January 2025

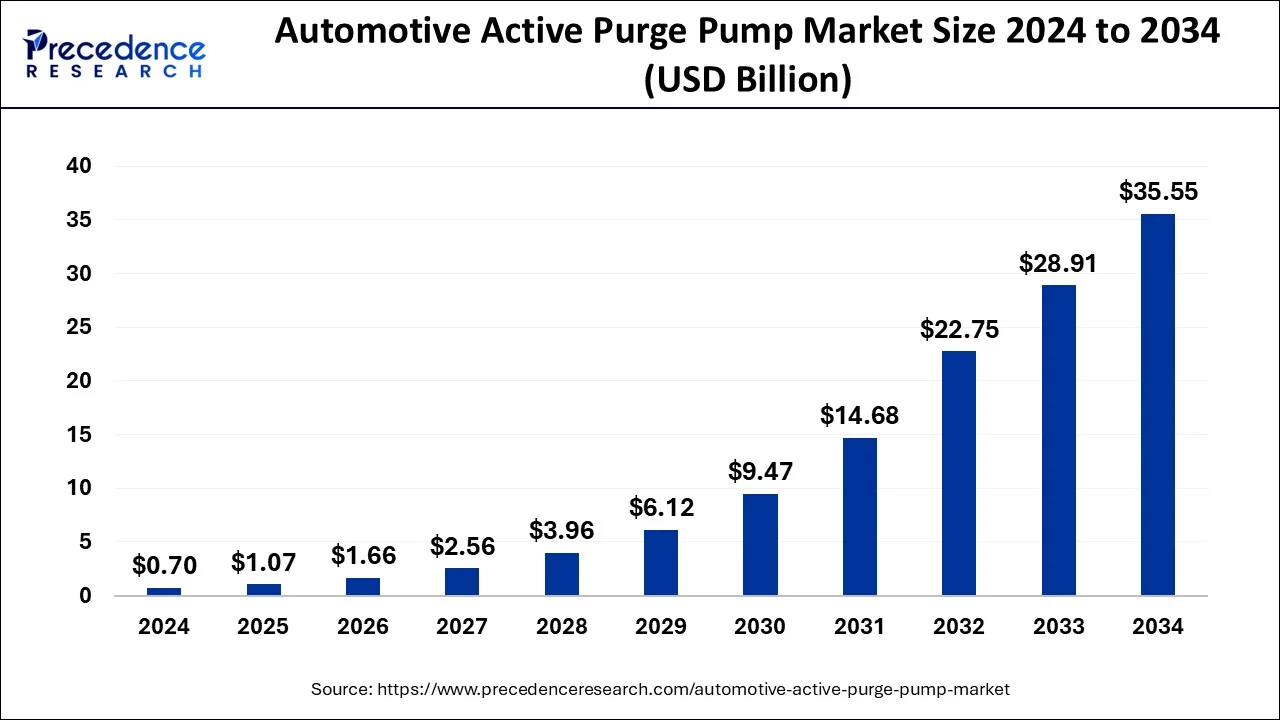

The global automotive active purge pump market size is calculated at USD 1.07 billion in 2025 and is forecasted to reach around USD 35.55 billion by 2034, accelerating at a CAGR of 48.10% from 2025 to 2034. The North America automotive active purge pump market size surpassed USD 340 million in 2024 and is expanding at a CAGR of 48.38% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive active purge pump market size was estimated at USD 0.70 billion in 2024 and is anticipated to reach around USD 35.55 billion by 2034, expanding at a CAGR of 48.10% from 2025 to 2034. The increased demand for fuel-efficient vehicles is the key driver of the global automotive active purge pump market. The rising automotive production and sales are driving the need for the active purge pumps. Furthermore, the stringent emission regulations worldwide are supporting the adoption of advanced emission control technologies, leading to the expansion of the automotive active purge pump market.

AI integration has become a primary tool to enhance the reliability of automobiles on advanced technologies. AI not only helps in the manufacturing of automobiles to reduce production costs and optimize maintenance but also helps to improve the safety, efficiency, effectiveness, and reliability of the tools. The rising demand for automobiles needs smart technologies to occupy with product quality and production efficiency, and AI plays a favorable role in emerging manufacturing.

Active purge pumps are essential to improving the eco-friendliness of the automotive industry. With the help of AI, it is easier to develop cutting-edge eco-friendly features, including fuel-efficient active purge pumps. AI algorithms are able to provide accurate information for fuel consumption and monitoring as well as provide real-time solutions to improve fuel efficiency. Integration of artificial intelligences helping to maintain emission control and performance of the active purge pumps.

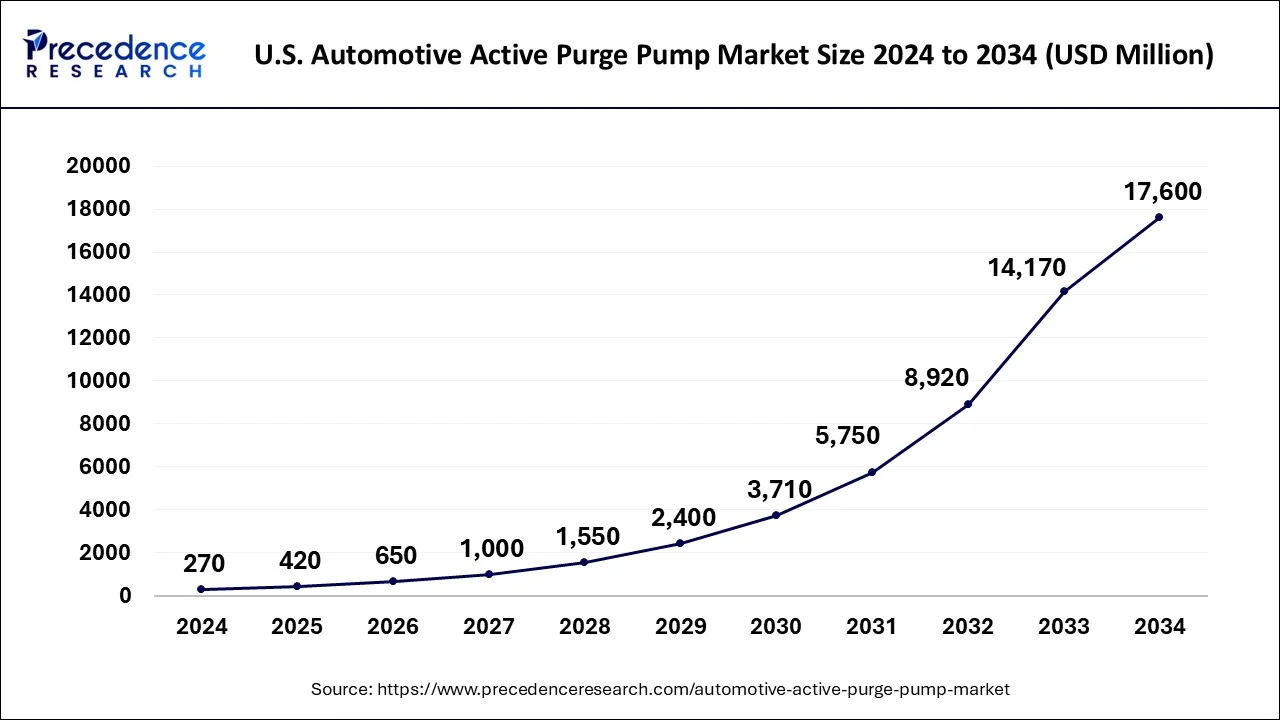

The U.S. automotive active purge pump market size was evaluated at USD 270 million in 2024 and is predicted to be worth around USD 17600 million by 2034, rising at a CAGR of 48.59% from 2025 to 2034.

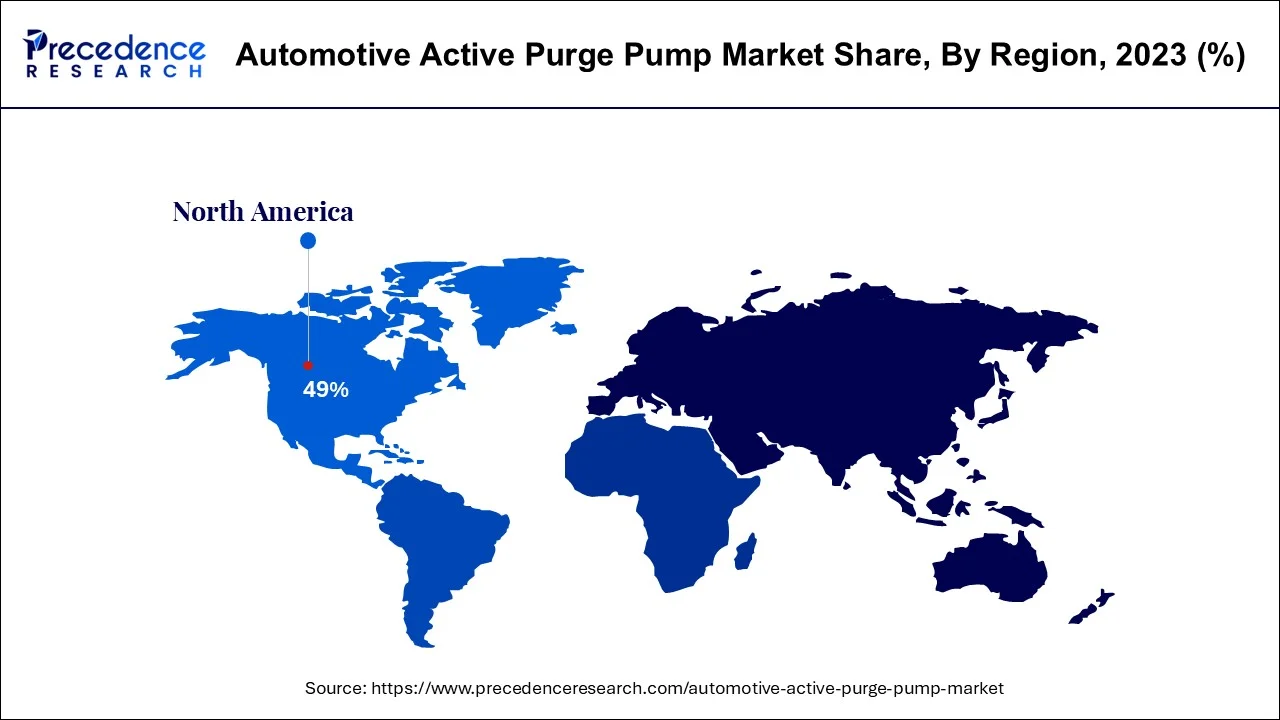

North America dominated the global automotive active purge pump market with the largest market share of 49% in 2024. Automakers are incorporating active purge pumps in order to comply with stringent emission rules and minimize evaporative emissions, with a primary focus on environmental sustainability. The automotive industry's continuous transition towards electrification and hybridization, associated with technology breakthroughs and collaboration between OEMs and manufacturers, is fueling market growth.

The United States is dominating the regional market due to rising adoption of electric vehicles (EVs) in the country. The rising government focus and encouragement for reduction of emissions and improvement of fuel efficiency are the significant drivers of the market expansion in the United States. With rising government and non-government organization investment, the electric vehicle sector is expected to continue to dominate the market.

Europe region is expected to register the fastest growth rate over the forecast period. This is mainly because of the rising awareness regarding stringent emission standards that has triggered the adoption of automotive active purge pumps in the region. Further, the region is a home for major automotive manufacturers that are estimated to be a key factor for market growth for automotive active purge pumps in the region. Apart from this, the Asia Pacific seems to be the most opportunistic region in the global market because of the increasing adoption of emission control features in a vehicle in order to curb the rate of CO2 emission from the transportation industry.

Countries like China and India are major leaders of the Asian automotive active purge pump market. The expanding automotive industries, active adoption of cutting-edge technologies, and government initiatives and investment in industrial developments are the major factors contributing to the market growth. The rapidly growing population and disposable income allowing for an expanded market in these countries. Furthermore, countries like South Korea and Japan are rapidly expanding the market in Asia due to their well-established automotive industries and adoption of modern automotive technologies. The large base of hybrid and electric vehicle development is fueling market expansion in Japan.

The adoption of advanced technologies is the key factor responsible for the growth of the global automotive active purge pump market. The growing shift of adoption of eco-friendly vehicles to reduce carbon emissions and environmental impacts is driving the surge of automotive active purge pumps. Government and regulatory frameworks have been focusing on innovation, developments, and the adoption of electric and hybrid vehicles in order to reduce hydrocarbon emissions. Companies are investing in the development of cutting-edge active purge pumps to meet stringent emission regulations standards, which further helps them to improve brand image and popularity.

Several cutting-edge technology developments, including the development of active purge pumps with more lightweight durability, are shaping the market growth. The expanding automotive industry in emerging markets like Asia and the Pacific and Europe are transforming the market. The rise in automation integration and collaboration between competitive landscapes is likely to open novel opportunities for the market to expand.

| Report Highlights | Details |

| Market Size in 2024 | USD 0.70 Billion |

| Market Size in 2025 | USD 1.07 Billion |

| Market Size by 2034 | USD 35.55 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 48.10% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Components, Material, Manufacturing Process, Vehicle Type, Sales Channel, Region |

Stringent emission regulations

The stringent emission regulation focus and support for the adoption of electric vehicles to reduce carbon emissions are the major drivers of the automotive active purge pump market. several regulations, including the United States Environmental Protection Agency’s and the European Union’s emission standards for new vehicles. China’s national emission standards and India’s emission standards are significantly contributing to the reduction of vehicle emissions and environmental impacts. The stringent emission regulatory frameworks are pressuring for the adoption of active purge pumps. Companies are increasing investment in innovation and developments of effective and efficient automotive active purge pumps to comply with regulatory standards.

Despite of numerous advantages, the automotive active purge pump has few drawbacks. Introduction to the electric vehicles as well as battery-powered vehicles with their increasing sales over the coming years expected to restrict the growth of the active purge pump market. Electric vehicles or battery-powered vehicles are a zero-emission vehicle that does not require an active purge pump. The above-mentioned factor is likely to hinder the demand for automotive active purge pump during the forthcoming years.

Fuel efficiency

Automotive active purge pumps help to reduce consumption of fuel and provide fuel vapor management, which further helps to improve engine performance and reduce hydrocarbon emissions. The developments of fuel-efficient active purge pumps have increased due to rising adoption of fuel-efficient technologies. Additionally, pressure from stringent emission regulations for the adoption of fuel-efficient technologies is contributing to more innovation and developments. The rising adoption of hybrid and electric vehicles with fuel-efficient properties is shaping the market. The need for more efficient and beneficial technologies to reduce hydrocarbon emissions, the development of fuel-efficient active purge pumps, are projected to boost the market in the upcoming period.

The DC motor segment has held the largest market share in 2024. DC motor anticipated to project lucrative growth over the coming years as it is a vital component responsible for the actions of automotive active purge pump. A brushless DC motor is an important component required to supply power to the automotive active purge pumps. Furthermore, high cost of brushless DC motor is the prime factor responsible for the significant market share of the segment in the global market. Thus, the market for DC motor estimated to witness notable expansion over the forthcoming years.

The sensors segment is anticipated to grow at a remarkable CAGR during the forecast period. This is majorly due to the declining cost of sensors along with their rising implementation in various functions of automobile. On an average the number of sensors applied in a vehicle may exceed 200 depending on the level of automation. Hence, presently sensors are counted as a vital component for any vehicle. Similarly, in regards to automotive active purge pumps, sensors are prominently used to monitor the flow of fuel vapors generated from an evaporative emission canister. Henceforth, the aforementioned factors are likely augment the market size of sensors in the automotive active purge pumps over the upcoming years.

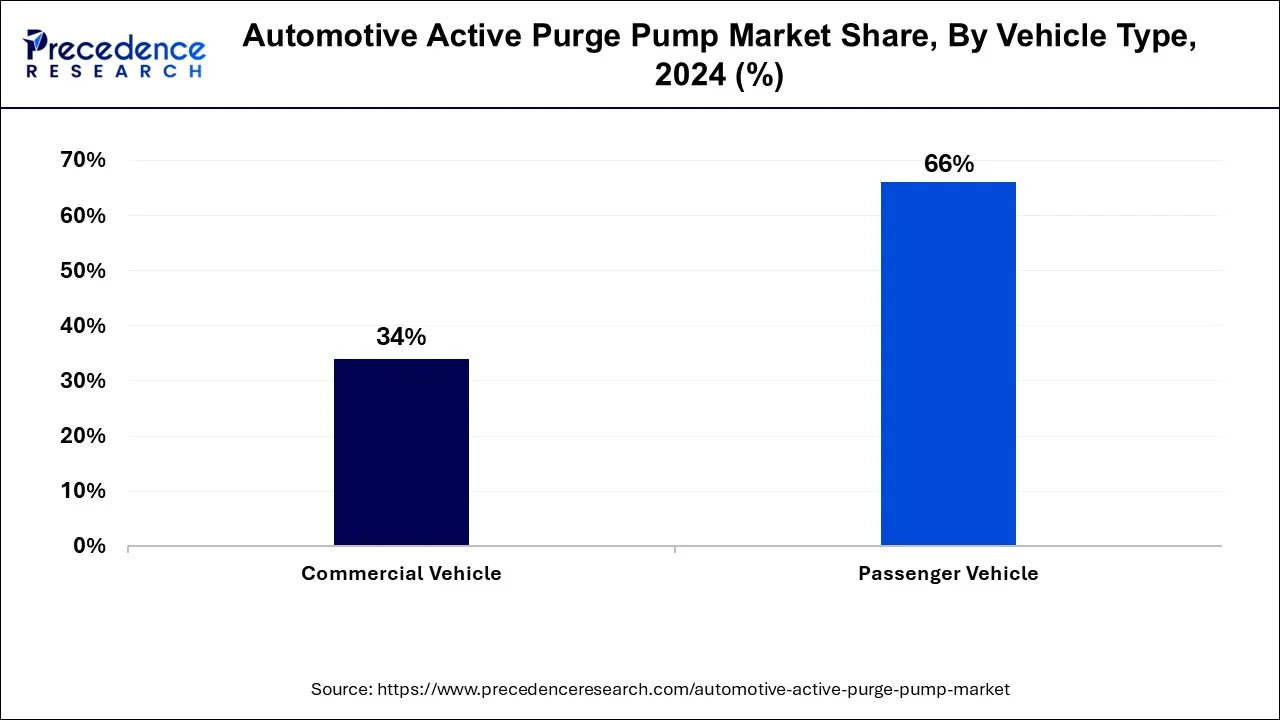

The passenger vehicle segment contributed the highest market share of 66% in 2024. In addition, the segment analyzed to continue its dominance during the forecast timeframe. Rising demand for personal transportation coupled with the rising population across the globe are the key factors attributed for the significant growth of the segment. The daily use of vehicles contributed to higher carbon and greenhouse gas emissions. In order to reduce carbon emissions and environmental impacts, the government and environmental regulatory strict emissions are supporting the adoption of automotive active purge pumps in passenger vehicles. With the government’s major focus on passenger vehicles, as they are higher in number on the road globally, the segment is expected to witness further growth.

However, the commercial vehicle segment expected to lead the market in forecast period. revolution in the industrial sector as well as shifting consumer preference towards online purchasing & retail shops is likely augment the growth of logistics & transportation, thereby propels the growth of automotive active purge pump in commercial vehicle over the analysis period. Growing eco-friendly commercial vehicles, including vans, buses, and trucks, are contributing to the segment's growth. Additionally, the stringent emission regulations are encouraging for the adoption of automotive active purge pumps in commercial vehicles.

The Original Equipment Manufacturers (OEMs) segment generated the largest share of the market. The segment growth is attributed to its supplying automotive manufacturers with active purge pumps with strong quality and regulatory compliance standards. OEMs help to negotiate supply prices and help to reduce the cost. The maintenance of high-quality standards and reliability making segment o grow further.

On the other hand, the aftermarket segment is observed to grow as the fastest-growing segment due to consumer preference for maintenance and replacements of vehicles. The automotive active purge pumps are cost-effective, which attracts consumers. Additionally, the availability of broad numbers of retailers, distributors, and online markets to provide active purge pumps is driving the aftermarket segment's expansions.

There are limited players operating holding the leading position in global automotive active purge pump market that turns the market into highly consolidated. Agilent Technologies and Continental AG are the prominent players operating in the market. Research & Development (R&D) is the key strategy adopted by the major market players to retain their competitiveness in the global market.

This research study comprises complete assessment of the market by means of far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers classification of marketplace into impending and niche sectors. Further, this research study calculates market size and its development drift at global, regional, and country from 2016 to 2027. This report contains market breakdown and its revenue estimation by classifying it on the basis of component, material type, manufacturing process, vehicle type, sales channel, and region:

By Components

By Vehicle Type

By Sales Channel

By Regional

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025