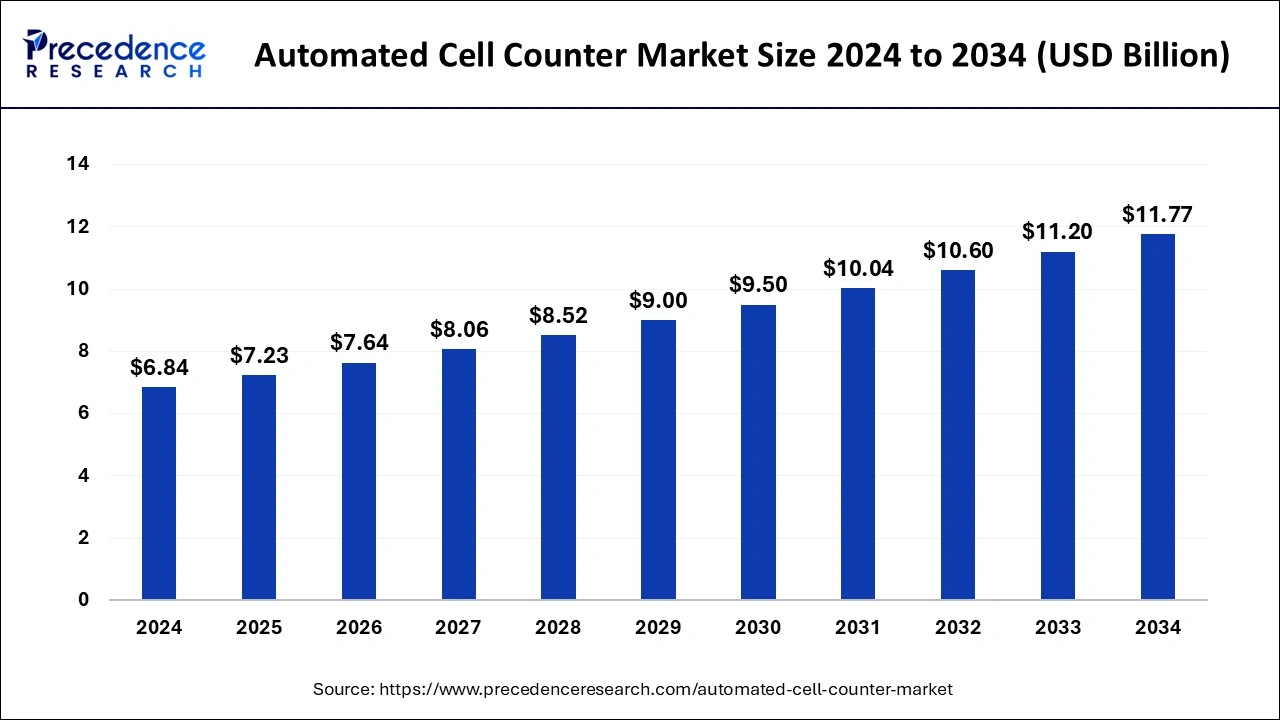

The global automated cell counter market size is calculated at USD 7.23 billion in 2025 and is forecasted to reach around USD 11.77 billion by 2034, accelerating at a CAGR of 5.58% from 2025 to 2034. The North America automated cell counter market size surpassed USD 4.10 billion in 2024 and is expanding at a CAGR of 5.67% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automated cell counter market size accounted for USD 6.84 billion in 2024, grew to USD 7.23 billion in 2025 and is projected to surpass around USD 11.77 billion by 2034, representing a healthy CAGR of 5.58% between 2024 and 2034. The increase in substance abuse and lifestyle behaviors like cigarette smoking and alcohol consumption will ultimately lead to the growth of the automated cell counter market.

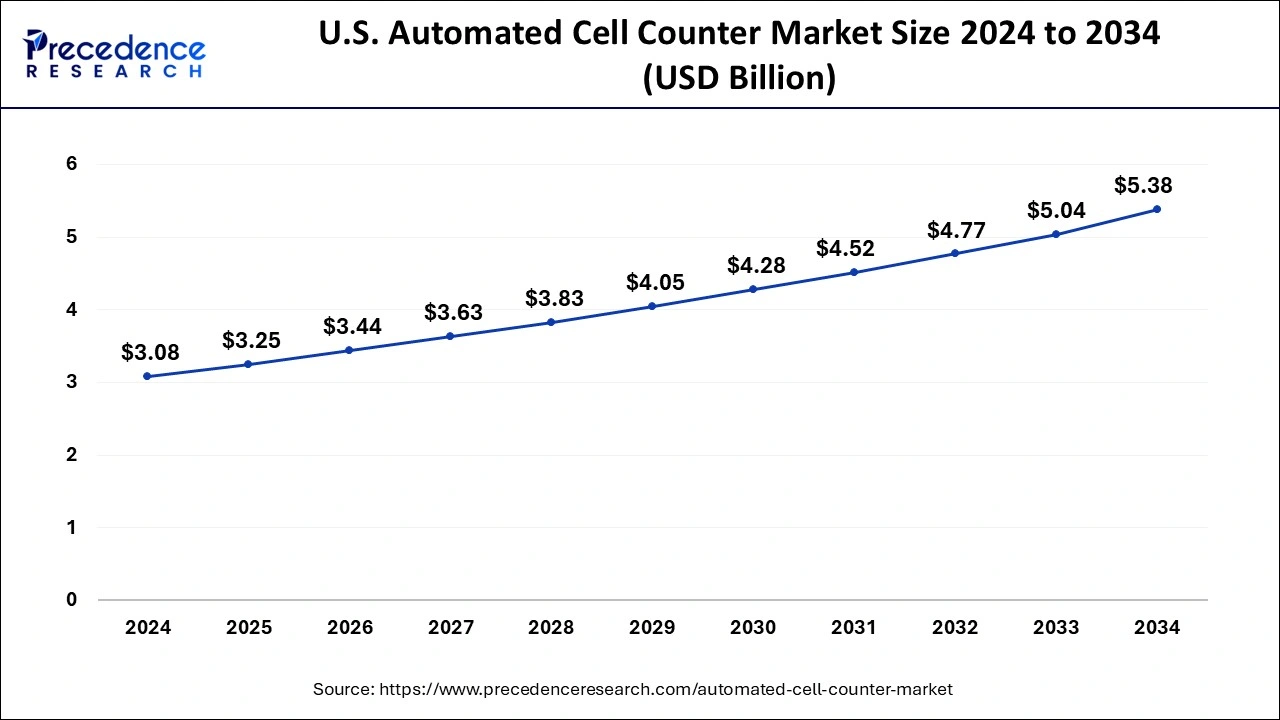

The U.S. automated cell counter market size was valued at USD 3.08 billion in 2024 and is predicted to be worth around USD 5.38 billion by 2034, poised to grow at a CAGR of 5.74% from 2025 to 2034.

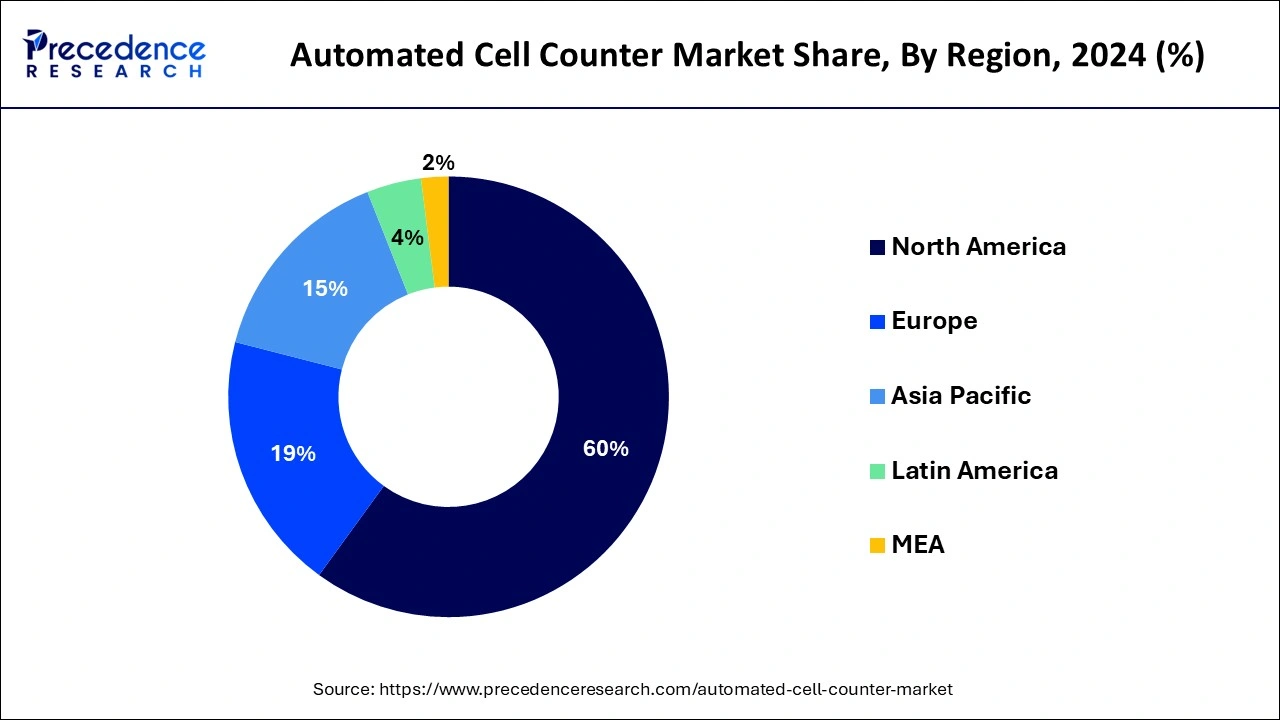

North America led the global market with the highest market share of 60% in 2024. and will continue to dominate in the coming years. The two major contributors in North America are the US and Canada. The United States has an increase in chronic diseases, which requires continuous monitoring and cell counting. According to the Centers for Disease Control and Prevention, chronic conditions are the leading cause of death and disability in the US, and $1.4 trillion is spent annually on healthcare costs. Also, the US has the largest pharmaceutical and research market that needs automated cell counters in research and production. The US is also a hub for technological advancement, which will provide an opportunity for the automated cell counter market to grow.

Asia-Pacific holds great potential for automated cell counters. The fastest expansion rate of the automated cell counter market in the forecasting period of 2025-2034 can be in the Asia-Pacific region with the fastest CAGR. Japan and China are considered among the top countries when it comes to technological advancements, and hence, they provide an excellent opportunity for the flourishment of the market. India, which is among the top economies and focuses on healthcare development, has also shown growth potential.

An automated cell counter market is necessary for healthcare and research. Cell counting is done to track cell growth, promote health, and monitor bacterial growth and plankton levels in the sea. Manual cell counting is full of human error, tedious, and time-consuming. The first automated cell counter was developed in the 50s for calculating blood cells. In medicine and biology, there are numerous procedures for which cell counts are needed. Some of the significant applications of cell counters in medicine are measuring the pathogen concentration during blood infection monitoring, measuring the concentration of different blood cells, and measuring the dose of cells given to the patient during cell therapy.

In the case of biology, cell counters are used for the calculation of cells in order to adjust the experiment reagents in molecular biology, examine microorganisms' growth rate, and calculate the live-to-death cell ratio for cell viability measurements. Due to strict regulatory controls on the manufacturing of drugs, automated cell counters are an integral part of biopharmaceutical manufacturing and bioprocessing. Most cell-counting machines are typically automated to count the cells autonomously and quickly. Cell counters are also known as cell sorters.

AI revolution

The existing automated cell counters are based on the Coulter Principle, which detects and measures the change in electrical resistance produced by cells or particles suspended in a conductive liquid. However, these automated cell counters do not provide any visual feedback, which is capable of delivering a lot of data about cell morphology. Lack of visual feedback makes it difficult to differentiate between normal and cancerous cells. Therefore, the AI-based approach is the new trend in the market, which is capable of resolving this issue. The AI-based automated cell counters are quick and can predict the distribution and number of cells in just a single image.

Gestalt Diagnostics announced the release of an AI-based mitotic counting algorithm. The algorithm is rained on more than 100,000 individual Mitosis, and it is also used across seven scanner models. The algorithm can be used in the case of breast cancer, lymphoma, cutaneous mast cell tumor, colon cancer, melanoma, neuroendocrine, and bladder carcinoma.

Cloud-based cell counting

In addition to the AI-based, cell detection is cloud-based cell counting. Cloud-based systems give the capability to use extremely high computing power. AI can recognize cells based on their extensive feature set, which will not be possible in offline systems without cloud-based systems. Cloud-based counting is also beneficial in providing regular updates without any inconvenience. One can access the ever-expanding library of cell counts on an online platform and share information with colleagues.

The first cloud-based automated cell counter launched by Corning is a combination of manual and automated cell counter and provides the best of both worlds. It is fast due to online imaging processing, cost-effective due to reusable glad hemocytometer, and an accurate cloud-based machine learning algorithm.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.58% |

| Global Market Size in 2025 | USD 7.23 Billion |

| Global Market Size by 2035 | USD 11.77 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increase in cell-based research

There is a rapid increase in cell-based research. A significant focus is given to stem cell research, due to which a new research discipline called "Translational Research" has evolved. Cell-based research is instrumental in preclinical lab testing of vaccines and new drug candidates. Cell-based research is valuable in providing high throughput viability, proliferation, and cytotoxicity screening assays for measuring the toxicity and efficacy of drugs. With continuous research, researchers are able to develop new therapies and cell-based solutions that are capable of treating many diseases while increasing efficiency and reducing costs. Governments and private organizations are also investing in cell-based research projects due to their clinical potential.

Increase in chronic conditions

Chronic disorders are the leading cause of death. According to the World Health Organization, chronic disorders, also called non-communicable diseases, are responsible for 41 million deaths annually, which is equivalent to 74% of total deaths worldwide. Out of 41 million deaths, 17.7 million die from cardiovascular diseases, 9.3 million die from cancers, 2.0 million die from diabetes, and 4.1 million die from chronic respiratory diseases. Chronic disorders occurrence increases due to alcohol consumption, unhealthy diet, air pollution, tobacco use, and physical inactivity.

These chronic disorders are responsible for the rise of the automated cell counter market because chronic conditions need constant monitoring and conducting tests. Tests include constant blood cell count, which increases the adoption of automated cell count. Automated cell counters are useful in providing accurate data in less time, even when large samples are analyzed.

Technology advancements in the automated cell counter market

Technological advancements are continuous for the improvement of current products and services for improving human life. These technological advancements are also applicable to the automated cell counter market. It helps in the adoption of clinical applications and research. Technology is integrated to increase accuracy and reduce time and cost. Many companies use advanced technology like flow cytometry and digital image processing to help capture better details and provide accurate phenotypic characterization. More technological advancements can be seen in the integration of AI, cloud computing, and deep learning algorithms for automation and intelligent analysis.

Research published in 2023 by Salek and colleagues showcased their work on a cell sorting device, COSMOS (Computation Sorting and Mapping of Single Cells). COSMOS is based on artificial intelligence and micro fluids. It is capable of sorting and characterizing single cells. High-resolution brightfield images are developed based on these images, and a real-time deep-learning interpretation can be conducted. COSMOS is capable of providing detailed images and data without using biomarker labels or dyes.

Lack of skilled professionals

Automated cell counters are advancing, and new technology developments are integrated into the devices. The incorporation of artificial intelligence and image-based systems is not easy to operate and requires skilled and trained technical expertise to operate and maintain the systems. Specialized training can be restricted due to budget and resource limitations, and qualified professionals may be unable to use an advanced system to its full potential.

Governments and organizations should provide training programs for professionals so that they will be able to learn and develop skills and knowledge for handling automated cell counters. These training programs should be continuously updated to ensure that the skills and expertise are as per the new advancements in the automated cell counter market.

Opportunity

Cell-based food products

Cell-based food products are new and different in the market and have opened a new opportunity for the automated cell counter market. According to the World Health Organization, there is a massive demand for affordable and safe protein sources. With increasing meat demand and continuous protests against animal harm, cell-based food is emerging as a new method of sustainably producing agricultural products from cell cultures instead of traditional livestock agriculture.

Culturing animal cells requires continuous and precise monitoring. Apart from animals, plant cells can also be used to produce edible products that will reduce deforestation and carbon footprints. GMP-grade automated cell counters can be used in cell-based agriculture. Organizations can collaborate to fulfill the demand for automated cell counters in the cell-based agriculture industry.

Israeli-based startup Pluri launched its cell-based coffee in January 2024. The production of coffee starts by growing coffee cells in 3D bioreactors, and later, the grown cells are harvested and roasted to get coffee granules. During the cell growth phase, automated cell counters are needed to monitor cell viability.

The fluorescence image-based cell counter segment dominated the market in 2024. Due to the increase in various chronic disorders, such as diabetes, kidney diseases, and urinary tract infections, fluorescence image-based cell counters are required in large numbers. Fluorescence image-based cell counters are significant in providing valuable insights about biomarker expression, disease progression, and cellular dynamics.

The coulter counters segment is observed to witness the fastest expansion during the forecast period. Coulter counters are highly accurate and precise in cell counting and cell size analysis. When the cells pass through a microscopic hole, the coulter counter uses electrical impedance theory to calculate the cells' volume. When it comes to precise measurements, clinical diagnosis, and research, then, coulter counters are preferred.

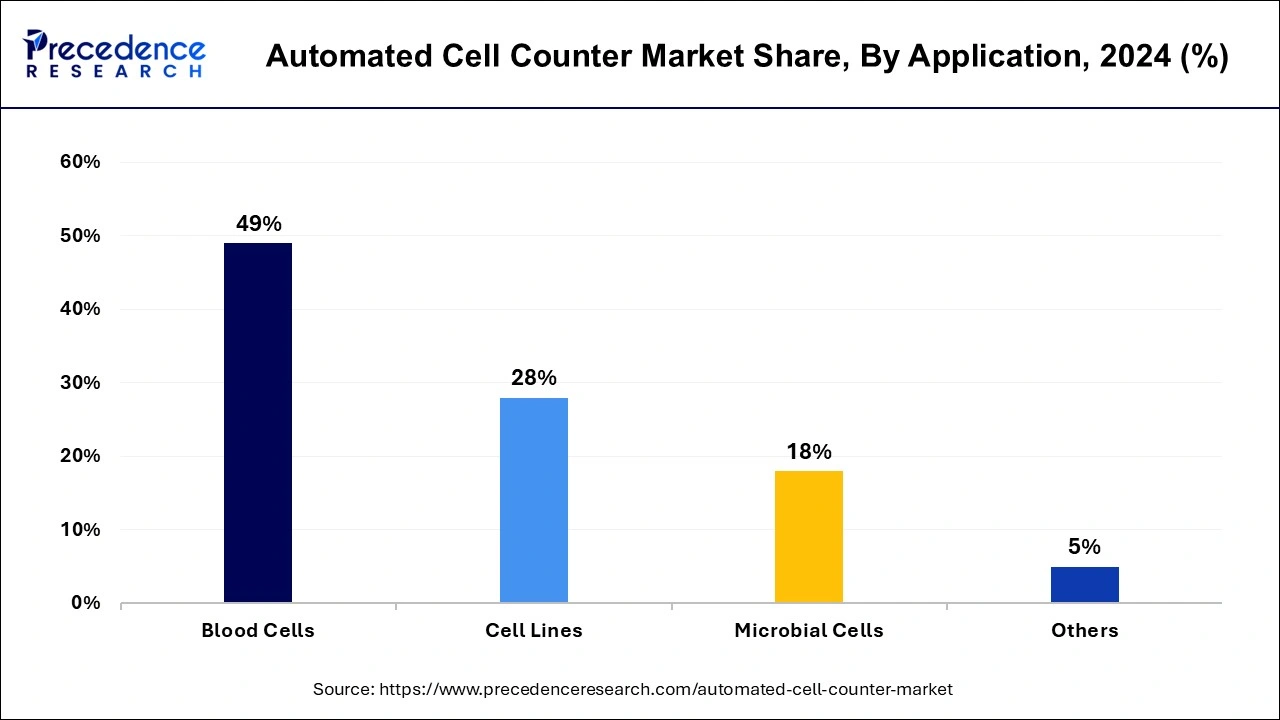

The blood cells segment recorded more than 49% of revenue share in 2024. Counting cells automatically is more dependable and accessible than manual counting, which is tedious and can be less accurate due to human errors. There are various blood-related diseases and populations, and blood-related diseases are increasing day by day. The diseases include leukemia, anemia, thrombocytopenia, and lymphoma. Counting blood cells is essential in monitoring the progression of these diseases. Counting blood cells, specifically white blood cells, also helps in understanding other infections in the body.

The cell lines segment is the second dominating segment by application type in the automated cell counter market. Cell lines are culturing cells in a controlled environment. This segment is highly flourishing as cell line culturing is used for different purposes. Cell lines are grown for drug analysis, cytotoxin analysis, cancer cell proliferation, and studying the impact of infection or diseases. Cell lines are also developed for the production of antibiotics, vaccines, antibodies, and biological compounds. A new application of cell culture is the development of cell-based animal products such as meat and dairy products to fulfill food demand sustainably and reduce animal cruelty.

The hospital segment dominated the automated cell counter market in 2024. The segment is estimated to sustain dominance throughout the forecast period. Clinical laboratories and blood cell counting are highly required in hospitals to analyze, treat, and monitor disease. The demand will increase in the future due to the growing number of people with chronic conditions. Older adults are also increasing the demand for automated cell counters as they are more inclined towards health issues that may require cell counting.

Followed by hospitals, the pharmaceutical and biotechnology companies segment is observed to grow at the fastest pace during the forecast period. Pharmaceutical and biotechnology companies grow cell lines for different purposes like drug testing, vaccine development, antibiotics testing, cytotoxins testing, producing antibiotics, producing biological compounds, and more. All these factors require cell sorting and counting, creating a significant opportunity for the automated cell counter market.

By Product Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

December 2024

November 2024

November 2024